Reports

Reports

The steadily increasing occurrence of post-traumatic arthritis, rheumatoid arthritis, and osteoarthritis is likely to provide immense growth prospects for the global knee implant market. Furthermore, due to the poor satisfaction levels of patients getting total knee replacement, knee arthroplasty has presented an opportunity for major competitors in the industry. As a result, producers have begun to utilize different biomaterials for improved strength to meet this growing demand, which is likely to drive global knee implant market in the forthcoming years. Furthermore, due to rising success rates, technical breakthroughs, and the simple availability of durable and higher-quality implants, knee replacement treatments are in great demand.

The most frequent orthopedic surgery is total knee replacement, or total knee arthroplasty, which involves substituting the articular surfaces of the knee joint with strongly cross-linked polyethylene plastic and polished metal. The end of the femur and lower leg bone are removed and replaced with synthetic material during total knee replacement surgery. Patients with substantial knee joint problems who experience growing pain and loss of function can be eligible for complete knee replacement.

The high cost of complete knee replacement surgery, on the other hand, may have a negative impact on market growth. Knee implants can account for 20% to 40% of a therapy's cost, which has a substantial influence on treatment margins, particularly in today's capitated reimbursement system. Because of the high costs connected with total knee replacement surgeries, the industry's expansion may be impeded in emerging nations with low income levels.

The growing senior population is driving the knee replacement market, which is fueling old-age illnesses including diabetes, osteoporosis, and arthritis. In addition to that, rising technical breakthroughs, such as less invasive operations and the availability of improved implant materials are expected to propel the global knee implant market forward in the years to come.

U.S. Knee Implant Market: Snapshot

In the last few years, there has been potential development in the medical sector, thanks to which, the U.S. knee implant market is anticipated to gain traction in the next few years. The rising initiatives being taken the key players for creating an understanding among the players regarding the advantages of knee implants are anticipated to support the growth of the market in the near future. In addition, the rise in the use of 3D technology is predicted to ensure the growth of the market in the next few years.

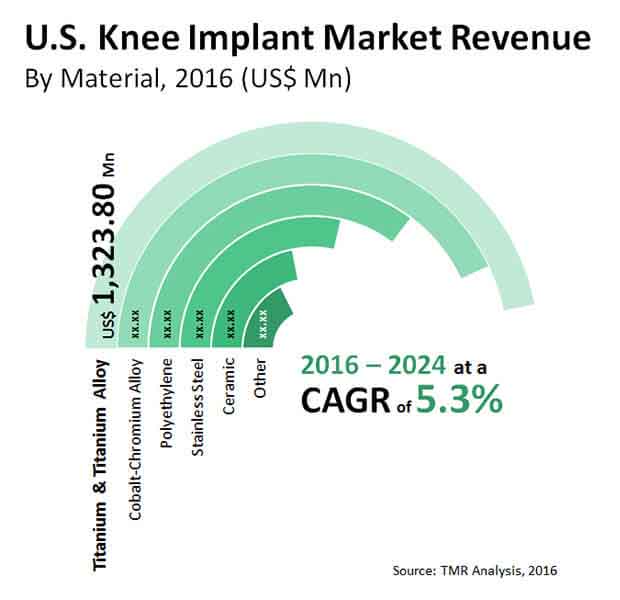

As per the study by TMR, in 2015, the U.S. market for knee implant was worth US$4.3 bn and is predicted to reach a value of US$7.0 bn by the end of 2024. The market is predicted to exhibit a 5.30% CAGR between 2016 and 2024.

Increasing Investments by Key Players to Drive U.S. Knee Implants Market

The rising developments and research activities in the medical industry are predicted to attract a large number of players, thus supporting the growth of the U.S. knee implant market in the coming years. The high rise in the geriatric population and the growing prevalence of several degenerative disease are further predicted to ensure the development of the overall market in the next few years. In addition to this, the presence of advanced healthcare infrastructure in this region and the rise in the awareness among people related to the availability of knee implants are the important factors that are projected to enhance the growth of the market over the next few years.

