Reports

Reports

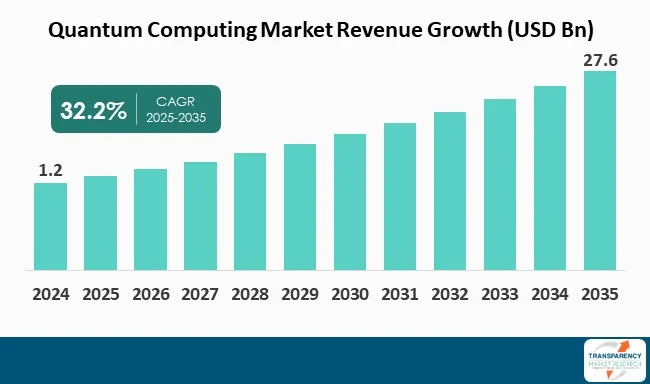

The global quantum computing market size was valued at US$ 1.2 billion in 2024 and is projected to reach US$ 27.6 billion by 2035, expanding at a CAGR of 32.2% from 2025 to 2035. The market growth is specifically driven by the increasing adoption of quantum computing by various industry verticals and government initiatives and funding among others.

The global quantum computing market is driven by the advanced quantum technology and government funding towards it. For instance, the South Korean government has announced significant funding for quantum technology development to support goals pertaining to technology, commercialization, and talent.

Additionally, adopting quantum computing will improve efficiencies for many business processes, which translate into increased revenue and enhancements to research capabilities. Processes can take advantage of phenomena such as superposition and entanglement to compute a vast amount of data simultaneously, finding solutions to complex problems that are not solvable today by classical systems. For instance, quantum computing can validate financial modeling processes, accelerated drug discovery, improved supply chain networks, and better simulation capabilities for manufacturing, logistics, healthcare, and finance.

As such, quantum computing can push the boundaries of innovation through research and development activities. As organizations increasingly incorporate quantum capabilities into their digital strategies, early adopters are likely to leapfrog competing organizations.

Therefore, investments into quantum readiness today will provide business with access to disruptive futures, shortly after the technology becomes available. Also, several key players in the market are planning to invest in strategic partnerships and collaborations, key launches, and quantum computing research to take the market forward.

Quantum computing is an emergent field of computer science and engineering that harnesses the unique qualities of quantum mechanics to solve problems beyond the ability of even the most powerful classical computers.

Quantum computing become necessary because, while traditional computers commonly provide singular answers, probabilistic quantum machines often provide ranges of possible answers. This range might make quantum computing seem less precise than traditional computation. For instance- In 2024, IBM introduced the first stable version of the Qiskit open source software development kit (SDK) - Qiskit SDK 1.x. With over 600,000 registered users and 700 global universities that use it to develop quantum computing classes, Qiskit has become the preferred software stack for quantum computing.

Additionally, the global quantum computing market is positioned for unprecedented growth. Factors that drive market growth include the level of funding being provided by government sources and the world's technology leaders, continued realization for the need of high-performance computing, and an improved level of hardware stability and qubit scalability.

| Attribute | Detail |

|---|---|

| Quantum Computing Market Drivers |

|

The growing use of quantum computing across diverse industry sectors represents a significant transformation in business processes related to complex problem-solving and innovation. As quantum technologies develop across industry sectors, quantum computing is being utilized to gain a competitive advantage in finance, healthcare, manufacturing, logistics, and energy.

Financial services organizations are exploring ways to use quantum computing for portfolio optimization, risk modeling, fraud detection, and pricing complex derivatives. The capacity to manage and assess huge datasets and model what-if scenarios at speeds unheard of with classical computers provides substantial efficiencies and accuracy improvements. In the healthcare and pharmaceutical sectors, quantum machine learning capabilities allow for rapid drug discovery, evaluating protein folding, and genomic studies and research to model molecular structures in ways not feasible using classical computers.

Hence, the adoption of quantum technology across industries is motivated by the pressure to solve more intricate problems, as well as the desire to innovate for competitive advantage. While excitement over experimental applications has transitioned to excitement for practical applications of quantum computing across industries. Early industry adopters are positioning themselves for significant leaps in efficiency, cost, and enhanced innovation.

Government actions and funding are key drivers in furthering the growth and development of the quantum computing industry. Governments across the globe are investing into research, nurturing talent, and establishing infrastructure to treat quantum technologies as a strategic asset and these countries are actually competing to be out in front of the other countries regarding quantum.

To that effect, numerous countries have developed national quantum strategies and funding opportunities. As an example, the National Quantum Initiative Act, enacted in the United States, provides billions of dollars for quantum R&D. The EU's Quantum Flagship program is providing €1 Bn over 10 years to support quantum technology.

