Reports

Reports

Analysts’ Viewpoint on Market Scenario

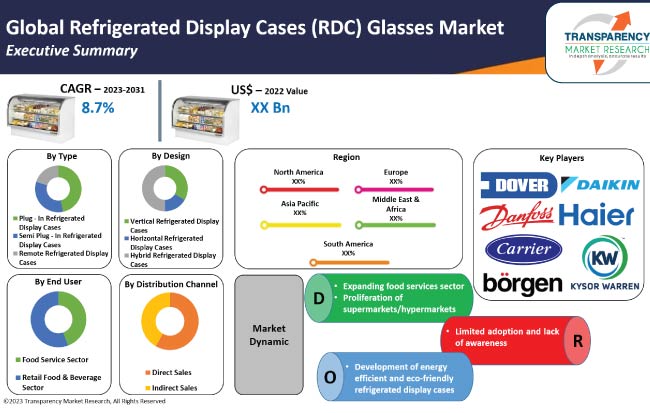

Proliferation of supermarkets/hypermarkets, and an expanding food services sector are the key factors expected to drive refrigerated display cases (RDC) glasses market development in the near future.

Need for high quality, energy efficient, and eco-friendly refrigerated display cases is increasing. These cases accommodate a wide range of products while maintaining optimal temperature control. Refrigerated display cases (RDC) glasses market players are constantly developing new technologies and designs to meet the evolving demands of retail giants.

Demand for these products is expected to continue to rise in the next few years. The rise in number of restaurants, cafes, and other food establishments bolsters the demand for attractive refrigerated glass cases that can keep food items safe and fresh.

Products that store and display chilled and/or frozen foods are known as refrigerator display cases. Foods and beverages are kept at cold or frozen temperatures in refrigerator display cases.

The different designs of glass display cases for refrigerated storage enable the customer to view the foodstuff stored in the cabinet, either through an opening in the case, or through a transparent door or lid. Forced air and gravity coil are the types of refrigerated display cases (RDC) glasses, based on system. Compared to other refrigeration and display devices, installing refrigerated glass display cases can significantly reduce energy and electricity consumption.

Refrigerated display cases are essential for food service establishments to display their products in an attractive and effective manner. These cases are used to store and display products such as sandwiches, pizzas, salads, and pastries that require refrigeration and a long shelf life. The refrigerated display cases (RDC) glasses industry growth is on the rise as the food services sector continues to expand.

Food retailing and food service industries supplied roughly US$ 2.1 Trillion worth of food in 2021, as per the U.S. Department of Agriculture. Because of a smaller comparable base in August 2021 and mild price increase for food, the China foodservice industry grew by 8.4% in August 2022. Retail sales of food increased by 7.8% year over year, and in August, sales of food alone outperformed sales of drinks.

The cases are available in different shapes, sizes, and colors, and are designed to meet the needs of the food services sector. Increase in the number of food service establishments is projected to further boost the refrigerated display cases (RDC) glasses market demand in the coming years.

The proliferation of supermarkets and hypermarkets over the past few decades has been a boon for the global refrigerated display cases glasses industry. Refrigerated display cases have become increasingly popular for supermarkets and hypermarkets as they provide a convenient way to display a variety of food items while keeping them fresh and safe for customers.

Applications of refrigerated display cases (RDC) glasses is mainly to display fruits, vegetables, meat, fish, poultry, dairy, and deli items, also allowing supermarkets and hypermarkets to make the best use of their space. Refrigerated display cases can further be customized to fit the needs of a particular store. Demand for refrigerated display cases is likely to remain strong due to the proliferation of supermarkets and hypermarkets, thus boosting the refrigerated display cases (RDC) glasses market growth.

Asia Pacific is expected to hold the largest refrigerated display cases glasses market share during the forecast period. The market is witnessing a rise in demand for hybrid display cases, which are used for both frozen and refrigerated foods. Moreover, government initiatives and subsidies to promote the adoption of energy-efficient equipment are expected to surge the demand for hybrid display cases in the region.

The refrigerated display cases (RDC) glasses market size in North America is anticipated to grow at the fastest rate during the forecast period. Surge in demand for organic and fresh food products and the increasing number of convenience stores and supermarkets being established in the region are contributing to the regional refrigerated display cases market growth.

