Reports

Reports

The changing tastes and preferences of consumers have caught the attention of manufacturers, as they are aiming to diversify their offerings in organic and natural ingredients in food and beverages. Similarly, producers operating in the mezcal market are creating awareness regarding natural products, and that their types can offer rich variety in taste and flavor.

A well-established trend that is circulating in the mezcal market is that of premiumization. Although tequila is highly consumed as a shot form drink, stakeholders are creating awareness by communicating that tequila is a spirit that can be savored and sipped instead of being consumed in record time. Thus, global trends regarding tequila are being driven by the change in consumer behavior, who are shifting focus from a price-centric point of view to opting for super-premium and luxury-priced products.

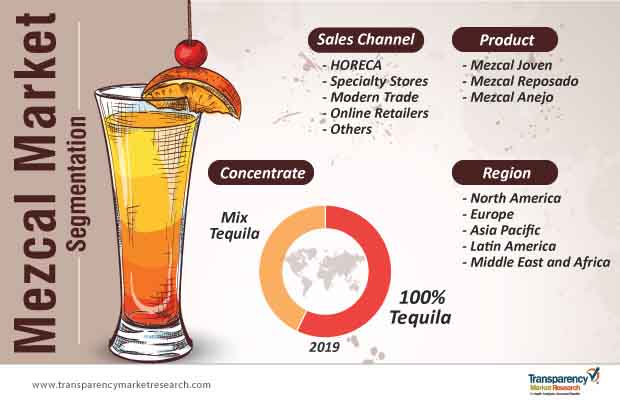

Likewise, the mezcal market is showing a significant rise in the demand for quality standard 100%-agave tequila. Premium product introductions by stakeholders have led to the on-boarding of new customers. Also, celebrity endorsements are helping leverage the product image of tequila by gaining a positive reputation and helps stakeholders sustain their business even during the price fluctuations of agave.

Stakeholders are noticing a shift in the common misconception among consumers that tequila and mezcal are the same. As consumers are becoming more aware about the transparent labeling of ingredients, and are using smart technologies such as mobile apps that scan QR (quick response) codes to ensure the authenticity of a product, this shift in the perspective of consumers has led to awareness about how mezcal is produced with the help of a traditional method using in-ground pits, whereas, tequila is produced using a specialized procedure.

The mezcal market is currently valued at ~US$ 242 million, and is expected to grow at a healthy rate and be valued at ~US$ 738 million by 2027. After the rise in the demand for premium tequila, consumers are now turning towards the golden age of mezcal. The mezcal market has a strong presence in the U.S.; the U.S. mezcal market is estimated to experience high growth in the future. One of the reasons for the increasing demand for mezcal stems from the fact that, the younger generation is on the pry for authentic flavors and small batch spirits.

Since mezcal is slightly on the expensive side as compared to most other alcoholic drinks, bartenders in hotels, restaurants, and cafes are luring consumers by combining the newly introduced floral and delicate notes of mezcal with tequila to lower the price bracket. Thus, stakeholders can target luxury hotels, resto-bars, and cafes to boost the sales of mezcal and create a new identity for mezcal amongst the young generation as well as upmarket consumers.

The complex and smoky flavor of mezcal, which is a parent to the more popular tequila, is an obscure and hard-to-fetch liquor, which is driving demand from connoisseurs and the youth. Likewise, stakeholders are planning innovative product launches to maximize business out of the growing popularity of mezcal. However, the increased consumption of mezcal has led to a significant agave shortage, which is creating pressure on local farmers and mezcal producers to increase their production outputs.

Subsequently, stakeholders are evolving business operations right from the plantation of agave to the process of burning wood to intensify the smoky flavor of mezcal. Thus, ongoing efforts by stakeholders are marching towards the adoption of sustainable operations in the production of agave and the bottling of mezcal. Stakeholders are aiming to achieve the benchmark of hundred percent production of sustainable agave by collaborating with local farmers and producers to generate in-house seed banks, backed by continuous maintenance of the plantations and harvest.