Similarly, nations like China, Canada, Germany, and South Korea are a national mission to make quantum computers a priority. South Korea also recently devoted substantial funds to the commercialization and workforce preparation of quantum technology. Also, Indian government made significant announcements including additional funding within the National Quantum Mission, and for research parks and tech hubs across the country to support an emerging start-up ecosystem. Hence, a number of countries started funding for quantum computing technological ease and advancement.

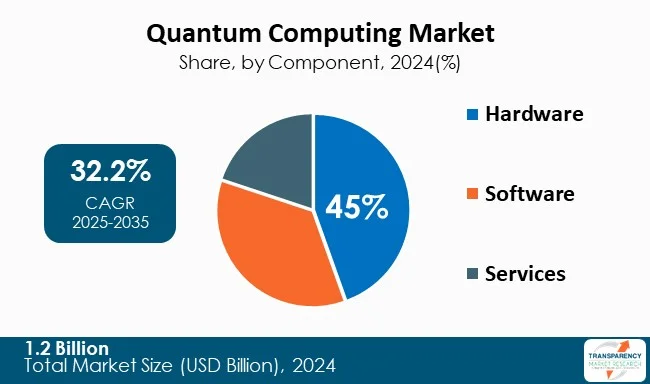

The hardware segment dominates the market for quantum computing with 45% revenue share, as hardware serves as a foundation to build fully functional, logical, and scalable quantum systems. In contrast to classical computing, the maturity of hardware has progressed a great deal versus quantum computing hardware, which is still at lower levels of maturity demanding significant funding in research, engineering, and innovation.

Leading technology firms and startups are competing to take the lead in developing stable and tolerant quantum processors utilizing a range of strategies from superconducting qubits, trapped ions, photonic qubits, and topological qubits. All strategies need developed fabrication techniques, precision engineering, and highly advanced infrastructure to maintain, such as cryogenic cooling systems. To sustain this investment, it pushes strong capital investment and research on hardware.

As a result of the importance of hardware, most public and private funding is pushed toward hardware to get over some of the most important modalities such as qubit scaling, quantum decoherence, and error correction. In addition to funding there's also leaders in the hardware space. Leaders like IBM, Google, Intel, and Rigetti have pushed much of their investments into a hardware strategy that provide quantum processor units that can be accessed in the cloud.

| Attribute | Detail |

|---|---|

| Leading Region |

|

North America holds the major market share of 41% in the global quantum computing industry, thanks to the well-developed technological ecosystem, governments’ support, and the key players like IBM, Google, Intel, etc. In terms of regional distribution, North America has the highest number of investment institutions, reaching 54, demonstrating the region's activity and importance in global investment activities.

Furthermore, the area is advantaged by a high amount of venture capital funding and an active major tech company presence, all of which is providing substantial investment in quantum R&D. North America also leads in building talent pipelines for quantum work, due to top universities leading programs for workforce development.

Key players operating in the quantum computing market are investing in innovation, technological advancements, and strategic partnerships. They emphasize expanding product portfolios and improving imaging clarity, thereby ensuring sustained growth and leadership in the evolving healthcare landscape.

1QB Information Technologies Inc., Accenture, Atos SE, Amazon Braket, Cambridge Quantum Computing Ltd, D-Wave Systems Inc., Fujitsu, Hewlett Packard Enterprise (HP), Hitachi Ltd, Honeywell Inc., IBM Corporation, Intel Corporation, Magiq Technologies Inc., QC Ware Corp., Quantum Circuits, Inc., Qxbranch, LLC, Google Research, Rigetti Computing, River Lane Research, Station Q - Microsoft Corporation, Toshiba Corporation, Weichai Power are the key players in quantum computing market.

Each of these players has been profiled in the quantum computing market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 1.2 Bn |

| Forecast Value in 2035 | US$ 27.6 Bn |

| CAGR | 32.2% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Quantum Computing Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Component

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The quantum computing market was valued at US$ 1.2 Bn in 2024

The quantum computing market is projected to reach US$ 27.6 Bn by the end of 2035

Increasing adoption of quantum computing by various industry vertical and government initiatives and funding are some of the driving factor of Quantum Computing market.

The CAGR is anticipated to be 32.2% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

1QB Information Technologies Inc., Accenture, Atos SE, Amazon Braket, Cambridge Quantum Computing Ltd, D-Wave Systems Inc., Fujitsu, Hewlett Packard Enterprise (HP), Hitachi Ltd, Honeywell Inc., IBM Corporation, Intel Corporation, Magiq Technologies Inc., QC Ware Corp., Quantum Circuits, Inc., Qxbranch, LLC, Google Research, Rigetti Computing, River Lane Research, Station Q - Microsoft Corporation, Toshiba Corporation, and Weichai Power among others.

