Reports

Reports

The molecular diagnostics market is expanding at a rapid pace due to rise in incidence of infectious diseases and cancer along with increasing frequency of genetic disorders, thereby resulting in increased need for quick and precise diagnostics. Technological developments in PCR, liquid biopsy, next generation sequencing (NGS), and point-of-care diagnostics are enhancing diagnostics efficiency and application areas, including advances in personalized medicine to cater to the market.

The global molecular diagnostics market has its limitations, including the capital cost of equipment and reagents, regulatory frameworks, reimbursement policies, and the fact that the developing parts of the world have limited skilled professionals.

The market for rapid diagnostics is projected to develop, including ascendance in certain segments like minimal residual disease (MRD) testing and companion diagnostics segments projected to realize the greatest growth revenue and consumption trends, and pharma companies pivoting diagnostics into point of need solutions.

| Market Drivers |

|

|---|

The rising incidence of chronic and infectious diseases is expected to propel growth of the molecular diagnostics market by increasing demand for quicker, more precise, and targeted diagnostic solutions. Infectious diseases that include COVID-19, HIV, Hepatitis, and respiratory infections require rapid detection in order to minimize the risk of transmission and initiate treatment at the earliest.

Molecular tests, for example PCR testing, have become essential tools in response to public health emergencies. For instance, as per the data published by Centers for Disease Control and Prevention in October 2024, 6 in 10 Americans are suffering from atleast one chronic disease, and 4 in 10 have two or more of them. It further states that sexually transmitted infections (STIs) continue to rise in the United States with over 2.5 million cases of gonorrhea, chlamydia, and syphilis in 2022

The molecular diagnostics market is expected to increase on a tremendous note during the forecast period owing to development of new technologies such as next-generation sequencing (NGS), polymerase chain reaction (PCR), liquid biopsy, and artificial intelligence (AI). PCR and NGS have turned out to be highly sensitive and reliable platforms for detecting and genetically profiling cancer biomarkers and infectious agents. This rapid detection and diagnostic accuracy enhance clinical outcomes via early and correct diagnosis.

The new liquid biopsy methods are enhancing access to tumor-specific DNA and RNA testing that is obtained in a minimally invasive manner since it is taken from blood samples rather than tumor tissue samples, which is used for an invasive biopsy. The availability of minimally invasive tests impacts additional areas of molecular testing in oncology and personalized medicine while expanding the utility and scope of these tests.

Advancements in AI-driven analysis are improving the speed and increasing the rate of test interpretation by analyzing the data faster, decreasing error, and recommending and supporting clinical decision-making in both - clinical laboratory and point-of-care settings. These developments will fundamentally improve the speed and accuracy of tests and expand testing diagnosis to include smaller clinics, hospitals, and home or remote testing capabilities that take advantage of advanced molecular technologies.

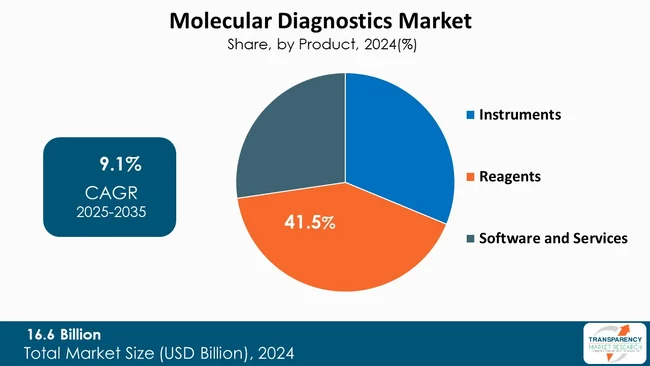

The reagents segment dominates the global molecular diagnostics market due to its critical role in test accuracy and repeat usage. Reagents include enzymes, primers, probes, buffers, and the other chemical components essential for molecular assays such as PCR, sequencing, and isothermal amplification. Their recurring consumption in every diagnostic test drives consistent demand, thereby making this segment a major revenue contributor.

