Reports

Reports

Analyst Viewpoint

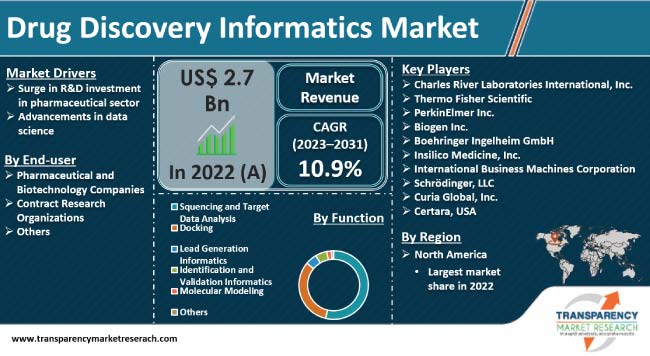

Surge in R&D investment in the pharmaceutical sector is a key factor that is fostering drug discovery informatics market development. Data-driven software and techniques offer assistance to researchers by optimizing the drug design and development process. They help in pre-clinical research, drug target identification, and prediction of drug resistance and side effects. Advancements in data science such as sophisticated data analytics and machine learning tools are also propelling drug discovery informatics industry size.

Critical research of conventional methods of drug development makes up for the majority of the R&D expenditure of big pharmaceutical firms. Prominent players in the global drug discovery informatics market are investing significantly in AI-driven drug discovery innovations. They are also using novel data-driven tools for digital transformation of the healthcare sector.

Drug discovery informatics entails the adoption of information technology to assist researchers in drug discovery and creation process. The process requires the usage of computational methods and tools such as Artificial Intelligence and advanced software to analyze large sets of biochemical data in order to identify possible drug candidates.

Drug discovery is a time and resource-draining initiative that involves isolating and fostering a compound that shows signs of treating an infection in a meaningful way A developed drug has to further meet strict health and safety regulations to be deemed safe and adequate for administration.

Individual bioinformatics tools and databases are constantly being updated to allow for the optimization of the drug discovery process, as vast sets of biological, chemical, and toxicological data can be analyzed to assist in novel drug development.

Pharmaceutical companies rely on data-driven informatics software to assist them in pre-clinical research, lead identification, and compound screening. They use this data to identify patterns, test theories, and understand the efficacy of treatments. Companies are investing significantly in R&D cycle of new drugs.

According to a report by Evaluate Pharma, the top 11 pharma firms globally invested more than US$ 104.0 Bn on R&D in 2022, accounting for 42% of total pharma research spending worldwide.

Surge in spending on R&D with long-term strategic aims helps build a foundation for the integration of public data with internal datasets and frameworks. It also allows for machine learning and artificial intelligence to train on well-managed datasets and help in standardization and centralization of sensitive information for better results.

As per the Information Technology & Innovation Foundation of the U.S., advancements in data science are likely to enable pharmaceutical companies to save about US$ 5.4 Bn in R&D costs each year. These developments are fostering the drug discovery informatics market value.

Integration of innovative data analytics, machine learning algorithms, and artificial intelligence (AI) substantially improves the drug discovery process. These tools enhance efficiency, identify patterns, and assist researchers in making data-driven decisions to reduce strain on both time and capital.

As per Stanford University’s 2021 Artificial Intelligence Index, the capital invested in AI-powered drug discovery stood at US$ 13.8 Bn in 2020.

Big data and AI contribute to the exploration of drug therapeutics from several perspectives such as genomics and pathways. They also facilitate molecular simulation and predictive modeling of active drug action, thus improving the chances of cataloging side effects and potential obstacles in development.

The inclusion of Artificial Intelligence and data analytics in drug manufacturing opens the pathway for personalized medicine and accelerates the time it takes for the said drugs to reach the market.

According to a recent drug discovery informatics market analysis, North America accounted for the largest share of the global landscape in 2022. Presence of a well-developed healthcare sector, rise in awareness about drug testing, and R&D of progressive drug discovery solutions are augmenting the market dynamics of the region.

As per the American Journal of Health-System Pharmacy, pharmaceutical expenditure in the U.S. reached a record US$ 535.3 Bn in 2020.

According to the latest drug discovery informatics market regional insights, Asia Pacific is a lucrative region for drug discovery informatics, led by the expansion of pharmacology and biotechnology industries and rise in awareness about indigenous drug development in various countries in the region.

As per Invest India, 62% of the global vaccine demand is met by India, making it the largest vaccine provider.

