Reports

Reports

The microbiology culture market is witnessing steadiness due to applications in clinical diagnostics, food testing, pharmaceuticals, and environmental testing. A growing emphasis on pathogen detection and contamination prevention, along with concentration on R&D, has pushed demand for different culture methods higher.

Large established competitors are harnessing the market demand for ready-to-use media, automation options, and included custom culture options. Global manufacturers have been implementing expansion strategies and establishing production facilitation closer to regional markets and research labs and hospitals.

.webp)

Biopharmaceuticals have also been an area of significant market growth by using microbial cultures in drug discovery and vaccine development. The move toward personalized medicine, an increase in clinical testing, and increased infectious disease watchfulness has created a favorable environment for this marketplace.

Additionally, established competitors are focusing on development of chromogenic media and automated culture systems to improve accuracy and speed of service in laboratories. Enhanced media formulations and also transport of actions for laboratories have improved the reliability of microbiological testing for a variety of major industries. Growing awareness of hygiene, safety, and microbial testing standards has increased institutional purchases as well.

The microbiology culture market is supported not just by a few performance metrics but by any number of indicators that show strong and continued growth. For example, the number of clinical laboratories performing microbial testing has increased by nearly 30% in the last five years. The increase was influenced by the demand for early recognition of pathogens and drug-resistant bacteria.

In pharmaceutical testing, microbiological monitoring that utilizes culture media has become a standard with over 80% of FDA-registered facilities, using some form of routine microbial load and/or sterility testing. Automated culture systems, in clinical labs, have enjoyed somewhat renaissance with the relevant installed base increasing between 15% and 20% every year, stressing again faster but with higher level of precision.

There is also a dramatic uptick in the volume of research published in a given year citing emerging culture media and/or microbial isolating techniques - estimated at 12%, focusing on either academic or industry research papers. Moreover, with the number of regulatory authorities around the planet requiring or recommending defined validated protocols for microbial testing in major industries including bottled water, cosmetics and medical devices, there is a more stable and consistent demand.

In summary, it is clear the microbiology culture market is dynamic and driven by innovation, as well as depth and complexity that continues to grow.

| Attribute | Detail |

|---|---|

| Microbiology Culture Market Drivers |

|

The increasing incidences of infectious diseases globally is the most significant driver of market growth for microbiology culture. As an example, as the incidence of multidrug-resistant organisms such as MRSA (Methicillin-resistant Staphylococcus aureus) and VRE (Vancomycin-resistant Enterococcus) increases, the need for microbiological culture media for accurate microbial identification has become paramount.

Healthcare organizations in hospitals and diagnostic labs are now using microbiological culture testing in a variety of infection types (respiratory, urinary tract, bloodstream, gastrointestinal, etc.) to conduct culture-based testing assuming molecular diagnostics do not exist if there is no facility to support molecular diagnostics, or if molecular diagnostics are available but have prohibitive cost.

More importantly, research that approximately 70% of clinical sepsis diagnoses within many of the larger public health systems begin with microbial culture that is confirmatory with molecular methods and clinical lab is sent out to confirm positive cultures.

While many public health systems continue to emphasize premature detection and containment as public health strategies, microbiology culture remains the benchmark for surveillance systems, outbreak systems, and response for public health agencies. Further, culture-based antibiograms serve as an important resource for physicians who want to modify their treatment regimens for bacterial infections for the betterment of patient care.

The ongoing challenge brought on by increased incidence of emerging infectious disease threats including zoonoses and illnesses acquired in an acute care facility will only increase the reliance on microbiology culture based diagnostics in clinical applications and public health. These elements combine to create a steady growth pattern for the microbiology culture market.

The growing intensity of pharmaceutical and biotechnology research will also have a positive effect on the microbiology culture market. Microbial cultures are basic to vaccines, antibiotics, and biologics discovery, development, and production. For example, microbial fermentation is dependent on culture media and used for the production of recombinant insulin, growth hormones, and vaccine production.

