Reports

Reports

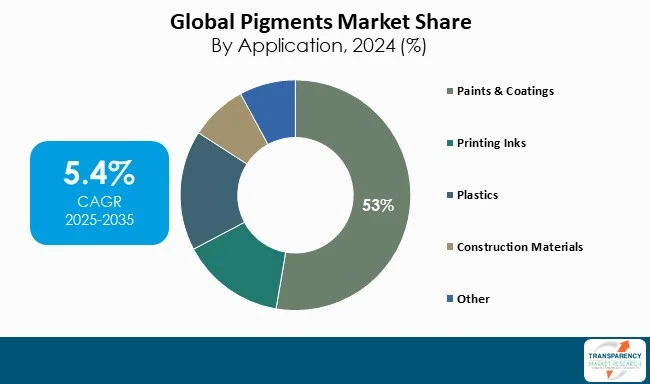

The pigments industry is set to experience modest growth owing to the increased buying by the leading sectors that include the paint and coatings industries, plastics, textiles, and printing ink. Growing construction and automotive sector, especially in the emerging economies, have created immense demand for high performance pigments that adds to the durability and beautifies the product.

Pigments play vital roles in imparting color, bettering the opacity, and providing protection against the environment in different end-use applications. The production procedure entails a mixture of natural or man-made compounds to synthesize colorants of definite chemical properties to be used in specific means.

The major manufacturers are working on R&D to come out with non-harmful and high-performance pigments such as organic and specialty pigments in tandem with the trend in the rest of the globe on sustainability. Also, companies are increasing their manufacturing capacities and strategic mergers and acquisitions of the different companies to enhance their global presence and customer needs.

Compared to dyes, pigments have more durability, opacity, and are more environmentally-free. Pigments find wider applications in various industries like paints and coatings, plastics, printing ink, textile, construction materials, and cosmetics. Pigments intensify the color in paints and coatings and block out the damaging effects of UV radiation as well as corrosion. They bring uniformity in color of plastics and heat resistance by textiles.

The production of pigments is normally done either through chemical synthesis or extraction in natural sources, after which it is milled and dispersed into different formulations. Firms are increasingly trying to formulate high-performance but environmentally-friendly pigments - organic and specialty pigments- to achieve sustainability goals and performance needs in such industries as automotive, packaging, or the electronic sector.

| Attribute | Detail |

|---|---|

| Pigments Market Drivers |

|

The pigments represent essential raw materials that are applied to provide magnetic paint and coatings with color, opacity and protective features, thus being of utmost concern to this industry. Improving sales of decorative paints in both - the residential and commercial buildings industry is another major force driving pigment demand.

Rampant urbanization in the emerging economies in Asia-Pacific, the Middle East, and Latin America are driving infrastructural development and housing activities. In addition, industrial coatings such as those applied in machinery, equipment, and structures made of metals need high-tech pigments that have anti-corrosive and durability properties, thereby enhancing the demand in the market.

Besides, automotive industry is critical in determining the consumption of pigments in paints and coating. With the need to paint vehicles with better looks and durable surfaces, high-performance pigments that avail heat resistance, are UV stable, and have brilliantly colored pigments are gaining momentum.

Automotive refinish and OEM specialty coatings are largely pigment dependent to provide one with the toughness and appearance required. In addition, personalization trend and the utilization of pearlescent and metallic finishing of automobiles are compounding the expansion of specialty pigments.

The paints and coatings business is also being affected by environmental policies and changing consumer trends where paints and coatings are becoming increasingly water-based and low-VOC (volatile organic compounds). This change necessitates the use of pigments that are adaptable to the environmentally acceptable coatings systems, thereby opening avenues of pigment-technological innovation.

On the whole, a mutually beneficial relationship between the expanding paints and coatings business sector and the development of pigment formulations is strengthening the pigments market. Manufacturers who are able to provide pigments with higher performance aspects, environmental compliances, and costs are in a good position to take this increased demand.

