Reports

Reports

Analysts’ Viewpoint on Diaper Market Scenario

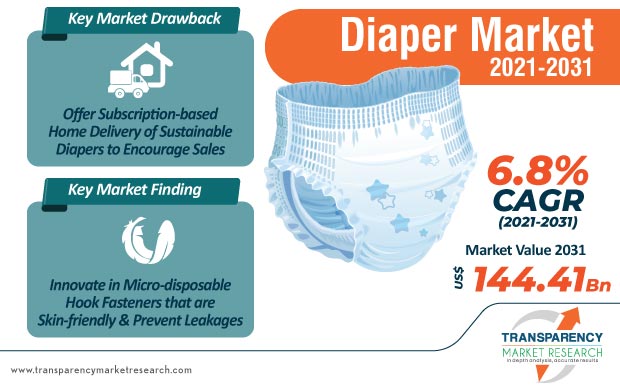

Restrictions and risks associated with the novel coronavirus & its variants are encouraging parents and caretakers to switch to reusable cloth diapers. The diaper market is positioned for healthy growth during the years 2021 to 2031. However, it has been found that sustainable diapers can be potentially be expensive and not readily available. Hence, manufacturers are increasing their production capabilities in bamboo diapers and creating awareness about the advantages of these diapers such as high absorbency to offset its high price. They are offering subscription-based home delivery of bamboo and other sustainable diapers to ensure that parents maintain regular stock of diapers.

Unchanged diapers increase the risk of skin problems, including diaper rash, as caregivers are unsure about the right time to change diapers. In order to address this issue, manufacturers are developing smart adult diapers with wearable sensor technology. This technology alerts the caregiver of when the diaper needs to be changed and prevents the risk of skin problems. The effective prevention of skin problems saves a lot of time, money, and resources of stakeholders in the healthcare industry as well as for individual consumers.

The wearable sensor technology in adult diapers serves as an effective management technique, addressing to the growing incidences of adult incontinence. As such, manufacturers in the diaper market are innovating in micro disposable hook fasteners that are gentle on the skin. These fasteners prevent leakages in diapers and are integrated with sensor attachment, which serves as an efficient product for consumers.

Companies in the diaper market are witnessing a surge in demand for products as stay-at-home households stock up on their core products amid the ongoing COVID-19 pandemic. Uncertainties associated with the Omicron variant are compelling diaper manufacturers to work at break-neck speeds to ensure a robust supply of products. They are drawing an analysis to understand their high-risk partners & clients where recovery of debt may be an issue.

The COVID-19 crisis has altered many consumer behaviors and changed how the global society functions. This is evident in the diaper market since frequent lockdown measures have compelled consumers to switch from disposable diapers to cloth diapers. This trend is prominent in India, keeping children’s comfort in mind, owing to the changing weather conditions. Manufacturers should capitalize on this opportunity to launch new cloth diapers that are sustainable and that help to keep economies running during the pandemic.

Switching to sustainable diapers is being met with challenges since these diapers are not readily available for purchase. Moreover, the issue of staining is concerning many parents. Such challenges have led to the popularity of sustainable bamboo diapers that are being made available through online subscription and can be disposed to avoid hassle of cleaning stains. Bamboo diapers are being known for their natural antimicrobial and antibacterial properties that help to eliminate odor-causing bacteria.

Even though the shift toward sustainable diapers is relatively gradual, growing awareness about environmental damage caused by disposable diapers is translating into revenue opportunities for manufacturers in the diaper market. Sustainable diapers are being highly publicized for their reusable attributes, style, and advantages of organic cloth that appeal to eco-conscious & fashion-savvy parents.

Brands in the diaper market are increasing the availability of cloth diapers that are better equipped to handle leaks and major messes. It has been found that in many cases, disposable diapers are notorious for leaks and blowouts. The accompanying costs and wastefulness associated with disposable diapers is leading to inclination of parents toward cloth diapers.

Wheat gluten is emerging as a new material for innovating in sustainable diapers. Companies in the diaper market are taking cues from researchers at top institutes and universities to boost R&D in wheat starch processing for sustainable diapers. Researchers suggest that wheat gluten proteins from wheat starch processing are capable of swelling up in water and saline solutions, which makes these diapers more absorbent for babies.

