Reports

Reports

Analysts’ Viewpoint on Fencing Market Scenario

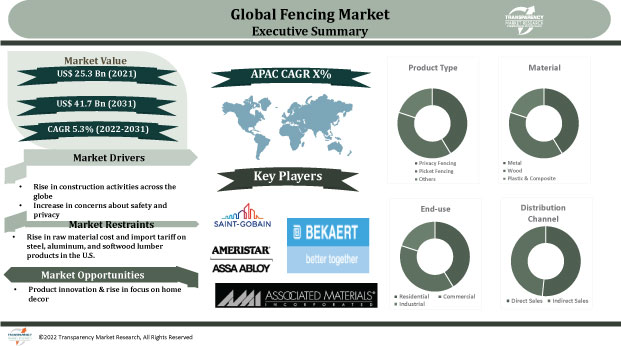

The global fencing market is expected to grow during the forecast period due to the rise in concerns about safety and privacy in residential, commercial, as well as industrial spaces. People are spending increasingly on home remodeling activities post the peak of the COVID-19 pandemic. Wood fences are growing in popularity due to their simple, organic appearance. Along with metal fences, wood fences are a popular choice among residential customers. Fences are becoming more expensive for owners of residential and non-residential buildings due to the increase in prices of fencing raw materials including steel, aluminum, and wood. Hence, fence companies and installers should concentrate on creating advanced fencing solutions such as electric fences, bamboo fencing, and long-lasting fencing that are esthetically pleasing and less expensive.

Fence is a structural element created to increase safety and prevent anyone from crossing a defined boundary. It differs from a wall in terms of weight, design, and structure. Fences are built for a variety of purposes including security, theft prevention, keeping children and pets in a specific area, protecting farmland from potential predators, and enhancing the esthetics of property and boundary fencing.

Leading fencing contractors, manufacturers, suppliers, and exporters are focusing on using plastic composites and synthetic raw materials in the production of fences due to their low cost and better esthetics.

Rise in building activities and infrastructure development in residential, commercial, and industrial sectors are likely to boost the global fencing market. Leading real estate players are increasing their investments in large-scale residential and commercial projects. Security fences are necessary to protect buildings and homes. Growth of the real estate sector and rise in construction of malls, offices, and industrial facilities are fueling the demand for fencing.

According to data issued by the Canadian Real Estate Association, home sales in Canada increased by 0.9% in September 2021 compared to August 2021, marking the first monthly increase in transactions since March as benchmark home prices increased by 1.7%. The need for fences is also anticipated to increase due to the growth in office and commercial building renovation and maintenance activities.

Growth of the global fencing market is also driven by the increase in concerns related to security and safety. Companies and institutions recognize the need to outfit their homes and places of business with security fences as security risks grow. Commercial, industrial, and even residential sectors are investing significantly in fences to protect their workplaces and homes. Demand for electrified fencing security systems has increased as a result of the rise in thefts and crime over the past several years. Customers are reinforcing their physical site security solutions by installing fences.

Residential fencing enhances the esthetic appeal of homes in addition to serving as a protective element for safety and privacy. The market for fences is being driven by the rise in demand for high value fencing materials and increase in consumer preference for home remodeling. Customers all over the world prefer to choose a fence that is durable and specifically made to improve the esthetic beauty of their areas. PVC and other synthetic raw materials can be ideal replacements for traditional fencing, as they enhance the esthetics of the area at a low cost.

The variable cost of raw materials has been hindering the fencing business. Metals such as aluminum, steel, and iron, are the primary raw materials used in fences. The worldwide fencing market is being hampered by the fluctuating cost of these raw materials as well as rising import taxes on raw materials including plastic, wood, and metal. The fencing market is also contracting as a result of low-quality and counterfeit items.

In terms of product type, the privacy fencing segment accounted for significant share of the fencing market in 2021. Privacy fencing can be made of raw materials such as metal, wood, or plastic, or a combination of these raw materials. Demand for privacy fencing is projected to rise significantly due to its ease of installation and ability to be shaped, colored, and molded to meet customer preferences.

