Reports

Reports

Analysts’ Viewpoint on Aseptic Paper Packaging Market Scenario

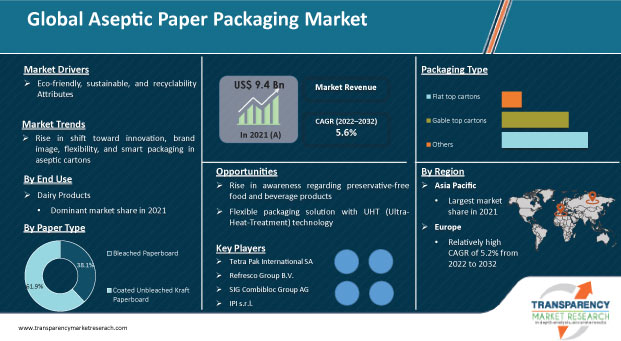

The aseptic paper packaging market is anticipated to grow at a CAGR of 5.6% from 2022 to 2032 owing to the increase in consumption of beverages and dairy products across the world. Aseptic paper packaging solutions are produced using bleached paperboard and coated unbleached kraft paperboard that is sustainable. Demand for aseptic paper packaging is expected to rise across the globe primarily due to the increase in consumer preference for sustainable packaging solutions. Rise in demand for convenient & sterile products and changes in consumer lifestyle are key factors driving the aseptic paper packaging market. Growth in demand for packaged beverages, flavored milk, juices, etc., especially in developing countries, is also augmenting the market.

The global aseptic paper packaging market is estimated to create an incremental opportunity of US$ 7.5 Bn by 2032. Significant growth of e-commerce and rise in demand for products with longer shelf-life are expected to drive the global aseptic paper packaging market from 2022 to 2032. Aseptic paper packaging is sterilized. Thus, it positively impacts the shelf life of products. Aseptic paper packaging manufacturers are focusing on launching innovative aseptic paper packaging solutions, which can enhance food & beverage safety and sustainability.

The COVID-19 pandemic has significantly impacted the purchasing habits of consumers. Consumer preferences are rapidly evolving toward sterile packaging and products with long shelf life. Aseptic paper packaging solutions possess high barrier properties and use state-of-the-art sterilization processes to lengthen the product shelf life. Online demand is rising and delivery platforms have witnessed significant spikes in sales. Consumption of UHT (Ultra Heat Treatment) milk, juices, and healthy dairy products has increased substantially during the pandemic. Thus, sales of aseptic paper cartons are likely to increase exponentially amid and post the pandemic.

Liquid food products are usually packaged using plastics, which are obtained from non-renewable resources. Plastic packaging solutions are harmful to the environment and have lasting effect on the marine life. Governments of several countries have implemented stringent regulations to eliminate the use of single-use plastic. This has influenced packaging solution providers to shift from conventional forms of packaging to eco-friendly packaging products. Aseptic packaging, with no glue or adhesive, supports effective recycling efforts, as it can be further repurposed into other paper products.

Manufacturers are also switching to aseptic paper packaging due to shipping benefits, as liquid food products packaged in aseptic materials take up 50% less space than plastic bottles. Furthermore, aseptic paper packaging maintains a sterile environment for packaged food products, which makes refrigerated shipments obsolete. The raw material used for manufacturing aseptic paper for cartons is highly bio-degradable and can be recycled easily. These factors are expected to increase the uptake of such aseptic paper cartons in beverage and dairy industries. Rise in demand for sustainable packaging solutions is anticipated to boost the market for aseptic paper packaging.

Cartons are considered a prominent tool for advertising and promoting products. Customers are always looking for a new experience with a variety of innovative packages and designs that stand out on the shelf. In today’s digital world, companies directly connect with consumers via their mobile devices. This encourages consumers to remain loyal and highly engaged with brands. Manufacturers are continuously striving to launch innovative yet sustainable aseptic paper packaging cartons. This is expected to augment the demand for aseptic paper packaging cartons. For instance, Greatview Aseptic Packaging Co., Ltd. has created an innovative smart packaging, which makes it possible for printing images, text, or QR codes on each individual carton to add differentiation, functionality, and appeal. In May 2022, Elopak ASA launched a carton called Pure-Pak eSense, which is a more environmentally friendly aseptic carton made without an aluminum layer.

Aseptic food and beverage package is sterilized prior to filling it with UHT (Ultra-Heat-Treatment), which results in extending the product's shelf life. Ultra-heat treatment maximizes the destruction of microorganisms in dairy products and dairy alternatives. This cost-efficient and flexible technology helps extend the product's shelf life.

Ultra-pasteurized milk comes in sterilized containers. Its special pasteurization and packaging process gives it a shelf life of several months. UHT milk that is packaged into aseptic cartons need not be refrigerated until the package is opened. It has a shelf life of many months. The preference for long-life dairy items is increasing among consumers due to the unaffordable refrigeration cost for dairy products. This is expected to present lucrative opportunities for manufacturers of aseptic paper carton packaging for ultra-heat treatment (UHT) milk during the forecast period.