Table 01: Global Quantum Computing Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 02: Global Quantum Computing Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 03: Global Quantum Computing Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 04: Global Quantum Computing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 05: Global Quantum Computing Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 06: Global Quantum Computing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 07: North America Quantum Computing Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 08: North America Quantum Computing Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 09: North America Quantum Computing Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 10: North America Quantum Computing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 11: North America Quantum Computing Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 12: North America Quantum Computing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 13: U.S. Quantum Computing Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 14: U.S. Quantum Computing Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 15: U.S. Quantum Computing Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 16: U.S. Quantum Computing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 17: U.S. Quantum Computing Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 18: Canada Quantum Computing Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 19: Canada Quantum Computing Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 20: Canada Quantum Computing Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 21: Canada Quantum Computing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 22: Canada Quantum Computing Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 23: Europe Quantum Computing Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 24: Europe Quantum Computing Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 25: Europe Quantum Computing Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 26: Europe Quantum Computing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 27: Europe Quantum Computing Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 28: Europe Quantum Computing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 29: Germany Quantum Computing Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 30: Germany Quantum Computing Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 31: Germany Quantum Computing Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 32: Germany Quantum Computing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 33: Germany Quantum Computing Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 34: U.K. Quantum Computing Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 35: U.K. Quantum Computing Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 36: U.K. Quantum Computing Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 37: U.K. Quantum Computing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 38: U.K. Quantum Computing Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 39: France Quantum Computing Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 40: France Quantum Computing Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 41: France Quantum Computing Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 42: France Quantum Computing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 43: France Quantum Computing Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 44: Italy Quantum Computing Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 45: Italy Quantum Computing Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 46: Italy Quantum Computing Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 47: Italy Quantum Computing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 48: Italy Quantum Computing Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 49: Spain Quantum Computing Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 50: Spain Quantum Computing Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 51: Spain Quantum Computing Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 52: Spain Quantum Computing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 53: Spain Quantum Computing Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 54: Switzerland Quantum Computing Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 55: Switzerland Quantum Computing Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 56: Switzerland Quantum Computing Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 57: Switzerland Quantum Computing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 58: Switzerland Quantum Computing Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 59: The Netherlands Quantum Computing Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 60: The Netherlands Quantum Computing Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 61: The Netherlands Quantum Computing Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 62: The Netherlands Quantum Computing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 63: The Netherlands Quantum Computing Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 64: Rest of Europe Quantum Computing Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 65: Rest of Europe Quantum Computing Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 66: Rest of Europe Quantum Computing Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 67: Rest of Europe Quantum Computing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 68: Rest of Europe Quantum Computing Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 69: Asia Pacific Quantum Computing Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 70: Asia Pacific Quantum Computing Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 71: Asia Pacific Quantum Computing Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 72: Asia Pacific Quantum Computing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 73: Asia Pacific Quantum Computing Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 74: Asia Pacific Quantum Computing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 75: China Quantum Computing Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 76: China Quantum Computing Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 77: China Quantum Computing Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 78: China Quantum Computing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 79: China Quantum Computing Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 80: Japan Quantum Computing Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 81: Japan Quantum Computing Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 82: Japan Quantum Computing Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 83: Japan Quantum Computing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 84: Japan Quantum Computing Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 85: India Quantum Computing Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 86: India Quantum Computing Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 87: India Quantum Computing Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 88: India Quantum Computing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 89: India Quantum Computing Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 90: South Korea Quantum Computing Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 91: South Korea Quantum Computing Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 92: South Korea Quantum Computing Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 93: South Korea Quantum Computing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 94: South Korea Quantum Computing Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 95: Australia and New Zealand Quantum Computing Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 96: Australia and New Zealand Quantum Computing Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 97: Australia and New Zealand Quantum Computing Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 98: Australia and New Zealand Quantum Computing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 99: Australia and New Zealand Quantum Computing Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 100: Rest of Asia Pacific Quantum Computing Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 101: Rest of Asia Pacific Quantum Computing Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 102: Rest of Asia Pacific Quantum Computing Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 103: Rest of Asia Pacific Quantum Computing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 104: Rest of Asia Pacific Quantum Computing Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 105: Latin America Quantum Computing Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 106: Latin America Quantum Computing Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 107: Latin America Quantum Computing Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 108: Latin America Quantum Computing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 109: Latin America Quantum Computing Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 110: Latin America Quantum Computing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 111: Brazil Quantum Computing Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 112: Brazil Quantum Computing Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 113: Brazil Quantum Computing Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 114: Brazil Quantum Computing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 115: Brazil Quantum Computing Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 116: Mexico Quantum Computing Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 117: Mexico Quantum Computing Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 118: Mexico Quantum Computing Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 119: Mexico Quantum Computing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 120: Mexico Quantum Computing Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 121: Argentina Quantum Computing Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 122: Argentina Quantum Computing Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 123: Argentina Quantum Computing Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 124: Argentina Quantum Computing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 125: Argentina Quantum Computing Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 126: Rest of Latin America Quantum Computing Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 127: Rest of Latin America Quantum Computing Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 128: Rest of Latin America Quantum Computing Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 129: Rest of Latin America Quantum Computing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 130: Rest of Latin America Quantum Computing Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 131: Middle East and Africa Quantum Computing Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 132: Middle East and Africa Quantum Computing Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 133: Middle East and Africa Quantum Computing Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 134: Middle East and Africa Quantum Computing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 135: Middle East and Africa Quantum Computing Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 136: Middle East and Africa Quantum Computing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 137: GCC Countries Quantum Computing Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 138: GCC Countries Quantum Computing Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 139: GCC Countries Quantum Computing Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 140: GCC Countries Quantum Computing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 141: GCC Countries Quantum Computing Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 142: South Africa Quantum Computing Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 143: South Africa Quantum Computing Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 144: South Africa Quantum Computing Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 145: South Africa Quantum Computing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 146: South Africa Quantum Computing Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Table 147: Rest of Middle East and Africa Quantum Computing Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 148: Rest of Middle East and Africa Quantum Computing Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 149: Rest of Middle East and Africa Quantum Computing Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 150: Rest of Middle East and Africa Quantum Computing Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 151: Rest of Middle East and Africa Quantum Computing Market Value (US$ Bn) Forecast, by End-User Industry, 2020 to 2035