Moreover, manufacturers are capitalizing on this opportunity to innovate in renewable materials in diapers to meet the demand for growing health and hygiene products.

|

Attribute |

Details |

|

Market Size Value in 2020 (Base Year) |

US$ 70 Bn |

|

Market Forecast Value in 2031 |

US$ 144.4 Bn |

|

Growth Rate (CAGR) |

6.8% |

|

Forecast Period |

2021-2031 |

|

Quantitative Units |

US$ Bn for Value & Thousand Units for Volume |

|

Market Analysis |

Global qualitative analysis includes drivers, restraints, opportunities, key trends, upcoming key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, brand analysis, and consumer buying behavior analysis. |

|

Competition Landscape |

|

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.5. Industry SWOT Analysis

5.6. Porter’s Five Forces Analysis

5.7. Value Chain Analysis

5.8. Regulatory Framework

5.9. Raw Material Analysis

5.10. Covid – 19 Impact Analysis

5.11. Technology Analysis

5.12. Global Diaper Market Analysis and Forecast, 2017‒2031

5.12.1. Market Value Projections (US$ Mn)

5.12.2. Market Volume Projections (Thousand Units)

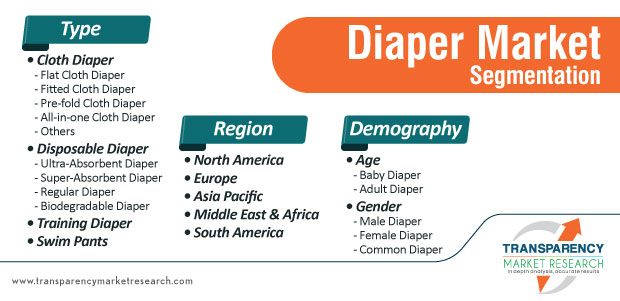

6. Global Diaper Market Analysis and Forecast, by Type

6.1. Global Diaper Market Size (US$ Mn and Thousand Units) Forecast, by Type, 2017‒2031

6.1.1. Cloth Diaper

6.1.1.1. Flat Cloth Diaper

6.1.1.2. Fitted Cloth Diaper

6.1.1.3. Pre-fold Cloth Diaper

6.1.1.4. All-in-one Cloth Diaper

6.1.1.5. Others

6.1.2. Disposable Diaper

6.1.2.1. Ultra-Absorbent Diaper

6.1.2.2. Super-Absorbent Diaper

6.1.2.3. Regular Diaper

6.1.2.4. Biodegradable Diaper

6.1.3. Training Diaper

6.1.4. Swim Pants

6.2. Incremental Opportunity, by Type

7. Global Diaper Market Analysis and Forecast, by Demography

7.1. Global Diaper Market Size (US$ Mn and Thousand Units) Forecast, by Demography, 2017‒2031

7.1.1. Age

7.1.1.1. Baby Diaper

7.1.1.2. Adult Diaper

7.1.2. Gender

7.1.2.1. Male Diaper

7.1.2.2. Female Diaper

7.1.2.3. Common Diaper

7.2. Incremental Opportunity, by Demography

8. Global Diaper Market Analysis and Forecast, Region

8.1. Global Diaper Market Size (US$ Mn and Thousand Units) Forecast, by Region, 2017‒2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Incremental Opportunity, by Region