Experts in the mezcal market landscape have suggested a restriction on harvesting wild agave, thus minimizing the strain on natural production. Also, reforestation initiatives will help fulfill the rising demand for timber, since the burning of wood to offer a smoky flavor to mezcal creates a strain on timber producers. Similarly, consumers are also becoming aware brands that incorporate sustainable operations, who are making huge investments in sustainability by incorporating comprehensive inventory systems to track agave supplies, and are increasing research & development to strategize on efficient waste management initiatives.

The mezcal market is dominated by a relatively low number of industry players who control a large market share. This restricts the entry of new market players, as the mezcal market is highly consolidated, with these few plays already having a stronghold over the limited regions that permit the production of mezcal. However, new regulations on the production of mezcal may create a strain on stakeholders to keep up with the rising demand for mezcal as well as balancing it with sustainable business operations.

New regulations outline how mezcal is to be made and how agave should be used in the production process in Mexican state of Oaxaca. However, these regulations are either unclear for other states or do not account for, thus creating further strain on stakeholders, as these regulations permit only a few states to sell mezcal. Stakeholders operating in other Mexican states are making ongoing efforts to expand their export business in the U.S. and Europe, but those from Oaxaca are against this, since they dictate ~90% of the commercially produced mezcal. Also, the concern whether market players can make it big with feasible business operations is still debatable.

However, brands such as Mezcales de Leyenda are still complying the traditional and feasible way of producing mezcal. Despite the regulations imposed on the production of mezcal, celebrity backing, marketing, and promotional strategies are opening up new opportunities for stakeholders to penetrate the market to efficaciously reach their target consumers. For instance, Casamigos – a tequila company founded by Hollywood celebrity George Clooney and American entertainment industry businessman Rande Gerber, was sold to Diageo – a leading British multinational alcoholic beverage company. This company launched Casamigos Mezcal in February 2018, which created quite the buzz in the mezcal market space.

Analysts’ Viewpoint

Analysts of the study on the mezcal market anticipate that, the market is likely to grow at a healthy CAGR of ~13% over the forecast period. The mezcal market enjoys a high presence in North America as compared to other regions. Premiumization of tequila and increased awareness about craft spirits are influencing the increased demand for mezcal, especially among younger consumers. However, stringent regulations regarding the production and sale of mezcal are likely to slow down exports to the U.S and Europe. As such, by adopting sustainable business operations, stakeholders can efficiently comply with these regulations. Also, celebrity endorsements are helping stakeholders further boost their business of mezcal and create opportunities for innovative marketing campaigns.

