Reports

Reports

Analysts’ Viewpoint on Market Scenario

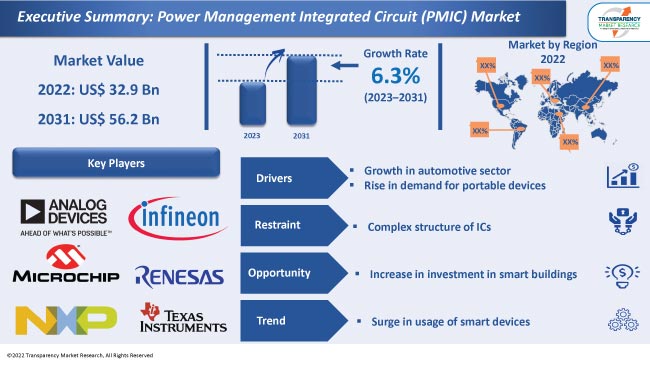

Growth in the automotive sector and rise in demand for portable devices are expected to augment the global Power Management Integrated Circuit (PMIC) market size in the near future. PMICs are ideal for embedded processing in a variety of applications such as Internet of Things (IoT), medical and industrial IoT, electric vehicles, edge computing, and autonomous vehicles.

Automotive PMICs are gaining traction in the global Power Management Integrated Circuit (PMIC) industry, as they provide highly integrated and high-performance power management solutions for automotive applications. Key players are upgrading their existing products to expand their customer base.

Power Management Integrated Circuit (PMIC) is an electronic device that manages power distribution and power consumption in electronic devices such as smartphones, tablets, and laptops. It is a highly integrated device that incorporates multiple functions, such as voltage regulation, current regulation, and power sequencing, into a single chip.

PMIC provides a stable and efficient power supply to electronic components of a device, while minimizing power loss and heat generation. They regulate the voltage and current supplied to each component to prevent overloading and damage to the device.

PMICs are used in a wide range of applications such as autonomous driving, Advanced Driver Assistance Systems (ADAS), intelligent cockpit, body electronics, cluster and infotainment systems, Battery Management Systems (BMS), and lighting systems. Thus, expansion in the automotive sector is projected to spur the Power Management Integrated Circuit (PMIC) market growth in the near future.

ADAS is gaining traction in the automotive sector due to the rise in focus on vehicle safety. According to the Highway Loss Data Institute, by 2026, two ADAS systems will be present in half or more registered vehicles and approximately 71% of registered vehicles will be equipped with rear cameras while 60% will have rear parking sensors. Thus, increase in usage of ADAS is driving Power Management Integrated Circuit (PMIC) market expansion.

Key players in the industry are simplifying power supply design for automotive camera applications. In November 2022, Renesas Electronics Corporation introduced the RAA271082 PMIC, a versatile multi-rail power IC with a primary high-voltage synchronous buck regulator, two secondary low-voltage synchronous buck regulators, and a low-voltage LDO regulator.

PMIC is an integral part of several portable devices such as media players, notebooks, smartphones, tablets, and navigation devices. It is also employed in portable medical and industrial devices.

According to the Cisco Mobile Visual Networking Index study, 11.6 billion mobile-connected devices were expected by 2021. Furthermore, the total number of smartphones was anticipated to be more than 50% of global devices by 2021. Thus, surge in adoption of portable devices is likely to fuel market progress in the next few years.

According to the latest Power Management Integrated Circuit (PMIC) market trends, the voltage regulator product type segment held 31.2% share in 2022. The segment is likely to maintain the status quo and grow at a CAGR of 6.6% from 2023 to 2031.

Voltage regulators are widely employed in various end-use industries such as automotive, IT & telecommunication, and consumer electronics. These ICs help increase the battery life of handheld devices, including laptops, smartphones, and tablets.

According to the latest Power Management Integrated Circuit (PMIC) market analysis, the consumer electronics end-use industry segment accounted for 32.4% share in 2022. It is likely to maintain its dominance and grow at a CAGR of 6.8% during the forecast period.

Growth of the segment can be ascribed to the rise in adoption of smartphones, tablets, and home appliances. According to India Brand Equity Foundation, the electronic manufacturing sector in India was valued at US$ 75.0 Bn in 2020-2021 and is expected to reach US$ 300.0 Bn by 2025-2026.

According to the latest Power Management Integrated Circuit (PMIC) market forecast, Asia Pacific is projected to hold the largest share from 2023 to 2031. The region accounted for 36.9% share in 2022. Presence of a large number of end-use industries is driving market statistics in the region.

North America accounted for 29.8% share in 2022. Rapid industrialization and growth in the automotive sector are boosting market development in the region.

