Reports

Reports

The hospitals in China have been adopting mobile telehealth systems (MTS) to enable sharing of patient information to clinicians in isolated COVID-19 (coronavirus) wards. Since doctors were unable to retrieve patient information from the hospital intranet, they resorted to mobile telehealth systems without compromising the security of patient information. More number of individuals are using telehealth and telemedicine, since people prefer remote medical services amidst the coronavirus pandemic.

Ongoing developments in mobile technologies are benefitting the proliferation of eHealth programs, thus driving the eHealth market. Telehealth systems are making it possible for healthcare professionals to share information from multiple locations. During the ongoing COVID-19 outbreak, IT companies experienced a dramatic increase in the adoption of home telehealth programs. On the other hand, the Union Health Ministry of India released telemedicine guidelines to cater the needs of hard-to-reach populations of rural India. This is anticipated to fuel the growth of the eHealth market during the forecast period.

The eHealth market is expected to register a staggering CAGR of 16.5% during the forecast period. This can be attributed to individuals preferring to receive medical services by the convenience of staying at home. The trend of app on prescription is bringing about a significant change in the eHealth market. Analysts of Transparency Market Research (TMR) opine that doctors will now be able to issue prescriptions for health apps to their patients and this trend will grow after the ongoing COVID-19 pandemic.

Organizations such as the National Association of Statutory Health Insurance Physicians is increasing efforts to introduce security regulations with the assistance of Federal Office for Information Security (BSI), Germany. These security regulations will play an instrumental role in the market for eHealth, since it will help to certify vendors of health apps.

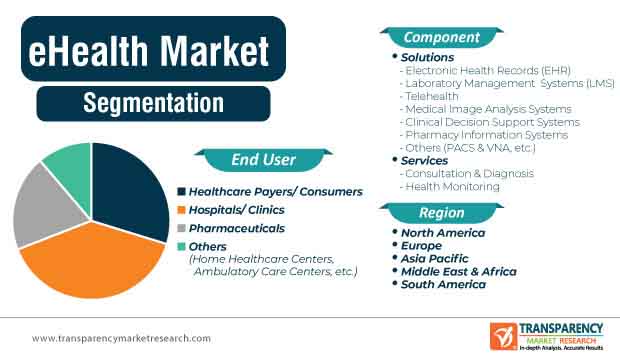

Innovations in the electronic health records (EHRs) domain are helping companies in the eHealth market to gain global recognition. For instance, IT service provider, the BITMARCK Group, has collaborated with Austrian firm RISE (Research Industrial Systems Engineering) to steer innovations in electronic patient records (EPR) by targeting the German healthcare systems. Electronic health records, being a part of solutions in the eHealth market, is predicted to generate the highest revenue as opposed to eHealth services during the forecast period.

Government organizations are scaling the extra mile to commission IT companies that are steering innovations in EHRs. Technical implementations of the EHR are being extended toward the health insurance companies, since insurance companies need to provide its insured persons with the records at the beginning of the year. Vendors in the eHealth market are increasing their capabilities to develop EHR mobile apps for the convenience of the insured persons.

The eHealth market is expected to reach a value of ~US$ 693 Bn by the end of 2030. However, the implementation of eHealth programs is significantly challenging for patients with chronic illnesses, as the gap between the healthcare system’s decision to adopt an eHealth program and its routine use in everyday processes is multifaceted and complex. Hence, companies in the eHealth market are warming up to the idea of adopting evidence-based health innovation programs to healthcare professionals in order to establish its routine practice.

IT companies are adopting various implementation strategies to increase the uptake of eHealth solutions, such as telehealth, laboratory management systems, and clinical decision support systems that increase productivity levels in healthcare facilities. Companies are achieving implementation success by providing training to healthcare professionals and healthcare payers about the follow-up during clinical interventions.

The progress of information communication technology (ICT) in China has fueled the adoption of eHealth and telemedicine in the country. This is evident since the Asia Pacific region is projected to take an estimated leap from a revenue share of ~22% in 2020 to ~28% by the end of 2030. On the other hand, a large number of African expat community residing in mainland China is experiencing health issues due to dissimilar environmental conditions in the country. Hence, the African expat community is resorting to the adoption of eHealth.