Figure 01: Global Quantum Computing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 02: Global Quantum Computing Market Value Share Analysis, by Component, 2024 and 2035

Figure 03: Global Quantum Computing Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 04: Global Quantum Computing Market Revenue (US$ Bn), by Hardware, 2020 to 2035

Figure 05: Global Quantum Computing Market Revenue (US$ Bn), by Software, 2020 to 2035

Figure 06: Global Quantum Computing Market Revenue (US$ Bn), by Services, 2020 to 2035

Figure 07: Global Quantum Computing Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 08: Global Quantum Computing Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 09: Global Quantum Computing Market Revenue (US$ Bn), by On-premise, 2020 to 2035

Figure 10: Global Quantum Computing Market Revenue (US$ Bn), by Cloud-based, 2020 to 2035

Figure 11: Global Quantum Computing Market Value Share Analysis, by Technology, 2024 and 2035

Figure 12: Global Quantum Computing Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 13: Global Quantum Computing Market Revenue (US$ Bn), by Superconducting Qubits, 2020 to 2035

Figure 14: Global Quantum Computing Market Revenue (US$ Bn), by Trapped Ions, 2020 to 2035

Figure 15: Global Quantum Computing Market Revenue (US$ Bn), by Quantum Annealing, 2020 to 2035

Figure 16: Global Quantum Computing Market Revenue (US$ Bn), by Others (Photonic Qubits, Neutral Atoms, etc.), 2020 to 2035

Figure 17: Global Quantum Computing Market Value Share Analysis, by Application, 2024 and 2035

Figure 18: Global Quantum Computing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 19: Global Quantum Computing Market Revenue (US$ Bn), by Optimization, 2020 to 2035

Figure 20: Global Quantum Computing Market Revenue (US$ Bn), by Simulation & Modelling, 2020 to 2035

Figure 21: Global Quantum Computing Market Revenue (US$ Bn), by Machine Learning & AI, 2020 to 2035

Figure 22: Global Quantum Computing Market Revenue (US$ Bn), by Cryptography & Security, 2020 to 2035

Figure 23: Global Quantum Computing Market Revenue (US$ Bn), by Others (Sampling, Drug discovery, etc.), 2020 to 2035

Figure 24: Global Quantum Computing Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 25: Global Quantum Computing Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 26: Global Quantum Computing Market Revenue (US$ Bn), by BFSI (Banking, Financial Services & Insurance), 2020 to 2035

Figure 27: Global Quantum Computing Market Revenue (US$ Bn), by Healthcare & Pharmaceuticals, 2020 to 2035

Figure 28: Global Quantum Computing Market Revenue (US$ Bn), by Chemicals, Materials & Energy, 2020 to 2035

Figure 29: Global Quantum Computing Market Revenue (US$ Bn), by Aerospace & Defense, 2020 to 2035

Figure 30: Global Quantum Computing Market Revenue (US$ Bn), by Automotive, 2020 to 2035

Figure 31: Global Quantum Computing Market Revenue (US$ Bn), by Government, Academia & Research, 2020 to 2035