The business model of prominent manufacturers includes investments in R&D, product expansions, and mergers and acquisitions. Product development is a major strategy of top players. The market is highly competitive, with the presence of various global and regional players.

Arneg S.p.A, Borgen Systems, Carrier Corporation, Daikin Industries, Danfoss A/S, Dover Corporation, Fagor Industries, Haier Group, Hussmann Corporation, and Kysor Warren are the prominent entities profiled in the refrigerated display cases (RDC) glasses market report.

Each of these players has been profiled in the refrigerated display cases (RDC) glasses market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 17.3 Bn |

|

Market Forecast Value in 2031 |

US$ 27.9 Bn |

|

Growth Rate (CAGR) |

8.7% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value & Units for Volume |

|

Market Analysis |

Includes cross segment analysis at regional as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 17.3 Bn in 2022

The CAGR is projected to be 8.7% from 2023 to 2031

Expanding food services sector and proliferation of supermarkets/hypermarkets

The hybrid refrigerated display cases segment accounted for significant share in 2022

Asia Pacific is expected to hold the largest share during the forecast period

Arneg S.p.A, Borgen Systems, Carrier Corporation, Daikin Industries, Danfoss A/S, Dover Corporation, Fagor Industries, Haier Group, Hussmann Corporation, and Kysor Warren

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.5. Raw Material Analysis

5.6. Porter’s Five Forces Analysis

5.7. Industry SWOT Analysis

5.8. Value Chain Analysis

5.9. COVID-19 Impact Analysis

5.10. Key Regulatory Framework

5.11. Technological Overview Analysis

5.12. Trade Analysis

5.13. Global Refrigerated Display Cases (RDC) Glasses Market Analysis and Forecast, 2017 - 2031

5.13.1. Market Value Projections (US$ Bn)

5.13.2. Market Volume Projections (Units)

6. Global Refrigerated Display Cases (RDC) Glasses Market Analysis and Forecast, By Type

6.1. Refrigerated Display Cases (RDC) Glasses Market Size (US$ Bn and Units) Forecast, By Type,2017 - 2031

6.1.1. Plug-in Refrigerated Display Cases

6.1.2. Semi Plug-in Refrigerated Display Cases

6.1.3. Remote Refrigerated Display Cases

6.2. Incremental Opportunity, By Type

7. Global Refrigerated Display Cases (RDC) Glasses Market Analysis and Forecast, By Design

7.1. Refrigerated Display Cases (RDC) Glasses Market Size (US$ Bn and Units) Forecast, Design, 2017 - 2031

7.1.1. Vertical Refrigerated Display Cases

7.1.2. Horizontal Refrigerated Display Cases

7.1.3. Hybrid Refrigerated Display Cases

7.2. Incremental Opportunity, By Design

8. Global Refrigerated Display Cases (RDC) Glasses Market Analysis and Forecast, By End-use

8.1. Refrigerated Display Cases (RDC) Glasses Market Size (US$ Bn and Units) Forecast, End-use, 2017 - 2031

8.1.1. Food Service Sector

8.1.1.1. Quick Service Restaurants

8.1.1.2. Hotels

8.1.1.3. Others

8.1.2. Retail Food & Beverage Sector

8.1.2.1. Fuel Station Stores

8.1.2.2. Hypermarkets

8.1.2.3. Supermarkets

8.2. Incremental Opportunity, By End-use

9. Global Refrigerated Display Cases (RDC) Glasses Market Analysis and Forecast, By Distribution Channel

9.1. Refrigerated Display Cases (RDC) Glasses Market Size (US$ Bn and Units) Forecast, By Distribution Channel, 2017 - 2031

9.1.1. Direct Sales

9.1.2. Indirect Sales

9.2. Incremental Opportunity, By Distribution Channel

10. Global Refrigerated Display Cases (RDC) Glasses Market Analysis and Forecast, By Region

10.1. Refrigerated Display Cases (RDC) Glasses Market Size (US$ Bn and Units) Forecast, By Region, 2017 - 2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Incremental Opportunity, By Region

11. North America Refrigerated Display Cases (RDC) Glasses Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Macroeconomics Scenario