The aseptic paper packaging market in India is likely to grow at a CAGR of 7.3% during the forecast period. The aseptic paper packaging market in the country has been expanding due to factors such as government initiatives in food & beverage safety and reduction in single-use plastics. Alcohol adulteration is a major issue in India. Aseptic paper packaging is impossible to tamper with; hence, it plays a pivotal role in preventing alcohol adulteration. Consumption of milk is high in the country. Thus, India-based manufacturers are focusing on providing valve-added packaging. Aseptic paper packaging is expected to be a game-changer, as it helps reduce food waste and increases the shelf life of perishable products.

Manufacturers are expected to adopt innovative methods to meet the demand for healthy functional foods and beverages. The changing and busy lifestyles of consumers owing to rapid urbanization have boosted the demand for processed and convenient food and beverage products. Rise in disposable income due to growth in economies is driving the demand for ready-to-carry fid and beverages. The trend of consumers carrying food & beverage products while traveling is gaining momentum. Lightweight and downsized aseptic paper packaging cartons are trending in the market, as they are easy to carry and use. Consumption of convenient food and beverages is high, owing to the increase in working population. This is expected to boost the usage of aseptic paper cartons in ready-to-carry beverages.

Food and beverage preservatives are added to food items in order to keep the food and beverage safe, without spoiling, for longer. They are also used to add appealing features, such as flavor and color, to the packaged food or beverage. These preservatives help increase the shelf life of various products. However, they can cause side effects upon consumption. Preserving flavor and simultaneously maintaining the product’s quality and safety is important for manufacturers.

The removal of preservatives from packaging can act as a strong opportunity for the aseptic paper packaging market. Aseptic paper carton packaging retains the composition of food and beverages without adding any preservatives; therefore, the packaging technology is projected to help the food & beverage industry eliminate the usage of preservatives in the packaging of different products.

Asia Pacific is anticipated to dominate the global aseptic paper packaging market by the end of 2022. Demand for dairy products such as milk and yogurt has been increasing in the region during the pandemic. Steady increase in purchasing power of the people is also driving the demand for aseptic paper packaging in the region.

The aseptic paper packaging market in Europe is expected to witness an incremental value of US$ 1.9 Bn during the forecast period. This can be attributed to the rise in consumer preference for online retail, the Covid-19 pandemic situation, and dominance of local companies in the region.

Companies operating in the market are increasingly opting to produce environment-friendly products to gain a larger share of the market. They are focusing on launching innovative aseptic paper packaging solutions. Leading players analyzed in the report include Tetra Pak International SA, Refresco Group B.V., Nippon Paper Industries Co., Ltd., SIG Combibloc Group AG, Mondi Plc, Greatview Aseptic Packaging Co., Ltd., UFlex Limited, IPI s.r.l., and TidePak Aseptic Packaging Material Co., Ltd.

Each of these players has been profiled in the aseptic paper packaging market report based on parameters such as company overview, financial overview, business strategies, application portfolio, business segments, and recent developments

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 9.4 Bn |

|

Market Forecast Value in 2032 |

US$ 16.8 Bn |

|

Growth Rate (CAGR) |

5.6% |

|

Forecast Period |

2022–2032 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The aseptic paper packaging market was valued at US$ 9.8 Bn in 2022 and is expected to reach US$ 16.8 Bn by 2032

The aseptic paper packaging market is expected to grow at a CAGR of 5.6% during the forecast period

Increase in consumption of packaged beverage and dairy products; rise in demand for sterilized, convenient, and sustainable packaging solutions; and significant growth of e-commerce are projected to drive the market

The aseptic paper packaging market in Asia Pacific is likely to grow at the fastest CAGR during the forecast period

The dairy products segment is likely to generate the highest revenue in 2032

Tetra Pak International SA, Refresco Group B.V., Nippon Paper Industries Co., Ltd., SIG Combibloc Group AG, Mondi Plc are prominent players in the global market

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. TMR Analysis and Recommendations

