Reports

Reports

The growing specialty chemicals distribution sector is gaining attention of companies in the Middle East & Africa oilfield chemicals market. For instance, in October 2019, Azelis-a distributor of specialty chemicals and food ingredients, has announced to acquire Orkila-a supplier of specialty chemical products in Middle East & Africa to capitalize on opportunities in the specialty chemicals distribution sector. The specialty chemicals distribution sector is one of the fastest growing industries worldwide. Hence, companies in the market for Middle East & Africa oilfield chemicals are meeting growing demands for specialty chemicals arising from stakeholders in major multinationals and local producers in MEA.

The demand for specialty chemicals is anticipated to grow in the coming years, since stakeholders are seeking an added value for their brand. Hence, companies in the Middle East & Africa oilfield chemicals market are entering into strategic partnerships with end-use stakeholders, since stakeholders are in the need for reliable suppliers that help them to achieve success in the rapidly growing marketplace.

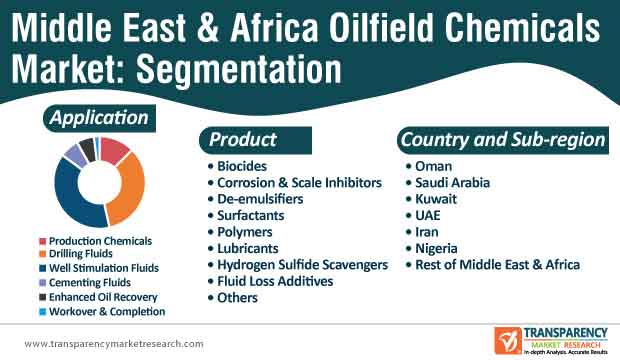

In order to boost the company’s credibility credentials in the highly competitive Middle East & Africa oilfield chemicals market, market players are eyeing opportunities in the regional market to generate stable revenue streams. For instance, in November 2019, Evonik-a German specialty chemicals company revealed that the company participated in the Abu Dhabi International Petroleum Exhibition and Conference in order to connect with regional oil and gas producers who are aiming toward maximizing their production targets. This is evident since production chemicals application segment is estimated to lead the Middle East & Africa oilfield chemicals market. The Middle East & Africa oilfield chemicals market is projected to reach a value of ~US$ 3.7 Bn by 2027.

Companies in the market for Middle East & Africa oilfield chemicals are committed toward strengthening their supply chains with regional producers and offer them innovative solutions that help them achieve production efficiency. Manufacturers in the Middle East & Africa oilfield chemicals market are focusing on product portfolio expansion by introducing high-performance polymer membranes and specialty methacrylate monomers to generate incremental opportunities.

Untapped Potential in Saudi Arabia Create Incremental Opportunities

Various drivers such as innovation and the localization mission in Saudi Arabia are catching the attention of companies in the market for Middle East & Africa oilfield chemicals. As revealed by the U.S.-Saudi Arabian Business Council (SABIC), Saudi Arabia is undergoing massive industrial transformation under the Vision 2030 initiative catering toward untapped potential in energy, logistics, and industry 4.0. This is well-justified, since Saudi Arabia is expected to lead the Middle East & Africa oilfield chemicals market, in terms of volume, and the total market is estimated to reach an output of ~3,100 kilo tons by the end of 2027.

Favorable business environment and access to greenfield projects in Saudi Arabia are some of the key drivers contributing toward the growth of the Middle East & Africa oilfield chemicals market. However, insufficient coordination across multiple government agencies and private companies pose a challenge for companies in the market for Middle East & Africa oilfield chemicals. Hence, innovative government programs such as NUSANED are aimed at addressing the issues of investors.

Winning Imperatives: Distribution in North America and Expansion of Product Portfolio

Due to the high prevalence of oil reserves in Middle East & Africa, companies are aiming toward strengthening their supply chains with stakeholders in other regions. For instance, North America is one of the leading consumer of biocides, corrosion inhibitors, and other oilfield chemicals. This is evident since biocides are anticipated for exponential growth in the Middle East & Africa oilfield chemicals market and the market is estimated to progress at a CAGR of ~4% during the forecast period. Hence, manufacturers in the Middle East & Africa oilfield chemicals market are collaborating with stakeholders in North America to establish harmonious business activities.