11.3. Key Supplier Analysis

11.4. Price Trend Analysis

11.4.1. Weighted Average Price

11.5. Key Trends Analysis

11.5.1. Demand Side

11.5.2. Supplier Side

11.6. Refrigerated Display Cases (RDC) Glasses Market Size (US$ Bn and Units) Forecast, By Type,2017 - 2031

11.6.1. Plug-in Refrigerated Display Cases

11.6.2. Semi Plug-in Refrigerated Display Cases

11.6.3. Remote Refrigerated Display Cases

11.7. Refrigerated Display Cases (RDC) Glasses Market Size (US$ Bn and Units) Forecast, Design, 2017 - 2031

11.7.1. Vertical Refrigerated Display Cases

11.7.2. Horizontal Refrigerated Display Cases

11.7.3. Hybrid Refrigerated Display Cases

11.8. Refrigerated Display Cases (RDC) Glasses Market Size (US$ Bn and Units) Forecast, End-use, 2017 - 2031

11.8.1. Food Service Sector

11.8.1.1. Quick Service Restaurants

11.8.1.2. Hotels

11.8.1.3. Others

11.8.2. Retail Food & Beverage Sector

11.8.2.1. Fuel Station Stores

11.8.2.2. Hypermarkets

11.8.2.3. Supermarkets

11.9. Refrigerated Display Cases (RDC) Glasses Market Size (US$ Bn and Units) Forecast, By Distribution Channel, 2017 - 2031

11.9.1. Direct Sales

11.9.2. Indirect Sales

11.10. Refrigerated Display Cases (RDC) Glasses Market Size (US$ Bn and Units) Forecast, By Country/Sub-region, 2017 - 2031

11.10.1. U.S

11.10.2. Canada

11.10.3. Rest of North America

11.11. Incremental Opportunity Analysis

12. Europe Refrigerated Display Cases (RDC) Glasses Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Macroeconomics Scenario

12.3. Key Supplier Analysis

12.4. Price Trend Analysis

12.4.1. Weighted Average Price

12.5. Key Trends Analysis

12.5.1. Demand Side

12.5.2. Supplier Side

12.6. Refrigerated Display Cases (RDC) Glasses Market Size (US$ Bn and Units) Forecast, By Type,2017 - 2031

12.6.1. Plug-in Refrigerated Display Cases

12.6.2. Semi Plug-in Refrigerated Display Cases

12.6.3. Remote Refrigerated Display Cases

12.7. Refrigerated Display Cases (RDC) Glasses Market Size (US$ Bn and Units) Forecast, Design, 2017 - 2031

12.7.1. Vertical Refrigerated Display Cases

12.7.2. Horizontal Refrigerated Display Cases

12.7.3. Hybrid Refrigerated Display Cases

12.8. Refrigerated Display Cases (RDC) Glasses Market Size (US$ Bn and Units) Forecast, End-use, 2017 - 2031

12.8.1. Food Service Sector

12.8.1.1. Quick Service Restaurants

12.8.1.2. Hotels

12.8.1.3. Others

12.8.2. Retail Food & Beverage Sector

12.8.2.1. Fuel Station Stores

12.8.2.2. Hypermarkets

12.8.2.3. Supermarkets

12.9. Refrigerated Display Cases (RDC) Glasses Market Size (US$ Bn and Units) Forecast, By Distribution Channel, 2017 - 2031

12.9.1. Direct Sales

12.9.2. Indirect Sales

12.10. Refrigerated Display Cases (RDC) Glasses Market Size (US$ Bn and Units) Forecast, By Country/Sub-region, 2017 - 2031

12.10.1. U.K

12.10.2. Germany

12.10.3. France

12.10.4. Rest of Europe

12.11. Incremental Opportunity Analysis

13. Asia Pacific Refrigerated Display Cases (RDC) Glasses Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Macroeconomics Scenario