During the global race to develop vaccines for COVID-19, bacterial and yeast cultures were fundamentally involved in antigen expression testing and production system or optimized delivery.

Furthermore, with renewed interest in the development of next-generation antibiotics in response to an increased incidence of resistant strains, pharmaceutical companies are willing to invest in broad screening programs, which depend on selective and differential culture media, for isolation of new microbial strains from soil, marine, and the other places.

In biotechnology, engineered microbes are cultivated to produce enzymes, amino acids, and biosurfactants for industrial and therapeutic use. For example, there are synthetic biology companies that now screen thousands of microbial colonies from culture plates to identify promising high yield strains for scale-up. The high demand for this high-throughput work has led to the production of a wide array of ready to use or informed custom culture media kits for specific organisms or processes.

As the biopharmaceutical pipelines further expand in a global context, there needs to be a continuing and stable recourse of reproducible microbial culture systems, and this will likely keep demand robust.

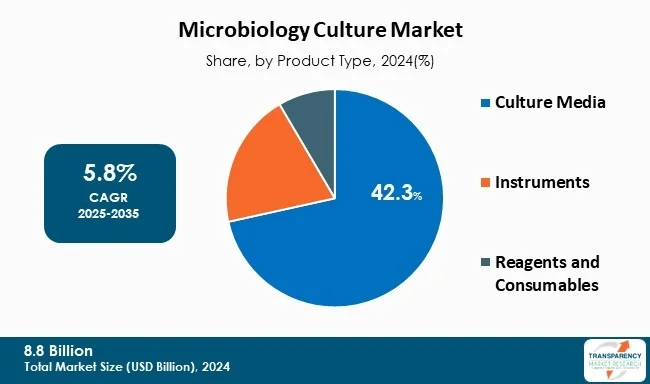

Culture media, as a product category, will continue to represent the most prominent segment impacting the overall microbiology culture market. Culture media are an essential component for the growth, isolation, and identification of microbes. Culture media are the fundamental foundation for nearly all microbiological studies and diagnosis across the healthcare, food safety, pharmaceutical, and research laboratory sectors. For example, chromogenic media formulations, which allow for faster visual identification of pathogens, are seeing increased demand.

Studies show that hospital laboratories have witnessed an increase in the demand for chromogenic media by more than 30% in the last two years. The majority of procurement from diagnostic labs and pharmaceutical companies is through pre-poured plates, dehydrated culture media, and custom formulations. For instance, one of the leading large chains in diagnostics indicated they process over 1 million clinical samples every year, using various general purpose and selective agar media.

In pharmaceutical microbiology, the use of culturing media has expanded to include isolating and counting bacteria for sterility testing, microbial limit tests and bioburden testing.

Likewise, in environmental monitoring programs, culture media kit will be preferred when standardization and reliability are required, so as to ensure real-time culture media format (ready-to-use). As end-users continue to ask for faster, more specified, and automation-ready solutions, the culture media segment will be strengthened through innovation, and continues to be the main driver for revenue

| Attribute | Detail |

|---|---|

| Leading Region | North America |

North America is at the forefront of the microbiology culture market, largely owing to its advanced health care infrastructure, notable research and development funding, and substantial regulatory governance. The region boasts many of the finest diagnostic laboratories, pharmaceutical manufacturers, and research institutions that regularly utilize microbial culture techniques. The United States, in particular, is a high-demand geography considering its large base of clinical laboratories and biotechnology firms.

The U.S. also accounts for a considerable portion, and high prevalence of culture-based antimicrobial resistance testing in the global marketplace due to CDC-supported initiatives in hospital infections, and American companies dominate the supply chain for culture media, incubators, and automation systems.

Microbial culture testing is also an essential aspect of the development and quality assurance processes for FDA licensed biologics, more than 70% of which undergo microbial culture testing. North American universities and government labs also play important roles as significant research contributors in the form of journal publications, involving microbial cultivation studies, and also the number of grants goes a long way for culture-based studies of the environment, agriculture, and food safety considerations.

