Reports

Reports

Analysts’ Viewpoint

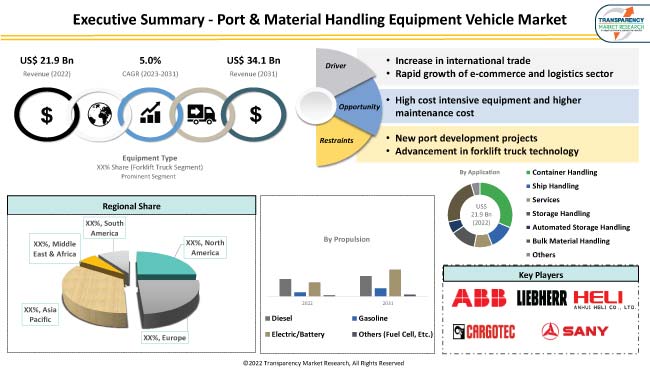

Growth of e-commerce and rise in export & import activities in major economies are expected to drive the global port & material handling equipment vehicle market during the forecast period. Constant infrastructure upgrade and renovation of infrastructure & industrial facilities are anticipated to propel market expansion. Furthermore, increase in international trade is likely to bolster the global port & material handling equipment vehicle market size during the forecast period.

Development of electric port & material handling equipment vehicles offers lucrative opportunities to market players. Manufacturers are focusing on development of hydrogen fuel cell powered vehicles and introduction of new technologies to realize global net-zero targets and achieve carbon neutrality.

Port & material handling equipment vehicles are utilized for material handling at maritime ports. These include tractors, stackers, and lift trucks that are used to carry material from the ship terminals to warehouses and distributor centers at ports.

These mechanical equipment vehicles are also employed for material handling at ports, in industries, and production plants. These are used to transport goods and material from one location to another.

Rise in need for efficient warehousing and distribution (logistics) systems is projected to boost demand for port and material handling equipment vehicles. Governments across the globe are emphasizing on developing their port infrastructure to cater to the rising shipping logistics and to improve efficacy of the stacking and distribution system so that international trading can increase.

The world economy has experienced a dynamic economic growth in the past couple of years. This process of economic growth has been accompanied by even faster growth in global trade. According to the World Trade Organization (WTO), global merchandise trade rose 12% in 2022 to US$ 25.26 Trn, with energy related goods accounting for the largest share.

In the modern global economic system, countries trade both final goods and intermediate inputs. Consequently, a complex global network of economic relationships has been created. The global port & material handling equipment vehicles market demand is projected to be fueled by the incorporation of autonomous and semi-autonomous systems for port equipment functions.

The global port & material handling equipment vehicle market growth is primarily driven by robust growth of the e-commerce industry as well as global logistics and supply chain sector. Governments of several countries, especially developing nations, are investing significantly in the manufacturing sector to enhance export activities.

Emerging technologies, such as the use of GPS, automated material handling equipment, and biometrics, are shaping the future of logistics, as the logistics business continues to undergo rapid change. Additionally, networks could be used by the Internet of Things to convey data while maintaining privacy and security.

Rapid expansion of fast transportation infrastructure across the globe has contributed to the rise in demand for port and material handling equipment vehicles to assist in movement of goods either in ports or in areas such as warehouses and production plants.

In terms of equipment type, the forklift trucks segment dominated the global port & material handling equipment vehicle market in terms of volume and revenue in 2022.

Economic growth and increase in spending in infrastructural and construction activities are playing a significant part in providing the necessary boost to the material handling equipment sector. Forklift truck is an important part of port and material handling industry. This, in turn, is expected to propel the segment during the forecast period.

Based on propulsion, the electric/battery segment accounted for the largest global port & material handling equipment vehicle market share in terms of volume in 2022. Electrification and automation of ports are receiving significant attention globally, with the majority of the largest ports in the world preparing or already implementing such programs.

Manufacturers and ports must accelerate the introduction of new technologies to realize global net-zero targets and achieve carbon neutrality. Several leading port and material handling equipment manufacturers are actively buying electric equipment despite its higher price than diesel equipment. Therefore, demand for electric/battery equipment for ports and material handling is projected to propel the segment during the forecast period.

For instance, Shanghai Zhenhua Heavy Industries (China) received assistance from the Editron division of Danfoss (Denmark) for developing electric straddle carriers using hybrid systems.

As per port & material handling equipment vehicle market forecast, Asia Pacific dominated the global industry in terms of volume and revenue in 2022. The region is considered a technology and innovation leader due to the presence of countries such as Japan, China, India, South Korea, and Singapore.

Asia Pacific has the fastest-growing technology companies based on annual percentage revenue growth. Investors are expected to be rewarded for their faith in pioneering startups by driving new products to the region.