In terms of material, the metal segment held the largest share of the global fencing market in 2021. Various metals generally used to make fences are aluminum, steel, and wrought iron. Metal fencing is popular among customers compared to wood fences due to its durability and lower maintenance cost. Metal fencing is preferred in the development of real estate projects and parks.

Asia Pacific held the largest share of the global fencing market in 2021, owing to the presence of the largest number of households in China and India. Rise in concerns regarding safety and privacy among the people is also driving the market for fencing in the region. Additionally, growth in end-use industries and increase in home improvement and remodeling activities are boosting the market for fencing in Asia Pacific.

The global fencing market is fragmented, with the presence of large-scale manufacturers as well as local fabricators across the globe. Most of the firms are spending significantly in comprehensive research and development activities, primarily to introduce durable and advanced products. Diversification of product portfolios and mergers and acquisitions are the key strategies adopted by well-known players. Compagnie de Saint-Gobain S.A., Bekaert, Ameristar Perimeter Security, Associated Materials, LLC, Jerith Manufacturing LLC., Long Fence Company Inc., Gregory Industries, Inc., Betafence Group, Ply Gem Holding Inc., and Builders Fence Company (BFC), Inc. are the prominent entities operating in this market.

Each of these players has been profiled in the fencing market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2021 | US$ 25.3 Bn |

| Market Forecast Value in 2031 | US$ 41.7 Bn |

| Growth Rate (CAGR) | 5.3% |

| Forecast Period | 2022-2031 |

| Historical Data Available for | 2017-2020 |

| Quantitative Units | US$ Bn for Value & Million Feet for Volume |

| Market Analysis | Includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The market stood at US$ 25.3 Bn in 2021.

The market is estimated to expand at a CAGR of 5.3% during 2022-2031.

Rise in construction activities across the globe and increase in concerns about safety and privacy among consumers.

The privacy fencing segment accounted for maximum share of the market in 2021.

Asia Pacific held the largest share of the global fencing market in 2021.

Compagnie de Saint-Gobain S.A., Bekaert, Ameristar Perimeter Security, Associated Materials, LLC., Jerith Manufacturing LLC., Long Fence Company Inc., Gregory Industries, Inc., Betafence Group, Ply Gem Holding Inc., and Builders Fence Company (BFC), Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.4.1. Overall Perimeter Security Industry Overview

5.5. Porter’s Five Forces Analysis

5.6. Industry SWOT Analysis

5.7. Value Chain Analysis

5.8. Covid-19 Impact Analysis

5.9. Raw Material Analysis

5.10. Global Fencing Market Analysis and Forecast, 2017-2031

5.10.1. Market Value Projections (US$ Bn)

5.10.2. Market Volume Projections (Million Feet)

6. Global Fencing Market Analysis and Forecast, By Product Type

6.1. Fencing Market Size (US$ Bn and Million Feet), By Product Type, 2017-2031

6.1.1. Privacy Fencing

6.1.2. Picket Fencing

6.1.3. Others

6.2. Incremental Opportunity, By Product Type

7. Global Fencing Market Analysis and Forecast, By Material

7.1. Fencing Market Size (US$ Bn and Million Feet), By Material, 2017-2031

7.1.1. Metal

7.1.2. Wood

7.1.3. Plastic & Composite

8. Global Fencing Market Analysis and Forecast, By End-use

8.1. Fencing Market Size (US$ Bn and Million Feet), By End-use, 2017-2031

8.1.1. Residential

8.1.2. Commercial

8.1.3. Industrial

8.2. Incremental Opportunity, By End-use

9. Global Fencing Market Analysis and Forecast, By Distribution Channel

9.1. Fencing Market Size (US$ Bn and Million Feet), By Distribution Channel, 2017-2031

9.1.1. Direct Sales

9.1.2. Indirect Sales

9.2. Incremental Opportunity, By Distribution Channel

10. Global Fencing Market Analysis and Forecast, By Region

10.1. Fencing Market Size (US$ Bn and Million Feet), By Region, 2017-2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Incremental Opportunity, By Region

