Reports

Reports

The global satellite IoT market is strongly affected by the coronavirus breakdown. The rapidly spreading COVID-19 cases across the globe are impacting on the global economy. Many developed nations have imposed strict lockdowns and ban on gatherings. Some businesses and manufacturing industries are temporarily closed, resulting in adverse effect on revenue growth. Manufacturers operating in the satellite IoT market have adopted innovative strategies to increase growth opportunities. In order to deal with uncertainties and to overcome challenges due to global financial crisis, service providers in the satellite IoT market are trying to re-establish their businesses with the help of advanced technological solutions. The increasing adoption of satellite IoT services in various end-use industries is driving the global market after the pandemic.

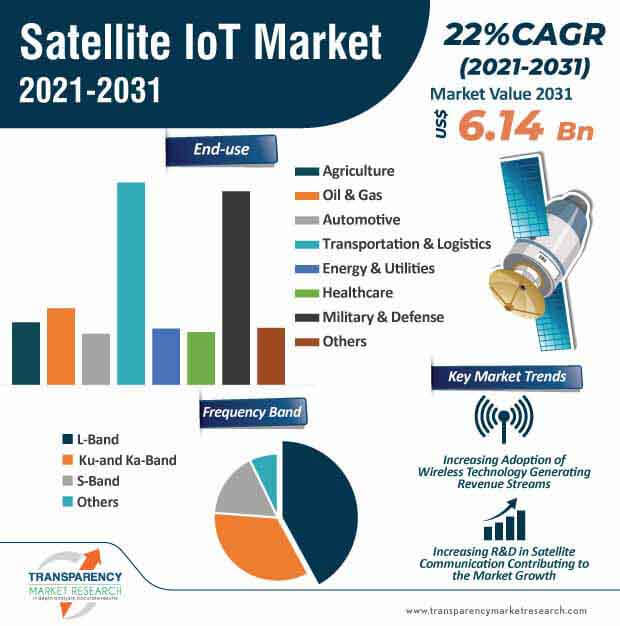

The satellite IoT market is expected to cross US$ 6.14 Bn by 2031. The global satellite IoT market is projected to expand at a rapid pace during the forecast period, due to advancements in technologies across the globe. For intelligent data conversions, many businesses use satellite IoT services to track and monitor assets. It is a complex network of Internet services over satellite connections. Satellite IoT is used to provide security to different in various end-use industries by connecting with sensors and actuators to the Internet. Growth and advancement in wireless technology are factors driving the global satellite IoT market. In order to go beyond the limit of terrestrial infrastructure of the cellular technology, satellite IoT services are extremely beneficial. Satellite communication supports IoT applications in areas where cellular connectivity is not possible, such as deep sea, remote sites, and mining locations.

The increasing adoption of satellite IoT services can be found in various industry verticals such as agriculture, healthcare, automobile, energy & utilities, oil & gas, military & defense, etc., creating value-grab opportunities for the market players. Due to the increasing efficiency to connect, monitor, and track assets in real time, many organizations and businesses are relying on satellite IoT services. The rising demand for better interaction and communication with the physical environment with the help of the smart technology is likely to boost the growth of the satellite IoT market during the forecast period. Safe logistic demands in various remote operations in different industries accelerate the demand for satellite IoT services. Heavy equipment manufacturing companies also remotely monitor their assets with the help of the satellite communication technology and give coverage on service & maintenance-related information in real time.

Iridium Communication, ORBCOMM, Inc., Inmarsat Global Limited, Global-star, and Airbus are some of the key players operating in the global satellite IoT market. The increasing competition among these players create better opportunities for the growth of the satellite IoT market. Market players are adopting technological advancements in IoT, which contribute to market expansion. Service providers in the satellite IoT market are focusing on overcoming challenges in the market. North America is expected to boost market growth, due to increasing adoption of satellite services in various industries such as transport and logistics, oil & gas, etc. to enhance productivity and reduce losses. Market contributors are focusing on low-cost and affordable satellite IoT services to cover the major areas of the planet.

