Reports

Reports

The bioinformatics market works on a spectrum between biology and data science. The field is shifting from niche research platform to standard infrastructure for drug discovery, diagnostics, and precision medicine. The primary growth factors in bioinformatics are lower sequencing costs, rapid adoption of NGS technologies into the clinic and research organizations, and the serious demand for AI/ML tools to turn large omics datasets into usable intelligence.

As innovation is rampant in the field, life science platform vendors (e.g., Illumina, Thermo Fisher, QIAGEN, Agilent) have leveraged what has become a formula for success, which is to bundle the analytic software and cloud services with their instruments to create an ecosystem for analytics and consumption of the data. Once an ecosystem is created there is significant value in the integration, leading to faster platform adoption and lower barrier entry. Large platforms have better access to financial resources necessary for building a strong integrated ecosystem, while independent analytics developers are often at a higher resource disadvantage due to funding and complimentary development costs associated with analytics tools.

Conversely, a variety of foundations, specialist service firms, and start-ups are building more lucrative niches (e.g., single-cell analytics, clinical-grade pipelines, real-world data integration) that have led to increased partnership and M&A activities to further consolidate capabilities into a more productized data analytics solution.

Regulatory clarity and guidance around clinical grade bioinformatics, advances in cloud compute available in the market, and outsourcing of data analysis by pharma companies are also expected to create continued double-digit growth in bioinformatics over the next several years. In addition to being core of future bioinformatics growth, strategic opportunities exist particularly in the area of AI-driven interpretation solutions, clinical validation of bioinformatics pipelines, and platform interoperability that improves data sharing across instruments, labs, and hospitals.

The momentum of bioinformatics is based on four drivers, which are being advanced together: increased adoption of high-throughput sequencing and multi-omics assays; growing R&D and clinical funding in precision medicine; the emergence of the cloud and scalable analytics; and the use of AI/ML tools to automate the interpretation of genomic data and the discovery of biomarkers.

Together, these drivers represent an expansion in addressable use cases — ranging from early stage target exploration to companion diagnostic development to post-market surveillance — and a shift in expenditure from one-off analysis to recurring contracts for platform and services. The trends for outsourcing in pharma/biotech and increased demands for faster time-to-insight in translational research have also encouraged organizations to consider outsourcing their analytical provision to managed bioinformatics services and validated pipelines. The ultimate result is a favorable market for both large platform vendors and boutique analytics vendors.

| Attribute | Detail |

|---|---|

| Bioinformatics Market Drivers |

|

A key contributing factor is the fast decline in sequencing and assay costs, measured on a per sample basis, which is lowering the entry requirement for large cohort studies and routine clinical use. Research centers and clinical labs have much lower reagent and instrument costs. Due to the significantly faster throughput of sequencing instruments, it is now possible for research centers and clinical labs to generate orders of magnitude more raw data — thus creating the need for more bioinformatics sophistication to store, process, and interpret the data.

As sequencing technology moves away from being limited to particular specialized centers through to work in hospital labs and contract research organizations (CRO), institutions must develop standardized pipelines, scalable compute capacities, and regulatory-grade analyses to allow for the transformation of a raw read into clinical or R&D value. This creates sustained growth for software platforms in their own right, creating an unprecedented level of both - cloud compute spend and third-party analysis services.

For instance, as various market analyses indicate, falling sequencing costs, and increasing NGS volumes have been a central reason behind multi-billion dollar expansions of markets related to genomics-informatics in the years since the advent of next-generation sequencing. This "ripple" effect means more samples → more data → greater proportional spend on annotation of those samples, calling variants, interpretation of differences in the samples and data management platforms. This dynamic benefits instrument vendors who bundle analytics and bioinformatics providers who supply validated pipelines and managed services.

The other big driver is the growing incorporation of AI/ML methods into bioinformatics workflows. Machine learning accelerates pattern finding across genomics, proteomics, and images datasets, making biomarker identification, phenotype prediction, and drug-response modeling occur faster than before. More vendors and start-ups are incorporating ML modules into their variant interpretation, single-cell clustering, and multi-omics integration tools that not only contribute to new commercialization opportunities for bioinformatics platforms, but create additional premium features (e.g., automated annotation of clinical evidence scoring, predictive models).