9. North America Diaper Market Analysis and Forecast

9.1. Regional Snapshot

9.1.1. By Type

9.1.2. By Demography

9.1.3. By Country

9.2. Price Trend Analysis

9.2.1. Weighted Average Price (US$)

9.3. Brand Analysis

9.4. Consumer Buying Behavior

9.4.1. Preferred Type

9.4.2. Preferred Capacity

9.4.3. Mode of Buying

9.4.4. Average Spend

9.5. Diaper Market Size (US$ Mn and Thousand Units) Forecast, by Type, 2017‒2031

9.5.1. Cloth Diaper

9.5.1.1. Flat Cloth Diaper

9.5.1.2. Fitted Cloth Diaper

9.5.1.3. Pre-fold Cloth Diaper

9.5.1.4. All-in-one Cloth Diaper

9.5.1.5. Others

9.5.2. Disposable Diaper

9.5.2.1. Ultra-Absorbent Diaper

9.5.2.2. Super-Absorbent Diaper

9.5.2.3. Regular Diaper

9.5.2.4. Biodegradable Diaper

9.5.3. Training Diaper

9.5.4. Swim Pants

9.6. Diaper Market Size (US$ Mn and Thousand Units) Forecast, by Demography, 2017‒2031

9.6.1. Age

9.6.1.1. Baby Diaper

9.6.1.2. Adult Diaper

9.6.2. Gender

9.6.2.1. Male Diaper

9.6.2.2. Female Diaper

9.6.2.3. Common Diaper

9.7. Diaper Market Size (US$ Mn and Thousand Units) Forecast, by Country & Sub-region, 2017‒2031

9.7.1. U.S.

9.7.2. Canada

9.7.3. Rest of North America

9.8. Incremental Opportunity Analysis

10. Europe Diaper Market Analysis and Forecast

10.1. Regional Snapshot

10.1.1. By Type

10.1.2. By Demography

10.1.3. By Country

10.2. Price Trend Analysis

10.2.1. Weighted Average Price (US$)

10.3. Brand Analysis

10.4. Consumer Buying Behavior

10.4.1. Preferred Type

10.4.2. Preferred Capacity

10.4.3. Mode of Buying

10.4.4. Average Spend

10.5. Diaper Market Size (US$ Mn and Thousand Units) Forecast, by Type, 2017‒2031

10.5.1. Cloth Diaper

10.5.1.1. Flat Cloth Diaper

10.5.1.2. Fitted Cloth Diaper

10.5.1.3. Pre-fold Cloth Diaper

10.5.1.4. All-in-one Cloth Diaper

10.5.1.5. Others

10.5.2. Disposable Diaper

10.5.2.1. Ultra-Absorbent Diaper

10.5.2.2. Super-Absorbent Diaper

10.5.2.3. Regular Diaper

10.5.2.4. Biodegradable Diaper

10.5.3. Training Diaper

10.5.4. Swim Pants

10.6. Diaper Market Size (US$ Mn and Thousand Units) Forecast, by Demography, 2017‒2031

10.6.1. Age

10.6.1.1. Baby Diaper

10.6.1.2. Adult Diaper

10.6.2. Gender

10.6.2.1. Male Diaper

10.6.2.2. Female Diaper

10.6.2.3. Common Diaper

10.7. Diaper Market Size (US$ Mn and Thousand Units) Forecast, by Country & Sub-region, 2017‒2031

10.7.1. UK

10.7.2. Germany

10.7.3. France

10.7.4. Rest of Europe

10.8. Incremental Opportunity Analysis

11. Asia Pacific Diaper Market Analysis and Forecast

11.1. Regional Snapshot

11.1.1. By Type

11.1.2. By Demography

11.1.3. By Country

11.2. Price Trend Analysis

11.2.1. Weighted Average Price (US$)

11.3. Brand Analysis

11.4. Consumer Buying Behavior

11.4.1. Preferred Type

11.4.2. Preferred Capacity

11.4.3. Mode of Buying

11.4.4. Average Spend

11.5. Diaper Market Size (US$ Mn and Thousand Units) Forecast, by Type, 2017‒2031

11.5.1. Cloth Diaper

11.5.1.1. Flat Cloth Diaper

11.5.1.2. Fitted Cloth Diaper

11.5.1.3. Pre-fold Cloth Diaper

11.5.1.4. All-in-one Cloth Diaper

11.5.1.5. Others

11.5.2. Disposable Diaper

11.5.2.1. Ultra-Absorbent Diaper

