Reports

Reports

Increased sophistication and technological advances has paved a new path for treatment of acute and chronic neurological diseases. According to the WHO, neurological disorders constitute approximately 12% of the total deaths worldwide, of which cerebrovascular diseases are responsible for 85% of the deaths due to neurological disorders. In addition, rise in ageing population and increasing awareness of neurological disorders has triggered the growth of this industry. According to the Brain Aneurysm Foundation it is estimated that around 6 million people in the U.S. alone have unruptured brain aneurysm and the annual rate of rupture is approximately 8 to 10 per 10,000 or about 30,000 people in the U.S. suffer a aneurysm rupture. Thus rise in number of surgeries compounded with rise in incidence of neurological diseases have boosted the overall growth of neurological devices industry.

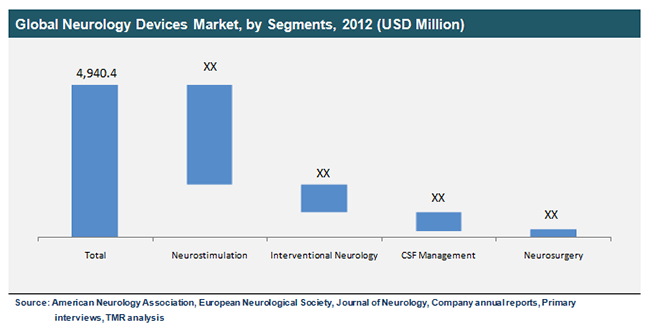

Neurological devices include CSF management devices, interventional neurology, neurosurgical devices and neurostimulation devices. The neurostimulation devices market is expected to foresee the highest growth rate during the forecast period and also accounted for the largest market in year 2012. This market holds immense growth owing to the aging population in the developed economies in the world, technological advancements in the field of medical devices, increasing prevalence of lifestyle induced diseases such as obesity and depression, increasing demand for minimally invasive medical procedures and rising healthcare related consumer expenditure in the developed economies. The interventional neurology market is also expected to have a healthy growth rate after neurostimulation devices market. The neurothrombectomy devices segment of interventional neurology is expected to have a strong growth in coming years of forecast period. This growth has been attributed to rise in incidence cases of stroke and cerebral aneurysms.

The growing burden of these diseases coupled with uncertain economic conditions in the U.S. and Europe has compelled the OEMs to introduce cost effective devices for treatment of neurological disorders. Tax reforms along with increased regulatory compliance norms are also restraining the growth and profitability of the major companies.

Geographically, the North American region constituted the largest market for neurological devices market in 2012; however, Asia-Pacific is predicted to foresee the highest growth rate of over 18% from 2013 to 2019. This growth has been attributed to increase in respiratory disease population and rising disposable incomes coupled with change in lifestyle. In addition, economic development and healthcare reforms would increase the government funding in its intensive R&D and would trigger the growth of this market in Asia-Pacific region.

The major players of this market are Medtronic, Covidien, Johnson & Johnson, Stryker, Integra, St.Jude, Boston Scientific and others.

