Reports

Reports

Broadcast infrastructure is arguably one of the most essential aspects of on-air presentation, and at present, broadcasters are seeking cost-effective solutions to improve their efficiency and overall output. The significant rise in the popularity of over-the-top (OTT) video streaming services, along with ascending Internet penetration, worldwide, is likely to aid the growth of the broadcast infrastructure market in the near future. Owing to remarkable advancements in technology over the past decade, viewers seek the flexibility of viewing content from any location, on any device, and at any given time. Key participants in the market are thus focusing on providing high-quality content across various networks, including digital terrestrial television (DTT) and broadband.

In their quest toward attaining commercial flexibility and agility, market players are developing new solutions in conjunction with the existing ones. This approach has paved the way for infrastructure duplication, isolated systems, and various other operational characteristics. However, at the back of these developments, players in the broadcast infrastructure market have expressed that operational costs are on the rise, and a sustainable delivery model is the need of the hour.

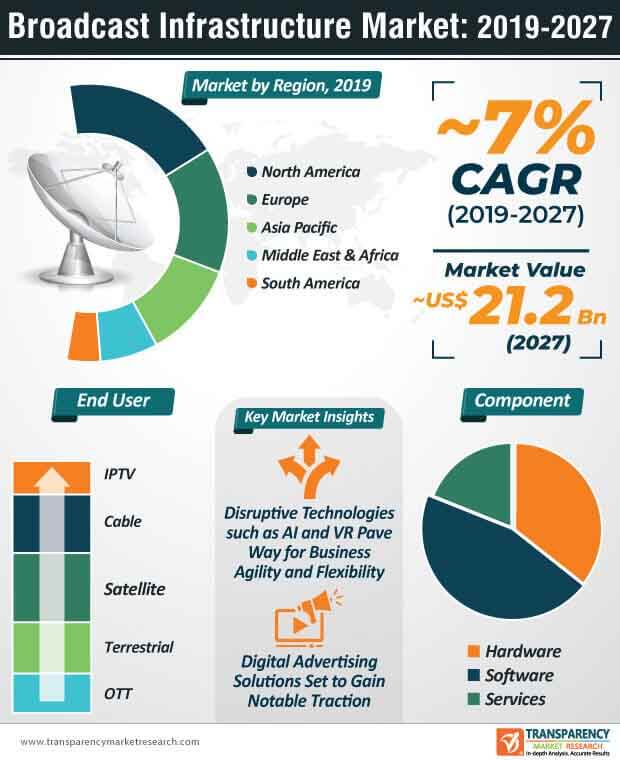

TMR predicts that, the broadcast infrastructure market will grow at a decent CAGR of ~7% from 2019 to 2027, expanding 1.75X by the end of the said period.

The onset of fresh video formats has played a key role in improving the adoption of IP technology in the last few years. Established market participants are currently exploring the potential benefits of this technology to overcome the barriers put forward by existing content delivery models. The integration of IP technology will not only allow broadcasters to provide high-quality video formats but also assist them with remote production and content delivery. For instance, by adopting IP technology, broadcasters at Wimbledon could use any signal from any court without a different routing infrastructure. The adoption of IP technology within broadcast companies is expected to grow at the back of the entry of SMPTE 2110 into the market. SMPTE 2110 is a major step in moving broadcast production toward IP, and will enable broadcasters to adopt a flexible workflow, as they can efficiently differentiate audio, video, and ancillary data.

Industry experts are of the opinion that, the adoption of IP technology is one of the most disruptive trends within the broadcast infrastructure market sector. However, despite the numerous benefits of this technology, at present, only a few media companies are completely relying on IP, as the inclination toward selective dissemination of information (SDI) infrastructure still remains high. As broadcasters continue to recognize the potential of IP, significant uptake of this technology is expected in the next five years. With broadcast infrastructure swaying toward IP and cloud, media companies and broadcasters are expected to invest in cybersecurity to fend off hackers.

In the current day and age, video consumption patterns have witnessed a drastic change, worldwide. To stay relevant in the market, broadcast companies are gradually leaning away from conventional platforms and embracing cutting-edge solutions such as cloud technologies. At present, video on demand (VOD) is predominant in the broadcasting sphere – a trend that is expected to continue in the foreseeable future, as traditional TV viewing continues to take a hit. Steep pricing models, inconsistent broadcast schedules, and lack of flexibility in terms of access are some of the leading factors that have propelled the demand for online broadcasting. Further, conventional processes that are deployed to encode, capture, archive, and distribute video require very high investments in hardware equipment. Production teams are thus moving away from legacy broadcast hardware solutions toward agile and scalable software solutions in the cloud.