Chinese doctors are not well-trained in the culturally adapted care sector and this issue overlooks the betterment of the African expat community residing in China. Hence, companies in the eHealth market are tapping into incremental opportunities in China.

Companies in the eHealth market are augmenting the advantages of medical deep learning to predict potential risks of dementia and Parkinson’s disease in individuals. Several startups are gaining proficiency in medical artificial intelligence (AI) that helps to predict possible disease patterns in patients. As such the eHealth market is primarily dominated by emerging players who dictate ~75%-80% of the market stake. This has intensified competition in the global market landscape.

A research team at the Charité - Universitätsmedizin Berlin initiated its TrueBrainConnect research project with the help of the medical AI to investigate non-invasive connections between brain regions to detect mental illnesses at very early stages in patients. Hence, IT companies should collaborate with researchers and innovators to gain efficacy in early detection of mental illnesses that eliminate the need for surgical interventions.

Analysts’ Viewpoint

Countries in Europe are taking cues from Estonian doctors who are feeding information about new COVID-19 infections from laboratories to eHealth systems so that patients can gain quick access to data. Paid video consultations with the help of telemedicine is currently one of the booming industries in the eHealth market.

African expats in China are using eHealth programs to receive quality medical diagnosis from clinicians around the world. However, lack of regulations and policies pertaining to the implementation of eHealth is emerging as one of the biggest challenges for IT companies. Hence, companies should begin by increasing focus on the development of healthcare cards for individuals so that people can claim concessions in medicines and other medical services.

Allscripts Healthcare Solutions Inc.: Allscripts Healthcare Solutions Inc. delivers information technology solutions and services to help healthcare organizations achieve optimal clinical, financial, and operational results. The company’s solutions and services are sold to physicians, retail pharmacies, hospitals, pharmacy benefit managers, governments, insurance companies, health systems, employer wellness clinics, post-acute organizations, life-sciences companies, consumers, retail clinics, and lab companies.

Cerner Corporation: Cerner Corporation develops health information technology solutions for the healthcare sector. It is also a supplier of health information technology services, devices, and hardware. The company offers advance analytics solutions, population health management, clinical solutions, open & interoperable, and revenue cycle management solutions.

Epic Systems Corporation: Epic Systems Corporation is a healthcare IT solutions company, which develops and designs software for healthcare payers/consumers, hospitals/clinics, pharmaceuticals, etc. At present, more than 250 million patients have an electronic record in Epic and 100 million peoples are using Epic’s MyChart, to stay connected to care virtually. The company provides various solutions such as Patient Experience, Revenue Cycle, Telehealth, Population Health, Managed Care, etc.

Koninklijke Philips N.V.: Koninklijke Philips N.V. is a Dutch technology company that provides products across healthcare, lighting, and consumer electronics segments. Philips provides VitalHealth QuestLink, a cloud-based patient engagement solution, which supports patient reported outcomes and routine outcome monitoring. The company has sales and services in more than 100 countries.

1. Preface

1.1. Market Introduction

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Research Methodology

2.1.1. List of Primary and Secondary Sources

2.2. Key Assumptions for Data Modelling

3. Executive Summary - Global eHealth Market

4. Market Overview

4.1. Market Definition

4.2. Macroeconomic Factors

4.2.1. World GDP Indicator – For Top Economies

4.2.2. Global ICT Spending (US$ Bn)

4.3. Market Factor Analysis

4.3.1. Forecast Factors

4.3.2. Ecosystem/ Value Chain Analysis

4.3.3. Market Dynamics (Growth Influencers)

4.3.3.1. Drivers

4.3.3.2. Restraints

4.3.3.3. Opportunities

4.3.3.4. Impact Analysis of Drivers and Restraints

4.4. Market Opportunity Assessment – by Region (North America/ Europe/ Asia Pacific/ Middle East & Africa/ South America)