1. Introduction

1.1. Report Description

1.1.1. Research Methodology

1.1.2. Sources

1.1.2.1. Secondary Research

1.1.2.2. Primary Research

1.1.3. Assumptions

1.1.4. Market Segmentation

2. Executive Summary

2.1. Market Snapshot: Global Neurology Devices Market (2012 & 2019)

2.2. Global Neurology Devices Market, By Segments, 2012 (USD Million)

3. Global Neurology Devices Market Dynamics

3.1. Introduction

3.1.1. Drivers

3.1.1.1. Technological Advances Driving the Growth

3.1.1.2. Aging Population Inducing Chronic Diseases such as Parkinson’s and Alzheimer’s Disorders

3.1.1.3. Increasing Demand for Minimally Invasive Surgeries

3.1.1.4. Rising Number of Stroke Patients

3.1.2. Restraints

3.1.2.1. Rising Intricacies of Clinical Trials

3.1.2.2. Hospital Budget Constraints & Alternative Treatment Facilities

3.1.2.3. Implementation of the Affordable Healthcare For America Act, 2010

3.2. Opportunities

3.2.1. Emerging Economies in Asia, Latin America and Eastern European Countries

3.3. Porter’s Five Forces Analysis for the Global Neurology Devices Market

3.3.1. Threat of New Entrants

3.3.2. Bargaining Power of Suppliers

3.3.3. Bargaining Power of Buyers

3.3.4. Threat of Substitutes

3.3.5. Competitive Rivalry

3.4. Market Attractiveness Analysis of the Global Neurology Devices Market, by Geography

4. Global Neurology Devices Market, by Segments

4.1. Introduction

4.2. Cerebrospinal Fluid Management Devices Market

4.2.1. Cerebral Shunts

4.2.1.1. Global Cerebral Shunts Market Revenue, 2011-2019 (USD Million)

4.2.2. Cerebral External Drainage

4.2.2.1. Global Cerebral External Drainage Market Revenue, 2011-2019 (USD Million)

4.3. Interventional Neurology Devices Market

4.3.1. Neurothrombectomy Devices

4.3.1.1. Global Neurothrombectomy Devices Market Revenue, 2011-2019 (USD Million)

4.3.1.2. Clot Retrievers

4.3.1.2.1. Global Clot Retrievers Market Revenue, 2011-2019 (USD Million)

4.3.1.3. Suction Aspiration Devices

4.3.1.3.1. Global Suction Aspiration Devices Market Revenue, 2011-2019 (USD Million)

4.3.1.4. Snare Devices

4.3.1.4.1. Global Snare Devices Market Revenue, 2011-2019 (USD Million)

4.3.2. Cerebral Balloon Angioplasty & Stents

4.3.2.1. Carotid Artery Stents

4.3.2.1.1. Global Carotid Artery Stents Market Revenue, 2011-2019 (USD Million)

4.3.2.2. Filter Devices

4.3.2.2.1. Global Filter Devices Market Revenue, 2011-2019 (USD Million)

4.3.2.3. Balloon Occlusion Devices

4.3.2.3.1. Global Balloon Occlusion Devices Market Revenue, 2011-2019 (USD Million)

4.3.3. Aneurysm Coiling & Embolization

4.3.3.1. Embolic Coils

4.3.3.1.1. Global Embolic Coil Devices Market Revenue, 2011-2019 (USD Million)

4.3.3.2. Liquid Embolic Agents

4.3.3.2.1. Global Liquid Embolic Agents Market Revenue, 2011-2019 (USD Million)

4.3.3.3. Flow Diversion Devices

4.3.3.3.1. Global Flow Diversion Devices Market Revenue, 2011-2019 (USD Million)

4.3.4. Support Devices

4.3.4.1. Global Support Devices Market Revenue, 2011-2019 (USD Million)

4.3.4.2. Micro Catheters

4.3.4.2.1. Global Flow Diversion Devices Market Revenue, 2011-2019 (USD Million)

4.3.4.3. Micro Guidewires

4.3.4.3.1. Global Micro Guidewires Market Revenue, 2011-2019 (USD Million)

4.4. Neurosurgery Devices Market

4.4.1. Global Neurosurgery Devices Market Revenue, 2011-2019 (USD Million)

4.4.2. Neuroendoscopes

4.4.2.1. Global Neuroendoscopes Market Revenue, 2011-2019 (USD Million)

4.4.3. Stereotactic Systems

4.4.3.1. Global Stereotactic Systems Market Revenue, 2011-2019 (USD Million)

4.4.4. Aneurysm Clips

4.4.4.1. Global Aneurysm Clips Market Revenue, 2011-2019 (USD Million)

4.4.5. Ultrasonic Aspirators

4.4.5.1. Global Ultrasonic Aspirators Market Revenue, 2011-2019 (USD Million)

4.5. Neurostimulation Devices Market

4.5.1. Spinal Cord Stimulation Devices

4.5.1.1. Global Spinal Cord Stimulation Devices Market Revenue, 2011-2019 (USD Million)

4.5.2. Deep Brain Stimulation Devices

4.5.2.1. Global Deep Brain Stimulation Devices Market Revenue, 2011-2019 (USD Million)

4.5.3. Sacral Nerve Stimulation Devices

4.5.3.1. Global Sacral Nerve Stimulation Devices Market Revenue, 2011-2019 (USD Million)

4.5.4. Vagus Nerve Stimulation Devices

4.5.4.1. Global Vagus Nerve Stimulation Devices Market Revenue, 2011-2019 (USD Million)

4.5.5. Gastric Electric Stimulation Devices

4.5.5.1. Global Gastric Electric Stimulation Devices Market Revenue, 2011-2019 (USD Million)