Key players operating in the microbiology culture industry are investing through innovation, technological advancements, and strategic partnerships. They focus on enhancing imaging clarity, and expanding product portfolios, ensuring sustained growth and leadership in the evolving healthcare landscape.

Thermo Fisher Scientific Inc., Sartorius AG, Merck KGaA, Bio-Rad Laboratories, Inc., Becton, Dickinson and Company, Eiken Chemical Co., Ltd., HiMedia Laboratories, Cytiva (Danaher Corporation), CONDALAB, Biomed Diagnostics, Hardy Diagnostics, Scharlab S.L., Eklavya Biotech Private Limited are the key players in microbiology culture market.

Each of these players has been profiled in the market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 8.8 Bn |

| Forecast Value in 2035 | US$ 16.4 Bn |

| CAGR | 5.8% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Microbiology Culture Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The microbiology culture market was valued at US$ 8.8 Bn in 2024.

The microbiology culture market is projected to cross US$ 16.4 Bn by the end of 2035.

Increasing prevalence of infectious diseases and growth in pharmaceutical and biotech R&D.

The CAGR is anticipated to be 5.8% from 2025 to 2035.

North America is expected to account for the largest share from 2025 to 2035.

Thermo Fisher Scientific Inc., Sartorius AG, Merck KGaA, Bio-Rad Laboratories, Inc., Becton, Dickinson and Company, Eiken Chemical Co., Ltd., HiMedia Laboratories, Cytiva (Danaher Corporation), CONDALAB, Biomed Diagnostics, Hardy Diagnostics, Scharlab S.L., Eklavya Biotech Private Limited, and others.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Microbiology Culture Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Microbiology Culture Market Analysis and Forecast, 2020 to 2035

4.4.1. Market Revenue Projections (US$ Bn)

5. Key Insights

5.1. Technological Advancements in Microbiology Culture Techniques

5.2. Microbiology Culture Products Pricing and Brand Analysis

5.3. Regulatory Scenario across Key Regions / Countries

5.4. PORTER’s Five Forces Analysis

5.5. PESTEL Analysis

5.6. Value Chain Analysis

5.7. Key Purchase Metrics for End-users

5.8. Go-to-Market Strategy for New Market Entrants

5.9. Key Industry Events (Partnerships, Collaborations, Product approvals, mergers & acquisitions)

5.10. Benchmarking of the Products Offered by the Leading Competitors

6. Global Microbiology Culture Market Analysis and Forecast, by Product Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product Type, 2020 to 2035

6.3.1. Culture Media

6.3.1.1. Basal Media

6.3.1.2. Enriched Media

6.3.1.3. Selective Media

6.3.1.4. Differential Media

6.3.1.5. Others

6.3.2. Instruments

6.3.3. Reagents and Consumables

6.4. Market Attractiveness Analysis, by Product Type

7. Global Microbiology Culture Market Analysis and Forecast, by Culture Type

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Culture Type, 2020 to 2035

7.3.1. Bacterial

7.3.2. Eukaryotic

7.3.3. Viral

7.3.4. Others

7.4. Market Attractiveness Analysis, by Culture Type

8. Global Microbiology Culture Market Analysis and Forecast, by Application

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by Application, 2020 to 2035

8.3.1. Clinical Diagnostics

8.3.2. Bioenergy & Agriculture Research

8.3.3. Cosmetic Industry

8.3.4. Pharmaceutical and Biotechnology Industry

8.3.5. Food and Beverage Industry

8.3.6. Water Testing

8.3.7. Others

8.4. Market Attractiveness Analysis, by Application

9. Global Microbiology Culture Market Analysis and Forecast, by End-user

9.1. Introduction & Definition

9.2. Key Findings/Developments

9.3. Market Value Forecast, by End-user, 2020 to 2035

9.3.1. Hospitals

9.3.2. Diagnostic Laboratories

9.3.3. Pharmaceutical and Biotechnology Companies

9.3.4. Academic and Research Institutes

9.3.5. Others

9.4. Market Attractiveness Analysis, by End-user

10. Global Microbiology Culture Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Market Value Forecast, by Region, 2020 to 2035