13.3. Key Supplier Analysis

13.4. Key Trends Analysis

13.4.1. Demand Side

13.4.2. Supplier Side

13.5. Refrigerated Display Cases (RDC) Glasses Market Size (US$ Bn and Units) Forecast, By Type,2017 - 2031

13.5.1. Plug-in Refrigerated Display Cases

13.5.2. Semi Plug-in Refrigerated Display Cases

13.5.3. Remote Refrigerated Display Cases

13.6. Refrigerated Display Cases (RDC) Glasses Market Size (US$ Bn and Units) Forecast, Design, 2017 - 2031

13.6.1. Vertical Refrigerated Display Cases

13.6.2. Horizontal Refrigerated Display Cases

13.6.3. Hybrid Refrigerated Display Cases

13.7. Refrigerated Display Cases (RDC) Glasses Market Size (US$ Bn and Units) Forecast, End-use, 2017 - 2031

13.7.1. Food Service Sector

13.7.1.1. Quick Service Restaurants

13.7.1.2. Hotels

13.7.1.3. Others

13.7.2. Retail Food & Beverage Sector

13.7.2.1. Fuel Station Stores

13.7.2.2. Hypermarkets

13.7.2.3. Supermarkets

13.8. Refrigerated Display Cases (RDC) Glasses Market Size (US$ Bn and Units) Forecast, By Distribution Channel, 2017 - 2031

13.8.1. Direct Sales

13.8.2. Indirect Sales

13.9. Refrigerated Display Cases (RDC) Glasses Market Size (US$ Bn and Units) Forecast, By Country/Sub-region, 2017 - 2031

13.9.1. India

13.9.2. China

13.9.3. Japan

13.9.4. Rest of Asia Pacific

13.10. Incremental Opportunity Analysis

14. Middle East & South Africa Refrigerated Display Cases (RDC) Glasses Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Macroeconomics Scenario

14.3. Key Supplier Analysis

14.4. Price Trend Analysis

14.4.1. Weighted Average Price

14.5. Key Trends Analysis

14.5.1. Demand Side

14.5.2. Supplier Side

14.6. Refrigerated Display Cases (RDC) Glasses Market Size (US$ Bn and Units) Forecast, By Type,2017 - 2031

14.6.1. Plug-in Refrigerated Display Cases

14.6.2. Semi Plug-in Refrigerated Display Cases

14.6.3. Remote Refrigerated Display Cases

14.7. Refrigerated Display Cases (RDC) Glasses Market Size (US$ Bn and Units) Forecast, Design, 2017 - 2031

14.7.1. Vertical Refrigerated Display Cases

14.7.2. Horizontal Refrigerated Display Cases

14.7.3. Hybrid Refrigerated Display Cases

14.8. Refrigerated Display Cases (RDC) Glasses Market Size (US$ Bn and Units) Forecast, End-use, 2017 - 2031

14.8.1. Food Service Sector

14.8.1.1. Quick Service Restaurants

14.8.1.2. Hotels

14.8.1.3. Others

14.8.2. Retail Food & Beverage Sector

14.8.2.1. Fuel Station Stores

14.8.2.2. Hypermarkets

14.8.2.3. Supermarkets

14.9. Refrigerated Display Cases (RDC) Glasses Market Size (US$ Bn and Units) Forecast, By Distribution Channel, 2017 - 2031

14.9.1. Direct Sales

14.9.2. Indirect Sales

14.10. Refrigerated Display Cases (RDC) Glasses Market Size (US$ Bn and Units) Forecast, By Country/Sub-region, 2017 - 2031

14.10.1. GCC

14.10.2. Rest of MEA

14.11. Incremental Opportunity Analysis

15. South America Refrigerated Display Cases (RDC) Glasses Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Macroeconomics Scenario

15.3. Key Supplier Analysis

15.4. Price Trend Analysis

15.4.1. Weighted Average Price

15.5. Key Trends Analysis

15.5.1. Demand Side

15.5.2. Supplier Side

15.6. Refrigerated Display Cases (RDC) Glasses Market Size (US$ Bn and Units) Forecast, By Type,2017 - 2031

15.6.1. Plug-in Refrigerated Display Cases

15.6.2. Semi Plug-in Refrigerated Display Cases

15.6.3. Remote Refrigerated Display Cases

15.7. Refrigerated Display Cases (RDC) Glasses Market Size (US$ Bn and Units) Forecast, Design, 2017 - 2031

15.7.1. Vertical Refrigerated Display Cases

15.7.2. Horizontal Refrigerated Display Cases

15.7.3. Hybrid Refrigerated Display Cases

15.8. Refrigerated Display Cases (RDC) Glasses Market Size (US$ Bn and Units) Forecast, End-use, 2017 - 2031

15.8.1. Food Service Sector

15.8.1.1. Quick Service Restaurants

15.8.1.2. Hotels

15.8.1.3. Others

15.8.2. Retail Food & Beverage Sector

15.8.2.1. Fuel Station Stores

15.8.2.2. Hypermarkets

15.8.2.3. Supermarkets

15.9. Refrigerated Display Cases (RDC) Glasses Market Size (US$ Bn and Units) Forecast, By Distribution Channel, 2017 - 2031