2. Aseptic Paper Packaging Market Introduction

2.1. Aseptic Paper Packaging Market Definition

2.2. Aseptic Paper Packaging Market Taxonomy

3. Aseptic Paper Packaging Market Overview

3.1. Global Packaging Industry

3.2. Micro Economic Factors

3.3. Global Market Demand Analysis 2015-2021 and Forecast 2022-2032

3.4. Pricing Analysis

3.5. Value Chain Analysis

3.5.1. Profitability Margins

3.5.2. List of Active Participants

3.5.2.1. Raw Material Supplier

3.5.2.2. Aseptic Paper Packaging Manufacturers

3.5.2.3. End Users

3.6. Market Dynamics

3.6.1. Drivers

3.6.2. Restraints

3.6.3. Trends

3.6.4. Opportunities

3.7. Regulatory Landscape

4. Impact of COVID-19

4.1. Current Statistics and Probable Future Impact

4.2. Impact of COVID-19 on Aseptic Paper Packaging Market

5. Global Aseptic Paper Packaging Market Analysis and Forecast, By Paper Type

5.1. Introduction

5.1.1. Market Share and BPS Analysis, By Paper Type

5.1.2. Y-o-Y Growth Projections, By Paper Type

5.2. Market Size (US$ Bn) and Historical 2015-2021 and Forecast 2022-2032, By Paper Type

5.2.1. Bleached Paperboard

5.2.2. Coated Unbleached Kraft Paperboard

5.3. Market Attractiveness Analysis By Paper Type

5.4. Prominent Trends

6. Global Aseptic Paper Packaging Market Analysis and Forecast, By Thickness

6.1. Introduction

6.1.1. Market Share and BPS Analysis, By Thickness

6.1.2. Y-o-Y Growth Projections, By Thickness

6.2. Market Size (US$ Bn) and Historical 2013-2021and Forecast 2022-2032, By Thickness

6.2.1. Less than 240µm

6.2.2. 240 to 260µm

6.2.3. 260 to 280µm

6.2.4. More than 280µm

6.3. Market Attractiveness Analysis By Thickness

6.4. Prominent Trends

7. Global Aseptic Paper Packaging Market Analysis and Forecast, By Packaging Structure

7.1. Introduction

7.1.1. Market Share and BPS Analysis, By Packaging Structure

7.1.2. Y-o-Y Growth Projections, By Packaging Structure

7.2. Market Size (US$ Bn) and Historical 2015-2021 and Forecast 2022-2032, By Packaging Structure

7.2.1. 3 Layer

7.2.2. 4 Layer

7.2.3. 6 Layer

7.2.4. Others

7.3. Market Attractiveness Analysis By Packaging Structure

7.4. Prominent Trends

8. Global Aseptic Paper Packaging Market Analysis and Forecast, By Packaging Type

8.1. Introduction

8.1.1. Market Share and BPS Analysis, By Packaging Type

8.1.2. Y-o-Y Growth Projections, By Packaging Type

8.2. Market Size (US$ Bn) and Historical 2015-2021 and Forecast 2022-2032, By Packaging Type

8.2.1. Flat Top Cartons

8.2.2. Gable Top Cartons

8.2.3. Others

8.3. Market Attractiveness Analysis By Packaging Type

8.4. Prominent Trends

9. Global Aseptic Paper Packaging Market Analysis and Forecast, By End Use

9.1. Introduction

9.1.1. Market Share and BPS Analysis, By End Use

9.1.2. Y-o-Y Growth Projections, By End Use

9.2. Market Size (US$ Bn) and Historical 2015-2021 and Forecast 2022-2032, By End Use

9.2.1. Dairy Products

9.2.1.1. Milk

9.2.1.2. Yogurt & Butter Milk

9.2.2. Beverages

9.2.2.1. Fruit Juice

9.2.2.2. Carbonated Soft Drinks

9.2.2.3. Alcoholic Beverages

9.3. Market Attractiveness Analysis By End Use

9.4. Prominent Trends

10. Global Aseptic Paper Packaging Market Analysis and Forecast, By Region

10.1. Introduction

10.1.1. Market Share and BPS Analysis By Region

10.1.2. Y-o-Y Growth Projections By Region

10.2. Market Size (US$ Bn) and Historical 2015-2021 and Forecast 2022-2032, By Region

10.2.1. North America

10.2.2. Latin America

10.2.3. Europe

10.2.4. Asia Pacific

10.2.5. Middle East and Africa (MEA)

10.3. Regional Attractiveness Analysis

10.4. Prominent Trends

10.5. Drivers & Restraints: Impact Analysis

11. North America Aseptic Paper Packaging Market Analysis and Forecast

11.1. Introduction

11.1.1. Market Share and BPS Analysis By Country

11.1.2. Y-o-Y Growth Projections By Country

11.2. Market Size (US$ Bn) and Historical 2015-2021 and Forecast 2022-2032, By Country

11.2.1. U.S.

11.2.2. Canada

11.3. Market Size (US$ Bn) and Historical 2015-2021 and Forecast 2022-2032, By Paper Type

11.3.1. Bleached Paperboard

11.3.2. Coated Unbleached Kraft Paperboard

11.4. Market Size (US$ Bn) and Historical 2015-2021 and Forecast 2022-2032, By Thickness

11.4.1. Less than 240µm

11.4.2. 240 to 260µm

11.4.3. 260 to 280µm

11.4.4. More than 280µm