On the other hand, the U.S. market for knee implants is predicted to face several challenges in the market, which might curtail the growth of the market in the near future. The high cost of surgery and implants and the lack of awareness among people regarding knee implants are predicted to restrict the market growth in the near future. Nonetheless, the advent of new products and the growing demand for minimally invasive surgeries are estimated to encourage the development of the knee implants market in the near future.

Rising Research Activities to Encourage Growth of Knee Implant Market in U.S.

The U.S. market for knee implants has been classified on the basis of geography into the South Atlantic, the Mountain, the Pacific, the South Central, the Midwest, and the North East region. Among these, the Midwest region is expected to witness high growth in the coming few years, owing to the presence and rise in the number of ambulatory surgical centers. In addition to this, the increasing focus on new and advanced technologies is likely to enhance the growth of the market in the next few years. Also, the increasing pool of patients and the rising number of manufacturers and the enhancement of distribution network is projected to support the development of the U.S. knee implant market in the next few years.

The U.S. market for knee implant is extremely consolidated in nature with a few players holding a large share of the market. This market is expected to witness a high level of competition among the key players and is likely to rise substantially in the coming few years. Also, the rise in the number of players is expected to rise substantially over the next few years, thus enhancing the competitive environment of the market in the coming few years. The key players engaged in the knee implant market across the U.S. are OMNIlife science, Inc., MicroPort Scientific Corp., DJO Global Inc., Johnson & Johnson, Arthrex, Zimmer Biomet Holdings Inc., Exactech Inc., B. Braun Melsungen AG, Stryker Corp., ConforMIS, and Smith & Nephew.

US Knee implant market to reach a value of US$7.0 bn by the end of 2024

US Knee implant market is predicted to exhibit a 5.30% CAGR between 2016 and 2024

US Knee implant market is driven by rising technical breakthroughs, such as less invasive operations and the availability of improved implant materia

The end-use segments in US knee implant market are ambulatory surgical centers, hospitals, and specific orthopedic clinics

Key players in the US Knee implant market OMNIlife science, Inc., MicroPort Scientific Corp., DJO Global Inc., Johnson & Johnson, Arthrex

