Reports

Reports

The solar cell films market is growing amid the global shift towards renewable energy generation and rise in demand for lightweight, flexible, inexpensive photovoltaic plastic products. Solar cell films are used primarily through integration into architectural components BIPV (Building-integrated photovoltaics), portable devices, or automotive.

The critical benefits of using solar films are the flexible form factors, ease of integration, and less wastage of material as compared to conventional crystalline silicon (c-Si) solar panels. The growth expected in solar films will occur as investment in solar energy infrastructure continues to rise, well-designed government policy favors non-fossil fuel energy options, and widespread adoption increases in line with development in awareness of and support for sustainable power. The major players in the industry have invested heavily in research and development activities to offer technologies that provide improved efficiencies, durability, and transparency in solar films. At the same time, solar films are looked upon as a viable option for widespread adoption across residential, commercial, and industrial applications. The investment and adoption efforts typically involve partnerships and collaborations to better leverage the growing developments in the construction and electronics sectors.

The solar cell film refers to the photovoltaic technology space made up of thin, lightweight films capable of transforming solar energy into electrical energy. These films are flexible (easier to integrate) than panels, which means that the cost to manufacture them is cheaper and they seek to enable more unique solar applications. Increasing interest in renewable energy and recent innovations in thin film materials help enhance their use across a variety of industries.

Solar cell films are invariably used in building-integrated photovoltaics (BIPV), portable solar, and automotive photovoltaics. They can also be incorporated into windows, façades, and roofs to produce energy that is integrated into its environment. Also, due to their lightweight, they can be used in off grid situations as well as consumer electronics. Solar films are produced by depositing thin films of semiconductor such as cadmium telluride (CdTe), copper indium gallium selenide (CIGS) silicon onto that substrates in order to maximize absorption of energy.

| Attribute | Detail |

|---|---|

| Solar Cell Films Market Drivers |

|

The growing global interest in renewable energy sources is one of the major factors driving growth in the solar cell films market. The governments, market players, and consumers are all advocating a sustainable, energy-independent future. They are shifting to renewable energy sources primarily due to climate change, carbon emissions, and uncertainties of fossil fuel pricing, as both environmental and economic impetus. Renewable energy, especially solar energy, will be increasingly critical to the world's energy transition. Solar cell films are lightweight, flexible, cheaper, and portraying reasonable performance in comparison with silicon solar panels, and they are increasingly being regarded as a favorable technology.

Solar cell films have several advantages, which support the use of both solar cell films for a wide range of applications, from photovoltaic utility scale, portable electronics, and building-integrated PV (BIPV) applications. This increased demand will also be bolstered by effective practices as per international climate agreements like the Paris Accord, and the ambitions of countries making net-zero pledges. Countries in Europe, North America, and Asia Pacific are installing market favorable regulatory frameworks, financial incentives, and subsidies to stimulate solar demand, thereby creating a conducive environment for solar film application.

The emergence of new high-efficiency thin-film technologies is viewed as a key growth area in the solar cell films industry as new developments regularly improve performance, durability, and application. Solar films are often compared unfavorably to crystalline silicon panels, and the perception has contributed to the lag in adoption at scale. However, significant breakthroughs in the field of materials science have led to improved energy conversion efficiency and added stability for cadmium telluride (CdTe), copper indium gallium selenide (CIGS), and perovskite based thin films.

These breakthroughs are helping these materials become more competitive with conventional solar panels and provide new attributes (flexibility, lightness, and cost savings) that solar panels do not offer.

In business, enhanced efficiency equals enhanced value to end-users as enhanced efficiency implies that more electricity is produced in a given square foot of surface area. This is poignant for space constrained applications including urban rooftops, building facades, portable energy systems and much more, where maximizing energy output is critical.

In addition, current research and development (R&D) efforts are focused on transparent solar films that could be integrated into building facades of traditional windows and glass features, increasing the inhabitable potential of building-integrated photovoltaics (BIPV). These types of activities not only create enhanced energy output but enhanced aesthetic and functional value for both commercial and residential clients.

