Reports

Reports

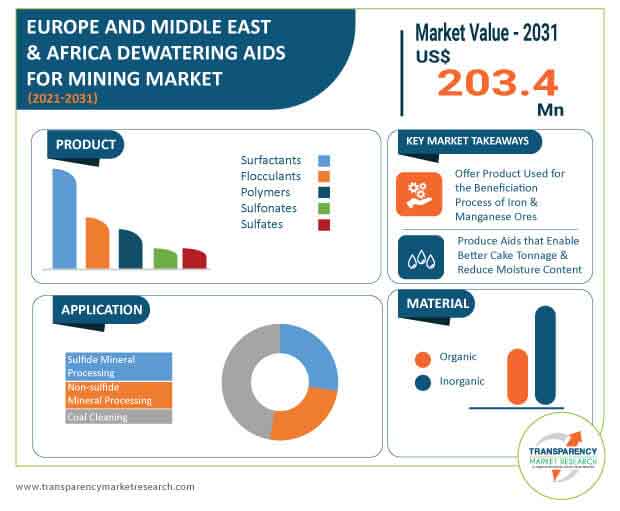

Mine dewatering aids are specifically formed surface-active agents that help reduce the moisture content of mineral aggregates during filtration and subsequent storage applications. These products usually decrease the surface tension of water to remove water from mineral surfaces during filtration and storage. Dewatering aids are mostly used in all wet mineral processing applications to increase the moisture content of filtered cakes as required. Application areas include both sulfide and non-sulfide minerals processing and as well as coal cleansing. Dewatering aid dosage specifications vary extensively based on end-use applications. Dewatering aids can be applied directly or in diluted form and points of application in the process must be carefully selected. Improved filtration of mineral concentrates and better filtration efficiency are primarily driving the Europe and Middle East & Africa dewatering aids for mining market.

In the mineral processing industry, dewatering operations are generally carried out at raw materials or product-handling stage. For instance, after beneficiation or concentration, the ore may require drying to some maximum level to expedite handling. The minerals are very often available as solids, aqueous liquids, or slurries with varying particle sizes. Distinct dewatering technologies are presently being used to dehydrate minerals. Although dewatering is a highly energy-intensive operation that is difficult at lower moisture contents, no special attention is normally given to the technical and economic aspects of the dewatering process applications in the mineral processing industry. This creates new opportunities for dewatering aids for mining market in Europe and Middle East & Africa in the near future. Dewatering aids include surfactants, flocculants, polymers, sulfonates, and sulfates mostly used to control moisture levels and increase throughput in filter applications.

The COVID-19 pandemic has changed the global economy rapidly, without warning, and severely affecting mining, making a huge impact on the dewatering aids for mining market. After the first few months of the spread of the coronavirus disease, the mining pillar seemed to be relatively stable. However, the outbreak of the COVID-19 pandemic had disrupted the political, economic, financial, and social structures all over the world. In 2020, the consequences of the pandemic reached far extending to limited communication, trade, access to all kinds of goods, and supply chain of raw material services. Moreover, it reduced the demand for and sales of dewatering aids and stopped many economic activities, including production. Growth rates of markets relevant to mining indicate the highest decline for the Europe and Middle East & Africa dewatering aids for mining market. The limits also extended to mining metal ores together with other non-metallic mineral products, and mining and quarrying.

Mining of coal and lignite is at the opposite extreme, and this is the only industry with a positive result that generated demand for dewatering products. Additionally, many governments have allowed mining to continue during the pandemic with limited work staff, raw materials, and restrictions relating to COVID-19 mitigation. This distinguishes this branch of the economy from other industries that have been closed for several months due to government decisions. Additionally, significant changes have been observed in the economic and social policy of most countries, especially in the aspect of government interventionism. Nevertheless, with rapid vaccination drives and innovations in medical technology, the pandemic is nearing its end in Europe and Middle East& Africa. The post-pandemic period offers various opportunities for dewatering aids manufacturers, owing to increased mining activities to flatten the demand curve.