According to recent drug discovery informatics market trends, prominent manufacturers are investing substantially in the development of pharmaceutical informatics and computational drug discovery technologies.

They are carrying out advancements in conventional drug testing to resolve critical issues for both patients and healthcare workers.

Charles River Laboratories International, Inc., Thermo Fisher Scientific, PerkinElmer Inc., Biogen Inc., Boehringer Ingelheim GmbH, Insilico Medicine, Inc., International Business Machines Corporation, Schrödinger, LLC, Curia Global, Inc., Certara, USA are key firms that account for significant drug discovery informatics market share.

The drug discovery informatics market report highlights the leading companies in the global landscape in terms of parameters such as company overview, business strategies, product portfolio, financial overview, and business segments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 2.7 Bn |

| Market Forecast Value in 2031 | US$ 6.8 Bn |

| Growth Rate (CAGR) | 10.9% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Regions Covered |

|

| Countries Covered |

|

| Market Segmentation |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 2.7 Bn in 2022

It is projected to advance at a CAGR of 10.9% from 2023 to 2031

Surge in R&D investment in the pharmaceutical sector and advancements in data science

The sequencing and target data analysis function segment constituted the largest share in 2022

North America was the leading region in 2022

Charles River Laboratories International, Inc., Thermo Fisher Scientific, PerkinElmer Inc., Biogen Inc., Boehringer Ingelheim GmbH, Insilico Medicine, Inc., International Business Machines Corporation, Schrödinger, LLC, Curia Global, Inc., Certara, USA

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Drug Discovery Informatics Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Drug Discovery Informatics Market Analysis and Forecast, 2023-2031

5. Key Insights

5.1. Pipeline Analysis

5.2. Key Product/Brand Analysis

5.3. Key Mergers & Acquisitions

5.4. COVID-19 Pandemic Impact on Industry

6. Global Drug Discovery Informatics Market Analysis and Forecast, by Product

6.1. Introduction and Definitions

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product, 2017–2031

6.3.1. Discovery Informatics

6.3.2. Development Informatics

6.4. Market Attractiveness, by Product

7. Global Drug Discovery Informatics Market Analysis and Forecast, by Mode

7.1. Introduction and Definitions

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Mode, 2017–2031

7.3.1. In-house Informatics

7.3.2. Outsourced Informatics

7.4. Market Attractiveness, by Mode

8. Global Drug Discovery Informatics Market Analysis and Forecast, by Function

8.1. Introduction and Definitions

8.2. Key Findings/Developments

8.3. Market Value Forecast, by Function, 2017–2031

8.3.1. Sequencing and Target Data Analysis

8.3.2. Docking

8.3.3. Lead Generation Informatics

8.3.4. Identification and Validation Informatics

8.3.5. Molecular Modeling

8.3.6. Others

8.4. Market Attractiveness, by Function

9. Global Drug Discovery Informatics Market Analysis and Forecast, by End-user

9.1. Introduction and Definitions

9.2. Key Findings/Developments

9.3. Market Value Forecast, by End-user, 2017–2031

9.3.1. Pharmaceutical and Biotechnology Companies

9.3.2. Contract Research Organizations

9.3.3. Others

9.4. Market Attractiveness, by End-user

10. Global Drug Discovery Informatics Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Market Value Forecast, by Region, 2017–2031

