Reports

Reports

Analysts’ Viewpoint on RTC IC Market Scenario

Growing use of RTC IC across wearable devices, computers, IoT devices, digital cameras, battery management units, and dashboards in the case of automotive applications is the key driver for the global RTC IC market. Technological advancements have prompted manufacturers to continuously introduce new features such as embedded memory, alarms, timestamp recording, and watchdog, among others. Rise in demand for low power applications is driving technological developments in real-time clock ICs, as keeping time is crucial for all IoT devices. In the absence of a main power source, having reliable information of event occurrences and communication time slots is accomplished with the use of either a small battery or a capacitor. Thus, RTC IC is widely deployed across range of devices, which is driving the global market.

A real-time clock IC (RTC IC) is an integrated circuit that keeps track of the current time and date, typically counting seconds, minutes, hours, days, months, and years with leap-year compensation. These ICs are available in 12 hour and 24-hour time format with AM/PM display. Real-time Clock (RTC) ICs are low current devices that can sustain for years on a single lithium cell. RTC IC runs on a battery that keeps tracking the time even it is disconnected from the main power.

Although the term often refers to the devices in personal computers, servers and embedded systems, RTCs are present in almost any electronic device which needs to keep the accurate time of day. RTC ICs are extensively used in several applications such as burglar alarm systems, gaming devices, e-metering, building access control, industrial applications, Point-of-Sale terminals, and numerous other applications in various industry verticals. Moreover, RTCs are frequently integrated into other devices, for instance, the broadband communications ICs used in car radios.

RTC IC plays an important role in IoT applications ranging from multi-core smartphones to small connected sensors. In these devices, power and accuracy are critical factors. The RTC ICs offers extended battery lifetime to the IoT devices, which is the fundamental requirement for all these devices. The standalone RTC ICs are designed to keep backup of capacitors by analyzing different parameters such as current consumption, minimum and maximum voltage supply. For instance, STMicroelectronics offers M41T62, a standalone RTC that keeps the time with a supply voltage as low as 1.0V and can tolerate voltages up to 4.5V.

Thus, rising demand for standalone RTC IC in low power IoT devices enabling businesses to minimize the manufacturing cost is projected to have a positive impact on the global real-time clock (RTC) IC market during the forecast period.

Electrification is a key issue in various countries of the world. This is expected to hinder the growth of industrial and construction sectors. Governments across various countries are undertaking several initiatives to meet future electricity demands, and concentrating on reducing carbon footprint by promoting the use of renewable energy sources to produce energy. Smart meters will play a significant role in achieving these initiatives. The increase in the acceptance of electric vehicles, development of micro grids, distributed energy storage, and the need for net metering are boosting the installation of smart utility and energy meters across the globe.

Smart Meter National Programme aims to replace 25 crore conventional meters with smart meters in India. Smart meters are connected through a web-based monitoring system, which will help to reduce commercial losses of utilities, enhance revenues and serve as an important tool in power sector reforms.

According to Tepco, in 2018 the U.S. had over 86 million smart meters installed. In 2017, there were 665 million smart meters installed globally. Revenue generation is expected to grow from $12.8 Bn in 2017 to $20 Bn by 2022.

As of 2018, the electrification rate in rural areas was less than 75% in various Asian countries such as Myanmar, Pakistan, North Korea, Bangladesh, and less than 50% in many African countries. Keeping accurate time in an energy meter is critical when billing is associated with the time of use. It is especially important when there is no constant communication between a meter and a reference clock. RTC ICs are mainly used in metering applications such as E-meter, heating counter, smart meters, PV counter, and utility metering, among others.

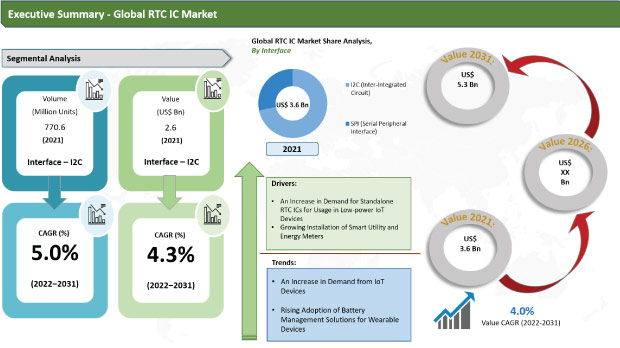

In terms of interface, the global RTC IC market is divided into I2C (Inter-Integrated Circuit) and SPI (Serial Peripheral Interface). The I2C (Inter-Integrated Circuit) segment held a large share of 71.68% in 2021 and will maintain the status quo with a growth rate of 4.3% during the forecast period.

I2C interface offers several benefits over SPI as I2 C-bus shrinks the IC footprint and leads to lower IC costs. In addition, far fewer copper traces are required for I2C, which enables a smaller PCB, reduced design complexity, and lowered system cost. I2C interface is a bus interface connection protocol incorporated into devices for serial communication; it is a most widely used protocol for short-distance communication.

RTC IC are classified into surface mount and through hole, in terms of their mounting type. The surface mount category dominated the global RTC IC market in 2021 with a market share of 86.45%. Furthermore, this segment is also expected to register the CAGR of 4.1% during the forecast period. This growth can be attributed to the substantial features offered by surface mounted RTC ICs. These circuits offer high accuracy time stamping and total reliability over wide temperature variations.

Surface-mount technology (SMT) is a method in which the electrical components are mounted directly onto the surface of a PCB. An electronics component mounted in this manner is referred to as a surface-mount device (SMD). In industry, this approach has largely replaced the through-hole technology construction method of fitting components, in large part, as SMT allows for increased manufacturing automation, which reduces cost and improves quality.