China is expected to be the largest economy by 2025 and one of the largest markets for trading in the world. Trade has become an increasingly important part of China’s overall economy and has been a significant tool used for economic modernization.

Most of China’s imports consist of machinery and apparatus (including semiconductors, computers, and office machines), chemicals, and fuels. This is anticipated to fuel the port & material handling equipment vehicle market development during the forecast period.

The global port & material handling equipment vehicle market is consolidated, with a large number of manufacturers controlling significant market share. Major manufacturers are focused on increasing market presence by investing in R&D activities for the development of electric port & material handling equipment vehicles to be future ready. Expansion of product portfolio and new product launches are the major strategies adopted by key players.

ABB, American Crane & Equipment, Anhui Heli, Cavotec, CVS Ferrari, Famur Famak, Hyster, Kalmar, Konecranes, Liebherr, Lonking Holdings Limited, Mcnally Bharat Engineering, Sany, Shanghai Zhenhua Heavy Industries (ZPMC), Til Limited, Timars Svets & Smide AB, and TTS are the prominent players in the market.

Each of these players has been profiled in the port & material handling equipment vehicle market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 21.9 Bn |

| Forecast (Value) in 2031 | US$ 34.1 Bn |

| Growth Rate (CAGR) | 5.0% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes cross-segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profile |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 21.9 Bn in 2022

It is projected to expand at a CAGR of 5.0% by 2031.

It is expected to reach US$ 34.1 Bn in 2031.

Increase in international trading and rapid growth of e-commerce & logistics sector.

The forklift trucks equipment type segment accounted for majority share in 2022.

Asia Pacific is anticipated to be a highly lucrative region for manufacturers.

ABB, American Crane & Equipment, Anhui Heli, Cavotec, CVS Ferrari, Famur Famak, Hyster, Kalmar, Konecranes, Liebherr, Lonking Holdings Limited, Mcnally Bharat Engineering, Sany, Shanghai Zhenhua Heavy Industries (ZPMC), Til Limited, Timars Svets & Smide AB, and TTS

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Value US$ Mn, 2017-2031

1.2. Go to Market Strategy

1.2.1. Demand & Supply Side Trends

1.2.2. Identification of Potential Market Spaces

1.2.3. Understanding the Buying Process of the Customers

1.2.4. Preferred Sales & Marketing Strategy

1.3. TMR Analysis and Recommendations

2. Market Overview

2.1. Market Definition / Scope / Limitations

2.2. Macro-Economic Factors

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunity

2.4. Market Factor Analysis

2.4.1. Porter’s Five Force Analysis

2.4.2. SWOT Analysis

2.5. Regulatory Scenario

2.6. Key Trend Analysis

2.7. Value Chain Analysis

2.8. Cost Structure Analysis

2.9. Profit Margin Analysis

3. Impact Factors: Port & Material Handling Equipment Vehicle

3.1. Emergence of Electric/battery powered Vehicles

4. Global Port & Material Handling Equipment Vehicle Market, By Equipment Type

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Port & Material Handling Equipment Vehicle Market Size Analysis & Forecast, 2017-2031, By Equipment Type

4.2.1. Tug Boats

4.2.2. Cranes

4.2.2.1. Rubber-tired Gantry (RTG) Cranes

4.2.2.2. Electrified Rubber-tired Gantry (E-RTGS) Cranes

4.2.2.3. Ship-to-Shore Cranes

4.2.2.4. Yard Cranes

4.2.2.5. Rail-mounted Gantry (RMG) Cranes

4.2.2.6. Automated Stacking Cranes

4.2.3. Shiploaders

4.2.4. Reach Stackers

4.2.5. Mooring Systems

4.2.6. Automated Guided Vehicles (AGVS)

4.2.7. Forklift Trucks

4.2.8. Container Lift Trucks

4.2.9. Terminal Tractors

4.2.10. Straddle Carriers

4.2.11. Others

5. Global Port & Material Handling Equipment Vehicle Market, By Application

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Port & Material Handling Equipment Vehicle Market Size Analysis & Forecast, 2017-2031, By Application

5.2.1. Container Handling

5.2.2. Ship Handling

5.2.3. Services

5.2.4. Storage Handling

5.2.5. Automated Storage Handling

5.2.6. Bulk Material Handling

5.2.7. Others

6. Global Port & Material Handling Equipment Vehicle Market, By Propulsion

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Port & Material Handling Equipment Vehicle Market Size Analysis & Forecast, 2017-2031, By Propulsion

6.2.1. Diesel

6.2.2. Gasoline

6.2.3. Electric/Battery

6.2.4. Others (fuel cell, etc.)

7. Global Port & Material Handling Equipment Vehicle Market, By Demand

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Port & Material Handling Equipment Vehicle Market Size Analysis & Forecast, 2017-2031, By Demand