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness By Region

11. North America Microbiology Culture Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product Type, 2020 to 2035

11.2.1. Culture Media

11.2.1.1. Basal Media

11.2.1.2. Enriched Media

11.2.1.3. Selective Media

11.2.1.4. Differential Media

11.2.1.5. Others

11.2.2. Instruments

11.2.3. Reagents and Consumables

11.3. Market Value Forecast, by Culture Type, 2020 to 2035

11.3.1. Bacterial

11.3.2. Eukaryotic

11.3.3. Viral

11.3.4. Others

11.4. Market Value Forecast, by Application, 2020 to 2035

11.4.1. Clinical Diagnostics

11.4.2. Bioenergy & Agriculture Research

11.4.3. Cosmetic Industry

11.4.4. Pharmaceutical and Biotechnology Industry

11.4.5. Food and Beverage Industry

11.4.6. Water Testing

11.4.7. Others

11.5. Market Value Forecast, by End-user, 2020 to 2035

11.5.1. Hospitals

11.5.2. Diagnostic Laboratories

11.5.3. Pharmaceutical and Biotechnology Companies

11.5.4. Academic and Research Institutes

11.5.5. Others

11.6. Market Value Forecast, by Country, 2020 to 2035

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Product Type

11.7.2. By Culture Type

11.7.3. By Application

11.7.4. By End-user

11.7.5. By Country

12. Europe Microbiology Culture Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product Type, 2020 to 2035

12.2.1. Culture Media

12.2.1.1. Basal Media

12.2.1.2. Enriched Media

12.2.1.3. Selective Media

12.2.1.4. Differential Media

12.2.1.5. Others

12.2.2. Instruments

12.2.3. Reagents and Consumables

12.3. Market Value Forecast, by Culture Type, 2020 to 2035

12.3.1. Bacterial

12.3.2. Eukaryotic

12.3.3. Viral

12.3.4. Others

12.4. Market Value Forecast, by Application, 2020 to 2035

12.4.1. Clinical Diagnostics

12.4.2. Bioenergy & Agriculture Research

12.4.3. Cosmetic Industry

12.4.4. Pharmaceutical and Biotechnology Industry

12.4.5. Food and Beverage Industry

12.4.6. Water Testing

12.4.7. Others

12.5. Market Value Forecast, by End-user, 2020 to 2035

12.5.1. Hospitals

12.5.2. Diagnostic Laboratories

12.5.3. Pharmaceutical and Biotechnology Companies

12.5.4. Academic and Research Institutes

12.5.5. Others

12.6. Market Value Forecast, by Country/Sub-region, 2020 to 2035

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Italy

12.6.5. Spain

12.6.6. Switzerland

12.6.7. The Netherlands

12.6.8. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. By Product Type

12.7.2. By Culture Type

12.7.3. By Application

12.7.4. By End-user

12.7.5. By Country/Sub-region

13. Asia Pacific Microbiology Culture Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product Type, 2020 to 2035

13.2.1. Culture Media

13.2.1.1. Basal Media

13.2.1.2. Enriched Media

13.2.1.3. Selective Media

13.2.1.4. Differential Media

13.2.1.5. Others

13.2.2. Instruments

13.2.3. Reagents and Consumables

13.3. Market Value Forecast, by Culture Type, 2020 to 2035

13.3.1. Bacterial

13.3.2. Eukaryotic

13.3.3. Viral

13.3.4. Others

13.4. Market Value Forecast, by Application, 2020 to 2035

13.4.1. Clinical Diagnostics

13.4.2. Bioenergy & Agriculture Research

13.4.3. Cosmetic Industry

13.4.4. Pharmaceutical and Biotechnology Industry