4.4.1. By Component

4.4.2. By End-user

4.5. Competitive Scenario and Trends

4.5.1. eHealth Market Concentration Rate

4.5.1.1. List of Emerging, Prominent and Leading Players

4.5.2. Mergers & Acquisitions, Expansions

4.6. Impact Analysis of COVID-19 on eHealth Market

4.6.1. End-user Sentiment Analysis: Comparative Analysis on Spending

4.6.1.1. Increase in Spending

4.6.1.2. Decrease in Spending

4.6.2. Short Term and Long Term Impact on the Market

4.7. Market Outlook

5. Global eHealth Market Analysis and Forecast

5.1.1. Market Revenue Analysis (US$ Bn) 2018-2030

5.1.1.1. Market Revenue (US$ Bn) Forecast, 2018-2030

5.1.1.2. Market Y-o-Y Growth (Value %), 2020-2030

6. Global eHealth Market Analysis, by Component

6.1. Definitions

6.2. Key Segment Analysis

6.3. eHealth Market Size (US$ Bn) Forecast, by Component, 2018-2030

6.3.1. Solutions

6.3.1.1. Electronic Health Records (EHR)

6.3.1.2. Laboratory Management Systems (LMS)

6.3.1.3. Telehealth

6.3.1.4. Medical Image Analysis Systems

6.3.1.5. Clinical Decision Support Systems

6.3.1.6. Pharmacy Information Systems

6.3.1.7. Others (PACS & VNA, etc.)

6.3.2. Services

6.3.2.1. Consultation & Diagnosis

6.3.2.2. Health Monitoring

7. Global eHealth Market Analysis, by End-user

7.1. Key Segment Analysis

7.2. eHealth Market Size (US$ Bn) Forecast, by End-user, 2018-2030

7.2.1. Healthcare Payers/ Consumers

7.2.2. Hospitals/ Clinics

7.2.3. Pharmaceuticals

7.2.4. Others (Home Healthcare Centers, Ambulatory Care Centers, etc.)

8. Global eHealth Market Analysis and Forecast, By Region

8.1. Key Findings

8.2. eHealth Market Size (US$ Bn) Forecast, by Region, 2018-2030

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. South America

9. North America eHealth Market Analysis

9.1. Regional Outlook

9.2. eHealth Market Size (US$ Bn) Analysis and Forecast (2018-2030)

9.2.1. By Component

9.2.2. By End-user

9.3. eHealth Market Size (US$ Bn) Forecast, by Country, 2018-2030

9.3.1. U.S.

9.3.2. Canada

9.3.3. Mexico

10. Europe eHealth Market Analysis and Forecast

10.1. Regional Outlook

10.2. eHealth Market Size (US$ Bn) Analysis and Forecast (2018-2030)

10.2.1. By Component

10.2.2. By End-user

10.3. eHealth Market Size (US$ Bn) Forecast, by Country & Sub-region, 2018-2030

10.3.1. Germany

10.3.2. U.K.

10.3.3. France

10.3.4. Italy

10.3.5. Rest of Europe

11. APAC eHealth Market Analysis and Forecast

11.1. Regional Outlook

11.2. eHealth Market Size (US$ Bn) Analysis and Forecast (2018-2030)

11.2.1. By Component

11.2.2. By End-user

11.3. eHealth Market Size (US$ Bn) Forecast, by Country & Sub-region, 2018-2030

11.3.1. China

11.3.2. India

11.3.3. Japan

11.3.4. ASEAN

11.3.5. Rest of Asia Pacific

12. Middle East & Africa (MEA) eHealth Market Analysis and Forecast

12.1. Regional Outlook

12.2. eHealth Market Size (US$ Bn) Analysis and Forecast (2018-2030)

12.2.1. By Component

12.2.2. By End-user

12.3. eHealth Market Size (US$ Bn) Forecast, by Country & Sub-region, 2018-2030

12.3.1. United Arab Emirates

12.3.2. South Africa

12.3.3. Rest of Middle East & Africa (MEA)

13. South America eHealth Market Analysis and Forecast

13.1. Regional Outlook

13.2. eHealth Market Size (US$ Bn) Analysis and Forecast (2018-2030)