11. North America Fencing Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Key Supplier Analysis

11.3. Price Trend Analysis

11.3.1. Weighted Average Price

11.4. Key Trends Analysis

11.4.1. Demand Side Analysis

11.4.2. Supply Side Analysis

11.5. Fencing Market Size (US$ Bn and Million Feet), By Product Type, 2017-2031

11.5.1. Privacy Fencing

11.5.2. Picket Fencing

11.5.3. Others

11.6. Fencing Market Size (US$ Bn and Million Feet), By Material, 2017-2031

11.6.1. Metal

11.6.2. Wood

11.6.3. Plastic & Composite

11.7. Fencing Market Size (US$ Bn and Million Feet), By End-use, 2017-2031

11.7.1. Residential

11.7.2. Commercial

11.7.3. Industrial

11.8. Fencing Market Size (US$ Bn and Million Feet), By Distribution Channel, 2017-2031

11.8.1. Direct Sales

11.8.2. Indirect Sales

11.9. Fencing Market Size (US$ Bn) (Bn Units), By Country & Sub-region, 2017-2031

11.9.1. The U.S.

11.9.2. Canada

11.9.3. Rest of North America

11.10. Incremental Opportunity Analysis

12. Europe Fencing Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Supplier Analysis

12.3. Price Trend Analysis

12.3.1. Weighted Average Price

12.4. Key Trends Analysis

12.4.1. Demand Side Analysis

12.4.2. Supply Side Analysis

12.5. Fencing Market Size (US$ Bn and Million Feet), By Product Type, 2017-2031

12.5.1. Privacy Fencing

12.5.2. Picket Fencing

12.5.3. Others

12.6. Fencing Market Size (US$ Bn and Million Feet), By Material, 2017-2031

12.6.1. Metal

12.6.2. Wood

12.6.3. Plastic & Composite

12.7. Fencing Market Size (US$ Bn and Million Feet), By End-use, 2017-2031

12.7.1. Residential

12.7.2. Commercial

12.7.3. Industrial

12.8. Fencing Market Size (US$ Bn and Million Feet), By Distribution Channel, 2017-2031

12.8.1. Direct Sales

12.8.2. Indirect Sales

12.9. Fencing Market Size (US$ Bn) (Bn Units), By Country & Sub-region, 2017-2031

12.9.1. U.K.

12.9.2. Germany

12.9.3. France

12.9.4. Rest of Europe

12.10. Incremental Opportunity Analysis

13. Asia Pacific Fencing Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Supplier Analysis

13.3. Price Trend Analysis

13.3.1. Weighted Average Price

13.4. Key Trends Analysis

13.4.1. Demand Side Analysis

13.4.2. Supply Side Analysis

13.5. Fencing Market Size (US$ Bn and Million Feet), By Product Type, 2017-2031

13.5.1. Privacy Fencing

13.5.2. Picket Fencing

13.5.3. Others

13.6. Fencing Market Size (US$ Bn and Million Feet), By Material, 2017-2031

13.6.1. Metal

13.6.2. Wood

13.6.3. Plastic & Composite

13.7. Fencing Market Size (US$ Bn and Million Feet), By End-use, 2017-2031

