Reports

Reports

Analysts’ Viewpoint on Global Gesture Recognition Market Scenario

The development of more accurate accelerometers, infrared cameras, and associated technologies has resulted in the accelerated use of gesture recognition systems. Touchless gesture recognition includes the use of various techniques such as motion sensor fusion, camera-based gesture, proximity touchscreen, short-range wireless, eye-tracking, voice recognition, etc. Companies operating in the gesture recognition market are focusing on high-growth applications such as automotive, consumer electronics, and healthcare to keep their businesses growing post the COVID-19 pandemic. In addition, the market is estimated to grow, owing to advancements in technology such as AI/ML, IoT, big data, Natural User Interface (NUI), etc., and increasing rate of adoption of gesture recognition technology in end-user segments.

Gesture recognition is a mathematical conversion of the human movement or gesture into a machine command. The technology enables anyone to interact with a machines using human gestures and movements such as hand, finger, arm, head, or complete body movement. It enables users to operate and control devices using only their hands, without the usage of physical devices such as touch panels, keyboards, or mouse. For instance, users can, move a cursor by pointing their finger at a screen.

The global gesture recognition market is likely to grow due to its favorable properties such as touchless control and higher safety specifically for applications in automotive and consumer electronics.

The global automotive sensors market is estimated to reach the value of US$ 11.7 Bn by 2023, owing to the increasing demand for safety and security in automobiles. Automotive Gesture Recognition Systems (AGRS) offer high accuracy, and enhance vehicle control and safety. These systems can use human touch or other gestures to start and complete the required activity. Increasing safety standards and initiatives to prevent driver distraction are only a few aspects to consider while designing and installing an automotive gesture recognition system.

The integration of electronics in vehicles has increased due to the rising demand for additional vehicle infotainment (entertainment and informative features such as video players and GPS) and safety features (e.g., backup cameras and sensors). These new components contribute around 30% to 35% to a vehicle's total cost, which is expected to reach 50% by 2030. As gesture control is part of vehicles electronics, inclusion of electronics into vehicles would have an impact on the gesture recognition market.

The automotive gesture recognition system reads and interprets hand movements as commands using sensors, which enables the driver and passengers to interact with the car usually to control the infotainment system without touching any buttons or screens in the vehicle.

The increased demand for luxury cars equipped with modern intelligent driving assistance, infotainment, and newly incorporated safety features and electronics control units is boosting the use of automotive electronics. Consequently, automakers are focusing on incorporating new features to their vehicles, and gesture recognition is a key feature being added.

For instance, touchless sensing gesture recognition helps reduce driver distraction and improves safety. Thus, more intuitive control can be also utilized for a wider range of car functions. Maxim Integrated Products, Inc. introduced the next generation of its infrared-based dynamic optical sensor, which is able to sense a broader range of gestures at extended distances. The MAX25405 detects a wider proximity of movement and doubles the sensing range to 40 cm, as compared to earlier generations, all in a quarter of the size and at 10x lower cost than time-of-flight (ToF) camera-based systems that are utilized in automotive, industrial, and consumer applications. These enhancements offer an alternative to voice communications, thereby enabling drivers to focus on the road.

Consumer electronics, such as gaming consoles, interactive devices, digital signage, and commercial automation account for more than half of the share of the global gesture recognition market. The gesture recognition technology has been considered to be a highly successful technology, as it ultimately saves time when interacting with a device. Internet of Things, or IoT, is a developed version of the Internet that connects sensors, consumer electrical devices, and other embedded systems remote access, in addition to computers, smartphones, and tablets, in order to gather and share data. The IoT technology can also be utilized to develop a smart home concept, which includes Gesture Recognition Smart TV that provides intelligence and comfort and consequently, improves the quality of life. For instance, with Google Assistant and Alexa built in, TCL AI TVs offer an AI solution for home life. One can easily control the TV and other home devices just with your voice.

Home automation refers to the use of remote control, the internet, speech, and gestures to operate appliances. Human-computer interaction (HCI) is the technology of computers and humans understanding each other's language and creating a user-friendly interface. HCI uses wireless interface controlled by gestures, a non-verbal means of communication. The market for home automation is predicted to grow at a steady pace to reach a value of US$ 124.1 Bn by 2027, from a value of US$ 69 Bn in 2018.

In 2018, in a survey of 1,000 U.S. households conducted by Alarm.com, a U.S.-based technology company, revealed that almost 48% of participants were excited about smart home solutions; however, 59% were bewildered about the wide variety of products available in the market. The survey participants placed high priority on the security that smart homes would offer and comfort, energy savings come next to security.