Analysts’ Viewpoint

Due to rising applications of satellite IoT services in various end-use industries, there are lucrative opportunities for service providers to increase revenue streams. Market stakeholders are extending their services to gain a competitive edge after the COVID-19 pandemic. Industrial growth, increasing adoption of satellite communication for tracking and managing remote operations in various end-use industries such as oil & gas, agriculture, healthcare, etc. are expected to drive the satellite IoT market in the upcoming years. However, market contributors should focus on overcoming challenges in the global market through strategic approaches.

|

Attribute |

Detail |

|

Market Size Value in 2020 (Base Year) |

US$ 737 Mn |

|

Market Forecast Value in 2031 |

US$ 6.14 Bn |

|

Growth Rate (CAGR) |

22% |

|

Forecast Period |

2021–2031 |

|

Quantitative Units |

US$ Mn for Value & Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, porters five forces analysis, supply chain analysis, parent industry overview, etc. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) or word + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

Satellite IoT Market To Surpass Valuation Of US$ 6.14 Bn By 2031.

The global satellite IoT market is estimated to expand at a CAGR of 22% from 2021 to 2031.

Increase in demand for connected devices for real-time monitoring and rise in deployment of satellites for terrestrial networks are major factors projected to drive the demand for satellite IoT during the forecast period.

In terms of end-use, the transportation & logistics segment held the largest market share of 27.16% in 2020. Satellite IoT is used in various industries to track parcels or consignments. Use of IoT in the agriculture sector is also rising at a rapid rate, owing to various benefits of real-time monitoring.

Key players operating in the global satellite IoT market are ORBCOMM, Inc., Iridium Communication, Globalstar, Inc., Inmarsat Global Limited, Astrocast, Airbus S.A.S, Intelsat Corporation, Thales Group, Swarm Technologies (Space X), Eutelsat Communication SA, Alen Space, OQ Technology, Swarm Technologies, Northrop Grumman, Thuraya Telecommunication, Verizon Communications, Virgin Galactic, and Vodafone Group plc.

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

2. Assumptions and Research Methodology

2.1. Research Methodology

2.2. Assumption and Acronyms

3. Executive Summary

3.1. Global Satellite IoT Market Analysis and Forecast

3.2. Market Dynamics Snapshot

3.3. Competition Blueprint

4. Market Overview

4.1. Definition’s

4.2. Technology Roadmap Analysis

4.3. Forecast Factors

4.4. Market Dynamics

4.4.1. Supply Side Drivers

4.4.2. Demand Side Drivers

4.4.3. Restraints and Opportunities

4.5. Ecosystem

4.6. COVID-19 Impact Analysis

4.7. Market Opportunity Assessment

4.8. Analysis of Global Satellite IoT/M2M Devises (Million Units), 2017‒2031

4.9. Competitive Scenario

5. Global Satellite IoT Market Analysis, by Service Type

5.1. Satellite IoT Market Size (US$ Mn) Analysis & Forecast, by Service Type, 2017‒2031

5.1.1. Sat-IoT Backhaul Services

5.1.2. Direct to Satellite Services

5.2. Market Attractiveness Analysis, by Service Type

6. Global Satellite IoT Market Analysis, by Frequency Band

6.1. Satellite IoT Market Size (US$ Mn) Analysis & Forecast, by Frequency Band, 2017‒2031

6.1.1. L-Band

6.1.2. Ku and Ka -Band

6.1.3. S-Band

6.1.4. Others

6.2. Market Attractiveness Analysis, by Frequency Band

7. Global Satellite IoT Market Analysis, by End-use

7.1. Satellite IoT Market Size (US$ Mn) Analysis & Forecast, by End-use, 2017‒2031

7.1.1. Agriculture

7.1.2. Oil & Gas

7.1.3. Automotive

7.1.4. Transportation & Logistics

7.1.5. Energy & Utilities

7.1.6. Healthcare

7.1.7. Military & Defense

7.1.8. Others

7.2. Market Attractiveness Analysis, by End-use

8. Global Satellite IoT Market Analysis and Forecast, by Region

8.1. Satellite IoT Market Size (US$ Mn) Analysis & Forecast, by Region, 2017‒2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Market Attractiveness Analysis, by Region