13.7.1. Residential

13.7.2. Commercial

13.7.3. Industrial

13.8. Fencing Market Size (US$ Bn and Million Feet), By Distribution Channel, 2017-2031

13.8.1. Direct Sales

13.8.2. Indirect Sales

13.9. Fencing Market Size (US$ Bn) (Bn Units), By Country & Sub-region, 2017-2031

13.9.1. China

13.9.2. India

13.9.3. Japan

13.9.4. Rest of Asia Pacific

13.10. Incremental Opportunity Analysis

14. Middle East & Africa Fencing Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Supplier Analysis

14.3. Price Trend Analysis

14.3.1. Weighted Average Price

14.4. Key Trends Analysis

14.4.1. Demand Side Analysis

14.4.2. Supply Side Analysis

14.5. Fencing Market Size (US$ Bn and Million Feet), By Product Type, 2017-2031

14.5.1. Privacy Fencing

14.5.2. Picket Fencing

14.5.3. Others

14.6. Fencing Market Size (US$ Bn and Million Feet), By Material, 2017-2031

14.6.1. Metal

14.6.2. Wood

14.6.3. Plastic & Composite

14.7. Fencing Market Size (US$ Bn and Million Feet), By End-use, 2017-2031

14.7.1. Residential

14.7.2. Commercial

14.7.3. Industrial

14.8. Fencing Market Size (US$ Bn and Million Feet), By Distribution Channel, 2017-2031

14.8.1. Direct Sales

14.8.2. Indirect Sales

14.9. Fencing Market Size (US$ Bn) (Bn Units), By Country & Sub-region, 2017-2031

14.9.1. GCC

14.9.2. South Africa

14.9.3. Rest of Middle East & Africa

14.10. Incremental Opportunity Analysis

15. South America Fencing Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Key Supplier Analysis

15.3. Price Trend Analysis

15.3.1. Weighted Average Price

15.4. Key Trends Analysis

15.4.1. Demand Side Analysis

15.4.2. Supply Side Analysis

15.5. Fencing Market Size (US$ Bn and Million Feet), By Product Type, 2017-2031

15.5.1. Privacy Fencing

15.5.2. Picket Fencing

15.5.3. Others

15.6. Fencing Market Size (US$ Bn and Million Feet), By Material, 2017-2031

15.6.1. Metal

15.6.2. Wood

15.6.3. Plastic & Composite

15.7. Fencing Market Size (US$ Bn and Million Feet), By End-use, 2017-2031

15.7.1. Residential

15.7.2. Commercial

15.7.3. Industrial

15.8. Fencing Market Size (US$ Bn and Million Feet), By Distribution Channel, 2017-2031

15.8.1. Direct Sales

15.8.2. Indirect Sales

15.9. Fencing Market Size (US$ Bn) (Bn Units), By Country & Sub-region, 2017-2031

15.9.1. Brazil

15.9.2. Rest of South America

15.10. Incremental Opportunity Analysis

16. Competition Landscape

16.1. Market Player - Competition Dashboard

16.2. Market Share Analysis % (2021)

16.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview, Go-To-Market Strategy)