The global industry is fragmented, with the presence of several players including Analog Devices, Inc., Infineon Technologies AG, Microchip Technology Inc., NXP Semiconductors, Qualcomm Technologies, Inc., Renesas Electronics Corporation, Ricoh Electronic Devices, Semtech Corporation, STMicroelectronics N.V, Texas Instruments, Inc., and Toshiba Corporation.

Each of these players has been profiled in the Power Management Integrated Circuit (PMIC) market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments. Majority of companies are investing significantly in R&D of new products to increase their Power Management Integrated Circuit (PMIC) market share.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 32.9 Bn |

|

Market Forecast Value in 2031 |

US$ 56.2 Bn |

|

Growth Rate (CAGR) |

6.3% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value and Billion Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 32.9 Bn in 2022

It is expected to grow at a CAGR of 6.3% from 2023 to 2031

Growth in the automotive sector and rise in demand for portable devices

The voltage regulator product type segment accounted for major share of 31.2% in 2022

The consumer electronics end-use industry segment accounted for major share of 32.4% in 2022

Asia Pacific was a more attractive region with 36.9% share in 2022

China accounted for US$ 5.3 Bn in 2022

Analog Devices, Inc., Infineon Technologies AG, Microchip Technology Inc., NXP Semiconductors, Qualcomm Technologies, Inc., Renesas Electronics Corporation, Ricoh Electronic Devices, Semtech Corporation, STMicroelectronics N.V, Texas Instruments, Inc., and Toshiba Corporation

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Power Management Integrated Circuit (PMIC) Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview - Global Power Management System Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap

4.5. Industry SWOT Analysis

4.6. Porter’s Five Forces Analysis

4.7. COVID-19 Impact and Recovery Analysis

5. Global Power Management Integrated Circuit (PMIC) Market Analysis, By Product Type

5.1. Power Management Integrated Circuit (PMIC) Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Product Type, 2017–2031

5.1.1. Voltage Regulator

5.1.2. Motor Control IC

5.1.3. Integrated ASSP Power Management IC

5.1.4. Battery Management IC

5.1.5. Microprocessor Supervisory IC

5.1.6. Others (Power-over-Ethernet (PoE) Controllers, Power Factor Correction (PFC) Controllers, etc.)

5.2. Market Attractiveness Analysis, By Product Type

6. Global Power Management Integrated Circuit (PMIC) Market Analysis, By Application

6.1. Power Management Integrated Circuit (PMIC) Market Size (US$ Bn) Analysis & Forecast, By Application, 2017–2031

6.1.1. Battery Management

6.1.2. ADAS

6.1.3. Infotainment and Monitoring

6.1.4. Lighting

6.1.5. HMI and Automation

6.1.6. HVAC Systems

6.1.7. Motor Drives

6.1.8. Chargers and Power Supply

6.1.9. Switches and Routers

6.1.10. Others (Embedded Computing, Medical Devices, Elevators and Escalators, etc.)

6.2. Market Attractiveness Analysis, By Application

7. Global Power Management Integrated Circuit (PMIC) Market Analysis, By End-use Industry

7.1. Power Management Integrated Circuit (PMIC) Market Size (US$ Bn) Analysis & Forecast, By End-use Industry, 2017–2031

7.1.1. Automotive

7.1.2. Aerospace & Defense

7.1.3. Energy & Utility

7.1.4. Consumer Electronics

7.1.5. Industrial

7.1.6. IT & Telecommunication

7.1.7. Others (Healthcare, Oil & Gas, etc.)

7.2. Market Attractiveness Analysis, By End-use Industry

8. Global Power Management Integrated Circuit (PMIC) Market Analysis and Forecast, By Region

8.1. Power Management Integrated Circuit (PMIC) Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Region, 2017–2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Market Attractiveness Analysis, By Region

9. North America Power Management Integrated Circuit (PMIC) Market Analysis and Forecast

9.1. Market Snapshot

9.2. Drivers and Restraints: Impact Analysis

9.3. Power Management Integrated Circuit (PMIC) Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Product Type, 2017–2031

