Reports

Reports

The telehealth sector is expanding exponentially, boosted by the COVID-19 pandemic to an extremely high degree. As health systems worldwide are utilizing remote consultations to uphold patient care with reduction in exposure to virus, telehealth has emerged a solution.

The shift has not only brought out the ease and convenience of virtual care but also suggested its cost-effectiveness and improved patient outcomes prospect. According to estimations, the telehealth market is expected to grow even further with technology utilization, smartphone penetration, and patient demand for on-demand delivery of healthcare services. Policy reform and payments policy are also evolving to facilitate telehealth programs to develop, which further enhances its position within the healthcare system.

Patients appreciate the comfort of being treated at home with ease, particularly those who are mobility disabled or in rural areas where there is no appropriate route to healthcare centers. Concerns remain about data protection, having adequate digital infrastructure, and uniformity of the states' laws. As long as the stakeholders still grapple with such challenges, the telehealth sector has the potential to paradigmatically redefine traditional healthcare delivery trends with enhanced models that maximize patient engagement and overall health outcomes.

Telehealth refers to the delivery of healthcare services by means of digital communications technology, whereby patients are able to receive care away from clinical environments. The new process encompasses virtual consultation, remote monitoring, and mobile health applications. Telehealth was needed more during the COVID-19 outbreak, whereby medical professionals attempted to minimize face-to-face encounters without disrupting continuity of care.

The model will benefit the system in many aspects, such as greater access for rural or under-served patients, less travel time, and increased scheduling flexibility around times of appointments. Telehealth may also foster greater patient participation and compliance with treatment regimens. There are also challenges facing the model, such as data security risks, disparity in state statute, and the necessity of sound reimbursement policies.

As technology advancements, and indeed health systems, continue, telehealth can increasingly be an active participant in the future of healthcare delivery in a manner that facilitates the continuation of maintaining a more efficient, patient-centered method of health management.

| Attribute | Detail |

|---|---|

| Telehealth Market Drivers |

|

Market growth is fueled mainly by the growing burden of chronic disease and aging. Chronic diseases like diabetes, heart disease, and respiratory disease are increasing worldwide mostly due to demographic as well as lifestyle factors. When population gets older, the prevalence of chronic disease grows, and thus it is an urgent need for the existing care interventions. Telehealth provides an economical solution to such a problem, with patients' liberty of ongoing observation and treatment from their homes.

Virtual consultations and monitoring of patients at home allow medical professionals to monitor patients' health data in real-time, enabling timely intervention and minimizing hospital visits. This is beneficial particularly for the old who may be having mobility issues or the rural dwellers with fewer points of access to the health centers.

Telehealth also frees the healthcare system from workloads by reducing hospitalization and emergency admissions, eventually leading to improved health outcomes. As the demand for the management of chronic disease increases, there is space for the telehealth marketplace to expand with the delivery of innovative, new solutions that enhance patient outcomes and help enable healthcare practitioners to manage more effectively patients with high-complexity health needs.

The telehealth industry is being fueled by the dual thrust of cost reduction and enhanced access to treatment. Traditional care models include the exorbitant expenses of in-clinic consultations, travel, and facility charges. Telehealth works to reduce the costs by making it easier for patients to reach healthcare providers from distant locations, thereby reducing the cost of transportation and time off work. It is easier to provide such affordability, particularly for the rural or poor patients who otherwise will have significant barriers to accessing life-saving care.

Moreover, telehealth expands the reach of healthcare through the elimination of physical and logistical impediments. Patients can access specialists at a distance, and benefit from timely intervention especially among chronic or mobility patients. The practice benefits not only individual needs but also the ability of healthcare systems toward the optimal utilization of resources by reducing the burden on hospital facilities and emergency departments.

As greater demand for universalized and accessible health care option has arisen, telehealth stands to be at the forefront. Through its ability to make service delivery more streamlined and maximize patient involvement, it favors a more universalized healthcare system, ultimately benefiting in terms of improved health outcomes and an improved sustainable health care system.

