Reports

Reports

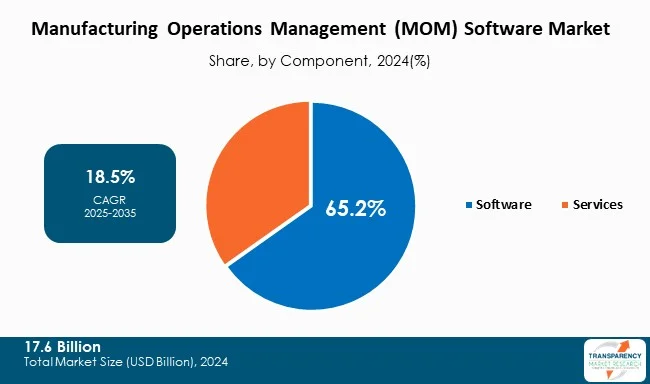

The global manufacturing operations management (MOM) software market size was valued at US$ 17.6 Bn in 2024 and is projected to reach US$ 80 Bn by 2035, expanding at a CAGR of 18.5% from 2025 to 2035. The market growth is driven by industry 4.0 & smart manufacturing adoption and integration of IoT, AI, & advanced analytics.

The manufacturing operations management (MOM) software market continues with its upward trend due to its strategic importance (i.e., as part of digital manufacturing transformation) rather than just being an IT standalone investment. As MOM grows in importance, MOM platforms form an important layer connecting enterprise systems (ERP, PLM, SCM) with the shop floor. With that layer connecting enterprise systems to real-time visibility and operational control of the manufacturing operations, manufacturers can achieve continuous optimization of their manufacturing operations.

Also, MOM software market is experiencing an increased demand due to not only large companies modernizing legacy MES systems, but also small and mid-sized manufacturing companies using MOM systems hosted on the cloud to enhance agility and reduce costs. Analysts have consistently stated that when determining whether manufacturers will purchase a MOM solution, integration, scale, and the new importance of advanced analytical capabilities represent the latest criteria for evaluating MOM products; they replace previous evaluations based solely on product features.

Additionally, MOM is converging with artificial intelligence (AI), the Internet of Things (IoT), and digital twin technologies. Thus, the combination of these technologies provides an important catalyst for value creation for manufacturers by transforming them from reactive operations to predictive and prescriptive operations.

Manufacturing operations management (MOM) software includes digital manufacturing management solutions that automate, provide visibility into, and manage production operations over their lifecycle. MOM software bridges enterprise systems (ERP and PLM) to provide a real-time link between enterprise-level operations and manufacturing execution on the shop floor.

MOM solution enables companies to handle all the operations across their manufacturing enterprise via a single, unified solution that operates as a highly configurable manufacturing platform. The increase in complexity related to manufacturing processes and the growing demand for mass customization along with increased end-to-end traceability are the main reasons for the rapid adoption of MOM software solutions.

The convergence of Industry 4.0 driven by emerging technologies such as Industrial Internet of Things (IIoT) Cloud Computing, AI, and Advanced Analytics has created the opportunity for MOM platforms to provide additional value beyond managing only the operational aspects of a manufacturer. Both - large and medium-small manufacturers are investing in connected data-driven production environments and the MOM software marketplace is becoming an enabler of smart manufacturing and providing long-term operational competitiveness to manufacturers.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The rapid growth of smart manufacturing practices is being driven by Industry 4.0 and the growing market for manufacturing operations management (MOM) software.

MOM software is the operational backbone for integrating these technologies into the shop floor, through which manufacturers are able to perform real-time production monitoring and control, optimize production performance, and enhance production efficiency by providing a real-time view of machines and equipment, labor, materials, and workflows.

Smart manufacturing requires manufacturers to have the ability to produce as per customer specifications, support shorter product life cycles, and respond quickly to changing market demands. The use of MOM platforms provides manufacturers with advanced planning, scheduling and execution capabilities to better support their requirements.

As such, as manufacturers continue to implement connected and autonomous factories, there is a growing emphasis on the use of standardized data, thereby creating a higher level of traceability and compliance, which, in turn, accelerates the use of MOM Software. Ultimately, the growth of MOM software and the growth of the Industry 4.0 will be directly related to continued global growth in the manufacturing sector.