11.5. Market Size (US$ Bn) and Historical 2015-2021 and Forecast 2022-2032, By Packaging Structure

11.5.1. 3 Layer

11.5.2. 4 Layer

11.5.3. 6 Layer

11.5.4. Others

11.6. Market Size (US$ Bn) and Historical 2015-2021 and Forecast 2022-2032, By Packaging Type

11.6.1. Flat Top Cartons

11.6.2. Gable Top Cartons

11.6.3. Others

11.7. Market Size (US$ Bn) and Historical 2015-2021 and Forecast 2022-2032, By End Use

11.7.1. Dairy Products

11.7.1.1. Milk

11.7.1.2. Yogurt & Butter Milk

11.7.2. Beverages

11.7.2.1. Fruit Juice

11.7.2.2. Carbonated Soft Drinks

11.7.2.3. Alcoholic Beverages

11.8. Prominent Trends

11.9. Drivers and Restraints: Impact Analysis

12. Latin America Aseptic Paper Packaging Market Analysis and Forecast

12.1. Introduction

12.1.1. Market Share and BPS Analysis By Country

12.1.2. Y-o-Y Growth Projections By Country

12.2. Market Size (US$ Bn) and Historical 2015-2021 and Forecast 2022-2032, By Country

12.2.1. Brazil

12.2.2. Mexico

12.2.3. Argentina

12.2.4. Rest of Latin America

12.3. Market Size (US$ Bn) and Historical 2015-2021 and Forecast 2022-2032, By Paper Type

12.3.1. Bleached Paperboard

12.3.2. Coated Unbleached Kraft Paperboard

12.4. Market Size (US$ Bn) and Historical 2015-2021 and Forecast 2022-2032, By Thickness

12.4.1. Less than 240µm

12.4.2. 240 to 260µm

12.4.3. 260 to 280µm

12.4.4. More than 280µm

12.5. Market Size (US$ Bn) and Historical 2015-2021 and Forecast 2022-2032, By Packaging Structure

12.5.1. 3 Layer

12.5.2. 4 Layer

12.5.3. 6 Layer

12.5.4. Others

12.6. Market Size (US$ Bn) and Historical 2015-2021 and Forecast 2022-2032, By Packaging Type

12.6.1. Flat Top Cartons

12.6.2. Gable Top Cartons

12.6.3. Others

12.7. Market Size (US$ Bn) and Historical 2015-2021 and Forecast 2022-2032, By End Use

12.7.1. Dairy Products

12.7.1.1. Milk

12.7.1.2. Yogurt & Butter Milk

12.7.2. Beverages

12.7.2.1. Fruit Juice

12.7.2.2. Carbonated Soft Drinks

12.7.2.3. Alcoholic Beverages

12.8. Prominent Trends

12.9. Drivers and Restraints: Impact Analysis

13. Europe Aseptic Paper Packaging Market Analysis and Forecast

13.1. Introduction

13.1.1. Market Share and BPS Analysis By Country

13.1.2. Y-o-Y Growth Projections By Country

13.2. Market Size (US$ Bn) and Historical 2015-2021 and Forecast 2022-2032, By Country

13.2.1. Germany

13.2.2. Spain

13.2.3. Italy

13.2.4. France

13.2.5. U.K.

13.2.6. BENELUX

13.2.7. Nordic Countries

13.2.8. Russia

13.2.9. Rest of Europe

13.3. Market Size (US$ Bn) and Historical 2015-2021 and Forecast 2022-2032, By Paper Type

13.3.1. Bleached Paperboard

13.3.2. Coated Unbleached Kraft Paperboard

13.4. Market Size (US$ Bn) and Historical 2015-2021 and Forecast 2022-2032, By Thickness

13.4.1. Less than 240µm

13.4.2. 240 to 260µm

13.4.3. 260 to 280µm

13.4.4. More than 280µm

13.5. Market Size (US$ Bn) and Historical 2015-2021 and Forecast 2022-2032, By Packaging Structure

13.5.1. 3 Layer

13.5.2. 4 Layer

13.5.3. 6 Layer

13.5.4. Others

13.6. Market Size (US$ Bn) and Historical 2015-2021 and Forecast 2022-2032, By Packaging Type

13.6.1. Flat Top Cartons

13.6.2. Gable Top Cartons

13.6.3. Others

13.7. Market Size (US$ Bn) and Historical 2015-2021 and Forecast 2022-2032, By End Use

13.7.1. Dairy Products

13.7.1.1. Milk

13.7.1.2. Yogurt & Butter Milk

13.7.2. Beverages

13.7.2.1. Fruit Juice

13.7.2.2. Carbonated Soft Drinks

13.7.2.3. Alcoholic Beverages

13.8. Prominent Trends

13.9. Drivers and Restraints: Impact Analysis

14. Asia Pacific Aseptic Paper Packaging Market Analysis and Forecast

14.1. Introduction

14.1.1. Market Share and BPS Analysis By Country

14.1.2. Y-o-Y Growth Projections By Country

14.2. Market Size (US$ Bn) and Historical 2015-2021 and Forecast 2022-2032, By Country

14.2.1. China

14.2.2. India

14.2.3. Japan

14.2.4. ASEAN

14.2.5. Australia and New Zealand

14.2.6. Rest of APAC

14.3. Market Size (US$ Bn) and Historical 2015-2021 and Forecast 2022-2032, By Paper Type

14.3.1. Bleached Paperboard

14.3.2. Coated Unbleached Kraft Paperboard

14.4. Market Size (US$ Bn) and Historical 2015-2021 and Forecast 2022-2032, By Thickness

14.4.1. Less than 240µm

14.4.2. 240 to 260µm

14.4.3. 260 to 280µm

14.4.4. More than 280µm

14.5. Market Size (US$ Bn) and Historical 2015-2021 and Forecast 2022-2032, By Packaging Structure

14.5.1. 3 Layer

14.5.2. 4 Layer