Industrial sludge and residue sludge hold varying amounts of organic chemicals, toxic metals, chemical irritants, and pathogens, which may cause several diseases. Untreated sludge disposed into rivers and seas negatively affects aquatic life and poses serious health hazards. Moreover, environmental protection standards have laid down sludge disposal laws that constrain pre-treatment as well as measures to be met prior to the disposal or reuse of sludge in agricultural or power generation activities. Thus, there is an increasing need for dewatering aids to meet all the standards in mining waste disposal. Furthermore, the dewatering technology has observed significant advancements with more effective units such as decanter centrifuges, screw presses, and belt presses available in the market. In addition, the demand for metals and minerals has been increasing significantly. As a result, mining companies are investing more in mining activities such as exploration, mining, and material processing. This is likely to propel the Europe and Middle East & Africa dewatering aids for mining market during the forecast period.

On the contrary, well-digested primary sludge is comparatively easy to dewater. Along with the developments in sludge dewatering to achieve the highest solid content, it is also necessary to establish a reliable dewatering index. Most popular dewatering techniques include Capillary Suction Time (CST) and Specific Resistance to Filtration (SRF), but these methods only measure the rate of filtration and do not consider complex variables associated with the dewatering process. In addition, different dewatering aids have varied processes and intensities, which considerably affect the performance of mineral sludge dewatering. This is most likely to restrain the growth of the dewatering aids for mining market in Europe and Middle East & Africa in the upcoming years. Hence, the evaluation of mineral sludge dewatering is critical for any sludge treatment system where optimizing the dewatering process is the primary goal.

Europe and Middle East & Africa are lucrative regions for dewatering aids for mining market. The supportive mineral mining policies and the successful historical record of mineral production & development in these regions are the primary reasons for the increasing growth rate of the market. Moreover, growing investments in the mining sector and increasing awareness about disposal of waste and sludge in an eco-friendly manner in these regions are influencing the growth of the dewatering aids for mining market in Europe and Middle East & Africa.

The dewatering aids for mining market in Europe and Middle East & Africa is expected to reach US$ 203.4 Mn by 2031, expanding at a CAGR of 3.2% during the forecast period.

Analysts' Viewpoint

There has been a rise in mining and related activities. The disposition of these materials is likely to address environmental issues for the mining industry. Environmental stability, social responsibility, and economic growth are the essentials that any industry needs to meet to counter growth hurdles in the long term. Additionally, the awareness for energy-efficient processes in the mining industry will have a positive impact on the Europe and Middle East & Africa dewatering aids for mining market. The growing expenditure on the sludge and wastewater treatment industry is also expected to propel the demand for dewatering aids during the forecast period.

Europe and Middle East & Africa Dewatering Aids for Mining Market: Overview

Key Growth Drivers of Europe and Middle East & Africa Dewatering Aids for Mining Market

Key Challenges in Europe and Middle East & Africa Dewatering Aids for Mining Market

Key Opportunities for Companies in Middle East & Africa Dewatering Aids for Mining Market

Major Players in Europe and Middle East & Africa Dewatering Aids for Mining Market

In 2020, Dewatering Aids for Mining Market was valued at US$ 148.3 Mn

Dewatering Aids for Mining Market is expected to Reach US$ 203.4 Mn By 2031

Dewatering Aids for Mining Market is estimated to rise at a CAGR of 3.2% during forecast period

Improvements in the efficiency of mining is expected to drive the Dewatering Aids for Mining Market

Key players of Dewatering Aids for Mining Market are Arrmazz, Alfa Laval, Flo Trend LLC, Veolia, Fournier Industries, Griffin Dewatering Corporation, Aqseptence Group, Hitachi Zosen Corporation, Kontek Ecology Systems Inc