The future of gesture recognition includes development of a system that can recognize and use specific human gestures to convey information or control devices. Hand gesture identification is difficult, as various people produce gestures in various ways and at varied speeds. The precision of hand detection remains an issue for hand gesture identification. Several algorithms have been proposed to improve the accuracy of gesture recognition.

Consistent rise in population, improving purchasing power of people, and technological advancements are fueling the demand for smart electronics, which, in turn, is propelling the demand for gesture recognition.

In terms of technology, the global gesture recognition market has been bifurcated into touch-based gesture recognition and touchless gesture recognition. The touchless gesture recognition segment held a key share of 56.7% of the global market in 2021. The segment is projected to maintain its position and grow at a considerable rate during the forecast period.

The preference for touchless gesture recognition is primarily due to the benefit of less wear & tear of the devices, as they have no contact from humans. Any gadget that can be used or operated without the use of physical contact is considered to be driven by touchless technology.

Moreover, improved health is a key benefit of touchless technology; for instance, hand-gesture recognition system enables doctors to manipulate digital images during medical procedures using hand gestures instead of touch screens or computer keyboards. Its appeal extends beyond cleanliness and safety. It can also boost customer satisfaction and simplify processes. Users can make simple gestures to control or interact with devices without physically touching them.

In terms of type, the global gesture recognition market has been classified into online and offline. The online segment dominated the global gesture recognition market and held 68.3% share in 2021. Furthermore, this segment is also expected to grow at a notable CAGR during the forecast period. Online gesture recognition offers relatively more advantages as compared to those offered by offline.

Vision-based gesture recognition (VGR) has been a key research topic in HCI for the past few years, and there are many real-life applications of vision gesture recognition (VGR). One of the breakthroughs in VGR is the introduction of Microsoft Kinect as a contact-less interface. The Kinect has significant potential in various applications, such as healthcare, education, automotive, etc.

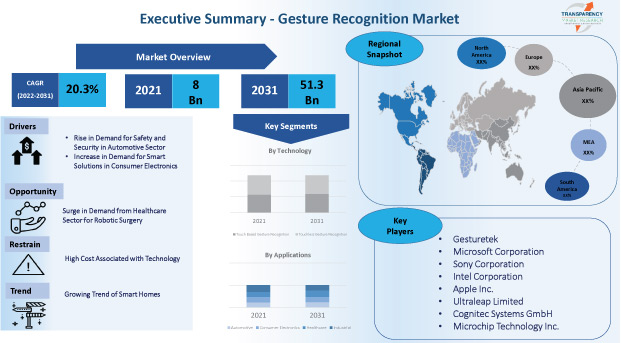

In terms of volume, North America accounted for 34.2% share of the global gesture recognition market in 2021, due to significantly high demand for consumer electronics, which accounted for 37.80% share of the total demand for gesture recognition across North America.

Asia Pacific and Europe are also witnessing higher penetration of gesture recognition, and the regions held shares of 29.10% and 22.10%, respectively, of the global market in 2021. Consumer electronics, automotive, and industrial automation are rapidly growing application segments of the gesture recognition market in these regions.

The penetration of the gesture recognition technology in Middle East & Africa is slower than that in South America. The market in South America is expected to grow at a faster pace than the market in Middle East & Africa.

The market is characterized by intensive research & development activities and extensive influx of investment, owing to the presence of some of the world’s largest and most popular technology brands. The market has witnessed continuous introduction of innovative and cutting-edge gesture recognition applications and features, which promise to empower the communication between humans and machines. Diversification of product portfolios and mergers & acquisitions are major strategies adopted by key players.

Gesturetek, Microsoft Corporation, Sony Corporation, Intel Corporation, Apple Inc., Ultraleap Limited, Cognitec Systems GmbH, and Microchip Technology Inc. are the prominent entities operating in this market.

Each of these players has been profiled in the gesture recognition market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 8 Bn |

|

Market Forecast Value in 2031 |

US$ 51.3 Bn |

|

Growth Rate (CAGR) |

20.3% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value and Million Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The market size of gesture recognition stood at US$ 8 Bn in 2021

The gesture recognition market is expected to grow at a CAGR of 20.3% from 2022 to 2031

Rapid adoption of technology by multiple end-users and rise in demand for smart devices are key factors driving the gesture recognition market

The consumer electronics segment accounted for a key share of 37.8% of the gesture recognition market in 2021

North America is a more attractive region for vendors in the gesture recognition market

Key players operating in the gesture recognition market include Gesturetek, Microsoft Corporation, Sony Corporation, Intel Corporation, Apple Inc., Ultraleap Limited, Cognitec Systems GmbH, and Microchip Technology Inc.

