Reports

Reports

With increasing demand for technologically advanced assistive devices for rising geriatric and disabled population, the manufacturers are gaining lucrative opportunities. Wheelchairs, mobility scooters, medical beds, bathroom safety devices, hearing aids, vision and reading aids, etc. are highly popular in elderly and disabled population. These devices are extremely helpful for them by making their day-to-day activities, such as walking and reading listening, much easier.

.webp)

There is a growing demand for efficient, reliable, and safe products from consumers. Manufacturers are focusing on product development using advanced techniques to stay ahead of the fierce competition in the global market. However, high costs and low awareness of assistive devices for elderly in some underdeveloped countries are the major restraining factors for the elderly and disabled assistive devices market.

The global disabled and elderly assistive devices market has experienced phenomenal growth in recent years due to the rise geriatric population across the globe, rising prevalence of chronic illnesses, and heightened awareness and independence among disabled people. These assistive devices are designed to improve the health and well-being of old individuals and individuals with physical, sensory, or intellectual impairment to make them more mobile, communicable, hearing, and able to carry out activities of daily living.

As the age group of above 65 years is likely to be over 1.5 billion in the year 2050, assistive products like mobility aids, hearing aids, vision & reading aids, and daily living aids' market growth is likely to surge. Increased life expectancy and demand for old age people living by themselves are also driving adoption.

Technological innovation is transforming the industry by way of support of devices like smart canes, artificial intelligence-hearing aids, speech-giving wheelchairs, and home healthcare monitoring systems. Wearable technology and IoT connectivity to assistive technology are enabling real-time monitoring and remote operation, becoming more effective and personalized.

| Attribute | Detail |

|---|---|

| Elderly and Disabled Assistive Devices Market Drivers |

|

The expanding market for assistive devices for the disabled and the elderly is mainly driven by greater awareness amongst the people and penetration of assistive devices among the disabled and elderly. With the aging population around the world facing disability from lifestyle-related diseases and chronic conditions, products that carry the potential to enhance independence, mobility, and quality of life are being sought more and more. Greater sensitization by governments, health institutions, and non-governmental bodies has done a lot in sensitizing individuals on the existence and benefits of assistive technology.

The elderly and caregivers are increasingly becoming aware of assistance they can receive to cope with disabilities caused by aging such as hearing disability, mobility disabilities, eyesight impairment, and loss of mental capacity.

In the same way, the disabled-congenitally, traumatically, or diseased-are more inclined to lend a helping hand and embrace devices that maximize everyday functioning and social interaction. This heightened awareness has helped to popularize the use of assistive devices so that social stigma is reduced and adoption is promoted.

In addition, the availability of friendly, dashing-looking, and high-tech assistive devices has also raised their popularity and appeal with clients. For instance, modern hearing aids are no longer noticeable and can be connected using Bluetooth. Intelligent wheelchairs have voice recognition; and wearable assistive technologies are wearable and can be accessed through mobile phones for increased control and monitoring.

Technological innovations are propelling expansion of the elderly and disabled assistive devices industry in the majority of instances with the modernization of conventional aids into intelligent, multi-function, and optimized devices. Technology that is increasingly fusing digital healthcare with artificial intelligence (AI), robots, and the Internet of Things (IoT) optimizes assistive devices to be more effective, customized, and integrated for the elderly and disabled.

The assistive technologies today incorporate onboard smart sensors, voice commands, Bluetooth wireless connectivity, and memory, all of which enable real-time tracking and self-sensing adaptive compensation depending on user demand. Advanced wheelchairs, for example, will drive through complex situations automatically without risk, whereas advanced hearing aids will cancel interference noise and connect to mobile phones or TVs via Bluetooth, and listeners have unbroken listening.

Remote monitoring systems, voice-controlled lighting, and falls detectors are providing safe living alone to the aged. Additionally, various public/private institutes and organizations are upgrading their assistive technologies. For instance, in June 2023, Indian Institute of Technology Madras (IIT Madras) launched the National Center for Assistive Health Technologies called IIT Madras (NCAHT-IITM), an initiative of the Indian Council for Medical Research (ICMR), to boost Research and Development in Assistive Technologies.