1. Executive Summary

1.1. Europe and Middle East & Africa Dewatering Aids for Mining Market Snapshot

1.2. Key Market Trends

1.3. Current Market and Future Potential

1.4. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Market Indicators

2.3. Market Definitions

2.4. Market Dynamics

2.4.1. Drivers

2.4.2. Restraints

2.4.3. Opportunities

2.5. Porter’s Five Forces Analysis

2.6. Value Chain Analysis

2.6.1. List of Potential Customers

3. COVID-19 Impact Analysis

4. Europe and Middle East & Africa Dewatering Aids for Mining Market Production Outlook

5. Europe and Middle East & Africa Dewatering Aids for Mining Market Price Trend Analysis, 2020–2031

5.1. By Product

5.2. By Region

6. Europe and Middle East & Africa Dewatering Aids for Mining Market Analysis and Forecast, 2020–2031

6.1. Key Findings

6.2. Europe Dewatering Aids for Mining Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

6.3. Europe Dewatering Aids for Mining Market Volume (Tons) and Value (US$ Mn) Forecast, by Material, 2020–2031

6.4. Europe Dewatering Aids for Mining Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

6.5. Europe Dewatering Aids for Mining Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

6.5.1. Germany Dewatering Aids for Mining Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

6.5.2. Germany Dewatering Aids for Mining Market Volume (Tons) and Value (US$ Mn) Forecast, by Material, 2020–2031

6.5.3. Germany Dewatering Aids for Mining Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

6.5.4. France Dewatering Aids for Mining Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

6.5.5. France Dewatering Aids for Mining Market Volume (Tons) and Value (US$ Mn) Forecast, by Material, 2020–2031

6.5.6. France Dewatering Aids for Mining Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

6.5.7. U.K. Dewatering Aids for Mining Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

6.5.8. U.K. Dewatering Aids for Mining Market Volume (Tons) and Value (US$ Mn) Forecast, by Material, 2020–2031

6.5.9. U.K. Dewatering Aids for Mining Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

6.5.10. Italy Dewatering Aids for Mining Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

6.5.11. Italy Dewatering Aids for Mining Market Volume (Tons) and Value (US$ Mn) Forecast, by Material, 2020–2031

6.5.12. Italy Dewatering Aids for Mining Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

6.5.13. Spain Dewatering Aids for Mining Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

6.5.14. Spain Dewatering Aids for Mining Market Volume (Tons) and Value (US$ Mn) Forecast, by Material, 2020–2031

6.5.15. Spain Dewatering Aids for Mining Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

6.5.16. Russia & CIS Dewatering Aids for Mining Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

6.5.17. Russia Dewatering Aids for Mining Market Volume (Tons) and Value (US$ Mn) Forecast, by Material, 2020–2031

6.5.18. Russia & CIS Dewatering Aids for Mining Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

6.5.19. Rest of Europe Dewatering Aids for Mining Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

6.5.20. Rest of Europe Dewatering Aids for Mining Market Volume (Tons) and Value (US$ Mn) Forecast, by Material, 2020–2031

6.5.21. Rest of Europe Dewatering Aids for Mining Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

6.6. Europe Dewatering Aids for Mining Market Attractiveness Analysis

7. Middle East & Africa Dewatering Aids for Mining Market Analysis and Forecast, 2020–2031

7.1. Key Findings

7.2. Middle East & Africa Dewatering Aids for Mining Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

7.3. Middle East & Africa Dewatering Aids for Mining Market Volume (Tons) and Value (US$ Mn) Forecast, by Material, 2020–2031

7.4. Middle East & Africa Dewatering Aids for Mining Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

7.5. Middle East & Africa Dewatering Aids for Mining Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

7.5.1. GCC Dewatering Aids for Mining Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

7.5.2. GCC Dewatering Aids for Mining Market Volume (Tons) and Value (US$ Mn) Forecast, by Material, 2020–2031

7.5.3. GCC Dewatering Aids for Mining Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

7.5.4. South Africa nada Dewatering Aids for Mining Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

7.5.5. South Africa Dewatering Aids for Mining Market Volume (Tons) and Value (US$ Mn) Forecast, by Material, 2020–2031

7.5.6. South Africa Dewatering Aids for Mining Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

7.5.7. Rest of Middle East & Africa Dewatering Aids for Mining Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

7.5.8. Rest of Middle East & Africa Dewatering Aids for Mining Market Volume (Tons) and Value (US$ Mn) Forecast, by Material, 2020–2031