Asia Pacific held the largest share of 38.58% in 2021 in the global RTC IC market. Asia Pacific and North America are the major hubs of research and development activities in the field of technology and new product development market as large number of manufactures are based in these regions. Additionally, factors such as increased expenditure on industrial automation, and manufacturing consumer electronics devices across the globe offers growth opportunities to the real-time clock (RTC) IC manufacturers.

North America and Europe are also large consumers of RTC IC, which held value shares of 29.55% and 24.55% respectively in 2021 in the global market. This growth is due to the presence of several largest multinational corporations in these regions offers devices for end-users like consumer electronics, military and defense, automotive, and IT & telecom industry.

The Middle East and African region is also growing rapidly in RTC IC market and offers lucrative opportunities for the global suppliers of RTC IC. Rise in Internet penetration, growing adoption of smartphone and social media use, and increasing digitalization activities among the countries such as the United Arab Emirates, Bahrain, and Qatar have fueled the demand of consumer electronics devices and data center servers across the region. This factor anticipated to drive the market growth in the region.

The global RTC IC market is consolidated with a small number of large scale vendors controlling the majority of the market share. The majority of the companies are spending a significant amount of money on comprehensive research and development, primarily to develop environmentally friendly products. Expansion of product portfolios and mergers and acquisitions are the key strategies adopted by the key players. ABLIC Inc., Abracon, LLC, Diodes Incorporated, Maxim Integrated Inc., Microchip Technology Inc., Micro Crystal AG, NXP Semiconductors, Renesas Electronics Corporation, RICOH Electronic Devices Co., Ltd., ROHM CO., LTD., Seiko Epson Corp., STMicroelectronic, and Texas Instruments Incorporated, are the prominent entities operating in this market.

Each of these players has been profiled in the RTC IC market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 3.5 Bn |

|

Market Forecast Value in 2031 |

US$ 5.2 Bn |

|

Growth Rate (CAGR) |

4% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Mn for Value and Million Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The revenue of RTC IC stood over US$ 3.5 Bn in 2021

The RTC IC market is expected to grow at a CAGR of 4% by 2031

The market size for RTC IC market value more than US$ 5.2 Bn in 2031

Prominent players operating in the RTC IC market include ABLIC Inc., Abracon, LLC, Diodes Incorporated, Maxim Integrated Inc., Microchip Technology Inc., Micro Crystal AG, NXP Semiconductors, Renesas Electronics Corporation, RICOH Electronic Devices Co., Ltd., ROHM CO., LTD., Seiko Epson Corp., STMicroelectronic, and Texas Instruments Incorporated

In 2021, the U.S. catered approximately 21.9% of share of the RTC IC market

Based on interface, I2C (Inter-Integrated Circuit) segment is expected to hold 71.68% share of the RTC IC market

Increase in demand from IoT devices and rise in adoption of real-time clock ICs in wearable medical devices

Asia Pacific region is more lucrative in RTC IC market

1. Preface

1.1. Research Scope

1.2. RTC IC Market Overview

1.3. Market and Segments Definition

1.4. Market Taxonomy

1.5. Research Methodology

1.6. Assumption and Acronyms

2. Executive Summary

2.1. Global RTC IC Market Analysis and Forecast

2.2. Regional Outline

2.3. Market Dynamics Snapshot

2.4. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Key Market Indicator

3.3. Drivers

3.4. Market Restraints and Opportunities

3.5. Operating Voltages Trends

3.6. Market Trends

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview

4.2. Supply Chain Analysis

4.3. Industry SWOT Analysis

4.4. Porter Five Forces Analysis

4.5. COVID-19 Impact Analysis

5. Global RTC IC Market Analysis, by Interface

5.1. Global RTC IC Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Interface, 2017‒2031

5.1.1. I2C (Inter-Integrated Circuit)

5.1.2. SPI (Serial Peripheral Interface)

5.2. Global RTC IC Market Attractiveness Analysis, by Interface

6. Global RTC IC Market Analysis, by Mounting Type

6.1. Global RTC IC Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Mounting Type, 2017‒2031

6.1.1. Surface Mount

6.1.2. Through Hole

6.2. Global RTC IC Market Attractiveness Analysis, by Mounting Type

7. Global RTC IC Market Analysis, by Operating Voltage

7.1. Global RTC IC Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Operating Voltage, 2017‒2031

7.1.1. 1V – 2V

7.1.2. 2.1V – 3.5V

7.1.3. 3.6V – 6V

7.2. Global RTC IC Market Attractiveness Analysis, by Operating Voltage

8. Global RTC IC Market Analysis, by End-use Industry

8.1. Global RTC IC Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by End-use Industry, 2017‒2031

8.1.1. Energy & Utility

8.1.1.1. Smart Water Meters

8.1.1.2. Smart Energy Meters

8.1.1.3. Smart Gas Meters

8.1.1.4. Others

8.1.2. Consumer Electronics

8.1.2.1. Wearable Devices

8.1.2.2. Computing Devices

8.1.2.3. Smartphones

8.1.2.4. Others

8.1.3. Automotive

8.1.4. Industrial

8.1.5. IT & Telecommunication

8.1.6. Others (Aerospace & Defense, Healthcare, etc.)

8.2. Global RTC IC Market Attractiveness Analysis, by End-use Industry

9. Global RTC IC Market Analysis and Forecast, by Region

9.1. Global RTC IC Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Region, 2017 – 2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Global RTC IC Market Attractiveness Analysis, by Region