The other essential development that has enhanced the growth of pigments market at a fast rate is the increased use of sustainable and high-performance pigments (HPPs) in a wide range of end-use industries. Growing environmental hazards and the risk posed by heavy-metal content and/or toxic chemical-based synthetic pigments in the environment that is being addressed by some strict international regulations like REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) in Europe and Toxic Substances Control Act (TSCA) in the United States are causing manufacturers to look to eco-friendly and bio-based alternatives.

Sustainable pigments such as organic pigment and natural dyes are coming up based on their potential to be biodegraded and exhibit lower toxicity, lesser production, and disposal impact on the environment. Moreover, the global industries are demanding pigments at a larger scale that can help them meet their sustainability targets and achieve their carbon footprint reduction targets.

At the same time, there is an increasing need of high performance pigments that provide better properties such as excellent light fast, heat stability, chemical, and weather stability. Automotive, aerospace, industrial coatings, and plastics industries need pigments capable not only of brilliant and permanently durable coloration, but also the ones that could resist extreme environmental conditions.

To cite the example of automotive coatings, they have to weather extreme conditions (including high temperatures and exposure to UV light), which leads to the advanced pigment technologies such as perylene, quinacridone, and dioxazine-based pigments. On the similar note, the plastics manufacturers are using high-performance pigments to fulfill the aesthetic and functional needs of the packaging and consumer electronics products.

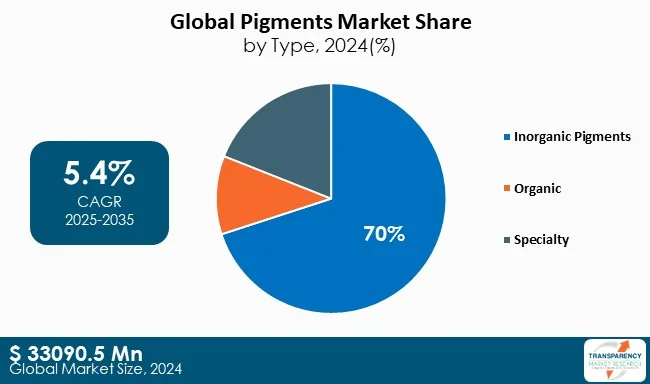

Specialty material types in the pigments market are growing due to increasing demand for high-performance pigments offering superior properties such as heat resistance, chemical stability, and enhanced color strength. Verticals such as automotive, construction, and electronics require pigments that provide durability, aesthetic appeal, and functionality. Additionally, the trend toward eco-friendly and sustainable products drive innovation in specialty pigments, supporting their faster adoption as compared to conventional pigment types.

Pigments market’s specialty material types are expanding on the basis of high level of demand regarding high performing pigments that have superior characteristics such as high temperature toleration, chemical stability, and color strength. Pigments are used to make cars, buildings, and electronic products durable, presentable, and useful.

| Attribute | Detail |

|---|---|

| Leading Region | Asia-Pacific |

The Asia Pacific has the highest share of the pigments industry owing to the huge industrial background, exploding population, and the speed of urbanization. Emerging construction and automotive industry in China, India, Japan, and increasing demand from the textile industry are some of the drivers. Also, the area is characterized by low production expenditure, easy access to raw materials, and increased exportation.

In China there are huge investments witnessed in infrastructure and auto manufacturing, which increase pigments’ consumption. In India, the increasing construction activities and manufacturing of consumer goods provide it the growth momentum. In Japan, the main direction is high-quality pigments in the manufacture of electronics and car paints. Vietnam and Indonesia within the Southeast Asia are also emerging markets as they offer more opportunities to industrialize and grow on the basis of domestic demand, and again complement the market share.