Technological advancements have led to the development of disease-specific reagent kits that enable early and precise detection of chronic and infectious diseases prevalent in Eastern Europe - such as tuberculosis, hepatitis, and cancer. Additionally, increasing investments in research and innovation, along with the rising prevalence of target diseases, have further expanded the reagents market.

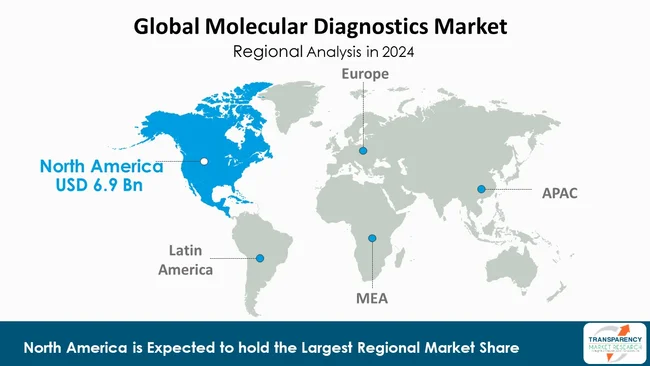

| Leading Region | North America |

|---|

North America is the torchbearer to the molecular diagnostics market due to a well-established healthcare infrastructure, technological advancements, and sizable investments in research and development.

Higher adoption rates of innovative diagnostic techniques, particularly in the U.S. and Canada, have further fueled market growth. Additionally, the presence of major biotechnology and pharmaceutical companies, along with supportive government initiatives and funding for infectious disease testing and precision medicine, have strengthened North America's position.

F. Hoffmann-La Roche AG, Abbott, Illumina, Inc., Thermo Fisher Scientific Inc., Becton, Dickinson and Company (BD), llumina, Inc., bioMérieux, DiaSorin S.p.A., Hologic, Inc., SD Biosensor, Inc., QIAGEN N.V., QuidelOrtho, Siemens Healthineers AG, and others

Each of these players has been profiled in the molecular diagnostics industry research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

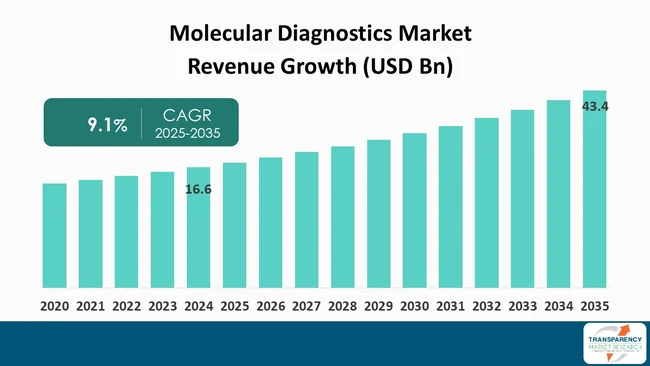

| Size in 2024 | US$ 16.6 Bn |

| Forecast Value in 2035 | US$ 43.4 Bn |

| CAGR | 9.1% |

| Forecast Period | 2025–2035 |

| Historical Data Available for | 2020–2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Product Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global molecular diagnostics market was valued at US$ 16.6 Bn in 2024

The molecular diagnostics market is projected to cross US$ 43.4 Bn by the end of 2035

Rising prevalence of infectious and chronic diseases, technological advances in PCR, NGS, liquid biopsy & AI, and Expansion of Point-of-Care (POC) Testing

It is anticipated to grow at a CAGR of 9.1% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

F. Hoffmann-La Roche AG, Abbott, Illumina, Inc., Thermo Fisher Scientific Inc., Becton, Dickinson and Company (BD), llumina, Inc., bioMérieux, DiaSorin S.p.A., Hologic, Inc., SD Biosensor, Inc., QIAGEN N.V., QuidelOrtho, Siemens Healthineers AG, and others.