13.2.1. By Component

13.2.2. By End-user

13.3. eHealth Market Size (US$ Bn) Forecast, by Country & Sub-region, 2018-2030

13.3.1. Brazil

13.3.2. Argentina

13.3.3. Rest of South America

14. Competition Landscape

14.1. Market Competition Matrix, by Leading Players

14.2. Market Revenue Share Analysis (%), by Leading Players (2019)

15. Company Profiles

15.1. AdvancedMD, Inc.

15.1.1. Company Description

15.1.2. Regional Presence

15.1.3. Strategic Overview

15.2. Allscript Healthcare Solution, Inc.

15.2.1. Company Description

15.2.2. Regional Presence

15.2.3. Revenue (US$ Mn) & Y-o-Y Growth (%), 2017-2019

15.2.4. Breakdown of Revenue, by Geography, 2019

15.2.5. Strategic Overview

15.3. AME International GmbH

15.3.1. Company Description

15.3.2. Regional Presence

15.3.3. Strategic Overview

15.4. athenahealth, Inc.

15.4.1. Company Description

15.4.2. Regional Presence

15.4.3. Strategic Overview

15.5. Cerner Corporation

15.5.1. Company Description

15.5.2. Regional Presence

15.5.3. Revenue (US$ Mn) & Y-o-Y Growth (%), 2017-2019

15.5.4. Breakdown of Revenue, by Geography, 2019

15.5.5. Strategic Overview

15.6. CGI Group Inc.

15.6.1. Company Description

15.6.2. Regional Presence

15.6.3. Revenue (US$ Mn) & Y-o-Y Growth (%), 2017-2019

15.6.4. Breakdown of Revenue, by Geography, 2019

15.6.5. Strategic Overview

15.7. Cisco Systems, Inc.

15.7.1. Company Description

15.7.2. Regional Presence

15.7.3. Revenue (US$ Mn) & Y-o-Y Growth (%), 2017-2019

15.7.4. Breakdown of Revenue, by Geography, 2019

15.7.5. Strategic Overview

15.8. Computer Programs and Systems, Inc.

15.8.1. Company Description

15.8.2. Regional Presence

15.8.3. Revenue (US$ Mn) & Y-o-Y Growth (%), 2017-2019

15.8.4. Breakdown of Revenue, by Geography, 2019

15.8.5. Strategic Overview

15.9. CureMD Healthcare

15.9.1. Company Description

15.9.2. Regional Presence

15.9.3. Strategic Overview

15.10. eClinicalWorks, LLC

15.10.1. Company Description

15.10.2. Regional Presence

15.10.3. Strategic Overview

15.11. Epic Systems Corporation

15.11.1. Company Description

15.11.2. Regional Presence

15.11.3. Strategic Overview

15.12. GE Healthcare Ltd

15.12.1. Company Description

15.12.2. Regional Presence

15.12.3. Revenue (US$ Mn) & Y-o-Y Growth (%), 2017-2019

15.12.4. Breakdown of Revenue, by Geography, 2019

15.12.5. Strategic Overview

15.13. Global Healthcare Exchange LLC

15.13.1. Company Description

15.13.2. Regional Presence

15.13.3. Strategic Overview

15.14. Greenway Health, LLC

15.14.1. Company Description

15.14.2. Regional Presence

15.14.3. Strategic Overview

15.15. IBM Corporation

15.15.1. Company Description

15.15.2. Regional Presence

15.15.3. Revenue (US$ Mn) & Y-o-Y Growth (%), 2017-2019

15.15.4. Breakdown of Revenue, by Geography, 2019

15.15.5. Strategic Overview

15.16. Koninklijke Philips N.V.

15.16.1. Company Description

15.16.2. Regional Presence

15.16.3. Revenue (US$ Mn) & Y-o-Y Growth (%), 2017-2019

15.16.4. Breakdown of Revenue, by Geography, 2019

15.16.5. Strategic Overview

15.17. McKesson Corporation

15.17.1. Company Description

15.17.2. Regional Presence