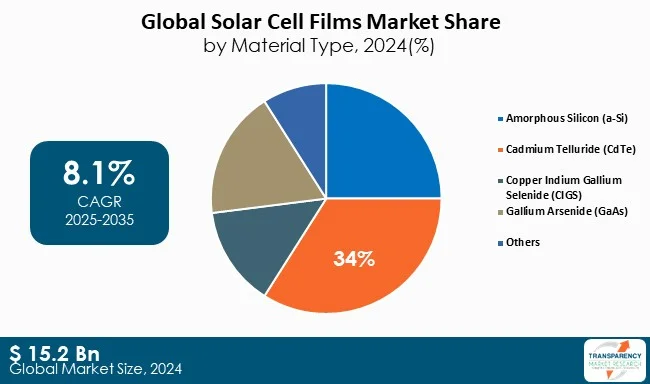

Cadmium Telluride (CdTe) solar cell films dominate as they are cheap, have good light absorption, and have relatively good energy conversion efficiencies as compared to the other thin film types. Their low energy payback time and application at scale make them even better. Further, given recent advances in the processes used to manufacture them and continued investment by large players, as exemplified by First Solar, CdTe is now also identified as the fastest growing segment for solar films.

| Attribute | Detail |

|---|---|

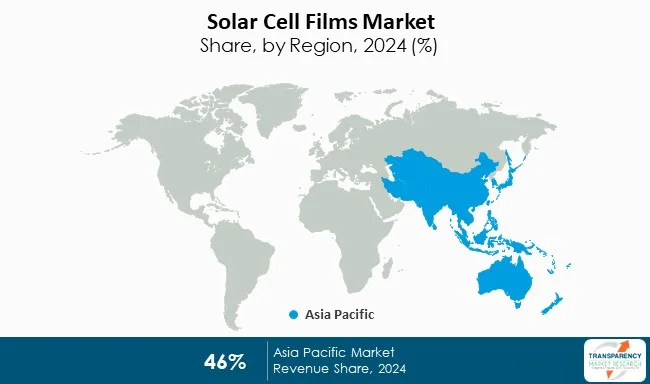

| Leading Region | Asia Pacific |

Asia Pacific is at the foremost regarding solar cell films as it has a strong manufacturing base, rapid urbanization, and favorable renewable energy policies for solar cell films. China is a large player in production at the global scale and uses CdTe and CIGS at a large scale in its production of solar cell films. India and Japan both are building solar infrastructure to meet their ever-increasing energy demands. With government incentives, cheaper labor wages, and increasingly large amounts of investments going into clean energy infrastructure projects, Asia Pacific will continue to be the fastest growing region during the forecast period.

First Solar Inc., Solar Frontier K.K, Hanergy Thin Film Power Group Ltd, Sharp Corporation offer thin film solar technologies including products likes Cadmium Telluride (CdTe), copper indium gallium selenide (CIGS) and amorphous silicon solar films. Thin-films are designed to be used in utility-scale solar power plants, building-integrated photovoltaics (BIPV), and flexible energy systems, with the benefits of high efficiencies, low weight integration, and low-cost competitive renewable power generation products with a variety of potential market applications around the world.

Additionally, Enel Spa, AVANCIS GmbH, Adani Solar, and PVThin also play a major role in the consolidated solar cell films market, with a competitive landscape governed by innovation and productivity

| Attribute | Detail |

|---|---|

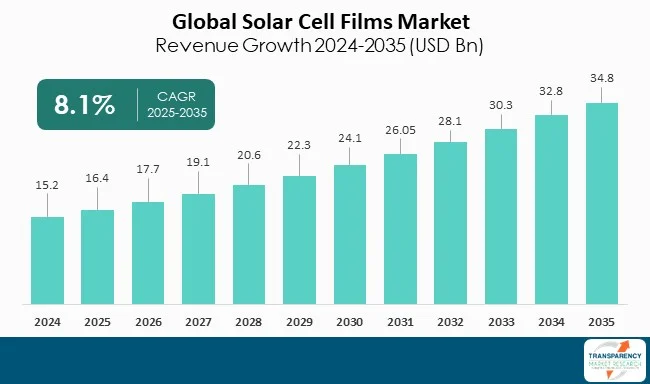

| Market Size Value in 2024 | US$ 15.2 Bn |

| Market Forecast Value in 2035 | US$ 34.8 Bn |

| Growth Rate (CAGR) | 8.1% |

| Forecast Period | 2025–2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | kW For Volume and US$ Bn For Value |

| Market Analysis | It includes cross segment analysis at Global as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Example: Electronic (PDF) + Excel |

| Market Segmentation | By Material Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled (Potential Manufacturers) |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The market stood at US$ 15.2 Bn in 2024

The solar cell films market is expected to grow at a CAGR of 8.1% from 2025 to 2035

Growing global demand for renewable energy solutions and Advancements in high-efficiency thin-film technologies

Cadmium Telluride (CdTe) held the largest share under material type segment in 2024

Asia pacific was the most lucrative region of the Solar cell films market in 2024

First Solar, Inc., Enel Spa, AVANCIS GmbH, Hanergy Thin Film Power Group, Adani Solar, PVThin, Kaneka Solar Energy, Oxford Instruments, Sharp Corporation, Saint-Gobain, and Mitsubishi Electric Corporation.