These discrepancies in traditional video broadcasting have significantly increased the adoption of cloud-based video solutions that provide the desired levels of speed and flexibility to broadcasters. Industry-grade cloud solutions are designed to tackle redundancy, and broadcasters can deploy their custom-built broadcasting infrastructure across various data centers and regions. Cloud-based solutions enable broadcasters to integrate their services with various software as a service (SaaS) platforms. Owing to the benefits offered by cloud-based technologies, players operating in the broadcast infrastructure market are gradually moving away from conventional broadcasting infrastructure techniques.

Companies involved in the broadcast infrastructure market are leveraging the benefits of cutting-edge technologies, including IP, artificial intelligence, virtual reality, and more, to enhance user experience. The shift toward the adoption of flexible and agile broadcast infrastructure solutions is on the rise, and companies seek cost-effective and sustainable content delivery network solutions. Complex and evolving viewing patterns across the globe are expected to create significant opportunities for broadcasters in the near future, and provide an impetus to the growth of the broadcast infrastructure market. The soaring adoption of online multimedia content is another major factor that is expected to boost the prospects of the broadcast infrastructure market over the forecast period.

Broadcast Infrastructure Market in Brief

Broadcast Infrastructure Market - Definition

North America Broadcast Infrastructure Market – Snapshot

Key Drivers of Global Broadcast Infrastructure Market

Growing demand for emerging technologies among broadcast and media companies

Broadcast Infrastructure Market - Company Profiles Snapshot

Grass Valley USA, LLC, a Belden brand, is a key player operating in the field of content & media technology. It provides broadcast solutions to broadcast and media companies. Grass Valley offers training, installation, and development services for customized software as well as aftersales services. The company serves broadcasters as well as IPTV, cable, and satellite operators. It offers media playout and automation products, which allows television broadcasters to manage the playout of live, pre-recorded, and graphic content to air. It also provides monitoring and control products to manage several broadcast signals across the globe

Cisco Systems, Inc. manufactures, designs, and sells Internet Protocol (IP) and other products related to the information technology (IT) industry and communications. Cisco offers software, hardware, and services that are used to build Internet solutions, which makes networks possible for broadcast infrastructure organizations. The company also offers media, broadcast, and content within the service provider market. Cisco provides its services and products directly through its own sales force and channel partners to consumers, large enterprises, service providers, and for commercial businesses.

Ericsson Inc. provides network and communication equipment, services, and software, for business and network operations. It is one of the leading providers of information and communication technology, with around 40% of the world’s mobile traffic carried over Ericsson networks. The company was established in 1984, and operates as a subsidiary of Telefonaktiebolaget LM Ericsson. It offers solutions such as 5G access, cellular IoT, and network intelligence for the media industry, telecom operators, transport sector, and utilities across the globe.

Broadcast Infrastructure market is projected to reach a value of ~US$ 12.8 Bn by the end of 2019, and to reach ~US$ 21.2 Bn by 2027

Broadcast Infrastructure market will grow at a decent CAGR of ~7% from 2019 to 2027

Broadcast Infrastructure market is driven by increasing investments in IT infrastructure across end-user verticals such as OTT, terrestrial, satellite, cable, and IPTV

North America holds a major share of the global broadcast infrastructure market and it is anticipated to dominate the global market during the forecast period

Key players in the global broadcast Infrastructure market include Acorde Technologies S.A, AVL Technologies, Inc., Cisco Systems, Inc., Clyde Broadcast, Eletec Broadcast Telecom S.A.R.L