15.17.3. Revenue (US$ Mn) & Y-o-Y Growth (%), 2017-2019

15.17.4. Breakdown of Revenue, by Geography, 2019

15.17.5. Strategic Overview

15.18. MedeAnalytics, Inc.

15.18.1. Company Description

15.18.2. Regional Presence

15.18.3. Strategic Overview

15.19. Medical Information Technology, Inc.

15.19.1. Company Description

15.19.2. Regional Presence

15.19.3. Strategic Overview

15.20. NextGen Healthcare

15.20.1. Company Description

15.20.2. Regional Presence

15.20.3. Revenue (US$ Mn) & Y-o-Y Growth (%), 2017-2019

15.20.4. Breakdown of Revenue, by Business Portfolio, 2019

15.20.5. Strategic Overview

15.21. Novartis International AG CGI UK

15.21.1. Company Description

15.21.2. Regional Presence

15.21.3. Revenue (US$ Mn) & Y-o-Y Growth (%), 2017-2019

15.21.4. Breakdown of Revenue, by Geography, 2019

15.21.5. Strategic Overview

15.22. Oracle Corporation

15.22.1. Company Description

15.22.2. Regional Presence

15.22.3. Revenue (US$ Mn) & Y-o-Y Growth (%), 2017-2019

15.22.4. Breakdown of Revenue, by Geography, 2019

15.22.5. Strategic Overview

15.23. Pfizer Health Solutions Inc.

15.23.1. Company Description

15.23.2. Regional Presence

15.23.3. Revenue (US$ Mn) & Y-o-Y Growth (%), 2017-2019

15.23.4. Breakdown of Revenue, by Geography, 2019

15.23.5. Strategic Overview

15.24. Siemens AG

15.24.1. Company Description

15.24.2. Regional Presence

15.24.3. Revenue (US$ Mn) & Y-o-Y Growth (%), 2017-2019

15.24.4. Breakdown of Revenue, by Geography, 2019

15.24.5. Strategic Overview

16. Key Takeaways

List of Tables

Table 1: Mergers & Acquisitions, Expansions

Table 2: Mergers & Acquisitions, Expansions

Table 3: Global eHealth Market Size (US$ Bn) Forecast, By Component, 2018-2030

Table 4: Global eHealth Market Size (US$ Bn) Forecast, By Component by Solutions, 2018-2030

Table 5: Global eHealth Market Size (US$ Bn) Forecast, By End-user, 2018-2030

Table 6: Global Automatic Identification and Data Capture (AIDC) Market Size (US$ Bn) Forecast, By Region, 2018-2030

Table 7: North America eHealth Market Size (US$ Bn) Forecast, By Component, 2018-2030

Table 8: North America eHealth Market Size (US$ Bn) Forecast, By Component by Solutions, 2018-2030

Table 9: North America eHealth Market Size (US$ Bn) Forecast, By End-user, 2018-2030

Table 10: North America eHealth Market Size (US$ Bn) Forecast, By Country, 2018-2030

Table 11: Europe eHealth Market Size (US$ Bn) Forecast, By Component, 2018-2030

Table 12: Europe eHealth Market Size (US$ Bn) Forecast, By Component by Solutions, 2018-2030

Table 13: Europe eHealth Market Size (US$ Bn) Forecast, By End-user, 2018-2030

Table 14: Europe eHealth Market Size (US$ Bn) Forecast, By Country, 2018-2030

Table 15: Asia Pacific eHealth Market Size (US$ Bn) Forecast, By Component, 2018-2030

Table 16: Asia Pacific eHealth Market Size (US$ Bn) Forecast, By Component by Solutions, 2018-2030

Table 17: Asia Pacific eHealth Market Size (US$ Bn) Forecast, By End-user, 2018-2030

Table 18: Asia Pacific eHealth Market Size (US$ Bn) Forecast, By Country, 2018-2030

Table 19: Middle East & Africa eHealth Market Size (US$ Bn) Forecast, By Component, 2018-2030