Pharma companies are increasingly adopting these types of capabilities, to reduce timelines for discovery, and for generating translational insight from real-world and clinical trial datasets.

For instance, companies with AI-enhanced analytic suites are seeing increasing partnership activity with pharma and diagnostics firms, and market study reports are citing AI/ML as the top theme delivering higher valuation and funding in the bioinformatics space. The net result is two-fold: (1) an increase in enterprise software and service contracts for sophisticated, validated ML pipelines; and (2) buyers are more likely to select vendors who can demonstrate clinical-grade interpretability and explainability, resulting in increased consolidation and strategic alliances.

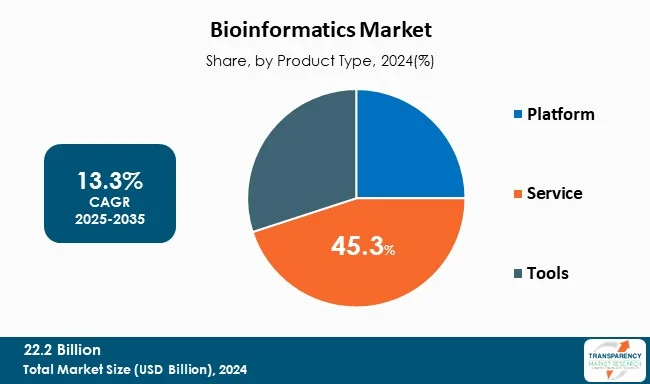

The services segment in the bioinformatics market is qualitatively favored, as end-users are increasingly relying on external resources, as opposed to developing internal capabilities. A number of academic institutions, small- to mid-sized biotech companies, and larger pharmaceutical companies choose only to outsource bioinformatics initiatives, such as interpretation of data, pipeline development, and compliance-ready reporting. This helps end users cut costs from hiring or obtaining specialized staff and maintaining HPC hardware.

Services provide more flexibility around the ability to scale resource usage up or down according to the maturity of the project, whether it be exploratory research or clinical trial support.

The emergence of validated workflows and regulatory-compliant analytics is a key factor in the predominance of services, and it is difficult for end-users to establish these processes internally. For example, several clinical research organizations and service providers now offer managed bioinformatics services, which leverage advanced cloud computing and domain expertise so that laboratories can focus on the actual research and be assured their analytics meet a very high standard. Bioinformatics services are no longer viewed as a support function but a crucial component of life science and healthcare research design.

| Attribute | Detail |

|---|---|

| Leading Region |

|

North America continues to be the largest market for bioinformatics because it has a strong research ecosystem, concentration of technology providers, and relatively favorable funding landscape. There is a multitude of the world’s largest pharmaceutical, biotechnology, and genomics companies based in North America with relatively consistent demand for innovative bioinformatics tools and services.

The United States, in particular, plays a central role in bioscience research, aided by the excess of research funding available from government and private sources. The U.S. academic medical centers and research universities are the early adopters of next generation sequencing and multi-omics technologies (including proteomics and metabolomics) and the rise of high-throughput data generation has greatly increased the need for scalable data-intensive analytical platforms.

The leading cloud providers from the U.S., along with countless AI-driven start-ups are introducing new and advanced means of integration between computing and biomedical research. To illustrate this point, U.S. based national initiatives focused on precision medicine have led to the large-scale collection of genomic data.

The scalable demands necessitates bioinformatics pipelines that provide both efficiency and reproducibility. These observations further establish North America as the acknowledged epicenter of biostatistics, bioinformatics, and computational biology implementation. In the context of bioinformatics, our current knowledge of known technologies, evolving practices, and development of new technologies can be piloted and confirmed for effectiveness in North America prior to appropriate adoption globally - United States is an exception.