Table 1 Global Linear Market Volume (KW) Forecast, by Material Type, 2020 to 2035

Table 2 Global Linear Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 3 Global Linear Market Volume (KW) Forecast, by Installation Type, 2020 to 2035

Table 4 Global Linear Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 5 Global Linear Market Volume (KW) Forecast, by Power Range 2020 to 2035

Table 6 Global Linear Market Value (US$ Bn) Forecast, by Power Range 2020 to 2035

Table 7 Global Linear Market Volume (KW) Forecast, by Application, 2020 to 2035

Table 8 Global Linear Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 9 Global Linear Market Volume (KW) Forecast, by End-use, 2020 to 2035

Table 10 Global Linear Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 11 Global Linear Market Volume (KW) Forecast, by Region, 2020 to 2035

Table 12 Global Linear Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 13 North America Linear Market Volume (KW) Forecast, by Material Type, 2020 to 2035

Table 14 North America Linear Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 15 North America Linear Market Volume (KW) Forecast, by Installation Type, 2020 to 2035

Table 16 North America Linear Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 17 North America Linear Market Volume (KW) Forecast, by Power Range 2020 to 2035

Table 18 North America Linear Market Value (US$ Bn) Forecast, by Power Range 2020 to 2035

Table 19 North America Linear Market Volume (KW) Forecast, by Application, 2020 to 2035

Table 20 North America Linear Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 21 North America Linear Market Volume (KW) Forecast, by End-use, 2020 to 2035

Table 22 North America Linear Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 23 North America Linear Market Volume (KW) Forecast, by Country, 2020 to 2035

Table 24 North America Linear Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 25 USA Linear Market Volume (KW) Forecast, by Material Type, 2020 to 2035

Table 26 USA Linear Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 27 USA Linear Market Volume (KW) Forecast, by Installation Type, 2020 to 2035

Table 28 USA Linear Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 29 USA Linear Market Volume (KW) Forecast, by Power Range 2020 to 2035

Table 30 USA Linear Market Value (US$ Bn) Forecast, by Power Range, 2020 to 2035

Table 31 USA Linear Market Volume (KW) Forecast, by Application, 2020 to 2035

Table 32 USA Linear Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 33 USA Linear Market Volume (KW) Forecast, by End-use, 2020 to 2035

Table 34 USA Linear Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 35 Canada Linear Market Volume (KW) Forecast, by Material Type, 2020 to 2035

Table 36 Canada Linear Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 37 Canada Linear Market Volume (KW) Forecast, by Installation Type, 2020 to 2035

Table 38 Canada Linear Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 39 Canada Linear Market Volume (KW) Forecast, by Power Range, 2020 to 2035

Table 40 Canada Linear Market Value (US$ Bn) Forecast, by Power Range, 2020 to 2035

Table 41 Canada Linear Market Volume (KW) Forecast, by Application, 2020 to 2035

Table 42 Canada Linear Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 43 Canada Linear Market Volume (KW) Forecast, by End-use, 2020 to 2035

Table 44 Canada Linear Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 45 Europe Linear Market Volume (KW) Forecast, by Material Type, 2020 to 2035

Table 46 Europe Linear Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 47 Europe Linear Market Volume (KW) Forecast, by Installation Type, 2020 to 2035

Table 48 Europe Linear Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 49 Europe Linear Market Volume (KW) Forecast, by Power Range 2020 to 2035

Table 50 Europe Linear Market Value (US$ Bn) Forecast, by Power Range, 2020 to 2035

Table 51 Europe Linear Market Volume (KW) Forecast, by Application, 2020 to 2035

Table 52 Europe Linear Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 53 Europe Linear Market Volume (KW) Forecast, by End-use, 2020 to 2035