11.5.2.2. Super-Absorbent Diaper

11.5.2.3. Regular Diaper

11.5.2.4. Biodegradable Diaper

11.5.3. Training Diaper

11.5.4. Swim Pants

11.6. Diaper Market Size (US$ Mn and Thousand Units) Forecast, by Demography, 2017‒2031

11.6.1. Age

11.6.1.1. Baby Diaper

11.6.1.2. Adult Diaper

11.6.2. Gender

11.6.2.1. Male Diaper

11.6.2.2. Female Diaper

11.6.2.3. Common Diaper

11.7. Diaper Market Size (US$ Mn and Thousand Units) Forecast, by Country & Sub-region, 2017‒2031

11.7.1. China

11.7.2. India

11.7.3. Japan

11.7.4. Rest of Asia Pacific

11.8. Incremental Opportunity Analysis

12. Middle East & Africa Diaper Market Analysis and Forecast

12.1. Regional Snapshot

12.1.1. By Type

12.1.2. By Demography

12.1.3. By Country

12.2. Price Trend Analysis

12.2.1. Weighted Average Price (US$)

12.3. Brand Analysis

12.4. Consumer Buying Behavior

12.4.1. Preferred Type

12.4.2. Preferred Capacity

12.4.3. Mode of Buying

12.4.4. Average Spend

12.5. Diaper Market Size (US$ Mn and Thousand Units) Forecast, by Type, 2017‒2031

12.5.1. Cloth Diaper

12.5.1.1. Flat Cloth Diaper

12.5.1.2. Fitted Cloth Diaper

12.5.1.3. Pre-fold Cloth Diaper

12.5.1.4. All-in-one Cloth Diaper

12.5.1.5. Others

12.5.2. Disposable Diaper

12.5.2.1. Ultra-Absorbent Diaper

12.5.2.2. Super-Absorbent Diaper

12.5.2.3. Regular Diaper

12.5.2.4. Biodegradable Diaper

12.5.3. Training Diaper

12.5.4. Swim Pants

12.6. Diaper Market Size (US$ Mn and Thousand Units) Forecast, by Demography, 2017‒2031

12.6.1. Age

12.6.1.1. Baby Diaper

12.6.1.2. Adult Diaper

12.6.2. Gender

12.6.2.1. Male Diaper

12.6.2.2. Female Diaper

12.6.2.3. Common Diaper

12.7. Diaper Market Size (US$ Mn and Thousand Units) Forecast, by Country & Sub-region, 2017‒2031

12.7.1. GCC

12.7.2. South Africa

12.7.3. Rest of Middle East & Africa

12.8. Incremental Opportunity Analysis

13. South America Diaper Market Analysis and Forecast

13.1. Regional Snapshot

13.1.1. By Type

13.1.2. By Demography

13.1.3. By Country

13.2. Price Trend Analysis

13.2.1. Weighted Average Price (US$)

13.3. Brand Analysis

13.4. Consumer Buying Behavior

13.4.1. Preferred Type

13.4.2. Preferred Capacity

13.4.3. Mode of Buying

13.4.4. Average Spend

13.5. Diaper Market Size (US$ Mn and Thousand Units) Forecast, by Type, 2017‒2031

13.5.1. Cloth Diaper

13.5.1.1. Flat Cloth Diaper

13.5.1.2. Fitted Cloth Diaper

13.5.1.3. Pre-fold Cloth Diaper

13.5.1.4. All-in-one Cloth Diaper

13.5.1.5. Others

13.5.2. Disposable Diaper

13.5.2.1. Ultra-Absorbent Diaper

13.5.2.2. Super-Absorbent Diaper

13.5.2.3. Regular Diaper

13.5.2.4. Biodegradable Diaper

13.5.3. Training Diaper

13.5.4. Swim Pants

13.6. Diaper Market Size (US$ Mn and Thousand Units) Forecast, by Demography, 2017‒2031

13.6.1. Age

13.6.1.1. Baby Diaper

13.6.1.2. Adult Diaper

13.6.2. Gender

13.6.2.1. Male Diaper

13.6.2.2. Female Diaper

13.6.2.3. Common Diaper

13.7. Diaper Market Size (US$ Mn and Thousand Units) Forecast, by Country & Sub-region, 2017‒2031

13.7.1. Brazil

13.7.2. Rest of South America

13.8. Incremental Opportunity Analysis

14. Competition Landscape