16.3.1. Compagnie de Saint-Gobain S.A.

16.3.1.1. Company Overview

16.3.1.2. Sales Area/Geographical Presence

16.3.1.3. Revenue

16.3.1.4. Strategy & Business Overview

16.3.1.5. Go-To-Market Strategy

16.3.2. N.V. Bekaert S.A

16.3.2.1. Company Overview

16.3.2.2. Sales Area/Geographical Presence

16.3.2.3. Revenue

16.3.2.4. Strategy & Business Overview

16.3.2.5. Go-To-Market Strategy

16.3.3. Ameristar Perimeter Security

16.3.3.1. Company Overview

16.3.3.2. Sales Area/Geographical Presence

16.3.3.3. Revenue

16.3.3.4. Strategy & Business Overview

16.3.3.5. Go-To-Market Strategy

16.3.4. Associated Materials, LLC.

16.3.4.1. Company Overview

16.3.4.2. Sales Area/Geographical Presence

16.3.4.3. Revenue

16.3.4.4. Strategy & Business Overview

16.3.4.5. Go-To-Market Strategy

16.3.5. Jerith Manufacturing LLC.

16.3.5.1. Company Overview

16.3.5.2. Sales Area/Geographical Presence

16.3.5.3. Revenue

16.3.5.4. Strategy & Business Overview

16.3.5.5. Go-To-Market Strategy

16.3.6. Long Fence Company Inc.

16.3.6.1. Company Overview

16.3.6.2. Sales Area/Geographical Presence

16.3.6.3. Revenue

16.3.6.4. Strategy & Business Overview

16.3.6.5. Go-To-Market Strategy

16.3.7. Gregory Industries, Inc.

16.3.7.1. Company Overview

16.3.7.2. Sales Area/Geographical Presence

16.3.7.3. Revenue

16.3.7.4. Strategy & Business Overview

16.3.7.5. Go-To-Market Strategy

16.3.8. Betafence Group

16.3.8.1. Company Overview

16.3.8.2. Sales Area/Geographical Presence

16.3.8.3. Revenue

16.3.8.4. Strategy & Business Overview

16.3.8.5. Go-To-Market Strategy

16.3.9. Ply Gem Holding Inc.

16.3.9.1. Company Overview

16.3.9.2. Sales Area/Geographical Presence

16.3.9.3. Revenue

16.3.9.4. Strategy & Business Overview

16.3.9.5. Go-To-Market Strategy

16.3.10. Builders Fence Company (BFC), Inc.

16.3.10.1. Company Overview

16.3.10.2. Sales Area/Geographical Presence

16.3.10.3. Revenue

16.3.10.4. Strategy & Business Overview

16.3.10.5. Go-To-Market Strategy

17. Key Takeaways

17.1. Identification of Potential Market Spaces

17.1.1. Product Type

17.1.2. Material

17.1.3. End-use

17.1.4. Distribution Channel

17.1.5. Region

17.2. Understanding the Buying Process of Customers

17.3. Prevailing Market Risks

List of Tables

Table 1: Global Fencing Market Volume (Million Feet) Forecast, by Product Type, 2017-2031

Table 2: Global Fencing Market Value (US$ Bn) Forecast, by Product Type, 2017-2031

Table 3: Global Fencing Market Volume (Million Feet) Forecast, by Material, 2017-2031

Table 4: Global Fencing Market Value (US$ Bn) Forecast, by Material, 2017-2031

Table 5: Global Fencing Market Volume (Million Feet) Forecast, by End-use, 2017-2031

Table 6: Global Fencing Market Value (US$ Bn) Forecast, by End-use, 2017-2031

Table 7: Global Fencing Market Volume (Million Feet) Forecast, by Distribution Channel, 2017-2031

Table 8: Global Fencing Market Value (US$ Bn) Forecast, by Distribution Channel, 2017-2031

Table 9: Global Fencing Market Volume (Million Feet) Forecast, by Region, 2017-2031

Table 10: Global Fencing Market Value (US$ Bn) Forecast, by Region, 2017-2031

Table 11: North America Fencing Market Volume (Million Feet) Forecast, by Product Type, 2017-2031

Table 12: North America Fencing Market Value (US$ Bn) Forecast, by Product Type, 2017-2031

Table 13: North America Fencing Market Volume (Million Feet) Forecast, by Material, 2017-2031

Table 14: North America Fencing Market Value (US$ Bn) Forecast, by Material, 2017-2031

Table 15: North America Fencing Market Volume (Million Feet) Forecast, by End-use, 2017-2031

Table 16: North America Fencing Market Value (US$ Bn) Forecast, by End-use, 2017-2031

Table 17: North America Fencing Market Volume (Million Feet) Forecast, by Distribution Channel, 2017-2031

Table 18: North America Fencing Market Value (US$ Bn) Forecast, by Distribution Channel, 2017-2031

Table 19: North America Fencing Market Volume (Million Feet) Forecast, by Country, 2017-2031

Table 20: North America Fencing Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 21: Europe Fencing Market Volume (Million Feet) Forecast, by Product Type, 2017-2031

Table 22: Europe Fencing Market Value (US$ Bn) Forecast, by Product Type, 2017-2031

Table 23: Europe Fencing Market Volume (Million Feet) Forecast, by Material, 2017-2031

Table 24: Europe Fencing Market Value (US$ Bn) Forecast, by Material, 2017-2031

Table 25: Europe Fencing Market Volume (Million Feet) Forecast, by End-use, 2017-2031

Table 26: Europe Fencing Market Value (US$ Bn) Forecast, by End-use, 2017-2031

Table 27: Europe Fencing Market Volume (Million Feet) Forecast, by Distribution Channel, 2017-2031