On the other hand, companies in the market for Middle East & Africa oilfield chemicals are increasing their production capabilities to develop cementing fluids. For instance, Solvay-an advanced materials and chemicals company has a rich product portfolio in cementing such as the Rhodibloc® FL Series and the Rhodibloc® GC surfactant system.

Analysts’ Viewpoint

Specialty methacrylate monomers are being highly publicized for the production of fluid loss agents, hydrate inhibitors, and water clarifiers. This is evident since fluid loss additives are expected to witness a rise in demand in the Middle East & Africa oilfield chemicals market. Companies should increase their efficacy in services catering to analytical price forecasting and reservoir audits to gain competitive edge over other market players.

Saudi Arabia is emerging as a hub for innovative projects associated with oilfield chemicals. However, challenges such as shortage of capabilities to execute and operate efficiently pose a restraint for manufacturers. Hence, companies should participate in localization initiatives driven by SABIC to address issues faced by potential investors.

Middle East & Africa Oilfield Chemicals Market: Key Drivers and Restraints

Middle East & Africa Oilfield Chemicals Market: Key Product Segments

Middle East & Africa Oilfield Chemicals Market: Key Segments

Saudi Arabia Expected to be Highly Lucrative Region of Middle East & Africa Oilfield Chemicals Market

Middle East & Africa Oilfield Chemicals Market: Competition Landscape

1. Executive Summary

1.1. Oilfield Chemicals Market Snapshot

1.2. Key Market Trends

1.3. Current Market & Future Potential

1.4. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Market Indicators

2.3. Market Definitions

2.4. Industry Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Market Outlook

2.7. Porters Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. Use of Oilfield Chemicals in Value Chain in Oil & Gas Sector

2.9.2. Middle East Oilfield Chemicals Manufacturing Value Chain

2.9.3. List of Raw Material Suppliers

2.9.4. List of Manufacturers of Oilfield Chemicals

2.9.5. List of Potential Customers

2.9.6. List of Distributors/Suppliers

2.9.7. Snapshot of Raw Material Prices Range for 2018

2.9.8. List of Customers in Oman and their Annual Consumption Range for 2018

3. Oilfield Chemicals Price Trend Analysis, 2018–2027

3.1. By Product

3.2. By Country and Sub-region

4. Middle East & Africa Oilfield Chemicals Market Analysis and Forecast, by Product

4.1. Key Findings, by Product

4.2. Middle East & Africa Oilfield Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

4.2.1. Biocides

4.2.2. Corrosion & Scale Inhibitors

4.2.3. De-emulsifier

4.2.4. Surfactants

4.2.5. Polymers

4.2.6. Lubricants

4.2.7. Hydrogen Sulfide Scavengers

4.2.8. Fluid Loss Additives

4.2.9. Others

4.3. Middle East & Africa Oilfield Chemicals Market Attractiveness Analysis, by Product

5. Middle East & Africa Oilfield Chemicals Market Analysis and Forecast, by Application

5.1. Key Findings, By Application

5.2. Middle East & Africa Oilfield Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

5.2.1. Production Chemicals

5.2.2. Drilling Fluids

5.2.3. Well Stimulation Fluids

5.2.4. Cementing Fluids

5.2.5. Enhanced Oil Recovery

5.2.6. Workover & Completion

5.3. Middle East & Africa Oilfield Chemicals Market Attractiveness Analysis, by Application

6. Middle East & Africa Oilfield Chemicals Market Analysis and Forecast, by Country and Sub-region and Sub-region

6.1. Middle East & Africa Oilfield Chemicals Market Volume (Kilo Tons) and Value (US$ Mn), by Country and Sub-region and Sub-region, 2018–2027