Figure 32: Global Quantum Computing Market Revenue (US$ Bn), by Others (Logistics, Supply Chain, etc.), 2020 to 2035

Figure 33: Global Quantum Computing Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 34: Global Quantum Computing Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 35: North America Quantum Computing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 36: North America Quantum Computing Market Value Share Analysis, by Component, 2024 and 2035

Figure 37: North America Quantum Computing Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 38: North America Quantum Computing Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 39: North America Quantum Computing Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 40: North America Quantum Computing Market Value Share Analysis, by Technology, 2024 and 2035

Figure 41: North America Quantum Computing Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 42: North America Quantum Computing Market Value Share Analysis, by Application, 2024 and 2035

Figure 43: North America Quantum Computing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 44: North America Quantum Computing Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 45: North America Quantum Computing Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 46: North America Quantum Computing Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 47: North America Quantum Computing Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 48: U.S. Quantum Computing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 49: U.S. Quantum Computing Market Value Share Analysis, by Component, 2024 and 2035

Figure 50: U.S. Quantum Computing Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 51: U.S. Quantum Computing Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 52: U.S. Quantum Computing Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 53: U.S. Quantum Computing Market Value Share Analysis, by Technology, 2024 and 2035

Figure 54: U.S. Quantum Computing Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 55: U.S. Quantum Computing Market Value Share Analysis, by Application, 2024 and 2035

Figure 56: U.S. Quantum Computing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 57: U.S. Quantum Computing Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 58: U.S. Quantum Computing Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 59: Canada Quantum Computing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 60: Canada Quantum Computing Market Value Share Analysis, by Component, 2024 and 2035

Figure 61: Canada Quantum Computing Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 62: Canada Quantum Computing Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 63: Canada Quantum Computing Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 64: Canada Quantum Computing Market Value Share Analysis, by Technology, 2024 and 2035

Figure 65: Canada Quantum Computing Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 66: Canada Quantum Computing Market Value Share Analysis, by Application, 2024 and 2035

Figure 67: Canada Quantum Computing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 68: Canada Quantum Computing Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 69: Canada Quantum Computing Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 70: Europe Quantum Computing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 71: Europe Quantum Computing Market Value Share Analysis, by Component, 2024 and 2035

Figure 72: Europe Quantum Computing Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 73: Europe Quantum Computing Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 74: Europe Quantum Computing Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 75: Europe Quantum Computing Market Value Share Analysis, by Technology, 2024 and 2035

Figure 76: Europe Quantum Computing Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 77: Europe Quantum Computing Market Value Share Analysis, by Application, 2024 and 2035

Figure 78: Europe Quantum Computing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 79: Europe Quantum Computing Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 80: Europe Quantum Computing Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 81: Europe Quantum Computing Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 82: Europe Quantum Computing Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 83: Germany Quantum Computing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 84: Germany Quantum Computing Market Value Share Analysis, by Component, 2024 and 2035

Figure 85: Germany Quantum Computing Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 86: Germany Quantum Computing Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 87: Germany Quantum Computing Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 88: Germany Quantum Computing Market Value Share Analysis, by Technology, 2024 and 2035

Figure 89: Germany Quantum Computing Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 90: Germany Quantum Computing Market Value Share Analysis, by Application, 2024 and 2035

Figure 91: Germany Quantum Computing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 92: Germany Quantum Computing Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 93: Germany Quantum Computing Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 94: U.K. Quantum Computing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 95: U.K. Quantum Computing Market Value Share Analysis, by Component, 2024 and 2035

Figure 96: U.K. Quantum Computing Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 97: U.K. Quantum Computing Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 98: U.K. Quantum Computing Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 99: U.K. Quantum Computing Market Value Share Analysis, by Technology, 2024 and 2035

Figure 100: U.K. Quantum Computing Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 101: U.K. Quantum Computing Market Value Share Analysis, by Application, 2024 and 2035

Figure 102: U.K. Quantum Computing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 103: U.K. Quantum Computing Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 104: U.K. Quantum Computing Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 105: France Quantum Computing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 106: France Quantum Computing Market Value Share Analysis, by Component, 2024 and 2035

Figure 107: France Quantum Computing Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 108: France Quantum Computing Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 109: France Quantum Computing Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 110: France Quantum Computing Market Value Share Analysis, by Technology, 2024 and 2035

Figure 111: France Quantum Computing Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 112: France Quantum Computing Market Value Share Analysis, by Application, 2024 and 2035

Figure 113: France Quantum Computing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 114: France Quantum Computing Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 115: France Quantum Computing Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 116: Italy Quantum Computing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 117: Italy Quantum Computing Market Value Share Analysis, by Component, 2024 and 2035

Figure 118: Italy Quantum Computing Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 119: Italy Quantum Computing Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 120: Italy Quantum Computing Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 121: Italy Quantum Computing Market Value Share Analysis, by Technology, 2024 and 2035