Table 54 Europe Linear Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 55 Europe Linear Market Volume (KW) Forecast, by Country and Sub-region, 2020 to 2035

Table 56 Europe Linear Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 57 Germany Linear Market Volume (KW) Forecast, by Material Type, 2020 to 2035

Table 58 Germany Linear Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 59 Germany Linear Market Volume (KW) Forecast, by Installation Type, 2020 to 2035

Table 60 Germany Linear Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 61 Germany Linear Market Volume (KW) Forecast, by Power Range, 2020 to 2035

Table 62 Germany Linear Market Value (US$ Bn) Forecast, by Power Range, 2020 to 2035

Table 63 Germany Linear Market Volume (KW) Forecast, by Application, 2020 to 2035

Table 64 Germany Linear Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 65 Germany Linear Market Volume (KW) Forecast, by End-use, 2020 to 2035

Table 66 Germany Linear Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 67 France Linear Market Volume (KW) Forecast, by Material Type, 2020 to 2035

Table 68 France Linear Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 69 France Linear Market Volume (KW) Forecast, by Installation Type, 2020 to 2035

Table 70 France Linear Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 71 France Linear Market Volume (KW) Forecast, by Power Range, 2020 to 2035

Table 72 France Linear Market Value (US$ Bn) Forecast, by Power Range, 2020 to 2035

Table 73 France Linear Market Volume (KW) Forecast, by Application, 2020 to 2035

Table 74 France Linear Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 75 France Linear Market Volume (KW) Forecast, by End-use, 2020 to 2035

Table 76 France Linear Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 77 UK Linear Market Volume (KW) Forecast, by Material Type, 2020 to 2035

Table 78 UK Linear Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 79 UK Linear Market Volume (KW) Forecast, by Installation Type, 2020 to 2035

Table 80 UK Linear Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 81 UK Linear Market Volume (KW) Forecast, by Power Range, 2020 to 2035

Table 82 UK Linear Market Value (US$ Bn) Forecast, by Power Range, 2020 to 2035

Table 83 UK Linear Market Volume (KW) Forecast, by Application, 2020 to 2035

Table 84 UK Linear Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 85 UK Linear Market Volume (KW) Forecast, by End-use, 2020 to 2035

Table 86 UK Linear Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 87 Italy Linear Market Volume (KW) Forecast, by Material Type, 2020 to 2035

Table 88 Italy Linear Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 89 Italy Linear Market Volume (KW) Forecast, by Installation Type, 2020 to 2035

Table 90 Italy Linear Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 91 Italy Linear Market Volume (KW) Forecast, by Power Range, 2020 to 2035

Table 92 Italy Linear Market Value (US$ Bn) Forecast, by Power Range, 2020 to 2035

Table 93 Italy Linear Market Volume (KW) Forecast, by Application, 2020 to 2035

Table 94 Italy Linear Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 95 Italy Linear Market Volume (KW) Forecast, by End-use, 2020 to 2035

Table 96 Italy Linear Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 97 Spain Linear Market Volume (KW) Forecast, by Material Type, 2020 to 2035

Table 98 Spain Linear Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 99 Spain Linear Market Volume (KW) Forecast, by Installation Type, 2020 to 2035

Table 100 Spain Linear Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 101 Spain Linear Market Volume (KW) Forecast, by Power Range, 2020 to 2035

Table 102 Spain Linear Market Value (US$ Bn) Forecast, by Power Range, 2020 to 2035

Table 103 Spain Linear Market Volume (KW) Forecast, by Application, 2020 to 2035

Table 104 Spain Linear Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 105 Spain Linear Market Volume (KW) Forecast, by End-use, 2020 to 2035

Table 106 Spain Linear Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 107 Russia & CIS Linear Market Volume (KW) Forecast, by Material Type, 2020 to 2035

Table 108 Russia & CIS Linear Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 109 Russia & CIS Linear Market Volume (KW) Forecast, by Installation Type, 2020 to 2035

Table 110 Russia & CIS Linear Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 111 Russia & CIS Linear Market Volume (KW) Forecast, by Power Range, 2020 to 2035

Table 112 Russia & CIS Linear Market Value (US$ Bn) Forecast, by Power Range, 2020 to 2035

Table 113 Russia & CIS Linear Market Volume (KW) Forecast, by Application, 2020 to 2035

Table 114 Russia & CIS Linear Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 115 Russia & CIS Linear Market Volume (KW) Forecast, by End-use, 2020 to 2035