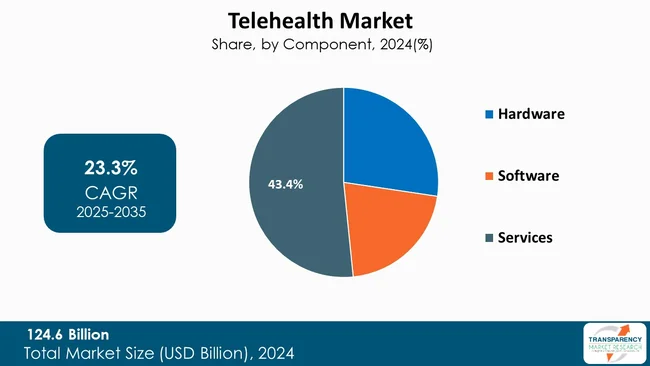

The services sector is leading the telehealth space as it is leading in the manner of end-to-end and patient-focused care. As healthcare has made inroads online, requirement for telehealth types of service—virtual consultations, remote monitoring of patients, and tele therapy-has been observed. They facilitate immediate access to healthcare experts so that one can diagnose and treat on time, which is extremely important in curing chronic diseases and acute conditions.

Flexibility is among the key drivers to the industry's success. They are able to schedule appointments at their convenience, thus reducing waiting time and satisfaction in general. Additionally, the remote monitoring services help doctors keep track of patients' health indicators in real time, thus making them more manageable and the number of hospital visits reduced.

Lastly, the COVID-19 pandemic hastened the use of telehealth services because patients and providers alike saw the advantages of long-term provision of services in a way that reduced exposure to risks. Long-term demand for telehealth services has attracted investment and innovation aimed at enhancing the quality and scope of service delivered. Therefore, services component not only fuels market expansion but also reconfigures the healthcare industry to become more accessible, effective, and responsive to existing patients' needs.

| Attribute | Detail |

|---|---|

| Leading Region | North America |

North America is spearheading the telehealth industry due to a chain of leading drivers that include access to innovative technology infrastructure, greater levels of internet penetration, and the presence of a developed healthcare infrastructure. The region has been abetted by massive investments pouring into digital health solutions that are making it possible for telehealth solutions to be executed by healthcare providers in a proper manner. The COVID-19 pandemic has also cemented the use of telehealth services, where patients and providers required safe alternatives to office visits.

.webp)

Reimbursement regulations and supportive regulatory environments promoting adoption have further led to the growth of telehealth in North America. The states have relaxed telehealth practice policies, thereby making it easier for providers to deliver services remotely. High rates of chronic disease occurrence and a growing aged population are also stimulating demand for convenient healthcare. Patients also appreciate the convenience and flexibility provided by telehealth, with a strong preference for virtual consultations. As such, North America is most likely to be leading the world telehealth market, paving the way in the provision of healthcare.

Key players in the global telehealth market are investing in innovation, technological advancements, and forming alliances. Their objective is to improve the precision of testing, diversify their products, and gain a stronger market presence in order to be ahead of the curve in the evolving healthcare market.

Koninklijke Philips N.V, GE HealthCare, Cerner Corporation (Oracle), Siemens Healthineers, Medtronic, Teladoc Health Inc, American Well, Doctor On Demand, Global Med, Ping An Good Doctor, Mfine, Access TeleCare, LLC and others are some of the leading key players.

Each of these players has been profiled in the telehealth market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

| Size in 2024 | US$ 124.6 Bn |

| Forecast Value in 2035 | US$ 1,238.3 Bn |

| CAGR | 23.3% |

| Forecast Period | 2025–2035 |

| Historical Data Available for | 2020–2023 |

| Quantitative Units | US$ Bn |

| Telehealth Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Component

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 124.6 Bn in 2024

It is projected to cross US$ 1,238.3 Bn by the end of 2035

Rising chronic disease burden & aging population and cost efficiency & healthcare accessibility

It is anticipated to grow at a CAGR of 23.3% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

Koninklijke Philips N.V, GE Healthcare, Cerner Corporation (Oracle), Siemens Healthineers, Medtronic, Teladoc Health Inc, American Well, Doctor On Demand, Global Med, Ping An Good Doctor, Mfine, Access TeleCare, LLC, and Others

Table 01: Global Telehealth Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 02: Global Telehealth Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 03: Global Telehealth Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 04: Global Telehealth Market Value (US$ Bn) Forecast, By Delivery Mode, 2020 to 2035