Figure 122: Italy Quantum Computing Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 123: Italy Quantum Computing Market Value Share Analysis, by Application, 2024 and 2035

Figure 124: Italy Quantum Computing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 125: Italy Quantum Computing Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 126: Italy Quantum Computing Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 127: Spain Quantum Computing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 128: Spain Quantum Computing Market Value Share Analysis, by Component, 2024 and 2035

Figure 129: Spain Quantum Computing Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 130: Spain Quantum Computing Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 131: Spain Quantum Computing Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 132: Spain Quantum Computing Market Value Share Analysis, by Technology, 2024 and 2035

Figure 133: Spain Quantum Computing Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 134: Spain Quantum Computing Market Value Share Analysis, by Application, 2024 and 2035

Figure 135: Spain Quantum Computing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 136: Spain Quantum Computing Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 137: Spain Quantum Computing Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 138: Switzerland Quantum Computing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 139: Switzerland Quantum Computing Market Value Share Analysis, by Component, 2024 and 2035

Figure 140: Switzerland Quantum Computing Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 141: Switzerland Quantum Computing Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 142: Switzerland Quantum Computing Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 143: Switzerland Quantum Computing Market Value Share Analysis, by Technology, 2024 and 2035

Figure 144: Switzerland Quantum Computing Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 145: Switzerland Quantum Computing Market Value Share Analysis, by Application, 2024 and 2035

Figure 146: Switzerland Quantum Computing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 147: Switzerland Quantum Computing Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 148: Switzerland Quantum Computing Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 149: The Netherlands Quantum Computing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 150: The Netherlands Quantum Computing Market Value Share Analysis, by Component, 2024 and 2035

Figure 151: The Netherlands Quantum Computing Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 152: The Netherlands Quantum Computing Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 153: The Netherlands Quantum Computing Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 154: The Netherlands Quantum Computing Market Value Share Analysis, by Technology, 2024 and 2035

Figure 155: The Netherlands Quantum Computing Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 156: The Netherlands Quantum Computing Market Value Share Analysis, by Application, 2024 and 2035

Figure 157: The Netherlands Quantum Computing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 158: The Netherlands Quantum Computing Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 159: The Netherlands Quantum Computing Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 160: Rest of Europe Quantum Computing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 161: Rest of Europe Quantum Computing Market Value Share Analysis, by Component, 2024 and 2035

Figure 162: Rest of Europe Quantum Computing Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 163: Rest of Europe Quantum Computing Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 164: Rest of Europe Quantum Computing Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 165: Rest of Europe Quantum Computing Market Value Share Analysis, by Technology, 2024 and 2035

Figure 166: Rest of Europe Quantum Computing Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 167: Rest of Europe Quantum Computing Market Value Share Analysis, by Application, 2024 and 2035

Figure 168: Rest of Europe Quantum Computing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 169: Rest of Europe Quantum Computing Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 170: Rest of Europe Quantum Computing Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 171: Asia Pacific Quantum Computing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 172: Asia Pacific Quantum Computing Market Value Share Analysis, by Component, 2024 and 2035

Figure 173: Asia Pacific Quantum Computing Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 174: Asia Pacific Quantum Computing Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 175: Asia Pacific Quantum Computing Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 176: Asia Pacific Quantum Computing Market Value Share Analysis, by Technology, 2024 and 2035

Figure 177: Asia Pacific Quantum Computing Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 178: Asia Pacific Quantum Computing Market Value Share Analysis, by Application, 2024 and 2035

Figure 179: Asia Pacific Quantum Computing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 180: Asia Pacific Quantum Computing Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 181: Asia Pacific Quantum Computing Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 182: Asia Pacific Quantum Computing Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 183: Asia Pacific Quantum Computing Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 184: China Quantum Computing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 185: China Quantum Computing Market Value Share Analysis, by Component, 2024 and 2035

Figure 186: China Quantum Computing Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 187: China Quantum Computing Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 188: China Quantum Computing Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 189: China Quantum Computing Market Value Share Analysis, by Technology, 2024 and 2035

Figure 190: China Quantum Computing Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 191: China Quantum Computing Market Value Share Analysis, by Application, 2024 and 2035

Figure 192: China Quantum Computing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 193: China Quantum Computing Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 194: China Quantum Computing Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 195: Japan Quantum Computing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 196: Japan Quantum Computing Market Value Share Analysis, by Component, 2024 and 2035

Figure 197: Japan Quantum Computing Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 198: Japan Quantum Computing Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 199: Japan Quantum Computing Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 200: Japan Quantum Computing Market Value Share Analysis, by Technology, 2024 and 2035

Figure 201: Japan Quantum Computing Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 202: Japan Quantum Computing Market Value Share Analysis, by Application, 2024 and 2035

