Reports

Reports

New Management Practices Help Ensure Business Continuity During COVID-19 Crisis

The COVID-19 outbreak has shaken up value chains and prompted governments to announce initiatives that help to meet consumer demands. Companies in the Europe barite market are enabling short-term management to ensure business continuity during the pandemic whilst adopting contingency planning to align with long-term trends. However, it has been found that trend analysis is a less reliable strategy due to the increasing frequency of global shocks. Nevertheless, companies in the Europe barite market are conducting SWOT analysis to stay resilient despite any potential business disruptions.

There is a need for new management practices that are more agile in terms of decision processes, monitoring, and planning. Market stakeholders are building local networks with suppliers, partners, and customers for early sensing of the triggers that require industry action.

Circular Vibrating Screener Associated with Low Failure Rate in Barite Processing

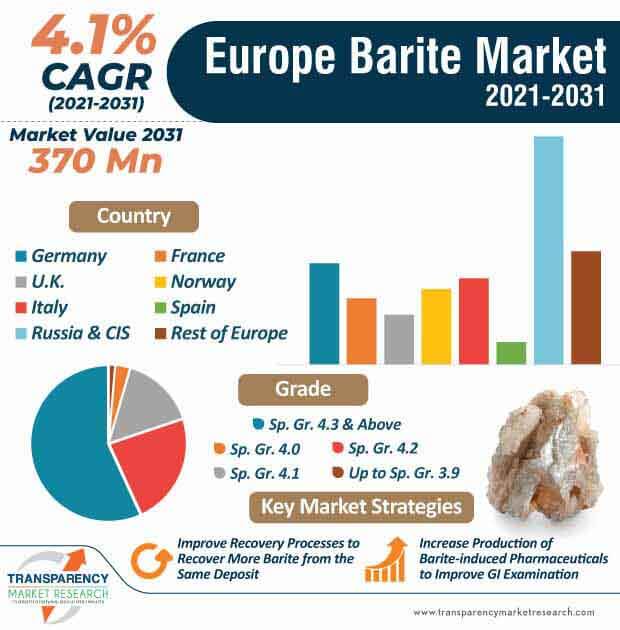

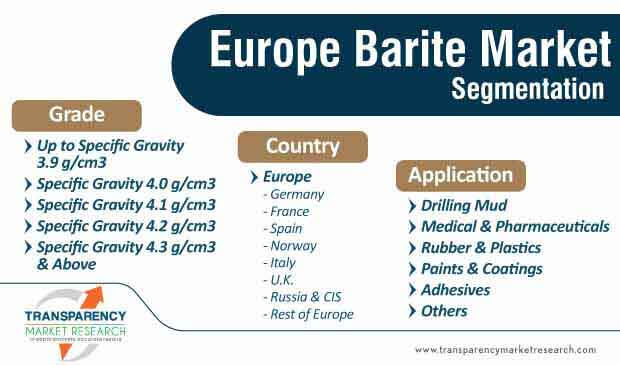

The Europe barite market was valued at US$ 244 Mn in 2020 and is expected to reach US$ 370 Mn by 2031. However, there is a need to improve processes in barite screening since the particle size of crushed barite fragments varies, and the barite beneficiation equipment generally has its own required feed particle size. Hence, stakeholders are adopting the circular vibrating screener, which leads to low failure rate, high screening efficiency, and large processing capacity.

The circular vibrating screener is linked with easy operation. It is a suitable machine for screening barite ore. Since a certain amount of dust will be produced in the screening process, it is recommended to set up water spraying devices to reduce dust pollution.

Mining Companies Establish Stable Revenue Streams in Weighting Agent Applications

Companies in the Europe barite market are establishing stable revenue streams in weighting agents for the oil & gas industry. Weighting agent in drilling fluids helps to suppress high pressure and drilling bursts. Moreover, barite offers an additional benefit that magnetic tracking does not hinder magnetic measurements.