7.2.1. New Demand

7.2.2. MRO/Services

7.2.3. Market Growth & Y-o-Y Projections

7.2.4. Base Point Share Analysis

8. Global Port & Material Handling Equipment Vehicle Market, By Region

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Port & Material Handling Equipment Vehicle Market Size Analysis & Forecast, 2017-2031, By Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. South America

9. North America Port & Material Handling Equipment Vehicle Market

9.1. Market Snapshot

9.2. North America Port & Material Handling Equipment Vehicle Market Size Analysis & Forecast, 2017-2031, By Equipment Type

9.2.1. Tug Boats

9.2.2. Cranes

9.2.2.1. Rubber-tired Gantry (RTG) Cranes

9.2.2.2. Electrified Rubber-tired Gantry (E-RTGS) Cranes

9.2.2.3. Ship-to-Shore Cranes

9.2.2.4. Yard Cranes

9.2.2.5. Rail-mounted Gantry (RMG) Cranes

9.2.2.6. Automated Stacking Cranes

9.2.3. Shiploaders

9.2.4. Reach Stackers

9.2.5. Mooring Systems

9.2.6. Automated Guided Vehicles (AGVS)

9.2.7. Forklift Trucks

9.2.8. Container Lift Trucks

9.2.9. Terminal Tractors

9.2.10. Straddle Carriers

9.2.11. Others

9.3. North America Port & Material Handling Equipment Vehicle Market Size Analysis & Forecast, 2017-2031, By Type

9.3.1. Conventional

9.3.2. LCD Sun Visor

9.3.3. Extendable Sun Visor

9.3.3.1. Folding Extension

9.3.3.2. Horizontal Extension

9.3.3.3. Guide Pins

9.3.3.4. Dual Extension

9.4. North America Port & Material Handling Equipment Vehicle Market Size Analysis & Forecast, 2017-2031, By Propulsion

9.4.1. Diesel

9.4.2. Gasoline

9.4.3. Electric/Battery

9.4.4. Others (fuel cell, etc.)

9.5. North America Port & Material Handling Equipment Vehicle Market Size Analysis & Forecast, 2017-2031, By Demand

9.5.1. New Demand

9.5.2. MRO/Services

9.6. Key Country Analysis – North America Port & Material Handling Equipment Vehicle Market Size Analysis & Forecast, 2017-2031

9.6.1. U.S.

9.6.2. Canada

9.6.3. Mexico

10. Europe Port & Material Handling Equipment Vehicle Market

10.1. Market Snapshot

10.2. Europe Port & Material Handling Equipment Vehicle Market Size Analysis & Forecast, 2017-2031, By Equipment Type

10.2.1. Tug Boats

10.2.2. Cranes

10.2.2.1. Rubber-tired Gantry (RTG) Cranes

10.2.2.2. Electrified Rubber-tired Gantry (E-RTGS) Cranes

10.2.2.3. Ship-to-Shore Cranes

10.2.2.4. Yard Cranes

10.2.2.5. Rail-mounted Gantry (RMG) Cranes

10.2.2.6. Automated Stacking Cranes

10.2.3. Shiploaders

10.2.4. Reach Stackers

10.2.5. Mooring Systems

10.2.6. Automated Guided Vehicles (AGVS)

10.2.7. Forklift Trucks

10.2.8. Container Lift Trucks

10.2.9. Terminal Tractors

10.2.10. Straddle Carriers

10.2.11. Others

10.3. Europe Port & Material Handling Equipment Vehicle Market Size Analysis & Forecast, 2017-2031, By Application

10.3.1. Container Handling

10.3.2. Ship Handling

10.3.3. Services

10.3.4. Storage Handling

10.3.5. Automated Storage Handling

10.3.6. Bulk Material Handling

10.3.7. Others

10.4. Europe Port & Material Handling Equipment Vehicle Market Size Analysis & Forecast, 2017-2031, By Propulsion

10.4.1. Diesel

10.4.2. Gasoline

10.4.3. Electric/Battery

10.4.4. Others (fuel cell, etc.)

10.5. Europe Port & Material Handling Equipment Vehicle Market Size Analysis & Forecast, 2017-2031, By Demand

10.5.1. New Demand

10.5.2. MRO/Services

10.6. Key Country Analysis – Europe Port & Material Handling Equipment Vehicle Market Size Analysis & Forecast, 2017-2031

10.6.1. Germany

10.6.2. U. K.

10.6.3. France

10.6.4. Italy

10.6.5. Spain

10.6.6. Nordic Countries

10.6.7. Russia & CIS

10.6.8. Rest of Europe

11. Asia Pacific Port & Material Handling Equipment Vehicle Market

11.1. Market Snapshot

11.2. Asia Pacific Port & Material Handling Equipment Vehicle Market Size Analysis & Forecast, 2017-2031, By Equipment Type