1. Preface

1.1. Research Scope

1.2. Gesture Recognition Market Overview

1.3. Market and Segments Definition

1.4. Market Taxonomy

1.5. Research Methodology

1.6. Assumption and Acronyms

2. Executive Summary

2.1. Global Gesture Recognition Market Analysis and Forecast

2.2. Regional Outline

2.3. Market Dynamics Snapshot

2.4. Competition Blueprint

3. Market Overview

3.1. Macro-economic Factors

3.2. Key Market Indicator

3.3. Drivers

3.4. Restraints

3.5. Opportunities

3.6. Trends

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview

4.2. Supply Chain Analysis

4.3. Industry SWOT Analysis

4.4. Porter Five Forces Analysis

4.5. COVID-19 Impact Analysis

4.6. Regulatory Analysis

4.7. Price Trend Analysis

5. Global Gesture Recognition Market Analysis and Forecast, by Technology, 2017–2031

5.1. Global Gesture Recognition Market Value (US$ Bn) and Volume (Million Units) Forecast, by Technology, 2017–2031

5.1.1. Touch based gesture recognition

5.1.1.1. Gyroscope

5.1.1.2. Accelerometer

5.1.1.3. Capacitive Touch

5.1.1.4. Others

5.1.2. Touchless gesture recognition

5.1.2.1. Ultrasonic (3D gesture) gesture recognition

5.1.2.2. Infrared 2D gesture recognition

5.1.2.3. Vision based gesture recognition

5.1.2.4. Others

5.2. Global Gesture Recognition Market Attractiveness, by Technology

6. Global Gesture Recognition Market Analysis and Forecast, by Type, 2017–2031

6.1. Global Gesture Recognition Market Value (US$ Bn) and Volume (Million Units) Forecast, by Type, 2017–2031

6.1.1. Offline

6.1.2. Online

6.2. Global Gesture Recognition Market Attractiveness, by Type

7. Global Gesture Recognition Market Analysis and Forecast, by End-use Industry, 2017–2031

7.1. Global Gesture Recognition Market Value (US$ Bn) and Volume (Million Units) Forecast, by End-use Industry, 2017–2031

7.1.1. Consumer Electronics

7.1.2. Automotive

7.1.3. Healthcare

7.1.4. Industrial

7.1.5. Others

7.2. Global Gesture Recognition Market Attractiveness, by End-use Industry

8. Global Gesture Recognition Market Analysis and Forecast, by Region, 2017–2031

8.1. Global Gesture Recognition Market Value (US$ Bn) and Volume (Million Units) Forecast, by Region, 2017–2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Global Gesture Recognition Market Attractiveness, by Region

9. North America Gesture Recognition Market Analysis and Forecast, 2017–2031

9.1. Market Snapshot

9.2. North America Gesture Recognition Market Value (US$ Bn) and Volume (Million Units) Forecast, by Technology, 2017–2031

9.2.1. Touch based gesture recognition

9.2.1.1. Gyroscope

9.2.1.2. Accelerometer

9.2.1.3. Capacitive Touch

9.2.1.4. Others

9.2.2. Touchless gesture recognition

9.2.2.1. Ultrasonic (3D gesture) gesture recognition

9.2.2.2. Infrared 2D gesture recognition

9.2.2.3. Vision based gesture recognition

9.2.2.4. Others

9.3. North America Gesture Recognition Market Value (US$ Bn) and Volume (Million Units) Forecast, by Type, 2017–2031

9.3.1. Offline

9.3.2. Online

9.4. North America Gesture Recognition Market Value (US$ Bn) and Volume (Million Units) Forecast, by End-use Industry, 2017–2031

9.5. Consumer Electronics

9.5.1. Consumer Electronics

9.5.2. Automotive

9.5.3. Healthcare

9.5.4. Industrial

9.5.5. Others

9.6. North America Gesture Recognition Market Value (US$ Bn) and Volume (Million Units) Forecast, by Country, 2017–2031

9.6.1. U.S.

9.6.2. Canada

9.6.3. Rest of North America

9.7. North America Gesture Recognition Market Attractiveness Analysis

10. Europe Gesture Recognition Market Analysis and Forecast, 2017–2031

10.1. Market Snapshot

10.2. Europe Gesture Recognition Market Value (US$ Bn) and Volume (Million Units) Forecast, by Technology, 2017–2031

10.2.1. Touch based gesture recognition

10.2.1.1. Gyroscope

10.2.1.2. Accelerometer

10.2.1.3. Capacitive Touch

10.2.1.4. Others

10.2.2. Touchless gesture recognition

10.2.2.1. Ultrasonic (3D gesture) gesture recognition

10.2.2.2. Infrared 2D gesture recognition

10.2.2.3. Vision based gesture recognition

10.2.2.4. Others

10.3. Europe Gesture Recognition Market Value (US$ Bn) and Volume (Million Units) Forecast, by Type, 2017–2031

10.3.1. Offline

10.3.2. Online

10.4. Europe Gesture Recognition Market Value (US$ Bn) and Volume (Million Units) Forecast, by End-use Industry, 2017–2031