Table 01: Global Molecular Diagnostics Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 02: Global Molecular Diagnostics Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 03: Global Molecular Diagnostics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 04: Global Molecular Diagnostics Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 05: Global Molecular Diagnostics Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 06: North America Molecular Diagnostics Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 07: North America Molecular Diagnostics Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 08: North America Molecular Diagnostics Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 09: North America Molecular Diagnostics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 10: North America Molecular Diagnostics Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 11: Europe Molecular Diagnostics Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 12: Europe Molecular Diagnostics Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 13: Europe Molecular Diagnostics Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 14: Europe Molecular Diagnostics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 15: Europe Molecular Diagnostics Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 16: Asia Pacific Molecular Diagnostics Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 17: Asia Pacific Molecular Diagnostics Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 18: Asia Pacific Molecular Diagnostics Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 19: Asia Pacific Molecular Diagnostics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 20: Asia Pacific Molecular Diagnostics Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 21: Latin America Molecular Diagnostics Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 22: Latin America Molecular Diagnostics Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 23: Latin America Molecular Diagnostics Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 24: Latin America Molecular Diagnostics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 25: Latin America Molecular Diagnostics Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 26: Middle East & Africa Molecular Diagnostics Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 27: Middle East & Africa Molecular Diagnostics Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 28: Middle East & Africa Molecular Diagnostics Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 29: Middle East & Africa Molecular Diagnostics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 30: Middle East & Africa Molecular Diagnostics Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Figure 01: Global Molecular Diagnostics Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 02: Global Molecular Diagnostics Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 03: Global Molecular Diagnostics Market Revenue (US$ Bn), by Instruments, 2020 to 2035

Figure 04: Global Molecular Diagnostics Market Revenue (US$ Bn), by Reagents, 2020 to 2035

Figure 05: Global Molecular Diagnostics Market Revenue (US$ Bn), by Software and Services, 2020 to 2035

Figure 06: Global Molecular Diagnostics Market Value Share Analysis, by Technology, 2024 and 2035

Figure 07: Global Molecular Diagnostics Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 08: Global Molecular Diagnostics Market Revenue (US$ Bn), by PCR, 2020 to 2035

Figure 09: Global Molecular Diagnostics Market Revenue (US$ Bn), by In Situ Hybridization (ISH), 2020 to 2035

Figure 10: Global Molecular Diagnostics Market Revenue (US$ Bn), by Isothermal Nucleic Acid Amplification, 2020 to 2035

Figure 11: Global Molecular Diagnostics Market Revenue (US$ Bn), by Sequencing, 2020 to 2035

Figure 12: Global Molecular Diagnostics Market Revenue (US$ Bn), by DNA Microarrays, 2020 to 2035

Figure 13: Global Molecular Diagnostics Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 14: Global Molecular Diagnostics Market Value Share Analysis, by Application, 2024 and 2035

Figure 15: Global Molecular Diagnostics Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 16: Global Molecular Diagnostics Market Revenue (US$ Bn), by Infectious Diseases, 2020 to 2035

Figure 17: Global Molecular Diagnostics Market Revenue (US$ Bn), by Oncology and Genetic Testing, 2020 to 2035

Figure 18: Global Molecular Diagnostics Market Revenue (US$ Bn), by Neurological Diseases, 2020 to 2035

Figure 19: Global Molecular Diagnostics Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 20: Global Molecular Diagnostics Market Value Share Analysis, By End-user, 2024 and 2035

Figure 21: Global Molecular Diagnostics Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 22: Global Molecular Diagnostics Market Revenue (US$ Bn), by Hospitals & Clinics, 2020 to 2035

Figure 23: Global Molecular Diagnostics Market Revenue (US$ Bn), by Diagnostic Laboratories, 2020 to 2035