9. North America Satellite IoT Market Analysis and Forecast

9.1. Market Snapshot

9.2. Key Trends Analysis

9.3. Drivers and Restraints: Impact Analysis

9.4. Pricing Analysis

9.5. Key Regulations

9.6. Satellite IoT Market Size (US$ Mn) Analysis & Forecast, by Service Type, 2017‒2031

9.6.1. Sat-IoT Backhaul Services

9.6.2. Direct to Satellite Services

9.7. Satellite IoT Market Size (US$ Mn) Analysis & Forecast, by Frequency Band, 2017‒2031

9.7.1. L-Band

9.7.2. Ku- and Ka -Band

9.7.3. S-Band

9.7.4. Others

9.8. Satellite IoT Market Size (US$ Mn) Analysis & Forecast, by End-use, 2017‒2031

9.8.1. Agriculture

9.8.2. Oil & Gas

9.8.3. Automotive

9.8.4. Transportation & Logistics

9.8.5. Energy & Utilities

9.8.6. Healthcare

9.8.7. Military & Defense

9.8.8. Others

9.9. Satellite IoT Market Size (US$ Mn) Analysis & Forecast, by Country & Sub-region, 2017‒2031

9.9.1. U.S.

9.9.2. Canada

9.9.3. Rest of North America

9.10. Market Attractiveness Analysis

9.10.1. By Service Type

9.10.2. By Frequency Band

9.10.3. By End-use

9.10.4. By Country & Sub-region

10. Europe Satellite IoT Market Analysis and Forecast

10.1. Market Snapshot

10.2. Key Trends Analysis

10.3. Drivers and Restraints: Impact Analysis

10.4. Pricing Analysis

10.5. Key Regulations

10.6. Satellite IoT Market Size (US$ Mn) Analysis & Forecast, by Service Type, 2017‒2031

10.6.1. Sat-IoT Backhaul Services

10.6.2. Direct to Satellite Services

10.7. Satellite IoT Market Size (US$ Mn) Analysis & Forecast, by Frequency Band, 2017‒2031

10.7.1. L-Band

10.7.2. Ku- and Ka -Band

10.7.3. S-Band

10.7.4. Others

10.8. Satellite IoT Market Size (US$ Mn) Analysis & Forecast, by End-use, 2017‒2031

10.8.1. Agriculture

10.8.2. Oil & Gas

10.8.3. Automotive

10.8.4. Transportation & Logistics

10.8.5. Energy & Utilities

10.8.6. Healthcare

10.8.7. Military & Defense

10.8.8. Others

10.9. Satellite IoT Market Size (US$ Mn) Analysis & Forecast, by Country & Sub-region, 2017‒2031

10.9.1. U.K.

10.9.2. Germany

10.9.3. France

10.9.4. Italy

10.9.5. Russia

10.9.6. Rest of Europe

10.10. Market Attractiveness Analysis

10.10.1. By Service Type

10.10.2. By Frequency Band

10.10.3. By End-use

10.10.4. By Country & Sub-region

11. Asia Pacific Satellite IoT Market Analysis and Forecast

11.1. Market Snapshot

11.2. Key Trends Analysis

11.3. Drivers and Restraints: Impact Analysis

11.4. Pricing Analysis

11.5. Key Regulations

11.6. Satellite IoT Market Size (US$ Mn) Analysis & Forecast, by Service Type, 2017‒2031

11.6.1. Sat-IoT Backhaul Services

11.6.2. Direct to Satellite Services

11.7. Satellite IoT Market Size (US$ Mn) Analysis & Forecast, by Frequency Band, 2017‒2031

11.7.1. L-Band

11.7.2. Ku- and Ka -Band

11.7.3. S-Band

11.7.4. Others

11.8. Satellite IoT Market Size (US$ Mn) Analysis & Forecast, by End-use, 2017‒2031

11.8.1. Agriculture

11.8.2. Oil & Gas

11.8.3. Automotive

11.8.4. Transportation & Logistics

11.8.5. Energy & Utilities

11.8.6. Healthcare

11.8.7. Military & Defense

11.8.8. Others

11.9. Satellite IoT Market Size (US$ Mn) Analysis & Forecast, by Country & Sub-region, 2017‒2031

11.9.1. China

11.9.2. India

11.9.3. Japan

11.9.4. South Korea

11.9.5. ASEAN