9.3.1. Voltage Regulator

9.3.2. Motor Control IC

9.3.3. Integrated ASSP Power Management IC

9.3.4. Battery Management IC

9.3.5. Microprocessor Supervisory IC

9.3.6. Others (Power-over-Ethernet (PoE) Controllers, Power Factor Correction (PFC) Controllers, etc.)

9.4. Power Management Integrated Circuit (PMIC) Market Size (US$ Bn) Analysis & Forecast, By Application, 2017–2031

9.4.1. Battery Management

9.4.2. ADAS

9.4.3. Infotainment and Monitoring

9.4.4. Lighting

9.4.5. HMI and Automation

9.4.6. HVAC Systems

9.4.7. Motor Drives

9.4.8. Chargers and Power Supply

9.4.9. Switches and Routers

9.4.10. Others (Embedded Computing, Medical Devices, Elevators and Escalators, etc.)

9.5. Power Management Integrated Circuit (PMIC) Market Size (US$ Bn) Analysis & Forecast, By End-use Industry, 2017–2031

9.5.1. Automotive

9.5.2. Aerospace & Defense

9.5.3. Energy & Utility

9.5.4. Consumer Electronics

9.5.5. Industrial

9.5.6. IT & Telecommunication

9.5.7. Others (Healthcare, Oil & Gas, etc.)

9.6. Power Management Integrated Circuit (PMIC) Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

9.6.1. U.S.

9.6.2. Canada

9.6.3. Rest of North America

9.7. Market Attractiveness Analysis

9.7.1. By Product Type

9.7.2. By Application

9.7.3. By End-use Industry

9.7.4. By Country/Sub-region

10. Europe Power Management Integrated Circuit (PMIC) Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. Power Management Integrated Circuit (PMIC) Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Product Type, 2017–2031

10.3.1. Voltage Regulator

10.3.2. Motor Control IC

10.3.3. Integrated ASSP Power Management IC

10.3.4. Battery Management IC

10.3.5. Microprocessor Supervisory IC

10.3.6. Others (Power-over-Ethernet (PoE) Controllers, Power Factor Correction (PFC) Controllers, etc.)

10.4. Power Management Integrated Circuit (PMIC) Market Size (US$ Bn) Analysis & Forecast, By Application, 2017–2031

10.4.1. Battery Management

10.4.2. ADAS

10.4.3. Infotainment and Monitoring

10.4.4. Lighting

10.4.5. HMI and Automation

10.4.6. HVAC Systems

10.4.7. Motor Drives

10.4.8. Chargers and Power Supply

10.4.9. Switches and Routers

10.4.10. Others (Embedded Computing, Medical Devices, Elevators and Escalators, etc.)

10.5. Power Management Integrated Circuit (PMIC) Market Size (US$ Bn) Analysis & Forecast, By End-use Industry, 2017–2031

10.5.1. Automotive

10.5.2. Aerospace & Defense

10.5.3. Energy & Utility

10.5.4. Consumer Electronics

10.5.5. Industrial

10.5.6. IT & Telecommunication

10.5.7. Others (Healthcare, Oil & Gas, etc.)

10.6. Power Management Integrated Circuit (PMIC) Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

10.6.1. U.K.

10.6.2. Germany

10.6.3. France

10.6.4. Rest of Europe

10.7. Market Attractiveness Analysis

10.7.1. By Product Type

10.7.2. By Application

10.7.3. By End-use Industry

10.7.4. By Country/Sub-region

11. Asia Pacific Power Management Integrated Circuit (PMIC) Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Power Management Integrated Circuit (PMIC) Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Product Type, 2017–2031

11.3.1. Voltage Regulator

11.3.2. Motor Control IC

11.3.3. Integrated ASSP Power Management IC

11.3.4. Battery Management IC

11.3.5. Microprocessor Supervisory IC

11.3.6. Others (Power-over-Ethernet (PoE) Controllers, Power Factor Correction (PFC) Controllers, etc.)

11.4. Power Management Integrated Circuit (PMIC) Market Size (US$ Bn) Analysis & Forecast, By Application, 2017–2031

11.4.1. Battery Management

11.4.2. ADAS

11.4.3. Infotainment and Monitoring

11.4.4. Lighting

11.4.5. HMI and Automation

11.4.6. HVAC Systems

11.4.7. Motor Drives

11.4.8. Chargers and Power Supply

11.4.9. Switches and Routers

11.4.10. Others (Embedded Computing, Medical Devices, Elevators and Escalators, etc.)

11.5. Power Management Integrated Circuit (PMIC) Market Size (US$ Bn) Analysis & Forecast, By End-use Industry, 2017–2031

11.5.1. Automotive

11.5.2. Aerospace & Defense

11.5.3. Energy & Utility

11.5.4. Consumer Electronics

11.5.5. Industrial

11.5.6. IT & Telecommunication

11.5.7. Others (Healthcare, Oil & Gas, etc.)

11.6. Power Management Integrated Circuit (PMIC) Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

11.6.1. China

11.6.2. Japan

11.6.3. India

11.6.4. South Korea

11.6.5. ASEAN

11.6.6. Rest of Asia Pacific

11.7. Market Attractiveness Analysis

11.7.1. By Product Type

11.7.2. By Application

11.7.3. By End-use Industry

11.7.4. By Country/Sub-region

12. Middle East & Africa Power Management Integrated Circuit (PMIC) Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Power Management Integrated Circuit (PMIC) Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Product Type, 2017–2031