10.4.1. Consumer Electronics

10.4.2. Automotive

10.4.3. Healthcare

10.4.4. Industrial

10.4.5. Others

10.5. Europe Gesture Recognition Market Value (US$ Bn) and Volume (Million Units) Forecast, by Country and Sub-region, 2017‒2031

10.5.1. Germany

10.5.2. U.K.

10.5.3. France

10.5.4. Rest of Europe

10.6. Europe Gesture Recognition Market Attractiveness Analysis

11. Asia Pacific Gesture Recognition Market Analysis and Forecast, 2017–2031

11.1. Market Snapshot

11.2. Asia Pacific Gesture Recognition Market Value (US$ Bn) and Volume (Million Units) Forecast, by Technology

11.2.1. Touch based gesture recognition

11.2.1.1. Gyroscope

11.2.1.2. Accelerometer

11.2.1.3. Capacitive Touch

11.2.1.4. Others

11.2.2. Touchless gesture recognition

11.2.2.1. Ultrasonic (3D gesture) gesture recognition

11.2.2.2. Infrared 2D gesture recognition

11.2.2.3. Vision based gesture recognition

11.2.2.4. Others

11.3. Asia Pacific Gesture Recognition Market Value (US$ Bn) and Volume (Million Units) Forecast, by Type, 2017–2031

11.3.1. Offline

11.3.2. Online

11.4. Asia Pacific Gesture Recognition Market Value (US$ Bn) and Volume (Million Units) Forecast, by End-use Industry, 2017–2031

11.4.1. Consumer Electronics

11.4.2. Automotive

11.4.3. Healthcare

11.4.4. Industrial

11.4.5. Others

11.5. Asia Pacific Gesture Recognition Market Value (US$ Bn) and Volume (Million Units) Forecast, by Country and Sub-region, 2017‒2031

11.5.1. Japan

11.5.2. China

11.5.3. India

11.5.4. South Korea

11.5.5. ASEAN

11.5.6. Rest of Asia Pacific

11.6. Asia Pacific Gesture Recognition Market Attractiveness Analysis

12. South America Gesture Recognition Market Analysis and Forecast, 2017–2031

12.1. Market Snapshot

12.2. South America Gesture Recognition Market Value (US$ Bn) and Volume (Million Units) Forecast, by Technology, 2017–2031

12.2.1. Touch based gesture recognition

12.2.1.1. Gyroscope

12.2.1.2. Accelerometer

12.2.1.3. Capacitive Touch

12.2.1.4. Others

12.2.2. Touchless gesture recognition

12.2.2.1. Ultrasonic (3D gesture) gesture recognition

12.2.2.2. Infrared 2D gesture recognition

12.2.2.3. Vision based gesture recognition

12.2.2.4. Others

12.3. South America Gesture Recognition Market Value (US$ Bn) and Volume (Million Units) Forecast, by Type, 2017–2031

12.3.1. Offline

12.3.2. Online

12.4. South America Gesture Recognition Market Value (US$ Bn) and Volume (Million Units) Forecast, by End-use Industry, 2017–2031

12.4.1. Consumer Electronics

12.4.2. Automotive

12.4.3. Healthcare

12.4.4. Industrial

12.4.5. Others

12.5. South America Gesture Recognition Market Value (US$ Bn) and Volume (Million Units) Forecast, by Country and Sub-region, 2017‒2031

12.5.1. Brazil

12.5.2. Rest of South America

12.6. South America Gesture Recognition Market Attractiveness Analysis

13. Middle East & Africa Gesture Recognition Market Analysis and Forecast, 2017–2031

13.1. Market Snapshot

13.2. Middle East & Africa Gesture Recognition Market Value (US$ Bn) and Volume (Million Units) Forecast, by Technology, 2017–2031