10. North America RTC IC Market Analysis and Forecast

10.1. Market Snapshot

10.2. North America RTC IC Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Interface, 2017‒2031

10.2.1. I2C (Inter-Integrated Circuit)

10.2.2. SPI (Serial Peripheral Interface)

10.3. North America RTC IC Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Mounting Type, 2017‒2031

10.3.1. Surface Mount

10.3.2. Through Hole

10.4. North America RTC IC Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Operating Voltage, 2017‒2031

10.4.1. 1V – 2V

10.4.2. 2.1V – 3.5V

10.4.3. 3.6V – 6V

10.5. North America RTC IC Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by End-use Industry, 2017‒2031

10.5.1. Energy & Utility

10.5.1.1. Smart Water Meters

10.5.1.2. Smart Energy Meters

10.5.1.3. Smart Gas Meters

10.5.1.4. Others

10.5.2. Consumer Electronics

10.5.2.1. Wearable Devices

10.5.2.2. Computing Devices

10.5.2.3. Smartphones

10.5.2.4. Others

10.5.3. Automotive

10.5.4. Industrial

10.5.5. IT & Telecommunication

10.5.6. Others (Aerospace & Defense, Healthcare, etc.)

10.6. North America RTC IC Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country & Sub-region, 2017 – 2031

10.6.1. U.S.

10.6.2. Canada

10.6.3. Rest of North America

10.7. North America RTC IC Market Attractiveness Analysis

10.7.1. By Interface

10.7.2. By Mounting Type

10.7.3. By Operating Voltage

10.7.4. By End-use Industry

10.7.5. By Country & Sub-region

11. Europe RTC IC Market Analysis and Forecast

11.1. Market Snapshot

11.2. Europe RTC IC Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Interface, 2017‒2031

11.2.1. I2C (Inter-Integrated Circuit)

11.2.2. SPI (Serial Peripheral Interface)

11.3. Europe RTC IC Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Mounting Type, 2017‒2031

11.3.1. Surface Mount

11.3.2. Through Hole

11.4. Europe RTC IC Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Operating Voltage, 2017‒2031

11.4.1. 1V – 2V

11.4.2. 2.1V – 3.5V

11.4.3. 3.6V – 6V

11.5. Europe RTC IC Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by End-use Industry, 2017‒2031

11.5.1. Energy & Utility

11.5.1.1. Smart Water Meters

11.5.1.2. Smart Energy Meters

11.5.1.3. Smart Gas Meters

11.5.1.4. Others

11.5.2. Consumer Electronics

11.5.2.1. Wearable Devices

11.5.2.2. Computing Devices

11.5.2.3. Smartphones

11.5.2.4. Others

11.5.3. Automotive

11.5.4. Industrial

11.5.5. IT & Telecommunication

11.5.6. Others (Aerospace & Defense, Healthcare, etc.)

11.6. Europe RTC IC Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country & Sub-region, 2017‒2031

11.6.1. U.K.

11.6.2. Germany

11.6.3. France

11.6.4. Rest of Europe

11.7. Europe RTC IC Market Attractiveness Analysis

11.7.1. By Interface

11.7.2. By Mounting Type

11.7.3. By Operating Voltage

11.7.4. By End-use Industry

11.7.5. By Country & Sub-region

12. Asia Pacific RTC IC Market Analysis and Forecast

12.1. Market Snapshot

12.2. Asia Pacific RTC IC Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Interface, 2017‒2031

12.2.1. I2C (Inter-Integrated Circuit)

12.2.2. SPI (Serial Peripheral Interface)

12.3. Asia Pacific RTC IC Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Mounting Type, 2017‒2031

12.3.1. Surface Mount

12.3.2. Through Hole

12.4. Asia Pacific RTC IC Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Operating Voltage, 2017‒2031

12.4.1. 1V – 2V

12.4.2. 2.1V – 3.5V

12.4.3. 3.6V – 6V

12.5. Asia Pacific RTC IC Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by End-use Industry, 2017‒2031

12.5.1. Energy & Utility

12.5.1.1. Smart Water Meters

12.5.1.2. Smart Energy Meters

12.5.1.3. Smart Gas Meters

12.5.1.4. Others

12.5.2. Consumer Electronics

12.5.2.1. Wearable Devices

12.5.2.2. Computing Devices

12.5.2.3. Smartphones

12.5.2.4. Others

12.5.3. Automotive

12.5.4. Industrial

12.5.5. IT & Telecommunication

12.5.6. Others (Aerospace & Defense, Healthcare, etc.)

12.6. Asia Pacific RTC IC Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country & Sub-region, 2017‒2031

12.6.1. China

12.6.2. India

12.6.3. Japan

12.6.4. South Korea

12.6.5. ASEAN

12.6.6. Rest of Asia Pacific

12.7. Asia Pacific RTC IC Market Attractiveness Analysis

12.7.1. By Interface

12.7.2. By Mounting Type

12.7.3. By End-use Industry

12.7.4. By Country & Sub-region

13. Middle East & Africa (MEA) RTC IC Market Analysis and Forecast

13.1. Market Snapshot

13.2. MEA RTC IC Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Interface, 2017‒2031

13.2.1. I2C (Inter-Integrated Circuit)

13.2.2. SPI (Serial Peripheral Interface)

13.3. MEA RTC IC Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Mounting Type, 2017‒2031

13.3.1. Surface Mount

13.3.2. Through Hole

13.4. MEA RTC IC Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Operating Voltage, 2017‒2031

13.4.1. 1V – 2V

13.4.2. 2.1V – 3.5V

13.4.3. 3.6V – 6V

13.5. MEA RTC IC Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by End-use Industry, 2017‒2031

13.5.1. Energy & Utility

13.5.1.1. Smart Water Meters

13.5.1.2. Smart Energy Meters

13.5.1.3. Smart Gas Meters

13.5.1.4. Others

13.5.2. Consumer Electronics

13.5.2.1. Wearable Devices

13.5.2.2. Computing Devices