7.5.9. Rest of Middle East & Africa Dewatering Aids for Mining Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

7.6. Middle East & Africa Dewatering Aids for Mining Market Attractiveness Analysis

8. Competition Landscape

8.1. Europe and Middle East & Africa Dewatering Aids for Mining Market Company Market Share Analysis, 2019

8.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

8.2.1. Arrmazz

8.2.1.1. Company Description

8.2.1.2. Business Overview

8.2.1.3. Financial Overview

8.2.1.4. Strategic Overview

8.2.2. Flo Trend LLC

8.2.2.1. Company Description

8.2.2.2. Business Overview

8.2.2.3. Financial Overview

8.2.2.4. Strategic Overview

8.2.3. Veolia

8.2.3.1. Company Description

8.2.3.2. Business Overview

8.2.3.3. Financial Overview

8.2.3.4. Strategic Overview

8.2.4. Fournier Industries

8.2.4.1. Company Description

8.2.4.2. Business Overview

8.2.5. Griffin Dewatering Corporation

8.2.5.1. Company Description

8.2.5.2. Business Overview

8.2.5.3. Financial Overview

8.2.5.4. Strategic Overview

8.2.6. Aqseptence Group

8.2.6.1. Company Description

8.2.6.2. Business Overview

8.2.6.3. Financial Overview

8.2.6.4. Strategic Overview

8.2.7. Hitachi Zosen Corporation

8.2.7.1. Company Description

8.2.7.2. Business Overview

8.2.7.3. Financial Overview

8.2.7.4. Strategic Overview

8.2.8. MCB INDUSTRIES SDN. BHD

8.2.8.1. Company Description

8.2.8.2. Business Overview

8.2.8.3. Financial Overview

8.2.8.4. Strategic Overview

8.2.9. Kontek Ecology Systems, Inc

8.2.9.1. Company Description

8.2.9.2. Business Overview

8.2.9.3. Financial Overview

8.2.9.4. Strategic Overview

9. Primary Research: Key Insights

10. Appendix

List of Tables

Table 1: Europe and Middle East & Africa Dewatering Aids for Mining Market Volume (Tons) Forecast, by Product, 2020–2031

Table 2: Europe and Middle East & Africa Dewatering Aids for Mining Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 3: Europe and Middle East & Africa Dewatering Aids for Mining Market Volume (Tons) Forecast, by Material, 2020–2031

Table 4: Europe and Middle East & Africa Dewatering Aids for Mining Market Value (US$ Mn) Forecast, by Material, 2020–2031

Table 5: Europe and Middle East & Africa Dewatering Aids for Mining Market Volume (Tons) Forecast, by Application, 2020–2031

Table 6: Europe and Middle East & Africa Dewatering Aids for Mining Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 7: Europe and Middle East & Africa Dewatering Aids for Mining Market Volume (Tons) Forecast, by Country and Sub-region, 2020–2031

Table 8: Europe and Middle East & Africa Dewatering Aids for Mining Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 9: Germany Dewatering Aids for Mining Market Volume (Tons) Forecast, by Product, 2020–2031

Table 10: Germany Dewatering Aids for Mining Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 11: Germany Dewatering Aids for Mining Market Volume (Tons) Forecast, by Material, 2020–2031

Table 12: Germany Dewatering Aids for Mining Market Value (US$ Mn) Forecast, by Material, 2020–2031

Table 13: Germany Dewatering Aids for Mining Market Volume (Tons) Forecast, by Application, 2020–2031

Table 14: Germany Dewatering Aids for Mining Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 15: U.K. Dewatering Aids for Mining Market Volume (Tons) Forecast, by Product, 2020–2031

Table 16: U.K. Dewatering Aids for Mining Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 17: U.K. Dewatering Aids for Mining Market Volume (Tons) Forecast, by Material, 2020–2031

Table 18: U.K. Dewatering Aids for Mining Market Value (US$ Mn) Forecast, by Material, 2020–2031

Table 19: U.K. Dewatering Aids for Mining Market Volume (Tons) Forecast, by Application, 2020–2031

Table 20: U.K. Dewatering Aids for Mining Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 21: France Dewatering Aids for Mining Market Volume (Tons) Forecast, by Product, 2020–2031

Table 22: France Dewatering Aids for Mining Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 23: France Dewatering Aids for Mining Market Volume (Tons) Forecast, by Material, 2020–2031

Table 24: France Dewatering Aids for Mining Market Value (US$ Mn) Forecast, by Material, 2020–2031

Table 25: France Dewatering Aids for Mining Market Volume (Tons) Forecast, by Application, 2020–2031

Table 26: France Dewatering Aids for Mining Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 27: Italy Dewatering Aids for Mining Market Volume (Tons) Forecast, by Product, 2020–2031

Table 28: Italy Dewatering Aids for Mining Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 29: Italy Dewatering Aids for Mining Market Volume (Tons) Forecast, by Material, 2020–2031

Table 30: Italy Dewatering Aids for Mining Market Value (US$ Mn) Forecast, by Material, 2020–2031

Table 31: Italy Dewatering Aids for Mining Market Volume (Tons) Forecast, by Application, 2020–2031

Table 32: Italy Dewatering Aids for Mining Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 33: Spain Dewatering Aids for Mining Market Volume (Tons) Forecast, by Product, 2020–2031

Table 34: Spain Dewatering Aids for Mining Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 35: Spain Dewatering Aids for Mining Market Volume (Tons) Forecast, by Material, 2020–2031

Table 36: Spain Dewatering Aids for Mining Market Value (US$ Mn) Forecast, by Material, 2020–2031