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Knee Replacement Market

4. Market Definition

4.1. Introduction

4.1.1. Industry Definition

4.1.2. Industry Evolution / Developments

4.2. Market Overview

4.3. Key Market Indicators

4.4. Market Dynamics

4.4.1. Drivers

4.4.2. Restraints

4.4.3. Opportunities

4.5. Knee Replacement Market Analysis and Forecast, 2016 – 2024

4.5.1. Market Volume Projections

4.5.2. Pricing - Actuals and Projections

4.5.3. Market Revenue Projections (US$ Mn)

4.6. Knee Replacement Market - U.S. Scenario

4.7. Porter’s Five Force Analysis

4.8. Value Chain Analysis

4.8.1. List of active market participants (suppliers/distributors/manufacturers/vendors)

4.8.1.1. Product Manufacturers

4.8.1.2. Product Distributors

4.8.1.3. Service Providers

4.8.2. Forward – Backward Integration Scenario

4.9. Future Market Outlook

4.10. Raw Material And Inventory Procurement Scenario, U.S. (Qualitative Analysis)

4.11. Supplier Life Cycle Management, U.S.

4.11.1. Planning and Selection of Potential Suppliers

4.11.1.1. Planning

4.11.1.2. Evaluation

4.11.1.3. Supplier Selection

4.11.2. Supplier Evaluation and Disposition Process

4.11.2.1. Supplier Initial Assessment

4.11.2.2. On-Site Assessment

4.11.2.3. Supplier Assessment- Inputs and Outputs

4.11.2.4. Others

4.11.3. Finalization Of Controls

4.11.4. Delivery, Measurements, and Monitoring

4.11.5. Feedback and Communication

4.12. Capital Investments for Knee Implants, U.S.

4.13. Knee Implants Business Challenges, U.S.

4.14. Knee Implants Market Opportunity/Demand Distribution, By State

4.14.1. Indiana

4.14.2. Minnesota

4.14.3. Pennsylvania

4.14.4. California

4.14.5. Oregon

4.14.6. Texas

4.14.7. Massachusetts

4.14.8. Florida

4.14.9. Tennessee

4.14.10. Virginia

4.14.11. Others (New York, New Jersey, North Carolina, etc.)

4.15. Market Share Analysis, Leading Companies (2015)

4.16. Heat Map Analysis

5. Knee Replacement Market Analysis and Forecasts, By Product

5.1. Introduction & Definition

5.2. Key Findings / Developments

5.3. Market Size (US$ Mn) Forecast, By Product

5.3.1. Total Knee Replacement Implant

5.3.1.1. Fixed Bearing Implants

5.3.1.2. Mobile Bearing Implants

5.3.1.3. Medial Pivot Implants

5.3.1.4. Other

5.3.2. Partial Knee Replacement Implants

5.3.3. Revision Knee Replacement Implants

5.4. Market Attractiveness By Product

6. Knee Replacement Market Analysis and Forecasts, By Implant Material

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Size (US$ Mn) Forecast, By Implant Material

6.3.1. Stainless Steel

6.3.2. Cobalt-chromium Alloys

6.3.3. Titanium and Titanium Alloys

6.3.4. Polyethylene

6.3.5. Ceramics

6.3.6. Other

6.4. Market Attractiveness By Implant Material

7. Knee Replacement Market Analysis and Forecasts, By End-user

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Size (US$ Mn) Forecast, By End-user