14.1. Market Player – Competition Dashboard

14.2. Market Revenue Share Analysis (%), (2020)

14.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

14.3.1. Domtar Corporation

14.3.1.1. Company Overview

14.3.1.2. Sales Area/Geographical Presence

14.3.1.3. Revenue

14.3.1.4. Strategy & Business Overview

14.3.2. DSG International

14.3.2.1. Company Overview

14.3.2.2. Sales Area/Geographical Presence

14.3.2.3. Revenue

14.3.2.4. Strategy & Business Overview

14.3.3. Essity Aktiebolag (publ)

14.3.3.1. Company Overview

14.3.3.2. Sales Area/Geographical Presence

14.3.3.3. Revenue

14.3.3.4. Strategy & Business Overview

14.3.4. Hengan

14.3.4.1. Company Overview

14.3.4.2. Sales Area/Geographical Presence

14.3.4.3. Revenue

14.3.4.4. Strategy & Business Overview

14.3.5. Kao Corporation

14.3.5.1. Company Overview

14.3.5.2. Sales Area/Geographical Presence

14.3.5.3. Revenue

14.3.5.4. Strategy & Business Overview

14.3.6. Kimberley Clark

14.3.6.1. Company Overview

14.3.6.2. Sales Area/Geographical Presence

14.3.6.3. Revenue

14.3.6.4. Strategy & Business Overview

14.3.7. Nobel Hygiene Private Limited

14.3.7.1. Company Overview

14.3.7.2. Sales Area/Geographical Presence

14.3.7.3. Revenue

14.3.7.4. Strategy & Business Overview

14.3.8. Oji Holdings Corporation

14.3.8.1. Company Overview

14.3.8.2. Sales Area/Geographical Presence

14.3.8.3. Revenue

14.3.8.4. Strategy & Business Overview

14.3.9. Ontex Group NV.

14.3.9.1. Company Overview

14.3.9.2. Sales Area/Geographical Presence

14.3.9.3. Revenue

14.3.9.4. Strategy & Business Overview

14.3.10. P&G

14.3.10.1. Company Overview

14.3.10.2. Sales Area/Geographical Presence

14.3.10.3. Revenue

14.3.10.4. Strategy & Business Overview

14.3.11. SCA Hygiene

14.3.11.1. Company Overview

14.3.11.2. Sales Area/Geographical Presence

14.3.11.3. Revenue

14.3.11.4. Strategy & Business Overview

14.3.12. Unicharm

14.3.12.1. Company Overview

14.3.12.2. Sales Area/Geographical Presence

14.3.12.3. Revenue

14.3.12.4. Strategy & Business Overview

15. Key Takeaways

15.1. Identification of Potential Market Spaces

15.2. Preferred Sales & Marketing Strategy

15.3. Prevailing Market Risks

15.4. Understanding the Buying Process of the Customers

List of Tables

Table 1: Global Diaper Market, by Type, Thousand Units, 2017‒2031

Table 2: Global Diaper Market, by Type, US$ Mn, 2017‒2031

Table 3: Global Diaper Market, by Demography, Thousand Units, 2017‒2031

Table 4: Global Diaper Market, by Demography, US$ Mn, 2017‒2031

Table 5: Global Diaper Market, by Region, Thousand Units, 2017‒2031

Table 6: Global Diaper Market, by Region, US$ Mn, 2017‒2031

Table 7: North America Diaper Market, by Type, Thousand Units, 2017‒2031

Table 8: North America Diaper Market, by Type, US$ Mn, 2017‒2031

Table 9: North America Diaper Market, by Demography, Thousand Units, 2017‒2031

Table 10: North America Diaper Market, by Demography, US$ Mn, 2017‒2031

Table 11: North America Diaper Market, by Country & Sub-region, Thousand Units, 2017‒2031

Table 12: North America Diaper Market, by Country & Sub-region, US$ Mn, 2017‒2031