Table 116 Russia & CIS Linear Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 117 Rest of Europe Linear Market Volume (KW) Forecast, by Material Type, 2020 to 2035

Table 118 Rest of Europe Linear Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 119 Rest of Europe Linear Market Volume (KW) Forecast, by Installation Type, 2020 to 2035

Table 120 Rest of Europe Linear Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 121 Rest of Europe Linear Market Volume (KW) Forecast, by Power Range, 2020 to 2035

Table 122 Rest of Europe Linear Market Value (US$ Bn) Forecast, by Power Range, 2020 to 2035

Table 123 Rest of Europe Linear Market Volume (KW) Forecast, by Application, 2020 to 2035

Table 124 Rest of Europe Linear Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 125 Rest of Europe Linear Market Volume (KW) Forecast, by End-use, 2020 to 2035

Table 126 Rest of Europe Linear Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 127 Asia Pacific Linear Market Volume (KW) Forecast, by Material Type, 2020 to 2035

Table 128 Asia Pacific Linear Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 129 Asia Pacific Linear Market Volume (KW) Forecast, by Installation Type, 2020 to 2035

Table 130 Asia Pacific Linear Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 131 Asia Pacific Linear Market Volume (KW) Forecast, by Power Range, 2020 to 2035

Table 132 Asia Pacific Linear Market Value (US$ Bn) Forecast, by Power Range, 2020 to 2035

Table 133 Asia Pacific Linear Market Volume (KW) Forecast, by Application, 2020 to 2035

Table 134 Asia Pacific Linear Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 135 Asia Pacific Linear Market Volume (KW) Forecast, by End-use, 2020 to 2035

Table 136 Asia Pacific Linear Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 137 Asia Pacific Linear Market Volume (KW) Forecast, by Country and Sub-region, 2020 to 2035

Table 138 Asia Pacific Linear Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 139 China Linear Market Volume (KW) Forecast, by Material Type, 2020 to 2035

Table 140 China Linear Market Value (US$ Bn) Forecast, by Material Type 2020 to 2035

Table 141 China Linear Market Volume (KW) Forecast, by Installation Type, 2020 to 2035

Table 142 China Linear Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 143 China Linear Market Volume (KW) Forecast, by Power Range, 2020 to 2035

Table 144 China Linear Market Value (US$ Bn) Forecast, by Power Range, 2020 to 2035

Table 145 China Linear Market Volume (KW) Forecast, by Application, 2020 to 2035

Table 146 China Linear Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 147 China Linear Market Volume (KW) Forecast, by End-use, 2020 to 2035

Table 148 China Linear Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 149 Japan Linear Market Volume (KW) Forecast, by Material Type, 2020 to 2035

Table 150 Japan Linear Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 151 Japan Linear Market Volume (KW) Forecast, by Installation Type, 2020 to 2035

Table 152 Japan Linear Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 153 Japan Linear Market Volume (KW) Forecast, by Power Range, 2020 to 2035

Table 154 Japan Linear Market Value (US$ Bn) Forecast, by Power Range, 2020 to 2035

Table 155 Japan Linear Market Volume (KW) Forecast, by Application, 2020 to 2035

Table 156 Japan Linear Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 157 Japan Linear Market Volume (KW) Forecast, by End-use, 2020 to 2035

Table 158 Japan Linear Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 159 India Linear Market Volume (KW) Forecast, by Material Type, 2020 to 2035

Table 160 India Linear Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 161 India Linear Market Volume (KW) Forecast, by Installation Type, 2020 to 2035

Table 162 India Linear Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 163 India Linear Market Volume (KW) Forecast, by Power Range, 2020 to 2035

Table 164 India Linear Market Value (US$ Bn) Forecast, by Power Range, 2020 to 2035

Table 165 India Linear Market Volume (KW) Forecast, by Application, 2020 to 2035

Table 166 India Linear Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 167 India Linear Market Volume (KW) Forecast, by End-use, 2020 to 2035

Table 168 India Linear Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 169 ASEAN Linear Market Volume (KW) Forecast, by Material Type, 2020 to 2035

Table 170 ASEAN Linear Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 171 ASEAN Linear Market Volume (KW) Forecast, by Installation Type, 2020 to 2035

Table 172 ASEAN Linear Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 173 ASEAN Linear Market Volume (KW) Forecast, by Power Range, 2020 to 2035

Table 174 ASEAN Linear Market Value (US$ Bn) Forecast, by Power Range, 2020 to 2035