Mezcal Market: Overview

Key Factors Influencing the Mezcal Market

Mezcal as an Organic Alcoholic Beverage

Increasing Club Culture

Gluten-free Nature of Mezcal

Mezcal Market: Structure Analysis

1. Global Economic Outlook

2. Global Mezcal Market - Executive Summary

3. Global Mezcal Market Overview

3.1. Introduction

3.1.1. Global Mezcal Market Taxonomy

3.2. Global Mezcal Market Size (US$ Mn) and Forecast, 2013-2027

a. 3.2.1 Global Mezcal Market Y-o-Y Growth

3.3. Beyond Mexico

3.4. FMI Analysis

3.5. Competition Analysis

3.6. Global Mezcal Market Dynamics

3.7. Food and Beverage Key Indicators

3.8. Mezcal Production Overview

3.9. Mezcal Export, 2012-2018

3.9.1. Packaging for Export Market

3.10. Supply Chain Analysis

3.11. Branding and Promotion Techniques

3.12. Factors Influencing Target Market Behavior

3.13. Macro-economic Factors

3.13.1. Macro-economic Indicators

3.14. Consumer Sentiment Analysis

3.14.1. Consumers Ready to Pay Premium Price for a Mezcal

3.14.2. Consumer Preferences – Flexible Packaging

3.15. Social Media Sentiment Analysis

3.15.1. Social Media Platforms that Companies Prefer for Branding

3.15.2. Social Media Penetration by Region

3.15.3. Mode of Advertisement that Vendors Prefer

3.16. Pricing Analysis

4. Global Mezcal Market Analysis and Forecast 2013-2027

4.1. Global Mezcal Market Size and Forecast By Product Type, 2013-2027

4.1.1. Mezcal Joven Market Size and Forecast, 2013-2027

4.1.1.1. Revenue (US$ Mn) Comparison, By Region

4.1.1.2. Market Share Comparison, By Region

4.1.1.3. Y-o-Y growth Comparison, By Region

4.1.2. Mezcal Reposado Market Size and Forecast, 2013-2027

4.1.2.1. Revenue (US$ Mn) Comparison, By Region

4.1.2.2. Market Share Comparison, By Region

4.1.2.3. Y-o-Y growth Comparison, By Region

4.1.3. Mezcal Anejo Market Size and Forecast, 2013-2027

4.1.3.1. Revenue (US$ Mn) Comparison, By Region

4.1.3.2. Market Share Comparison, By Region

4.1.3.3. Y-o-Y growth Comparison, By Region

4.2. Global Mezcal Market Size and Forecast By Concentrate, 2013-2027

4.2.1. 100% Tequila Market Size and Forecast, 2013-2027

4.2.1.1. Revenue (US$ Mn) Comparison, By Region

4.2.1.2. Market Share Comparison, By Region

4.2.1.3. Y-o-Y growth Comparison, By Region

4.2.2. Mix Tequila Market Size and Forecast, 2013-2027

4.2.2.1. Revenue (US$ Mn) Comparison, By Region

4.2.2.2. Market Share Comparison, By Region

4.2.2.3. Y-o-Y growth Comparison, By Region

4.3. Global Mezcal Market Size and Forecast By Sales Channel, 2013-2027

4.3.1. HORECA Market Size and Forecast, 2013-2027

4.3.1.1. Revenue (US$ Mn) Comparison, By Region

4.3.1.2. Market Share Comparison, By Region

4.3.1.3. Y-o-Y growth Comparison, By Region

4.3.2. Specialty Stores Market Size and Forecast, 2013-2027

4.3.2.1. Revenue (US$ Mn) Comparison, By Region

4.3.2.2. Market Share Comparison, By Region

4.3.2.3. Y-o-Y growth Comparison, By Region

4.3.3. Modern Trade Market Size and Forecast, 2013-2027

4.3.3.1. Revenue (US$ Mn) Comparison, By Region

4.3.3.2. Market Share Comparison, By Region

4.3.3.3. Y-o-Y growth Comparison, By Region

4.3.4. Online Retailers Market Size and Forecast, 2013-2027

4.3.4.1. Revenue (US$ Mn) Comparison, By Region

4.3.4.2. Market Share Comparison, By Region

4.3.4.3. Y-o-Y growth Comparison, By Region

4.3.5. Other Sales Channels Market Size and Forecast, 2013-2027

4.3.5.1. Revenue (US$ Mn) Comparison, By Region