13.4.5. Food and Beverage Industry

13.4.6. Water Testing

13.4.7. Others

13.5. Market Value Forecast, by End-user, 2020 to 2035

13.5.1. Hospitals

13.5.2. Diagnostic Laboratories

13.5.3. Pharmaceutical and Biotechnology Companies

13.5.4. Academic and Research Institutes

13.5.5. Others

13.6. Market Value Forecast, by Country/Sub-region, 2020 to 2035

13.6.1. China

13.6.2. India

13.6.3. Japan

13.6.4. South Korea

13.6.5. Australia & New Zealand

13.6.6. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. By Product Type

13.7.2. By Culture Type

13.7.3. By Application

13.7.4. By End-user

13.7.5. By Country/Sub-region

14. Latin America Microbiology Culture Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product Type, 2020 to 2035

14.2.1. Culture Media

14.2.1.1. Basal Media

14.2.1.2. Enriched Media

14.2.1.3. Selective Media

14.2.1.4. Differential Media

14.2.1.5. Others

14.2.2. Instruments

14.2.3. Reagents and Consumables

14.3. Market Value Forecast, by Culture Type, 2020 to 2035

14.3.1. Bacterial

14.3.2. Eukaryotic

14.3.3. Viral

14.3.4. Others

14.4. Market Value Forecast, by Application, 2020 to 2035

14.4.1. Clinical Diagnostics

14.4.2. Bioenergy & Agriculture Research

14.4.3. Cosmetic Industry

14.4.4. Pharmaceutical and Biotechnology Industry

14.4.5. Food and Beverage Industry

14.4.6. Water Testing

14.4.7. Others

14.5. Market Value Forecast, by End-user, 2020 to 2035

14.5.1. Hospitals

14.5.2. Diagnostic Laboratories

14.5.3. Pharmaceutical and Biotechnology Companies

14.5.4. Academic and Research Institutes

14.5.5. Others

14.6. Market Value Forecast, by Country/Sub-region, 2020 to 2035

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Argentina

14.6.4. Rest of Latin America

14.7. Market Attractiveness Analysis

14.7.1. By Product Type

14.7.2. By Culture Type

14.7.3. By Application

14.7.4. By End-user

14.7.5. By Country/Sub-region

15. Middle East & Africa Microbiology Culture Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Product Type, 2020 to 2035

15.2.1. Culture Media

15.2.1.1. Basal Media

15.2.1.2. Enriched Media

15.2.1.3. Selective Media

15.2.1.4. Differential Media

15.2.1.5. Others

15.2.2. Instruments

15.2.3. Reagents and Consumables

15.3. Market Value Forecast, by Culture Type, 2020 to 2035

15.3.1. Bacterial

15.3.2. Eukaryotic

15.3.3. Viral

15.3.4. Others

15.4. Market Value Forecast, by Application, 2020 to 2035

15.4.1. Clinical Diagnostics

15.4.2. Bioenergy & Agriculture Research

15.4.3. Cosmetic Industry

15.4.4. Pharmaceutical and Biotechnology Industry

15.4.5. Food and Beverage Industry

15.4.6. Water Testing

15.4.7. Others

15.5. Market Value Forecast, by End-user, 2020 to 2035

15.5.1. Hospitals

15.5.2. Diagnostic Laboratories

15.5.3. Pharmaceutical and Biotechnology Companies

15.5.4. Academic and Research Institutes

15.5.5. Others

15.6. Market Value Forecast, by Country/Sub-region, 2020 to 2035

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Market Attractiveness Analysis

15.7.1. By Product Type

15.7.2. By Culture Type

15.7.3. By Application

15.7.4. By End-user

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player – Competition Matrix (By Tier and Size of companies)