The TTK Center for Rehabilitation Research and Device Development (R2D2) is implementing this initiative at IIT Madras. NCAHT-IITM will be a showcase center that enables R&D in Assistive Technologies. It envisages user empowerment by showing the possibilities through technology, minimizing unconscious bias in the minds of engineers/Assistive Technology developers, policymakers, general public, and paving the way for better AT solutions and policies.

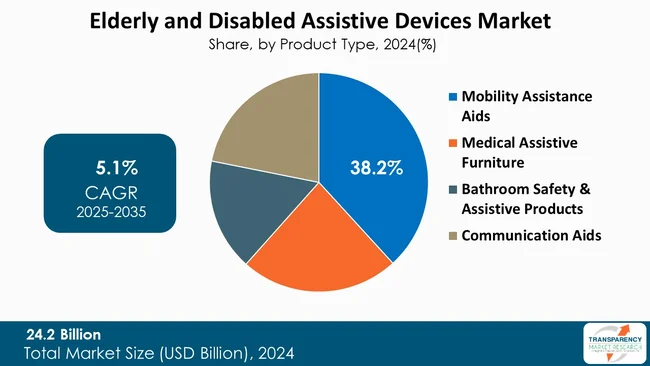

The mobility assistance aids segment is leading the elderly and disabled assistive devices market due to increased demand for powered mobility devices, scooters, wheelchairs, canes, and walkers. The growth in the aging population with mobility limitations and the growing number of arthritis, fractures, and degeneration cases due to old age are responsible for its leadership.

With age, they are prone to the onset of musculoskeletal disorders like arthritis, osteoporosis, degeneration of hip/knee joints, and poststroke syndrome, all of which contribute directly to an immediate impact on mobility.

People with disability resulting from injury, surgery, or birth also mostly depend on support mobility aids. The population of elderly people (65 years and older) all over the world is growing at a faster rate and is likely to double by the year 2050. One of the most prevalent disorders among them is impairment of mobility.

For this purpose, the demand for aids like canes, walkers, scooters, and wheelchairs is continuously rising. Most of the elderly people prefer home aging compared to institutionalization. Mobility aids help them maintain independence, performing daily activities, and reduce reliance on caregivers, thereby making these devices essential under home care.

| Attribute | Detail |

|---|---|

| Leading Region | North America |

North America, and most notably the United States and Canada, is home to a rapidly aging population. A large percentage of their population is over 65 years old, a segment highly susceptible to chronic diseases, mobility impairment, and sensory deficits. The U.S. Census Bureau, more than 20% of Americans will be 65 or older by 2030.

North America’s consumers generally possess greater disposable incomes and public and private insurance coverage such as Medicare and Medicaid. The systems subsidize a majority of the assistive products either fully or partly, hence lowering their costs for disabled and elderly people.

Leading companies are partnering with hospitals, specialty clinics, and research institutes are expected to expand inorganically. AI Squared, Drive Medical, GN Resound Group, Invacare, Nordic Capital, Pride Mobility Products Corporation, Siemens Ltd., Sonova Holding AG, Starkey hearing technologies, and William Demant Holding A/S are the prominent elderly and disabled assistive devices market players.

Each of these players has been profiled in the elderly and disabled assistive devices market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 24.2 Bn |

| Forecast Value in 2035 | More than US$ 41.8 Bn |

| CAGR | 5.1% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global elderly and disabled assistive devices market was valued at US$ 24.2 Bn in 2024.

Elderly and disabled assistive devices business is projected to cross US$ 41.8 Bn by the end of 2035.

Rising awareness and adoption of assistive devices in disabled and geriatric population and technological advancements in assistive devices.

The CAGR is anticipated to be 5.1% from 2025 to 2035.

North America is expected to account for the largest share from 2025 to 2035.