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness, by Region

11. North America Drug Discovery Informatics Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2017–2031

11.2.1. Discovery Informatics

11.2.2. Development Informatics

11.3. Market Attractiveness, by Product

11.4. Market Value Forecast, by Mode, 2017–2031

11.4.1. In-house Informatics

11.4.2. Outsourced Informatics

11.5. Market Attractiveness, by Mode

11.6. Market Value Forecast, by Function, 2017–2031

11.6.1. Sequencing and Target Data Analysis

11.6.2. Docking

11.6.3. Lead Generation Informatics

11.6.4. Identification and Validation Informatics

11.6.5. Molecular Modeling

11.6.6. Others

11.7. Market Attractiveness, by Function

11.8. Market Value Forecast, by End-user

11.8.1. Pharmaceutical and Biotechnology Companies

11.8.2. Contract Research Organizations

11.8.3. Others

11.9. Market Attractiveness, by End-user

11.10. Market Value Forecast, by Country/Sub-region, 2017–2031

11.10.1. U.S.

11.10.2. Canada

11.11. Market Attractiveness Analysis

11.11.1. By Product

11.11.2. By Mode

11.11.3. By Function

11.11.4. By End-user

11.11.5. By Country

12. Europe Drug Discovery Informatics Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2017–2031

12.2.1. Discovery Informatics

12.2.2. Development Informatics

12.3. Market Attractiveness, by Product

12.4. Market Value Forecast, by Mode, 2017–2031

12.4.1. In-house Informatics

12.4.2. Outsourced Informatics

12.5. Market Attractiveness, by Mode

12.6. Market Value Forecast, by Function, 2017–2031

12.6.1. Sequencing and Target Data Analysis

12.6.2. Docking

12.6.3. Lead Generation Informatics

12.6.4. Identification and Validation Informatics

12.6.5. Molecular Modeling

12.6.6. Others

12.7. Market Attractiveness, by Function

12.8. Market Value Forecast, by End-user, 2017–2031

12.8.1. Pharmaceutical and Biotechnology Companies

12.8.2. Contract Research Organizations

12.8.3. Others

12.9. Market Attractiveness, by End-user

12.10. Market Value Forecast, by Country/Sub-region, 2017–2031

12.10.1. Germany

12.10.2. U.K.

12.10.3. France

12.10.4. Italy

12.10.5. Spain

12.10.6. Rest of Europe

12.11. Market Attractiveness Analysis

12.11.1. By Product

12.11.2. By Mode

12.11.3. By Function

12.11.4. By End-user

12.11.5. By Country/Sub-region

13. Asia Pacific Drug Discovery Informatics Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2017–2031

13.2.1. Discovery Informatics

13.2.2. Development Informatics

13.3. Market Attractiveness, by Product

13.4. Market Value Forecast, by Mode, 2017–2031

13.4.1. In-house Informatics

13.4.2. Outsourced Informatics

13.5. Market Attractiveness, by Mode

13.6. Market Value Forecast, by Function, 2017–2031

13.6.1. Sequencing and Target Data Analysis

13.6.2. Docking

13.6.3. Lead Generation Informatics

13.6.4. Identification and Validation Informatics

13.6.5. Molecular Modeling

13.6.6. Others

13.7. Market Attractiveness, by Function

13.8. Market Value Forecast, by End-user, 2017–2031

13.8.1. Pharmaceutical and Biotechnology Companies

13.8.2. Contract Research Organizations

13.8.3. Others

13.9. Market Attractiveness, by End-user

13.10. Market Value Forecast, by Country/Sub-region, 2017–2031

13.10.1. China

13.10.2. Japan

13.10.3. India

13.10.4. Australia & New Zealand

13.10.5. Rest of Asia Pacific

13.11. Market Attractiveness Analysis

13.11.1. By Product

13.11.2. By Mode

13.11.3. By Function

13.11.4. By End-user

13.11.5. By Country/Sub-region

14. Latin America Drug Discovery Informatics Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product, 2017–2031

14.2.1. Discovery Informatics

14.2.2. Development Informatics

14.3. Market Attractiveness, by Product

14.4. Market Value Forecast, by Mode, 2017–2031

14.4.1. In-house Informatics

14.4.2. Outsourced Informatics

14.5. Market Attractiveness, by Mode

14.6. Market Value Forecast, by Function, 2017–2031

14.6.1. Sequencing and Target Data Analysis

14.6.2. Docking

14.6.3. Lead Generation Informatics

14.6.4. Identification and Validation Informatics

14.6.5. Molecular Modeling

14.6.6. Others

14.7. Market Attractiveness, by Function

14.8. Market Value Forecast, by End-user, 2017–2031

14.8.1. Pharmaceutical and Biotechnology Companies

14.8.2. Contract Research Organizations

14.8.3. Others

14.9. Market Attractiveness, by End-user

14.10. Market Value Forecast, by Country/Sub-region, 2017–2031

14.10.1. Brazil

14.10.2. Mexico

14.10.3. Rest of Latin America

14.11. Market Attractiveness Analysis

14.11.1. By Product

14.11.2. By Mode

14.11.3. By Function

14.11.4. By End-user

14.11.5. By Country/Sub-region

15. Middle East & Africa Drug Discovery Informatics Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Product, 2017–2031