4.3.5.2. Market Share Comparison, By Region

4.3.5.3. Y-o-Y growth Comparison, By Region

5. North America Mezcal Market Size and Forecast, 2013-2027

5.1. North America Outlook

5.2. North America Food Market

5.3. Revenue (US$ Mn) Comparison, By Country

5.2.1. US

5.2.2. Canada

5.3. Revenue (US$ Mn) Comparison, By Product Type

5.4. Revenue (US$ Mn) Comparison, By Concentrate

5.5. Revenue (US$ Mn) Comparison, By Sales Channel

6. Latin America Mezcal Market Size and Forecast, 2013-2027

6.1. Latin America Outlook

6.2. Latin America Food Market Outlook

6.3. Revenue (US$ Mn) Comparison, By Country

6.3.1. Brazil

6.3.2. Mexico

6.3.3. Argentina

6.3.4. Rest of LATAM

6.4. Revenue (US$ Mn) Comparison, By Product Type

6.5. Revenue (US$ Mn) Comparison, By Concentrate

6.6. Revenue (US$ Mn) Comparison, By Sales Channel

7. Europe Mezcal Market Size and Forecast, 2013-2027

7.1. Europe Outlook

7.2. Europe Food Market Outlook

7.3. Revenue (US$ Mn) Comparison, By Country

7.3.1. Germany

7.3.2. France

7.3.3. Italy

7.3.4. Spain

7.3.5. UK

7.3.6. BENELUX

7.3.7. Nordic

7.3.8. Rest of Europe

7.4. Revenue (US$ Mn) Comparison, By Product Type

7.5. Revenue (US$ Mn) Comparison, By Concentrate

7.6. Revenue (US$ Mn) Comparison, By Sales Channel

8. Japan Mezcal Market Size and Forecast, 2013-2027

8.1. Japan Outlook

8.2. Japan Food Market Outlook

8.3. Revenue (US$ Mn) Comparison

8.4. Revenue (US$ Mn) Comparison, By Product Type

8.5. Revenue (US$ Mn) Comparison, By Concentrate

8.6. Revenue (US$ Mn) Comparison, By Sales Channel

9. APEJ Mezcal Market Size and Forecast, 2013-2027

9.1. APEJ Outlook

9.2. Asia Pacific Excluding Japan (APEJ) Food Market Outlook

9.3. Revenue (US$ Mn) Comparison, By Country

9.3.1. China

9.3.2. India

9.3.3. ASEAN Countries

9.3.4. Oceania

9.3.5. Rest of APEJ

9.4. Revenue (US$ Mn) Comparison, By Product Type

9.5. Revenue (US$ Mn) Comparison, By Concentrate

9.6. Revenue (US$ Mn) Comparison, By Sales Channel

10. MEA Mezcal Market Size and Forecast, 2013-2027

10.1. MEA Outlook

10.2. MEA Food Market Outlook

10.3. Revenue (US$ Mn) Comparison, By Country

10.3.1. GCC Countries

10.3.2. South Africa

10.3.3. Nigeria

10.3.4. Israel

10.3.5. Rest of MEA

10.4. Revenue (US$ Mn) Comparison, By Product Type

10.5. Revenue (US$ Mn) Comparison, By Concentrate

10.6. Revenue (US$ Mn) Comparison, By Sales Channel

11. Global Mezcal Market – Competitive Assessment and Company Profiles

11.1. Competitive Assessment

11.1.1. Peer Analysis Dashboard

11.1.2. Competitive Benchmarking

11.1.3. Competitive Analysis: Strategy Matrix

11.1.4. Company Share Analysis- By Segment

11.1.5. Company Market Share Analysis of Top 10 Players, By Region

11.2. Company Profiles

11.2.1. Bacardi Limited

11.2.1.1. Key Developments

11.2.2. Craft Distillers

11.2.2.1. Key Developments

11.2.3. Familia Camarena Tequila

11.2.3.1. Key Developments

11.2.4. Del Maguey Co.

11.2.4.1. Key Developments

11.2.5. Destileria Tlacolula

11.2.5.1. Key Developments

11.2.6. Diageo Plc.

11.2.6.1. Key Developments

11.2.7. Don Julio, S.A.de

11.2.7.1. Key Developments

11.2.8. EI Silencio Holdings INC.

11.2.8.1. Key Developments

11.2.9. Fidencio Mezcal

11.2.9.1. Key Developments

11.2.10. Brown-Forman Corporation (Grupo Industrial Herradura, S.A. de C.V.)

11.2.10.1. Key Developments

11.2.11. Illegal Mezcal