15.9.1. Direct Sales

15.9.2. Indirect Sales

15.10. Refrigerated Display Cases (RDC) Glasses Market Size (US$ Bn and Units) Forecast, By Country/Sub-region, 2017 - 2031

15.10.1. Brazil

15.10.2. Rest of South America

15.11. Incremental Opportunity Analysis

16. Competition Landscape

16.1. Market Player - Competition Dashboard

16.2. Market Share Analysis (%), by Company, (2022)

16.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

16.3.1. Arneg S.p.A

16.3.1.1. Company Overview

16.3.1.2. Sales Area/Geographical Presence

16.3.1.3. Revenue

16.3.1.4. Strategy & Business Overview

16.3.2. Borgen Systems

16.3.2.1. Company Overview

16.3.2.2. Sales Area/Geographical Presence

16.3.2.3. Revenue

16.3.2.4. Strategy & Business Overview

16.3.3. Carrier Corporation

16.3.3.1. Company Overview

16.3.3.2. Sales Area/Geographical Presence

16.3.3.3. Revenue

16.3.3.4. Strategy & Business Overview

16.3.4. Daikin Industries

16.3.4.1. Company Overview

16.3.4.2. Sales Area/Geographical Presence

16.3.4.3. Revenue

16.3.4.4. Strategy & Business Overview

16.3.5. Danfoss A/S

16.3.5.1. Company Overview

16.3.5.2. Sales Area/Geographical Presence

16.3.5.3. Revenue

16.3.5.4. Strategy & Business Overview

16.3.6. Dover Corporation

16.3.6.1. Company Overview

16.3.6.2. Sales Area/Geographical Presence

16.3.6.3. Revenue

16.3.6.4. Strategy & Business Overview

16.3.7. Fagor Industries

16.3.7.1. Company Overview

16.3.7.2. Sales Area/Geographical Presence

16.3.7.3. Revenue

16.3.7.4. Strategy & Business Overview

16.3.8. Haier Group

16.3.8.1. Company Overview

16.3.8.2. Sales Area/Geographical Presence

16.3.8.3. Revenue

16.3.8.4. Strategy & Business Overview

16.3.9. Hussmann Corporation

16.3.9.1. Company Overview

16.3.9.2. Sales Area/Geographical Presence

16.3.9.3. Revenue

16.3.9.4. Strategy & Business Overview

16.3.10. Kysor Warren

16.3.10.1. Company Overview

16.3.10.2. Sales Area/Geographical Presence

16.3.10.3. Revenue

16.3.10.4. Strategy & Business Overview

16.3.11. Other Key Players

16.3.11.1. Company Overview

16.3.11.2. Sales Area/Geographical Presence

16.3.11.3. Revenue

16.3.11.4. Strategy & Business Overview

17. Go to Market Strategy

17.1. Identification of Potential Market Spaces

17.1.1. By Type

17.1.2. By Design

17.1.3. By End-use

17.1.4. By Distribution Channel

17.1.5. By Region

17.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by Type, 2017-2031

Table 2: Global Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by Type 2017-2031

Table 3: Global Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by Design, 2017-2031

Table 4: Global Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by Design 2017-2031

Table 5: Global Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by End-use, 2017-2031

Table 6: Global Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by End-use 2017-2031

Table 7: Global Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 8: Global Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by Distribution Channel 2017-2031

Table 9: Global Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by Region, 2017-2031

Table 10: Global Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by Region 2017-2031

Table 11: North America Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by Type, 2017-2031

Table 12: North America Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by Type 2017-2031

Table 13: North America Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by Design, 2017-2031

Table 14: North America Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by Design 2017-2031

Table 15: North America Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by End-use, 2017-2031

Table 16: North America Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by End-use 2017-2031

Table 17: North America Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 18: North America Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by Distribution Channel 2017-2031

Table 19: North America Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by Region, 2017-2031

Table 20: North America Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by Region 2017-2031

Table 21: Europe Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by Type, 2017-2031

Table 22: Europe Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by Type 2017-2031

Table 23: Europe Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by Design, 2017-2031