The rise of Internet of Things (IoT), Artificial Intelligence (AI) and Advanced Analytics is stimulating the growth of the manufacturing operations management (MOM) software market, further fueling the growth of the Industry 4.0 ecosystem. The volume of data produced in modern manufacturing environments from machines, sensors and production processes is huge.

The ability of the MOM platform to use the power of IoT connectivity to collect machine, sensor and production process data in real time allows manufacturers to effectively monitor equipment performance, production throughput and operations efficiency across the manufacturing floor. Additionally, IoT and AI Integration solutions allow for more Adaptive and Flexible Manufacturing Processes, which are becoming more necessary in industries that are faced with complex supply chains, customized production demands, and rapidly changing markets.

As the need for efficiency, agility, and operational excellence is placing an increasing emphasis on the Integrating IoT, AI, and Advanced Analytics with MOM Solutions, it is anticipated to be a major factor regarding MOM Software Use Growth and Adoption.

The software aspect dominates and is the largest segment of the global MOM software market with revenue share 65.2%. Software serves a key function that supports the optimization and control of all aspects of manufacturing operations management (MOM). For example, it has essential functions such as manufacturing execution, production planning, scheduling, quality, inventory, maintenance management, to name a few. These software applications allow for real-time visibility and operational performance within a manufacturing facility to help manufacturers improve their operational efficiency.

While the service option helps in the development and tailoring of the MOM application to fit the customer, the real drive for value is from the Software by creating an interface between the factory floor and Enterprise Resource Planning (ERP) and Product Lifecycle Management (PLM) systems.

The demand for automating manufacturing processes, monitoring real-time data, and providing reporting and analytics capabilities has only increased the demand for MOM software within many manufacturing verticals such as Automotive, Pharmaceuticals, Aerospace, Electronics, and More.

In addition to growing demand for MOM software from Enterprise manufacturers, cloud hosted application development has provided small to medium enterprises (SMEs) access to advanced MOM functionality this has created an increase in the utilization of MOM software by SMEs. Hence, the software aspect of this Industry will continue to be the largest and most important segment within the global MOM software market driving productivity, quality and agility within modern manufacturing environments.

| Attribute | Detail |

|---|---|

| Leading Region |

|

The Manufacturing Operations Management (MOM) Software is largely dominated by the North American region with 38.5% share, due to regionally developed business strategies and technological sophistication, as well as abundant industrial activities. North America's development of a complex, sophisticated manufacturing environment (automotive, aerospace, electronics, pharmaceutical, chemical, etc.), they require advanced manufacturing solutions such as data analytics, expediency, quality assurance, traceability, operational efficiency, etc.

They also have advanced manufacturing processes through Industry 4.0 technologies (that enable automated processes and intelligent factories) as well as significant demand for comprehensive MOM software enabling real-time monitoring, production control, and process improvement.

In addition, North America’s manufacturers have taken advantage of both - established technology and digital ecosystem development (with well-trained workers), as well as large investment amounts in research and development, which has allowed for rapid adoption and implementation of sophisticated MOM solutions.

Key players operating in the manufacturing operations management (MOM) software market are investing in technological advancements, innovation, and strategic partnerships. They emphasize expanding product portfolios and enhancing imaging clarity, thereby ascertaining sustained growth and leadership in the evolving healthcare landscape.

ABB Ltd, Aegis Industrial Software Corporation, Aspen Technology Inc., AVEVA Solutions Limited, Critical Manufacturing S.A., Dassault Systèmes, DURR Group, Emerson Electric Co, Epicor Software Corporation, GE Vernova / GE Digital, Honeywell International Inc., iBASEt, Oracle, Siemens AG, SAP SE, Rockwell Automation Inc. are the key players in manufacturing operations management (MOM) software market.

Each of these players has been profiled in the manufacturing operations management (MOM) software Industry research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 17.6 Bn |

| Forecast Value in 2035 | US$ 80 Bn |

| CAGR | 18.5% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Manufacturing Operations Management (MOM) Software Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Component

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The Manufacturing operations management (MOM) software market was valued at US$ 17.6 Bn in 2024

The manufacturing operations management (MOM) software market is projected to reach US$ 80 Bn by the end of 2035

Industry 4.0 & smart manufacturing adoption and integration of IoT, AI, & advanced analytics are some of the driving factor of manufacturing operations management (MOM) software market.