Table 13: Europe Diaper Market, by Type, Thousand Units, 2017‒2031

Table 14: Europe Diaper Market, by Type, US$ Mn, 2017‒2031

Table 15: Europe Diaper Market, by Demography, Thousand Units, 2017‒2031

Table 16: Europe Diaper Market, by Demography, US$ Mn, 2017‒2031

Table 17: Europe Diaper Market, by Country & Sub-region, Thousand Units, 2017‒2031

Table 18: Europe Diaper Market, by Country & Sub-region, US$ Mn 2017‒2031

Table 19: Asia Pacific Diaper Market, by Type, Thousand Units, 2017‒2031

Table 20: Asia Pacific Diaper Market, by Type, US$ Mn, 2017‒2031

Table 21: Asia Pacific Diaper Market, by Demography, Thousand Units, 2017‒2031

Table 22: Asia Pacific Diaper Market, by Demography, US$ Mn, 2017‒2031

Table 23: Asia Pacific Diaper Market, by Country & Sub-region, Thousand Units, 2017‒2031

Table 24: Asia Pacific Diaper Market, by Country & Sub-region, US$ Mn, 2017‒2031

Table 25: Middle East & Africa Diaper Market, by Type, Thousand Units, 2017‒2031

Table 26: Middle East & Africa Diaper Market, by Type, US$ Mn, 2017‒2031

Table 27: Middle East & Africa Diaper Market, by Demography, Thousand Units, 2017‒2031

Table 28: Middle East & Africa Diaper Market, by Demography, US$ Mn, 2017‒2031

Table 29: Middle East & Africa Diaper Market, by Country & Sub-region, Thousand Units, 2017‒2031

Table 30: Middle East & Africa Diaper Market, by Country & Sub-region, US$ Mn, 2017‒2031

Table 31: South America Diaper Market, by Type, Thousand Units, 2017‒2031

Table 32: South America Diaper Market, by Type, US$ Mn, 2017‒2031

Table 33: South America Diaper Market, by Demography, Thousand Units, 2017‒2031

Table 34: South America Diaper Market, by Demography, US$ Mn, 2017‒2031

Table 35: South America Diaper Market, by Country & Sub-region, Thousand Units, 2017‒2031

Table 36: South America Diaper Market, by Country & Sub-region, US$ Mn, 2017‒2031

List of Figures

Figure 1: Global Diaper Market Projections, by Type, Thousand Units, 2017‒2031

Figure 2: Global Diaper Market Projections, by Type, US$ Mn, 2017‒2031

Figure 3: Global Diaper Market, Incremental Opportunity, by Type, US$ Mn, 2021‒2031

Figure 4: Global Diaper Market Projections, by Demography, Thousand Units, 2017‒2031

Figure 5: Global Diaper Market Projections, by Demography, US$ Mn, 2017‒2031

Figure 6: Global Diaper Market, Incremental Opportunity, by Demography, US$ Mn, 2021‒2031

Figure 7: Global Diaper Market Projections, by Region, Thousand Units, 2017‒2031

Figure 8: Global Diaper Market Projections, by Region, US$ Mn, 2017‒2031

Figure 9: Global Diaper Market, Incremental Opportunity, by Region, US$ Mn, 2021‒2031

Figure 10: North America Diaper Market Projections, by Type, Thousand Units, 2017‒2031

Figure 11: North America Diaper Market Projections, by Type, US$ Mn, 2017‒2031

Figure 12: North America Diaper Market, Incremental Opportunity, by Type, US$ Mn, 2021‒2031

Figure 13: North America Diaper Market Projections, by Demography, Thousand Units, 2017‒2031

Figure 14: North America Diaper Market Projections, by Demography, US$ Mn, 2017‒2031

Figure 15: North America Diaper Market, Incremental Opportunity, by Demography, US$ Mn, 2021‒2031

Figure 16: North America Diaper Market Projections, by Country & Sub-region, Thousand Units, 2017‒2031

Figure 17: North America Diaper Market Projections, by Country & Sub-region, US$ Mn, 2017‒2031

Figure 18: North America Diaper Market, Incremental Opportunity, by Country & Sub-region, US$ Mn, 2021‒2031