The major players influence the global pigments market, thereby pushing innovation, product innovation, and market growth. BASF SE enjoys a good standing due to this broad portfolio of organic and inorganic pigments that include applications in automobile, coatings, plastics, and packaging industries.

The company focuses on sustainable technologies and high-tech technologies of pigments. Tronox Holdings plc and Venator Materials PLC are the major players in the titanium dioxide pigment industry aiming at improving their efficiency and coverage. Similarly, The Chemours Company utilizes its advanced technical know-how to provide high-performance TiO 2 pigments in coating and industrial functions.

Clariant AG and DIC Corporation are the leaders in organic and high-performance pigments market, covering the increasing need for sustainable and durable pigments in plastic, inks and coatings. LANXESS is having a well-established reputation in the production of iron oxide pigments, which find widespread applications in construction, plastics, and protective coating, specializing in environmentally harmless manufacture. Sudarshan Chemical Industries Limited and India Pigments have emerged as the key players in the Indian market and have tapped more markets across the seas due to their diversified pigment portfolio.

FP-Pigments takes part in the market with functional pigments made to increase the opacity as well as improve the performances in different applications. Molkem is targeting niche markets that concern specialty pigments and intermediates.

| Attribute | Detail |

|---|---|

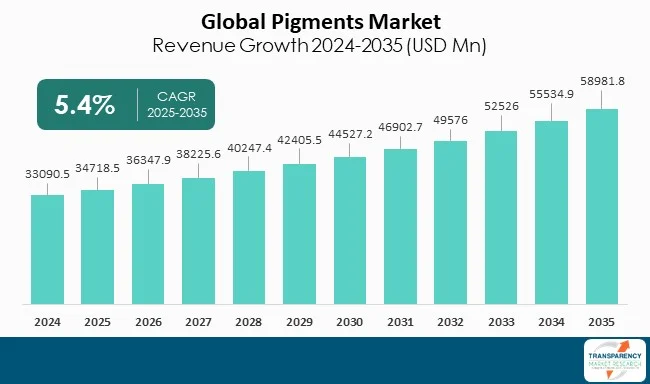

| Market Size Value in 2024 | US$ 33.0 Bn |

| Market Forecast Value in 2035 | US$ 58.9 Bn |

| Growth Rate (CAGR) | 5.4% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | Kilo Tons For Volume and US$ Bn For Value |

| Market Analysis | It includes cross segment analysis at Global as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Example: Electronic (PDF) + Excel |

| Market Segmentation | By Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled (Potential Manufacturers) |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The market stood at US$ 33.0 Bn in 2024.

The market is expected to grow at a CAGR of 5.4% from 2025 to 2035.

Growing demand from the paints & coatings industry are driving pigments market.

Asia Pacific was the most lucrative region of the pigments market in 2024

The Chemours Company, Sun Chemical Corporation, Tronox Limited, BASF SE, LANXESS, FP- pigments, and Molkem

Table 1 Global Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 to 2035

Table 2 Global Pigments Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 3 Global Pigments Market Volume (Kilo Tons) Forecast, by Application, 2020 to 2035

Table 4 Global Pigments Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 5 Global Pigments Market Volume (Kilo Tons) Forecast, by Region, 2020 to 2035

Table 6 Global Pigments Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 7 North America Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 to 2035

Table 8 North America Pigments Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 9 North America Pigments Market Volume (Kilo Tons) Forecast, by Application, 2020 to 2035

Table 10 North America Pigments Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 11 North America Pigments Market Volume (Kilo Tons) Forecast, by Country, 2020 to 2035

Table 12 North America Pigments Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 13 USA Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 to 2035

Table 14 USA Pigments Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 15 USA Pigments Market Volume (Kilo Tons) Forecast, by Application, 2020 to 2035

Table 16 USA Pigments Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 17 Canada Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 to 2035

Table 18 Canada Pigments Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 19 Canada Pigments Market Volume (Kilo Tons) Forecast, by Application, 2020 to 2035

Table 20 Canada Pigments Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 21 Europe Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 to 2035