The CAGR is anticipated to be 18.5% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

ABB Ltd, Aegis Industrial Software Corporation, Aspen Technology Inc., AVEVA Solutions Limited, Critical Manufacturing S.A., Dassault Systèmes, DURR Group, Emerson Electric Co, Epicor Software Corporation, GE Vernova / GE Digital, Honeywell International Inc., iBASEt, Oracle, Siemens AG, SAP SE, Rockwell Automation Inc., and other players.

Table 01: Global Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 02: Global Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 03: Global Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 04: Global Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 05: Global Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 06: Global Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 07: Global Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 08: North America Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 09: North America Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 10: North America Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 11: North America Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 12: North America Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 13: North America Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 14: North America Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 15: U.S. Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 16: U.S. Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 17: U.S. Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 18: U.S. Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 19: U.S. Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 20: U.S. Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 21: Canada Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 22: Canada Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 23: Canada Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 24: Canada Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 25: Canada Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 26: Canada Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 27: Europe Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 28: Europe Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 29: Europe Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 30: Europe Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 31: Europe Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 32: Europe Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 33: Europe Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 34: Germany Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 35: Germany Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 36: Germany Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 37: Germany Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 38: Germany Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 39: Germany Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 40: U.K. Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 41: U.K. Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 42: U.K. Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 43: U.K. Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 44: U.K. Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 45: U.K. Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 46: France Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 47: France Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 48: France Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 49: France Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 50: France Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 51: France Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 52: Italy Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 53: Italy Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 54: Italy Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 55: Italy Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 56: Italy Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 57: Italy Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 58: Spain Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 59: Spain Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 60: Spain Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 61: Spain Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 62: Spain Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 63: Spain Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 64: Switzerland Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 65: Switzerland Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 66: Switzerland Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 67: Switzerland Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 68: Switzerland Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 69: Switzerland Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 70: The Netherlands Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 71: The Netherlands Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 72: The Netherlands Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 73: The Netherlands Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 74: The Netherlands Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 75: The Netherlands Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 76: Rest of Europe Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 77: Rest of Europe Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 78: Rest of Europe Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 79: Rest of Europe Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 80: Rest of Europe Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 81: Rest of Europe Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 82: Asia Pacific Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 83: Asia Pacific Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 84: Asia Pacific Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 85: Asia Pacific Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 86: Asia Pacific Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 87: Asia Pacific Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 88: Asia Pacific Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 89: China Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 90: China Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 91: China Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 92: China Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 93: China Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 94: China Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 95: Japan Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 96: Japan Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 97: Japan Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 98: Japan Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 99: Japan Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 100: Japan Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 101: India Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 102: India Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 103: India Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 104: India Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 105: India Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 106: India Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 107: South Korea Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 108: South Korea Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 109: South Korea Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 110: South Korea Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 111: South Korea Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 112: South Korea Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 113: Australia and New Zealand Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 114: Australia and New Zealand Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 115: Australia and New Zealand Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 116: Australia and New Zealand Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 117: Australia and New Zealand Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 118: Australia and New Zealand Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 119: Rest of Asia Pacific Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 120: Rest of Asia Pacific Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 121: Rest of Asia Pacific Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 122: Rest of Asia Pacific Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 123: Rest of Asia Pacific Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 124: Rest of Asia Pacific Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 125: Latin America Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 126: Latin America Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 127: Latin America Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 128: Latin America Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 129: Latin America Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 130: Latin America Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 131: Latin America Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 132: Brazil Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 133: Brazil Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 134: Brazil Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 135: Brazil Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 136: Brazil Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 137: Brazil Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 138: Mexico Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 139: Mexico Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 140: Mexico Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 141: Mexico Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 142: Mexico Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 143: Mexico Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 144: Argentina Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 145: Argentina Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 146: Argentina Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 147: Argentina Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 148: Argentina Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 149: Argentina Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 150: Rest of Latin America Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 151: Rest of Latin America Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 152: Rest of Latin America Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 153: Rest of Latin America Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 154: Rest of Latin America Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 155: Rest of Latin America Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 156: Middle East and Africa Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 157: Middle East and Africa Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 158: Middle East and Africa Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 159: Middle East and Africa Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 160: Middle East and Africa Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 161: Middle East and Africa Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 162: Middle East and Africa Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 163: GCC Countries Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 164: GCC Countries Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 165: GCC Countries Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 166: GCC Countries Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 167: GCC Countries Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 168: GCC Countries Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 169: South Africa Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 170: South Africa Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 171: South Africa Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 172: South Africa Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 173: South Africa Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 174: South Africa Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 175: Rest of Middle East and Africa Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Component, 2020 to 2035