Table 175 ASEAN Linear Market Volume (KW) Forecast, by Application, 2020 to 2035

Table 176 ASEAN Linear Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 177 ASEAN Linear Market Volume (KW) Forecast, by End-use, 2020 to 2035

Table 178 ASEAN Linear Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 179 Rest of Asia Pacific Linear Market Volume (KW) Forecast, by Material Type, 2020 to 2035

Table 180 Rest of Asia Pacific Linear Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 181 Rest of Asia Pacific Linear Market Volume (KW) Forecast, by Installation Type, 2020 to 2035

Table 182 Rest of Asia Pacific Linear Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 183 Rest of Asia Pacific Linear Market Volume (KW) Forecast, by Power Range, 2020 to 2035

Table 184 Rest of Asia Pacific Linear Market Value (US$ Bn) Forecast, by Power Range, 2020 to 2035

Table 185 Rest of Asia Pacific Linear Market Volume (KW) Forecast, by Application, 2020 to 2035

Table 186 Rest of Asia Pacific Linear Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 187 Rest of Asia Pacific Linear Market Volume (KW) Forecast, by End-use, 2020 to 2035

Table 188 Rest of Asia Pacific Linear Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 189 Latin America Linear Market Volume (KW) Forecast, by Material Type, 2020 to 2035

Table 190 Latin America Linear Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 191 Latin America Linear Market Volume (KW) Forecast, by Installation Type, 2020 to 2035

Table 192 Latin America Linear Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 193 Latin America Linear Market Volume (KW) Forecast, by Power Range, 2020 to 2035

Table 194 Latin America Linear Market Value (US$ Bn) Forecast, by Power Range, 2020 to 2035

Table 195 Latin America Linear Market Volume (KW) Forecast, by Application, 2020 to 2035

Table 196 Latin America Linear Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 197 Latin America Linear Market Volume (KW) Forecast, by End-use, 2020 to 2035

Table 198 Latin America Linear Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 199 Latin America Linear Market Volume (KW) Forecast, by Country and Sub-region, 2020 to 2035

Table 200 Latin America Linear Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 201 Brazil Linear Market Volume (KW) Forecast, by Material Type, 2020 to 2035

Table 202 Brazil Linear Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 203 Brazil Linear Market Volume (KW) Forecast, by Installation Type, 2020 to 2035

Table 204 Brazil Linear Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 205 Brazil Linear Market Volume (KW) Forecast, by Power Range, 2020 to 2035

Table 206 Brazil Linear Market Value (US$ Bn) Forecast, by Power Range, 2020 to 2035

Table 207 Brazil Linear Market Volume (KW) Forecast, by Application, 2020 to 2035

Table 208 Brazil Linear Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 209 Brazil Linear Market Volume (KW) Forecast, by End-use, 2020 to 2035

Table 210 Brazil Linear Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 211 Mexico Linear Market Volume (KW) Forecast, by Material Type, 2020 to 2035

Table 212 Mexico Linear Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 213 Mexico Linear Market Volume (KW) Forecast, by Installation Type, 2020 to 2035

Table 214 Mexico Linear Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 215 Mexico Linear Market Volume (KW) Forecast, by Power Range, 2020 to 2035

Table 216 Mexico Linear Market Value (US$ Bn) Forecast, by Power Range, 2020 to 2035

Table 217 Mexico Linear Market Volume (KW) Forecast, by Application, 2020 to 2035

Table 218 Mexico Linear Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 219 Mexico Linear Market Volume (KW) Forecast, by End-use, 2020 to 2035

Table 220 Mexico Linear Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 221 Rest of Latin America Linear Market Volume (KW) Forecast, by Material Type, 2020 to 2035

Table 222 Rest of Latin America Linear Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 223 Rest of Latin America Linear Market Volume (KW) Forecast, by Installation Type, 2020 to 2035

Table 224 Rest of Latin America Linear Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 225 Rest of Latin America Linear Market Volume (KW) Forecast, by Power Range, 2020 to 2035

Table 226 Rest of Latin America Linear Market Value (US$ Bn) Forecast, by Power Range, 2020 to 2035

Table 227 Rest of Latin America Linear Market Volume (KW) Forecast, by Application, 2020 to 2035

Table 228 Rest of Latin America Linear Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 229 Rest of Latin America Linear Market Volume (KW) Forecast, by End-use, 2020 to 2035