11.2.1. Tug Boats

11.2.2. Cranes

11.2.2.1. Rubber-tired Gantry (RTG) Cranes

11.2.2.2. Electrified Rubber-tired Gantry (E-RTGS) Cranes

11.2.2.3. Ship-to-Shore Cranes

11.2.2.4. Yard Cranes

11.2.2.5. Rail-mounted Gantry (RMG) Cranes

11.2.2.6. Automated Stacking Cranes

11.2.3. Shiploaders

11.2.4. Reach Stackers

11.2.5. Mooring Systems

11.2.6. Automated Guided Vehicles (AGVS)

11.2.7. Forklift Trucks

11.2.8. Container Lift Trucks

11.2.9. Terminal Tractors

11.2.10. Straddle Carriers

11.2.11. Others

11.3. Asia Pacific Port & Material Handling Equipment Vehicle Market Size Analysis & Forecast, 2017-2031, By Application

11.3.1. Container Handling

11.3.2. Ship Handling

11.3.3. Services

11.3.4. Storage Handling

11.3.5. Automated Storage Handling

11.3.6. Bulk Material Handling

11.3.7. Others

11.4. Asia Pacific Port & Material Handling Equipment Vehicle Market Size Analysis & Forecast, 2017-2031, By Propulsion

11.4.1. Diesel

11.4.2. Gasoline

11.4.3. Electric/Battery

11.4.4. Others (Fuel Cell, Etc.)

11.5. Asia Pacific Port & Material Handling Equipment Vehicle Market Size Analysis & Forecast, 2017-2031, By Demand

11.5.1. New Demand

11.5.2. MRO/Services

11.6. Key Country Analysis – Asia Pacific Port & Material Handling Equipment Vehicle Market Size Analysis & Forecast, 2017-2031

11.6.1. China

11.6.2. India

11.6.3. Japan

11.6.4. ASEAN Countries

11.6.5. South Korea

11.6.6. ANZ

11.6.7. Rest of Asia Pacific

12. Middle East & Africa Port & Material Handling Equipment Vehicle Market

12.1. Market Snapshot

12.2. Middle East & Africa Port & Material Handling Equipment Vehicle Market Size Analysis & Forecast, 2017-2031, By Equipment Type

12.2.1. Tug Boats

12.2.2. Cranes

12.2.2.1. Rubber-tired Gantry (RTG) Cranes

12.2.2.2. Electrified Rubber-tired Gantry (E-RTGS) Cranes

12.2.2.3. Ship-to-Shore Cranes

12.2.2.4. Yard Cranes

12.2.2.5. Rail-mounted Gantry (RMG) Cranes

12.2.2.6. Automated Stacking Cranes

12.2.3. Shiploaders

12.2.4. Reach Stackers

12.2.5. Mooring Systems

12.2.6. Automated Guided Vehicles (AGVS)

12.2.7. Forklift Trucks

12.2.8. Container Lift Trucks

12.2.9. Terminal Tractors

12.2.10. Straddle Carriers

12.2.11. Others

12.3. Middle East & Africa Port & Material Handling Equipment Vehicle Market Size Analysis & Forecast, 2017-2031, By Application

12.3.1. Container Handling

12.3.2. Ship Handling

12.3.3. Services

12.3.4. Storage Handling

12.3.5. Automated Storage Handling

12.3.6. Bulk Material Handling

12.3.7. Others

12.4. Middle East & Africa Port & Material Handling Equipment Vehicle Market Size Analysis & Forecast, 2017-2031, By Propulsion

12.4.1. Diesel

12.4.2. Gasoline

12.4.3. Electric/Battery

12.4.4. Others (Fuel Cell, Etc.)

12.5. Middle East & Africa Port & Material Handling Equipment Vehicle Market Size Analysis & Forecast, 2017-2031, By Demand

12.5.1. New Demand

12.5.2. MRO/Services

12.6. Key Country Analysis – Middle East & Africa Port & Material Handling Equipment Vehicle Market Size Analysis & Forecast, 2017-2031

12.6.1. GCC

12.6.2. South Africa

12.6.3. Turkey

12.6.4. Rest of Middle East & Africa

13. South America Port & Material Handling Equipment Vehicle Market

13.1. Market Snapshot

13.2. South America Port & Material Handling Equipment Vehicle Market Size Analysis & Forecast, 2017-2031, By Equipment Type