13.2.1. Touch based gesture recognition

13.2.1.1. Gyroscope

13.2.1.2. Accelerometer

13.2.1.3. Capacitive Touch

13.2.1.4. Others

13.2.2. Touchless gesture recognition

13.2.2.1. Ultrasonic (3D gesture) gesture recognition

13.2.2.2. Infrared 2D gesture recognition

13.2.2.3. Vision based gesture recognition

13.2.2.4. Others

13.3. Middle East & Africa Gesture Recognition Market Value (US$ Bn) and Volume (Million Units) Forecast, by Type, 2017–2031

13.3.1.1. Offline

13.3.1.2. Online

13.4. Middle East & Africa Gesture Recognition Market Value (US$ Bn) and Volume (Million Units) Forecast, by End-use Industry, 2017–2031

13.4.1.1. Consumer Electronics

13.4.1.2. Automotive

13.4.1.3. Healthcare

13.4.1.4. Industrial

13.4.1.5. Others

13.5. Middle East & Africa Gesture Recognition Market Value (US$ Bn) and Volume (Million Units) Forecast, by Country and Sub-region, 2017‒2031

13.5.1.1. GCC

13.5.1.2. South Africa

13.5.1.3. Rest of Middle East & Africa

13.6. Middle East & Africa Gesture Recognition Market Attractiveness Analysis

14. Competition Landscape

14.1. Global Gesture Recognition Company Market Share Analysis, 2022

14.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

14.2.1. Apple Inc.

14.2.1.1. Overview

14.2.1.2. Product Portfolio

14.2.1.3. Sales Footprint

14.2.1.4. Key Subsidiaries or Distributors

14.2.1.5. Strategy and Recent Developments

14.2.1.6. Key Financials

14.2.2. Cognitec Systems GmbH

14.2.2.1. Overview

14.2.2.2. Product Portfolio

14.2.2.3. Sales Footprint

14.2.2.4. Key Subsidiaries or Distributors

14.2.2.5. Strategy and Recent Developments

14.2.2.6. Key Financials

14.2.3. Gesturetek

14.2.3.1. Overview

14.2.3.2. Product Portfolio

14.2.3.3. Sales Footprint

14.2.3.4. Key Subsidiaries or Distributors

14.2.3.5. Strategy and Recent Developments

14.2.3.6. Key Financials

14.2.4. Intel Corporation

14.2.4.1. Overview

14.2.4.2. Product Portfolio

14.2.4.3. Sales Footprint

14.2.4.4. Key Subsidiaries or Distributors

14.2.4.5. Strategy and Recent Developments

14.2.4.6. Key Financials

14.2.5. Microchip Technology Inc.

14.2.5.1. Overview

14.2.5.2. Product Portfolio

14.2.5.3. Sales Footprint

14.2.5.4. Key Subsidiaries or Distributors

14.2.5.5. Strategy and Recent Developments

14.2.5.6. Key Financials

14.2.6. Microsoft Corporation

14.2.6.1. Overview

14.2.6.2. Product Portfolio

14.2.6.3. Sales Footprint

14.2.6.4. Key Subsidiaries or Distributors

14.2.6.5. Strategy and Recent Developments

14.2.6.6. Key Financials

14.2.7. NVIDIA Corporation

14.2.7.1. Overview

14.2.7.2. Product Portfolio

14.2.7.3. Sales Footprint

14.2.7.4. Key Subsidiaries or Distributors

14.2.7.5. Strategy and Recent Developments

14.2.7.6. Key Financials

14.2.8. Sony Corporation

14.2.8.1. Overview

14.2.8.2. Product Portfolio

14.2.8.3. Sales Footprint

14.2.8.4. Key Subsidiaries or Distributors

14.2.8.5. Strategy and Recent Developments

14.2.8.6. Key Financials

14.2.9. Ultraleap Limited

14.2.9.1. Overview

14.2.9.2. Product Portfolio

14.2.9.3. Sales Footprint

14.2.9.4. Key Subsidiaries or Distributors

14.2.9.5. Strategy and Recent Developments

14.2.9.6. Key Financials

14.2.10. Semiconductor Components Industries, LLC (Onsemi)

14.2.10.1. Overview

14.2.10.2. Product Portfolio

14.2.10.3. Sales Footprint

14.2.10.4. Key Subsidiaries or Distributors

14.2.10.5. Strategy and Recent Developments

14.2.10.6. Key Financials

14.2.11. STMicroelectronics

14.2.11.1. Overview

14.2.11.2. Product Portfolio

14.2.11.3. Sales Footprint

14.2.11.4. Key Subsidiaries or Distributors

14.2.11.5. Strategy and Recent Developments

14.2.11.6. Key Financials

14.2.12. Synaptics Incorporated

14.2.12.1. Overview

14.2.12.2. Product Portfolio

14.2.12.3. Sales Footprint

14.2.12.4. Key Subsidiaries or Distributors

14.2.12.5. Strategy and Recent Developments

14.2.12.6. Key Financials

14.2.13. Vishay Intertechnology, Inc.

14.2.13.1. Overview

14.2.13.2. Product Portfolio