AI Squared, Drive Medical, GN Resound Group, Invacare, Nordic Capital, Pride Mobility Products Corporation, Siemens Ltd., Sonova Holding AG, Starkey hearing technologies, and William Demant Holding A/S are the prominent elderly and disabled assistive devices market players.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Elderly and Disabled Assistive Devices Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Elderly and Disabled Assistive Devices Market Analysis and Forecasts, 2020 to 2035

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Key Industry Events (Partnerships, Collaborations, Mergers, Acquisitions, etc.)

5.2. Technological Advancements

5.3. Consumer Behavior Analysis

5.4. Key Purchase Metrics for End-Users

5.5. PORTER’s Five Forces Analysis

5.6. PESTLE Analysis

5.7. Regulatory Scenario by Key Countries/Regions

5.8. Value Chain Analysis

5.9. Pricing Trends

5.10. Benchmarking of the Products Offered by the Leading Competitors

5.11. Go-to-Market Strategy for New Market Entrants

6. Global Elderly and Disabled Assistive Devices Market Analysis and Forecasts, By Product Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast By Product Type, 2020 to 2035

6.3.1. Mobility Assistance Aids

6.3.1.1. Wheelchairs

6.3.1.2. Mobility Scooters

6.3.1.3. Crutches & Canes

6.3.1.4. Patient Mechanical Lift Handling

6.3.1.5. Walkers & Rollators

6.3.1.6. Others

6.3.2. Medical Assistive Furniture

6.3.2.1. Medical Beds

6.3.2.2. Riser Reclining Chairs

6.3.2.3. Railings & Bar

6.3.2.4. Door Openers

6.3.2.5. Others

6.3.3. Bathroom Safety & Assistive Products

6.3.3.1. Commodes Chairs

6.3.3.2. Shower Chairs

6.3.3.3. Ostomy Products

6.3.3.4. Others

6.3.4. Communication Aids

6.3.4.1. Speech & Writing Therapy Devices

6.3.4.2. Hearing Aids

6.3.4.2.1. Canal Hearing Aids

6.3.4.2.2. Receiver-in-the-Ear (RITE) Aids

6.3.4.2.3. Cochlear Implants

6.3.4.2.4. Behind-the-Ear (BTE) Aids

6.3.4.2.5. Bone Anchored Hearing Aids (BAHA)

6.3.4.2.6. In-the-Ear (ITE) Aids

6.3.4.3. Vision & Reading Aids

6.3.4.3.1. Reading Machines

6.3.4.3.2. Video Magnifiers

6.3.4.3.3. Braille Translators

6.3.4.3.4. Others

6.4. Market Attractiveness By Product Type

7. Global Elderly and Disabled Assistive Devices Market Analysis and Forecasts, By End-user

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast By End-user, 2020 to 2035

7.3.1. Hospital

7.3.2. Home Care Settings

7.3.3. Nursing Homes

7.3.4. Assisted Living Facilities

7.3.5. Others

7.4. Market Attractiveness By End-user

8. Global Elderly and Disabled Assistive Devices Market Analysis and Forecasts, By Region

8.1. Key Findings

8.2. Market Value Forecast By Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness By Country/Region

9. North America Elderly and Disabled Assistive Devices Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast By Product Type, 2020 to 2035