1. Preface

1.1. Market Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

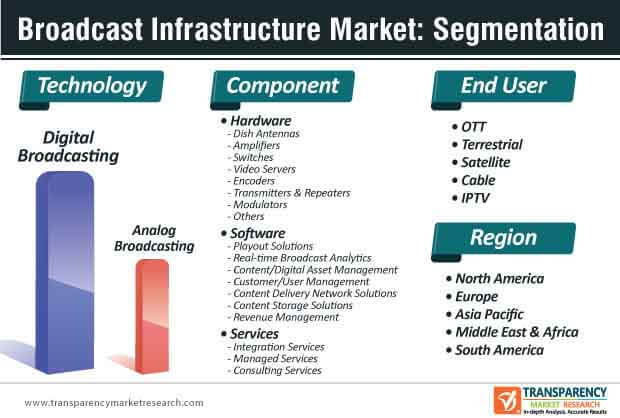

2.1. Market Taxonomy - Segment Definitions

2.2. Research Methodology

2.2.1. List of Primary and Secondary Sources

2.3. Key Assumptions for Data Modelling

3. Executive Summary: Global Broadcast Infrastructure Market

4. Market Overview

4.1. Introduction

4.2. Global Market – Macroeconomic Factors Overview

4.2.1. World GDP Indicator – For Top Economies

4.2.2. Global ICT Spending (US$ Mn), 2013, 2019, 2023 and 2027

4.3. Technology/ Product Roadmap

4.4. Market Factor Analysis

4.4.1. Porter’s Five Forces Analysis

4.4.2. Ecosystem Analysis

4.4.3. PEST Analysis

4.4.4. Market Dynamics (Growth Influencers)

4.4.4.1. Drivers

4.4.4.2. Restraints

4.4.4.3. Opportunities

4.4.4.4. Impact Analysis of Drivers and Restraints

4.5. Global Broadcast Infrastructure Market Analysis and Forecast, 2014 - 2027

4.5.1. Market Revenue Analysis (US$ Mn)

4.5.1.1. Historic Growth Trends, 2014-2018

4.5.1.2. Forecast Trends, 2019-2027

4.6. Market Opportunity Assessment – by Region (North America/ Europe/ Asia Pacific/ Middle East & Africa/ South America)