Table 37: Spain Dewatering Aids for Mining Market Volume (Tons) Forecast, by Application, 2020–2031

Table 38: Spain Dewatering Aids for Mining Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 39: Russia & CIS Dewatering Aids for Mining Market Volume (Tons) Forecast, by Product, 2020–2031

Table 40: Russia & CIS Dewatering Aids for Mining Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 41: Russia & CIS Dewatering Aids for Mining Market Volume (Tons) Forecast, by Material, 2020–2031

Table 42: Russia & CIS Dewatering Aids for Mining Market Value (US$ Mn) Forecast, by Material, 2020–2031

Table 43: Russia & CIS Dewatering Aids for Mining Market Volume (Tons) Forecast, by Application, 2020–2031

Table 44: Russia & CIS Dewatering Aids for Mining Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 45: Rest of Europe Dewatering Aids for Mining Market Volume (Tons) Forecast, by Product, 2020–2031

Table 46: Rest of Europe Dewatering Aids for Mining Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 47: Rest of Europe Dewatering Aids for Mining Market Volume (Tons) Forecast, by Material, 2020–2031

Table 48: Rest of Europe Dewatering Aids for Mining Market Value (US$ Mn) Forecast, by Material, 2020–2031

Table 49: Rest of Europe Dewatering Aids for Mining Market Volume (Tons) Forecast, by Application, 2020–2031

Table 50: Russia & CIS Dewatering Aids for Mining Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 51: GCC Dewatering Aids for Mining Market Volume (Tons) Forecast, by Product, 2020–2031

Table 52: GCC Dewatering Aids for Mining Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 53: GCC Dewatering Aids for Mining Market Volume (Tons) Forecast, by Material, 2020–2031

Table 54: GCC Dewatering Aids for Mining Market Value (US$ Mn) Forecast, by Material, 2020–2031

Table 55: GCC Dewatering Aids for Mining Market Volume (Tons) Forecast, by Application, 2020–2031

Table 56: GCC Dewatering Aids for Mining Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 57: South Africa Dewatering Aids for Mining Market Volume (Tons) Forecast, by Product, 2020–2031

Table 58: South Africa Dewatering Aids for Mining Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 59: South Africa Dewatering Aids for Mining Market Volume (Tons) Forecast, by Material, 2020–2031

Table 60: South Africa Dewatering Aids for Mining Market Value (US$ Mn) Forecast, by Material, 2020–2031

Table 61: South Africa Dewatering Aids for Mining Market Volume (Tons) Forecast, by Application, 2020–2031

Table 62: South Africa Dewatering Aids for Mining Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 63: Rest of Middle East & Africa Dewatering Aids for Mining Market Volume (Tons) Forecast, by Product, 2020–2031

Table 64: Rest of Middle East & Africa Dewatering Aids for Mining Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 65: Rest of Middle East & Africa Dewatering Aids for Mining Market Volume (Tons) Forecast, by Material, 2020–2031

Table 66: Rest of Middle East & Africa Dewatering Aids for Mining Market Value (US$ Mn) Forecast, by Material, 2020–2031

Table 67: Rest of Middle East & Africa Dewatering Aids for Mining Market Volume (Tons) Forecast, by Application, 2020–2031

Table 68: Rest of Middle East & Africa Dewatering Aids for Mining Market Value (US$ Mn) Forecast, by Application, 2020–2031

List of Figures

Figure 1: Europe and Middle East & Africa Dewatering Aids for Mining Market Volume Share, by Product, 2020, 2025, and 2031

Figure 2: Europe and Middle East & Africa Dewatering Aids for Mining Market Attractiveness, by Product

Figure 3: Europe and Middle East & Africa Dewatering Aids for Mining Market Volume Share, by Material, 2020, 2025, and 2031

Figure 4: Europe and Middle East & Africa Dewatering Aids for Mining Market Attractiveness, by Material

Figure 5: Europe and Middle East & Africa Dewatering Aids for Mining Market Volume Share, by Application, 2020, 2025, and 2031

Figure 6: Europe and Middle East & Africa Dewatering Aids for Mining Market Attractiveness, by Application

Figure 7: Europe and Middle East & Africa Dewatering Aids for Mining Market Volume Share, by Country and Sub-region, 2020, 2025, and 2031

Figure 8: Europe and Middle East & Africa Dewatering Aids for Mining Market Attractiveness, by Country and Sub-region