13.5.2.3. Smartphones

13.5.2.4. Others

13.5.3. Automotive

13.5.4. Industrial

13.5.5. IT & Telecommunication

13.5.6. Others (Aerospace & Defense, Healthcare, etc.)

13.6. MEA RTC IC Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country & Sub-region, 2017‒2031

13.6.1. GCC

13.6.2. South Africa

13.6.3. Rest of Middle East & Africa

13.7. MEA RTC IC Market Attractiveness Analysis

13.7.1. By Interface

13.7.2. By Mounting Type

13.7.3. By End-use Industry

13.7.4. By Country & Sub-region

14. South America RTC IC Market Analysis and Forecast

14.1. Market Snapshot

14.2. South America RTC IC Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Interface, 2017‒2031

14.2.1. I2C (Inter-Integrated Circuit)

14.2.2. SPI (Serial Peripheral Interface)

14.3. South America RTC IC Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Mounting Type, 2017‒2031

14.3.1. Surface Mount

14.3.2. Through Hole

14.4. South America RTC IC Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Operating Voltage, 2017‒2031

14.4.1. 1V – 2V

14.4.2. 2.1V – 3.5V

14.4.3. 3.6V – 6V

14.5. South America RTC IC Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by End-use Industry, 2017‒2031

14.5.1. Energy & Utility

14.5.1.1. Smart Water Meters

14.5.1.2. Smart Energy Meters

14.5.1.3. Smart Gas Meters

14.5.1.4. Others

14.5.2. Consumer Electronics

14.5.2.1. Wearable Devices

14.5.2.2. Computing Devices

14.5.2.3. Smartphones

14.5.2.4. Others

14.5.3. Automotive

14.5.4. Industrial

14.5.5. IT & Telecommunication

14.5.6. Others (Aerospace & Defense, Healthcare, etc.)

14.6. South America RTC IC Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country & Sub-region, 2017‒2031

14.6.1. Brazil

14.6.2. Rest of South America

14.7. South America RTC IC Market Attractiveness Analysis

14.7.1. By Interface

14.7.2. By Mounting Type

14.7.3. By Operating Voltage

14.7.4. By End-use Industry

14.7.5. By Country & Sub-region

15. Competition Assessment

15.1. Global RTC IC Market Competition Matrix - a Dashboard View

15.2. Global RTC IC Market Company Share Analysis, by Value (2020)

15.3. Technological Differentiator

16. Company Profiles (Manufacturers/Suppliers)

16.1. ABLIC Inc.

16.1.1. Overview

16.1.2. Product Portfolio

16.1.3. Sales Footprint

16.1.4. Key Subsidiaries or Distributors

16.1.5. Strategy and Recent Developments

16.1.6. Key Financials

16.2. Abracon, LLC

16.2.1. Overview

16.2.2. Product Portfolio

16.2.3. Sales Footprint

16.2.4. Key Subsidiaries or Distributors

16.2.5. Strategy and Recent Developments

16.2.6. Key Financials

16.3. Diodes Incorporated

16.3.1. Overview

16.3.2. Product Portfolio

16.3.3. Sales Footprint

16.3.4. Key Subsidiaries or Distributors

16.3.5. Strategy and Recent Developments

16.3.6. Key Financials

16.4. Analog Devices, Inc. (Maxim)

16.4.1. Overview

16.4.2. Product Portfolio

16.4.3. Sales Footprint

16.4.4. Key Subsidiaries or Distributors

16.4.5. Strategy and Recent Developments

16.4.6. Key Financials

16.5. Microchip Technology Inc.

16.5.1. Overview

16.5.2. Product Portfolio

16.5.3. Sales Footprint

16.5.4. Key Subsidiaries or Distributors

16.5.5. Strategy and Recent Developments

16.5.6. Key Financials

16.6. Micro Crystal AG

16.6.1. Overview

16.6.2. Product Portfolio

16.6.3. Sales Footprint

16.6.4. Key Subsidiaries or Distributors

16.6.5. Strategy and Recent Developments

16.6.6. Key Financials

16.7. NXP Semiconductors

16.7.1. Overview

16.7.2. Product Portfolio

16.7.3. Sales Footprint

16.7.4. Key Subsidiaries or Distributors

16.7.5. Strategy and Recent Developments

16.7.6. Key Financials

16.8. Renesas Electronics Corporation

16.8.1. Overview

16.8.2. Product Portfolio

16.8.3. Sales Footprint

16.8.4. Key Subsidiaries or Distributors

16.8.5. Strategy and Recent Developments

16.8.6. Key Financials

16.9. RICOH Electronic Devices Co., Ltd.

16.9.1. Overview

16.9.2. Product Portfolio

16.9.3. Sales Footprint

16.9.4. Key Subsidiaries or Distributors

16.9.5. Strategy and Recent Developments

16.9.6. Key Financials

16.10. ROHM CO., LTD.

16.10.1. Overview

16.10.2. Product Portfolio

16.10.3. Sales Footprint

16.10.4. Key Subsidiaries or Distributors

16.10.5. Strategy and Recent Developments

16.10.6. Key Financials

16.11. Seiko Epson Corp.

16.11.1. Overview

16.11.2. Product Portfolio

16.11.3. Sales Footprint

16.11.4. Key Subsidiaries or Distributors

16.11.5. Strategy and Recent Developments

16.11.6. Key Financials

16.12. STMicroelectronic.

16.12.1. Overview

16.12.2. Product Portfolio

16.12.3. Sales Footprint

16.12.4. Key Subsidiaries or Distributors

16.12.5. Strategy and Recent Developments

16.12.6. Key Financials

16.13. Texas Instruments Incorporated

16.13.1. Overview

16.13.2. Product Portfolio

16.13.3. Sales Footprint

16.13.4. Key Subsidiaries or Distributors

16.13.5. Strategy and Recent Developments

16.13.6. Key Financials

17. Recommendation

17.1. Opportunity Assessment

17.1.1. By Interface

17.1.2. By Mounting Type

17.1.3. By Operating Voltage

17.1.4. By End-use Industry

17.1.5. By Region

List of Tables

Table 01: Global Real-time Clock (RTC) IC Market Size & Forecast, By Interface, Value (US$ Mn), 2017-2031