9.2.1. Mobility Assistance Aids

9.2.1.1. Wheelchairs

9.2.1.2. Mobility Scooters

9.2.1.3. Crutches & Canes

9.2.1.4. Patient Mechanical Lift Handling

9.2.1.5. Walkers & Rollators

9.2.1.6. Others

9.2.2. Medical Assistive Furniture

9.2.2.1. Medical Beds

9.2.2.2. Riser Reclining Chairs

9.2.2.3. Railings & Bar

9.2.2.4. Door Openers

9.2.2.5. Others

9.2.3. Bathroom Safety & Assistive Products

9.2.3.1. Commodes Chairs

9.2.3.2. Shower Chairs

9.2.3.3. Ostomy Products

9.2.3.4. Others

9.2.4. Communication Aids

9.2.4.1. Speech & Writing Therapy Devices

9.2.4.2. Hearing Aids

9.2.4.2.1. Canal Hearing Aids

9.2.4.2.2. Receiver-in-the-Ear (RITE) Aids

9.2.4.2.3. Cochlear Implants

9.2.4.2.4. Behind-the-Ear (BTE) Aids

9.2.4.2.5. Bone Anchored Hearing Aids (BAHA)

9.2.4.2.6. In-the-Ear (ITE) Aids

9.2.4.3. Vision & Reading Aids

9.2.4.3.1. Reading Machines

9.2.4.3.2. Video Magnifiers

9.2.4.3.3. Braille Translators

9.2.4.3.4. Others

9.3. Market Value Forecast By End-user, 2020 to 2035

9.3.1. Hospital

9.3.2. Home Care Settings

9.3.3. Nursing Homes

9.3.4. Assisted Living Facilities

9.3.5. Others

9.4. Market Value Forecast By Country, 2020 to 2035

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Product Type

9.5.2. By End-user

9.5.3. By Country

10. Europe Elderly and Disabled Assistive Devices Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast By Product Type, 2020 to 2035

10.2.1. Mobility Assistance Aids

10.2.1.1. Wheelchairs

10.2.1.2. Mobility Scooters

10.2.1.3. Crutches & Canes

10.2.1.4. Patient Mechanical Lift Handling

10.2.1.5. Walkers & Rollators

10.2.1.6. Others

10.2.2. Medical Assistive Furniture

10.2.2.1. Medical Beds

10.2.2.2. Riser Reclining Chairs

10.2.2.3. Railings & Bar

10.2.2.4. Door Openers

10.2.2.5. Others

10.2.3. Bathroom Safety & Assistive Products

10.2.3.1. Commodes Chairs

10.2.3.2. Shower Chairs

10.2.3.3. Ostomy Products

10.2.3.4. Others

10.2.4. Communication Aids

10.2.4.1. Speech & Writing Therapy Devices

10.2.4.2. Hearing Aids

10.2.4.2.1. Canal Hearing Aids

10.2.4.2.2. Receiver-in-the-Ear (RITE) Aids

10.2.4.2.3. Cochlear Implants

10.2.4.2.4. Behind-the-Ear (BTE) Aids

10.2.4.2.5. Bone Anchored Hearing Aids (BAHA)

10.2.4.2.6. In-the-Ear (ITE) Aids

10.2.4.3. Vision & Reading Aids

10.2.4.3.1. Reading Machines

10.2.4.3.2. Video Magnifiers

10.2.4.3.3. Braille Translators

10.2.4.3.4. Others

10.3. Market Value Forecast By End-user, 2020 to 2035

10.3.1. Hospital

10.3.2. Home Care Settings

10.3.3. Nursing Homes

10.3.4. Assisted Living Facilities

10.3.5. Others

10.4. Market Value Forecast By Country, 2020 to 2035

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Italy

10.4.5. Spain

10.4.6. Switzerland

10.4.7. The Netherlands

10.4.8. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Product Type

10.5.2. By End-user

10.5.3. By Country

11. Asia Pacific Elderly and Disabled Assistive Devices Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast By Product Type, 2020 to 2035