12.3.1. Voltage Regulator

12.3.2. Motor Control IC

12.3.3. Integrated ASSP Power Management IC

12.3.4. Battery Management IC

12.3.5. Microprocessor Supervisory IC

12.3.6. Others (Power-over-Ethernet (PoE) Controllers, Power Factor Correction (PFC) Controllers, etc.)

12.4. Power Management Integrated Circuit (PMIC) Market Size (US$ Bn) Analysis & Forecast, By Application, 2017–2031

12.4.1. Battery Management

12.4.2. ADAS

12.4.3. Infotainment and Monitoring

12.4.4. Lighting

12.4.5. HMI and Automation

12.4.6. HVAC Systems

12.4.7. Motor Drives

12.4.8. Chargers and Power Supply

12.4.9. Switches and Routers

12.4.10. Others (Embedded Computing, Medical Devices, Elevators and Escalators, etc.)

12.5. Power Management Integrated Circuit (PMIC) Market Size (US$ Bn) Analysis & Forecast, By End-use Industry, 2017–2031

12.5.1. Automotive

12.5.2. Aerospace & Defense

12.5.3. Energy & Utility

12.5.4. Consumer Electronics

12.5.5. Industrial

12.5.6. IT & Telecommunication

12.5.7. Others (Healthcare, Oil & Gas, etc.)

12.6. Power Management Integrated Circuit (PMIC) Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

12.6.1. GCC

12.6.2. South Africa

12.6.3. Rest of Middle East & Africa

12.7. Market Attractiveness Analysis

12.7.1. By Product Type

12.7.2. By Application

12.7.3. By End-use Industry

12.7.4. By Country/Sub-region

13. South America Power Management Integrated Circuit (PMIC) Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Power Management Integrated Circuit (PMIC) Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Product Type, 2017–2031

13.3.1. Voltage Regulator

13.3.2. Motor Control IC

13.3.3. Integrated ASSP Power Management IC

13.3.4. Battery Management IC

13.3.5. Microprocessor Supervisory IC

13.3.6. Others (Power-over-Ethernet (PoE) Controllers, Power Factor Correction (PFC) Controllers, etc.)

13.4. Power Management Integrated Circuit (PMIC) Market Size (US$ Bn) Analysis & Forecast, By Application, 2017–2031

13.4.1. Battery Management

13.4.2. ADAS

13.4.3. Infotainment and Monitoring

13.4.4. Lighting

13.4.5. HMI and Automation

13.4.6. HVAC Systems

13.4.7. Motor Drives

13.4.8. Chargers and Power Supply

13.4.9. Switches and Routers

13.4.10. Others (Embedded Computing, Medical Devices, Elevators and Escalators, etc.)

13.5. Power Management Integrated Circuit (PMIC) Market Size (US$ Bn) Analysis & Forecast, By End-use Industry, 2017–2031