Table 02: Global Real-time Clock (RTC) IC Market Size & Forecast, by Interface, Volume (Million Units), 2017-2031

Table 03: Global Real-time Clock (RTC) IC Market Size & Forecast, By Mounting Type, Value (US$ Mn), 2017-2031

Table 04: Global Real-time Clock (RTC) IC Market Size & Forecast, by Mounting Type, Volume (Million Units), 2017-2031

Table 05: Global Real-time Clock (RTC) IC Market Size & Forecast, By Operating Voltage, Value (US$ Mn), 2017-2031

Table 06: Global Real-time Clock (RTC) IC Market Size & Forecast, By Operating Voltage, Volume (Million Units), 2017-2031

Table 07: Global Real-time Clock (RTC) IC Market Size & Forecast, By End-use Industry, Value (US$ Mn), 2017-2031

Table 08: Global Real-time Clock (RTC) IC Market Size & Forecast, By End-use Industry, Volume (Million Units), 2017-2031

Table 09: Global Real-time Clock (RTC) IC Market Size & Forecast, By Region, Value (US$ Mn), 2017-2031

Table 10: Global Real-time Clock (RTC) IC Market Size & Forecast, By Region, Volume (Million Units), 2017-2031

Table 11: North America Real-time Clock (RTC) IC Market Size & Forecast, By Interface, Value (US$ Mn), 2017-2031

Table 12: North America Real-time Clock (RTC) IC Market Size & Forecast, by Interface, Volume (Million Units), 2017-2031

Table 13: North America Real-time Clock (RTC) IC Market Size & Forecast, By Mounting Type, Value (US$ Mn), 2017-2031

Table 14: North America Real-time Clock (RTC) IC Market Size & Forecast, by Mounting Type, Volume (Million Units), 2017-2031

Table 15: North America Real-time Clock (RTC) IC Market Size & Forecast, By Operating Voltage, Value (US$ Mn), 2017-2031

Table 16: North America Real-time Clock (RTC) IC Market Size & Forecast, By Operating Voltage, Volume (Million Units), 2017-2031

Table 17: North America Real-time Clock (RTC) IC Market Size & Forecast, By End-use Industry, Value (US$ Mn), 2017-2031

Table 18: North America Real-time Clock (RTC) IC Market Size & Forecast, By End-use Industry, Volume (Million Units), 2017-2031

Table 19: North America Real-time Clock (RTC) IC Market Size & Forecast, By Country, Value (US$ Mn), 2017-2031

Table 20: North America Real-time Clock (RTC) IC Market Size & Forecast, By Country, Volume (Million Units), 2017-2031

Table 21: Europe Real-time Clock (RTC) IC Market Size & Forecast, By Interface, Value (US$ Mn), 2017-2031

Table 22: Europe Real-time Clock (RTC) IC Market Size & Forecast, by Interface, Volume (Million Units), 2017-2031

Table 23: Europe Real-time Clock (RTC) IC Market Size & Forecast, By Mounting Type, Value (US$ Mn), 2017-2031

Table 24: Europe Real-time Clock (RTC) IC Market Size & Forecast, by Mounting Type, Volume (Million Units), 2017-2031

Table 25: Europe Real-time Clock (RTC) IC Market Size & Forecast, By Operating Voltage, Value (US$ Mn), 2017-2031

Table 26: Europe Real-time Clock (RTC) IC Market Size & Forecast, By Operating Voltage, Volume (Million Units), 2017-2031

Table 27: Europe Real-time Clock (RTC) IC Market Size & Forecast, By End-use Industry, Value (US$ Mn), 2017-2031

Table 28: Europe Real-time Clock (RTC) IC Market Size & Forecast, By End-use Industry, Volume (Million Units), 2017-2031

Table 29: Europe Real-time Clock (RTC) IC Market Size & Forecast, By Country, Value (US$ Mn), 2017-2031

Table 30: Europe Real-time Clock (RTC) IC Market Size & Forecast, By Country, Volume (Million Units), 2017-2031

Table 31: Asia Pacific Real-time Clock (RTC) IC Market Size & Forecast, By Interface, Value (US$ Mn), 2017-2031

Table 32: Asia Pacific Real-time Clock (RTC) IC Market Size & Forecast, by Interface, Volume (Million Units), 2017-2031

Table 33: Asia Pacific Real-time Clock (RTC) IC Market Size & Forecast, By Mounting Type, Value (US$ Mn), 2017-2031

Table 34: Asia Pacific Real-time Clock (RTC) IC Market Size & Forecast, by Mounting Type, Volume (Million Units), 2017-2031

Table 35: Asia Pacific Real-time Clock (RTC) IC Market Size & Forecast, By Operating Voltage, Value (US$ Mn), 2017-2031

Table 36: Asia Pacific Real-time Clock (RTC) IC Market Size & Forecast, By Operating Voltage, Volume (Million Units), 2017-2031

Table 37: Asia Pacific Real-time Clock (RTC) IC Market Size & Forecast, By End-use Industry, Value (US$ Mn), 2017-2031

Table 38: Asia Pacific Real-time Clock (RTC) IC Market Size & Forecast, By End-use Industry, Volume (Million Units), 2017-2031

Table 39: Asia Pacific Real-time Clock (RTC) IC Market Size & Forecast, By Country, Value (US$ Mn), 2017-2031

Table 40: Asia Pacific Real-time Clock (RTC) IC Market Size & Forecast, By Country, Volume (Million Units), 2017-2031

Table 41: Middle East and Africa Real-time Clock (RTC) IC Market Size & Forecast, By Interface, Value (US$ Mn), 2017-2031

Table 42: Middle East and Africa Real-time Clock (RTC) IC Market Size & Forecast, by Interface, Volume (Million Units), 2017-2031