11.2.1. Mobility Assistance Aids

11.2.1.1. Wheelchairs

11.2.1.2. Mobility Scooters

11.2.1.3. Crutches & Canes

11.2.1.4. Patient Mechanical Lift Handling

11.2.1.5. Walkers & Rollators

11.2.1.6. Others

11.2.2. Medical Assistive Furniture

11.2.2.1. Medical Beds

11.2.2.2. Riser Reclining Chairs

11.2.2.3. Railings & Bar

11.2.2.4. Door Openers

11.2.2.5. Others

11.2.3. Bathroom Safety & Assistive Products

11.2.3.1. Commodes Chairs

11.2.3.2. Shower Chairs

11.2.3.3. Ostomy Products

11.2.3.4. Others

11.2.4. Communication Aids

11.2.4.1. Speech & Writing Therapy Devices

11.2.4.2. Hearing Aids

11.2.4.2.1. Canal Hearing Aids

11.2.4.2.2. Receiver-in-the-Ear (RITE) Aids

11.2.4.2.3. Cochlear Implants

11.2.4.2.4. Behind-the-Ear (BTE) Aids

11.2.4.2.5. Bone Anchored Hearing Aids (BAHA)

11.2.4.2.6. In-the-Ear (ITE) Aids

11.2.4.3. Vision & Reading Aids

11.2.4.3.1. Reading Machines

11.2.4.3.2. Video Magnifiers

11.2.4.3.3. Braille Translators

11.2.4.3.4. Others

11.3. Market Value Forecast By End-user, 2020 to 2035

11.3.1. Hospital

11.3.2. Home Care Settings

11.3.3. Nursing Homes

11.3.4. Assisted Living Facilities

11.3.5. Others

11.4. Market Value Forecast By Country, 2020 to 2035

11.4.1. China

11.4.2. India

11.4.3. Japan

11.4.4. South Korea

11.4.5. Australia & New Zealand

11.4.6. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Product Type

11.5.2. By End-user

11.5.3. By Country

12. Latin America Elderly and Disabled Assistive Devices Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast By Product Type, 2020 to 2035

12.2.1. Mobility Assistance Aids

12.2.1.1. Wheelchairs

12.2.1.2. Mobility Scooters

12.2.1.3. Crutches & Canes

12.2.1.4. Patient Mechanical Lift Handling

12.2.1.5. Walkers & Rollators

12.2.1.6. Others

12.2.2. Medical Assistive Furniture

12.2.2.1. Medical Beds

12.2.2.2. Riser Reclining Chairs

12.2.2.3. Railings & Bar

12.2.2.4. Door Openers

12.2.2.5. Others

12.2.3. Bathroom Safety & Assistive Products

12.2.3.1. Commodes Chairs

12.2.3.2. Shower Chairs

12.2.3.3. Ostomy Products

12.2.3.4. Others

12.2.4. Communication Aids

12.2.4.1. Speech & Writing Therapy Devices

12.2.4.2. Hearing Aids

12.2.4.2.1. Canal Hearing Aids

12.2.4.2.2. Receiver-in-the-Ear (RITE) Aids

12.2.4.2.3. Cochlear Implants

12.2.4.2.4. Behind-the-Ear (BTE) Aids

12.2.4.2.5. Bone Anchored Hearing Aids (BAHA)

12.2.4.2.6. In-the-Ear (ITE) Aids

12.2.4.3. Vision & Reading Aids

12.2.4.3.1. Reading Machines

12.2.4.3.2. Video Magnifiers

12.2.4.3.3. Braille Translators

12.2.4.3.4. Others

12.3. Market Value Forecast By End-user, 2020 to 2035

12.3.1. Hospital

12.3.2. Home Care Settings

12.3.3. Nursing Homes

12.3.4. Assisted Living Facilities

12.3.5. Others

12.4. Market Value Forecast By Country, 2020 to 2035

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Argentina

12.4.4. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Product Type

12.5.2. By End-user

12.5.3. By Country

13. Middle East & Africa Elderly and Disabled Assistive Devices Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast By Product Type, 2020 to 2035