14.5.3. 6 Layer

14.5.4. Others

14.6. Market Size (US$ Bn) and Historical 2015-2021 and Forecast 2022-2032, By Packaging Type

14.6.1. Flat Top Cartons

14.6.2. Gable Top Cartons

14.6.3. Others

14.7. Market Size (US$ Bn) and Historical 2015-2021 and Forecast 2022-2032, By End Use

14.7.1. Dairy Products

14.7.1.1. Milk

14.7.1.2. Yogurt & Butter Milk

14.7.2. Beverages

14.7.2.1. Fruit Juice

14.7.2.2. Carbonated Soft Drinks

14.7.2.3. Alcoholic Beverages

14.8. Prominent Trends

14.9. Drivers and Restraints: Impact Analysis

15. Middle East and Africa Aseptic Paper Packaging Market Analysis and Forecast

15.1. Introduction

15.1.1. Market Share and BPS Analysis By Country

15.1.2. Y-o-Y Growth Projections By Country

15.1.3. Key Regulations

15.2. Market Size (US$ Bn) and Historical 2015-2021 and Forecast 2022-2032, By Country

15.2.1. North Africa

15.2.2. South Africa

15.2.3. GCC countries

15.2.4. Rest of MEA

15.3. Market Size (US$ Bn) and Historical 2015-2021 and Forecast 2022-2032, By Paper Type

15.4. Market Size (US$ Bn) and Historical 2015-2021 and Forecast 2022-2032, By Paper Type

15.4.1. Bleached Paperboard

15.4.2. Coated Unbleached Kraft Paperboard

15.5. Market Size (US$ Bn) and Historical 2015-2021 and Forecast 2022-2032, By Thickness

15.5.1. Less than 240µm

15.5.2. 240 to 260µm

15.5.3. 260 to 280µm

15.5.4. More than 280µm

15.6. Market Size (US$ Bn) and Historical 2015-2021 and Forecast 2022-2032, By Packaging Structure

15.6.1. 3 Layer

15.6.2. 4 Layer

15.6.3. 6 Layer

15.6.4. Others

15.7. Market Size (US$ Bn) and Historical 2015-2021 and Forecast 2022-2032, By Packaging Type

15.7.1. Flat Top Cartons

15.7.2. Gable Top Cartons

15.7.3. Others

15.8. Market Size (US$ Bn) and Historical 2015-2021 and Forecast 2022-2032, By End Use

15.8.1. Dairy Products

15.8.1.1. Milk

15.8.1.2. Yogurt & Butter Milk

15.8.2. Beverages

15.8.2.1. Fruit Juice

15.8.2.2. Carbonated Soft Drinks

15.8.2.3. Alcoholic Beverages

15.9. Prominent Trends

15.10. Drivers and Restraints: Impact Analysis

16. Competitive Landscape

16.1. Competition Dashboard

16.2. Companies USP Analysis

16.3. Company Share Analysis – Global

16.4. Company Profiles (Details – Overview, Financials, Strategy, SWOT Analysis, Recent Developments)

16.5. Company Profiles

(Key Global Market Players)

16.5.1. Tetra Pak International SA

16.5.1.1. Overview

16.5.1.2. Financials

16.5.1.3. Strategy

16.5.1.4. Recent Developments

16.5.1.5. SWOT Analysis

(The same will be provided for all the companies)

16.5.2. Refresco Group B.V.

16.5.2.1. Overview

16.5.2.2. Financials

16.5.2.3. Strategy

16.5.2.4. Recent Developments

16.5.2.5. SWOT Analysis

16.5.3. Nippon Paper Industries Co., Ltd.

16.5.3.1. Overview

16.5.3.2. Financials

16.5.3.3. Strategy

16.5.3.4. Recent Developments

16.5.3.5. SWOT Analysis

16.5.4. SIG Combibloc Group AG

16.5.4.1. Overview

16.5.4.2. Financials

16.5.4.3. Strategy

16.5.4.4. Recent Developments

16.5.4.5. SWOT Analysis

16.5.5. Mondi Plc

16.5.5.1. Overview

16.5.5.2. Financials

16.5.5.3. Strategy

16.5.5.4. Recent Developments

16.5.5.5. SWOT Analysis

16.5.6. Elopak ASA

16.5.6.1. Overview

16.5.6.2. Financials

16.5.6.3. Strategy

16.5.4. Recent Developments

16.5.6.4. SWOT Analysis

16.5.7. IPI s.r.l.

16.5.7.1. Overview

16.5.7.2. Financials

16.5.7.3. Strategy

16.5.7.4. Recent Developments

16.5.7.5. SWOT Analysis

16.5.8. UFlex Limited

16.5.8.1. Overview

16.5.8.2. Financials

16.5.8.3. Strategy

16.5.8.4. Recent Developments

16.5.8.5. SWOT Analysis

16.5.9. Evergreen Packaging Inc.

16.5.9.1. Overview

16.5.9.2. Financials

16.5.9.3. Strategy

16.5.9.4. Recent Developments

16.5.9.5. SWOT Analysis

16.5.10. Greatview Aseptic Packaging Co., Ltd.

16.5.10.1. Overview

16.5.10.2. Financials

16.5.10.3. Strategy

16.5.10.4. Recent Developments

16.5.10.5. SWOT Analysis

16.5.11. Lami Packaging (Kunshan) Co., Ltd.

16.5.11.1. Overview

16.5.11.2. Financials

16.5.11.3. Strategy

16.5.11.4. Recent Developments

16.5.11.5. SWOT Analysis

16.5.12. TidePak Aseptic Packaging Material Co.,Ltd.

16.5.12.1. Overview

16.5.12.2. Financials

16.5.12.3. Strategy

16.5.12.4. Recent Developments

16.5.12.5. SWOT Analysis

*The list of companies is indicative in nature and is subject to change during the course of research