4.6.1. By Country

4.6.2. By Component

4.6.3. By Technology

4.6.4. By End-user

4.7. Competitive Scenario and Trends

4.7.1. Broadcast Infrastructure Market Concentration Rate

4.7.1.1. List of Emerging, Prominent and Leading Players

4.7.2. Mergers & Acquisitions, Expansions

4.8. Market Outlook

5. Global Broadcast Infrastructure Market Analysis and Forecast, by Component

5.1. Overview and Definitions

5.2. Key Segment Analysis

5.3. Broadcast Infrastructure Market Size (US$ Mn) Forecast, By Component, 2017 - 2027

5.3.1. Hardware

5.3.1.1. Dish Antennas

5.3.1.2. Amplifiers

5.3.1.3. Switches

5.3.1.4. Video Servers

5.3.1.5. Encoders

5.3.1.6. Transmitters & Repeaters

5.3.1.7. Modulators

5.3.1.8. Others

5.3.2. Software

5.3.2.1. Playout Solution

5.3.2.2. Real-time Broadcast Analytics

5.3.2.3. Content/Digital Asset Management

5.3.2.4. Customer/User Management

5.3.2.5. Content Delivery Network Solution

5.3.2.6. Content Storage Solution

5.3.2.7. Revenue Management

5.3.3. Services

5.3.3.1. Integration Services

5.3.3.2. Managed Services

5.3.3.3. Consulting Services

6. Global Broadcast Infrastructure Market Analysis and Forecast, by Technology

6.1. Overview

6.2. Key Segment Analysis

6.3. Broadcast Infrastructure Market Size (US$ Mn) Forecast, By Technology, 2017 - 2027

6.3.1. Analog Broadcasting

6.3.2. Digital Broadcasting

7. Global Broadcast Infrastructure Market Analysis and Forecast, by End-user

7.1. Overview

7.2. Key Segment Analysis

7.3. Broadcast Infrastructure Market Size (US$ Mn) Forecast, By End-user, 2017 - 2027

7.3.1. OTT

7.3.2. Terrestrial

7.3.3. Satellite

7.3.4. Cable

7.3.5. IPTV

8. Global Broadcast Infrastructure Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Emerging Markets/Countries

8.3. Broadcast Infrastructure Market Size (US$ Mn) Forecast, by Region, 2017 - 2027

8.3.1. North America

8.3.2. Europe

8.3.3. Asia Pacific

8.3.4. Middle East & Africa

8.3.5. South America

9. North America Broadcast Infrastructure Market Analysis and Forecast

9.1. Regional Outlook

9.2. Key Findings

9.3. Impact Analysis of Drivers and Restraints

9.4. Broadcast Infrastructure Market Size (US$ Mn) Forecast, By Component, 2017 - 2027

9.4.1. Hardware

9.4.1.1. Dish Antennas

9.4.1.2. Amplifiers

9.4.1.3. Switches

9.4.1.4. Video Servers

9.4.1.5. Encoders

9.4.1.6. Transmitters & Repeaters

9.4.1.7. Modulators

9.4.1.8. Others

9.4.2. Software

9.4.2.1. Playout Solution

9.4.2.2. Real-time Broadcast Analytics

9.4.2.3. Content/Digital Asset Management

9.4.2.4. Customer/User Management

9.4.2.5. Content Delivery Network Solution

9.4.2.6. Content Storage Solution

9.4.2.7. Revenue Management

9.4.3. Services

9.4.3.1. Integration Services

9.4.3.2. Managed Services

9.4.3.3. Consulting Services

9.5. Broadcast Infrastructure Market Size (US$ Mn) Forecast, By Technology, 2017 - 2027

9.5.1. Analog Broadcasting

9.5.2. Digital Broadcasting

9.6. Broadcast Infrastructure Market Size (US$ Mn) Forecast, By End-user, 2017 - 2027

9.6.1. OTT

9.6.2. Terrestrial

9.6.3. Satellite

9.6.4. Cable

9.6.5. IPTV

9.7. Broadcast Infrastructure Market Size (US$ Mn) Forecast, by Country, 2017 - 2027

9.7.1. U.S.

9.7.2. Canada

9.7.3. Mexico

10. Europe Broadcast Infrastructure Market Analysis and Forecast

10.1. Regional Outlook

10.2. Key Findings

10.3. Impact Analysis of Drivers and Restraints

10.4. Broadcast Infrastructure Market Size (US$ Mn) Forecast, By Component, 2017 - 2027

10.4.1. Hardware

10.4.1.1. Dish Antennas

10.4.1.2. Amplifiers

10.4.1.3. Switches

10.4.1.4. Video Servers

10.4.1.5. Encoders

10.4.1.6. Transmitters & Repeaters

10.4.1.7. Modulators

10.4.1.8. Others

10.4.2. Software

10.4.2.1. Playout Solution

10.4.2.2. Real-time Broadcast Analytics

10.4.2.3. Content/Digital Asset Management

10.4.2.4. Customer/User Management

10.4.2.5. Content Delivery Network Solution

10.4.2.6. Content Storage Solution

10.4.2.7. Revenue Management

10.4.3. Services

10.4.3.1. Integration Services

10.4.3.2. Managed Services

10.4.3.3. Consulting Services

10.5. Broadcast Infrastructure Market Size (US$ Mn) Forecast, By Technology, 2017 - 2027

10.5.1. Analog Broadcasting

10.5.2. Digital Broadcasting

10.6. Broadcast Infrastructure Market Size (US$ Mn) Forecast, By End-user, 2017 - 2027

10.6.1. OTT

10.6.2. Terrestrial

10.6.3. Satellite

10.6.4. Cable

10.6.5. IPTV

10.7. Broadcast Infrastructure Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017 - 2027

10.7.1. Western Europe

10.7.1.1. Germany

10.7.1.2. U.K.

10.7.1.3. France

10.7.1.4. Italy

10.7.1.5. Spain

10.7.1.6. Rest of Western Europe

10.7.2. Eastern Europe

10.7.2.1. Russia

10.7.2.2. Rest of Eastern Europe

11. Asia Pacific Broadcast Infrastructure Market Analysis and Forecast

11.1. Regional Outlook

11.2. Key Findings

11.3. Impact Analysis of Drivers and Restraints

11.4. Broadcast Infrastructure Market Size (US$ Mn) Forecast, By Component, 2017 - 2027

11.4.1. Hardware

11.4.1.1. Dish Antennas

11.4.1.2. Amplifiers

11.4.1.3. Switches

11.4.1.4. Video Servers

11.4.1.5. Encoders

11.4.1.6. Transmitters & Repeaters

11.4.1.7. Modulators

11.4.1.8. Others

11.4.2. Software

11.4.2.1. Playout Solution

11.4.2.2. Real-time Broadcast Analytics

11.4.2.3. Content/Digital Asset Management

11.4.2.4. Customer/User Management

11.4.2.5. Content Delivery Network Solution

11.4.2.6. Content Storage Solution