11.2.11.1. Key Developments

11.2.12. Pensador Mezcal

11.2.12.1. Key Developments

11.2.13. Pernod Ricard

11.2.13.1. Key Developments

11.2.14. Sombra Mezcal

11.2.14.1. Key Developments

11.2.15. Pierde Almas

11.2.15.1. Key Developments

11.2.16. William Grant & Sons Ltd

11.2.16.1. Key Developments

11.2.17. Sauza Tequila Import Company

11.2.17.1. Key Developments

11.2.18. Rey Campero

11.2.18.1. Key Developments

12. Disclaimer

List of Tables

TABLE 1Global Mezcal Market Value (US$ Mn), 2013-2018

TABLE 2Global Mezcal Market Value (US$ Mn), 2019-2027

TABLE 3Global Mezcal Market Value (US$ Mn) and Y-o-Y, 2018-2027

TABLE 4Global Mezcal Joven Segment Value (US$ Mn), By Region 2013-2018

TABLE 5Global Mezcal Joven Segment Value (US$ Mn), By Region 2019-2027

TABLE 6Global Mezcal Joven Segment Market Share, By Region 2013-2018

TABLE 7Global Mezcal Joven Segment Market Share, By Region 2019-2027

TABLE 8Global Mezcal Joven Segment Y-o-Y, By Region 2018-2027

TABLE 9Global Mezcal Reposado Segment Value (US$ Mn), By Region 2013-2018

TABLE 10Global Mezcal Reposado Segment Value (US$ Mn), By Region 2019-2027

TABLE 11Global Mezcal Reposado Segment Market Share, By Region 2013-2018

TABLE 12Global Mezcal Reposado Segment Market Share, By Region 2019-2027

TABLE 13Global Mezcal Reposado Segment Y-o-Y, By Region 2018-2027

TABLE 14Global Mezcal Anejo Segment Value (US$ Mn), By Region 2013-2018

TABLE 15Global Mezcal Anejo Segment Value (US$ Mn), By Region 2019-2027

TABLE 16Global Mezcal Anejo Segment Market Share, By Region 2013-2018

TABLE 17Global Mezcal Anejo Segment Market Share, By Region 2019-2027

TABLE 18Global Mezcal Anejo Segment Y-o-Y, By Region 2018-2027

TABLE 19Global 100% Tequila Segment Value (US$ Mn), By Region 2013-2018

TABLE 20Global 100% Tequila Segment Value (US$ Mn), By Region 2019-2027

TABLE 21Global 100% Tequila Segment Market Share, By Region 2013-2018

TABLE 22Global 100% Tequila Segment Market Share, By Region 2019-2027

TABLE 23Global 100% Tequila Segment Y-o-Y, By Region 2018-2027

TABLE 24Global Mix Tequila Segment Value (US$ Mn), By Region 2013-2018

TABLE 25Global Mix Tequila Segment Value (US$ Mn), By Region 2019-2027

TABLE 26Global Mix Tequila Segment Market Share, By Region 2013-2018

TABLE 27Global Mix Tequila Segment Market Share, By Region 2019-2027

TABLE 28Global Mix Tequila Segment Y-o-Y, By Region 2018-2027

TABLE 29Global HORECA Segment Value (US$ Mn), By Region 2013-2018

TABLE 30Global HORECA Segment Value (US$ Mn), By Region 2019-2027

TABLE 31Global HORECA Segment Market Share, By Region 2013-2018

TABLE 32Global HORECA Segment Market Share, By Region 2019-2027

TABLE 33Global HORECA Segment Y-o-Y, By Region 2018-2027

TABLE 34Global Specialty Stores Segment Value (US$ Mn), By Region 2013-2018

TABLE 35Global Specialty Stores Segment Value (US$ Mn), By Region 2019-2027

TABLE 36Global Specialty Stores Segment Market Share, By Region 2013-2018

TABLE 37Global Specialty Stores Segment Market Share, By Region 2019-2027

TABLE 38Global Specialty Stores Segment Y-o-Y, By Region 2018-2027

TABLE 39Global Modern Trade Segment Value (US$ Mn), By Region 2013-2018

TABLE 40Global Modern Trade Segment Value (US$ Mn), By Region 2019-2027

TABLE 41Global Modern Trade Segment Market Share, By Region 2013-2018

TABLE 42Global Modern Trade Segment Market Share, By Region 2019-2027

TABLE 43Global Modern Trade Segment Y-o-Y, By Region 2018-2027

