Reports

Reports

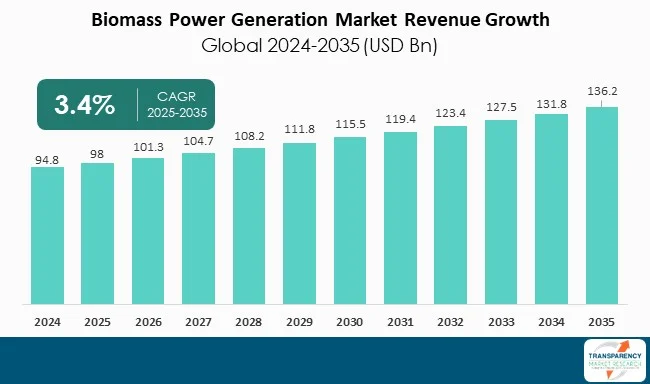

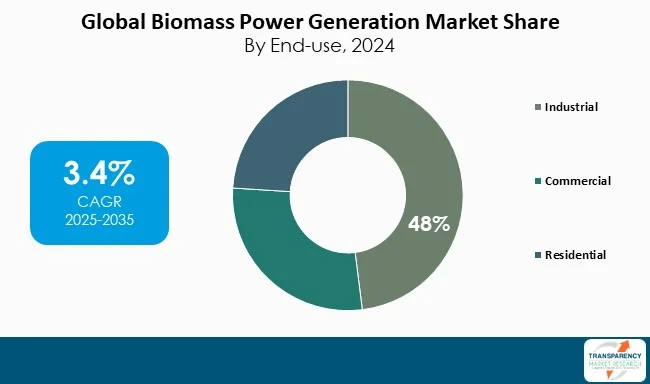

The global biomass power generation market is expected to witness a CAGR of 3.4% due to the competing forces of energy security and decarbonization. The sector's strength is that industrial users typically represent about 48% of global demand as it offers baseload energy supporting intermittent renewables.

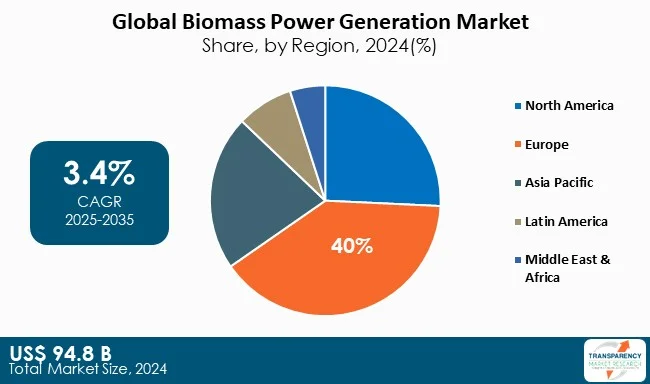

Based on industry share, Europe, at nearly 40%, stays as the lead market supported by climate policies and district heating systems, while the Asia-Pacific will exhibit the highest growth based on demand for energy and supply of feedstocks. Players such as Drax Group and Ørsted A/S are raising the bar regarding industry regulations to incorporate biomass in large-scale grid (reliable) and combined heat and power (CHP) systems.

In the long run, government policy will likely provide incentives, and monetization from carbon credits will make biomass a commercially viable, dependable, and critical pillar of the global clean energy transition.

Biomass power generation is one of the major players regarding the global renewable energy mix. Biomass power generation uses organic matter including agricultural residues, forestry by-products, wood pellets, and municipal solid waste materials to produce electricity and heat. Biomass supports energy diversification, and it helps reduce waste through circular economy activities.

Governments across the globe are promoting and recognizing biomass as a reliable and dispatchable source of renewable energy. Tax incentives, subsidies, and renewable portfolio standards are used to attract users and nudge consumers to either adopt or consume biomass based energy.

Biomass plants are baseload generation sources and can provide a continuous supply of power and energy that offers a level of reliability that solar and wind sources cannot offer. This reliability can also help industries and utilities reduce their carbon footprint while maintaining a reliable supply of energy. Emerging markets such as Asia-Pacific and Latin America are seeing users in these regions adopting biomass rapidly as there is an abundance of feedstock and a growing customer demand to support it.

| Attribute | Detail |

|---|---|

| Biomass Power Generation Market Drivers |

|

The worldwide transition to decarbonization is one of the primary growth factors for the biomass power generation market. With so many governmental commitments to achieve net zero emissions goals by 2050, renewable power generation will change the energy mix. The International Energy Agency (IEA) forecasts that over 60% of total world power generation will be sourced from renewable energy by 2030.