Table 43: Middle East and Africa Real-time Clock (RTC) IC Market Size & Forecast, By Mounting Type, Value (US$ Mn), 2017-2031

Table 44: Middle East and Africa Real-time Clock (RTC) IC Market Size & Forecast, by Mounting Type, Volume (Million Units), 2017-2031

Table 45: Middle East and Africa Real-time Clock (RTC) IC Market Size & Forecast, By Operating Voltage, Value (US$ Mn), 2017-2031

Table 46: Middle East and Africa Real-time Clock (RTC) IC Market Size & Forecast, By Operating Voltage, Volume (Million Units), 2017-2031

Table 47: Middle East and Africa Real-time Clock (RTC) IC Market Size & Forecast, By End-use Industry, Value (US$ Mn), 2017-2031

Table 48: Middle East and Africa Real-time Clock (RTC) IC Market Size & Forecast, By End-use Industry, Volume (Million Units), 2017-2031

Table 49: Middle East & Africa (MEA) Real-time Clock (RTC) IC Market Size & Forecast, By Country, Value (US$ Mn), 2017-2031

Table 50: Middle East & Africa (MEA) Real-time Clock (RTC) IC Market Size & Forecast, By Country, Volume (Million Units), 2017-2031

Table 51: South America Real-time Clock (RTC) IC Market Size & Forecast, By Interface, Value (US$ Mn), 2017-2031

Table 52: South America Real-time Clock (RTC) IC Market Size & Forecast, by Interface, Volume (Million Units), 2017-2031

Table 53: South America Real-time Clock (RTC) IC Market Size & Forecast, By Mounting Type, Value (US$ Mn), 2017-2031

Table 54: South America Real-time Clock (RTC) IC Market Size & Forecast, by Mounting Type, Volume (Million Units), 2017-2031

Table 55: South America Real-time Clock (RTC) IC Market Size & Forecast, By Operating Voltage, Value (US$ Mn), 2017-2031

Table 56: South America Real-time Clock (RTC) IC Market Size & Forecast, By Operating Voltage, Volume (Million Units), 2017-2031

Table 57: South America Real-time Clock (RTC) IC Market Size & Forecast, By End-use Industry, Value (US$ Mn), 2017-2031

Table 58: South America Real-time Clock (RTC) IC Market Size & Forecast, By End-use Industry, Volume (Million Units), 2017-2031

Table 59: South America Real-time Clock (RTC) IC Market Size & Forecast, By Country, Value (US$ Mn), 2017-2031

Table 60: South America Real-time Clock (RTC) IC Market Size & Forecast, By Country, Volume (Million Units), 2017-2031

List of Figures

Figure 01: Global Real-time Clock (RTC) IC Market Size & Forecast, Value (US$ Mn ), 2017-2031

Figure 02: Global Real-time Clock (RTC) IC Market Size & Forecast, Volume (Million Units), 2017-2031

Figure 03: Global Real-time Clock (RTC) IC Market, Y-o-Y, 2017-2031

Figure 04: Global Real-time Clock (RTC) IC Price Trend, 2017-2031

Figure 05: Global Real-time Clock (RTC) IC Market Size & Forecast, By Interface, Revenue (US$ Mn), 2017-2031

Figure 06: Global Real-time Clock (RTC) IC Market Attractiveness, By Interface, Value (US$ Mn), 2021-2031

Figure 07: Global Real-time Clock (RTC) IC Market Share Analysis, by Interface, 2021 and 2031

Figure 08: Global Real-time Clock (RTC) IC Market Size & Forecast, By Mounting Type, Revenue (US$ Mn), 2017-2031

Figure 09: Global Real-time Clock (RTC) IC Market Attractiveness, By Mounting Type, Value (US$ Mn), 2021-2031

Figure 10: Global Real-time Clock (RTC) IC Market Share Analysis, by Mounting Type, 2021 and 2031

Figure 11: Global Real-time Clock (RTC) IC Market Size & Forecast, By Operating Voltage, Revenue (US$ Mn), 2017-2031

Figure 12: Global Real-time Clock (RTC) IC Market Attractiveness, By Operating Voltage, Value (US$ Mn), 2021-2031

Figure 13: Global Real-time Clock (RTC) IC Market Share Analysis, by Operating Voltage, 2021 and 2031

Figure 14: Global Real-time Clock (RTC) IC Market Size & Forecast, By End-use Industry, Revenue (US$ Mn), 2017-2031

Figure 15: Global Real-time Clock (RTC) IC Market Attractiveness, By End-use Industry, Value (US$ Mn), 2021-2031

Figure 16: Global Real-time Clock (RTC) IC Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 17: Global Real-time Clock (RTC) IC Market Size & Forecast, By Region, Revenue (US$ Mn), 2017-2031

Figure 18: Global Real-time Clock (RTC) IC Market Attractiveness, By Region, Value (US$ Mn), 2021-2031

Figure 19: Global Real-time Clock (RTC) IC Market Share Analysis, by Region, 2021 and 2031

Figure 20: North America Real-time Clock (RTC) IC Market Size & Forecast, Value (US$ Mn ), 2017-2031

Figure 21: North America Real-time Clock (RTC) IC Market Size & Forecast, Volume (Million Units), 2017-2031

Figure 22: North America Real-time Clock (RTC) IC Market, Value (US$ Mn), 2017-2031

Figure 23: North America Real-time Clock (RTC) IC Price Trend, 2017-2031

Figure 24: North America Real-time Clock (RTC) IC Market Size & Forecast, By Interface, Revenue (US$ Mn), 2017-2031

Figure 25: North America Real-time Clock (RTC) IC Market Attractiveness, By Interface, Value (US$ Mn), 2021-2031

Figure 26: North America Real-time Clock (RTC) IC Market Share Analysis, by Interface, 2021 and 2031