17. Assumptions and Acronyms Used

18. Research Methodology

List of Tables

Table 01: Global Aseptic Paper Packaging Market Value (Tonnes) by Paper Type, 2015(H)-2032(F)

Table 02: Global Aseptic Paper Packaging Market Value (US$ Bn) by Paper Type, 2015(H)-2032(F)

Table 03: Global Aseptic Paper Packaging Market Value (Tonnes) by Thickness, 2015(H)-2032(F)

Table 04: Global Aseptic Paper Packaging Market Value (US$ Bn) by Thickness, 2015(H)-2032(F)

Table 05: Global Aseptic Paper Packaging Market Value (Tonnes) by Packaging Structure, 2015(H)-2032(F)

Table 06: Global Aseptic Paper Packaging Market Value (US$ Bn) by Packaging Structure, 2015(H)-2032(F)

Table 07: Global Aseptic Paper Packaging Market Value (Tonnes) by Packaging Type, 2015(H)-2032(F)

Table 08: Global Aseptic Paper Packaging Market Value (US$ Bn) by Packaging Type, 2015(H)-2032(F)

Table 09: Global Aseptic Paper Packaging Market Volume (Tonnes) by End Use, 2015(H)-2032(F)

Table 10: Global Aseptic Paper Packaging Market Value (US$ Bn) by End Use, 2015(H)-2032(F)

Table 11: Global Aseptic Paper Packaging Market Volume (Tonnes) by Region, 2015(H)-2032(F)

Table 12: Global Aseptic Paper Packaging Market Volume (US$ Bn) by Region, 2015(H)-2032(F)

Table 13: North America Aseptic Paper Packaging Market Value (Tonnes) by Paper Type, 2015(H)-2032(F)

Table 14: North America Aseptic Paper Packaging Market Value (US$ Bn) by Paper Type, 2015(H)-2032(F)

Table 15: North America Aseptic Paper Packaging Market Value (Tonnes) by Thickness, 2015(H)-2032(F)

Table 16: North America Aseptic Paper Packaging Market Value (US$ Bn) by Thickness, 2015(H)-2032(F)

Table 17: North America Aseptic Paper Packaging Market Value (Tonnes) by Packaging Structure, 2015(H)-2032(F)

Table 18: North America Aseptic Paper Packaging Market Value (US$ Bn) by Packaging Structure, 2015(H)-2032(F)

Table 19: North America Aseptic Paper Packaging Market Value (Tonnes) by Packaging Type, 2015(H)-2032(F)

Table 20: North America Aseptic Paper Packaging Market Value (US$ Bn) by Packaging Type, 2015(H)-2032(F)

Table 21: North America Aseptic Paper Packaging Market Volume (Tonnes) by End Use, 2015(H)-2032(F)

Table 22: North America Aseptic Paper Packaging Market Value (US$ Bn) by End Use, 2015(H)-2032(F)

Table 23: North America Aseptic Paper Packaging Market Value (Tonnes) by Country, 2015(H)-2032(F)

Table 24: North America Aseptic Paper Packaging Market Value (US$ Bn) by Country, 2015(H)-2032(F)

Table 25: Latin America Aseptic Paper Packaging Market Value (Tonnes) by Paper Type, 2015(H)-2032(F)

Table 26: Latin America Aseptic Paper Packaging Market Value (US$ Bn) by Paper Type, 2015(H)-2032(F)

Table 27: Latin America Aseptic Paper Packaging Market Value (Tonnes) by Thickness, 2015(H)-2032(F)

Table 28: Latin America Aseptic Paper Packaging Market Value (US$ Bn) by Thickness, 2015(H)-2032(F)

Table 29: Latin America Aseptic Paper Packaging Market Value (Tonnes) by Packaging Structure, 2015(H)-2032(F)

Table 30: Latin America Aseptic Paper Packaging Market Value (US$ Bn) by Packaging Structure, 2015(H)-2032(F)

Table 31: Latin America Aseptic Paper Packaging Market Value (Tonnes) by Packaging Type, 2015(H)-2032(F)

Table 32: Latin America Aseptic Paper Packaging Market Value (US$ Bn) by Packaging Type, 2015(H)-2032(F)

Table 33: Latin America Aseptic Paper Packaging Market Volume (Tonnes) by End Use, 2015(H)-2032(F)

Table 34: Latin America Aseptic Paper Packaging Market Value (US$ Bn) by End Use, 2015(H)-2032(F)

Table 35: Latin America Aseptic Paper Packaging Market Value (Tonnes) by Country, 2015(H)-2032(F)

Table 36: Latin America Aseptic Paper Packaging Market Value (US$ Bn) by Country, 2015(H)-2032(F)

Table 37: Europe Aseptic Paper Packaging Market Value (Tonnes) by Paper Type, 2015(H)-2032(F)

Table 38: Europe Aseptic Paper Packaging Market Value (US$ Bn) by Paper Type, 2015(H)-2032(F)

Table 39: Europe Aseptic Paper Packaging Market Value (Tonnes) by Thickness, 2015(H)-2032(F)

Table 40: Europe Aseptic Paper Packaging Market Value (US$ Bn) by Thickness, 2015(H)-2032(F)

Table 41: Europe Aseptic Paper Packaging Market Value (Tonnes) by Packaging Structure, 2015(H)-2032(F)