The aggressive nature of biomass power is needed to underpin the intermittent time of solar and wind power on a dispatchable and baseload power generation basis. For example, the European Union has a Renewable Energy Directive II (RED II), where the target is to have 32% or more of total energy consumption sourced from renewables by 2030, with a significant focus area on renewable energy from plant biomass.

Countries like India have a new national goal for 10 GW of biomass based capacity by 2030, and China is producing over 140 TWh per year of total biomass energy. With the available policies being supported such as Feed In Tariffs, Renewable Purchase Requirements and Carbon Credit Programs, biomass power generation is being billed as a commercial opportunity in the energy sector solutions for both - Industrial and Utility scale. At the core of this advanced integration of biomass technology is the coinciding establishment of biomass as an enabler and facilitator of a global transition to clean and secure energy infrastructure implementation.

The availability of a large range of agricultural and forestry residues is a strong driver to the growth of biomass power generation. It is estimated that over 140 billion metric tons of biomass will be generated from agriculture and forestry sectors globally, much of which is currently wasted. For example, India produces about 500 million tons of crop residues each year with very little of it being effectively utilized and the majority adding to air pollution through stubble burning.

Biomass power plants provide organized and systematic methods to recycle back some of this excess residue into a useful, valuable energy source, thus reducing carbon emissions that contribute to climate change and difficulties associated with waste disposal. For example, China is estimated to utilize almost 60 million tons of agricultural residues a year through the biomass industry, and produce more than 35 GW of installed capacity. In Europe, wood pellets and forestry waste are a substantial source of renewable heating and power.

The industrial sector represents the largest end-use segment of the global biomass power generation market, with almost 48% of global installations driven by these industries' high and continuous energy needs. The Indian sugar industry produces and utilizes more than 8,000 MW of power annually from bagasse-based biomass power plants for captive use and contributes to the grid.

The pulp & paper industry in Europe uses nearly 55 million tons of biomass on a yearly basis, making it one of the largest industrial users of renewable energy. Since 2020, in Japan, more than 70 biomass-fired power projects with capacities between 5 MW and 50 MW have been commissioned to serve industrial parks. The utilization of residues that are sourced locally, such as rice husk, sawdust, and agricultural waste, can help achieve even greater value for the energy user. Biomass provides the ability for the industrial user to achieve energy security, cost savings, and sustainability on a continuing basis.

| Attribute | Detail |

|---|---|

| Leading Region |

|

Europe holds the most biomass power generation capacity, with nearly 40% of global biomass capacity. The size of Europe's biomass market is driven by strict decarbonization mandates and advanced waste-to-energy infrastructure. Countries such as Sweden and Finland use biomass for more than 20% of their district heating use, and highlight the large-scale (on a per capita basis) integration of biomass to urban energy systems.

North America is using its abundance of feedstock from forests and agriculture to set up biomass-based power systems. Canada alone generates over 2,000 MW of electricity from biomass power systems, especially in provinces like British Columbia, where wood residues from the timber industry can be considered a comparatively inexpensive source of energy. This has been further reinforced by a federal clean energy incentive/environmental regulation.

The regional biomass power market across Asia-Pacific is growing at a strong rate day-to-day because of the strong dimensions of energy security in this region. Japan installed over 500 MW of biomass plants in 2023 (feed-in tariffs program) and Thailand has improved their renewables through biomass, accounting for 8% of their energy supply (largely through palm oil and sugar). Government investment in this segment is significant, creating the fastest-growing region for biomass energy generation in the years ahead.