14.2.13.3. Sales Footprint

14.2.13.4. Key Subsidiaries or Distributors

14.2.13.5. Strategy and Recent Developments

14.2.13.6. Key Financials

15. Recommendation

15.1. Opportunity Assessment

15.1.1.1. By Technology

15.1.1.2. By Type

15.1.1.3. By End-use Industry

15.1.1.4. By Region

List of Tables

Table 1: Global Gesture Recognition Market Value (US$ Bn) & Forecast, by Technology, 2017‒2031

Table 2: Global Gesture Recognition Market Volume (Thousand Unit) & Forecast, by Technology, 2017‒2031

Table 3: Global Gesture Recognition Market Value (US$ Bn) & Forecast, by Type, 2017‒2031

Table 4: Global Gesture Recognition Market Value (US$ Bn) & Forecast, by End-use Industry, 2017‒2031

Table 5: Global Gesture Recognition Market Value (US$ Bn) & Forecast, by Region, 2017‒2031

Table 6: North America Gesture Recognition Market Value (US$ Bn) & Forecast, by Technology, 2017‒2031

Table 7: North America Gesture Recognition Market Volume (Thousand Unit) & Forecast, by Technology, 2017‒2031

Table 8: North America Gesture Recognition Market Value (US$ Bn) & Forecast, by Type, 2017‒2031

Table 9: North America Gesture Recognition Market Value (US$ Bn) & Forecast, by End-use Industry, 2017‒2031

Table 10: North America Gesture Recognition Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017‒2031

Table 11: Europe Gesture Recognition Market Value (US$ Bn) & Forecast, by Technology, 2017‒2031

Table 12: Europe Gesture Recognition Market Volume (Thousand Unit) & Forecast, by Technology, 2017‒2031

Table 13: Europe Gesture Recognition Market Value (US$ Bn) & Forecast, by Type, 2017‒2031

Table 14: Europe Gesture Recognition Market Value (US$ Bn) & Forecast, by End-use Industry, 2017‒2031

Table 15: Europe Gesture Recognition Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017‒2031

Table 16: Asia Pacific Gesture Recognition Market Value (US$ Bn) & Forecast, by Technology, 2017‒2031

Table 17: Asia Pacific Gesture Recognition Market Volume (Thousand Unit) & Forecast, by Technology, 2017‒2031

Table 18: Asia Pacific Gesture Recognition Market Value (US$ Bn) & Forecast, by Type, 2017‒2031

Table 19: Asia Pacific Gesture Recognition Market Value (US$ Bn) & Forecast, by End-use Industry, 2017‒2031

Table 20: Asia Pacific Gesture Recognition Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017‒2031

Table 21: Middle East & Africa Gesture Recognition Market Value (US$ Bn) & Forecast, by Technology, 2017‒2031

Table 22: Middle East & Africa Gesture Recognition Market Volume (Thousand Unit) & Forecast, by Technology, 2017‒2031

Table 23: Middle East & Africa Gesture Recognition Market Value (US$ Bn) & Forecast, by Type, 2017‒2031

Table 24: Middle East & Africa Gesture Recognition Market Value (US$ Bn) & Forecast, by End-use Industry, 2017‒2031

Table 25: Middle East & Africa Gesture Recognition Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017‒2031

Table 26: South America Gesture Recognition Market Value (US$ Bn) & Forecast, by Technology, 2017‒2031

Table 27: South America Gesture Recognition Market Volume (Thousand Unit) & Forecast, by Technology, 2017‒2031

Table 28: South America Gesture Recognition Market Value (US$ Bn) & Forecast, by Type, 2017‒2031

Table 29: South America Gesture Recognition Market Value (US$ Bn) & Forecast, by End-use Industry, 2017‒2031

Table 30: South America Gesture Recognition Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017‒2031

List of Figures

Figure 01: Supply Chain Analysis - Global Gesture Recognition

Figure 02: Global Gesture Recognition Price Trend Analysis (Average Price, US$)

Figure 03: Porter Five Forces Analysis - Global Gesture Recognition

Figure 04: Technology Road Map - Global Gesture Recognition

Figure 05: Global Gesture Recognitions Market, Value (US$ Bn), 2017-2031

Figure 06: Global Gesture Recognition Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 07: Global Gesture Recognitions Market, Volume (Million Units), 2017-2031