Table 05: Global Telehealth Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 06: Global Telehealth Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 07: Global Telehealth Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 08: North America Telehealth Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 09: North America Telehealth Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 10: North America Telehealth Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 11: North America Telehealth Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 12: North America Telehealth Market Value (US$ Bn) Forecast, By Delivery Mode, 2020 to 2035

Table 13: North America Telehealth Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 14: North America Telehealth Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 15: Europe Telehealth Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 16: Europe Telehealth Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 17: Europe Telehealth Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 18: Europe Telehealth Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 19: Europe Telehealth Market Value (US$ Bn) Forecast, By Delivery Mode, 2020 to 2035

Table 20: Europe Telehealth Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 21: Europe Telehealth Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 22: Asia Pacific Telehealth Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 23: Asia Pacific Telehealth Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 24: Asia Pacific Telehealth Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 25: Asia Pacific Telehealth Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 26: Asia Pacific Telehealth Market Value (US$ Bn) Forecast, By Delivery Mode, 2020 to 2035

Table 27: Asia Pacific Telehealth Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 28: Asia Pacific Telehealth Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 29: Latin America Telehealth Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 30: Latin America Telehealth Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 31: Latin America Telehealth Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 32: Latin America Telehealth Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 33: Latin America Telehealth Market Value (US$ Bn) Forecast, By Delivery Mode, 2020 to 2035

Table 34: Latin America Telehealth Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 35: Latin America Telehealth Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 36: Middle East & Africa Telehealth Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 37: Middle East & Africa Telehealth Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 38: Middle East & Africa Telehealth Market Value (US$ Bn) Forecast, By Software, 2020 to 2035

Table 39: Middle East & Africa Telehealth Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 40: Middle East & Africa Telehealth Market Value (US$ Bn) Forecast, By Delivery Mode, 2020 to 2035

Table 41: Middle East & Africa Telehealth Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 42: Middle East & Africa Telehealth Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Figure 01: Global Telehealth Market Value Share Analysis, By Component, 2024 and 2035

Figure 02: Global Telehealth Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 03: Global Telehealth Market Revenue (US$ Bn), by Hardware, 2020 to 2035

Figure 04: Global Telehealth Market Revenue (US$ Bn), by Software, 2020 to 2035

Figure 05: Global Telehealth Market Revenue (US$ Bn), by Services, 2020 to 2035

Figure 06: Global Telehealth Market Value Share Analysis, By Delivery Mode, 2024 and 2035

Figure 07: Global Telehealth Market Attractiveness Analysis, By Delivery Mode, 2025 to 2035

Figure 08: Global Telehealth Market Revenue (US$ Bn), by On-Premise, 2020 to 2035

Figure 09: Global Telehealth Market Revenue (US$ Bn), by Cloud, 2020 to 2035

Figure 10: Global Telehealth Market Value Share Analysis, By Application, 2024 and 2035

Figure 11: Global Telehealth Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 12: Global Telehealth Market Revenue (US$ Bn), by Radiology, 2020 to 2035

Figure 13: Global Telehealth Market Revenue (US$ Bn), by Endocrinology, 2020 to 2035

Figure 14: Global Telehealth Market Revenue (US$ Bn), by Dermatology, 2020 to 2035

Figure 15: Global Telehealth Market Revenue (US$ Bn), by Gastroenterology, 2020 to 2035

Figure 16: Global Telehealth Market Revenue (US$ Bn), by Neurological Medicine, 2020 to 2035

Figure 17: Global Telehealth Market Revenue (US$ Bn), by ENT, 2020 to 2035

Figure 18: Global Telehealth Market Revenue (US$ Bn), by Cardiology, 2020 to 2035

Figure 19: Global Telehealth Market Revenue (US$ Bn), by Oncology, 2020 to 2035

Figure 20: Global Telehealth Market Revenue (US$ Bn), by Dental, 2020 to 2035

Figure 21: Global Telehealth Market Revenue (US$ Bn), by Gynecology, 2020 to 2035

Figure 22: Global Telehealth Market Revenue (US$ Bn), by General Medicine, 2020 to 2035

Figure 23: Global Telehealth Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 24: Global Telehealth Market Value Share Analysis, By End-user, 2024 and 2035

Figure 25: Global Telehealth Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 26: Global Telehealth Market Revenue (US$ Bn), by Payers, 2020 to 2035