6.1.1. Oman

6.1.2. Saudi Arabia

6.1.3. Kuwait

6.1.4. UAE

6.1.5. Iran

6.1.6. Nigeria

6.1.7. Rest of Middle East & Africa

6.2. Middle East & Africa Oilfield Chemicals Market Attractiveness Analysis, by Country and Sub-region and Sub-region

6.3. Oman Oilfield Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

6.3.1. Biocides

6.3.2. Corrosion & Scale Inhibitors

6.3.3. De-emulsifier

6.3.4. Surfactants

6.3.5. Polymers

6.3.6. Lubricants

6.3.7. Hydrogen Sulfide Scavengers

6.3.8. Fluid Loss Additives

6.3.9. Others

6.4. Oman Oilfield Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

6.4.1. Production Chemicals

6.4.2. Drilling Fluids

6.4.3. Well Stimulation Fluids

6.4.4. Cementing Fluids

6.4.5. Enhanced Oil Recovery

6.4.6. Workover & Completion

6.5. Saudi Arabia Oilfield Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

6.5.1. Biocides

6.5.2. Corrosion & Scale Inhibitors

6.5.3. De-emulsifier

6.5.4. Surfactants

6.5.5. Polymers

6.5.6. Lubricants

6.5.7. Hydrogen Sulfide Scavengers

6.5.8. Fluid Loss Additives

6.5.9. Others

6.6. Saudi Arabia Oilfield Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

6.6.1. Production Chemicals

6.6.2. Drilling Fluids

6.6.3. Well Stimulation Fluids

6.6.4. Cementing Fluids

6.6.5. Enhanced Oil Recovery

6.6.6. Workover & Completion

6.7. Kuwait Oilfield Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

6.7.1. Biocides

6.7.2. Corrosion & Scale Inhibitors

6.7.3. De-emulsifier

6.7.4. Surfactants

6.7.5. Polymers

6.7.6. Lubricants

6.7.7. Hydrogen Sulfide Scavengers

6.7.8. Fluid Loss Additives

6.7.9. Others

6.8. Kuwait Oilfield Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

6.8.1. Production Chemicals

6.8.2. Drilling Fluids

6.8.3. Well Stimulation Fluids

6.8.4. Cementing Fluids

6.8.5. Enhanced Oil Recovery

6.8.6. Workover & Completion

6.9. UAE Oilfield Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

6.9.1. Biocides

6.9.2. Corrosion & Scale Inhibitors

6.9.3. De-emulsifier

6.9.4. Surfactants

6.9.5. Polymers

6.9.6. Lubricants

6.9.7. Hydrogen Sulfide Scavengers

6.9.8. Fluid Loss Additives

6.9.9. Others

6.10. UAE Oilfield Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

6.10.1. Production Chemicals

6.10.2. Drilling Fluids

6.10.3. Well Stimulation Fluids

6.10.4. Cementing Fluids

6.10.5. Enhanced Oil Recovery

6.10.6. Workover & Completion

6.11. Iran Oilfield Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

6.11.1. Biocides

6.11.2. Corrosion & Scale Inhibitors

6.11.3. De-emulsifier

6.11.4. Surfactants

6.11.5. Polymers

6.11.6. Lubricants

6.11.7. Hydrogen Sulfide Scavengers

6.11.8. Fluid Loss Additives

6.11.9. Others

6.12. Iran Oilfield Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

6.12.1. Production Chemicals

6.12.2. Drilling Fluids

6.12.3. Well Stimulation Fluids

6.12.4. Cementing Fluids

6.12.5. Enhanced Oil Recovery

6.12.6. Workover & Completion

6.13. Nigeria Oilfield Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

6.13.1. Biocides

6.13.2. Corrosion & Scale Inhibitors

6.13.3. De-emulsifier

6.13.4. Surfactants

6.13.5. Polymers

6.13.6. Lubricants

6.13.7. Hydrogen Sulfide Scavengers

6.13.8. Fluid Loss Additives

6.13.9. Others

6.14. Nigeria Oilfield Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

6.14.1. Production Chemicals

6.14.2. Drilling Fluids

6.14.3. Well Stimulation Fluids

6.14.4. Cementing Fluids

6.14.5. Enhanced Oil Recovery

6.14.6. Workover & Completion

6.15. Rest of Middle East & Africa Oilfield Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

6.15.1. Biocides

6.15.2. Corrosion & Scale Inhibitors

6.15.3. De-emulsifier

6.15.4. Surfactants

6.15.5. Polymers

6.15.6. Lubricants

6.15.7. Hydrogen Sulfide Scavengers

6.15.8. Fluid Loss Additives

6.15.9. Others

6.16. Rest of Middle East & Africa Oilfield Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

6.16.1. Production Chemicals

6.16.2. Drilling Fluids

6.16.3. Well Stimulation Fluids

6.16.4. Cementing Fluids

6.16.5. Enhanced Oil Recovery

6.16.6. Workover & Completion

7. Competition Landscape

7.1. List of Local Blending Facilities in Middle East & Africa

7.2. Competition Matrix, by Key Players