11.9.6. Rest of Asia Pacific

11.10. Market Attractiveness Analysis

11.10.1. By Service Type

11.10.2. By Frequency Band

11.10.3. By End-use

11.10.4. By Country & Sub-region

12. Middle East & Africa (MEA) Satellite IoT Market Analysis and Forecast

12.1. Market Snapshot

12.2. Key Trends Analysis

12.3. Drivers and Restraints: Impact Analysis

12.4. Pricing Analysis

12.5. Key Regulations

12.6. Satellite IoT Market Size (US$ Mn) Analysis & Forecast, by Service Type, 2017‒2031

12.6.1. Sat-IoT Backhaul Services

12.6.2. Direct to Satellite Services

12.7. Satellite IoT Market Size (US$ Mn) Analysis & Forecast, by Frequency Band, 2017‒2031

12.7.1. L-Band

12.7.2. Ku- and Ka -Band

12.7.3. S-Band

12.7.4. Others

12.8. Satellite IoT Market Size (US$ Mn) Analysis & Forecast, by End-use, 2017‒2031

12.8.1. Agriculture

12.8.2. Oil & Gas

12.8.3. Automotive

12.8.4. Transportation & Logistics

12.8.5. Energy & Utilities

12.8.6. Healthcare

12.8.7. Military & Defense

12.8.8. Others

12.9. Satellite IoT Market Size (US$ Mn) Analysis & Forecast, by Country & Sub-region, 2017‒2031

12.9.1. GCC

12.9.2. South Africa

12.9.3. North Africa

12.9.4. Rest of Middle East & Africa

12.10. Market Attractiveness Analysis

12.10.1. By Service Type

12.10.2. By Frequency Band

12.10.3. By End-use

12.10.4. By Country & Sub-region

13. South America Satellite IoT Market Analysis and Forecast

13.1. Market Snapshot

13.2. Key Trends Analysis

13.3. Drivers and Restraints: Impact Analysis

13.4. Pricing Analysis

13.5. Key Regulations

13.6. Satellite IoT Market Size (US$ Mn) Analysis & Forecast, by Service Type, 2017‒2031

13.6.1. Sat-IoT Backhaul Services

13.6.2. Direct to Satellite Services

13.7. Satellite IoT Market Size (US$ Mn) Analysis & Forecast, by Frequency Band, 2017‒2031

13.7.1. L-Band

13.7.2. Ku- and Ka -Band

13.7.3. S-Band

13.7.4. Others

13.8. Satellite IoT Market Size (US$ Mn) Analysis & Forecast, by End-use, 2017‒2031

13.8.1. Agriculture

13.8.2. Oil & Gas

13.8.3. Automotive

13.8.4. Transportation & Logistics

13.8.5. Energy & Utilities

13.8.6. Healthcare

13.8.7. Military & Defense

13.8.8. Others

13.9. Satellite IoT Market Size (US$ Mn) Analysis & Forecast, by Country & Sub-region, 2017‒2031

13.9.1. Brazil

13.9.2. Argentina

13.9.3. Rest of South America

13.10. Market Attractiveness Analysis

13.10.1. By Service Type

13.10.2. By Frequency Band

13.10.3. By End-use

13.10.4. By Country & Sub-region

14. Competition Assessment

14.1. Global Satellite IoT Market Competition Matrix - a Dashboard View

14.1.1. Global Satellite IoT Market Company Share Analysis, by Value (2020)

14.1.2. Technological Differentiator

15. Company Profiles (Manufacturers/Suppliers)

15.1. ORBCOMM Inc.

15.1.1. Overview

15.1.2. Product Portfolio

15.1.3. Sales Footprint

15.1.4. Strategy and Recent Developments

15.1.5. Key Financial

15.2. Iridium Communication

15.2.1. Overview

15.2.2. Product Portfolio

15.2.3. Sales Footprint

15.2.4. Strategy and Recent Developments

15.2.5. Key Financial

15.3. Globalstar

15.3.1. Overview

15.3.2. Product Portfolio

15.3.3. Sales Footprint

15.3.4. Strategy and Recent Developments

15.3.5. Key Financial

15.4. Inmarsat Global Limited

15.4.1. Overview