Table 24: Europe Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by Design 2017-2031

Table 25: Europe Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by End-use, 2017-2031

Table 26: Europe Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by End-use 2017-2031

Table 27: Europe Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 28: Europe Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by Distribution Channel 2017-2031

Table 29: Europe Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by Region, 2017-2031

Table 30: Europe Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by Region 2017-2031

Table 31: Asia Pacific Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by Type, 2017-2031

Table 32: Asia Pacific Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by Type 2017-2031

Table 33: Asia Pacific Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by Design, 2017-2031

Table 34: Asia Pacific Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by Design 2017-2031

Table 35: Asia Pacific Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by End-use, 2017-2031

Table 36: Asia Pacific Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by End-use 2017-2031

Table 37: Asia Pacific Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 38: Asia Pacific Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by Distribution Channel 2017-2031

Table 39: Asia Pacific Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by Region, 2017-2031

Table 40: Asia Pacific Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by Region 2017-2031

Table 41: Middle East & Africa Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by Type, 2017-2031

Table 42: Middle East & Africa Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by Type 2017-2031

Table 43: Middle East & Africa Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by Design, 2017-2031

Table 44: Middle East & Africa Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by Design 2017-2031

Table 45: Middle East & Africa Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by End-use, 2017-2031

Table 46: Middle East & Africa Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by End Use 2017-2031

Table 47: Middle East & Africa Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 48: Middle East & Africa Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by Distribution Channel 2017-2031

Table 49: Middle East & Africa Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by Region, 2017-2031

Table 50: Middle East & Africa Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by Region 2017-2031

Table 51: South America Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by Type, 2017-2031

Table 52: South America Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by Type 2017-2031

Table 53: South America Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by Design, 2017-2031

Table 54: South America Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by Design 2017-2031

Table 55: South America Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by End-use, 2017-2031

Table 56: South America Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by End-use 2017-2031

Table 57: South America Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 58: South America Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by Distribution Channel 2017-2031

Table 59: South America Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by Region, 2017-2031

Table 60: South America Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by Region 2017-2031

List of Figures

Figure 1: Global Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by Type, 2017-2031

Figure 2: Global Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by Type 2017-2031

Figure 3: Global Refrigerated Display Cases (RDC) Glasses Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 4: Global Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by Design, 2017-2031

Figure 5: Global Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by Design 2017-2031

Figure 6: Global Refrigerated Display Cases (RDC) Glasses Market Incremental Opportunity (US$ Bn), Forecast, by Design, 2023-2031

Figure 7: Global Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by End-use, 2017-2031

Figure 8: Global Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by End-use 2017-2031

Figure 9: Global Refrigerated Display Cases (RDC) Glasses Market Incremental Opportunity (US$ Bn), Forecast, by End Use, 2023-2031

Figure 10: Global Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 11: Global Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by Distribution Channel 2017-2031

Figure 12: Global Refrigerated Display Cases (RDC) Glasses Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 13: Global Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by Region, 2017-2031

Figure 14: Global Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by Region 2017-2031

Figure 15: Global Refrigerated Display Cases (RDC) Glasses Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 16: North America Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by Type, 2017-2031

Figure 17: North America Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by Type 2017-2031

Figure 18: North America Refrigerated Display Cases (RDC) Glasses Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 19: North America Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by Design, 2017-2031

Figure 20: North America Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by Design 2017-2031

Figure 21: North America Refrigerated Display Cases (RDC) Glasses Market Incremental Opportunity (US$ Bn), Forecast, by Design, 2023-2031

Figure 22: North America Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by End-use, 2017-2031

Figure 23: North America Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by End-use 2017-2031

Figure 24: North America Refrigerated Display Cases (RDC) Glasses Market Incremental Opportunity (US$ Bn), Forecast, by End-use, 2023-2031

Figure 25: North America Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 26: North America Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by Distribution Channel 2017-2031

Figure 27: North America Refrigerated Display Cases (RDC) Glasses Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 28: North America Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by Region, 2017-2031

Figure 29: North America Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by Region 2017-2031

Figure 30: North America Refrigerated Display Cases (RDC) Glasses Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 31: Europe Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by Type, 2017-2031

Figure 32: Europe Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by Type 2017-2031

Figure 33: Europe Refrigerated Display Cases (RDC) Glasses Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 34: Europe Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by Design, 2017-2031

Figure 35: Europe Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by Design 2017-2031

Figure 36: Europe Refrigerated Display Cases (RDC) Glasses Market Incremental Opportunity (US$ Bn), Forecast, by Design, 2023-2031