5. Neurological Devices Market, By Geography

5.1. Overview

5.1.1. Global Neurology Devices Market, By Geography, 2011-2019 (USD Million)

5.1.2. Comparative Analysis: Neurology Devices Market, By Geography, 2012 & 2019 (Value %)

5.2. North America

5.2.1. North America Neurology Devices Market, By Geography, 2011-2019(USD Million

5.3. Europe

5.3.1. Europe Neurology Devices Market, By Geography, 2011-2019 (USD Million)

5.4. Asia

5.4.1. Asia Neurology Devices Market, By Geography, 2011-2019 (USD Million)

5.5. Rest Of The World (Row)

5.5.1. Row Neurology Devices Market, By Geography, 2011-2019 (USD Million)

6. Global Neurological Devices Market Share Analysis

6.1. Global Neurology Devices Market

6.1.1. Global Neurology Devices Market Share Analysis, By Key Players, 2012 (%)

6.2. Market Share Analysis By Key Players of Global CSF Management Devices Market, 2012 (%)

6.2.1. Global CSF Management Devices Market Analysis, By Key Players, 2012 (%)

6.3. Market Share Analysis By Key Players Of Global Interventional Neurology Market, 2012 (%)

6.3.1. Global Interventional Neurology Devices Market Analysis, By Key Players, 2012 (%)

6.4. Market Share Analysis By Key Players of Global Neurosurgery Devices Market, 2012 (%)

6.4.1. Global Neurosurgery Devices Market Analysis, By Key Players, 2012 (%)

6.5. Market Share Analysis By Key Players Of Global Neuromodulation Devices Market, 2012 (%)

6.5.1. Global Neuromodulation Market Analysis, By Key Players, 2012 (%)

7. Recommendations

7.1. Success Strategies

7.1.1. Rigorous Research and Development (R&D) Initiatives

7.1.2. Investing in Emerging Economies

7.2. Barriers to be Considered

7.2.1. High Cost of Investment

8. Company Profiles

8.1. B. Braun Melsungen AG

8.1.1. Company Overview

8.1.2. Financial Overview

8.1.3. Product Portfolio

8.1.4. Business Strategies

8.1.5. Recent Developments

8.2. Boston Scientific Corporation

8.2.1. Company Overview

8.2.2. Financial Overview

8.2.3. Product Portfolio

8.2.4. Business Strategies

8.2.5. Recent Developments

8.3. Covidien Plc

8.3.1. Company Overview

8.3.2. Financial Overview

8.3.3. Product Portfolio

8.3.4. Business Strategies

8.3.5. Recent Developments

8.4. Integra Lifesciences Holding Corporation

8.4.1. Company Overview

8.4.2. Financial Overview

8.4.3. Product Portfolio

8.4.4. Business Strategies

8.4.5. Recent Developments

8.5. Johnson and Johnson

8.5.1. Company Overview

8.5.2. Financial Overview

8.5.3. Product Portfolio

8.5.4. Business Strategies

8.5.5. Recent Developments

8.6. Magstim Company, Ltd.

8.6.1. Company Overview

8.6.2. Product Portfolio

8.6.3. Business Strategies

8.6.4. Recent Developments

8.7. Medtronic, Inc.

8.7.1. Company Overview

8.7.2. Financial Overview

8.7.3. Product Portfolio

8.7.4. Business Strategies

8.7.5. Recent Developments

8.8. St Jude Medical, Inc.

8.8.1. Company Overview

8.8.2. Financial Overview

8.8.3. Product Portfolio

8.8.4. Business Strategies

8.8.5. Recent Developments

8.9. Stryker Corporation

8.9.1. Company Overview

8.9.2. Financial Overview

8.9.3. Product Portfolio

8.9.4. Business Strategies

8.9.5. Recent Developments

8.10. W.L. Gore & Associates, Inc.

8.10.1. Company Overview

8.10.2. Product Portfolio

8.10.3. Business Strategies

8.10.4. Recent Developments

8.11. Cyberonics, Inc.

8.11.1. Company Profile

8.11.2. Financial Overview

8.11.3. Product Portfolio

8.11.4. Business Strategies

8.11.5. Recent Developments

List of Tables

TABLE 1: Market Snapshot: Global Neurology Devices Market (2012 & 2019)

TABLE 2: Global Neurology Devices Market Revenue, By Types, 2011-2019 (USD Million)

TABLE 3: Global CSF Management Devices Market Revenue, By Types, 2011-2019 (USD Million)

TABLE 4: Common Shunt Systems: By Types & Drainage Location

TABLE 5: Global Interventional Neurology Market Revenue, By Types, 2011-2019 (USD Million)

TABLE 6: Suction Aspiration Devices: Product Profile

TABLE 7: Global Cerebral Balloon Angioplasty & Stents Market Revenue, By Types, 2011-2019 (USD Million)

TABLE 8: Global Aneurysm Coiling & Embolization Market Revenue, By Types, 2011-2019 (USD Million)

TABLE 9: Global Support Devices Revenue, By Types, 2011-2019 (USD Million)

TABLE 10: Global Neurosurgery Devices Market Revenue, By Types, 2011-2019 (USD Million)

TABLE 11: Global Neurostimulation Devices Market Revenue, By Types, 2011-2019 (USD Million