11.4.2.7. Revenue Management

11.4.3. Services

11.4.3.1. Integration Services

11.4.3.2. Managed Services

11.4.3.3. Consulting Services

11.5. Broadcast Infrastructure Market Size (US$ Mn) Forecast, By Technology, 2017 - 2027

11.5.1. Analog Broadcasting

11.5.2. Digital Broadcasting

11.6. Broadcast Infrastructure Market Size (US$ Mn) Forecast, By End-user, 2017 - 2027

11.6.1. OTT

11.6.2. Terrestrial

11.6.3. Satellite

11.6.4. Cable

11.6.5. IPTV

11.7. Broadcast Infrastructure Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017 - 2027

11.7.1. China

11.7.2. Japan

11.7.3. India

11.7.4. Australia

11.7.5. ASEAN

11.7.6. Rest of Asia Pacific

12. Middle East & Africa (MEA) Broadcast Infrastructure Market Analysis and Forecast

12.1. Regional Outlook

12.2. Key Findings

12.3. Impact Analysis of Drivers and Restraints

12.4. Broadcast Infrastructure Market Size (US$ Mn) Forecast, By Component, 2017 - 2027

12.4.1. Hardware

12.4.1.1. Dish Antennas

12.4.1.2. Amplifiers

12.4.1.3. Switches

12.4.1.4. Video Servers

12.4.1.5. Encoders

12.4.1.6. Transmitters & Repeaters

12.4.1.7. Modulators

12.4.1.8. Others

12.4.2. Software

12.4.2.1. Playout Solution

12.4.2.2. Real-time Broadcast Analytics

12.4.2.3. Content/Digital Asset Management

12.4.2.4. Customer/User Management

12.4.2.5. Content Delivery Network Solution

12.4.2.6. Content Storage Solution

12.4.2.7. Revenue Management

12.4.3. Services

12.4.3.1. Integration Services

12.4.3.2. Managed Services

12.4.3.3. Consulting Services

12.5. Broadcast Infrastructure Market Size (US$ Mn) Forecast, By Technology, 2017 - 2027

12.5.1. Analog Broadcasting

12.5.2. Digital Broadcasting

12.6. Broadcast Infrastructure Market Size (US$ Mn) Forecast, By End-user, 2017 - 2027

12.6.1. OTT

12.6.2. Terrestrial

12.6.3. Satellite

12.6.4. Cable

12.6.5. IPTV

12.7. Broadcast Infrastructure Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017 - 2027

12.7.1. GCC

12.7.2. South Africa

12.7.3. Rest of MEA

13. South America Broadcast Infrastructure Market Analysis and Forecast

13.1. Regional Outlook

13.2. Key Findings

13.3. Impact Analysis of Drivers and Restraints

13.4. Broadcast Infrastructure Market Size (US$ Mn) Forecast, By Component, 2017 - 2027

13.4.1. Hardware

13.4.1.1. Dish Antennas

13.4.1.2. Amplifiers

13.4.1.3. Switches

13.4.1.4. Video Servers

13.4.1.5. Encoders

13.4.1.6. Transmitters & Repeaters

13.4.1.7. Modulators

13.4.1.8. Others

13.4.2. Software

13.4.2.1. Playout Solution

13.4.2.2. Real-time Broadcast Analytics

13.4.2.3. Content/Digital Asset Management

13.4.2.4. Customer/User Management

13.4.2.5. Content Delivery Network Solution

13.4.2.6. Content Storage Solution

13.4.2.7. Revenue Management

13.4.3. Services

13.4.3.1. Integration Services

13.4.3.2. Managed Services

13.4.3.3. Consulting Services

13.5. Broadcast Infrastructure Market Size (US$ Mn) Forecast, By Technology, 2017 - 2027

13.5.1. Analog Broadcasting

13.5.2. Digital Broadcasting

13.6. Broadcast Infrastructure Market Size (US$ Mn) Forecast, By End-user, 2017 - 2027

13.6.1. OTT

13.6.2. Terrestrial

13.6.3. Satellite

13.6.4. Cable

13.6.5. IPTV

13.7. Broadcast Infrastructure Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017 - 2027

13.7.1. Brazil

13.7.2. Rest of South America

14. Competition Landscape

14.1. Market Competition Matrix, by Leading Players

14.2. Market Revenue Share Analysis (%), by Leading Players (2018)

15. Company Profiles (Details – Business Overview, Geographical Presence, Key Competitors, Revenue and Strategy)

15.1. Acorde Technologies S.A

15.1.1. Business Overview

15.1.2. Geographical Presence

15.1.3. Key Competitors

15.1.4. Revenue and Strategy

15.2. AVL Technologies, Inc.

15.2.1. Business Overview

15.2.2. Geographical Presence

15.2.3. Key Competitors

15.2.4. Revenue and Strategy

15.3. Cisco Systems, Inc.

15.3.1. Business Overview

15.3.2. Geographical Presence

15.3.3. Key Competitors

15.3.4. Revenue and Strategy

15.4. Clyde Broadcast

15.4.1. Business Overview

15.4.2. Geographical Presence

15.4.3. Key Competitors

15.4.4. Revenue and Strategy

15.5. Eletec Broadcast Telecom S.A.R.L

15.5.1. Business Overview

15.5.2. Geographical Presence

15.5.3. Key Competitors

15.5.4. Revenue and Strategy

15.6. Ericsson AB

15.6.1. Business Overview

15.6.2. Geographical Presence

15.6.3. Key Competitors

15.6.4. Revenue and Strategy

15.7. Evertz Microsystems, Ltd.

15.7.1. Business Overview

15.7.2. Geographical Presence

15.7.3. Key Competitors

15.7.4. Revenue and Strategy

15.8. EVS Broadcast Equipment

15.8.1. Business Overview

15.8.2. Geographical Presence

15.8.3. Key Competitors

15.8.4. Revenue and Strategy

15.9. Grass Valley

15.9.1. Business Overview

15.9.2. Geographical Presence

15.9.3. Key Competitors

15.9.4. Revenue and Strategy

15.10. Harmonic Inc.

15.10.1. Business Overview

15.10.2. Geographical Presence

15.10.3. Key Competitors

15.10.4. Revenue and Strategy

15.11. Kaltura Inc.

15.11.1. Business Overview

15.11.2. Geographical Presence

15.11.3. Key Competitors

15.11.4. Revenue and Strategy

15.12. Zixi, LLC

15.12.1. Business Overview

15.12.2. Geographical Presence

15.12.3. Key Competitors

15.12.4. Revenue and Strategy

16. Key Takeaways

List of Tables

Table: 1 Acronyms Used

Table: 2 Broadcast Infrastructure Market: Product Launch, Acquisition, Partnership