15.2.1. Discovery Informatics

15.2.2. Development Informatics

15.3. Market Attractiveness, by Product

15.4. Market Value Forecast, by Mode, 2017–2031

15.4.1. In-house Informatics

15.4.2. Outsourced Informatics

15.5. Market Attractiveness, by Mode

15.6. Market Value Forecast, by Function, 2017–2031

15.6.1. Sequencing and Target Data Analysis

15.6.2. Docking

15.6.3. Lead Generation Informatics

15.6.4. Identification and Validation Informatics

15.6.5. Molecular Modeling

15.6.6. Others

15.7. Market Attractiveness, by Function

15.8. Market Value Forecast, by End-user, 2017–2031

15.8.1. Pharmaceutical and Biotechnology Companies

15.8.2. Contract Research Organizations

15.8.3. Others

15.9. Market Attractiveness, by End-user

15.10. Market Value Forecast, by Country/Sub-region, 2017–2031

15.10.1. GCC Countries

15.10.2. South Africa

15.10.3. Rest of Middle East & Africa

15.11. Market Attractiveness Analysis

15.11.1. By Product

15.11.2. By Mode

15.11.3. By Function

15.11.4. By End-user

15.11.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player – Competition Matrix (By Tier and Size of Companies)

16.2. Market Share Analysis, by Company (2022)

16.3. Company Profiles

16.3.1. Charles River Laboratories International, Inc.

16.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.1.2. Product Portfolio

16.3.1.3. Financial Overview

16.3.1.4. SWOT Analysis

16.3.1.5. Strategic Overview

16.3.2. Thermo Fisher Scientific

16.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.2.2. Product Portfolio

16.3.2.3. Financial Overview

16.3.2.4. SWOT Analysis

16.3.2.5. Strategic Overview

16.3.3. PerkinElmer Inc.

16.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.3.2. Product Portfolio

16.3.3.3. Financial Overview

16.3.3.4. SWOT Analysis

16.3.3.5. Strategic Overview

16.3.4. Biogen Inc.

16.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.4.2. Product Portfolio

16.3.4.3. Financial Overview

16.3.4.4. SWOT Analysis

16.3.4.5. Strategic Overview

16.3.5. Boehringer Ingelheim GmbH

16.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.5.2. Product Portfolio

16.3.5.3. Financial Overview

16.3.5.4. SWOT Analysis

16.3.5.5. Strategic Overview

16.3.6. Insilico Medicine, Inc.

16.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.6.2. Product Portfolio

16.3.6.3. Financial Overview

16.3.6.4. SWOT Analysis

16.3.6.5. Strategic Overview

16.3.7. International Business Machines Corporation

16.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.7.2. Product Portfolio

16.3.7.3. Financial Overview

16.3.7.4. SWOT Analysis

16.3.7.5. Strategic Overview

16.3.8. Schrödinger, LLC

16.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.8.2. Product Portfolio

16.3.8.3. Financial Overview

16.3.8.4. SWOT Analysis

16.3.8.5. Strategic Overview

16.3.9. Curia Global, Inc.

16.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.9.2. Product Portfolio

16.3.9.3. Financial Overview

16.3.9.4. SWOT Analysis

16.3.9.5. Strategic Overview

16.3.10. Certara, USA

16.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.10.2. Product Portfolio

16.3.10.3. Financial Overview

16.3.10.4. SWOT Analysis

16.3.10.5. Strategic Overview

List of Tables

Table 01: Global Drug Discovery Informatics Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 02: Global Drug Discovery Informatics Market Size (US$ Mn) Forecast, by Mode, 2017–2031

Table 03: Global Drug Discovery Informatics Market Size (US$ Mn) Forecast, by Function, 2017–2031

Table 04: Global Drug Discovery Informatics Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 05: Global Drug Discovery Informatics Market Size (US$ Mn) Forecast, by Region, 2017–2031

Table 06: North America Drug Discovery Informatics Market Size (US$ Mn) Forecast, by Country, 2017–2031

Table 07: North America Drug Discovery Informatics Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 08: North America Drug Discovery Informatics Market Size (US$ Mn) Forecast, by Mode, 2017–2031

Table 09: North America Drug Discovery Informatics Market Size (US$ Mn) Forecast, by Function, 2017–2031

Table 10: North America Drug Discovery Informatics Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 11: Europe Drug Discovery Informatics Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 12: Europe Drug Discovery Informatics Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 13: Europe Drug Discovery Informatics Market Size (US$ Mn) Forecast, by Mode, 2017–2031

Table 14: Europe Drug Discovery Informatics Market Size (US$ Mn) Forecast, by Function, 2017–2031