Table 176: Rest of Middle East and Africa Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 177: Rest of Middle East and Africa Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 178: Rest of Middle East and Africa Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Deployment Model, 2020 to 2035

Table 179: Rest of Middle East and Africa Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 180: Rest of Middle East and Africa Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Figure 01: Global Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 02: Global Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Component, 2024 and 2035

Figure 03: Global Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 04: Global Manufacturing Operations Management (MOM) Software Market Revenue (US$ Bn), by Software, 2020 to 2035

Figure 05: Global Manufacturing Operations Management (MOM) Software Market Revenue (US$ Bn), by Service, 2020 to 2035

Figure 06: Global Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 07: Global Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 08: Global Manufacturing Operations Management (MOM) Software Market Revenue (US$ Bn), by On-Premise, 2020 to 2035

Figure 09: Global Manufacturing Operations Management (MOM) Software Market Revenue (US$ Bn), by Cloud/SaaS, 2020 to 2035

Figure 10: Global Manufacturing Operations Management (MOM) Software Market Revenue (US$ Bn), by Hybrid, 2020 to 2035

Figure 11: Global Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Organization Size, 2024 and 2035

Figure 12: Global Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Organization Size, 2025 to 2035

Figure 13: Global Manufacturing Operations Management (MOM) Software Market Revenue (US$ Bn), by Small & Medium Enterprises (SMEs), 2020 to 2035

Figure 14: Global Manufacturing Operations Management (MOM) Software Market Revenue (US$ Bn), by Large Enterprises, 2020 to 2035

Figure 15: Global Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 16: Global Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 17: Global Manufacturing Operations Management (MOM) Software Market Revenue (US$ Bn), by Automotive, 2020 to 2035

Figure 18: Global Manufacturing Operations Management (MOM) Software Market Revenue (US$ Bn), by Aerospace & Defense, 2020 to 2035

Figure 19: Global Manufacturing Operations Management (MOM) Software Market Revenue (US$ Bn), by High-Tech & Electronics, 2020 to 2035

Figure 20: Global Manufacturing Operations Management (MOM) Software Market Revenue (US$ Bn), by Industrial Equipment, 2020 to 2035

Figure 21: Global Manufacturing Operations Management (MOM) Software Market Revenue (US$ Bn), by Pharmaceutical Industry, 2020 to 2035

Figure 22: Global Manufacturing Operations Management (MOM) Software Market Revenue (US$ Bn), by Consumer Goods, 2020 to 2035

Figure 23: Global Manufacturing Operations Management (MOM) Software Market Revenue (US$ Bn), by Others (Chemical Manufacturing, Energy & Utilities, etc.), 2020 to 2035

Figure 24: Global Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 25: Global Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 26: North America Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 27: North America Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Component, 2024 and 2035

Figure 28: North America Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 29: North America Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 30: North America Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 31: North America Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Organization Size, 2024 and 2035

Figure 32: North America Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Organization Size, 2025 to 2035

Figure 33: North America Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 34: North America Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 35: North America Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 36: North America Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 37: U.S. Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 38: U.S. Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Component, 2024 and 2035

Figure 39: U.S. Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 40: U.S. Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 41: U.S. Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 42: U.S. Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Organization Size, 2024 and 2035

Figure 43: U.S. Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Organization Size, 2025 to 2035

Figure 44: U.S. Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 45: U.S. Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 46: Canada Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 47: Canada Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Component, 2024 and 2035

Figure 48: Canada Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 49: Canada Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 50: Canada Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 51: Canada Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Organization Size, 2024 and 2035

Figure 52: Canada Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Organization Size, 2025 to 2035

Figure 53: Canada Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 54: Canada Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 55: Europe Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 56: Europe Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Component, 2024 and 2035

Figure 57: Europe Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 58: Europe Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 59: Europe Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 60: Europe Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Organization Size, 2024 and 2035

Figure 61: Europe Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Organization Size, 2025 to 2035

Figure 62: Europe Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 63: Europe Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 64: Europe Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 65: Europe Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 66: Germany Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 67: Germany Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Component, 2024 and 2035