Figure 24: Global Molecular Diagnostics Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 25: Global Molecular Diagnostics Market Value Share Analysis, By Region, 2024 and 2035

Figure 26: Global Molecular Diagnostics Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 27: North America Molecular Diagnostics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 28: North America Molecular Diagnostics Market Value Share Analysis, by Country, 2024 and 2035

Figure 29: North America Molecular Diagnostics Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 30: North America Molecular Diagnostics Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 31: North America Molecular Diagnostics Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 32: North America Molecular Diagnostics Market Value Share Analysis, by Technology, 2024 and 2035

Figure 33: North America Molecular Diagnostics Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 34: North America Molecular Diagnostics Market Value Share Analysis, by Application, 2024 and 2035

Figure 35: North America Molecular Diagnostics Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 36: North America Molecular Diagnostics Market Value Share Analysis, By End-user, 2024 and 2035

Figure 37: North America Molecular Diagnostics Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 38: Europe Molecular Diagnostics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 39: Europe Molecular Diagnostics Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 40: Europe Molecular Diagnostics Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 41: Europe Molecular Diagnostics Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 42: Europe Molecular Diagnostics Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 43: Europe Molecular Diagnostics Market Value Share Analysis, by Technology, 2024 and 2035

Figure 44: Europe Molecular Diagnostics Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 45: Europe Molecular Diagnostics Market Value Share Analysis, by Application, 2024 and 2035

Figure 46: Europe Molecular Diagnostics Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 47: Europe Molecular Diagnostics Market Value Share Analysis, By End-user, 2024 and 2035

Figure 48: Europe Molecular Diagnostics Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 49: Asia Pacific Molecular Diagnostics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 50: Asia Pacific Molecular Diagnostics Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 51: Asia Pacific Molecular Diagnostics Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 52: Asia Pacific Molecular Diagnostics Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 53: Asia Pacific Molecular Diagnostics Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 54: Asia Pacific Molecular Diagnostics Market Value Share Analysis, by Technology, 2024 and 2035

Figure 55: Asia Pacific Molecular Diagnostics Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 56: Asia Pacific Molecular Diagnostics Market Value Share Analysis, by Application, 2024 and 2035

Figure 57: Asia Pacific Molecular Diagnostics Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 58: Asia Pacific Molecular Diagnostics Market Value Share Analysis, By End-user, 2024 and 2035

Figure 59: Asia Pacific Molecular Diagnostics Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 60: Latin America Molecular Diagnostics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 61: Latin America Molecular Diagnostics Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 62: Latin America Molecular Diagnostics Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 63: Latin America Molecular Diagnostics Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 64: Latin America Molecular Diagnostics Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 65: Latin America Molecular Diagnostics Market Value Share Analysis, by Technology, 2024 and 2035

Figure 66: Latin America Molecular Diagnostics Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 67: Latin America Molecular Diagnostics Market Value Share Analysis, by Application, 2024 and 2035

Figure 68: Latin America Molecular Diagnostics Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 69: Latin America Molecular Diagnostics Market Value Share Analysis, By End-user, 2024 and 2035

Figure 70: Latin America Molecular Diagnostics Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 71: Middle East & Africa Molecular Diagnostics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 72: Middle East & Africa Molecular Diagnostics Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 73: Middle East & Africa Molecular Diagnostics Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 74: Middle East & Africa Molecular Diagnostics Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 75: Middle East & Africa Molecular Diagnostics Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 76: Middle East & Africa Molecular Diagnostics Market Value Share Analysis, by Technology, 2024 and 2035

Figure 77: Middle East & Africa Molecular Diagnostics Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 78: Middle East & Africa Molecular Diagnostics Market Value Share Analysis, by Application, 2024 and 2035

Figure 79: Middle East & Africa Molecular Diagnostics Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 80: Middle East & Africa Molecular Diagnostics Market Value Share Analysis, By End-user, 2024 and 2035

Figure 81: Middle East & Africa Molecular Diagnostics Market Attractiveness Analysis, By End-user, 2025 to 2035