Table 42: Europe Aseptic Paper Packaging Market Value (US$ Bn) by Packaging Structure, 2015(H)-2032(F)

Table 43: Europe Aseptic Paper Packaging Market Value (Tonnes) by Packaging Type, 2015(H)-2032(F)

Table 44: Europe Aseptic Paper Packaging Market Value (US$ Bn) by Packaging Type, 2015(H)-2032(F)

Table 45: Europe Aseptic Paper Packaging Market Volume (Tonnes) by End Use, 2015(H)-2032(F)

Table 46: Europe Aseptic Paper Packaging Market Value (US$ Bn) by End Use, 2015(H)-2032(F)

Table 47: Europe Aseptic Paper Packaging Market Volume (Tonnes) by Country, 2015(H)-2032(F)

Table 48: Europe Aseptic Paper Packaging Market Value (US$ Bn) by Country, 2015(H)-2032(F)

Table 49: Asia Pacific Aseptic Paper Packaging Market Value (Tonnes) by Paper Type, 2015(H)-2032(F)

Table 50: Asia Pacific Aseptic Paper Packaging Market Value (US$ Bn) by Paper Type, 2015(H)-2032(F)

Table 51: Asia Pacific Aseptic Paper Packaging Market Value (Tonnes) by Thickness, 2015(H)-2032(F)

Table 52: Asia Pacific Aseptic Paper Packaging Market Value (US$ Bn) by Thickness, 2015(H)-2032(F)

Table 53: Asia Pacific Aseptic Paper Packaging Market Value (Tonnes) by Packaging Structure, 2015(H)-2032(F)

Table 54: Asia Pacific Aseptic Paper Packaging Market Value (US$ Bn) by Packaging Structure, 2015(H)-2032(F)

Table 55: Asia Pacific Aseptic Paper Packaging Market Value (Tonnes) by Packaging Type, 2015(H)-2032(F)

Table 56: Asia Pacific Aseptic Paper Packaging Market Value (US$ Bn) by Packaging Type, 2015(H)-2032(F)

Table 57: Asia Pacific Aseptic Paper Packaging Market Volume (Tonnes) by End Use, 2015(H)-2032(F)

Table 58: Asia Pacific Aseptic Paper Packaging Market Value (US$ Bn) by End Use, 2015(H)-2032(F)

Table 59 Asia Pacific Aseptic Paper Packaging Market Volume (Tonnes) by Country, 2015(H)-2032(F)

Table 60: Asia Pacific Aseptic Paper Packaging Market Value (US$ Bn) by Country, 2015(H)-2032(F)

Table 61: Middle East & Africa Aseptic Paper Packaging Market Value (Tonnes) by Paper Type, 2015(H)-2032(F)

Table 62: Middle East & Africa Aseptic Paper Packaging Market Value (US$ Bn) by Paper Type, 2015(H)-2032(F)

Table 63: Middle East & Africa Aseptic Paper Packaging Market Value (Tonnes) by Thickness, 2015(H)-2032(F)

Table 64: Middle East & Africa Aseptic Paper Packaging Market Value (US$ Bn) by Thickness, 2015(H)-2032(F)

Table 65: Middle East & Africa Aseptic Paper Packaging Market Value (Tonnes) by Packaging Structure, 2015(H)-2032(F)

Table 66: Middle East & Africa Aseptic Paper Packaging Market Value (US$ Bn) by Packaging Structure, 2015(H)-2032(F)

Table 67: Middle East & Africa Aseptic Paper Packaging Market Value (Tonnes) by Packaging Type, 2015(H)-2032(F)

Table 68: Middle East & Africa Aseptic Paper Packaging Market Value (US$ Bn) by Packaging Type, 2015(H)-2032(F)

Table 69: Middle East & Africa Aseptic Paper Packaging Market Volume (Tonnes) by End Use, 2015(H)-2032(F)

Table 70: Middle East & Africa Aseptic Paper Packaging Market Value (US$ Bn) by End Use, 2015(H)-2032(F)

Table 71: Middle East & Africa Aseptic Paper Packaging Market Value (Tonnes) by Country, 2015(H)-2032(F)

Table 72: Middle East & Africa Aseptic Paper Packaging Market Value (US$ Bn) by Country, 2015(H)-2032(F)

List of Figures

Figure 01: Global Aseptic Paper Packaging Market Attractiveness by Paper Type, 2022(E)-2032(F)

Figure 02: Global Aseptic Paper Packaging Market Y-o-Y Analysis by Paper Type, 2019(H)-2032(F)

Figure 03: Global Aseptic Paper Packaging Market Share Analysis by Paper Type, 2022(E)-2032(F)

Figure 04: Global Aseptic Paper Packaging Market Attractiveness by Thickness, 2022(E)-2032(F)

Figure 05: Global Aseptic Paper Packaging Market Y-o-Y Analysis by Thickness, 2019(H)-2032(F)

Figure 06: Global Aseptic Paper Packaging Market Share Analysis by Thickness, 2022(E)-2032(F)

Figure 07: Global Aseptic Paper Packaging Market Attractiveness by Packaging Structure, 2022(E)-2032(F)

Figure 08: Global Aseptic Paper Packaging Market Y-o-Y Analysis by Packaging Structure, 2019(H)-2032(F)