Table 22 Europe Pigments Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 23 Europe Pigments Market Volume (Kilo Tons) Forecast, by Application, 2020 to 2035

Table 24 Europe Pigments Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 25 Europe Pigments Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 26 Europe Pigments Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 27 Germany Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 to 2035

Table 28 Germany Pigments Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 29 Germany Pigments Market Volume (Kilo Tons) Forecast, by Application, 2020 to 2035

Table 30 Germany Pigments Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 31 France Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 to 2035

Table 32 France Pigments Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 33 France Pigments Market Volume (Kilo Tons) Forecast, by Application, 2020 to 2035

Table 34 France Pigments Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 35 UK Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 to 2035

Table 36 UK Pigments Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 37 UK Pigments Market Volume (Kilo Tons) Forecast, by Application, 2020 to 2035

Table 38 UK Pigments Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 39 Italy Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 to 2035

Table 40 Italy Pigments Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 41 Italy Pigments Market Volume (Kilo Tons) Forecast, by Application, 2020 to 2035

Table 42 Italy Pigments Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 43 Spain Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 to 2035

Table 44 Spain Pigments Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 45 Spain Pigments Market Volume (Kilo Tons) Forecast, by Application, 2020 to 2035

Table 46 Spain Pigments Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 47 Russia & CIS Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 to 2035

Table 48 Russia & CIS Pigments Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 49 Russia & CIS Pigments Market Volume (Kilo Tons) Forecast, by Application, 2020 to 2035

Table 50 Russia & CIS Pigments Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 51 Rest of Europe Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 to 2035

Table 52 Rest of Europe Pigments Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 53 Rest of Europe Pigments Market Volume (Kilo Tons) Forecast, by Application, 2020 to 2035

Table 54 Rest of Europe Pigments Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 55 Asia Pacific Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 to 2035

Table 56 Asia Pacific Pigments Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 57 Asia Pacific Pigments Market Volume (Kilo Tons) Forecast, by Application, 2020 to 2035

Table 58 Asia Pacific Pigments Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 59 Asia Pacific Pigments Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 60 Asia Pacific Pigments Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 61 China Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 to 2035

Table 62 China Pigments Market Value (US$ Bn) Forecast, by Product 2020 to 2035

Table 63 China Pigments Market Volume (Kilo Tons) Forecast, by Application, 2020 to 2035

Table 64 China Pigments Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 65 Japan Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 to 2035

Table 66 Japan Pigments Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 67 Japan Pigments Market Volume (Kilo Tons) Forecast, by Application, 2020 to 2035

Table 68 Japan Pigments Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 69 India Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 to 2035

Table 70 India Pigments Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 71 India Pigments Market Volume (Kilo Tons) Forecast, by Application, 2020 to 2035

Table 72 India Pigments Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 73 ASEAN Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 to 2035

Table 74 ASEAN Pigments Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 75 ASEAN Pigments Market Volume (Kilo Tons) Forecast, by Application, 2020 to 2035

Table 76 ASEAN Pigments Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 77 Rest of Asia Pacific Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 to 2035

Table 78 Rest of Asia Pacific Pigments Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 79 Rest of Asia Pacific Pigments Market Volume (Kilo Tons) Forecast, by Application, 2020 to 2035

Table 80 Rest of Asia Pacific Pigments Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 81 Latin America Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 to 2035

Table 82 Latin America Pigments Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 83 Latin America Pigments Market Volume (Kilo Tons) Forecast, by Application, 2020 to 2035

Table 84 Latin America Pigments Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 85 Latin America Pigments Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 86 Latin America Pigments Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 87 Brazil Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 to 2035

Table 88 Brazil Pigments Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 89 Brazil Pigments Market Volume (Kilo Tons) Forecast, by Application, 2020 to 2035

Table 90 Brazil Pigments Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 91 Mexico Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 to 2035

Table 92 Mexico Pigments Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 93 Mexico Pigments Market Volume (Kilo Tons) Forecast, by Application, 2020 to 2035