Table 20: Middle East & Africa eHealth Market Size (US$ Bn) Forecast, By Component by Solutions, 2018-2030

Table 21: Middle East & Africa eHealth Market Size (US$ Bn) Forecast, By End-user, 2018-2030

Table 22: Middle East & Africa eHealth Market Size (US$ Bn) Forecast, By Country, 2018-2030

Table 23: South America eHealth Market Size (US$ Bn) Forecast, By Component, 2018-2030

Table 24: South America eHealth Market Size (US$ Bn) Forecast, By Component by Solutions, 2018-2030

Table 25: South America eHealth Market Size (US$ Bn) Forecast, By End-user, 2018-2030

Table 26: South America eHealth Market Size (US$ Bn) Forecast, By Country, 2018-2030

List of Figures

Figure 1: Global eHealth Market Size (US$ Bn) Forecast, 2018-2030

Figure 2: Global eHealth Market Revenue (US$ Bn) Opportunity Assessment, by Region, 2020E

Figure 3: Global eHealth Market Revenue (US$ Bn) Opportunity Assessment, by Region, 2030F

Figure 4: Top Segment Analysis

Figure 5: REGIONAL OUTLINE: CAGR %

Figure 6: GDP (US$ Bn), Top Countries (2014-2019)

Figure 7: Top Economies GDP Landscape, 2019

Figure 8: Global ICT Spending (US$ Bn) 2018-2030

Figure 9: Global ICT Spending (%), by Region, 2019

Figure 10: Global ICT Spending (US$ Bn), Regional Contribution, 2019

Figure 11: Global ICT Spending (US$ Bn), Spending Type Contribution, 2019

Figure 12: Global ICT Spending (%), by Type, 2019

Figure 13: Global eHealth Market Attractiveness Assessment, by Component

Figure 14: Global eHealth Market Relative Opportunity Assessment, by Component

Figure 15: Global eHealth Market Attractiveness Assessment, by End-user

Figure 16: Global eHealth Market Relative Opportunity Assessment, by End-user

Figure 17: Global eHealth Market Attractiveness Assessment, by Region

Figure 18: Global eHealth Market Relative Opportunity Assessment, by Region

Figure 19: Five Firm Concentration Ratio Analysis (2019)

Figure 20: Worldwide ICT Technology Spending YoY Trend

Figure 21: COVID-19 Impact on ICT Spending

Figure 22: End-user Sentiment Analysis: Comparative Analysis on Spending

Figure 23: Expansion of Telehealth During the COVID-19 Pandemic, by Age Group in U.S.

Figure 24: Global eHealth Market, by Component, CAGR (%) (2020-2030)

Figure 25: Global eHealth Market, by End-user, CAGR (%) (2020-2030)

Figure 26: Global eHealth Market, by Region, CAGR (%) (2020-2030)

Figure 27: Global eHealth Market Revenue (US$ Bn) Forecast, 2018 – 2030

Figure 28: Global eHealth Market Y-o-Y Growth (Value %), 2019 - 2030

Figure 29: Global eHealth Market Share Analysis, By Component (2020)

Figure 30: Global eHealth Market Share Analysis, By Component (2030)

Figure 31: Global eHealth Market Share Analysis, By End-user (2020)

Figure 32: Global eHealth Market Share Analysis, By End-user (2030)

Figure 33: Global eHealth Market Share Analysis, By Region (2020)

Figure 34: Global eHealth Market Share Analysis, By Region (2030)

Figure 35: North America eHealth Market Share Analysis, By Component (2020)

Figure 36: North America eHealth Market Share Analysis, By Component (2030)

Figure 37: North America eHealth Market Share Analysis, By End-user (2020)

Figure 38: North America eHealth Market Share Analysis, By End-user (2030)

Figure 39: North America eHealth Market Share Analysis, By Country (2020)

Figure 40: North America eHealth Market Share Analysis, By Country (2030)

Figure 41: Europe eHealth Market Share Analysis, By Component (2020)

Figure 42: Europe eHealth Market Share Analysis, By Component (2030)

Figure 43: Europe eHealth Market Share Analysis, By End-user (2020)