Figure 09: Global Aseptic Paper Packaging Market Share Analysis by Packaging Structure, 2022(E)-2032(F)

Figure 10: Global Aseptic Paper Packaging Market Attractiveness by Packaging Type, 2022(E)-2032(F)

Figure 11: Global Aseptic Paper Packaging Market Y-o-Y Analysis by Packaging Type, 2019(H)-2032(F)

Figure 12: Global Aseptic Paper Packaging Market Share Analysis by Packaging Type, 2022(E)-2032(F)

Figure 13: Global Aseptic Paper Packaging Market Attractiveness by End Use, 2022(E)-2032(F)

Figure 14: Global Aseptic Paper Packaging Market Y-o-Y Analysis by End Use, 2019(H)-2032(F)

Figure 15: Global Aseptic Paper Packaging Market Share Analysis by End Use, 2022(E)-2032(F)

Figure 16: Global Aseptic Paper Packaging Market Attractiveness by Region, 2022(E)-2032(F)

Figure 17: Global Aseptic Paper Packaging Market Y-o-Y Analysis by Region, 2019(H)-2032(F)

Figure 18: Global Aseptic Paper Packaging Market Share Analysis by Region, 2022(E)-2032(F)

Figure 19: North America Aseptic Paper Packaging Market Share Analysis, by Paper Type, 2022(E) & 2032(F)

Figure 20: North America Aseptic Paper Packaging Market Attractiveness Analysis, by Thickness, 2022(E)-2032(F)

Figure 21: North America Aseptic Paper Packaging Market Share Analysis, by Packaging Structure, 2022(E) & 20232(F)

Figure 22: North America Aseptic Paper Packaging Market Share Analysis, by Packaging Type, 2022(E) & 2032(F)

Figure 23: North America Aseptic Paper Packaging Market Share Analysis, by End Use, 2022(E) & 2032(F)

Figure 24: North America Aseptic Paper Packaging Market Share Analysis, by Country, 2022(E) & 2032(F)

Figure 25: Latin America Aseptic Paper Packaging Market Share Analysis, by Paper Type, 2022(E) & 2032(F)

Figure 26: Latin America Aseptic Paper Packaging Market Attractiveness Analysis, by Thickness, 2022(E)-2032(F)

Figure 27: Latin America Aseptic Paper Packaging Market Share Analysis, by Packaging Structure, 2022(E) & 20232(F)

Figure 28: Latin America Aseptic Paper Packaging Market Share Analysis, by Packaging Type, 2022(E) & 2032(F)

Figure 29: Latin America Aseptic Paper Packaging Market Share Analysis, by End Use, 2022(E) & 2032(F)

Figure 30: Latin America Aseptic Paper Packaging Market Share Analysis, by Country, 2022(E) & 2032(F)

Figure 31: Europe Aseptic Paper Packaging Market Share Analysis, by Paper Type, 2022(E) & 2032(F)

Figure 32: Europe Aseptic Paper Packaging Market Attractiveness Analysis, by Thickness, 2022(E)-2032(F)

Figure 33: Europe Aseptic Paper Packaging Market Share Analysis, by Packaging Structure, 2022(E) & 20232(F)

Figure 34: Europe Aseptic Paper Packaging Market Share Analysis, by Packaging Type, 2022(E) & 2032(F)

Figure 35: Europe Aseptic Paper Packaging Market Share Analysis, by End Use, 2022(E) & 2032(F)

Figure 36: Europe Aseptic Paper Packaging Market Share Analysis, by Country, 2022(E) & 2032(F)

Figure 37: Asia Pacific Aseptic Paper Packaging Market Share Analysis, by Paper Type, 2022(E) & 2032(F)

Figure 38: Asia Pacific Aseptic Paper Packaging Market Attractiveness Analysis, by Thickness, 2022(E)-2032(F)

Figure 39: Asia Pacific Aseptic Paper Packaging Market Share Analysis, by Packaging Structure, 2022(E) & 20232(F)

Figure 40: Asia Pacific Aseptic Paper Packaging Market Share Analysis, by Packaging Type, 2022(E) & 2032(F)

Figure 41: Asia Pacific Aseptic Paper Packaging Market Share Analysis, by End Use, 2022(E) & 2032(F)

Figure 42: Asia Pacific Aseptic Paper Packaging Market Share Analysis, by Country, 2022(E) & 2032(F)

Figure 43: Middle East & Africa Aseptic Paper Packaging Market Share Analysis, by Paper Type, 2022(E) & 2032(F)

Figure 44: Middle East & Africa Aseptic Paper Packaging Market Attractiveness Analysis, by Thickness, 2022(E)-2032(F)

Figure 45: Middle East & Africa Aseptic Paper Packaging Market Share Analysis, by Packaging Structure, 2022(E) & 20232(F)

Figure 46: Middle East & Africa Aseptic Paper Packaging Market Share Analysis, by Packaging Type, 2022(E) & 2032(F)

Figure 47: Middle East & Africa Aseptic Paper Packaging Market Share Analysis, by End Use, 2022(E) & 2032(F)

Figure 48: Middle East & Africa Aseptic Paper Packaging Market Share Analysis, by Country, 2022(E) & 2032(F)