Figure 68: Germany Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 69: Germany Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 70: Germany Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 71: Germany Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Organization Size, 2024 and 2035

Figure 72: Germany Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Organization Size, 2025 to 2035

Figure 73: Germany Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 74: Germany Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 75: U.K. Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 76: U.K. Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Component, 2024 and 2035

Figure 77: U.K. Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 78: U.K. Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 79: U.K. Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 80: U.K. Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Organization Size, 2024 and 2035

Figure 81: U.K. Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Organization Size, 2025 to 2035

Figure 82: U.K. Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 83: U.K. Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 84: France Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 85: France Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Component, 2024 and 2035

Figure 86: France Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 87: France Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 88: France Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 89: France Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Organization Size, 2024 and 2035

Figure 90: France Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Organization Size, 2025 to 2035

Figure 91: France Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 92: France Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 93: Italy Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 94: Italy Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Component, 2024 and 2035

Figure 95: Italy Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 96: Italy Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 97: Italy Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 98: Italy Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Organization Size, 2024 and 2035

Figure 99: Italy Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Organization Size, 2025 to 2035

Figure 100: Italy Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 101: Italy Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 102: Spain Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 103: Spain Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Component, 2024 and 2035

Figure 104: Spain Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 105: Spain Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 106: Spain Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 107: Spain Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Organization Size, 2024 and 2035

Figure 108: Spain Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Organization Size, 2025 to 2035

Figure 109: Spain Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 110: Spain Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 111: Switzerland Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 112: Switzerland Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Component, 2024 and 2035

Figure 113: Switzerland Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 114: Switzerland Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 115: Switzerland Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 116: Switzerland Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Organization Size, 2024 and 2035

Figure 117: Switzerland Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Organization Size, 2025 to 2035

Figure 118: Switzerland Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 119: Switzerland Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 120: The Netherlands Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 121: The Netherlands Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Component, 2024 and 2035

Figure 122: The Netherlands Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 123: The Netherlands Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 124: The Netherlands Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 125: The Netherlands Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Organization Size, 2024 and 2035

Figure 126: The Netherlands Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Organization Size, 2025 to 2035

Figure 127: The Netherlands Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 128: The Netherlands Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 129: Rest of Europe Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 130: Rest of Europe Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Component, 2024 and 2035

Figure 131: Rest of Europe Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 132: Rest of Europe Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 133: Rest of Europe Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 134: Rest of Europe Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Organization Size, 2024 and 2035

Figure 135: Rest of Europe Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Organization Size, 2025 to 2035

Figure 136: Rest of Europe Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 137: Rest of Europe Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 138: Asia Pacific Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 139: Asia Pacific Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Component, 2024 and 2035

Figure 140: Asia Pacific Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 141: Asia Pacific Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 142: Asia Pacific Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 143: Asia Pacific Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Organization Size, 2024 and 2035

Figure 144: Asia Pacific Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Organization Size, 2025 to 2035

Figure 145: Asia Pacific Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 146: Asia Pacific Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 147: Asia Pacific Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 148: Asia Pacific Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 149: China Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 150: China Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Component, 2024 and 2035

Figure 151: China Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 152: China Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 153: China Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 154: China Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Organization Size, 2024 and 2035

Figure 155: China Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Organization Size, 2025 to 2035

Figure 156: China Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 157: China Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 158: Japan Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 159: Japan Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Component, 2024 and 2035

Figure 160: Japan Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 161: Japan Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 162: Japan Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 163: Japan Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Organization Size, 2024 and 2035

Figure 164: Japan Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Organization Size, 2025 to 2035

Figure 165: Japan Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 166: Japan Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 167: India Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 168: India Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Component, 2024 and 2035

Figure 169: India Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 170: India Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 171: India Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 172: India Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Organization Size, 2024 and 2035

Figure 173: India Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Organization Size, 2025 to 2035

Figure 174: India Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 175: India Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 176: South Korea Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 177: South Korea Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Component, 2024 and 2035

Figure 178: South Korea Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 179: South Korea Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 180: South Korea Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 181: South Korea Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Organization Size, 2024 and 2035

Figure 182: South Korea Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Organization Size, 2025 to 2035

Figure 183: South Korea Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 184: South Korea Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 185: Australia and New Zealand Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 186: Australia and New Zealand Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Component, 2024 and 2035

Figure 187: Australia and New Zealand Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 188: Australia and New Zealand Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 189: Australia and New Zealand Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 190: Australia and New Zealand Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Organization Size, 2024 and 2035