13.2.1. Mobility Assistance Aids

13.2.1.1. Wheelchairs

13.2.1.2. Mobility Scooters

13.2.1.3. Crutches & Canes

13.2.1.4. Patient Mechanical Lift Handling

13.2.1.5. Walkers & Rollators

13.2.1.6. Others

13.2.2. Medical Assistive Furniture

13.2.2.1. Medical Beds

13.2.2.2. Riser Reclining Chairs

13.2.2.3. Railings & Bar

13.2.2.4. Door Openers

13.2.2.5. Others

13.2.3. Bathroom Safety & Assistive Products

13.2.3.1. Commodes Chairs

13.2.3.2. Shower Chairs

13.2.3.3. Ostomy Products

13.2.3.4. Others

13.2.4. Communication Aids

13.2.4.1. Speech & Writing Therapy Devices

13.2.4.2. Hearing Aids

13.2.4.2.1. Canal Hearing Aids

13.2.4.2.2. Receiver-in-the-Ear (RITE) Aids

13.2.4.2.3. Cochlear Implants

13.2.4.2.4. Behind-the-Ear (BTE) Aids

13.2.4.2.5. Bone Anchored Hearing Aids (BAHA)

13.2.4.2.6. In-the-Ear (ITE) Aids

13.2.4.3. Vision & Reading Aids

13.2.4.3.1. Reading Machines

13.2.4.3.2. Video Magnifiers

13.2.4.3.3. Braille Translators

13.2.4.3.4. Others

13.3. Market Value Forecast By End-user, 2020 to 2035

13.3.1. Hospital

13.3.2. Home Care Settings

13.3.3. Nursing Homes

13.3.4. Assisted Living Facilities

13.3.5. Others

13.4. Market Value Forecast By Country, 2020 to 2035

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Product Type

13.5.2. By End-user

13.5.3. By Country

14. Competition Landscape

14.1. Market Player – Competition Matrix (By Tier and Size of companies)

14.2. Market Share Analysis By Company (2024)

14.3. Company Profiles

14.3.1. AI Squared

14.3.1.1. Company Overview

14.3.1.2. Financial Overview

14.3.1.3. Financial Overview

14.3.1.4. Business Strategies

14.3.1.5. Recent Developments

14.3.2. Drive Medical

14.3.2.1. Company Overview

14.3.2.2. Financial Overview

14.3.2.3. Financial Overview

14.3.2.4. Business Strategies

14.3.2.5. Recent Developments

14.3.3. GN Resound Group

14.3.3.1. Company Overview

14.3.3.2. Financial Overview

14.3.3.3. Financial Overview

14.3.3.4. Business Strategies

14.3.3.5. Recent Developments

14.3.4. Invacare

14.3.4.1. Company Overview

14.3.4.2. Financial Overview

14.3.4.3. Financial Overview

14.3.4.4. Business Strategies

14.3.4.5. Recent Developments

14.3.5. Nordic Capital

14.3.5.1. Company Overview

14.3.5.2. Financial Overview

14.3.5.3. Financial Overview

14.3.5.4. Business Strategies

14.3.5.5. Recent Developments

14.3.6. Pride Mobility Products Corporation

14.3.6.1. Company Overview

14.3.6.2. Financial Overview

14.3.6.3. Financial Overview

14.3.6.4. Business Strategies

14.3.6.5. Recent Developments

14.3.7. Siemens Ltd.

14.3.7.1. Company Overview

14.3.7.2. Financial Overview

14.3.7.3. Financial Overview

14.3.7.4. Business Strategies

14.3.7.5. Recent Developments

14.3.8. Sonova Holding AG

14.3.8.1. Company Overview

14.3.8.2. Financial Overview

14.3.8.3. Financial Overview

14.3.8.4. Business Strategies

14.3.8.5. Recent Developments

14.3.9. Starkey hearing technologies

14.3.9.1. Company Overview

14.3.9.2. Financial Overview

14.3.9.3. Financial Overview

14.3.9.4. Business Strategies

14.3.9.5. Recent Developments

14.3.10. William Demant Holding A/S

14.3.10.1. Company Overview

14.3.10.2. Financial Overview

14.3.10.3. Financial Overview

14.3.10.4. Business Strategies

14.3.10.5. Recent Developments

14.3.11. Other Prominent Players

14.3.11.1. Company Overview

14.3.11.2. Financial Overview

14.3.11.3. Financial Overview

14.3.11.4. Business Strategies

14.3.11.5. Recent Developments

List of Tables

Table 01: Global Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, By Product Type, 2020 to 2035

Table 02: Global Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, by Mobility Assistance Aids, 2020 to 2035

Table 03: Global Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, by Medical Assistive Furniture, 2020 to 2035

Table 04: Global Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, by Bathroom Safety & Assistive Products, 2020 to 2035

Table 05: Global Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, by Communication Aids, 2020 to 2035

Table 06: Global Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, by Hearing Aids, 2020 to 2035

Table 07: Global Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, by Vision & Reading Aids, 2020 to 2035