15.4.2. Product Portfolio

15.4.3. Sales Footprint

15.4.4. Strategy and Recent Developments

15.4.5. Key Financial

15.5. Astrocast

15.5.1. Overview

15.5.2. Product Portfolio

15.5.3. Sales Footprint

15.5.4. Strategy and Recent Developments

15.5.5. Key Financial

15.6. Airbus S.A.S

15.6.1. Overview

15.6.2. Product Portfolio

15.6.3. Sales Footprint

15.6.4. Strategy and Recent Developments

15.6.5. Key Financial

15.7. Intelsat Corporation

15.7.1. Overview

15.7.2. Product Portfolio

15.7.3. Sales Footprint

15.7.4. Strategy and Recent Developments

15.7.5. Key Financial

15.8. Thales Group

15.8.1. Overview

15.8.2. Product Portfolio

15.8.3. Sales Footprint

15.8.4. Strategy and Recent Developments

15.8.5. Key Financial

15.9. Swarm Technologies (Space X)

15.9.1. Overview

15.9.2. Product Portfolio

15.9.3. Sales Footprint

15.9.4. Strategy and Recent Developments

15.9.5. Key Financial

15.10. Eutelsat Communication SA

15.10.1. Overview

15.10.2. Product Portfolio

15.10.3. Sales Footprint

15.10.4. Strategy and Recent Developments

15.10.5. Key Financial

15.11. Alen Space

15.11.1. Overview

15.11.2. Product Portfolio

15.11.3. Sales Footprint

15.11.4. Strategy and Recent Developments

15.11.5. Key Financial

15.12. OQ Technology

15.12.1. Overview

15.12.2. Product Portfolio

15.12.3. Sales Footprint

15.12.4. Strategy and Recent Developments

15.12.5. Key Financial

15.13. Swarm Technologies

15.13.1. Overview

15.13.2. Product Portfolio

15.13.3. Sales Footprint

15.13.4. Strategy and Recent Developments

15.13.5. Key Financial

15.14. Northrop Grumman

15.14.1. Overview

15.14.2. Product Portfolio

15.14.3. Sales Footprint

15.14.4. Strategy and Recent Developments

15.14.5. Key Financial

15.15. Thuraya Telecommunication

15.15.1. Overview

15.15.2. Product Portfolio

15.15.3. Sales Footprint

15.15.4. Strategy and Recent Developments

15.15.5. Key Financial

15.16. Verizon Communications

15.16.1. Overview

15.16.2. Product Portfolio

15.16.3. Sales Footprint

15.16.4. Strategy and Recent Developments

15.16.5. Key Financial

15.17. Virgin Galactic

15.17.1. Overview

15.17.2. Product Portfolio

15.17.3. Sales Footprint

15.17.4. Strategy and Recent Developments

15.17.5. Key Financial

15.18. Vodafone Group plc

15.18.1. Overview

15.18.2. Product Portfolio

15.18.3. Sales Footprint

15.18.4. Strategy and Recent Developments

15.18.5. Key Financial

16. Key Takeaways

16.1. Opportunity Assessment

16.1.1. By Service Type

16.1.2. By Frequency Band

16.1.3. By End-use

16.1.4. By Region

List of Tables

Table 01: Global Satellite IoT Market Value (US$ Mn) Forecast, by Service Type, Value (US$ Mn), 2017‒2031

Table 02: Global Satellite IoT Market Value (US$ Mn) Forecast, by Frequency Band, Value (US$ Mn), 2017‒2031

Table 03: Global Satellite IoT Market Value (US$ Mn) Forecast, by End-use, Value (US$ Mn), 2017‒2031

Table 04: Global Satellite IoT Market Value (US$ Mn) Forecast, by Region, Value (US$ Mn), 2017‒2031

Table 05: North America Satellite IoT Market Value (US$ Mn) Forecast, by Service type, Value (US$ Mn), 2017‒2031

Table 06: North America Satellite IoT Market Value (US$ Mn) Forecast, by Frequency Band, Value (US$ Mn), 2017‒2031