13.5.1. Automotive

13.5.2. Aerospace & Defense

13.5.3. Energy & Utility

13.5.4. Consumer Electronics

13.5.5. Industrial

13.5.6. IT & Telecommunication

13.5.7. Others (Healthcare, Oil & Gas, etc.)

13.6. Power Management Integrated Circuit (PMIC) Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

13.6.1. Brazil

13.6.2. Rest of South America

13.7. Market Attractiveness Analysis

13.7.1. By Product Type

13.7.2. By Application

13.7.3. By End-use Industry

13.7.4. By Country/Sub-region

14. Competition Assessment

14.1. Global Power Management Integrated Circuit (PMIC) Market Competition Matrix - a Dashboard View

14.1.1. Global Power Management Integrated Circuit (PMIC) Market Company Share Analysis, by Value (2022)

14.1.2. Technological Differentiator

15. Company Profiles (Global Manufacturers/Suppliers)

15.1. Analog Devices, Inc.

15.1.1. Overview

15.1.2. Product Portfolio

15.1.3. Sales Footprint

15.1.4. Key Subsidiaries or Distributors

15.1.5. Strategy and Recent Developments

15.1.6. Key Financials

15.2. Infineon Technologies AG

15.2.1. Overview

15.2.2. Product Portfolio

15.2.3. Sales Footprint

15.2.4. Key Subsidiaries or Distributors

15.2.5. Strategy and Recent Developments

15.2.6. Key Financials

15.3. Microchip Technology Inc.

15.3.1. Overview

15.3.2. Product Portfolio

15.3.3. Sales Footprint

15.3.4. Key Subsidiaries or Distributors

15.3.5. Strategy and Recent Developments

15.3.6. Key Financials

15.4. NXP Semiconductors

15.4.1. Overview

15.4.2. Product Portfolio

15.4.3. Sales Footprint

15.4.4. Key Subsidiaries or Distributors

15.4.5. Strategy and Recent Developments

15.4.6. Key Financials

15.5. Qualcomm Technologies, Inc.

15.5.1. Overview

15.5.2. Product Portfolio

15.5.3. Sales Footprint

15.5.4. Key Subsidiaries or Distributors

15.5.5. Strategy and Recent Developments

15.5.6. Key Financials

15.6. Renesas Electronics Corporation

15.6.1. Overview

15.6.2. Product Portfolio

15.6.3. Sales Footprint

15.6.4. Key Subsidiaries or Distributors

15.6.5. Strategy and Recent Developments

15.6.6. Key Financials

15.7. Ricoh Electronic Devices

15.7.1. Overview

15.7.2. Product Portfolio

15.7.3. Sales Footprint

15.7.4. Key Subsidiaries or Distributors

15.7.5. Strategy and Recent Developments

15.7.6. Key Financials

15.8. Semtech Corporation

15.8.1. Overview

15.8.2. Product Portfolio

15.8.3. Sales Footprint

15.8.4. Key Subsidiaries or Distributors

15.8.5. Strategy and Recent Developments

15.8.6. Key Financials

15.9. STMicroelectronics N.V.

15.9.1. Overview

15.9.2. Product Portfolio

15.9.3. Sales Footprint

15.9.4. Key Subsidiaries or Distributors

15.9.5. Strategy and Recent Developments

15.9.6. Key Financials

15.10. Texas Instruments, Inc.

15.10.1. Overview

15.10.2. Product Portfolio

15.10.3. Sales Footprint

15.10.4. Key Subsidiaries or Distributors

15.10.5. Strategy and Recent Developments

15.10.6. Key Financials

15.11. Toshiba Corporation

15.11.1. Overview

15.11.2. Product Portfolio

15.11.3. Sales Footprint

15.11.4. Key Subsidiaries or Distributors

15.11.5. Strategy and Recent Developments

15.11.6. Key Financials

16. Go to Market Strategy

16.1. Identification of Potential Market Spaces

16.2. Understanding Buying Process of Customers

16.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Power Management Integrated Circuit (PMIC) Market Value (US$ Bn) & Forecast, by Product Type, 2017‒2031

Table 2: Global Power Management Integrated Circuit (PMIC) Market Volume (Billion Units) & Forecast, by Product Type, 2017‒2031

Table 3: Global Power Management Integrated Circuit (PMIC) Market Value (US$ Bn) & Forecast, by Application, 2017‒2031

Table 4: Global Power Management Integrated Circuit (PMIC) Market Value (US$ Bn) & Forecast, by End-use Industry, 2017‒2031

Table 5: Global Power Management Integrated Circuit (PMIC) Market Value (US$ Bn) & Forecast, by Region, 2017‒2031

Table 6: Global Power Management Integrated Circuit (PMIC) Market Volume (Billion Units) & Forecast, by Region, 2017‒2031

Table 7: North America Power Management Integrated Circuit (PMIC) Market Value (US$ Bn) & Forecast, by Product Type, 2017‒2031

Table 8: North America Power Management Integrated Circuit (PMIC) Market Volume (Billion Units) & Forecast, by Product Type, 2017‒2031

Table 9: North America Power Management Integrated Circuit (PMIC) Market Value (US$ Bn) & Forecast, by Application, 2017‒2031

Table 10: North America Power Management Integrated Circuit (PMIC) Market Value (US$ Bn) & Forecast, by End-use Industry, 2017‒2031

Table 11: North America Power Management Integrated Circuit (PMIC) Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017‒2031

Table 12: North America Power Management Integrated Circuit (PMIC) Market Volume (Billion Units) & Forecast, by Country and Sub-region, 2017‒2031

Table 13: Europe Power Management Integrated Circuit (PMIC) Market Value (US$ Bn) & Forecast, by Product Type, 2017‒2031

Table 14: Europe Power Management Integrated Circuit (PMIC) Market Volume (Billion Units) & Forecast, by Product Type, 2017‒2031

Table 15: Europe Power Management Integrated Circuit (PMIC) Market Volume (Billion Units) & Forecast, by Offering, 2017‒2031

Table 16: Europe Power Management Integrated Circuit (PMIC) Market Value (US$ Bn) & Forecast, by Application, 2017‒2031