Ørsted A/S, Drax Group plc, ACCIONA, RWE, MGT Teesside Ltd, Babcock & Wilcox, Vattenfall AB, Ameresco, Inc., Engie SA., E. ON Global, Xcel Energy Inc, Energetický a průmyslový holding (EPH), RENOVA, Inc., and EDF are some other companies operating in the global market. Each of these players has been profiled in the biomass power generation market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 | US$ 94.8 Bn |

| Market Forecast Value in 2035 | US$ 136.2 Bn |

| Growth Rate (CAGR) | 3.4% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value & MW for Size |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, Biomass Power Generation market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | Feedstock

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The biomass power generation market was valued at US$ 94.8 Bn in 2024

The biomass power generation industry is expected to grow at a CAGR of 3.4% from 2025 to 2035

Rising global focus on renewable energy and decarbonization and abundant availability of agricultural and forestry residues

Industrial was the largest end-use segment in the biomass power generation market

Europe was the most lucrative region in 2024

Ørsted A/S, Drax Group plc, ACCIONA, RWE, MGT Teesside Ltd, Babcock & Wilcox, Vattenfall AB, Ameresco, Inc., Engie SA., E. ON Global, Xcel Energy Inc, Energetický a průmyslový holding (EPH), RENOVA, Inc., and EDF are some other companies in the global Biomass Power Generation market are the major companies in the global biomass power generation market.

Table 1 Global Market Size (MW) Forecast, by Feedstock, 2025 to 2035

Table 2 Global Market Value (US$ Bn) Forecast, by Feedstock, 2025 to 2035

Table 3 Global Market Size (MW) Forecast, by Technology, 2025 to 2035

Table 4 Global Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 5 Global Market Size (MW) Forecast, by End-use, 2025 to 2035

Table 6 Global Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 7 Global Market Size (MW) Forecast, by Region, 2025 to 2035

Table 8 Global Market Value (US$ Bn) Forecast, by Region, 2025 to 2035

Table 9 North America Market Size (MW) Forecast, by Feedstock, 2025 to 2035

Table 10 North America Market Value (US$ Bn) Forecast, by Feedstock, 2025 to 2035

Table 11 North America Market Size (MW) Forecast, by Technology, 2025 to 2035

Table 12 North America Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 13 North America Market Size (MW) Forecast, by End-use, 2025 to 2035

Table 14 North America Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 15 North America Market Size (MW) Forecast, by Country, 2025 to 2035

Table 16 North America Market Value (US$ Bn) Forecast, by Country, 2025 to 2035

Table 17 U.S. Market Size (MW) Forecast, by Feedstock, 2025 to 2035

Table 18 U.S. Market Value (US$ Bn) Forecast, by Feedstock, 2025 to 2035

Table 19 U.S. Market Size (MW) Forecast, by Technology, 2025 to 2035

Table 20 U.S. Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 21 U.S. Market Size (MW) Forecast, by End-use, 2025 to 2035

Table 22 U.S. Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 23 Canada Market Size (MW) Forecast, by Feedstock, 2025 to 2035

Table 24 Canada Market Value (US$ Bn) Forecast, by Feedstock, 2025 to 2035

Table 25 Canada Market Size (MW) Forecast, by Technology, 2025 to 2035

Table 26 Canada Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 27 Canada Market Size (MW) Forecast, by End-use, 2025 to 2035

Table 28 Canada Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 29 Europe Market Size (MW) Forecast, by Feedstock, 2025 to 2035

Table 30 Europe Market Value (US$ Bn) Forecast, by Feedstock, 2025 to 2035

Table 31 Europe Market Size (MW) Forecast, by Technology, 2025 to 2035

Table 32 Europe Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 33 Europe Market Size (MW) Forecast, by End-use, 2025 to 2035

Table 34 Europe Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 35 Europe Market Size (MW) Forecast, by Country and Sub-region, 2025 to 2035

Table 36 Europe Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 37 Germany Market Size (MW) Forecast, by Feedstock, 2025 to 2035

Table 38 Germany Market Value (US$ Bn) Forecast, by Feedstock, 2025 to 2035

Table 39 Germany Market Size (MW) Forecast, by Technology, 2025 to 2035

Table 40 Germany Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 41 Germany Market Size (MW) Forecast, by End-use, 2025 to 2035

Table 42 Germany Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 43 France Market Size (MW) Forecast, by Feedstock, 2025 to 2035

Table 44 France Market Value (US$ Bn) Forecast, by Feedstock, 2025 to 2035

Table 45 France Market Size (MW) Forecast, by Technology, 2025 to 2035

Table 46 France Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 47 France Market Size (MW) Forecast, by End-use, 2025 to 2035