Table 15: Europe Drug Discovery Informatics Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 16: Asia Pacific Drug Discovery Informatics Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 17: Asia Pacific Drug Discovery Informatics Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 18: Asia Pacific Drug Discovery Informatics Market Size (US$ Mn) Forecast, by Mode, 2017–2031

Table 19: Asia Pacific Drug Discovery Informatics Market Size (US$ Mn) Forecast, by Function, 2017–2031

Table 20: Asia Pacific Drug Discovery Informatics Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 21: Latin America Drug Discovery Informatics Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Latin America Drug Discovery Informatics Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 23: Latin America Drug Discovery Informatics Market Size (US$ Mn) Forecast, by Mode, 2017–2031

Table 24: Latin America Drug Discovery Informatics Market Size (US$ Mn) Forecast, by Function, 2017–2031

Table 25: Latin America Drug Discovery Informatics Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 26: Middle East & Africa Drug Discovery Informatics Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 27: Middle East & Africa Drug Discovery Informatics Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 28: Middle East & Africa Drug Discovery Informatics Market Size (US$ Mn) Forecast, by Mode, 2017–2031

Table 29: Middle East & Africa Drug Discovery Informatics Market Size (US$ Mn) Forecast, by Function, 2017–2031

Table 30: Middle East & Africa Drug Discovery Informatics Market Size (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Drug Discovery Informatics Market Size (US$ Mn) and Distribution (%), by Region, 2022 and 2031

Figure 02: Global Drug Discovery Informatics Market Revenue (US$ Mn), by Product, 2022

Figure 03: Global Drug Discovery Informatics Market Value Share, by Product, 2022

Figure 04: Global Drug Discovery Informatics Market Revenue (US$ Mn), by Mode, 2022

Figure 05: Global Drug Discovery Informatics Market Value Share, by Mode, 2022

Figure 06: Global Drug Discovery Informatics Market Revenue (US$ Mn), by Function, 2022

Figure 07: Global Drug Discovery Informatics Market Value Share, by Function, 2022

Figure 08: Global Drug Discovery Informatics Market Value Share, by End-user, 2022

Figure 09: Global Drug Discovery Informatics Market Value Share, by End-user, 2022

Figure 10: Global Drug Discovery Informatics Market Value Share, by Region, 2022

Figure 11: Global Drug Discovery Informatics Market Value (US$ Mn) Forecast, 2017–2031

Figure 12: Global Drug Discovery Informatics Market Value Share Analysis, by Product, 2022 and 2031

Figure 13: Global Drug Discovery Informatics Market Attractiveness Analysis, by Product, 2023-2031

Figure 14: Global Drug Discovery Informatics Market Value Share Analysis, by Mode, 2022 and 2031

Figure 15: Global Drug Discovery Informatics Market Attractiveness Analysis, by Mode, 2023-2031

Figure 16: Global Drug Discovery Informatics Market Value Share Analysis, by Function, 2022 and 2031

Figure 17: Global Drug Discovery Informatics Market Attractiveness Analysis, by Function, 2023-2031

Figure 18: Global Drug Discovery Informatics Market Revenue (US$ Mn), by End-user, 2022

Figure 19: Global Drug Discovery Informatics Market Value Share, by End-user, 2022

Figure 20: Global Drug Discovery Informatics Market Value Share Analysis, by Region, 2022 and 2031

Figure 21: Global Drug Discovery Informatics Market Attractiveness Analysis, by Region, 2023-2031

Figure 22: North America Drug Discovery Informatics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 23: North America Drug Discovery Informatics Market Attractiveness Analysis, by Country, 2023–2031

Figure 24: North America Drug Discovery Informatics Market Value Share Analysis, by Country, 2022 and 2031

Figure 25: North America Drug Discovery Informatics Market Value Share Analysis, by Product, 2022 and 2031

Figure 26: North America Drug Discovery Informatics Market Value Share Analysis, by Mode, 2022 and 2031

Figure 27: North America Drug Discovery Informatics Market Value Share Analysis, by Function, 2022 and 2031

Figure 28: North America Drug Discovery Informatics Market Value Share Analysis, by End-user, 2022 and 2031

Figure 29: North America Drug Discovery Informatics Market Attractiveness Analysis, by Product, 2023–2031

Figure 30: North America Drug Discovery Informatics Market Attractiveness Analysis, by Mode, 2023–2031

Figure 31: North America Drug Discovery Informatics Market Attractiveness Analysis, by Function, 2023–2031

Figure 32: North America Drug Discovery Informatics Market Attractiveness Analysis, by End-user, 2023–2031