TABLE 44Global Online Retailers Segment Value (US$ Mn), By Region 2013-2018

TABLE 45Global Online Retailers Segment Value (US$ Mn), By Region 2019-2027

TABLE 46Global Online Retailers Segment Market Share, By Region 2013-2018

TABLE 47Global Online Retailers Segment Market Share, By Region 2019-2027

TABLE 48Global Online Retailers Segment Y-o-Y, By Region 2018-2027

TABLE 49Global Other Sales Channels Segment Value (US$ Mn), By Region 2013-2018

TABLE 50Global Other Sales Channels Segment Value (US$ Mn), By Region 2019-2027

TABLE 51Global Other Sales Channels Segment Market Share, By Region 2013-2018

TABLE 52Global Other Sales Channels Segment Market Share, By Region 2019-2027

TABLE 53Global Other Sales Channels Segment Y-o-Y, By Region 2018-2027

TABLE 54North America Mezcal Market Value (US$ Mn), By Country 2013-2018

TABLE 55North America Mezcal Market Value (US$ Mn), By Country 2019-2027

TABLE 56North America Mezcal Market Value (US$ Mn), By Product Type 2013-2018

TABLE 57North America Mezcal Market Value (US$ Mn), By Product Type 2019-2027

TABLE 58North America Mezcal Market Value (US$ Mn), By Concentrate 2013-2018

TABLE 59North America Mezcal Market Value (US$ Mn), By Concentrate 2019-2027

TABLE 60North America Mezcal Market Value (US$ Mn), By Sales Channel 2013-2018

TABLE 61North America Mezcal Market Value (US$ Mn), By Sales Channel 2019-2027

TABLE 62Latin America Mezcal Market Value (US$ Mn), By Country 2013-2018

TABLE 63Latin America Mezcal Market Value (US$ Mn), By Country 2019-2027

TABLE 64Latin America Mezcal Market Value (US$ Mn), By Product Type 2013-2018

TABLE 65Latin America Mezcal Market Value (US$ Mn), By Product Type 2019-2027

TABLE 66Latin America Mezcal Market Value (US$ Mn), By Concentrate 2013-2018

TABLE 67Latin America Mezcal Market Value (US$ Mn), By Concentrate 2019-2027

TABLE 68Latin America Mezcal Market Value (US$ Mn), By Sales Channel 2013-2018

TABLE 69Latin America Mezcal Market Value (US$ Mn), By Sales Channel 2019-2027

TABLE 70Europe Mezcal Market Value (US$ Mn), By Country 2013-2018

TABLE 71Europe Mezcal Market Value (US$ Mn), By Country 2019-2027

TABLE 72Europe Mezcal Market Value (US$ Mn), By Product Type 2013-2018

TABLE 73Europe Mezcal Market Value (US$ Mn), By Product Type 2019-2027

TABLE 74Europe Mezcal Market Value (US$ Mn), By Concentrate 2013-2018

TABLE 75Europe Mezcal Market Value (US$ Mn), By Concentrate 2019-2027

TABLE 76Europe Mezcal Market Value (US$ Mn), By Sales Channel 2013-2018

TABLE 77Europe Mezcal Market Value (US$ Mn), By Sales Channel 2019-2027

TABLE 78Japan Mezcal Market Value (US$ Mn), 2013-2018

TABLE 79Japan Mezcal Market Value (US$ Mn), 2019-2027

TABLE 80Japan Mezcal Market Value (US$ Mn), By Product Type 2013-2018

TABLE 81Japan Mezcal Market Value (US$ Mn), By Product Type 2019-2027

TABLE 82Japan Mezcal Market Value (US$ Mn), By Concentrate 2013-2018

TABLE 83Japan Mezcal Market Value (US$ Mn), By Concentrate 2019-2027

TABLE 84Japan Mezcal Market Value (US$ Mn), By Sales Channel 2013-2018

TABLE 85Japan Mezcal Market Value (US$ Mn), By Sales Channel 2019-2027

TABLE 86APEJ Mezcal Market Value (US$ Mn), By Country 2013-2018

TABLE 87APEJ Mezcal Market Value (US$ Mn), By Country 2019-2027

TABLE 88APEJ Mezcal Market Value (US$ Mn), By Product Type 2013-2018

TABLE 89APEJ Mezcal Market Value (US$ Mn), By Product Type 2019-2027