Figure 191: Australia and New Zealand Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Organization Size, 2025 to 2035

Figure 192: Australia and New Zealand Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 193: Australia and New Zealand Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 194: Rest of Asia Pacific Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 195: Rest of Asia Pacific Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Component, 2024 and 2035

Figure 196: Rest of Asia Pacific Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 197: Rest of Asia Pacific Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 198: Rest of Asia Pacific Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 199: Rest of Asia Pacific Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Organization Size, 2024 and 2035

Figure 200: Rest of Asia Pacific Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Organization Size, 2025 to 2035

Figure 201: Rest of Asia Pacific Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 202: Rest of Asia Pacific Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 203: Latin America Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 204: Latin America Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Component, 2024 and 2035

Figure 205: Latin America Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 206: Latin America Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 207: Latin America Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 208: Latin America Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Organization Size, 2024 and 2035

Figure 209: Latin America Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Organization Size, 2025 to 2035

Figure 210: Latin America Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 211: Latin America Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 212: Latin America Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 213: Latin America Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 214: Brazil Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 215: Brazil Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Component, 2024 and 2035

Figure 216: Brazil Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 217: Brazil Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 218: Brazil Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 219: Brazil Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Organization Size, 2024 and 2035

Figure 220: Brazil Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Organization Size, 2025 to 2035

Figure 221: Brazil Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 222: Brazil Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 223: Mexico Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 224: Mexico Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Component, 2024 and 2035

Figure 225: Mexico Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 226: Mexico Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 227: Mexico Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 228: Mexico Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Organization Size, 2024 and 2035

Figure 229: Mexico Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Organization Size, 2025 to 2035

Figure 230: Mexico Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 231: Mexico Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 232: Argentina Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 233: Argentina Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Component, 2024 and 2035

Figure 234: Argentina Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 235: Argentina Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 236: Argentina Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 237: Argentina Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Organization Size, 2024 and 2035

Figure 238: Argentina Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Organization Size, 2025 to 2035

Figure 239: Argentina Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 240: Argentina Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 241: Rest of Latin America Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 242: Rest of Latin America Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Component, 2024 and 2035

Figure 243: Rest of Latin America Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 244: Rest of Latin America Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 245: Rest of Latin America Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 246: Rest of Latin America Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Organization Size, 2024 and 2035

Figure 247: Rest of Latin America Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Organization Size, 2025 to 2035

Figure 248: Rest of Latin America Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 249: Rest of Latin America Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 250: Middle East and Africa Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 251: Middle East and Africa Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Component, 2024 and 2035

Figure 252: Middle East and Africa Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 253: Middle East and Africa Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 254: Middle East and Africa Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 255: Middle East and Africa Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Organization Size, 2024 and 2035

Figure 256: Middle East and Africa Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Organization Size, 2025 to 2035

Figure 257: Middle East and Africa Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 258: Middle East and Africa Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 259: Middle East and Africa Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 260: Middle East and Africa Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 261: GCC Countries Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 262: GCC Countries Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Component, 2024 and 2035

Figure 263: GCC Countries Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 264: GCC Countries Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 265: GCC Countries Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 266: GCC Countries Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Organization Size, 2024 and 2035

Figure 267: GCC Countries Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Organization Size, 2025 to 2035

Figure 268: GCC Countries Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 269: GCC Countries Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 270: South Africa Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 271: South Africa Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Component, 2024 and 2035

Figure 272: South Africa Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 273: South Africa Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 274: South Africa Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 275: South Africa Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Organization Size, 2024 and 2035

Figure 276: South Africa Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Organization Size, 2025 to 2035

Figure 277: South Africa Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 278: South Africa Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 279: Rest of Middle East and Africa Manufacturing Operations Management (MOM) Software Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 280: Rest of Middle East and Africa Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Component, 2024 and 2035

Figure 281: Rest of Middle East and Africa Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 282: Rest of Middle East and Africa Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Deployment Model, 2024 and 2035

Figure 283: Rest of Middle East and Africa Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Deployment Model, 2025 to 2035

Figure 284: Rest of Middle East and Africa Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by Organization Size, 2024 and 2035

Figure 285: Rest of Middle East and Africa Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by Organization Size, 2025 to 2035

Figure 286: Rest of Middle East and Africa Manufacturing Operations Management (MOM) Software Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 287: Rest of Middle East and Africa Manufacturing Operations Management (MOM) Software Market Attractiveness Analysis, by End-use Industry, 2025 to 2035