13.2.1. Tug Boats

13.2.2. Cranes

13.2.2.1. Rubber-tired Gantry (RTG) Cranes

13.2.2.2. Electrified Rubber-tired Gantry (E-RTGS) Cranes

13.2.2.3. Ship-to-Shore Cranes

13.2.2.4. Yard Cranes

13.2.2.5. Rail-mounted Gantry (RMG) Cranes

13.2.2.6. Automated Stacking Cranes

13.2.3. Shiploaders

13.2.4. Reach Stackers

13.2.5. Mooring Systems

13.2.6. Automated Guided Vehicles (AGVS)

13.2.7. Forklift Trucks

13.2.8. Container Lift Trucks

13.2.9. Terminal Tractors

13.2.10. Straddle Carriers

13.2.11. Others

13.3. South America Port & Material Handling Equipment Vehicle Market Size Analysis & Forecast, 2017-2031, By Application

13.3.1. Container Handling

13.3.2. Ship Handling

13.3.3. Services

13.3.4. Storage Handling

13.3.5. Automated Storage Handling

13.3.6. Bulk Material Handling

13.3.7. Others

13.4. South America Port & Material Handling Equipment Vehicle Market Size Analysis & Forecast, 2017-2031, By Propulsion

13.4.1. Diesel

13.4.2. Gasoline

13.4.3. Electric/Battery

13.4.4. Others (Fuel Cell, Etc.)

13.5. South America Port & Material Handling Equipment Vehicle Market Size Analysis & Forecast, 2017-2031, By Demand

13.5.1. New Demand

13.5.2. MRO/Services

13.6. Key Country Analysis – South America Port & Material Handling Equipment Vehicle Market Size Analysis & Forecast, 2017-2031

13.6.1. Brazil

13.6.2. Argentina

13.6.3. Rest of South America

14. Competitive Landscape

14.1. Company Share Analysis/Brand Share Analysis, 2022

14.2. Company Analysis for each player

Company Overview, Company Footprints, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis

15. Company Profile/Key Players

15.1. ABB

15.1.1. Company Overview

15.1.2. Company Footprints

15.1.3. Product Portfolio

15.1.4. Competitors & Customers

15.1.5. Subsidiaries & Parent Organization

15.1.6. Recent Developments

15.1.7. Financial Analysis

15.2. American Crane & Equipment

15.2.1. Company Overview

15.2.2. Company Footprints

15.2.3. Product Portfolio

15.2.4. Competitors & Customers

15.2.5. Subsidiaries & Parent Organization

15.2.6. Recent Developments

15.2.7. Financial Analysis

15.3. Anhui Heli

15.3.1. Company Overview

15.3.2. Company Footprints

15.3.3. Product Portfolio

15.3.4. Competitors & Customers

15.3.5. Subsidiaries & Parent Organization

15.3.6. Recent Developments

15.3.7. Financial Analysis

15.4. Cavotec

15.4.1. Company Overview

15.4.2. Company Footprints

15.4.3. Product Portfolio

15.4.4. Competitors & Customers

15.4.5. Subsidiaries & Parent Organization

15.4.6. Recent Developments

15.4.7. Financial Analysis

15.5. CVS Ferrari

15.5.1. Company Overview

15.5.2. Company Footprints

15.5.3. Product Portfolio

15.5.4. Competitors & Customers

15.5.5. Subsidiaries & Parent Organization

15.5.6. Recent Developments

15.5.7. Financial Analysis

15.6. Famur Famak

15.6.1. Company Overview

15.6.2. Company Footprints

15.6.3. Product Portfolio

15.6.4. Competitors & Customers

15.6.5. Subsidiaries & Parent Organization

15.6.6. Recent Developments

15.6.7. Financial Analysis

15.7. Hyster

15.7.1. Company Overview

15.7.2. Company Footprints

15.7.3. Product Portfolio

15.7.4. Competitors & Customers

15.7.5. Subsidiaries & Parent Organization

15.7.6. Recent Developments

15.7.7. Financial Analysis

15.8. Kalmar

15.8.1. Company Overview

15.8.2. Company Footprints

15.8.3. Product Portfolio

15.8.4. Competitors & Customers

15.8.5. Subsidiaries & Parent Organization

15.8.6. Recent Developments

15.8.7. Financial Analysis

15.9. Konecranes

15.9.1. Company Overview

15.9.2. Company Footprints

15.9.3. Product Portfolio

15.9.4. Competitors & Customers

15.9.5. Subsidiaries & Parent Organization

15.9.6. Recent Developments

15.9.7. Financial Analysis

15.10. Liebherr

15.10.1. Company Overview

15.10.2. Company Footprints

15.10.3. Product Portfolio

15.10.4. Competitors & Customers

15.10.5. Subsidiaries & Parent Organization

15.10.6. Recent Developments

15.10.7. Financial Analysis

15.11. Lonking Holdings Limited

15.11.1. Company Overview

15.11.2. Company Footprints

15.11.3. Product Portfolio

15.11.4. Competitors & Customers

15.11.5. Subsidiaries & Parent Organization

15.11.6. Recent Developments

15.11.7. Financial Analysis

15.12. Mcnally Bharat Engineering

15.12.1. Company Overview

15.12.2. Company Footprints

15.12.3. Product Portfolio

15.12.4. Competitors & Customers

15.12.5. Subsidiaries & Parent Organization

15.12.6. Recent Developments

15.12.7. Financial Analysis

15.13. Sany

15.13.1. Company Overview

15.13.2. Company Footprints

15.13.3. Product Portfolio

15.13.4. Competitors & Customers

15.13.5. Subsidiaries & Parent Organization

15.13.6. Recent Developments

15.13.7. Financial Analysis

15.14. Shanghai Zhenhua Heavy Industries (ZPMC)

15.14.1. Company Overview

15.14.2. Company Footprints

15.14.3. Product Portfolio

15.14.4. Competitors & Customers

15.14.5. Subsidiaries & Parent Organization

15.14.6. Recent Developments

15.14.7. Financial Analysis

15.15. Til Limited

15.15.1. Company Overview

15.15.2. Company Footprints

15.15.3. Product Portfolio

15.15.4. Competitors & Customers

15.15.5. Subsidiaries & Parent Organization

15.15.6. Recent Developments

15.15.7. Financial Analysis

15.16. Timars Svets & Smide Ab

15.16.1. Company Overview

15.16.2. Company Footprints

15.16.3. Product Portfolio

15.16.4. Competitors & Customers

15.16.5. Subsidiaries & Parent Organization

15.16.6. Recent Developments

15.16.7. Financial Analysis

15.17. TTS

15.17.1. Company Overview

15.17.2. Company Footprints

15.17.3. Product Portfolio

15.17.4. Competitors & Customers

15.17.5. Subsidiaries & Parent Organization

15.17.6. Recent Developments

15.17.7. Financial Analysis

List of Tables

Table 1: Global Port & Material Handling Equipment Vehicle Market Volume (Thousand Units) Forecast, by Equipment Type, 2017-2031

Table 2: Global Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Equipment Type, 2017-2031

Table 3: Global Port & Material Handling Equipment Vehicle Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Table 4: Global Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Propulsion, 2017-2031

Table 5: Global Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Application, 2017-2031

Table 6: Global Port & Material Handling Equipment Vehicle Market Volume (Thousand Units) Forecast, by Demand, 2017-2031

Table 7: Global Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Demand, 2017-2031

Table 8: Global Port & Material Handling Equipment Vehicle Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Table 9: Global Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Region, 2017-2031

Table 10: North America Port & Material Handling Equipment Vehicle Market Volume (Thousand Units) Forecast, by Equipment Type, 2017-2031

Table 11: North America Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Equipment Type, 2017-2031

Table 12: North America Port & Material Handling Equipment Vehicle Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Table 13: North America Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Propulsion, 2017-2031

Table 14: North America Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Application, 2017-2031

Table 15: North America Port & Material Handling Equipment Vehicle Market Volume (Thousand Units) Forecast, by Demand, 2017-2031

Table 16: North America Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Demand, 2017-2031

Table 17: North America Port & Material Handling Equipment Vehicle Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 18: North America Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Table 19: Europe Port & Material Handling Equipment Vehicle Market Volume (Thousand Units) Forecast, by Equipment Type, 2017-2031

Table 20: Europe Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Equipment Type, 2017-2031

Table 21: Europe Port & Material Handling Equipment Vehicle Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Table 22: Europe Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Propulsion, 2017-2031

Table 23: Europe Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Application, 2017-2031

Table 24: Europe Port & Material Handling Equipment Vehicle Market Volume (Thousand Units) Forecast, by Demand, 2017-2031

Table 25: Europe Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Demand, 2017-2031

Table 26: Europe Port & Material Handling Equipment Vehicle Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 27: Europe Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Table 28: Asia Pacific Port & Material Handling Equipment Vehicle Market Volume (Thousand Units) Forecast, by Equipment Type, 2017-2031

Table 29: Asia Pacific Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Equipment Type, 2017-2031

Table 30: Asia Pacific Port & Material Handling Equipment Vehicle Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Table 31: Asia Pacific Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Propulsion, 2017-2031

Table 32: Asia Pacific Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Application, 2017-2031

Table 33: Asia Pacific Port & Material Handling Equipment Vehicle Market Volume (Thousand Units) Forecast, by Demand, 2017-2031

Table 34: Asia Pacific Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Demand, 2017-2031

Table 35: Asia Pacific Port & Material Handling Equipment Vehicle Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 36: Asia Pacific Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Table 37: Middle East & Africa Port & Material Handling Equipment Vehicle Market Volume (Thousand Units) Forecast, by Equipment Type, 2017-2031

Table 38: Middle East & Africa Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Equipment Type, 2017-2031

Table 39: Middle East & Africa Port & Material Handling Equipment Vehicle Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Table 40: Middle East & Africa Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Propulsion, 2017-2031