Table 48 France Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 49 U.K. Market Size (MW) Forecast, by Feedstock, 2025 to 2035

Table 50 U.K. Market Value (US$ Bn) Forecast, by Feedstock, 2025 to 2035

Table 51 U.K. Market Size (MW) Forecast, by Technology, 2025 to 2035

Table 52 U.K. Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 53 U.K. Market Size (MW) Forecast, by End-use, 2025 to 2035

Table 54 U.K. Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 55 Italy Market Size (MW) Forecast, by Feedstock, 2025 to 2035

Table 56 Italy Market Value (US$ Bn) Forecast, by Feedstock, 2025 to 2035

Table 57 Italy Market Size (MW) Forecast, by Technology, 2025 to 2035

Table 58 Italy Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 59 Italy Market Size (MW) Forecast, by End-use, 2025 to 2035

Table 60 Italy Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 61 Spain Market Size (MW) Forecast, by Feedstock, 2025 to 2035

Table 62 Spain Market Value (US$ Bn) Forecast, by Feedstock, 2025 to 2035

Table 63 Spain Market Size (MW) Forecast, by Technology, 2025 to 2035

Table 64 Spain Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 65 Spain Market Size (MW) Forecast, by End-use, 2025 to 2035

Table 66 Spain Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 67 Russia & CIS Market Size (MW) Forecast, by Feedstock, 2025 to 2035

Table 68 Russia & CIS Market Value (US$ Bn) Forecast, by Feedstock, 2025 to 2035

Table 69 Russia & CIS Market Size (MW) Forecast, by Technology, 2025 to 2035

Table 70 Russia & CIS Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 71 Russia & CIS Market Size (MW) Forecast, by End-use, 2025 to 2035

Table 72 Russia & CIS Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 73 Rest of Europe Market Size (MW) Forecast, by Feedstock, 2025 to 2035

Table 74 Rest of Europe Market Value (US$ Bn) Forecast, by Feedstock, 2025 to 2035

Table 75 Rest of Europe Market Size (MW) Forecast, by Technology, 2025 to 2035

Table 76 Rest of Europe Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 77 Rest of Europe Market Size (MW) Forecast, by End-use, 2025 to 2035

Table 78 Rest of Europe Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 79 Asia Pacific Market Size (MW) Forecast, by Feedstock, 2025 to 2035

Table 80 Asia Pacific Market Value (US$ Bn) Forecast, by Feedstock, 2025 to 2035

Table 81 Asia Pacific Market Size (MW) Forecast, by Technology, 2025 to 2035

Table 82 Asia Pacific Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 83 Asia Pacific Market Size (MW) Forecast, by End-use, 2025 to 2035

Table 84 Asia Pacific Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 85 Asia Pacific Market Size (MW) Forecast, by Country and Sub-region, 2025 to 2035

Table 86 Asia Pacific Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 87 China Market Size (MW) Forecast, by Feedstock, 2025 to 2035

Table 88 China Market Value (US$ Bn) Forecast, by Feedstock 2025 to 2035

Table 89 China Market Size (MW) Forecast, by Technology, 2025 to 2035

Table 90 China Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 91 China Market Size (MW) Forecast, by End-use, 2025 to 2035

Table 92 China Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 93 Japan Market Size (MW) Forecast, by Feedstock, 2025 to 2035

Table 94 Japan Market Value (US$ Bn) Forecast, by Feedstock, 2025 to 2035

Table 95 Japan Market Size (MW) Forecast, by Technology, 2025 to 2035

Table 96 Japan Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 97 Japan Market Size (MW) Forecast, by End-use, 2025 to 2035

Table 98 Japan Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 99 India Market Size (MW) Forecast, by Feedstock, 2025 to 2035

Table 100 India Market Value (US$ Bn) Forecast, by Feedstock, 2025 to 2035

Table 101 India Market Size (MW) Forecast, by Technology, 2025 to 2035

Table 102 India Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 103 India Market Size (MW) Forecast, by End-use, 2025 to 2035

Table 104 India Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 105 India Market Size (MW) Forecast, by End-use, 2025 to 2035