Figure 203: Japan Quantum Computing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 204: Japan Quantum Computing Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 205: Japan Quantum Computing Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 206: India Quantum Computing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 207: India Quantum Computing Market Value Share Analysis, by Component, 2024 and 2035

Figure 208: India Quantum Computing Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 209: India Quantum Computing Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 210: India Quantum Computing Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 211: India Quantum Computing Market Value Share Analysis, by Technology, 2024 and 2035

Figure 212: India Quantum Computing Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 213: India Quantum Computing Market Value Share Analysis, by Application, 2024 and 2035

Figure 214: India Quantum Computing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 215: India Quantum Computing Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 216: India Quantum Computing Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 217: South Korea Quantum Computing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 218: South Korea Quantum Computing Market Value Share Analysis, by Component, 2024 and 2035

Figure 219: South Korea Quantum Computing Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 220: South Korea Quantum Computing Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 221: South Korea Quantum Computing Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 222: South Korea Quantum Computing Market Value Share Analysis, by Technology, 2024 and 2035

Figure 223: South Korea Quantum Computing Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 224: South Korea Quantum Computing Market Value Share Analysis, by Application, 2024 and 2035

Figure 225: South Korea Quantum Computing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 226: South Korea Quantum Computing Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 227: South Korea Quantum Computing Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 228: Australia and New Zealand Quantum Computing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 229: Australia and New Zealand Quantum Computing Market Value Share Analysis, by Component, 2024 and 2035

Figure 230: Australia and New Zealand Quantum Computing Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 231: Australia and New Zealand Quantum Computing Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 232: Australia and New Zealand Quantum Computing Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 233: Australia and New Zealand Quantum Computing Market Value Share Analysis, by Technology, 2024 and 2035

Figure 234: Australia and New Zealand Quantum Computing Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 235: Australia and New Zealand Quantum Computing Market Value Share Analysis, by Application, 2024 and 2035

Figure 236: Australia and New Zealand Quantum Computing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 237: Australia and New Zealand Quantum Computing Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 238: Australia and New Zealand Quantum Computing Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 239: Rest of Asia Pacific Quantum Computing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 240: Rest of Asia Pacific Quantum Computing Market Value Share Analysis, by Component, 2024 and 2035

Figure 241: Rest of Asia Pacific Quantum Computing Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 242: Rest of Asia Pacific Quantum Computing Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 243: Rest of Asia Pacific Quantum Computing Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 244: Rest of Asia Pacific Quantum Computing Market Value Share Analysis, by Technology, 2024 and 2035

Figure 245: Rest of Asia Pacific Quantum Computing Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 246: Rest of Asia Pacific Quantum Computing Market Value Share Analysis, by Application, 2024 and 2035

Figure 247: Rest of Asia Pacific Quantum Computing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 248: Rest of Asia Pacific Quantum Computing Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 249: Rest of Asia Pacific Quantum Computing Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 250: Latin America Quantum Computing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 251: Latin America Quantum Computing Market Value Share Analysis, by Component, 2024 and 2035

Figure 252: Latin America Quantum Computing Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 253: Latin America Quantum Computing Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 254: Latin America Quantum Computing Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 255: Latin America Quantum Computing Market Value Share Analysis, by Technology, 2024 and 2035

Figure 256: Latin America Quantum Computing Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 257: Latin America Quantum Computing Market Value Share Analysis, by Application, 2024 and 2035

Figure 258: Latin America Quantum Computing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 259: Latin America Quantum Computing Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 260: Latin America Quantum Computing Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 261: Latin America Quantum Computing Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 262: Latin America Quantum Computing Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 263: Brazil Quantum Computing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 264: Brazil Quantum Computing Market Value Share Analysis, by Component, 2024 and 2035

Figure 265: Brazil Quantum Computing Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 266: Brazil Quantum Computing Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 267: Brazil Quantum Computing Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 268: Brazil Quantum Computing Market Value Share Analysis, by Technology, 2024 and 2035

Figure 269: Brazil Quantum Computing Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 270: Brazil Quantum Computing Market Value Share Analysis, by Application, 2024 and 2035

Figure 271: Brazil Quantum Computing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 272: Brazil Quantum Computing Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 273: Brazil Quantum Computing Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 274: Mexico Quantum Computing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 275: Mexico Quantum Computing Market Value Share Analysis, by Component, 2024 and 2035

Figure 276: Mexico Quantum Computing Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 277: Mexico Quantum Computing Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 278: Mexico Quantum Computing Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 279: Mexico Quantum Computing Market Value Share Analysis, by Technology, 2024 and 2035

Figure 280: Mexico Quantum Computing Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 281: Mexico Quantum Computing Market Value Share Analysis, by Application, 2024 and 2035