Table 28: Europe Fencing Market Value (US$ Bn) Forecast, by Distribution Channel, 2017-2031

Table 29: Europe Fencing Market Volume (Million Feet) Forecast, by Country, 2017-2031

Table 30: Europe Fencing Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 31: APAC Fencing Market Volume (Million Feet) Forecast, by Product Type, 2017-2031

Table 32: APAC Fencing Market Value (US$ Bn) Forecast, by Product Type, 2017-2031

Table 33: APAC Fencing Market Volume (Million Feet) Forecast, by Material, 2017-2031

Table 34: APAC Fencing Market Value (US$ Bn) Forecast, by Material, 2017-2031

Table 35: APAC Fencing Market Volume (Million Feet) Forecast, by End-use, 2017-2031

Table 36: APAC Fencing Market Value (US$ Bn) Forecast, by End-use, 2017-2031

Table 37: APAC Fencing Market Volume (Million Feet) Forecast, by Distribution Channel, 2017-2031

Table 38: APAC Fencing Market Value (US$ Bn) Forecast, by Distribution Channel, 2017-2031

Table 39: APAC Fencing Market Volume (Million Feet) Forecast, by Country, 2017-2031

Table 40: APAC Fencing Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 41: MEA Fencing Market Volume (Million Feet) Forecast, by Product Type, 2017-2031

Table 42: MEA Fencing Market Value (US$ Bn) Forecast, by Product Type, 2017-2031

Table 43: MEA Fencing Market Volume (Million Feet) Forecast, by Material, 2017-2031

Table 44: MEA Fencing Market Value (US$ Bn) Forecast, by Material, 2017-2031

Table 45: MEA Fencing Market Volume (Million Feet) Forecast, by End-use, 2017-2031

Table 46: MEA Fencing Market Value (US$ Bn) Forecast, by End-use, 2017-2031

Table 47: MEA Fencing Market Volume (Million Feet) Forecast, by Distribution Channel, 2017-2031

Table 48: MEA Fencing Market Value (US$ Bn) Forecast, by Distribution Channel, 2017-2031

Table 49: MEA Fencing Market Volume (Million Feet) Forecast, by Country, 2017-2031

Table 50: MEA Fencing Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 51: South America Fencing Market Volume (Million Feet) Forecast, by Product Type, 2017-2031

Table 52: South America Fencing Market Value (US$ Bn) Forecast, by Product Type, 2017-2031

Table 53: South America Fencing Market Volume (Million Feet) Forecast, by Material, 2017-2031

Table 54: South America Fencing Market Value (US$ Bn) Forecast, by Material, 2017-2031

Table 55: South America Fencing Market Volume (Million Feet) Forecast, by End-use, 2017-2031

Table 56: South America Fencing Market Value (US$ Bn) Forecast, by End-use, 2017-2031

Table 57: South America Fencing Market Volume (Million Feet) Forecast, by Distribution Channel, 2017-2031

Table 58: South America Fencing Market Value (US$ Bn) Forecast, by Distribution Channel, 2017-2031

Table 59: South America Fencing Market Volume (Million Feet) Forecast, by Country, 2017-2031

Table 60: South America Fencing Market Value (US$ Bn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Fencing Market Volume (Million Feet) Forecast, by Product Type, 2017-2031

Figure 2: Global Fencing Market Value (US$ Bn) Forecast, by Product Type, 2017-2031

Figure 3: Global Fencing Market, by Product Type, Incremental Opportunity, 2017-2031

Figure 4: Global Fencing Market Volume (Million Feet) Forecast, by Material, 2017-2031

Figure 5: Global Fencing Market Value (US$ Bn) Forecast, by Material, 2017-2031

Figure 6: Global Fencing Market, by Material, Incremental Opportunity, 2017-2031

Figure 7: Global Fencing Market Volume (Million Feet) Forecast, by End-use, 2017-2031