TABLE 90APEJ Mezcal Market Value (US$ Mn), By Concentrate 2013-2018

TABLE 91APEJ Mezcal Market Value (US$ Mn), By Concentrate 2019-2027

TABLE 92APEJ Mezcal Market Value (US$ Mn), By Sales Channel 2013-2018

TABLE 93APEJ Mezcal Market Value (US$ Mn), By Sales Channel 2019-2027

TABLE 94MEA Mezcal Market Value (US$ Mn), By Country 2013-2018

TABLE 95MEA Mezcal Market Value (US$ Mn), By Country 2019-2027

TABLE 96MEA Mezcal Market Value (US$ Mn), By Product Type 2013-2018

TABLE 97MEA Mezcal Market Value (US$ Mn), By Product Type 2019-2027

TABLE 98MEA Mezcal Market Value (US$ Mn), By Concentrate 2013-2018

TABLE 99MEA Mezcal Market Value (US$ Mn), By Concentrate 2019-2027

TABLE 100MEA Mezcal Market Value (US$ Mn), By Sales Channel 2013-2018

TABLE 101MEA Mezcal Market Value (US$ Mn), By Sales Channel 2019-2027

List of Figure

FIG. 1Global Mezcal Market Value (US$ Mn), 2013-2018

FIG. 2Global Mezcal Market Value (US$ Mn) Forecast, 2019-2027

FIG. 3Global Mezcal Market Value (US$ Mn) and Y-o-Y, 2018-2027

FIG. 4Global Mezcal Joven Segment Market Value (US$ Mn) By Region, 2013-2018

FIG. 5Global Mezcal Joven Segment Market Value (US$ Mn) By Region, 2019-2027

FIG. 6Global Mezcal Joven Segment Y-o-Y Growth Rate, By Region, 2018-2027

FIG. 7Global Mezcal Reposado Segment Market Value (US$ Mn) By Region, 2013-2018

FIG. 8Global Mezcal Reposado Segment Market Value (US$ Mn) By Region, 2019-2027

FIG. 9Global Mezcal Reposado Segment Y-o-Y Growth Rate, By Region, 2018-2027

FIG. 10Global Mezcal Anejo Segment Market Value (US$ Mn) By Region, 2013-2018

FIG. 11Global Mezcal Anejo Segment Market Value (US$ Mn) By Region, 2019-2027

FIG. 12Global Mezcal Anejo Segment Y-o-Y Growth Rate, By Region, 2018-2027

FIG. 13Global 100% Tequila Segment Market Value (US$ Mn) By Region, 2013-2018

FIG. 14Global 100% Tequila Segment Market Value (US$ Mn) By Region, 2019-2027

FIG. 15Global 100% Tequila Segment Y-o-Y Growth Rate, By Region, 2018-2027

FIG. 16Global Mix Tequila Segment Market Value (US$ Mn) By Region, 2013-2018

FIG. 17Global Mix Tequila Segment Market Value (US$ Mn) By Region, 2019-2027

FIG. 18Global Mix Tequila Segment Y-o-Y Growth Rate, By Region, 2018-2027

FIG. 19Global HORECA Segment Market Value (US$ Mn) By Region, 2013-2018

FIG. 20Global HORECA Segment Market Value (US$ Mn) By Region, 2019-2027

FIG. 21Global HORECA Segment Y-o-Y Growth Rate, By Region, 2018-2027

FIG. 22Global Specialty Stores Segment Market Value (US$ Mn) By Region, 2013-2018

FIG. 23Global Specialty Stores Segment Market Value (US$ Mn) By Region, 2019-2027

FIG. 24Global Specialty Stores Segment Y-o-Y Growth Rate, By Region, 2018-2027

FIG. 25Global Modern Trade Segment Market Value (US$ Mn) By Region, 2013-2018

FIG. 26Global Modern Trade Segment Market Value (US$ Mn) By Region, 2019-2027

FIG. 27Global Modern Trade Segment Y-o-Y Growth Rate, By Region, 2018-2027

FIG. 28Global Online Retailers Segment Market Value (US$ Mn) By Region, 2013-2018

FIG. 29Global Online Retailers Segment Market Value (US$ Mn) By Region, 2019-2027

FIG. 30Global Online Retailers Segment Y-o-Y Growth Rate, By Region, 2018-2027

FIG. 31Global Other Sales Channels Segment Market Value (US$ Mn) By Region, 2013-2018

FIG. 32Global Other Sales Channels Segment Market Value (US$ Mn) By Region, 2019-2027

FIG. 33Global Other Sales Channels Segment Y-o-Y Growth Rate, By Region, 2018-2027