The Europe barite market is slated to clock a modest CAGR of 4.1% during the forecast period. Barite helps to adjust the density of mud as the basic drilling grade weighing material. The softness of barite powder allows it to act as a surface and prevent damage to the drilling bit during drilling.

Medical & Pharmaceutical Applications Expand Income Streams for Market Stakeholders

Pharmaceutical and medical applications are contributing to the growth of the Europe barite market. High purity form of barite is used in the gastrointestinal (GI) tract, owing to its X-ray protection properties. Thus, the outline of the GI tract becomes visible allowing clear gastrointestinal examination.

Excellent adhesion, suspensibility, and acid & alkali resistance of barite are preferred in pharmaceutical applications. Medicines made with barite powder make the gastric mucosa surface evenly spread and coat, and make the tissue structure of each examination site clear. Companies in the Europe barite market are improving their barite recovery processes to gain a competitive edge over other market players.

Analysts’ Viewpoint

Multi-stakeholder and cross-sector collaboration platforms are being publicized for emerging resilient to the challenges of the ongoing COVID-19 outbreak. Barite holds promising potentials in jewelry making. However, gem cutters find faceting barite quite challenging. Since barite’s fragility is not advisable for jewelry, jewelers should target barite jewelry stones for collectors of unusual gemstones or aficionados of the art of gem cutting. Companies in the Europe barite market should enter new markets and realize new revenue opportunities from downstream industrial sectors that require high quality barite. They are increasing efforts to extend mine life by recovering more barite from the same deposit.

Europe Barite Market: Overview

Key Growth Drivers of Europe Barite Market

Lucrative Opportunities for Players in Europe Barite Market

Leading Players in Europe Barite Market

Europe Barite Market Snapshot

|

Attribute |

Detail |

|

Market Size Value in 2020 |

US$ 244 Mn |

|

Market Forecast Value in 2031 |

US$ 370 Mn |

|

Growth Rate (CAGR) |

4.1% |

|

Forecast Period |

2021-2031 |

|

Quantitative Units |

US$ Mn for Value & Kilo Tons for Volume |

|

Market Analysis |

It includes cross segment analysis in Europe. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Key Countries Covered |

|

|

Key Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

Europe Barite Market is expected is expected to reach US$ 370 Mn by 2031

Europe Barite Market is estimated to rise at a CAGR of 4.1% during forecast period

Rising production of oil & gas around the globe coupled with increasing penetration of barite in drilling fluids is a key factor that is expected to boost the europe barite market

Key players operating in Europe Barite Market are Ashapura Group, Anglo Pacific Minerals, Schlumberger Limited, The Kish Company, Inc., ALCOR MINERALS, J & H Minerals Pvt. Ltd., Minerals Girona SA, Sibelco NV, VB Technochemicals SA, Steinbock Minerals Ltd, Barit Maden Turk A.S., and Sachtleben Minerals GmbH & Co. KG