Figure 282: Mexico Quantum Computing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 283: Mexico Quantum Computing Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 284: Mexico Quantum Computing Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 285: Argentina Quantum Computing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 286: Argentina Quantum Computing Market Value Share Analysis, by Component, 2024 and 2035

Figure 287: Argentina Quantum Computing Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 288: Argentina Quantum Computing Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 289: Argentina Quantum Computing Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 290: Argentina Quantum Computing Market Value Share Analysis, by Technology, 2024 and 2035

Figure 291: Argentina Quantum Computing Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 292: Argentina Quantum Computing Market Value Share Analysis, by Application, 2024 and 2035

Figure 293: Argentina Quantum Computing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 294: Argentina Quantum Computing Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 295: Argentina Quantum Computing Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 296: Rest of Latin America Quantum Computing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 297: Rest of Latin America Quantum Computing Market Value Share Analysis, by Component, 2024 and 2035

Figure 298: Rest of Latin America Quantum Computing Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 299: Rest of Latin America Quantum Computing Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 300: Rest of Latin America Quantum Computing Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 301: Rest of Latin America Quantum Computing Market Value Share Analysis, by Technology, 2024 and 2035

Figure 302: Rest of Latin America Quantum Computing Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 303: Rest of Latin America Quantum Computing Market Value Share Analysis, by Application, 2024 and 2035

Figure 304: Rest of Latin America Quantum Computing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 305: Rest of Latin America Quantum Computing Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 306: Rest of Latin America Quantum Computing Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 307: Middle East and Africa Quantum Computing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 308: Middle East and Africa Quantum Computing Market Value Share Analysis, by Component, 2024 and 2035

Figure 309: Middle East and Africa Quantum Computing Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 310: Middle East and Africa Quantum Computing Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 311: Middle East and Africa Quantum Computing Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 312: Middle East and Africa Quantum Computing Market Value Share Analysis, by Technology, 2024 and 2035

Figure 313: Middle East and Africa Quantum Computing Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 314: Middle East and Africa Quantum Computing Market Value Share Analysis, by Application, 2024 and 2035

Figure 315: Middle East and Africa Quantum Computing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 316: Middle East and Africa Quantum Computing Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 317: Middle East and Africa Quantum Computing Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 318: Middle East and Africa Quantum Computing Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 319: Middle East and Africa Quantum Computing Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 320: GCC Countries Quantum Computing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 321: GCC Countries Quantum Computing Market Value Share Analysis, by Component, 2024 and 2035

Figure 322: GCC Countries Quantum Computing Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 323: GCC Countries Quantum Computing Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 324: GCC Countries Quantum Computing Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 325: GCC Countries Quantum Computing Market Value Share Analysis, by Technology, 2024 and 2035

Figure 326: GCC Countries Quantum Computing Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 327: GCC Countries Quantum Computing Market Value Share Analysis, by Application, 2024 and 2035

Figure 328: GCC Countries Quantum Computing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 329: GCC Countries Quantum Computing Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 330: GCC Countries Quantum Computing Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 331: South Africa Quantum Computing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 332: South Africa Quantum Computing Market Value Share Analysis, by Component, 2024 and 2035

Figure 333: South Africa Quantum Computing Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 334: South Africa Quantum Computing Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 335: South Africa Quantum Computing Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 336: South Africa Quantum Computing Market Value Share Analysis, by Technology, 2024 and 2035

Figure 337: South Africa Quantum Computing Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 338: South Africa Quantum Computing Market Value Share Analysis, by Application, 2024 and 2035

Figure 339: South Africa Quantum Computing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 340: South Africa Quantum Computing Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 341: South Africa Quantum Computing Market Attractiveness Analysis, by End-User Industry, 2025 to 2035

Figure 342: Rest of Middle East and Africa Quantum Computing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 343: Rest of Middle East and Africa Quantum Computing Market Value Share Analysis, by Component, 2024 and 2035

Figure 344: Rest of Middle East and Africa Quantum Computing Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 345: Rest of Middle East and Africa Quantum Computing Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 346: Rest of Middle East and Africa Quantum Computing Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 347: Rest of Middle East and Africa Quantum Computing Market Value Share Analysis, by Technology, 2024 and 2035

Figure 348: Rest of Middle East and Africa Quantum Computing Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 349: Rest of Middle East and Africa Quantum Computing Market Value Share Analysis, by Application, 2024 and 2035

Figure 350: Rest of Middle East and Africa Quantum Computing Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 351: Rest of Middle East and Africa Quantum Computing Market Value Share Analysis, by End-User Industry, 2024 and 2035

Figure 352: Rest of Middle East and Africa Quantum Computing Market Attractiveness Analysis, by End-User Industry, 2025 to 2035