Figure 27: North America Real-time Clock (RTC) IC Market Size & Forecast, By Mounting Type, Revenue (US$ Mn), 2017-2031

Figure 28: North America Real-time Clock (RTC) IC Market Attractiveness, By Mounting Type, Value (US$ Mn), 2021-2031

Figure 29: North America Real-time Clock (RTC) IC Market Share Analysis, by Mounting Type, 2021 and 2031

Figure 30: North America Real-time Clock (RTC) IC Market Size & Forecast, By Operating Voltage, Revenue (US$ Mn), 2017-2031

Figure 31: North America Real-time Clock (RTC) IC Market Attractiveness, By Operating Voltage, Value (US$ Mn), 2021-2031

Figure 32: North America Real-time Clock (RTC) IC Market Share Analysis, by Operating Voltage, 2021 and 2031

Figure 33: North America Real-time Clock (RTC) IC Market Size & Forecast, By End-use Industry, Revenue (US$ Mn), 2017-2031

Figure 34: North America Real-time Clock (RTC) IC Market Attractiveness, By End-use Industry, Value (US$ Mn), 2021-2031

Figure 35: North America Real-time Clock (RTC) IC Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 36: North America Real-time Clock (RTC) IC Market Size & Forecast, By Country, Revenue (US$ Mn), 2017-2031

Figure 37: North America Real-time Clock (RTC) IC Market Attractiveness, By Country, Value (US$ Mn), 2021-2031

Figure 38: North America Real-time Clock (RTC) IC Market Share Analysis, by Country, 2021 and 2031

Figure 39: Europe Real-time Clock (RTC) IC Market Size & Forecast, Value (US$ Mn ), 2017-2031

Figure 40: Europe Real-time Clock (RTC) IC Market Size & Forecast, Volume (Million Units), 2017-2031

Figure 41: Europe Real-time Clock (RTC) IC Market, Y-o-Y, 2017-2031

Figure 42: Europe Real-time Clock (RTC) IC Price Trend, 2017-2031

Figure 43: Europe Real-time Clock (RTC) IC Market Size & Forecast, By Interface, Revenue (US$ Mn), 2017-2031

Figure 44: Europe Real-time Clock (RTC) IC Market Attractiveness, By Interface, Value (US$ Mn), 2021-2031

Figure 45: Europe Real-time Clock (RTC) IC Market Share Analysis, by Interface, 2021 and 2031

Figure 46: Europe Real-time Clock (RTC) IC Market Size & Forecast, By Mounting Type, Revenue (US$ Mn), 2017-2031

Figure 47: Europe Real-time Clock (RTC) IC Market Attractiveness, By Mounting Type, Value (US$ Mn), 2021-2031

Figure 48: Europe Real-time Clock (RTC) IC Market Share Analysis, by Mounting Type, 2021 and 2031

Figure 49: Europe Real-time Clock (RTC) IC Market Size & Forecast, By Operating Voltage, Revenue (US$ Mn), 2017-2031

Figure 50: Europe Real-time Clock (RTC) IC Market Attractiveness, By Operating Voltage, Value (US$ Mn), 2021-2031

Figure 51: Europe Real-time Clock (RTC) IC Market Share Analysis, by Operating Voltage, 2021 and 2031

Figure 52: Europe Real-time Clock (RTC) IC Market Size & Forecast, By End-use Industry, Revenue (US$ Mn), 2017-2031

Figure 53: Europe Real-time Clock (RTC) IC Market Attractiveness, By End-use Industry, Value (US$ Mn), 2021-2031

Figure 54: Europe Real-time Clock (RTC) IC Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 55: Europe Real-time Clock (RTC) IC Market Size & Forecast, By Country, Revenue (US$ Mn), 2017-2031

Figure 56: Europe Real-time Clock (RTC) IC Market Attractiveness, By Country, Value (US$ Mn), 2021-2031

Figure 57: Europe Real-time Clock (RTC) IC Market Share Analysis, by Country, 2021 and 2031

Figure 58: Asia Pacific Real-time Clock (RTC) IC Market Size & Forecast, Value (US$ Mn ), 2017-2031

Figure 59: Asia Pacific Real-time Clock (RTC) IC Market Size & Forecast, Volume (Million Units), 2017-2031

Figure 60: Asia Pacific Real-time Clock (RTC) IC Market, Y-o-Y, 2017-2031

Figure 61: Asia Pacific Real-time Clock (RTC) IC Price Trend, 2017-2031

Figure 62: Asia Pacific Real-time Clock (RTC) IC Market Size & Forecast, By Interface, Revenue (US$ Mn), 2017-2031

Figure 63: Asia Pacific Real-time Clock (RTC) IC Market Attractiveness, By Interface, Value (US$ Mn), 2021-2031

Figure 64: Asia Pacific Real-time Clock (RTC) IC Market Share Analysis, by Interface, 2021 and 2031

Figure 65: Asia Pacific Real-time Clock (RTC) IC Market Size & Forecast, By Mounting Type, Revenue (US$ Mn), 2017-2031

Figure 66: Asia Pacific Real-time Clock (RTC) IC Market Attractiveness, By Mounting Type, Value (US$ Mn), 2021-2031

Figure 67: Asia Pacific Real-time Clock (RTC) IC Market Share Analysis, by Mounting Type, 2021 and 2031

Figure 68: Asia Pacific Real-time Clock (RTC) IC Market Size & Forecast, By Operating Voltage, Revenue (US$ Mn), 2017-2031

Figure 69: Asia Pacific Real-time Clock (RTC) IC Market Attractiveness, By Operating Voltage, Value (US$ Mn), 2021-2031

Figure 70: Asia Pacific Real-time Clock (RTC) IC Market Share Analysis, by Operating Voltage, 2021 and 2031