Table 230 Rest of Latin America Linear Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 231 Middle East & Africa Linear Market Volume (KW) Forecast, by Material Type, 2020 to 2035

Table 232 Middle East & Africa Linear Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 233 Middle East & Africa Linear Market Volume (KW) Forecast, by Installation Type, 2020 to 2035

Table 234 Middle East & Africa Linear Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 235 Middle East & Africa Linear Market Volume (KW) Forecast, by Power Range, 2020 to 2035

Table 236 Middle East & Africa Linear Market Value (US$ Bn) Forecast, by Power Range, 2020 to 2035

Table 237 Middle East & Africa Linear Market Volume (KW) Forecast, by Application, 2020 to 2035

Table 238 Middle East & Africa Linear Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 239 Middle East & Africa Linear Market Volume (KW) Forecast, by End-use, 2020 to 2035

Table 240 Middle East & Africa Linear Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 241 Middle East & Africa Linear Market Volume (KW) Forecast, by Country and Sub-region, 2020 to 2035

Table 242 Middle East & Africa Linear Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 243 GCC Linear Market Volume (KW) Forecast, by Material Type, 2020 to 2035

Table 244 GCC Linear Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 245 GCC Linear Market Volume (KW) Forecast, by Installation Type, 2020 to 2035

Table 246 GCC Linear Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 247 GCC Linear Market Volume (KW) Forecast, by Power Range, 2020 to 2035

Table 248 GCC Linear Market Value (US$ Bn) Forecast, by Power Range, 2020 to 2035

Table 249 GCC Linear Market Volume (KW) Forecast, by Application, 2020 to 2035

Table 250 GCC Linear Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 251 GCC Linear Market Volume (KW) Forecast, by End-use, 2020 to 2035

Table 252 GCC Linear Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 253 South Africa Linear Market Volume (KW) Forecast, by Material Type, 2020 to 2035

Table 254 South Africa Linear Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 255 South Africa Linear Market Volume (KW) Forecast, by Installation Type, 2020 to 2035

Table 256 South Africa Linear Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 257 South Africa Linear Market Volume (KW) Forecast, by Power Range, 2020 to 2035

Table 258 South Africa Linear Market Value (US$ Bn) Forecast, by Power Range, 2020 to 2035

Table 259 South Africa Linear Market Volume (KW) Forecast, by Application, 2020 to 2035

Table 260 South Africa Linear Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 261 South Africa Linear Market Volume (KW) Forecast, by End-use, 2020 to 2035

Table 262 South Africa Linear Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 263 Rest of Middle East & Africa Linear Market Volume (KW) Forecast, by Material Type, 2020 to 2035

Table 264 Rest of Middle East & Africa Linear Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 265 Rest of Middle East & Africa Linear Market Volume (KW) Forecast, by Installation Type, 2020 to 2035

Table 266 Rest of Middle East & Africa Linear Market Value (US$ Bn) Forecast, by Installation Type, 2020 to 2035

Table 267 Rest of Middle East & Africa Linear Market Volume (KW) Forecast, by Power Range, 2020 to 2035

Table 268 Rest of Middle East & Africa Linear Market Value (US$ Bn) Forecast, by Power Range, 2020 to 2035

Table 269 Rest of Middle East & Africa Linear Market Volume (KW) Forecast, by Application, 2020 to 2035

Table 270 Rest of Middle East & Africa Linear Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 271 Rest of Middle East & Africa Linear Market Volume (KW) Forecast, by End-use, 2020 to 2035

Table 272 Rest of Middle East & Africa Linear Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Figure 1 Global Linear Market Volume Share Analysis, by Material Type, 2024, 2027, and 2035

Figure 2 Global Linear Market Attractiveness, by Material Type

Figure 3 Global Linear Market Volume Share Analysis, by Installation Type, 2024, 2027, and 2035

Figure 4 Global Linear Market Attractiveness, by Installation Type

Figure 5 Global Linear Market Volume Share Analysis, by Power Range, 2024, 2027, and 2035

Figure 6 Global Linear Market Attractiveness, by Power Range

Figure 7 Global Linear Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 8 Global Linear Market Attractiveness, by Application

Figure 9 Global Linear Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 10 Global Linear Market Attractiveness, by End-use

Figure 11 Global Linear Market Volume Share Analysis, by Region, 2024, 2027, and 2035

Figure 12 Global Linear Market Attractiveness, by Region

Figure 13 North America Linear Market Volume Share Analysis, by Material Type, 2024, 2027, and 2035