Table 17: Europe Power Management Integrated Circuit (PMIC) Market Volume (Billion Units) & Forecast, by Application, 2017‒2031

Table 18: Europe Power Management Integrated Circuit (PMIC) Market Value (US$ Bn) & Forecast, by Application, 2017‒2031

Table 19: Europe Power Management Integrated Circuit (PMIC) Market Value (US$ Bn) & Forecast, by End-use Industry, 2017‒2031

Table 20: Europe Power Management Integrated Circuit (PMIC) Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017‒2031

Table 21: Europe Power Management Integrated Circuit (PMIC) Market Volume (Billion Units) & Forecast, by Country and Sub-region, 2017‒2031

Table 22: Asia Pacific Power Management Integrated Circuit (PMIC) Market Value (US$ Bn) & Forecast, by Product Type, 2017‒2031

Table 23: Asia Pacific Power Management Integrated Circuit (PMIC) Market Volume (Billion Units) & Forecast, by Product Type, 2017‒2031

Table 24: Asia Pacific Power Management Integrated Circuit (PMIC) Market Value (US$ Bn) & Forecast, by Application, 2017‒2031

Table 25: Asia Pacific Power Management Integrated Circuit (PMIC) Market Value (US$ Bn) & Forecast, by End-use Industry, 2017‒2031

Table 26: Asia Pacific Power Management Integrated Circuit (PMIC) Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017‒2031

Table 27: Asia Pacific Power Management Integrated Circuit (PMIC) Market Volume (Billion Units) & Forecast, by Country and Sub-region, 2017‒2031

Table 28: Middle East & Africa Power Management Integrated Circuit (PMIC) Market Value (US$ Bn) & Forecast, by Product Type, 2017‒2031

Table 29: Middle East & Africa Power Management Integrated Circuit (PMIC) Market Volume (Billion Units) & Forecast, by Product Type, 2017‒2031

Table 30: Middle East & Africa Power Management Integrated Circuit (PMIC) Market Value (US$ Bn) & Forecast, by Application, 2017‒2031

Table 31: Middle East & Africa Power Management Integrated Circuit (PMIC) Market Value (US$ Bn) & Forecast, by End-use Industry, 2017‒2031

Table 32: Middle East & Africa Power Management Integrated Circuit (PMIC) Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017‒2031

Table 33: Middle East & Africa Power Management Integrated Circuit (PMIC) Market Volume (Billion Units) & Forecast, by Country and Sub-region, 2017‒2031

Table 34: South America Power Management Integrated Circuit (PMIC) Market Value (US$ Bn) & Forecast, by Product Type, 2017‒2031

Table 35: South America Power Management Integrated Circuit (PMIC) Market Volume (Billion Units) & Forecast, by Product Type, 2017‒2031

Table 36: South America Power Management Integrated Circuit (PMIC) Market Value (US$ Bn) & Forecast, by Application, 2017‒2031

Table 37: South America Power Management Integrated Circuit (PMIC) Market Value (US$ Bn) & Forecast, by End-use Industry, 2017‒2031

Table 38: South America Power Management Integrated Circuit (PMIC) Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017‒2031

Table 39: South America Power Management Integrated Circuit (PMIC) Market Volume (Billion Units) & Forecast, by Country and Sub-region, 2017‒2031

List of Figures

Figure 01: Supply Chain Analysis - Global Power Management Integrated Circuit (PMIC) Market

Figure 02: Porter Five Forces Analysis - Global Power Management Integrated Circuit (PMIC) Market

Figure 03: Technology Road Map - Global Power Management Integrated Circuit (PMIC) Market

Figure 04: Global Power Management Integrated Circuit (PMIC) Market, Value (US$ Bn), 2017-2031

Figure 05: Global Power Management Integrated Circuit (PMIC) Market Size & Forecast, Y-o-Y, Value (US$ Bn), 2017‒2031

Figure 06: Global Power Management Integrated Circuit (PMIC) Market Projections by Product Type, Value (US$ Bn), 2017‒2031

Figure 07: Global Power Management Integrated Circuit (PMIC) Market, Incremental Opportunity, by Product Type, 2023‒2031

Figure 08: Global Power Management Integrated Circuit (PMIC) Market Share Analysis, by Product Type, 2023 and 2031

Figure 09: Global Power Management Integrated Circuit (PMIC) Market Projections by Application, Value (US$ Bn), 2017‒2031

Figure 10: Global Power Management Integrated Circuit (PMIC) Market, Incremental Opportunity, by Application, 2023‒2031

Figure 11: Global Power Management Integrated Circuit (PMIC) Market Share Analysis, by Application, 2023 and 2031