16.2. Market Share Analysis, by Company (2024)

16.3. Company Profiles

16.3.1. Thermo Fisher Scientific Inc.

16.3.1.1. Company Overview

16.3.1.2. Financial Overview

16.3.1.3. Product Portfolio

16.3.1.4. Business Strategies

16.3.1.5. Recent Developments

16.3.2. Sartorius AG

16.3.2.1. Company Overview

16.3.2.2. Financial Overview

16.3.2.3. Product Portfolio

16.3.2.4. Business Strategies

16.3.2.5. Recent Developments

16.3.3. Merck KGaA

16.3.3.1. Company Overview

16.3.3.2. Financial Overview

16.3.3.3. Product Portfolio

16.3.3.4. Business Strategies

16.3.3.5. Recent Developments

16.3.4. Bio-Rad Laboratories, Inc.

16.3.4.1. Company Overview

16.3.4.2. Financial Overview

16.3.4.3. Product Portfolio

16.3.4.4. Business Strategies

16.3.4.5. Recent Developments

16.3.5. Becton, Dickinson and Company

16.3.5.1. Company Overview

16.3.5.2. Financial Overview

16.3.5.3. Product Portfolio

16.3.5.4. Business Strategies

16.3.5.5. Recent Developments

16.3.6. Eiken Chemical Co., Ltd.

16.3.6.1. Company Overview

16.3.6.2. Financial Overview

16.3.6.3. Product Portfolio

16.3.6.4. Business Strategies

16.3.6.5. Recent Developments

16.3.7. HiMedia Laboratories

16.3.7.1. Company Overview

16.3.7.2. Financial Overview

16.3.7.3. Product Portfolio

16.3.7.4. Business Strategies

16.3.7.5. Recent Developments

16.3.8. Cytiva (Danaher Corporation)

16.3.8.1. Company Overview

16.3.8.2. Financial Overview

16.3.8.3. Product Portfolio

16.3.8.4. Business Strategies

16.3.8.5. Recent Developments

16.3.9. CONDALAB

16.3.9.1. Company Overview

16.3.9.2. Financial Overview

16.3.9.3. Product Portfolio

16.3.9.4. Business Strategies

16.3.9.5. Recent Developments

16.3.10. Biomed Diagnostics

16.3.10.1. Company Overview

16.3.10.2. Financial Overview

16.3.10.3. Product Portfolio

16.3.10.4. Business Strategies

16.3.10.5. Recent Developments

16.3.11. Hardy Diagnostics

16.3.11.1. Company Overview

16.3.11.2. Financial Overview

16.3.11.3. Product Portfolio

16.3.11.4. Business Strategies

16.3.11.5. Recent Developments

16.3.12. Scharlab S.L.

16.3.12.1. Company Overview

16.3.12.2. Financial Overview

16.3.12.3. Product Portfolio

16.3.12.4. Business Strategies

16.3.12.5. Recent Developments

16.3.13. Eklavya Biotech Private Limited

16.3.13.1. Company Overview

16.3.13.2. Financial Overview

16.3.13.3. Product Portfolio

16.3.13.4. Business Strategies

16.3.13.5. Recent Developments

List of Tables

Table 01: Global Microbiology Culture Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 02: Global Microbiology Culture Market Value (US$ Bn) Forecast, By Culture Media, 2020 to 2035

Table 03: Global Microbiology Culture Market Value (US$ Bn) Forecast, By Culture Type, 2020 to 2035

Table 04: Global Microbiology Culture Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 05: Global Microbiology Culture Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 06: Global Microbiology Culture Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 07: North America Microbiology Culture Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 08: North America Microbiology Culture Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 09: North America Microbiology Culture Market Value (US$ Bn) Forecast, By Culture Media, 2020 to 2035

Table 10: North America Microbiology Culture Market Value (US$ Bn) Forecast, by Culture Type, 2020 to 2035

Table 11: North America Microbiology Culture Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 12: North America Microbiology Culture Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 13: Europe Microbiology Culture Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 14: Europe Microbiology Culture Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 15: Europe Microbiology Culture Market Value (US$ Bn) Forecast, By Culture Media, 2020 to 2035

Table 16: Europe Microbiology Culture Market Value (US$ Bn) Forecast, by Culture Type, 2020 to 2035

Table 17: Europe Microbiology Culture Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 18: Europe Microbiology Culture Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 19: Asia Pacific Microbiology Culture Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 20: Asia Pacific Microbiology Culture Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 21: Asia Pacific Microbiology Culture Market Value (US$ Bn) Forecast, By Culture Media, 2020 to 2035