Table 07: North America Satellite IoT Market Value (US$ Mn) Forecast, by End-use, Value (US$ Mn), 2017‒2031

Table 08: North America Satellite IoT Market Value (US$ Mn) Forecast, by Country, Value (US$ Mn), 2017‒2031

Table 09: Asia Pacific Satellite IoT Market Value (US$ Mn) Forecast, by Service type, Value (US$ Mn), 2017‒2031

Table 10: Asia Pacific Satellite IoT Market Value (US$ Mn) Forecast, by Frequency Band, Value (US$ Mn), 2017‒2031

Table 11: Asia Pacific Satellite IoT Market Value (US$ Mn) Forecast, by End-use, Value (US$ Mn), 2017‒2031

Table 12: Asia Pacific Satellite IoT Market Value (US$ Mn) Forecast, by Country, Value (US$ Mn), 2017‒2031

Table 13: Europe Satellite IoT Market Value (US$ Mn) Forecast, by Service type, Value (US$ Mn), 2017‒2031

Table 14: Europe Satellite IoT Market Value (US$ Mn) Forecast, by Frequency Band, Value (US$ Mn), 2017‒2031

Table 15: Europe Satellite IoT Market Value (US$ Mn) Forecast, by End-use, Value (US$ Mn), 2017‒2031

Table 16: Europe Satellite IoT Market Value (US$ Mn) Forecast, by Country, Value (US$ Mn), 2017‒2031

Table 17: Middle East & Africa Satellite IoT Market Value (US$ Mn) Forecast, by Service type, Value (US$ Mn), 2017‒2031

Table 18: Middle East & Africa Satellite IoT Market Value (US$ Mn) Forecast, by Frequency Band, Value (US$ Mn), 2017‒2031

Table 19: Middle East & Africa Satellite IoT Market Value (US$ Mn) Forecast, by End-use, Value (US$ Mn), 2017‒2031

Table 20: Middle East & Africa Satellite IoT Market Value (US$ Mn) Forecast, by Country, Value (US$ Mn), 2017‒2031

Table 21: South America Satellite IoT Market Value (US$ Mn) Forecast, by Service type, Value (US$ Mn), 2017‒2031

Table 22: South America Satellite IoT Market Value (US$ Mn) Forecast, by Frequency Band, Value (US$ Mn), 2017‒2031

Table 23: South America Satellite IoT Market Value (US$ Mn) Forecast, by End-use, Value (US$ Mn), 2017‒2031

Table 24: South America Satellite IoT Market Value (US$ Mn) Forecast, by Country, Value (US$ Mn), 2017‒2031

List of Figures

Figure 01: Global Satellite IoT Market, Value (US$ Mn), 2017‒2031

Figure 02: Global Satellite IoT Market, Value (US$ Mn), Y-o-Y Growth, 2017‒2031

Figure 03: Global Satellite IoT Market Size & Forecast, by Service Type, Revenue (US$ Mn), 2017‒2031

Figure 04: Global Satellite IoT Market Attractiveness, by Service Type, Value (US$ Mn), 2021-2031

Figure 05: Global Satellite IoT Market Share Analysis, by Service Type, 2021 and 2031

Figure 07: Global Satellite IoT Market Size & Forecast, by Frequency Band, Revenue (US$ Mn), 2017‒2031

Figure 08: Global Satellite IoT Market Attractiveness, by Frequency Band, Value (US$ Mn), 2021-2031

Figure 09: Global Satellite IoT Market Share Analysis, by Frequency Band, 2021 and 2031

Figure 10: Global Satellite IoT Market Size & Forecast, by End-use, Revenue (US$ Mn), 2017‒2031

Figure 11: Global Satellite IoT Market Attractiveness, by End-use, Value (US$ Mn), 2021-2031

Figure 12: Global Satellite IoT Market Share Analysis, by End-use, 2021 and 2031

Figure 13: Global Satellite IoT Market Size & Forecast, by Region, Revenue (US$ Mn), 2017‒2031

Figure 14: Global Satellite IoT Market Attractiveness, by Region, Value (US$ Mn), 2021-2031