Figure 37: Europe Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by End-use, 2017-2031

Figure 38: Europe Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by End-use 2017-2031

Figure 39: Europe Refrigerated Display Cases (RDC) Glasses Market Incremental Opportunity (US$ Bn), Forecast, by End-use, 2023-2031

Figure 40: Europe Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 41: Europe Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by Distribution Channel 2017-2031

Figure 42: Europe Refrigerated Display Cases (RDC) Glasses Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 43: Europe Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by Region, 2017-2031

Figure 44: Europe Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by Region 2017-2031

Figure 45: Europe Refrigerated Display Cases (RDC) Glasses Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 46: Asia Pacific Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by Type, 2017-2031

Figure 47: Asia Pacific Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by Type 2017-2031

Figure 48: Asia Pacific Refrigerated Display Cases (RDC) Glasses Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 49: Asia Pacific Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by Design, 2017-2031

Figure 50: Asia Pacific Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by Design 2017-2031

Figure 51: Asia Pacific Refrigerated Display Cases (RDC) Glasses Market Incremental Opportunity (US$ Bn), Forecast, by Design, 2023-2031

Figure 52: Asia Pacific Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by End-use, 2017-2031

Figure 53: Asia Pacific Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by End-use 2017-2031

Figure 54: Asia Pacific Refrigerated Display Cases (RDC) Glasses Market Incremental Opportunity (US$ Bn), Forecast, by End-use, 2023-2031

Figure 55: Asia Pacific Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 56: Asia Pacific Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by Distribution Channel 2017-2031

Figure 57: Asia Pacific Refrigerated Display Cases (RDC) Glasses Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 58: Asia Pacific Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by Region, 2017-2031

Figure 59: Asia Pacific Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by Region 2017-2031

Figure 60: Asia Pacific Refrigerated Display Cases (RDC) Glasses Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 61: Middle East & Africa Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by Type, 2017-2031

Figure 62: Middle East & Africa Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by Type 2017-2031

Figure 63: Middle East & Africa Refrigerated Display Cases (RDC) Glasses Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 64: Middle East & Africa Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by Design, 2017-2031

Figure 65: Middle East & Africa Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by Design 2017-2031

Figure 66: Middle East & Africa Refrigerated Display Cases (RDC) Glasses Market Incremental Opportunity (US$ Bn), Forecast, by Design,2023-2031

Figure 67: Middle East & Africa Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by End-use, 2017-2031

Figure 68: Middle East & Africa Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by End-use 2017-2031

Figure 69: Middle East & Africa Refrigerated Display Cases (RDC) Glasses Market Incremental Opportunity (US$ Bn), Forecast, by End-use, 2017-2031

Figure 70: Middle East & Africa Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 71: Middle East & Africa Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by Distribution Channel 2017-2031

Figure 72: Middle East & Africa Refrigerated Display Cases (RDC) Glasses Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 73: Middle East & Africa Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by Region, 2017-2031

Figure 74: Middle East & Africa Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by Region 2017-2031

Figure 75: Middle East & Africa Refrigerated Display Cases (RDC) Glasses Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 76: South America Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by Type, 2017-2031

Figure 77: South America Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by Type 2017-2031

Figure 78: South America Refrigerated Display Cases (RDC) Glasses Market Incremental Opportunity (US$ Bn), Forecast, by Type, 2023-2031

Figure 79: South America Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by Design, 2017-2031

Figure 80: South America Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by Design 2017-2031

Figure 81: South America Refrigerated Display Cases (RDC) Glasses Market Incremental Opportunity (US$ Bn), Forecast, by Design, 2023-2031

Figure 82: South America Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by End-use, 2017-2031

Figure 83: South America Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by End-use 2017-2031

Figure 84: South America Refrigerated Display Cases (RDC) Glasses Market Incremental Opportunity (US$ Bn), Forecast, by End-use, 2023-2031

Figure 85: South America Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 86: South America Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by Distribution Channel 2017-2031

Figure 87: South America Refrigerated Display Cases (RDC) Glasses Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 88: South America Refrigerated Display Cases (RDC) Glasses Market Value (US$ Bn), by Region, 2017-2031

Figure 89: South America Refrigerated Display Cases (RDC) Glasses Market Volume (Units), by Region 2017-2031

Figure 90: South America Refrigerated Display Cases (RDC) Glasses Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031