Figure 33: Europe Drug Discovery Informatics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 34: Europe Drug Discovery Informatics Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 35: Europe Drug Discovery Informatics Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 36: Europe Drug Discovery Informatics Market Value Share Analysis, by Product, 2022 and 2031

Figure 37: Europe Drug Discovery Informatics Market Value Share Analysis, by Mode, 2022 and 2031

Figure 38: Europe Drug Discovery Informatics Market Value Share Analysis, by Function, 2022 and 2031

Figure 39: Europe Drug Discovery Informatics Market Value Share Analysis, by End-user, 2022 and 2031

Figure 40: Europe Drug Discovery Informatics Market Attractiveness Analysis, by Product, 2023–2031

Figure 41: Europe Drug Discovery Informatics Market Attractiveness Analysis, by Mode, 2023–2031

Figure 42: Europe Drug Discovery Informatics Market Attractiveness Analysis, by Function, 2023–2031

Figure 43: Europe Drug Discovery Informatics Market Attractiveness Analysis, by End-user, 2023–2031

Figure 44: Asia Pacific Drug Discovery Informatics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2023–2031

Figure 45: Asia Pacific Drug Discovery Informatics Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 46: Asia Pacific Drug Discovery Informatics Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 47: Asia Pacific Drug Discovery Informatics Market Value Share Analysis, by Product, 2022 and 2031

Figure 48: Asia Pacific Drug Discovery Informatics Market Value Share Analysis, by Mode, 2022 and 2031

Figure 49: Asia Pacific Drug Discovery Informatics Market Value Share Analysis, by Function, 2022 and 2031

Figure 50: Asia Pacific Drug Discovery Informatics Market Value Share Analysis, by End-user, 2022 and 2031

Figure 51: Asia Pacific Drug Discovery Informatics Market Attractiveness Analysis, by Product, 2017–2031

Figure 52: Asia Pacific Drug Discovery Informatics Market Attractiveness Analysis, by Mode, 2023–2031

Figure 53: Asia Pacific Drug Discovery Informatics Market Attractiveness Analysis, by Function, 2023–2031

Figure 54: Asia Pacific Drug Discovery Informatics Market Attractiveness Analysis, by End-user, 2023–2031

Figure 55: Latin America Drug Discovery Informatics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 56: Latin America Drug Discovery Informatics Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 57: Latin America Drug Discovery Informatics Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 58: Latin America Drug Discovery Informatics Market Value Share Analysis, by Product, 2022 and 2031

Figure 59: Latin America Drug Discovery Informatics Market Value Share Analysis, by Mode, 2022 and 2031

Figure 60: Latin America Drug Discovery Informatics Market Value Share Analysis, by Function, 2022 and 2031

Figure 61: Latin America Drug Discovery Informatics Market Value Share Analysis, by End-user, 2022 and 2031

Figure 62: Latin America Drug Discovery Informatics Market Attractiveness Analysis, by Product, 2023–2031

Figure 63: Latin America Drug Discovery Informatics Market Attractiveness Analysis, by Mode, 2023–2031

Figure 64: Latin America Drug Discovery Informatics Market Attractiveness Analysis, by Function, 2023–2031

Figure 65: Latin America Drug Discovery Informatics Market Attractiveness Analysis, by End-user, 2023–2031

Figure 66: Middle East & Africa Drug Discovery Informatics Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 67: Middle East & Africa Drug Discovery Informatics Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 68: Middle East & Africa Drug Discovery Informatics Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 69: Middle East & Africa Drug Discovery Informatics Market Value Share Analysis, by Product, 2022 and 2031

Figure 70: Middle East & Africa Drug Discovery Informatics Market Value Share Analysis, by Mode, 2022 and 2031

Figure 71: Middle East & Africa Drug Discovery Informatics Market Value Share Analysis, by Function, 2022 and 2031

Figure 72: Middle East & Africa Drug Discovery Informatics Market Value Share Analysis, by End-user, 2022 and 2031

Figure 73: Middle East & Africa Drug Discovery Informatics Market Attractiveness Analysis, by Product, 2023–2031

Figure 74: Middle East & Africa Drug Discovery Informatics Market Attractiveness Analysis, by Mode, 2023–2031

Figure 75: Middle East & Africa Drug Discovery Informatics Market Attractiveness Analysis, by Function, 2023–2031

Figure 76: Middle East & Africa Drug Discovery Informatics Market Attractiveness Analysis, by End-user, 2023–2031