Table 08: Global Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

Table 09: Global Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, By Region, 2020 to 2035

Table 10: North America - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, by Country, 2020 to 2035

Table 11: North America - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, by Product Type, 2020 to 2035

Table 12: North America - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, by Mobility Assistance Aids, 2020 to 2035

Table 13: North America - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, by Medical Assistive Furniture, 2020 to 2035

Table 14: North America - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, by Bathroom Safety & Assistive Products, 2020 to 2035

Table 15: North America - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, by Communication Aids, 2020 to 2035

Table 16: North America - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, by Hearing Aids, 2020 to 2035

Table 17: North America - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, by Vision & Reading Aids, 2020 to 2035

Table 18: North America - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

Table 19: Europe - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, by Country, 2020 to 2035

Table 20: Europe - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, by Product Type, 2020 to 2035

Table 21: Europe - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, by Mobility Assistance Aids, 2020 to 2035

Table 22: Europe - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, by Medical Assistive Furniture, 2020 to 2035

Table 23: Europe - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, by Bathroom Safety & Assistive Products, 2020 to 2035

Table 24: Europe - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, by Communication Aids, 2020 to 2035

Table 25: Europe - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, by Hearing Aids, 2020 to 2035

Table 26: Europe - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, by Vision & Reading Aids, 2020 to 2035

Table 27: Europe - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

Table 28: Asia Pacific - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, by Country, 2020 to 2035

Table 29: Asia Pacific - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, by Product Type, 2020 to 2035

Table 30: Asia Pacific - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, by Mobility Assistance Aids, 2020 to 2035

Table 31: Asia Pacific - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, by Medical Assistive Furniture, 2020 to 2035

Table 32: Asia Pacific - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, by Bathroom Safety & Assistive Products, 2020 to 2035

Table 33: Asia Pacific - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, by Communication Aids, 2020 to 2035

Table 34: Asia Pacific - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, by Hearing Aids, 2020 to 2035

Table 35: Asia Pacific - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, by Vision & Reading Aids, 2020 to 2035

Table 36: Asia Pacific - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

Table 37: Latin America - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, by Country, 2020 to 2035

Table 38: Latin America - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, by Product Type, 2020 to 2035

Table 39: Latin America - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, by Mobility Assistance Aids, 2020 to 2035

Table 40: Latin America - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, by Medical Assistive Furniture, 2020 to 2035

Table 41: Latin America - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, by Bathroom Safety & Assistive Products, 2020 to 2035

Table 42: Latin America - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, by Communication Aids, 2020 to 2035

Table 43: Latin America - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, by Hearing Aids, 2020 to 2035

Table 44: Latin America - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, by Vision & Reading Aids, 2020 to 2035

Table 45: Latin America - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

Table 46: Middle East & Africa - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, by Country, 2020 to 2035

Table 47: Middle East & Africa - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, by Product Type, 2020 to 2035

Table 48: Middle East & Africa - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, by Mobility Assistance Aids, 2020 to 2035

Table 49: Middle East & Africa - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, by Medical Assistive Furniture, 2020 to 2035

Table 50: Middle East & Africa - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, by Bathroom Safety & Assistive Products, 2020 to 2035

Table 51: Middle East & Africa - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, by Communication Aids, 2020 to 2035

Table 52: Middle East & Africa - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, by Hearing Aids, 2020 to 2035

Table 53: Middle East & Africa - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, by Vision & Reading Aids, 2020 to 2035

Table 54: Middle East & Africa - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

List of Figures

Figure 01: Global Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, by Region, 2020 to 2035

Figure 02: Global Elderly and Disabled Assistive Devices Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 03: Global Elderly and Disabled Assistive Devices Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 04: Global Elderly and Disabled Assistive Devices Market Revenue (US$ Mn), by Mobility Assistance Aids, 2020 to 2035

Figure 05: Global Elderly and Disabled Assistive Devices Market Revenue (US$ Mn), by Medical Assistive Furniture, 2020 to 2035

Figure 06: Global Elderly and Disabled Assistive Devices Market Revenue (US$ Mn), by Bathroom Safety & Assistive Products, 2020 to 2035