Figure 08: Global Gesture Recognition Market Size & Forecast, Y-O-Y, Volume (Million Units), 2017‒2031

Figure 09: Global Gesture Recognition Market Projections by Technology, Value (US$ Bn), 2017‒2031

Figure 10: Global Gesture Recognition Market, Incremental Opportunity, by Technology, 2022‒2031

Figure 11: Global Gesture Recognition Market Share Analysis, by Technology, 2021 and 2031

Figure 12: Global Gesture Recognition Market Projections by Type, Value (US$ Bn), 2017‒2031

Figure 13: Global Gesture Recognition Market, Incremental Opportunity, by Type, 2022‒2031

Figure 14: Global Gesture Recognition Market Share Analysis, by Type, 2021 and 2031

Figure 15: Global Gesture Recognition Market Projections by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 16: Global Gesture Recognition Market, Incremental Opportunity, by End-use Industry, 2022‒2031

Figure 17: Global Gesture Recognition Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 18: Global Gesture Recognition Market Projections by Region, Value (US$ Bn), 2017‒2031

Figure 19: Global Gesture Recognition Market, Incremental Opportunity, by Region, 2022‒2031

Figure 20: Global Gesture Recognition Market Share Analysis, by Region, 2021 and 2031

Figure 21: North America Gesture Recognition Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 22: North America Gesture Recognition Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 23: North America Gesture Recognitions Market, Volume (Million Units), 2017-2031

Figure 24: North America Gesture Recognition Market Size & Forecast, Y-O-Y, Volume (Million Units), 2017‒2031

Figure 25: North America Gesture Recognition Market Projections by Technology Value (US$ Bn), 2017‒2031

Figure 26: North America Gesture Recognition Market, Incremental Opportunity, by Technology, 2022‒2031

Figure 27: North America Gesture Recognition Market Share Analysis, by Technology, 2021 and 2031

Figure 28: North America Gesture Recognition Market Projections by Type, Value (US$ Bn), 2017‒2031

Figure 29: North America Gesture Recognition Market, Incremental Opportunity, by Type, 2022‒2031

Figure 30: North America Gesture Recognition Market Share Analysis, by Type, 2021 and 2031

Figure 31: North America Gesture Recognition Market Projections by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 32: North America Gesture Recognition Market, Incremental Opportunity, by End-use Industry, 2022‒2031

Figure 33: North America Gesture Recognition Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 34: North America Gesture Recognition Market Projections by Country & Sub-region, Value (US$ Bn), 2017‒2031

Figure 35: North America Gesture Recognition Market, Incremental Opportunity, by Country & Sub-region, 2022‒2031

Figure 36: North America Gesture Recognition Market Share Analysis, by Country & Sub-region 2021 and 2031

Figure 37: Europe Gesture Recognition Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 38: Europe Gesture Recognition Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 39: Europe Gesture Recognitions Market, Volume (Million Units), 2017-2031

Figure 40: Europe Gesture Recognition Market Size & Forecast, Y-O-Y, Volume (Million Units), 2017‒2031

Figure 41: Europe Gesture Recognition Market Projections by Technology Value (US$ Bn), 2017‒2031

Figure 42: Europe Gesture Recognition Market, Incremental Opportunity, by Technology, 2022‒2031

Figure 43: Europe Gesture Recognition Market Share Analysis, by Technology, 2021 and 2031

Figure 44: Europe Gesture Recognition Market Projections by Type, Value (US$ Bn), 2017‒2031

Figure 45: Europe Gesture Recognition Market, Incremental Opportunity, by Type, 2022‒2031

Figure 46: Europe Gesture Recognition Market Share Analysis, by Type, 2021 and 2031

Figure 47: Europe Gesture Recognition Market Projections by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 48: Europe Gesture Recognition Market, Incremental Opportunity, by End-use Industry, 2022‒2031

Figure 49: Europe Gesture Recognition Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 50: Europe Gesture Recognition Market Projections by Country & Sub-region, Value (US$ Bn), 2017‒2031

Figure 51: Europe Gesture Recognition Market, Incremental Opportunity, by Country & Sub-region, 2022‒2031

Figure 52: Europe Gesture Recognition Market Share Analysis, by Country & Sub-region 2021 and 2031

Figure 53: Asia Pacific Gesture Recognition Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 54: Asia Pacific Gesture Recognition Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 55: Asia Pacific Gesture Recognitions Market, Volume (Million Units), 2017-2031