7.3.1. Hospital

7.3.2. Specialized Orhtopedic Clinics

7.3.3. Ambulatory Surgery Centers

7.4. Market Attractiveness By End-user

8. Knee Replacement Market Analysis and Forecasts, By Region

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Key Trends

8.4. Market Size (US$ Mn) Forecast, By Region

8.4.1. Pacific Region

8.4.2. Midwest Region

8.4.3. Mountain Region

8.4.4. South Central Region

8.4.5. South Atlantic Region

8.4.6. Northeast Region

9. Competition Landscape

9.1. Market Player – Competition Matrix

9.2. Company Share Analysis (2016)

9.3. Company Profiles (Details – Overview, Financials, Recent Developments, Strategy)

9.3.1. B. Braun Melsungen AG

9.3.1.1. Company Details

9.3.1.2. Business Overview

9.3.1.3. Financial Overview

9.3.1.4. Strategy Overview

9.3.1.5. SWOT Analysis

9.3.2. Smith & Nephew

9.3.2.1. Company Details

9.3.2.2. Business Overview

9.3.2.3. Financial Overview

9.3.2.4. Strategy Overview

9.3.2.5. SWOT Analysis

9.3.3. Zimmer Biomet Holding Inc.

9.3.3.1. Company Details

9.3.3.2. Business Overview

9.3.3.3. Financial Overview

9.3.3.4. Strategy Overview

9.3.3.5. SWOT Analysis

9.3.4. Stryker Corporation

9.3.4.1. Company Details

9.3.4.2. Business Overview

9.3.4.3. Financial Overview

9.3.4.4. Strategy Overview

9.3.4.5. SWOT Analysis

9.3.5. Exactech, Inc.

9.3.5.1. Company Details

9.3.5.2. Business Overview

9.3.5.3. Financial Overview

9.3.5.4. Strategy Overview

9.3.5.5. SWOT Analysis

9.3.6. Johnson & Johnson

9.3.6.1. Company Details

9.3.6.2. Business Overview

9.3.6.3. Financial Overview

9.3.6.4. Strategy Overview

9.3.6.5. SWOT Analysis

9.3.7. Arthrex, Inc.

9.3.7.1. Company Details

9.3.7.2. Business Overview

9.3.7.3. Financial Overview

9.3.7.4. Strategy Overview

9.3.7.5. SWOT Analysis

9.3.8. ConforMIS

9.3.8.1. Company Details

9.3.8.2. Business Overview

9.3.8.3. Financial Overview

9.3.8.4. Strategy Overview

9.3.8.5. SWOT Analysis

9.3.9. DJO Surgical

9.3.9.1. Company Details

9.3.9.2. Business Overview

9.3.9.3. Financial Overview

9.3.9.4. Strategy Overview

9.3.9.5. SWOT Analysis

9.3.10. MicroPort Scientific Corporation

9.3.10.1. Company Details

9.3.10.2. Business Overview

9.3.10.3. Financial Overview

9.3.10.4. Strategy Overview

9.3.10.5. SWOT Analysis

9.3.11. Omni life science

9.3.11.1. Company Details

9.3.11.2. Business Overview

9.3.11.3. Financial Overview

9.3.11.4. Strategy Overview

9.3.11.5. SWOT Analysis

10. Key Takeaways

List of Tables

Table 01: U.S. Knee Implant Market Size (US$ Mn) Forecast, By Product, 2016–2024

Table 02: U.S. Knee Implant Market Volume Forecast, By Product, 2016–2024

Table 03: U.S. Knee Implant Market Size (US$ Mn) Forecast, By Total Knee Replacement Implants, 2016– 2024

Table 04: U.S. Knee Implant Market Size (US$ Mn) Forecast, By Total Knee Replacement Implants, 2016–2024

Table 05: U.S. Knee Implant Market Size (US$ Mn) Forecast, By End-user, 2016–2024

List of Figures

Figure 01: U.S. Knee Implant Market Value (US$ Mn) & Growth Forecast, 2015–2024

Figure 02: U.S. Knee Implant Market, Volume Forecast 2016–2024

Figure 03: U.S. Knee Implant Market Value Forecast, 2016 – 2024 and Y-o-Y growth projection, 2015-2024, By Total Knee Replacement Implants

Figure 04: U.S. Knee Implant Market Value Forecast, 2016 – 2024 and Y-o-Y growth projection, 2015 – 2024, By Partial Knee Replacement Implants

Figure 05: U.S. Knee Implant Market Value Forecast, 2016 – 2024 and Y-o-Y growth projection, 2015-2024, By Revision Knee Replacement Implants

Figure 06: U.S. Knee Implant Market Value Forecast, 2016 – 2024 and Y-o-Y growth projection, 2015-2024, By Fixed Bearing Implants

Figure 07: U.S. Knee Implant Market Value Forecast, 2016 – 2024 and Y-o-Y growth projection, 2015 – 2024, By Mobile Bearing Implants

Figure 08: U.S. Knee Implant Market Value Forecast, 2016 – 2024 and Y-o-Y growth projection, 2015-2024, By Medial Pivot Implants

Figure 09: U.S. Knee Implant Market Value Forecast, 2016 – 2024 and Y-o-Y growth projection, 2015 – 2024, By Other

Figure 10: Knee Implant Market Attractiveness Analysis By Product, 2016 – 2024

Figure 11: U.S. Knee Implant Market Value Forecast, 2016 – 2024 and Y-o-Y growth projection, 2015-2024, By Stainless Steel

Figure 12: U.S. Knee Implant Market Value Forecast, 2016 – 2024 and Y-o-Y growth projection, 2015 – 2024, By Cobalt-Chromium Alloys

Figure 13: U.S. Knee Implant Market Value Forecast, 2016 – 2024 and Y-o-Y growth projection, 2015-2024, By Titanium and Titanium Alloys

Figure 14: U.S. Knee Implant Market Value Forecast, 2016 – 2024 and Y-o-Y growth projection, 2015 – 2024, By Polyethylene

Figure 15: U.S. Knee Implant Market Value Forecast, 2016 – 2024 and Y-o-Y growth projection, 2015-2024, Ceramics

Figure 16: U.S. Knee Implant Market Value Forecast, 2016 – 2024 and Y-o-Y growth projection, 2015 – 2024, By Others

Figure 17: Knee Implant Market Attractiveness Analysis By Implant Material, 2016 – 2024

Figure 18: U.S. Knee Implant Market Value Forecast, 2016 – 2024 and Y-o-Y growth projection, 2015-2024, By Hospitals

Figure 19: U.S. Knee Implant Market Value Forecast, 2016 – 2024 and Y-o-Y growth projection, 2015 – 2024, By Specialized Orthopedic Clinics

Figure 20: U.S. Knee Implant Market Value Forecast, 2016 – 2024 and Y-o-Y growth projection, 2015-2024, By Ambulatory Surgery Centers

Figure 21: Knee Implant Market Attractiveness Analysis By End-user, 2016 – 2024

Figure 22: U.S. Knee Implant Market Size (US$ Mn) Forecast, 2016–2024