Table 106 India Market Value (US$ Bn) Forecast, by End-use 2025 to 2035

Table 107 ASEAN Market Size (MW) Forecast, by Feedstock, 2025 to 2035

Table 108 ASEAN Market Value (US$ Bn) Forecast, by Feedstock, 2025 to 2035

Table 109 ASEAN Market Size (MW) Forecast, by Technology, 2025 to 2035

Table 110 ASEAN Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 111 ASEAN Market Size (MW) Forecast, by End-use, 2025 to 2035

Table 112 ASEAN Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 113 Rest of Asia Pacific Market Size (MW) Forecast, by Feedstock, 2025 to 2035

Table 114 Rest of Asia Pacific Market Value (US$ Bn) Forecast, by Feedstock, 2025 to 2035

Table 115 Rest of Asia Pacific Market Size (MW) Forecast, by Technology, 2025 to 2035

Table 116 Rest of Asia Pacific Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 117 Rest of Asia Pacific Market Size (MW) Forecast, by End-use, 2025 to 2035

Table 118 Rest of Asia Pacific Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 119 Latin America Market Size (MW) Forecast, by Feedstock, 2025 to 2035

Table 120 Latin America Market Value (US$ Bn) Forecast, by Feedstock, 2025 to 2035

Table 121 Latin America Market Size (MW) Forecast, by Technology, 2025 to 2035

Table 122 Latin America Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 123 Latin America Market Size (MW) Forecast, by End-use, 2025 to 2035

Table 124 Latin America Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 125 Latin America Market Size (MW) Forecast, by Country and Sub-region, 2025 to 2035

Table 126 Latin America Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 127 Brazil Market Size (MW) Forecast, by Feedstock, 2025 to 2035

Table 128 Brazil Market Value (US$ Bn) Forecast, by Feedstock, 2025 to 2035

Table 129 Brazil Market Size (MW) Forecast, by Technology, 2025 to 2035

Table 130 Brazil Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 131 Brazil Market Size (MW) Forecast, by End-use, 2025 to 2035

Table 132 Brazil Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 133 Mexico Market Size (MW) Forecast, by Feedstock, 2025 to 2035

Table 134 Mexico Market Value (US$ Bn) Forecast, by Feedstock, 2025 to 2035

Table 135 Mexico Market Size (MW) Forecast, by Technology, 2025 to 2035

Table 136 Mexico Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 137 Mexico Market Size (MW) Forecast, by End-use, 2025 to 2035

Table 138 Mexico Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 139 Rest of Latin America Market Size (MW) Forecast, by Feedstock, 2025 to 2035

Table 140 Rest of Latin America Market Value (US$ Bn) Forecast, by Feedstock, 2025 to 2035

Table 141 Rest of Latin America Market Size (MW) Forecast, by Technology, 2025 to 2035

Table 142 Rest of Latin America Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 143 Rest of Latin America Market Size (MW) Forecast, by End-use, 2025 to 2035

Table 144 Rest of Latin America Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 145 Middle East & Africa Market Size (MW) Forecast, by Feedstock, 2025 to 2035

Table 146 Middle East & Africa Market Value (US$ Bn) Forecast, by Feedstock, 2025 to 2035

Table 147 Middle East & Africa Market Size (MW) Forecast, by Technology, 2025 to 2035

Table 148 Middle East & Africa Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 149 Middle East & Africa Market Size (MW) Forecast, by End-use, 2025 to 2035

Table 150 Middle East & Africa Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 151 Middle East & Africa Market Size (MW) Forecast, by Country and Sub-region, 2025 to 2035

Table 152 Middle East & Africa Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 153 GCC Market Size (MW) Forecast, by Feedstock, 2025 to 2035

Table 154 GCC Market Value (US$ Bn) Forecast, by Feedstock, 2025 to 2035

Table 155 GCC Market Size (MW) Forecast, by Technology, 2025 to 2035

Table 156 GCC Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 157 GCC Market Size (MW) Forecast, by End-use, 2025 to 2035

Table 158 GCC Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 159 South Africa Market Size (MW) Forecast, by Feedstock, 2025 to 2035

Table 160 South Africa Market Value (US$ Bn) Forecast, by Feedstock, 2025 to 2035

Table 161 South Africa Market Size (MW) Forecast, by Technology, 2025 to 2035

Table 162 South Africa Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 163 South Africa Market Size (MW) Forecast, by End-use, 2025 to 2035