Table 41: Middle East & Africa Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Application, 2017-2031

Table 42: Middle East & Africa Port & Material Handling Equipment Vehicle Market Volume (Thousand Units) Forecast, by Demand, 2017-2031

Table 43: Middle East & Africa Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Demand, 2017-2031

Table 44: Middle East & Africa Port & Material Handling Equipment Vehicle Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 45: Middle East & Africa Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Table 46: South America Port & Material Handling Equipment Vehicle Market Volume (Thousand Units) Forecast, by Equipment Type, 2017-2031

Table 47: South America Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Equipment Type, 2017-2031

Table 48: South America Port & Material Handling Equipment Vehicle Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Table 49: South America Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Propulsion, 2017-2031

Table 50: South America Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Application, 2017-2031

Table 51: South America Port & Material Handling Equipment Vehicle Market Volume (Thousand Units) Forecast, by Demand, 2017-2031

Table 52: South America Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Demand, 2017-2031

Table 53: South America Port & Material Handling Equipment Vehicle Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 54: South America Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Port & Material Handling Equipment Vehicle Market Volume (Thousand Units) Forecast, by Equipment Type, 2017-2031

Figure 2: Global Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Equipment Type, 2017-2031

Figure 3: Global Port & Material Handling Equipment Vehicle Market, Incremental Opportunity, by Equipment Type, Value (US$ Mn), 2023-2031

Figure 4: Global Port & Material Handling Equipment Vehicle Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Figure 5: Global Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Propulsion, 2017-2031

Figure 6: Global Port & Material Handling Equipment Vehicle Market, Incremental Opportunity, by Propulsion, Value (US$ Mn), 2023-2031

Figure 7: Global Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Application, 2017-2031

Figure 8: Global Port & Material Handling Equipment Vehicle Market, Incremental Opportunity, by Application, Value (US$ Mn), 2023-2031

Figure 9: Global Port & Material Handling Equipment Vehicle Market Volume (Thousand Units) Forecast, by Demand, 2017-2031

Figure 10: Global Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Demand, 2017-2031

Figure 11: Global Port & Material Handling Equipment Vehicle Market, Incremental Opportunity, by Demand, Value (US$ Mn), 2023-2031

Figure 12: Global Port & Material Handling Equipment Vehicle Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Figure 13: Global Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Region, 2017-2031

Figure 14: Global Port & Material Handling Equipment Vehicle Market, Incremental Opportunity, by Region, Value (US$ Mn), 2023-2031

Figure 15: North America Port & Material Handling Equipment Vehicle Market Volume (Thousand Units) Forecast, by Equipment Type, 2017-2031

Figure 16: North America Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Equipment Type, 2017-2031

Figure 17: North America Port & Material Handling Equipment Vehicle Market, Incremental Opportunity, by Equipment Type, Value (US$ Mn), 2023-2031

Figure 18: North America Port & Material Handling Equipment Vehicle Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Figure 19: North America Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Propulsion, 2017-2031

Figure 20: North America Port & Material Handling Equipment Vehicle Market, Incremental Opportunity, by Propulsion, Value (US$ Mn), 2023-2031

Figure 21: North America Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Application, 2017-2031

Figure 22: North America Port & Material Handling Equipment Vehicle Market, Incremental Opportunity, by Application, Value (US$ Mn), 2023-2031

Figure 23: North America Port & Material Handling Equipment Vehicle Market Volume (Thousand Units) Forecast, by Demand, 2017-2031

Figure 24: North America Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Demand, 2017-2031

Figure 25: North America Port & Material Handling Equipment Vehicle Market, Incremental Opportunity, by Demand, Value (US$ Mn), 2023-2031

Figure 26: North America Port & Material Handling Equipment Vehicle Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 27: North America Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Figure 28: North America Port & Material Handling Equipment Vehicle Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031

Figure 29: Europe Port & Material Handling Equipment Vehicle Market Volume (Thousand Units) Forecast, by Equipment Type, 2017-2031

Figure 30: Europe Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Equipment Type, 2017-2031

Figure 31: Europe Port & Material Handling Equipment Vehicle Market, Incremental Opportunity, by Equipment Type, Value (US$ Mn), 2023-2031

Figure 32: Europe Port & Material Handling Equipment Vehicle Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Figure 33: Europe Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Propulsion, 2017-2031

Figure 34: Europe Port & Material Handling Equipment Vehicle Market, Incremental Opportunity, by Propulsion, Value (US$ Mn), 2023-2031

Figure 35: Europe Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Application, 2017-2031

Figure 36: Europe Port & Material Handling Equipment Vehicle Market, Incremental Opportunity, by Application, Value (US$ Mn), 2023-2031

Figure 37: Europe Port & Material Handling Equipment Vehicle Market Volume (Thousand Units) Forecast, by Demand, 2017-2031