Figure 15: Global Satellite IoT Market Share Analysis, by Region, 2021 and 2031

Figure 16: North America Satellite IoT Market, Value (US$ Mn), 2017‒2031

Figure 17: North America Satellite IoT Market, Value (US$ Mn), 2017‒2031 (YoY Growth)

Figure 18: North America Satellite IoT Market Size & Forecast, by Service Type, Revenue (US$ Mn), 2017‒2031

Figure 19: North America Satellite IoT Market Attractiveness, by Service Type, Value (US$ Mn), 2021-2031

Figure 20: North America Satellite IoT Market Share Analysis, by Service Type, 2021 and 2031

Figure 21: North America Satellite IoT Market Size & Forecast, by Frequency Band, Revenue (US$ Mn), 2017‒2031

Figure 22: North America Satellite IoT Market Attractiveness, by Frequency Band, Value (US$ Mn), 2021-2031

Figure 23: North America Satellite IoT Market Share Analysis, by Frequency Band, 2021 and 2031

Figure 24: North America Satellite IoT Market Size & Forecast, by End-use, Revenue (US$ Mn), 2017‒2031

Figure 25: North America Satellite IoT Market Attractiveness, by End-use, Value (US$ Mn), 2021-2031

Figure 26: North America Satellite IoT Market Share Analysis, by End-use, 2021 and 2031

Figure 27: North America Satellite IoT Market Size & Forecast, by Country, Revenue (US$ Mn), 2017‒2031

Figure 28: North America Satellite IoT Market Attractiveness, by Country, Value (US$ Mn), 2021-2031

Figure 29: North America Satellite IoT Market Share Analysis, by Country, 2021 and 2031

Figure 30: Europe Satellite IoT Market, Value (US$ Mn), 2017‒2031

Figure 31: Europe Satellite IoT Market, Value (US$ Mn), 2017‒2031 (YoY Growth)

Figure 32: Europe Satellite IoT Market Size & Forecast, by Service Type, Revenue (US$ Mn), 2017‒2031

Figure 33: Europe Satellite IoT Market Attractiveness, by Service Type, Value (US$ Mn), 2021-2031

Figure 34: Europe Satellite IoT Market Share Analysis, by Service Type, 2021 and 2031

Figure 35: Europe Satellite IoT Market Size & Forecast, by Frequency Band, Revenue (US$ Mn), 2017‒2031

Figure 36: Europe Satellite IoT Market Attractiveness, by Frequency Band, Value (US$ Mn), 2021-2031

Figure 37: Europe Satellite IoT Market Share Analysis, by Frequency Band, 2021 and 2031

Figure 38: Europe Satellite IoT Market Size & Forecast, by End-use, Revenue (US$ Mn), 2017‒2031

Figure 39: Europe Satellite IoT Market Attractiveness, by End-use, Value (US$ Mn), 2021-2031

Figure 40: Europe Satellite IoT Market Share Analysis, by End-use, 2021 and 2031

Figure 41: Europe Satellite IoT Market Size & Forecast, by Country, Revenue (US$ Mn), 2017‒2031

Figure 42: Europe Satellite IoT Market Attractiveness, by Country, Value (US$ Mn), 2021-2031

Figure 43: Europe Satellite IoT Market Share Analysis, by Country, 2021 and 2031

Figure 44: Asia Pacific Satellite IoT Market, Value (US$ Mn), 2017‒2031

Figure 45: Asia Pacific Satellite IoT Market, Value (US$ Mn), 2017‒2031 (YoY Growth)

Figure 46: Asia Pacific Satellite IoT Market Size & Forecast, by Service Type, Revenue (US$ Mn), 2017‒2031

Figure 47: Asia Pacific Satellite IoT Market Attractiveness, by Service Type, Value (US$ Mn), 2021-2031

Figure 48: Asia Pacific Satellite IoT Market Share Analysis, by Service Type, 2021 and 2031

Figure 49: Asia Pacific Satellite IoT Market Size & Forecast, by Frequency Band, Revenue (US$ Mn), 2017‒2031

Figure 50: Asia Pacific Satellite IoT Market Attractiveness, by Frequency Band, Value (US$ Mn), 2021-2031

Figure 51: Asia Pacific Satellite IoT Market Share Analysis, by Frequency Band, 2021 and 2031