The forecast period considered for the Europe Barite Market is 2021-2031

1. Executive Summary

1.1. Europe Barite Snapshot

1.2. Key Market Trends

1.3. Current Market and Future Potential

1.4. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Market Indicators

2.3. Market Definitions

2.4. Market Dynamics

2.4.1. Drivers

2.4.2. Restraints

2.4.3. Opportunities

2.5. Porter’s Five Forces Analysis

2.6. Value Chain Analysis

2.6.1. List of Potential Customers

3. COVID-19 Impact Analysis

4. Europe Barite Market Production Outlook

5. Europe Barite Market Price Trend Analysis, 2021‒2031

5.1. By Grade

5.2. By Country

6. Europe Barite Market Analysis and Forecast, 2021‒2031

6.1. Key Findings

6.1.1. Europe Barite Market Volume (Kilo Tone) and Value (US$ Mn) Forecast, by Grade, 2021‒2031

6.1.2. Europe Barite Market Volume (Kilo Tone) and Value (US$ Mn) Forecast, by Application, 2021‒2031

6.1.3. Europe Barite Market Volume (Kilo Tone) and Value (US$ Mn) Forecast, by Country, 2021‒2031

6.1.4. Germany Barite Market Volume (Kilo Tone) and Value (US$ Mn) Forecast, by Grade, 2021‒2031

6.1.5. Germany Europe Barite Market Volume (Kilo Tone) and Value (US$ Mn) Forecast, by Application, 2021‒2031

6.1.6. France Barite Market Volume (Kilo Tone) and Value (US$ Mn) Forecast, by Grade, 2021‒2031

6.1.7. France Barite Market Volume (Kilo Tone) and Value (US$ Mn) Forecast, by Application, 2021‒2031

6.1.8. Spain Barite Market Volume (Kilo Tone) and Value (US$ Mn) Forecast, by Grade, 2021‒2031

6.1.9. Spain Barite Market Volume (Kilo Tone) and Value (US$ Mn) Forecast, by Application, 2021‒2031

6.1.10. Norway Barite Market Volume (Kilo Tone) and Value (US$ Mn) Forecast, by Grade, 2021‒2031

6.1.11. Norway Barite Market Volume (Kilo Tone) and Value (US$ Mn) Forecast, by Application, 2021‒2031

6.1.12. Italy Barite Market Volume (Kilo Tone) and Value (US$ Mn) Forecast, by Grade, 2021‒2031

6.1.13. Italy Barite Market Volume (Kilo Tone) and Value (US$ Mn) Forecast, by Application, 2021‒2031

6.1.14. U.K. Barite Market Volume (Kilo Tone) and Value (US$ Mn) Forecast, by Grade, 2021‒2031

6.1.15. U.K. Barite Market Volume (Kilo Tone) and Value (US$ Mn) Forecast, by Application, 2021‒2031

6.1.16. Russia & CIS Barite Market Volume (Kilo Tone) and Value (US$ Mn) Forecast, by Grade, 2021‒2031

6.1.17. Russia & CIS Barite Market Volume (Kilo Tone) and Value (US$ Mn) Forecast, by Application, 2021‒2031

6.1.18. Rest of Europe Barite Market Volume (Kilo Tone) and Value (US$ Mn) Forecast, by Grade, 2021‒2031

6.1.19. Rest of Europe Barite Market Volume (Kilo Tone) and Value (US$ Mn) Forecast, by Application, 2021‒2031

6.2. Europe Barite Market Attractiveness Analysis

7. Competition Landscape

7.1. Europe Barite Market Share Analysis, 2019

7.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

7.2.1. Ashapura Group

7.2.1.1. Company Description

7.2.1.2. Business Overview

7.2.1.3. Financial Overview

7.2.1.4. Strategic Overview

7.2.2. Anglo Pacific Minerals

7.2.2.1. Company Description

7.2.2.2. Business Overview

7.2.2.3. Financial Overview

7.2.2.4. Strategic Overview

7.2.3. Schlumberger Limited

7.2.3.1. Company Description

7.2.3.2. Business Overview

7.2.3.3. Financial Overview

7.2.3.4. Strategic Overview

7.2.4. The Kish Company, Inc.

7.2.4.1. Company Description

7.2.4.2. Business Overview

7.2.5. ALCOR MINERALS

7.2.5.1. Company Description

7.2.5.2. Business Overview

7.2.5.3. Financial Overview

7.2.5.4. Strategic Overview

7.2.6. J & H Minerals Pvt. Ltd.

7.2.6.1. Company Description

7.2.6.2. Business Overview

7.2.6.3. Financial Overview

7.2.6.4. Strategic Overview

7.2.7. Minerals Girona SA

7.2.7.1. Company Description

7.2.7.2. Business Overview

7.2.7.3. Financial Overview

7.2.7.4. Strategic Overview

7.2.8. Sibelco NV

7.2.8.1. Company Description

7.2.8.2. Business Overview

7.2.8.3. Financial Overview

7.2.8.4. Strategic Overview

7.2.9. VB Technochemicals SA

7.2.9.1. Company Description

7.2.9.2. Business Overview