Figure 14 North America Linear Market Attractiveness, by Material Type

Figure 15 North America Linear Market Attractiveness, by Material Type

Figure 16 North America Linear Market Volume Share Analysis, by Installation Type, 2024, 2027, and 2035

Figure 17 North America Linear Market Attractiveness, by Installation Type

Figure 18 North America Linear Market Volume Share Analysis, by Power Range, 2024, 2027, and 2035

Figure 19 North America Linear Market Attractiveness, by Power Range

Figure 20 North America Linear Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 21 North America Linear Market Attractiveness, by Application

Figure 22 North America Linear Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 23 North America Linear Market Attractiveness, by End-use

Figure 24 North America Linear Market Attractiveness, by Country and Sub-region

Figure 25 Europe Linear Market Volume Share Analysis, by Material Type, 2024, 2027, and 2035

Figure 26 Europe Linear Market Attractiveness, by Material Type

Figure 27 Europe Linear Market Volume Share Analysis, by Installation Type, 2024, 2027, and 2035

Figure 28 Europe Linear Market Attractiveness, by Installation Type

Figure 29 Europe Linear Market Volume Share Analysis, by Power Range, 2024, 2027, and 2035

Figure 30 Europe Linear Market Attractiveness, by Power Range

Figure 31 Europe Linear Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 32 Europe Linear Market Attractiveness, by Application

Figure 33 Europe Linear Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 34 Europe Linear Market Attractiveness, by End-use

Figure 35 Europe Linear Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 36 Europe Linear Market Attractiveness, by Country and Sub-region

Figure 37 Asia Pacific Linear Market Volume Share Analysis, by Material Type, 2024, 2027, and 2035

Figure 38 Asia Pacific Linear Market Attractiveness, by Material Type

Figure 39 Asia Pacific Linear Market Volume Share Analysis, by Installation Type, 2024, 2027, and 2035

Figure 40 Asia Pacific Linear Market Attractiveness, by Installation Type

Figure 41 Asia Pacific Linear Market Volume Share Analysis, by Power Range, 2024, 2027, and 2035

Figure 42 Asia Pacific Linear Market Attractiveness, by Power Range

Figure 43 Asia Pacific Linear Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 44 Asia Pacific Linear Market Attractiveness, by Application

Figure 45 Asia Pacific Linear Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 46 Asia Pacific Linear Market Attractiveness, by End-use

Figure 47 Asia Pacific Linear Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 48 Asia Pacific Linear Market Attractiveness, by Country and Sub-region

Figure 49 Latin America Linear Market Volume Share Analysis, by Material Type, 2024, 2027, and 2035

Figure 50 Latin America Linear Market Attractiveness, by Material Type

Figure 51 Latin America Linear Market Volume Share Analysis, by Installation Type, 2024, 2027, and 2035

Figure 52 Latin America Linear Market Attractiveness, by Installation Type

Figure 53 Latin America Linear Market Volume Share Analysis, by Power Range, 2024, 2027, and 2035

Figure 54 Latin America Linear Market Attractiveness, by Power Range

Figure 55 Latin America Linear Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 56 Latin America Linear Market Attractiveness, by Application

Figure 57 Latin America Linear Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 58 Latin America Linear Market Attractiveness, by End-use

Figure 59 Latin America Linear Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 60 Latin America Linear Market Attractiveness, by Country and Sub-region

Figure 61 Middle East & Africa Linear Market Volume Share Analysis, by Material Type, 2024, 2027, and 2035

Figure 62 Middle East & Africa Linear Market Attractiveness, by Material Type

Figure 63 Middle East & Africa Linear Market Volume Share Analysis, by Installation Type, 2024, 2027, and 2035

Figure 64 Middle East & Africa Linear Market Attractiveness, by Installation Type

Figure 65 Middle East & Africa Linear Market Volume Share Analysis, by Power Range, 2024, 2027, and 2035

Figure 66 Middle East & Africa Linear Market Attractiveness, by Power Range

Figure 67 Middle East & Africa Linear Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 68 Middle East & Africa Linear Market Attractiveness, by Application

Figure 69 Middle East & Africa Linear Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 70 Middle East & Africa Linear Market Attractiveness, by End-use

Figure 71 Middle East & Africa Linear Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 72 Middle East & Africa Linear Market Attractiveness, by Country and Sub-region