Key players operating in the bioinformatics industry are investing in technological advancements, innovation, and strategic partnerships. They focus on enhancing imaging clarity and expanding product portfolios, thereby ensuring sustained leadership and growth in the evolving healthcare landscape.

Thermo Fisher Scientific Inc., Illumina, Inc., PerkinElmer Genomics, Eurofins Genomics LLC, NeoGenomics Laboratories, QIAGEN, DNASTAR, Psomagen, Waters, Microsynth AG, MedGenome, Nucleome Informatics Private Limited, Symyx Technologies, Inc., IDBS, SYNSIGHT are the key players in bioinformatics industry.

Each of these players has been profiled in the bioinformatics market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

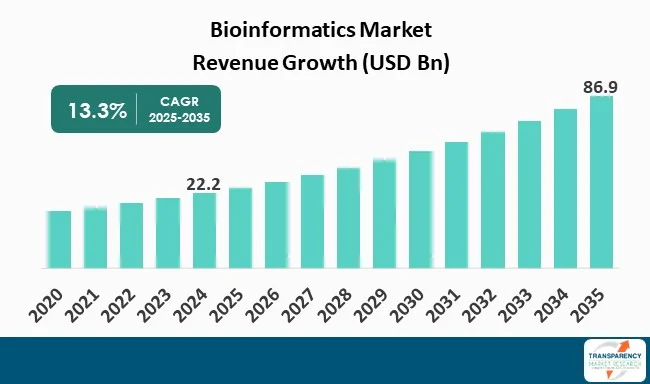

| Size in 2024 | US$ 22.2 Bn |

| Forecast Value in 2035 | US$ 86.9 Bn |

| CAGR | 13.3% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Bioinformatics Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Product & Service

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The bioinformatics market was valued at US$ 22.2 Bn in 2024

The bioinformatics market is projected to cross US$ 86.9 Bn by the end of 2035

Falling cost & democratization of sequencing and omics and AI/ML adoption and platformization of analytics

The CAGR is anticipated to be 13.3% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

Thermo Fisher Scientific Inc., Illumina, Inc., PerkinElmer Genomics, Eurofins Genomics LLC, NeoGenomics Laboratories, QIAGEN, DNASTAR, Psomagen, Waters, Microsynth AG, MedGenome, Nucleome Informatics Private Limited, Symyx Technologies, Inc., IDBS, SYNSIGHT and others

Table 01: Global Bioinformatics Market Value (US$ Bn) Forecast, by Product & Service, 2020 to 2035

Table 02: Global Bioinformatics Market Value (US$ Bn) Forecast, by Platform, 2020 to 2035

Table 03: Global Bioinformatics Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 04: Global Bioinformatics Market Value (US$ Bn) Forecast, by Tools, 2020 to 2035

Table 05: Global Bioinformatics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 06: Global Bioinformatics Market Value (US$ Bn) Forecast, by Sector, 2020 to 2035

Table 07: Global Bioinformatics Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 08: North America Bioinformatics Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 09: North America Bioinformatics Market Value (US$ Bn) Forecast, by Product & Service, 2020 to 2035

Table 10: North America Bioinformatics Market Value (US$ Bn) Forecast, by Platform, 2020 to 2035

Table 11: North America Bioinformatics Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 12: North America Bioinformatics Market Value (US$ Bn) Forecast, by Tools, 2020 to 2035

Table 13: North America Bioinformatics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 14: North America Bioinformatics Market Value (US$ Bn) Forecast, by Sector, 2020 to 2035

Table 15: Europe Bioinformatics Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 16: Europe Bioinformatics Market Value (US$ Bn) Forecast, by Product & Service, 2020 to 2035

Table 17: Europe Bioinformatics Market Value (US$ Bn) Forecast, by Platform, 2020 to 2035

Table 18: Europe Bioinformatics Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 19: Europe Bioinformatics Market Value (US$ Bn) Forecast, by Tools, 2020 to 2035

Table 20: Europe Bioinformatics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 21: Europe Bioinformatics Market Value (US$ Bn) Forecast, by Sector, 2020 to 2035