Figure 56: Asia Pacific Gesture Recognition Market Size & Forecast, Y-O-Y, Volume (Million Units), 2017‒2031

Figure 57: Asia Pacific Gesture Recognition Market Projections by Technology Value (US$ Bn), 2017‒2031

Figure 58: Asia Pacific Gesture Recognition Market, Incremental Opportunity, by Technology, 2022‒2031

Figure 59: Asia Pacific Gesture Recognition Market Share Analysis, by Technology, 2021 and 2031

Figure 60: Asia Pacific Gesture Recognition Market Projections by Type, Value (US$ Bn), 2017‒2031

Figure 61: Asia Pacific Gesture Recognition Market, Incremental Opportunity, by Type, 2022‒2031

Figure 62: Asia Pacific Gesture Recognition Market Share Analysis, by Type, 2021 and 2031

Figure 63: Asia Pacific Gesture Recognition Market Projections by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 64: Asia Pacific Gesture Recognition Market, Incremental Opportunity, by End-use Industry, 2022‒2031

Figure 65: Asia Pacific Gesture Recognition Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 66: Asia Pacific Gesture Recognition Market Projections by Country & Sub-region, Value (US$ Bn), 2017‒2031

Figure 67: Asia Pacific Gesture Recognition Market, Incremental Opportunity, by Country & Sub-region, 2022‒2031

Figure 68: Asia Pacific Gesture Recognition Market Share Analysis, by Country & Sub-region 2021 and 2031

Figure 69: MEA Gesture Recognition Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 70: MEA Gesture Recognition Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 71: MEA Gesture Recognitions Market, Volume (Million Units), 2017-2031

Figure 72: MEA Gesture Recognition Market Size & Forecast, Y-O-Y, Volume (Million Units), 2017‒2031

Figure 73: MEA Gesture Recognition Market Projections by Technology Value (US$ Bn), 2017‒2031

Figure 74: MEA Gesture Recognition Market, Incremental Opportunity, by Technology, 2022‒2031

Figure 75: MEA Gesture Recognition Market Share Analysis, by Technology, 2021 and 2031

Figure 76: MEA Gesture Recognition Market Projections by Type, Value (US$ Bn), 2017‒2031

Figure 77: MEA Gesture Recognition Market, Incremental Opportunity, by Type, 2022‒2031

Figure 78: MEA Gesture Recognition Market Share Analysis, by Type, 2021 and 2031

Figure 79: MEA Gesture Recognition Market Projections by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 80: MEA Gesture Recognition Market, Incremental Opportunity, by End-use Industry, 2022‒2031

Figure 81: MEA Gesture Recognition Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 82: MEA Gesture Recognition Market Projections by Country & Sub-region, Value (US$ Bn), 2017‒2031

Figure 83: MEA Gesture Recognition Market, Incremental Opportunity, by Country & Sub-region, 2022‒2031

Figure 84: MEA Gesture Recognition Market Share Analysis, by Country & Sub-region 2021 and 2031

Figure 85: South America Gesture Recognition Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 86: South America Gesture Recognition Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 87: South America Gesture Recognitions Market, Volume (Million Units), 2017-2031

Figure 88: South America Gesture Recognition Market Size & Forecast, Y-O-Y, Volume (Million Units), 2017‒2031

Figure 89: South America Gesture Recognition Market Projections by Technology Value (US$ Bn), 2017‒2031

Figure 90: South America Gesture Recognition Market, Incremental Opportunity, by Technology, 2022‒2031

Figure 91: South America Gesture Recognition Market Share Analysis, by Technology, 2021 and 2031

Figure 92: South America Gesture Recognition Market Projections by Type, Value (US$ Bn), 2017‒2031

Figure 93: South America Gesture Recognition Market, Incremental Opportunity, by Type, 2022‒2031

Figure 94: South America Gesture Recognition Market Share Analysis, by Type, 2021 and 2031

Figure 95: South America Gesture Recognition Market Projections by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 96: South America Gesture Recognition Market, Incremental Opportunity, by End-use Industry, 2022‒2031

Figure 97: South America Gesture Recognition Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 98: South America Gesture Recognition Market Projections by Country & Sub-region, Value (US$ Bn), 2017‒2031

Figure 99: South America Gesture Recognition Market, Incremental Opportunity, by Country & Sub-region, 2022‒2031

Figure 100: South America Gesture Recognition Market Share Analysis, by Country & Sub-region 2021 and 2031

Figure 101: Global Gesture Recognitions Market Competition

Figure 102: Global Gesture Recognition Market Company Share Analysis