Table 22: Asia Pacific Microbiology Culture Market Value (US$ Bn) Forecast, by Culture Type, 2020 to 2035

Table 23: Asia Pacific Microbiology Culture Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 24: Asia Pacific Microbiology Culture Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 25: Latin America Microbiology Culture Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 26: Latin America Microbiology Culture Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 27: Latin America Microbiology Culture Market Value (US$ Bn) Forecast, By Culture Media, 2020 to 2035

Table 28: Latin America Microbiology Culture Market Value (US$ Bn) Forecast, by Culture Type, 2020 to 2035

Table 29: Latin America Microbiology Culture Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 30: Latin America Microbiology Culture Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 31: Middle East & Africa Microbiology Culture Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 32: Middle East and Africa Microbiology Culture Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 33: Middle East and Africa Microbiology Culture Market Value (US$ Bn) Forecast, By Culture Media, 2020 to 2035

Table 34: Middle East and Africa Microbiology Culture Market Value (US$ Bn) Forecast, by Culture Type, 2020 to 2035

Table 35: Middle East and Africa Microbiology Culture Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 36: Middle East and Africa Microbiology Culture Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

List of Figures

Figure 01: Global Microbiology Culture Market Value (US$ Bn), 2020 to 2035

Figure 02: Global Microbiology Culture Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 03: Global Microbiology Culture Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 04: Global Microbiology Culture Market Revenue (US$ Bn), by Culture Media, 2020 to 2035

Figure 05: Global Microbiology Culture Market Revenue (US$ Bn), by Instruments, 2020 to 2035

Figure 06: Global Microbiology Culture Market Revenue (US$ Bn), by Reagents and Consumables, 2020 to 2035

Figure 07: Global Microbiology Culture Market Value Share Analysis, by Culture Type, 2024 and 2035

Figure 08: Global Microbiology Culture Market Attractiveness Analysis, by Culture Type, 2025 to 2035

Figure 09: Global Microbiology Culture Market Revenue (US$ Bn), by Bacterial, 2020 to 2035

Figure 10: Global Microbiology Culture Market Revenue (US$ Bn), by Eukaryotic, 2020 to 2035

Figure 11: Global Microbiology Culture Market Revenue (US$ Bn), by Viral, 2020 to 2035

Figure 12: Global Microbiology Culture Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 13: Global Microbiology Culture Market Value Share Analysis, by Application, 2024 and 2035

Figure 14: Global Microbiology Culture Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 15: Global Microbiology Culture Market Revenue (US$ Bn), by Clinical Diagnostics, 2020 to 2035

Figure 16: Global Microbiology Culture Market Revenue (US$ Bn), by Bioenergy & Agriculture Research, 2020 to 2035

Figure 17: Global Microbiology Culture Market Revenue (US$ Bn), by Cosmetic Industry, 2020 to 2035

Figure 18: Global Microbiology Culture Market Revenue (US$ Bn), by Pharmaceutical and Biotechnology Industry, 2020 to 2035

Figure 19: Global Microbiology Culture Market Revenue (US$ Bn), by Food and Beverage Industry, 2020 to 2035

Figure 20: Global Microbiology Culture Market Revenue (US$ Bn), by Water Testing, 2020 to 2035

Figure 21: Global Microbiology Culture Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 22: Global Microbiology Culture Market Value Share Analysis, by End-user, 2024 and 2035

Figure 23: Global Microbiology Culture Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 24: Global Microbiology Culture Market Revenue (US$ Bn), by Hospitals , 2020 to 2035

Figure 25: Global Microbiology Culture Market Revenue (US$ Bn), by Diagnostic Laboratories, 2020 to 2035

Figure 26: Global Microbiology Culture Market Revenue (US$ Bn), by Pharmaceutical and Biotechnology Companies, 2020 to 2035

Figure 27: Global Microbiology Culture Market Revenue (US$ Bn), by Academic and Research Institutes , 2020 to 2035

Figure 28: Global Microbiology Culture Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 29: Global Microbiology Culture Market Value Share Analysis, By Region, 2024 and 2035