Table 22: Asia Pacific Bioinformatics Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 23: Asia Pacific Bioinformatics Market Value (US$ Bn) Forecast, by Product & Service, 2020 to 2035

Table 24: Asia Pacific Bioinformatics Market Value (US$ Bn) Forecast, by Platform, 2020 to 2035

Table 25: Asia Pacific Bioinformatics Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 26: Asia Pacific Bioinformatics Market Value (US$ Bn) Forecast, by Tools, 2020 to 2035

Table 27: Asia Pacific Bioinformatics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 28: Asia Pacific Bioinformatics Market Value (US$ Bn) Forecast, by Sector, 2020 to 2035

Table 29: Latin America Bioinformatics Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 30: Latin America Bioinformatics Market Value (US$ Bn) Forecast, by Product & Service, 2020 to 2035

Table 31: Latin America Bioinformatics Market Value (US$ Bn) Forecast, by Platform, 2020 to 2035

Table 32: Latin America Bioinformatics Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 33: Latin America Bioinformatics Market Value (US$ Bn) Forecast, by Tools, 2020 to 2035

Table 34: Latin America Bioinformatics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 35: Latin America Bioinformatics Market Value (US$ Bn) Forecast, by Sector, 2020 to 2035

Table 36: Middle East & Africa Bioinformatics Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 37: Middle East and Africa Bioinformatics Market Value (US$ Bn) Forecast, by Product & Service, 2020 to 2035

Table 38: Middle East and Africa Bioinformatics Market Value (US$ Bn) Forecast, by Platform, 2020 to 2035

Table 39: Middle East and Africa Bioinformatics Market Value (US$ Bn) Forecast, by Service, 2020 to 2035

Table 40: Middle East and Africa Bioinformatics Market Value (US$ Bn) Forecast, by Tools, 2020 to 2035

Table 41: Middle East and Africa Bioinformatics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 42: Middle East and Africa Bioinformatics Market Value (US$ Bn) Forecast, by Sector, 2020 to 2035

Figure 01: Global Bioinformatics Market Value Share Analysis, by Product & Service, 2024 and 2035

Figure 02: Global Bioinformatics Market Attractiveness Analysis, by Product & Service, 2025 to 2035

Figure 03: Global Bioinformatics Market Revenue (US$ Bn), by Platform, 2020 to 2035

Figure 04: Global Bioinformatics Market Revenue (US$ Bn), by Service, 2020 to 2035

Figure 05: Global Bioinformatics Market Revenue (US$ Bn), by Tools, 2020 to 2035

Figure 06: Global Bioinformatics Market Value Share Analysis, by Application, 2024 and 2035

Figure 07: Global Bioinformatics Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 08: Global Bioinformatics Market Revenue (US$ Bn), by Genomics, 2020 to 2035

Figure 09: Global Bioinformatics Market Revenue (US$ Bn), by Chemoinformatics & Drug Discovery, 2020 to 2035

Figure 10: Global Bioinformatics Market Revenue (US$ Bn), by Proteomics, 2020 to 2035

Figure 11: Global Bioinformatics Market Revenue (US$ Bn), by Transcriptomics, 2020 to 2035

Figure 12: Global Bioinformatics Market Revenue (US$ Bn), by Metabolomics, 2020 to 2035

Figure 13: Global Bioinformatics Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 14: Global Bioinformatics Market Value Share Analysis, by Sector, 2024 and 2035

Figure 15: Global Bioinformatics Market Attractiveness Analysis, by Sector, 2025 to 2035

Figure 16: Global Bioinformatics Market Revenue (US$ Bn), by Animal Bioinformatics, 2020 to 2035

Figure 17: Global Bioinformatics Market Revenue (US$ Bn), by Plant Bioinformatics, 2020 to 2035

Figure 18: Global Bioinformatics Market Revenue (US$ Bn), by Medical Bioinformatics, 2020 to 2035

Figure 19: Global Bioinformatics Market Revenue (US$ Bn), by Environmental Bioinformatics, 2020 to 2035