Figure 44: Europe eHealth Market Share Analysis, By End-user (2030)

Figure 45: Europe eHealth Market Share Analysis, By Country (2020)

Figure 46: Europe eHealth Market Share Analysis, By Country (2030)

Figure 47: Asia Pacific eHealth Market Share Analysis, By Component (2020)

Figure 48: Asia Pacific eHealth Market Share Analysis, By Component (2030)

Figure 49: Asia Pacific eHealth Market Share Analysis, By End-user (2020)

Figure 50: Asia Pacific eHealth Market Share Analysis, By End-user (2030)

Figure 51: Asia Pacific eHealth Market Share Analysis, By Country (2020)

Figure 52: Asia Pacific eHealth Market Share Analysis, By Country (2030)

Figure 53: Middle East & Africa eHealth Market Share Analysis, By Component (2020)

Figure 54: Middle East & Africa eHealth Market Share Analysis, By Component (2030)

Figure 55: Middle East & Africa eHealth Market Share Analysis, By End-user (2020)

Figure 56: Middle East & Africa eHealth Market Share Analysis, By End-user (2030)

Figure 57: Middle East & Africa eHealth Market Share Analysis, By Country (2020)

Figure 58: Middle East & Africa eHealth Market Share Analysis, By Country (2030)

Figure 59: South America eHealth Market Share Analysis, By Component (2020)

Figure 60: South America eHealth Market Share Analysis, By Component (2030)

Figure 61: South America eHealth Market Share Analysis, By End-user (2020)

Figure 62: South America eHealth Market Share Analysis, By End-user (2030)

Figure 63: South eHealth Market Share Analysis, By Country (2020)

Figure 64: South America eHealth Market Share Analysis, By Country (2030)

Figure 65: Revenue (US$ Mn) & Y-o-Y Growth (%), 2017-2019

Figure 66: Breakdown of Revenue, by Geography, 2019

Figure 67: Revenue (US$ Mn) & Y-o-Y Growth (%), 2017-2019

Figure 68: Breakdown of Revenue, by Geography, 2019

Figure 69: Revenue (US$ Mn) & Y-o-Y Growth (%), 2017-2019

Figure 70: Breakdown of Revenue, by Geography, 2019

Figure 71: Revenue (US$ Mn) & Y-o-Y Growth (%), 2017-2019

Figure 72: Breakdown of Revenue, by Geography, 2019

Figure 73: Revenue (US$ Mn) & Y-o-Y Growth (%), 2017-2019

Figure 74: Breakdown of Revenue, by Geography, 2019

Figure 75: Revenue (US$ Mn) & Y-o-Y Growth (%), 2017-2019

Figure 76: Breakdown of Revenue, by Geography, 2019

Figure 77: Revenue (US$ Mn) & Y-o-Y Growth (%), 2017-2019

Figure 78: Breakdown of Revenue, by Geography, 2019

Figure 79: Revenue (US$ Mn) & Y-o-Y Growth (%), 2017-2019

Figure 80: Breakdown of Revenue, by Geography, 2019

Figure 81: Revenue (US$ Mn) & Y-o-Y Growth (%), 2017-2019

Figure 82: Breakdown of Revenue, by Geography, 2019

Figure 83: Revenue (US$ Mn) & Y-o-Y Growth (%), 2017-2019

Figure 84: Breakdown of Revenue, by Business Portfolio, 2019

Figure 85: Revenue (US$ Mn) & Y-o-Y Growth (%), 2017-2019

Figure 86: Breakdown of Revenue, by Geography, 2019

Figure 87: Revenue (US$ Mn) & Y-o-Y Growth (%), 2017-2019

Figure 88: Breakdown of Revenue, by Geography, 2019

Figure 89: Revenue (US$ Mn) & Y-o-Y Growth (%), 2017-2019

Figure 90: Breakdown of Revenue, by Geography, 2019

Figure 91: Revenue (US$ Mn) & Y-o-Y Growth (%), 2017-2019

Figure 92: Breakdown of Revenue, by Geography, 2019