Table 94 Mexico Pigments Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 95 Rest of Latin America Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 to 2035

Table 96 Rest of Latin America Pigments Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 97 Rest of Latin America Pigments Market Volume (Kilo Tons) Forecast, by Application, 2020 to 2035

Table 98 Rest of Latin America Pigments Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 99 Middle East & Africa Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 to 2035

Table 100 Middle East & Africa Pigments Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 101 v Pigments Market Volume (Kilo Tons) Forecast, by Application, 2020 to 2035

Table 102 Middle East & Africa Pigments Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 103 Middle East & Africa Pigments Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 104 Middle East & Africa Pigments Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 105 GCC Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 to 2035

Table 106 GCC Pigments Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 107 GCC Pigments Market Volume (Kilo Tons) Forecast, by Application, 2020 to 2035

Table 108 GCC Pigments Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 109 South Africa Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 to 2035

Table 110 South Africa Pigments Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 111 South Africa Pigments Market Volume (Kilo Tons) Forecast, by Application, 2020 to 2035

Table 112 South Africa Pigments Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 113 Rest of Middle East & Africa Pigments Market Volume (Kilo Tons) Forecast, by Product, 2020 to 2035

Table 114 Rest of Middle East & Africa Pigments Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 115 Rest of Middle East & Africa Pigments Market Volume (Kilo Tons) Forecast, by Application, 2020 to 2035

Table 116 Rest of Middle East & Africa Pigments Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Figure 1 Global Pigments Market Volume Share Analysis, by Product, 2024, 2027, and 2035

Figure 2 Global Pigments Market Attractiveness, by Product

Figure 3 Global Pigments Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 4 Global Pigments Market Attractiveness, by Application

Figure 5 Global Pigments Market Volume Share Analysis, by Region, 2024, 2027, and 2035

Figure 6 Global Pigments Market Attractiveness, by Region

Figure 7 North America Pigments Market Volume Share Analysis, by Product, 2024, 2027, and 2035

Figure 8 North America Pigments Market Attractiveness, by Product

Figure 9 North America Pigments Market Attractiveness, by Product

Figure 10 North America Pigments Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 11 North America Pigments Market Attractiveness, by Application

Figure 12 North America Pigments Market Attractiveness, by Country and Sub-region

Figure 13 Europe Pigments Market Volume Share Analysis, by Product, 2024, 2027, and 2035

Figure 14 Europe Pigments Market Attractiveness, by Product

Figure 15 Europe Pigments Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 16 Europe Pigments Market Attractiveness, by Application

Figure 17 Europe Pigments Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 18 Europe Pigments Market Attractiveness, by Country and Sub-region

Figure 19 Asia Pacific Pigments Market Volume Share Analysis, by Product, 2024, 2027, and 2035

Figure 20 Asia Pacific Pigments Market Attractiveness, by Product

Figure 21 Asia Pacific Pigments Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 22 Asia Pacific Pigments Market Attractiveness, by Application

Figure 23 Asia Pacific Pigments Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 24 Asia Pacific Pigments Market Attractiveness, by Country and Sub-region

Figure 25 Latin America Pigments Market Volume Share Analysis, by Product, 2024, 2027, and 2035

Figure 26 Latin America Pigments Market Attractiveness, by Product

Figure 27 Latin America Pigments Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 28 Latin America Pigments Market Attractiveness, by Application

Figure 29 Latin America Pigments Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 30 Latin America Pigments Market Attractiveness, by Country and Sub-region

Figure 31 Middle East & Africa Pigments Market Volume Share Analysis, by Product, 2024, 2027, and 2035

Figure 32 Middle East & Africa Pigments Market Attractiveness, by Product

Figure 33 Middle East & Africa Pigments Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 34 Middle East & Africa Pigments Market Attractiveness, by Application

Figure 35 Middle East & Africa Pigments Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 36 Middle East & Africa Pigments Market Attractiveness, by Country and Sub-region