Figure 71: Asia Pacific Real-time Clock (RTC) IC Market Size & Forecast, By End-use Industry, Revenue (US$ Mn), 2017-2031

Figure 72: Asia Pacific Real-time Clock (RTC) IC Market Attractiveness, By End-use Industry, Value (US$ Mn), 2021-2031

Figure 73: Asia Pacific Real-time Clock (RTC) IC Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 74: Asia Pacific Real-time Clock (RTC) IC Market Size & Forecast, By Country, Revenue (US$ Mn), 2017-2031

Figure 75: Asia Pacific Real-time Clock (RTC) IC Market Attractiveness, By Country, Value (US$ Mn), 2021-2031

Figure 76: Asia Pacific Real-time Clock (RTC) IC Market Share Analysis, by Country, 2021 and 2031

Figure 77: Middle East and Africa Real-time Clock (RTC) IC Market Size & Forecast, Value (US$ Mn ), 2017-2031

Figure 78: Middle East and Africa Real-time Clock (RTC) IC Market Size & Forecast, Volume (Million Units), 2017-2031

Figure 79: Middle East and Africa Real-time Clock (RTC) IC Market, Y-o-Y, 2017-2031

Figure 80: Middle East and Africa Real-time Clock (RTC) IC Price Trend, 2017-2031

Figure 81: Middle East and Africa Real-time Clock (RTC) IC Market Size & Forecast, By Interface, Revenue (US$ Mn), 2017-2031

Figure 82: Middle East and Africa Real-time Clock (RTC) IC Market Attractiveness, By Interface, Value (US$ Mn), 2021-2031

Figure 83: Middle East and Africa Real-time Clock (RTC) IC Market Share Analysis, by Interface, 2021 and 2031

Figure 84: Middle East and Africa Real-time Clock (RTC) IC Market Size & Forecast, By Mounting Type, Revenue (US$ Mn), 2017-2031

Figure 85: Middle East and Africa Real-time Clock (RTC) IC Market Attractiveness, By Mounting Type, Value (US$ Mn), 2021-2031

Figure 86: Middle East and Africa Real-time Clock (RTC) IC Market Share Analysis, by Mounting Type, 2021 and 2031

Figure 87: Middle East and Africa Real-time Clock (RTC) IC Market Size & Forecast, By Operating Voltage, Revenue (US$ Mn), 2017-2031

Figure 88: Middle East and Africa Real-time Clock (RTC) IC Market Attractiveness, By Operating Voltage, Value (US$ Mn), 2021-2031

Figure 89: Middle East and Africa Real-time Clock (RTC) IC Market Share Analysis, by Operating Voltage, 2021 and 2031

Figure 90: Middle East and Africa Real-time Clock (RTC) IC Market Size & Forecast, By End-use Industry, Revenue (US$ Mn), 2017-2031

Figure 91: Middle East and Africa Real-time Clock (RTC) IC Market Attractiveness, By End-use Industry, Value (US$ Mn), 2021-2031

Figure 92: Middle East and Africa Real-time Clock (RTC) IC Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 93: Middle East and Africa Real-time Clock (RTC) IC Market Size & Forecast, By Country, Revenue (US$ Mn), 2017-2031

Figure 94: Middle East and Africa Real-time Clock (RTC) IC Market Attractiveness, By Country, Value (US$ Mn), 2021-2031

Figure 95: Middle East and Africa Real-time Clock (RTC) IC Market Share Analysis, by Country, 2021 and 2031

Figure 96: South America Real-time Clock (RTC) IC Market Size & Forecast, Value (US$ Mn ), 2017-2031

Figure 97: South America Real-time Clock (RTC) IC Market Size & Forecast, Volume (Million Units), 2017-2031

Figure 98: South America Real-time Clock (RTC) IC Market, Value (US$ Mn), 2017-2031

Figure 99: South Africa Real-time Clock (RTC) IC Price Trend, 2017-2031

Figure 100: South America Real-time Clock (RTC) IC Market Size & Forecast, By Interface, Revenue (US$ Mn), 2017-2031

Figure 101: South America Real-time Clock (RTC) IC Market Attractiveness, By Interface, Value (US$ Mn), 2021-2031

Figure 102: South America Real-time Clock (RTC) IC Market Share Analysis, by Interface, 2021 and 2031

Figure 103: South America Real-time Clock (RTC) IC Market Size & Forecast, By Mounting Type, Revenue (US$ Mn), 2017-2031

Figure 104: South America Real-time Clock (RTC) IC Market Attractiveness, By Mounting Type, Value (US$ Mn), 2021-2031

Figure 105: South America Real-time Clock (RTC) IC Market Share Analysis, by Mounting Type, 2021 and 2031

Figure 106: South America Real-time Clock (RTC) IC Market Size & Forecast, By Operating Voltage, Revenue (US$ Mn), 2017-2031

Figure 107: South America Real-time Clock (RTC) IC Market Attractiveness, By Operating Voltage, Value (US$ Mn), 2021-2031

Figure 108: South America Real-time Clock (RTC) IC Market Share Analysis, by Operating Voltage, 2021 and 2031

Figure 109: South America Real-time Clock (RTC) IC Market Size & Forecast, By End-use Industry, Revenue (US$ Mn), 2017-2031

Figure 110: South America Real-time Clock (RTC) IC Market Attractiveness, By End-use Industry, Value (US$ Mn), 2021-2031

Figure 111: South America Real-time Clock (RTC) IC Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 112: South America Real-time Clock (RTC) IC Market Size & Forecast, By Country, Revenue (US$ Mn), 2017-2031

Figure 113: South America Real-time Clock (RTC) IC Market Attractiveness, By Country, Value (US$ Mn), 2021-2031

Figure 114: South America Real-time Clock (RTC) IC Market Share Analysis, by Country, 2021 and 2031