7.3. Middle East & Africa Oilfield Chemicals Market Share Analysis, by Company (2018)

7.4. Product Mapping

7.5. Application Mapping

7.6. Company Profiles

7.6.1. Baker Hughes (a GE Company)

7.6.1.1. Company Description

7.6.1.2. Business Overview

7.6.1.3. Financial Overview

7.6.1.4. Strategic Overview

7.6.2. Halliburton

7.6.2.1. Company Description

7.6.2.2. Business Overview

7.6.2.3. Financial Overview

7.6.2.4. Strategic Overview

7.6.3. Solvay S.A.

7.6.3.1. Company Description

7.6.3.2. Business Overview

7.6.3.3. Financial Overview

7.6.3.4. Strategic Overview

7.6.4. BASF SE

7.6.4.1. Company Description

7.6.4.2. Business Overview

7.6.4.3. Financial Overview

7.6.4.4. Strategic Overview

7.6.5. Schlumberger Limited

7.6.5.1. Company Description

7.6.5.2. Business Overview

7.6.5.3. Financial Overview

7.6.5.4. Strategic Overview

7.6.6. Newpark Resources Inc.

7.6.6.1. Company Description

7.6.6.2. Business Overview

7.6.6.3. Financial Overview

7.6.7. Nouryon

7.6.7.1. Company Description

7.6.7.2. Business Overview

7.6.8. Albemarle Corporation

7.6.8.1. Company Description

7.6.8.2. Business Overview

7.6.8.3. Financial Overview

7.6.9. Versalis S.p.A.

7.6.9.1. Company Description

7.6.9.2. Business Overview

7.6.9.3. Financial Overview

7.6.10. MCC Chemicals,

7.6.10.1. Company Description

7.6.10.2. Business Overview

7.6.11. Oleon NV

7.6.11.1. Company Description

7.6.11.2. Business Overview

7.6.12. Rakchem Industries L.L.C.

7.6.12.1. Company Description

7.6.12.2. Business Overview

7.6.13. NuGenTec

7.6.13.1. Company Description

7.6.13.2. Business Overview

7.6.14. Proec Middle East DMCC

7.6.14.1. Company Description

7.6.14.2. Business Overview

7.6.15. Oren Hydrocarbons Middle East Inc.

7.6.15.1. Company Description

7.6.15.2. Business Overview

7.6.16. Catalyst LLC

7.6.16.1. Company Description

7.6.16.2. Business Overview

7.6.17. ALXA SPECIALTY

7.6.17.1. Company Description

7.6.17.2. Business Overview

8. Key Primary Insights

List of Tables

Table 1 Middle East & Africa Oilfield Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

Table 2 Middle East & Africa Oilfield Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 3 Middle East & Africa Oilfield Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region and Sub-region, 2018–2027

Table 4 Oman Oilfield Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

Table 5 Oman Oilfield Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 6 Saudi Arabia Oilfield Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

Table 7 Saudi Arabia Oilfield Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 8 Kuwait Oilfield Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

Table 9 Kuwait Oilfield Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 10 UAE Oilfield Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

Table 11 UAE Oilfield Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 12 Iran Oilfield Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

Table 13 Iran Oilfield Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 14 Nigeria Oilfield Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

Table 15 Nigeria Oilfield Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 16 Rest of Middle East & Africa Oilfield Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

Table 17 Rest of Middle East & Africa Oilfield Chemicals Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

List of Figures

Figure 1 Middle East & Africa Oilfield Chemicals Market Volume Share, by Application, 2018 and 2027

Figure 2 Middle East & Africa Oilfield Chemicals Market Volume Share, by Country and Sub-region, 2018 and 2027

Figure 3 Middle East & Africa Oilfield Chemicals Market Value Share Analysis, by Product

Figure 4 Middle East & Africa Oilfield Chemicals Market Attractiveness Analysis, by Product

Figure 5 Middle East & Africa Oilfield Chemicals Market Value Share Analysis, by Application

Figure 6 Middle East & Africa Oilfield Chemicals Market Attractiveness Analysis, by Application

Figure 7 Middle East & Africa Oilfield Chemicals Market Value Share Analysis, by Country and Sub-region and Sub-region

Figure 8 Middle East & Africa Oilfield Chemicals Market Attractiveness Analysis, by Country and Sub-region and Sub-region