Figure 52: Asia Pacific Satellite IoT Market Size & Forecast, by End-use, Revenue (US$ Mn), 2017‒2031

Figure 53: Asia Pacific Satellite IoT Market Attractiveness, by End-use, Value (US$ Mn), 2021-2031

Figure 54: Asia Pacific Satellite IoT Market Share Analysis, by End-use, 2021 and 2031

Figure 55: Asia Pacific Satellite IoT Market Size & Forecast, by Country, Revenue (US$ Mn), 2017‒2031

Figure 56: Asia Pacific Satellite IoT Market Attractiveness, by Country, Value (US$ Mn), 2021-2031

Figure 57: Asia Pacific Satellite IoT Market Share Analysis, by Country, 2021 and 2031

Figure 58: Middle East & Africa Satellite IoT Market, Value (US$ Mn), 2017‒2031

Figure 59: Middle East & Africa Satellite IoT Market, Value (US$ Mn), 2017‒2031 (YoY Growth)

Figure 60: Middle East & Africa Satellite IoT Market Size & Forecast, by Service Type, Revenue (US$ Mn), 2017‒2031

Figure 61: Middle East & Africa Satellite IoT Market Attractiveness, by Service Type, Value (US$ Mn), 2021-2031

Figure 62: Middle East & Africa Satellite IoT Market Share Analysis, by Service Type, 2021 and 2031

Figure 63: Middle East & Africa Satellite IoT Market Size & Forecast, by Frequency Band, Revenue (US$ Mn), 2017‒2031

Figure 64: Middle East & Africa Satellite IoT Market Attractiveness, by Frequency Band, Value (US$ Mn), 2021-2031

Figure 65: Middle East & Africa Satellite IoT Market Share Analysis, by Frequency Band, 2021 and 2031

Figure 66: Middle East & Africa Satellite IoT Market Size & Forecast, by End-use, Revenue (US$ Mn), 2017‒2031

Figure 67: Middle East & Africa Satellite IoT Market Attractiveness, by End-use, Value (US$ Mn), 2021-2031

Figure 68: Middle East & Africa Satellite IoT Market Share Analysis, by End-use, 2021 and 2031

Figure 69: Middle East & Africa Satellite IoT Market Size & Forecast, by Country, Revenue (US$ Mn), 2017‒2031

Figure 70: Middle East & Africa Satellite IoT Market Attractiveness, by Country, Value (US$ Mn), 2021-2031

Figure 71: Middle East & Africa Satellite IoT Market Share Analysis, by Country, 2021 and 2031

Figure 72: South America Satellite IoT Market, Value (US$ Mn), 2017‒2031

Figure 73: South America Satellite IoT Market, Value (US$ Mn), 2017‒2031 (YoY Growth)

Figure 74: South America Satellite IoT Market Size & Forecast, by Service Type, Revenue (US$ Mn), 2017‒2031

Figure 75: South America Satellite IoT Market Attractiveness, by Service Type, Value (US$ Mn), 2021-2031

Figure 76: South America Satellite IoT Market Share Analysis, by Service Type, 2021 and 2031

Figure 77: South America Satellite IoT Market Size & Forecast, by Frequency Band, Revenue (US$ Mn), 2017‒2031

Figure 78: South America Satellite IoT Market Attractiveness, by Frequency Band, Value (US$ Mn), 2021-2031

Figure 79: South America Satellite IoT Market Share Analysis, by Frequency Band, 2021 and 2031

Figure 80: South America Satellite IoT Market Size & Forecast, by End-use, Revenue (US$ Mn), 2017‒2031

Figure 81: South America Satellite IoT Market Attractiveness, by End-use, Value (US$ Mn), 2021-2031

Figure 82: South America Satellite IoT Market Share Analysis, by End-use, 2021 and 2031

Figure 83: South America Satellite IoT Market Size & Forecast, by Country, Revenue (US$ Mn), 2017‒2031

Figure 84: South America Satellite IoT Market Attractiveness, by Country, Value (US$ Mn), 2021-2031

Figure 85: South America Satellite IoT Market Share Analysis, by Country, 2021 and 2031

Figure 86: Global Satellite IoT Satellite IoT Market Share Analysis, by Company