Table 164 South Africa Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Table 165 Rest of Middle East & Africa Market Size (MW) Forecast, by Feedstock, 2025 to 2035

Table 166 Rest of Middle East & Africa Market Value (US$ Bn) Forecast, by Feedstock, 2025 to 2035

Table 167 Rest of Middle East & Africa Market Size (MW) Forecast, by Technology, 2025 to 2035

Table 168 Rest of Middle East & Africa Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 169 Rest of Middle East & Africa Market Size (MW) Forecast, by End-use, 2025 to 2035

Table 170 Rest of Middle East & Africa Market Value (US$ Bn) Forecast, by End-use, 2025 to 2035

Figure 1 Global Market Value Share Analysis, by Feedstock, 2024, 2028, and 2035

Figure 2 Global Market Attractiveness, by Feedstock

Figure 3 Global Market Value Share Analysis, by Technology, 2024, 2028, and 2035

Figure 4 Global Market Attractiveness, by Technology

Figure 5 Global Market Value Share Analysis, by End-use, 2024, 2028, and 2035

Figure 6 Global Market Attractiveness, by End-use

Figure 7 Global Market Value Share Analysis, by Region, 2024, 2028, and 2035

Figure 8 Global Market Attractiveness, by Region

Figure 9 North America Market Value Share Analysis, by Feedstock, 2024, 2028, and 2035

Figure 10 North America Market Attractiveness, by Feedstock

Figure 11 North America Market Value Share Analysis, by Technology, 2024, 2028, and 2035

Figure 12 North America Market Attractiveness, by Technology

Figure 13 North America Market Value Share Analysis, by End-use, 2024, 2028, and 2035

Figure 14 North America Market Attractiveness, by End-use

Figure 15 North America Market Attractiveness, by Country and Sub-region

Figure 16 Europe Market Value Share Analysis, by Feedstock, 2024, 2028, and 2035

Figure 17 Europe Market Attractiveness, by Feedstock

Figure 18 Europe Market Value Share Analysis, by Technology, 2024, 2028, and 2035

Figure 19 Europe Market Attractiveness, by Technology

Figure 20 Europe Market Value Share Analysis, by End-use, 2024, 2028, and 2035

Figure 21 Europe Market Attractiveness, by End-use

Figure 22 Europe Market Value Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 23 Europe Market Attractiveness, by Country and Sub-region

Figure 24 Asia Pacific Market Value Share Analysis, by Feedstock, 2024, 2028, and 2035

Figure 25 Asia Pacific Market Attractiveness, by Feedstock

Figure 26 Asia Pacific Market Value Share Analysis, by Technology, 2024, 2028, and 2035

Figure 27 Asia Pacific Market Attractiveness, by Technology

Figure 28 Asia Pacific Market Value Share Analysis, by End-use, 2024, 2028, and 2035

Figure 29 Asia Pacific Market Attractiveness, by End-use

Figure 30 Asia Pacific Market Value Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 31 Asia Pacific Market Attractiveness, by Country and Sub-region

Figure 32 Latin America Market Value Share Analysis, by Feedstock, 2024, 2028, and 2035

Figure 33 Latin America Market Attractiveness, by Feedstock

Figure 34 Latin America Market Value Share Analysis, by Technology, 2024, 2028, and 2035

Figure 35 Latin America Market Attractiveness, by Technology

Figure 36 Latin America Market Value Share Analysis, by End-use, 2024, 2028, and 2035

Figure 37 Latin America Market Attractiveness, by End-use

Figure 38 Latin America Market Value Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 39 Latin America Market Attractiveness, by Country and Sub-region

Figure 40 Middle East & Africa Market Value Share Analysis, by Feedstock, 2024, 2028, and 2035

Figure 41 Middle East & Africa Market Attractiveness, by Feedstock

Figure 42 Middle East & Africa Market Value Share Analysis, by Technology, 2024, 2028, and 2035

Figure 43 Middle East & Africa Market Attractiveness, by Technology

Figure 44 Middle East & Africa Market Value Share Analysis, by End-use, 2024, 2028, and 2035

Figure 45 Middle East & Africa Market Attractiveness, by End-use

Figure 46 Middle East & Africa Market Value Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 47 Middle East & Africa Market Attractiveness, by Country and Sub-region