Table: 3 Global Broadcast Infrastructure Market Size (US$ Mn) Forecast, by Component, 2017–2027

Table: 4 Global Broadcast Infrastructure Market Size (US$ Mn) Forecast, by Component, 2017–2027

Table: 5 Global Broadcast Infrastructure Market Size (US$ Mn) Forecast, by Component, 2017–2027

Table: 6 Global Broadcast Infrastructure Market Size (US$ Mn) Forecast, by Technology, 2017–2027

Table: 7 Global Broadcast Infrastructure Market Size (US$ Mn) Forecast, by End-user, 2017–2027

Table: 8 Global Broadcast Infrastructure Market Size (US$ Mn) Forecast, by Regions, 2017–2027

Table: 9 North America Broadcast Infrastructure Market Size (US$ Mn) Forecast, by Component, 2017–2027

Table: 10 North America Broadcast Infrastructure Market Size (US$ Mn) Forecast, by Component, 2017–2027

Table: 11 North America Broadcast Infrastructure Market Size (US$ Mn) Forecast, by Component, 2017–2027

Table: 12 North America Broadcast Infrastructure Market Size (US$ Mn) Forecast, by Technology, 2017–2027

Table: 13 North America Broadcast Infrastructure Market Size (US$ Mn) Forecast, by End-user, 2017–2027

Table: 14 North America Broadcast Infrastructure Market Size (US$ Mn) Forecast, by Country, 2017–2027

Table: 15 Europe Broadcast Infrastructure Market Size (US$ Mn) Forecast, by Component, 2017–2027

Table: 16 Europe Broadcast Infrastructure Market Size (US$ Mn) Forecast, by Component, 2017–2027

Table: 17 Europe Broadcast Infrastructure Market Size (US$ Mn) Forecast, by Component, 2017–2027

Table: 18 Europe Broadcast Infrastructure Market Size (US$ Mn) Forecast, by Technology, 2017–2027

Table: 19 Europe Broadcast Infrastructure Market Size (US$ Mn) Forecast, by End-user, 2017–2027

Table: 20 Europe Broadcast Infrastructure Market Size (US$ Mn) Forecast, by Country, 2017–2027

Table: 21 Asia Pacific Broadcast Infrastructure Market Size (US$ Mn) Forecast, by Component, 2017–2027

Table: 22 Asia Pacific Broadcast Infrastructure Market Size (US$ Mn) Forecast, by Component, 2017–2027

Table: 23 Asia Pacific Broadcast Infrastructure Market Size (US$ Mn) Forecast, by Component, 2017–2027

Table: 24 Asia Pacific Broadcast Infrastructure Market Size (US$ Mn) Forecast, by Technology, 2017–2027

Table: 25 Asia Pacific Broadcast Infrastructure Market Size (US$ Mn) Forecast, by End-user, 2017–2027

Table: 26 Asia Pacific Broadcast Infrastructure Market Size (US$ Mn) Forecast, by Country, 2017–2027

Table: 27 Middle East & Africa Broadcast Infrastructure Market Size (US$ Mn) Forecast, by Component, 2017–2027

Table: 28 Middle East & Africa Broadcast Infrastructure Market Size (US$ Mn) Forecast, by Component, 2017–2027

Table: 29 Middle East & Africa Broadcast Infrastructure Market Size (US$ Mn) Forecast, by Component, 2017–2027

Table: 30 Middle East & Africa Broadcast Infrastructure Market Size (US$ Mn) Forecast, by Technology, 2017–2027

Table: 31 Middle East & Africa Broadcast Infrastructure Market Size (US$ Mn) Forecast, by End-user, 2017–2027

Table: 32 Middle East & Africa Broadcast Infrastructure Market Size (US$ Mn) Forecast, by Country, 2017–2027

Table: 33 South America Broadcast Infrastructure Market Size (US$ Mn) Forecast, by Component, 2017–2027

Table: 34 South America Broadcast Infrastructure Market Size (US$ Mn) Forecast, by Component, 2017–2027

Table: 35 South America Broadcast Infrastructure Market Size (US$ Mn) Forecast, by Component, 2017–2027

Table: 36 South America Broadcast Infrastructure Market Size (US$ Mn) Forecast, by Technology, 2017–2027

Table: 37 South America Broadcast Infrastructure Market Size (US$ Mn) Forecast, by End-user, 2017–2027

Table: 38 South America Broadcast Infrastructure Market Size (US$ Mn) Forecast, by Country, 2017–2027