Figure 12: Global Power Management Integrated Circuit (PMIC) Market Projections by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 13: Global Power Management Integrated Circuit (PMIC) Market, Incremental Opportunity, by End-use Industry, 2023‒2031

Figure 14: Global Power Management Integrated Circuit (PMIC) Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 15: Global Power Management Integrated Circuit (PMIC) Market Projections by Region, Value (US$ Bn), 2017‒2031

Figure 16: Global Power Management Integrated Circuit (PMIC) Market, Incremental Opportunity, by Region, 2023‒2031

Figure 17: Global Power Management Integrated Circuit (PMIC) Market Share Analysis, by Region, 2023 and 2031

Figure 18: North America Power Management Integrated Circuit (PMIC) Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 19: North America Power Management Integrated Circuit (PMIC) Market Size & Forecast, Y-o-Y, Value (US$ Bn), 2017‒2031

Figure 20: North America Power Management Integrated Circuit (PMIC) Market Projections by Product Type Value (US$ Bn), 2017‒2031

Figure 21: North America Power Management Integrated Circuit (PMIC) Market, Incremental Opportunity, by Product Type, 2023‒2031

Figure 22: North America Power Management Integrated Circuit (PMIC) Market Share Analysis, by Product Type, 2023 and 2031

Figure 23: North America Power Management Integrated Circuit (PMIC) Market Projections by Application (US$ Bn), 2017‒2031

Figure 24: North America Power Management Integrated Circuit (PMIC) Market, Incremental Opportunity, by Application, 2023‒2031

Figure 25: North America Power Management Integrated Circuit (PMIC) Market Share Analysis, by Application, 2023 and 2031

Figure 26: North America Power Management Integrated Circuit (PMIC) Market Projections by End-use Industry Value (US$ Bn), 2017‒2031

Figure 27: North America Power Management Integrated Circuit (PMIC) Market, Incremental Opportunity, by End-use Industry, 2023‒2031

Figure 28: North America Power Management Integrated Circuit (PMIC) Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 29: North America Power Management Integrated Circuit (PMIC) Market Projections by Country and Sub-region, Value (US$ Bn), 2017‒2031

Figure 30: North America Power Management Integrated Circuit (PMIC) Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 31: North America Power Management Integrated Circuit (PMIC) Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 32: Europe Power Management Integrated Circuit (PMIC) Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 33: Europe Power Management Integrated Circuit (PMIC) Market Size & Forecast, Y-o-Y, Value (US$ Bn), 2017‒2031

Figure 34: Europe Power Management Integrated Circuit (PMIC) Market Projections by Product Type Value (US$ Bn), 2017‒2031

Figure 35: Europe Power Management Integrated Circuit (PMIC) Market, Incremental Opportunity, by Product Type, 2023‒2031

Figure 36: Europe Power Management Integrated Circuit (PMIC) Market Share Analysis, by Product Type, 2023 and 2031

Figure 37: Europe Power Management Integrated Circuit (PMIC) Market Projections by Application, Value (US$ Bn), 2017‒2031

Figure 38: Europe Power Management Integrated Circuit (PMIC) Market, Incremental Opportunity, by Application, 2023‒2031

Figure 39: Europe Power Management Integrated Circuit (PMIC) Market Share Analysis, by Application, 2023 and 2031

Figure 40: Europe Power Management Integrated Circuit (PMIC) Market Projections by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 41: Europe Power Management Integrated Circuit (PMIC) Market, Incremental Opportunity, by End-use Industry, 2023‒2031

Figure 42: Europe Power Management Integrated Circuit (PMIC) Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 43: Europe Power Management Integrated Circuit (PMIC) Market Projections by Country and Sub-region, Value (US$ Bn), 2017‒2031

Figure 44: Europe Power Management Integrated Circuit (PMIC) Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 45: Europe Power Management Integrated Circuit (PMIC) Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 46: Asia Pacific Power Management Integrated Circuit (PMIC) Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 47: Asia Pacific Power Management Integrated Circuit (PMIC) Market Size & Forecast, Y-o-Y, Value (US$ Bn), 2017‒2031

Figure 48: Asia Pacific Power Management Integrated Circuit (PMIC) Market Projections by Product Type Value (US$ Bn), 2017‒2031

Figure 49: Asia Pacific Power Management Integrated Circuit (PMIC) Market, Incremental Opportunity, by Product Type, 2023‒2031

Figure 50: Asia Pacific Power Management Integrated Circuit (PMIC) Market Share Analysis, by Product Type, 2023 and 2031

Figure 51: Asia Pacific Power Management Integrated Circuit (PMIC) Market Projections by Application, Value (US$ Bn), 2017‒2031