7.2.9.3. Financial Overview

7.2.9.4. Strategic Overview

7.2.10. Steinbock Minerals Ltd

7.2.10.1. Company Description

7.2.10.2. Business Overview

7.2.10.3. Financial Overview

7.2.10.4. Strategic Overview

7.2.11. Barit Maden Turk A.S.

7.2.11.1. Company Description

7.2.11.2. Business Overview

7.2.11.3. Financial Overview

7.2.11.4. Strategic Overview

7.2.12. Sachtleben Minerals GmbH & Co. KG

7.2.12.1. Company Description

7.2.12.2. Business Overview

7.2.12.3. Financial Overview

7.2.12.4. Strategic Overview

8. Primary Research: Key Insights

9. Appendix

List of Tables

Table 1: Europe Barite Market Volume (Kilo Tone) Forecast, by Grade, 2020–2031

Table 2: Europe Barite Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 3: Europe Barite Market Volume (Kilo Tone) Forecast, by Application, 2020–2031

Table 4: Europe Barite Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 5: Europe Barite Market Volume (Kilo Tone) Forecast, by Country, 2020–2031

Table 6: Europe Barite Market Value (US$ Mn) Forecast, by Country, 2020–2031

Table 7: Germany Barite Market Volume (Kilo Tone) Forecast, by Grade, 2020–2031

Table 8: Germany Barite Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 9: Germany Barite Market Volume (Kilo Tone) Forecast, by Application, 2020–2031

Table 10: Germany Barite Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 11: France Barite Market Volume (Kilo Tone) Forecast, by Grade, 2020–2031

Table 12: France Barite Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 13: France Barite Market Volume (Kilo Tone) Forecast, by Application, 2020–2031

Table 14: France Barite Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 15: U.K. Barite Market Volume (Kilo Tone) Forecast, by Grade, 2020–2031

Table 16: U.K. Barite Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 17: U.K. Barite Market Volume (Kilo Tone) Forecast, by Application, 2020–2031

Table 18: U.K. Barite Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 19: Norway Barite Market Volume (Kilo Tone) Forecast, by Grade, 2020–2031

Table 20: Norway Barite Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 21: Norway Barite Market Volume (Kilo Tone) Forecast, by Application, 2020–2031

Table 22: Norway Barite Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 23: Italy Barite Market Volume (Kilo Tone) Forecast, by Grade, 2020–2031

Table 24: Italy Barite Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 25: Italy Barite Market Volume (Kilo Tone) Forecast, by Application, 2020–2031

Table 26: Italy Barite Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 27: Spain Barite Market Volume (Kilo Tone) Forecast, by Grade, 2020–2031

Table 28: Spain Barite Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 29: Spain Barite Market Volume (Kilo Tone) Forecast, by Application, 2020–2031

Table 30: Spain Barite Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 31: Russia & CSI Barite Market Volume (Kilo Tone) Forecast, by Grade, 2020–2031

Table 32: Russia & CSI Barite Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 33: Russia & CSI Barite Market Volume (Kilo Tone) Forecast, by Application, 2020–2031

Table 34: Russia & CSI Barite Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 35: Rest of Europe Barite Market Volume (Kilo Tone) Forecast, by Grade, 2020–2031

Table 36: Rest of Europe Barite Market Value (US$ Mn) Forecast, by Grade, 2020–2031

Table 37: Rest of Europe Barite Market Volume (Kilo Tone) Forecast, by Application, 2020–2031

Table 38: Rest of Europe Barite Market Value (US$ Mn) Forecast, by Application, 2020–2031

List of Figures

Figure 1: Europe Barite Market Volume Share, by Grade, 2020, 2025, and 2031

Figure 2: Europe Barite Market Attractiveness, by Grade

Figure 3: Europe Barite Market Volume Share, by Application, 2020, 2025, and 2031

Figure 4: Europe Barite Market Attractiveness, by Application

Figure 5: Europe Barite Market Volume Share, by Country, 2020, 2025, and 2031

Figure 6: Europe Barite Market Attractiveness, by Country