List of Figures

Figure: 1 Global Broadcast Infrastructure Market Size (US$ Mn) and Forecast, 2017–2027

Figure: 2 Global Broadcast Infrastructure Market CAGR Breakdown

Figure: 3 Global Broadcast Infrastructure Market Regional Outline – CAGR (2019-2027)

Figure: 4 Global Broadcast Infrastructure Market Size, by Component (2019 V/S 2027)

Figure: 5 GDP (US$ Bn), Top Countries (2014 – 2019)

Figure: 6 Top Economies GDP Landscape, 2018

Figure: 7 Global ICT Spending (%), by Region, 2019E

Figure: 8 Global ICT Spending (US$ Bn), Regional Contribution, 2019E

Figure: 9 Global ICT Spending (US$ Bn), Spending Type Contribution, 2019E

Figure: 10 Global ICT Spending (%), by Type, 2019E

Figure: 11 Global Broadcast Infrastructure Market Historic Growth Trends (US$ Mn), 2014 – 2018

Figure: 12 Global Broadcast Infrastructure Market Y-o-Y Growth (Value %), 2014 – 2018

Figure: 13 Global Broadcast Infrastructure Market Size (US$ Mn) Forecast, 2019 - 2027

Figure: 14 Global Broadcast Infrastructure Market Y-o-Y Growth (Value %), 2019 - 2027

Figure: 15 Global Broadcast Infrastructure Market Opportunity Analysis, by Component (2019)

Figure: 16 Global Broadcast Infrastructure Market Opportunity Analysis, by Technology (2019)

Figure: 17 Global Broadcast Infrastructure Market Opportunity Analysis, by End-user (2019)

Figure: 18 Global Broadcast Infrastructure Market Opportunity Analysis, by Region (2019)

Figure: 19 North America Broadcast Infrastructure Market Opportunity Analysis, by Component (2019)

Figure: 20 North America Broadcast Infrastructure Market Opportunity Analysis, by Technology (2019)

Figure: 21 North America Broadcast Infrastructure Market Opportunity Analysis, by End-user (2019)

Figure: 22 North America Broadcast Infrastructure Market Opportunity Analysis, by Country (2019)

Figure: 23 Europe Broadcast Infrastructure Market Opportunity Analysis, by Component (2019)

Figure: 24 Europe Broadcast Infrastructure Market Opportunity Analysis, by Technology (2019)

Figure: 25 Europe Broadcast Infrastructure Market Opportunity Analysis, by End-user (2019)

Figure: 26 Europe Broadcast Infrastructure Market Opportunity Analysis, by Country (2019)

Figure: 27 Asia Pacific Broadcast Infrastructure Market Opportunity Analysis, by Component (2019)

Figure: 28 Asia Pacific Broadcast Infrastructure Market Opportunity Analysis, by Technology (2019)

Figure: 29 Asia Pacific Broadcast Infrastructure Market Opportunity Analysis, by End-user (2019)

Figure: 30 Asia Pacific Broadcast Infrastructure Market Opportunity Analysis, by Country (2019)

Figure: 31 Middle East & Africa Broadcast Infrastructure Market Opportunity Analysis, by Component (2019)

Figure: 32 Middle East & Africa Broadcast Infrastructure Market Opportunity Analysis, by Technology (2019)

Figure: 33 Middle East & Africa Broadcast Infrastructure Market Opportunity Analysis, by End-user (2019)

Figure: 34 Middle East & Africa Broadcast Infrastructure Market Opportunity Analysis, by Country (2019)

Figure: 35 South America Broadcast Infrastructure Market Opportunity Analysis, by Component (2019)

Figure: 36 South America Broadcast Infrastructure Market Opportunity Analysis, by Technology (2019)

Figure: 37 South America Broadcast Infrastructure Market Opportunity Analysis, by End-user (2019)

Figure: 38 South America Broadcast Infrastructure Market Opportunity Analysis, by Country (2019)

Figure: 39 Global Broadcast Infrastructure Market, Component, CAGR (%) (2019 – 2027)

Figure: 40 Global Broadcast Infrastructure Market, Technology CAGR (%) (2019 – 2027)

Figure: 41 Global Broadcast Infrastructure Market, End-user CAGR (%) (2019 – 2027)

Figure: 42 Global Broadcast Infrastructure Market, Region CAGR (%) (2019 – 2027)

Figure: 43 Global Broadcast Infrastructure Market Share Analysis, by Component (2019)

Figure: 44 Global Broadcast Infrastructure Market Share Analysis, by Component (2027)

Figure: 45 Global Broadcast Infrastructure Market Value Share, by Technology (2027)

Figure: 46 Global Broadcast Infrastructure Market Value Share, by End-User (2019)