Figure 52: Asia Pacific Power Management Integrated Circuit (PMIC) Market, Incremental Opportunity, by Application, 2023‒2031

Figure 53: Asia Pacific Power Management Integrated Circuit (PMIC) Market Share Analysis, by Application, 2023 and 2031

Figure 54: Asia Pacific Power Management Integrated Circuit (PMIC) Market Projections by End-use Industry, Value (US$ Bn), 2017‒2031

Figure 55: Asia Pacific Power Management Integrated Circuit (PMIC) Market, Incremental Opportunity, by End-use Industry, 2023‒2031

Figure 56: Asia Pacific Power Management Integrated Circuit (PMIC) Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 57: Asia Pacific Power Management Integrated Circuit (PMIC) Market Projections by Country and Sub-region, Value (US$ Bn), 2017‒2031

Figure 58: Asia Pacific Power Management Integrated Circuit (PMIC) Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 59: Asia Pacific Power Management Integrated Circuit (PMIC) Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 60: Middle East & Africa Power Management Integrated Circuit (PMIC) Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 61: Middle East & Africa Power Management Integrated Circuit (PMIC) Market Size & Forecast, Y-o-Y, Value (US$ Bn), 2017‒2031

Figure 62: Middle East & Africa Power Management Integrated Circuit (PMIC) Market Projections by Product Type Value (US$ Bn), 2017‒2031

Figure 63: Middle East & Africa Power Management Integrated Circuit (PMIC) Market, Incremental Opportunity, by Product Type, 2023‒2031

Figure 64: Middle East & Africa Power Management Integrated Circuit (PMIC) Market Share Analysis, by Product Type, 2023 and 2031

Figure 65: Middle East & Africa Power Management Integrated Circuit (PMIC) Market Projections by Application, Value (US$ Bn), 2017‒2031

Figure 66: Middle East & Africa Power Management Integrated Circuit (PMIC) Market, Incremental Opportunity, by Application, 2023‒2031

Figure 67: Middle East & Africa Power Management Integrated Circuit (PMIC) Market Share Analysis, by Application, 2023 and 2031

Figure 68: Middle East & Africa Power Management Integrated Circuit (PMIC) Market Projections by End-use Industry Value (US$ Bn), 2017‒2031

Figure 69: Middle East & Africa Power Management Integrated Circuit (PMIC) Market, Incremental Opportunity, by End-use Industry, 2023‒2031

Figure 70: Middle East & Africa Power Management Integrated Circuit (PMIC) Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 71: Middle East & Africa Power Management Integrated Circuit (PMIC) Market Projections by Country and Sub-region, Value (US$ Bn), 2017‒2031

Figure 72: Middle East & Africa Power Management Integrated Circuit (PMIC) Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 73: Middle East & Africa Power Management Integrated Circuit (PMIC) Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 74: South America Power Management Integrated Circuit (PMIC) Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 75: South America Power Management Integrated Circuit (PMIC) Market Size & Forecast, Y-o-Y, Value (US$ Bn), 2017‒2031

Figure 76: South America Power Management Integrated Circuit (PMIC) Market Projections by Product Type Value (US$ Bn), 2017‒2031

Figure 77: South America Power Management Integrated Circuit (PMIC) Market, Incremental Opportunity, by Product Type, 2023‒2031

Figure 78: South America Power Management Integrated Circuit (PMIC) Market Share Analysis, by Product Type, 2023 and 2031

Figure 79: South America Power Management Integrated Circuit (PMIC) Market Projections by Application, Value (US$ Bn), 2017‒2031

Figure 80: South America Power Management Integrated Circuit (PMIC) Market, Incremental Opportunity, by Application, 2023‒2031

Figure 81: South America Power Management Integrated Circuit (PMIC) Market Share Analysis, by Application, 2023 and 2031

Figure 82: South America Power Management Integrated Circuit (PMIC) Market Projections by End-use Industry Value (US$ Bn), 2017‒2031

Figure 83: South America Power Management Integrated Circuit (PMIC) Market, Incremental Opportunity, by End-use Industry, 2023‒2031

Figure 84: South America Power Management Integrated Circuit (PMIC) Market Share Analysis, by End-use Industry, 2023 and 2031

Figure 85: South America Power Management Integrated Circuit (PMIC) Market Projections by Country and Sub-region, Value (US$ Bn), 2017‒2031

Figure 86: South America Power Management Integrated Circuit (PMIC) Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 87: South America Power Management Integrated Circuit (PMIC) Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 88: Global Power Management Integrated Circuit (PMIC) Market Competition

Figure 89: Global Power Management Integrated Circuit (PMIC) Market Company Share Analysis