Figure 20: Global Bioinformatics Market Revenue (US$ Bn), by Agricultural Bioinformatics, 2020 to 2035

Figure 21: Global Bioinformatics Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 22: Global Bioinformatics Market Value Share Analysis, By Region, 2024 and 2035

Figure 23: Global Bioinformatics Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 24: North America Bioinformatics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 25: North America Bioinformatics Market Value Share Analysis, by Country, 2024 and 2035

Figure 26: North America Bioinformatics Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 27: North America Bioinformatics Market Value Share Analysis, by Product & Service, 2024 and 2035

Figure 28: North America Bioinformatics Market Attractiveness Analysis, by Product & Service, 2025 to 2035

Figure 29: North America Bioinformatics Market Value Share Analysis, by Application, 2024 and 2035

Figure 30: North America Bioinformatics Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 31: North America Bioinformatics Market Value Share Analysis, by Sector, 2024 and 2035

Figure 32: North America Bioinformatics Market Attractiveness Analysis, by Sector, 2025 to 2035

Figure 33: Europe Bioinformatics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 34: Europe Bioinformatics Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 35: Europe Bioinformatics Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 36: Europe Bioinformatics Market Value Share Analysis, by Product & Service, 2024 and 2035

Figure 37: Europe Bioinformatics Market Attractiveness Analysis, by Product & Service, 2025 to 2035

Figure 38: Europe Bioinformatics Market Value Share Analysis, by Application, 2024 and 2035

Figure 39: Europe Bioinformatics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 40: Europe Bioinformatics Market Value Share Analysis, by Sector, 2024 and 2035

Figure 41: Europe Bioinformatics Market Attractiveness Analysis, by Sector, 2025 to 2035

Figure 42: Asia Pacific Bioinformatics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 43: Asia Pacific Bioinformatics Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 44: Asia Pacific Bioinformatics Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 45: Asia Pacific Bioinformatics Market Value Share Analysis, by Product & Service, 2024 and 2035

Figure 46: Asia Pacific Bioinformatics Market Attractiveness Analysis, by Product & Service, 2025 to 2035

Figure 47: Asia Pacific Bioinformatics Market Value Share Analysis, by Application, 2024 and 2035

Figure 48: Asia Pacific Bioinformatics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 49: Asia Pacific Bioinformatics Market Value Share Analysis, by Sector, 2024 and 2035

Figure 50: Asia Pacific Bioinformatics Market Attractiveness Analysis, by Sector, 2025 to 2035

Figure 51: Latin America Bioinformatics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 52: Latin America Bioinformatics Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 53: Latin America Bioinformatics Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 54: Latin America Bioinformatics Market Value Share Analysis, by Product & Service, 2024 and 2035

Figure 55: Latin America Bioinformatics Market Attractiveness Analysis, by Product & Service, 2025 to 2035

Figure 56: Latin America Bioinformatics Market Value Share Analysis, by Application, 2024 and 2035

Figure 57: Latin America Bioinformatics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 58: Latin America Bioinformatics Market Value Share Analysis, by Sector, 2024 and 2035

Figure 59: Latin America Bioinformatics Market Attractiveness Analysis, by Sector, 2025 to 2035

Figure 60: Middle East and Africa Bioinformatics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 61: Middle East and Africa Bioinformatics Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 62: Middle East and Africa Bioinformatics Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 63: Middle East and Africa Bioinformatics Market Value Share Analysis, by Product & Service, 2024 and 2035

Figure 64: Middle East and Africa Bioinformatics Market Attractiveness Analysis, by Product & Service, 2025 to 2035

Figure 65: Middle East and Africa Bioinformatics Market Value Share Analysis, by Application, 2024 and 2035

Figure 66: Middle East and Africa Bioinformatics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 67: Middle East and Africa Bioinformatics Market Value Share Analysis, by Sector, 2024 and 2035

Figure 68: Middle East and Africa Bioinformatics Market Attractiveness Analysis, by Sector, 2025 to 2035