Figure 8: Global Fencing Market Value (US$ Bn) Forecast, by End-use, 2017-2031

Figure 9: Global Fencing Market, by End-use, Incremental Opportunity, 2017-2031

Figure 10: Global Fencing Market Volume (Million Feet) Forecast, by Distribution Channel, 2017-2031

Figure 11: Global Fencing Market Value (US$ Bn) Forecast, by Distribution Channel, 2017-2031

Figure 12: Global Fencing Market, by Distribution Channel, Incremental Opportunity, 2017-2031

Figure 13: Global Fencing Market Volume (Million Feet) Forecast, by Region, 2017-2031

Figure 14: Global Fencing Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 15: Global Fencing Market, by Region, Incremental Opportunity, 2017-2031

Figure 16: North America Fencing Market Volume (Million Feet) Forecast, by Product Type, 2017-2031

Figure 17: North America Fencing Market Value (US$ Bn) Forecast, by Product Type, 2017-2031

Figure 18: North America Fencing Market, by Product Type, Incremental Opportunity, 2017-2031

Figure 19: North America Fencing Market Volume (Million Feet) Forecast, by Material, 2017-2031

Figure 20: North America Fencing Market Value (US$ Bn) Forecast, by Material, 2017-2031

Figure 21: North America Fencing Market, by Material, Incremental Opportunity, 2017-2031

Figure 22: North America Fencing Market Volume (Million Feet) Forecast, by End-use, 2017-2031

Figure 23: North America Fencing Market Value (US$ Bn) Forecast, by End-use, 2017-2031

Figure 24: North America Fencing Market, by End-use, Incremental Opportunity, 2017-2031

Figure 25: North America Fencing Market Volume (Million Feet) Forecast, by Distribution Channel, 2017-2031

Figure 26: North America Fencing Market Value (US$ Bn) Forecast, by Distribution Channel, 2017-2031

Figure 27: North America Fencing Market, by Distribution Channel, Incremental Opportunity, 2017-2031

Figure 28: North America Fencing Market Volume (Million Feet) Forecast, by Country, 2017-2031

Figure 29: North America Fencing Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 30: North America Fencing Market, by Country, Incremental Opportunity, 2017-2031

Figure 31: Europe Fencing Market Volume (Million Feet) Forecast, by Product Type, 2017-2031

Figure 32: Europe Fencing Market Value (US$ Bn) Forecast, by Product Type, 2017-2031

Figure 33: Europe Fencing Market, by Product Type, Incremental Opportunity, 2017-2031

Figure 34: Europe Fencing Market Volume (Million Feet) Forecast, by Material, 2017-2031

Figure 35: Europe Fencing Market Value (US$ Bn) Forecast, by Material, 2017-2031

Figure 36: Europe Fencing Market, by Material, Incremental Opportunity, 2017-2031

Figure 37: Europe Fencing Market Volume (Million Feet) Forecast, by End-use, 2017-2031

Figure 38: Europe Fencing Market Value (US$ Bn) Forecast, by End-use, 2017-2031

Figure 39: Europe Fencing Market, by End-use, Incremental Opportunity, 2017-2031

Figure 40: Europe Fencing Market Volume (Million Feet) Forecast, by Distribution Channel, 2017-2031

Figure 41: Europe Fencing Market Value (US$ Bn) Forecast, by Distribution Channel, 2017-2031

Figure 42: Europe Fencing Market, by Distribution Channel, Incremental Opportunity, 2017-2031

Figure 43: Europe Fencing Market Volume (Million Feet) Forecast, by Country, 2017-2031

Figure 44: Europe Fencing Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 45: Europe Fencing Market, by Country, Incremental Opportunity, 2017-2031

Figure 46: APAC Fencing Market Volume (Million Feet) Forecast, by Product Type, 2017-2031

Figure 47: APAC Fencing Market Value (US$ Bn) Forecast, by Product Type, 2017-2031

Figure 48: APAC Fencing Market, by Product Type, Incremental Opportunity, 2017-2031

Figure 49: APAC Fencing Market Volume (Million Feet) Forecast, by Material, 2017-2031