Figure 19: Europe Diaper Market Projections, by Type, Thousand Units, 2017‒2031

Figure 20: Europe Diaper Market Projections, by Type, US$ Mn, 2017‒2031

Figure 21: Europe Diaper Market, Incremental Opportunity, by Type, US$ Mn, 2021‒2031

Figure 22: Europe Diaper Market Projections, by Demography, Thousand Units, 2017‒2031

Figure 23: Europe Diaper Market Projections, by Demography, US$ Mn, 2017‒2031

Figure 24: Europe Diaper Market, Incremental Opportunity, by Demography, US$ Mn, 2021‒2031

Figure 25: Europe Diaper Market Projections, by Country & Sub-region, Thousand Units, 2017‒2031

Figure 26: Europe Diaper Market Projections, by Country & Sub-region, US$ Mn, 2017‒2031

Figure 27: Europe Diaper Market, Incremental Opportunity, by Country & Sub-region, US$ Mn, 2021‒2031

Figure 28: Asia Pacific Diaper Market Projections, by Type, Thousand Units, 2017‒2031

Figure 29: Asia Pacific Diaper Market Projections, by Type, US$ Mn, 2017‒2031

Figure 30: Asia Pacific Diaper Market, Incremental Opportunity, by Type, US$ Mn, 2021‒2031

Figure 31: Asia Pacific Diaper Market Projections, by Demography, Thousand Units, 2017‒2031

Figure 32: Asia Pacific Diaper Market Projections, by Demography, US$ Mn, 2017‒2031

Figure 33: Asia Pacific Diaper Market, Incremental Opportunity, by Demography, US$ Mn, 2021‒2031

Figure 34: Asia Pacific Diaper Market Projections, by Country & Sub-region, Thousand Units, 2017‒2031

Figure 35: Asia Pacific Diaper Market Projections, by Country & Sub-region, US$ Mn, 2017‒2031

Figure 36: Asia Pacific Diaper Market, Incremental Opportunity, by Country & Sub-region, US$ Mn, 2021‒2031

Figure 37: Middle East & Africa Diaper Market Projections, by Type, Thousand Units, 2017‒2031

Figure 38: Middle East & Africa Diaper Market Projections, by Type, US$ Mn, 2017‒2031

Figure 39: Middle East & Africa Diaper Market, Incremental Opportunity, by Type, US$ Mn, 2021‒2031

Figure 40: Middle East & Africa Diaper Market Projections, by Demography, Thousand Units, 2017‒2031

Figure 41: Middle East & Africa Diaper Market Projections, by Demography, US$ Mn, 2017‒2031

Figure 42: Middle East & Africa Diaper Market, Incremental Opportunity, by Demography, US$ Mn, 2021‒2031

Figure 43: Middle East & Africa Diaper Market Projections, by Country & Sub-region, Thousand Units, 2017‒2031

Figure 44: Middle East & Africa Diaper Market Projections, by Country & Sub-region, US$ Mn, 2017‒2031

Figure 45: Middle East & Africa Diaper Market, Incremental Opportunity, by Country & Sub-region, US$ Mn, 2021‒2031

Figure 46: South America Diaper Market Projections, by Type, Thousand Units, 2017‒2031

Figure 47: South America Diaper Market Projections, by Type, US$ Mn, 2017‒2031

Figure 48: South America Diaper Market, Incremental Opportunity, by Type, US$ Mn, 2021‒2031

Figure 49: South America Diaper Market Projections, by Demography, Thousand Units, 2017‒2031

Figure 50: South America Diaper Market Projections, by Demography, US$ Mn, 2017‒2031

Figure 51: South America Diaper Market, Incremental Opportunity, by Demography, US$ Mn, 2021‒2031

Figure 52: South America Diaper Market Projections, by Country & Sub-region, Thousand Units, 2017‒2031

Figure 53: South America Diaper Market Projections, by Country & Sub-region, US$ Mn, 2017‒2031

Figure 54: South America Diaper Market, Incremental Opportunity, by Country & Sub-region, US$ Mn, 2021‒2031