Figure 30: Global Microbiology Culture Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 31: North America Microbiology Culture Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 32: North America Microbiology Culture Market Value Share Analysis, by Country, 2024 and 2035

Figure 33: North America Microbiology Culture Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 34: North America Microbiology Culture Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 35: North America Microbiology Culture Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 36: North America Microbiology Culture Market Value Share Analysis, by Culture Type, 2025 to 2035

Figure 37: North America Microbiology Culture Market Attractiveness Analysis, by Culture Type, 2025 to 2035

Figure 38: North America Microbiology Culture Market Value Share Analysis, by Application, 2024 and 2035

Figure 39: North America Microbiology Culture Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 40: North America Microbiology Culture Market Value Share Analysis, by End-user, 2024 and 2035

Figure 41: North America Microbiology Culture Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 42: Europe Microbiology Culture Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 43: Europe Microbiology Culture Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 44: Europe Microbiology Culture Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 45: Europe Microbiology Culture Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 46: Europe Microbiology Culture Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 47: Europe Microbiology Culture Market Value Share Analysis, by Culture Type, 2024 and 2035

Figure 48: Europe Microbiology Culture Market Attractiveness Analysis, by Culture Type, 2025 to 2035

Figure 49: Europe Microbiology Culture Market Value Share Analysis, by Application, 2024 and 2035

Figure 50: Europe Microbiology Culture Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 51: Europe Microbiology Culture Market Value Share Analysis, by End-user, 2024 and 2035

Figure 52: Europe Microbiology Culture Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 53: Asia Pacific Microbiology Culture Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 54: Asia Pacific Microbiology Culture Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 55: Asia Pacific Microbiology Culture Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 56: Asia Pacific Microbiology Culture Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 57: Asia Pacific Microbiology Culture Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 58: Asia Pacific Microbiology Culture Market Value Share Analysis, by Culture Type, 2024 and 2035

Figure 59: Asia Pacific Microbiology Culture Market Attractiveness Analysis, by Culture Type, 2025 to 2035

Figure 60: Asia Pacific Microbiology Culture Market Value Share Analysis, By Application, 2024 and 2035

Figure 61: Asia Pacific Microbiology Culture Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 62: Asia Pacific Microbiology Culture Market Value Share Analysis, by End-user, 2024 and 2035

Figure 63: Asia Pacific Microbiology Culture Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 64: Latin America Microbiology Culture Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 65: Latin America Microbiology Culture Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 66: Latin America Microbiology Culture Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 67: Latin America Microbiology Culture Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 68: Latin America Microbiology Culture Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 69: Latin America Microbiology Culture Market Value Share Analysis, by Culture Type, 2024 and 2035

Figure 70: Latin America Microbiology Culture Market Attractiveness Analysis, by Culture Type, 2025 to 2035

Figure 71: Latin America Microbiology Culture Market Value Share Analysis, By Application, 2024 and 2035

Figure 72: Latin America Microbiology Culture Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 73: Latin America Microbiology Culture Market Value Share Analysis, by End-user, 2024 and 2035

Figure 74: Latin America Microbiology Culture Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 75: Middle East & Africa Microbiology Culture Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 76: Middle East & Africa Microbiology Culture Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 77: Middle East & Africa Microbiology Culture Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 78: Middle East and Africa Microbiology Culture Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 79: Middle East and Africa Microbiology Culture Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 80: Middle East and Africa Microbiology Culture Market Value Share Analysis, by Culture Type, 2024 and 2035

Figure 81: Middle East and Africa Microbiology Culture Market Attractiveness Analysis, by Culture Type, 2025 to 2035

Figure 82: Middle East and Africa Microbiology Culture Market Value Share Analysis, by Application, 2024 and 2035

Figure 83: Middle East and Africa Microbiology Culture Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 84: Middle East and Africa Microbiology Culture Market Value Share Analysis, by End-user, 2024 and 2035

Figure 85: Middle East and Africa Microbiology Culture Market Attractiveness Analysis, by End-user, 2025 to 2035