Figure 07: Global Elderly and Disabled Assistive Devices Market Revenue (US$ Mn), by Communication Aids, 2020 to 2035

Figure 08: Global Elderly and Disabled Assistive Devices Market Value Share Analysis, By End-user, 2024 and 2035

Figure 09: Global Elderly and Disabled Assistive Devices Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 10: Global Elderly and Disabled Assistive Devices Market Revenue (US$ Mn), by Hospitals, 2020 to 2035

Figure 11: Global Elderly and Disabled Assistive Devices Market Revenue (US$ Mn), by Home Care Settings, 2020 to 2035

Figure 12: Global Elderly and Disabled Assistive Devices Market Revenue (US$ Mn), by Nursing Homes, 2020 to 2035

Figure 13: Global Elderly and Disabled Assistive Devices Market Revenue (US$ Mn), by Assisted Living Facilities, 2020 to 2035

Figure 14: Global Elderly and Disabled Assistive Devices Market Revenue (US$ Mn), by Others, 2020 to 2035

Figure 15: Global Elderly and Disabled Assistive Devices Market Value Share Analysis, By Region, 2024 and 2035

Figure 16: Global Elderly and Disabled Assistive Devices Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 17: North America - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 18: North America - Elderly and Disabled Assistive Devices Market Value Share Analysis, by Country, 2024 and 2035

Figure 19: North America - Elderly and Disabled Assistive Devices Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 20: North America Elderly and Disabled Assistive Devices Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 21: North America Elderly and Disabled Assistive Devices Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 22: North America - Elderly and Disabled Assistive Devices Market Value Share Analysis, By End-user, 2024 and 2035

Figure 23: North America - Elderly and Disabled Assistive Devices Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 24: Europe - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 25: Europe - Elderly and Disabled Assistive Devices Market Value Share Analysis, by Country, 2024 and 2035

Figure 26: Europe - Elderly and Disabled Assistive Devices Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 27: Europe Elderly and Disabled Assistive Devices Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 28: Europe Elderly and Disabled Assistive Devices Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 29: Europe - Elderly and Disabled Assistive Devices Market Value Share Analysis, By End-user, 2024 and 2035

Figure 30: Europe - Elderly and Disabled Assistive Devices Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 31: Asia Pacific - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 32: Asia Pacific - Elderly and Disabled Assistive Devices Market Value Share Analysis, by Country, 2024 and 2035

Figure 33: Asia Pacific - Elderly and Disabled Assistive Devices Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 34: Asia Pacific Elderly and Disabled Assistive Devices Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 35: Asia Pacific Elderly and Disabled Assistive Devices Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 36: Asia Pacific - Elderly and Disabled Assistive Devices Market Value Share Analysis, By End-user, 2024 and 2035

Figure 37: Asia Pacific - Elderly and Disabled Assistive Devices Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 38: Latin America - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 39: Latin America - Elderly and Disabled Assistive Devices Market Value Share Analysis, by Country, 2024 and 2035

Figure 40: Latin America - Elderly and Disabled Assistive Devices Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 41: Latin America Elderly and Disabled Assistive Devices Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 42: Latin America Elderly and Disabled Assistive Devices Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 43: Latin America - Elderly and Disabled Assistive Devices Market Value Share Analysis, By End-user, 2024 and 2035

Figure 44: Latin America - Elderly and Disabled Assistive Devices Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 45: Middle East & Africa - Elderly and Disabled Assistive Devices Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 46: Middle East & Africa - Elderly and Disabled Assistive Devices Market Value Share Analysis, by Country, 2024 and 2035

Figure 47: Middle East & Africa - Elderly and Disabled Assistive Devices Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 48: Middle East & Africa Elderly and Disabled Assistive Devices Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 49: Middle East & Africa Elderly and Disabled Assistive Devices Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 50: Middle East & Africa - Elderly and Disabled Assistive Devices Market Value Share Analysis, By End-user, 2024 and 2035

Figure 51: Middle East & Africa - Elderly and Disabled Assistive Devices Market Attractiveness Analysis, By End-user, 2025 to 2035