Figure: 47 Global Broadcast Infrastructure Market Value Share, by End-User (2027)

Figure: 48 Global Broadcast Infrastructure Market Value Share, by Region (2019)

Figure: 49 Global Broadcast Infrastructure Market Value Share, by Region (2027)

Figure: 50 North America Broadcast Infrastructure Market Size (US$ Bn), 2019

Figure: 51 North America Broadcast Infrastructure Market Share Analysis, by Component (2019)

Figure: 52 North America Broadcast Infrastructure Market Share Analysis, by Component (2027)

Figure: 53 North America Broadcast Infrastructure Market Share Analysis, by Technology (2019)

Figure: 54 North America Broadcast Infrastructure Market Share Analysis, by Technology (2027)

Figure: 55 North America Broadcast Infrastructure Market Share Analysis, by End-user (2019)

Figure: 56 North America Broadcast Infrastructure Market Share Analysis, by End-user (2027)

Figure: 57 North America Broadcast Infrastructure Market Share Analysis, by Country (2019)

Figure: 58 North America Broadcast Infrastructure Market Share Analysis, by Country (2027)

Figure: 59 Europe Broadcast Infrastructure Market Size (US$ Bn), 2019

Figure: 60 Europe Broadcast Infrastructure Market Share Analysis, by Component (2019)

Figure: 61 Europe Broadcast Infrastructure Market Share Analysis, by Component (2027)

Figure: 62 Europe Broadcast Infrastructure Market Share Analysis, by Technology (2019)

Figure: 63 Europe Broadcast Infrastructure Market Share Analysis, by Technology (2027)

Figure: 64 Europe Broadcast Infrastructure Market Share Analysis, by End-user (2019)

Figure: 65 Europe Broadcast Infrastructure Market Share Analysis, by End-user (2027)

Figure: 66 Europe Broadcast Infrastructure Market Share Analysis, by Country (2019)

Figure: 67 Europe Broadcast Infrastructure Market Share Analysis, by Country (2027)

Figure: 68 Asia Pacific Broadcast Infrastructure Market Size (US$ Bn), 2019

Figure: 69 Asia Pacific Broadcast Infrastructure Market Share Analysis, by Component (2019)

Figure: 70 Asia Pacific Broadcast Infrastructure Market Share Analysis, by Component (2027)

Figure: 71 Asia Pacific Broadcast Infrastructure Market Share Analysis, by Technology (2019)

Figure: 72 Asia Pacific Broadcast Infrastructure Market Share Analysis, by Technology (2027)

Figure: 73 Asia Pacific Broadcast Infrastructure Market Share Analysis, by End-user (2019)

Figure: 74 Asia Pacific Broadcast Infrastructure Market Share Analysis, by End-user (2027)

Figure: 75 Asia Pacific Broadcast Infrastructure Market Share Analysis, by Country (2019)

Figure: 76 Asia Pacific Broadcast Infrastructure Market Share Analysis, by Country (2027)

Figure: 77 Middle East & Africa Broadcast Infrastructure Market Size (US$ Bn), 2019

Figure: 78 Middle East & Africa Broadcast Infrastructure Market Share Analysis, by Component (2019)

Figure: 79 Middle East & Africa Broadcast Infrastructure Market Share Analysis, by Component (2027)

Figure: 80 Middle East & Africa Broadcast Infrastructure Market Share Analysis, by Technology (2019)

Figure: 81 Middle East & Africa Broadcast Infrastructure Market Share Analysis, by Technology (2027)

Figure: 82 Middle East & Africa Broadcast Infrastructure Market Share Analysis, by End-user (2019)

Figure: 83 Middle East & Africa Broadcast Infrastructure Market Share Analysis, by End-user (2027)

Figure: 84 Middle East & Africa Broadcast Infrastructure Market Share Analysis, by Country (2019)

Figure: 85 Middle East & Africa Broadcast Infrastructure Market Share Analysis, by Country (2027)

Figure: 86 South America Broadcast Infrastructure Market Size (US$ Bn), 2019

Figure: 87 South America Broadcast Infrastructure Market Share Analysis, by Component (2019)

Figure: 88 South America Broadcast Infrastructure Market Share Analysis, by Component (2027)

Figure: 89 South America Broadcast Infrastructure Market Share Analysis, by Technology (2019)

Figure: 90 South America Broadcast Infrastructure Market Share Analysis, by Technology (2027)

Figure: 91 South America Broadcast Infrastructure Market Share Analysis, by End-user (2019)

Figure: 92 South America Broadcast Infrastructure Market Share Analysis, by End-user (2027)

Figure: 93 South America Broadcast Infrastructure Market Share Analysis, by Country (2019)

Figure: 94 South America Broadcast Infrastructure Market Share Analysis, by Country (2027)