Figure 50: APAC Fencing Market Value (US$ Bn) Forecast, by Material, 2017-2031

Figure 51: APAC Fencing Market, by Material, Incremental Opportunity, 2017-2031

Figure 52: APAC Fencing Market Volume (Million Feet) Forecast, by End-use, 2017-2031

Figure 53: APAC Fencing Market Value (US$ Bn) Forecast, by End-use, 2017-2031

Figure 54: APAC Fencing Market, by End-use, Incremental Opportunity, 2017-2031

Figure 55: APAC Fencing Market Volume (Million Feet) Forecast, by Distribution Channel, 2017-2031

Figure 56: APAC Fencing Market Value (US$ Bn) Forecast, by Distribution Channel, 2017-2031

Figure 57: APAC Fencing Market, by Distribution Channel, Incremental Opportunity, 2017-2031

Figure 58: APAC Fencing Market Volume (Million Feet) Forecast, by Country, 2017-2031

Figure 59: APAC Fencing Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 60: APAC Fencing Market, by Country, Incremental Opportunity, 2017-2031

Figure 61: MEA Fencing Market Volume (Million Feet) Forecast, by Product Type, 2017-2031

Figure 62: MEA Fencing Market Value (US$ Bn) Forecast, by Product Type, 2017-2031

Figure 63: MEA Fencing Market, by Product Type, Incremental Opportunity, 2017-2031

Figure 64: MEA Fencing Market Volume (Million Feet) Forecast, by Material, 2017-2031

Figure 65: MEA Fencing Market Value (US$ Bn) Forecast, by Material, 2017-2031

Figure 66: MEA Fencing Market, by Material, Incremental Opportunity, 2017-2031

Figure 67: MEA Fencing Market Volume (Million Feet) Forecast, by End-use, 2017-2031

Figure 68: MEA Fencing Market Value (US$ Bn) Forecast, by End-use, 2017-2031

Figure 69: MEA Fencing Market, by End-use, Incremental Opportunity, 2017-2031

Figure 70: MEA Fencing Market Volume (Million Feet) Forecast, by Distribution Channel, 2017-2031

Figure 71: MEA Fencing Market Value (US$ Bn) Forecast, by Distribution Channel, 2017-2031

Figure 72: MEA Fencing Market, by Distribution Channel, Incremental Opportunity, 2017-2031

Figure 73: MEA Fencing Market Volume (Million Feet) Forecast, by Country, 2017-2031

Figure 74: MEA Fencing Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 75: MEA Fencing Market, by Country, Incremental Opportunity, 2017-2031

Figure 76: South America Fencing Market Volume (Million Feet) Forecast, by Product Type, 2017-2031

Figure 77: South America Fencing Market Value (US$ Bn) Forecast, by Product Type, 2017-2031

Figure 78: South America Fencing Market, by Product Type, Incremental Opportunity, 2017-2031

Figure 79: South America Fencing Market Volume (Million Feet) Forecast, by Material, 2017-2031

Figure 80: South America Fencing Market Value (US$ Bn) Forecast, by Material, 2017-2031

Figure 81: South America Fencing Market, by Material, Incremental Opportunity, 2017-2031

Figure 82: South America Fencing Market Volume (Million Feet) Forecast, by End-use, 2017-2031

Figure 83: South America Fencing Market Value (US$ Bn) Forecast, by End-use, 2017-2031

Figure 84: South America Fencing Market, by End-use, Incremental Opportunity, 2017-2031

Figure 85: South America Fencing Market Volume (Million Feet) Forecast, by Distribution Channel, 2017-2031

Figure 86: South America Fencing Market Value (US$ Bn) Forecast, by Distribution Channel, 2017-2031

Figure 87: South America Fencing Market, by Distribution Channel, Incremental Opportunity, 2017-2031

Figure 88: South America Fencing Market Volume (Million Feet) Forecast, by Country, 2017-2031

Figure 89: South America Fencing Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 90: South America Fencing Market, by Country, Incremental Opportunity, 2017-2031