Figure 27: Global Telehealth Market Revenue (US$ Bn), by Providers, 2020 to 2035

Figure 28: Global Telehealth Market Revenue (US$ Bn), by Patients, 2020 to 2035

Figure 29: Global Telehealth Market Value Share Analysis, By Region, 2024 and 2035

Figure 30: Global Telehealth Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 31: North America Telehealth Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 32: North America Telehealth Market Value Share Analysis, by Country, 2024 and 2035

Figure 33: North America Telehealth Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 34: North America Telehealth Market Value Share Analysis, By Component, 2024 and 2035

Figure 35: North America Telehealth Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 36: North America Telehealth Market Value Share Analysis, By Delivery Mode, 2024 and 2035

Figure 37: North America Telehealth Market Attractiveness Analysis, By Delivery Mode, 2025 to 2035

Figure 38: North America Telehealth Market Value Share Analysis, By Application, 2024 and 2035

Figure 39: North America Telehealth Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 40: North America Telehealth Market Value Share Analysis, By End-user, 2024 and 2035

Figure 41: North America Telehealth Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 42: Europe Telehealth Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 43: Europe Telehealth Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 44: Europe Telehealth Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 45: Europe Telehealth Market Value Share Analysis, By Component, 2024 and 2035

Figure 46: Europe Telehealth Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 47: Europe Telehealth Market Value Share Analysis, By Delivery Mode, 2024 and 2035

Figure 48: Europe Telehealth Market Attractiveness Analysis, By Delivery Mode, 2025 to 2035

Figure 49: Europe Telehealth Market Value Share Analysis, By Application, 2024 and 2035

Figure 50: Europe Telehealth Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 51: Europe Telehealth Market Value Share Analysis, By End-user, 2024 and 2035

Figure 52: Europe Telehealth Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 53: Asia Pacific Telehealth Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 54: Asia Pacific Telehealth Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 55: Asia Pacific Telehealth Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 56: Asia Pacific Telehealth Market Value Share Analysis, By Component, 2024 and 2035

Figure 57: Asia Pacific Telehealth Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 58: Asia Pacific Telehealth Market Value Share Analysis, By Delivery Mode, 2024 and 2035

Figure 59: Asia Pacific Telehealth Market Attractiveness Analysis, By Delivery Mode, 2025 to 2035

Figure 60: Asia Pacific Telehealth Market Value Share Analysis, By Application, 2024 and 2035

Figure 61: Asia Pacific Telehealth Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 62: Asia Pacific Telehealth Market Value Share Analysis, By End-user, 2024 and 2035

Figure 63: Asia Pacific Telehealth Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 64: Latin America Telehealth Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 65: Latin America Telehealth Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 66: Latin America Telehealth Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 67: Latin America Telehealth Market Value Share Analysis, By Component, 2024 and 2035

Figure 68: Latin America Telehealth Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 69: Latin America Telehealth Market Value Share Analysis, By Delivery Mode, 2024 and 2035

Figure 70: Latin America Telehealth Market Attractiveness Analysis, By Delivery Mode, 2025 to 2035

Figure 71: Latin America Telehealth Market Value Share Analysis, By Application, 2024 and 2035

Figure 72: Latin America Telehealth Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 73: Latin America Telehealth Market Value Share Analysis, By End-user, 2024 and 2035

Figure 74: Latin America Telehealth Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 75: Middle East & Africa Telehealth Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 76: Middle East & Africa Telehealth Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 77: Middle East & Africa Telehealth Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 78: Middle East & Africa Telehealth Market Value Share Analysis, By Component, 2024 and 2035

Figure 79: Middle East & Africa Telehealth Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 80: Middle East & Africa Telehealth Market Value Share Analysis, By Delivery Mode, 2024 and 2035

Figure 81: Middle East & Africa Telehealth Market Attractiveness Analysis, By Delivery Mode, 2025 to 2035

Figure 82: Middle East & Africa Telehealth Market Value Share Analysis, By Application, 2024 and 2035

Figure 83: Middle East & Africa Telehealth Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 84: Middle East & Africa Telehealth Market Value Share Analysis, By End-user, 2024 and 2035

Figure 85: Middle East & Africa Telehealth Market Attractiveness Analysis, By End-user, 2025 to 2035