FIG. 34North America Mezcal Market Value (US$ Mn), By Country 2013-2018

FIG. 35North America Mezcal Market Value (US$ Mn), By Country 2019-2027

FIG. 36North America Mezcal Market Value (US$ Mn), By Product Type 2013-2018

FIG. 37North America Mezcal Market Value (US$ Mn), By Product Type 2019-2027

FIG. 38North America Mezcal Market Value (US$ Mn), By Concentrate 2013-2018

FIG. 39North America Mezcal Market Value (US$ Mn), By Concentrate 2019-2027

FIG. 40North America Mezcal Market Value (US$ Mn), By Sales Channel 2013-2018

FIG. 41North America Mezcal Market Value (US$ Mn), By Sales Channel 2019-2027

FIG. 42Latin America Mezcal Market Value (US$ Mn), By Country 2013-2018

FIG. 43Latin America Mezcal Market Value (US$ Mn), By Country 2019-2027

FIG. 44Latin America Mezcal Market Value (US$ Mn), By Product Type 2013-2018

FIG. 45Latin America Mezcal Market Value (US$ Mn), By Product Type 2019-2027

FIG. 46Latin America Mezcal Market Value (US$ Mn), By Concentrate 2013-2018

FIG. 47Latin America Mezcal Market Value (US$ Mn), By Concentrate 2019-2027

FIG. 48Latin America Mezcal Market Value (US$ Mn), By Sales Channel 2013-2018

FIG. 49Latin America Mezcal Market Value (US$ Mn), By Sales Channel 2019-2027

FIG. 50Europe Mezcal Market Value (US$ Mn), By Country 2013-2018

FIG. 51Europe Mezcal Market Value (US$ Mn), By Country 2019-2027

FIG. 52Europe Mezcal Market Value (US$ Mn), By Product Type 2013-2018

FIG. 53Europe Mezcal Market Value (US$ Mn), By Product Type 2019-2027

FIG. 54Europe Mezcal Market Value (US$ Mn), By Concentrate 2013-2018

FIG. 55Europe Mezcal Market Value (US$ Mn), By Concentrate 2019-2027

FIG. 56Europe Mezcal Market Value (US$ Mn), By Sales Channel 2013-2018

FIG. 57Europe Mezcal Market Value (US$ Mn), By Sales Channel 2019-2027

FIG. 58Japan Mezcal Market Value (US$ Mn), 2013-2018

FIG. 59Japan Mezcal Market Value (US$ Mn), 2019-2027

FIG. 60Japan Mezcal Market Value (US$ Mn), By Product Type 2013-2018

FIG. 61Japan Mezcal Market Value (US$ Mn), By Product Type 2019-2027

FIG. 62Japan Mezcal Market Value (US$ Mn), By Sales Channel 2013-2018

FIG. 63Japan Mezcal Market Value (US$ Mn), By Concentrate 2019-2027

FIG. 64Japan Mezcal Market Value (US$ Mn), By Sales Channel 2013-2018

FIG. 65Japan Mezcal Market Value (US$ Mn), By Sales Channel 2019-2027

FIG. 66APEJ Mezcal Market Value (US$ Mn), By Country 2013-2018

FIG. 67APEJ Mezcal Market Value (US$ Mn), By Country 2019-2027

FIG. 68APEJ Mezcal Market Value (US$ Mn), By Product Type 2013-2018

FIG. 69APEJ Mezcal Market Value (US$ Mn), By Product Type 2019-2027

FIG. 70APEJ Mezcal Market Value (US$ Mn), By Concentrate 2013-2018

FIG. 71APEJ Mezcal Market Value (US$ Mn), By Concentrate 2019-2027

FIG. 72APEJ Mezcal Market Value (US$ Mn), By Sales Channel 2013-2018

FIG. 73APEJ Mezcal Market Value (US$ Mn), By Sales Channel 2019-2027

FIG. 74MEA Mezcal Market Value (US$ Mn), By Country 2013-2018

FIG. 75MEA Mezcal Market Value (US$ Mn), By Country 2019-2027

FIG. 76MEA Mezcal Market Value (US$ Mn), By Product Type 2013-2018

FIG. 77MEA Mezcal Market Value (US$ Mn), By Product Type 2019-2027

FIG. 78MEA Mezcal Market Value (US$ Mn), By Concentrate 2013-2018

FIG. 79MEA Mezcal Market Value (US$ Mn), By Concentrate 2019-2027

FIG. 80MEA Mezcal Market Value (US$ Mn), By Sales Channel 2013-2018

FIG. 81MEA Mezcal Market Value (US$ Mn), By Sales Channel 2019-2027