TABLE 12: Global Neurology Devices Market, By Geography, 2011-2019 (USD Million)

TABLE 13: North America Neurology Devices Market, By Geography, 2011-2019 (USD Million)

TABLE 14: Europe Neurology Devices Market, By Geography, 2011-2019 (USD Million)

TABLE 15: Asia Neurology Devices Market, By Geography, 2011-2019 (USD Million)

TABLE 16: Row Neurology Devices Market, By Geography, 2011-2019 (USD Million)

List of Figures

FIG. 1: Global Neurology Devices Market Segmentation

FIG. 2: Global Neurology Devices Market, By Segments, 2012 (USD Million)

FIG. 3: Global Neurology Devices Market, Drivers and Restraints

FIG. 4: Porter’s Five Forces Analysis: Global Neurology Devices Market

FIG. 5: Market Attractiveness Analysis: Global Neurology Devices Market, By Geography

FIG. 6: Global Cerebral Shunts Market Revenue, 2011-2019 (USD Million)

FIG. 7: Global Cerebral External Drainage Market Revenue, 2011-2019 (USD Million)

FIG. 8: Global Clot Retrievers Market Revenue, 2011-2019 (USD Million)

FIG. 9: Global Suction Aspiration Devices Market Revenue, 2011-2019 (USD Million)

FIG. 10: Global Snare Devices Market Revenue, 2011-2019 (USD Million)

FIG. 11: Global Carotid Artery Stent Market Revenue, 2011-2019 (USD Million)

FIG. 12: Global Filter Devices Market Revenue, 2011-2019 (USD Million)

FIG. 13: Global Balloon Occlusion Devices Market Revenue, 2011-2019 (USD Million)

FIG. 14: Global Embolic Coil Market Revenue, 2011-2019 (USD Million)

FIG. 15: Global Embolic Coil Market Revenue, 2011-2019 (USD Million)

FIG. 16: Global Flow Diversion Devices Revenue, 2011-2019 (USD Million)

FIG. 17: Global Flow Diversion Devices Revenue, 2011-2019 (USD Million)

FIG. 18: Global Micro Guidewires Devices Revenue, 2011-2019 (USD Million)

FIG. 19: Global Neuroendoscopes Market Revenue, 2011-2019 (USD Million)

FIG. 20: Global Stereotactic Systems Market Revenue, 2011-2019 (USD Million)

FIG. 21: Global Aneurysm Clips Market Revenue, 2011-2019 (USD Million)

FIG. 22: Global Ultrasonic Aspirators Market Revenue, 2011-2019 (USD Million)

FIG. 23: Global Spinal Cord Stimulation Devices Market Revenue, 2011-2019 (USD Million)

FIG. 24: Global Deep Brain Stimulation Devices Market Revenue, 2011-2019 (USD Million)

FIG. 25: Global Sacral Nerve Stimulation Devices Market Revenue, 2011-2019 (USD Million)

FIG. 26: Global Vagus Nerve Stimulation Devices Market Revenue, 2011-2019 (USD Million)

FIG. 27: Global Gastric Electric Stimulation Devices Market Revenue, 2011-2019 (USD Million)

FIG. 28: Comparative Analysis: Neurology Devices Market, By Geography, 2012 & 2019 (Value %)

FIG. 29: Global Neurology Devices: Market Share, By Key Players, 2012 (%)

FIG. 30: Global CSF Management Devices : Market Share, By Key Players, 2012 (%)

FIG. 31: Global Interventional Neurology Devices : Market Share, By Key Players, 2012 (%)

FIG. 32: Global Neurosurgery Devices : Market Share, By Key Players, 2012 (%)

FIG. 33: Global Neuromodulation Devices : Market Share, By Key Players, 2012 (%)

FIG. 34: B. Braun Melsungen AG: Annual Sales Revenue, 2010-2012 (USD Billion)

FIG. 35: Boston Scientific: Annual Sales Revenue, 2010-2012 (USD Million)

FIG. 36: Covidien Plc: Annual Sales Revenue, 2010-2012 (USD Million)

FIG. 37: Integra Lifesciences Holdings Corporation: Annual Sales Revenue, 2010-2012 (USD Million)

FIG. 38: Johnson And Johnson: Annual Sales Revenue, 2010-2012 (USD Million)

FIG. 39: Medtronic, Inc.: Annual Sales Revenue, 2010-2012 (USD Million)

FIG. 40: St Jude Medical, Inc.: Annual Sales Revenue, 2010-2012 (USD Million)

FIG. 41: Stryker Corporation: Annual Sales Revenue, 2010-2012 (USD Million)

FIG. 42: Cyberonics, Inc: Annual Sales Revenue, 2010-2012 (USD Million)