Figure 38: Europe Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Demand, 2017-2031

Figure 39: Europe Port & Material Handling Equipment Vehicle Market, Incremental Opportunity, by Demand, Value (US$ Mn), 2023-2031

Figure 40: Europe Port & Material Handling Equipment Vehicle Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 41: Europe Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Figure 42: Europe Port & Material Handling Equipment Vehicle Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031

Figure 43: Asia Pacific Port & Material Handling Equipment Vehicle Market Volume (Thousand Units) Forecast, by Equipment Type, 2017-2031

Figure 44: Asia Pacific Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Equipment Type, 2017-2031

Figure 45: Asia Pacific Port & Material Handling Equipment Vehicle Market, Incremental Opportunity, by Equipment Type, Value (US$ Mn), 2023-2031

Figure 46: Asia Pacific Port & Material Handling Equipment Vehicle Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Figure 47: Asia Pacific Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Propulsion, 2017-2031

Figure 48: Asia Pacific Port & Material Handling Equipment Vehicle Market, Incremental Opportunity, by Propulsion, Value (US$ Mn), 2023-2031

Figure 49: Asia Pacific Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Application, 2017-2031

Figure 50: Asia Pacific Port & Material Handling Equipment Vehicle Market, Incremental Opportunity, by Application, Value (US$ Mn), 2023-2031

Figure 51: Asia Pacific Port & Material Handling Equipment Vehicle Market Volume (Thousand Units) Forecast, by Demand, 2017-2031

Figure 52: Asia Pacific Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Demand, 2017-2031

Figure 53: Asia Pacific Port & Material Handling Equipment Vehicle Market, Incremental Opportunity, by Demand, Value (US$ Mn), 2023-2031

Figure 54: Asia Pacific Port & Material Handling Equipment Vehicle Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 55: Asia Pacific Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Figure 56: Asia Pacific Port & Material Handling Equipment Vehicle Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031

Figure 57: Middle East & Africa Port & Material Handling Equipment Vehicle Market Volume (Thousand Units) Forecast, by Equipment Type, 2017-2031

Figure 58: Middle East & Africa Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Equipment Type, 2017-2031

Figure 59: Middle East & Africa Port & Material Handling Equipment Vehicle Market, Incremental Opportunity, by Equipment Type, Value (US$ Mn), 2023-2031

Figure 60: Middle East & Africa Port & Material Handling Equipment Vehicle Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Figure 61: Middle East & Africa Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Propulsion, 2017-2031

Figure 62: Middle East & Africa Port & Material Handling Equipment Vehicle Market, Incremental Opportunity, by Propulsion, Value (US$ Mn), 2023-2031

Figure 63: Middle East & Africa Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Application, 2017-2031

Figure 64: Middle East & Africa Port & Material Handling Equipment Vehicle Market, Incremental Opportunity, by Application, Value (US$ Mn), 2023-2031

Figure 65: Middle East & Africa Port & Material Handling Equipment Vehicle Market Volume (Thousand Units) Forecast, by Demand, 2017-2031

Figure 66: Middle East & Africa Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Demand, 2017-2031

Figure 67: Middle East & Africa Port & Material Handling Equipment Vehicle Market, Incremental Opportunity, by Demand, Value (US$ Mn), 2023-2031

Figure 68: Middle East & Africa Port & Material Handling Equipment Vehicle Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 69: Middle East & Africa Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Figure 70: Middle East & Africa Port & Material Handling Equipment Vehicle Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031

Figure 71: South America Port & Material Handling Equipment Vehicle Market Volume (Thousand Units) Forecast, by Equipment Type, 2017-2031

Figure 72: South America Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Equipment Type, 2017-2031

Figure 73: South America Port & Material Handling Equipment Vehicle Market, Incremental Opportunity, by Equipment Type, Value (US$ Mn), 2023-2031

Figure 74: South America Port & Material Handling Equipment Vehicle Market Volume (Thousand Units) Forecast, by Propulsion, 2017-2031

Figure 75: South America Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Propulsion, 2017-2031

Figure 76: South America Port & Material Handling Equipment Vehicle Market, Incremental Opportunity, by Propulsion, Value (US$ Mn), 2023-2031

Figure 77: South America Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Application, 2017-2031

Figure 78: South America Port & Material Handling Equipment Vehicle Market, Incremental Opportunity, by Application, Value (US$ Mn), 2023-2031

Figure 79: South America Port & Material Handling Equipment Vehicle Market Volume (Thousand Units) Forecast, by Demand, 2017-2031

Figure 80: South America Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Demand, 2017-2031

Figure 81: South America Port & Material Handling Equipment Vehicle Market, Incremental Opportunity, by Demand, Value (US$ Mn), 2023-2031

Figure 82: South America Port & Material Handling Equipment Vehicle Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 83: South America Port & Material Handling Equipment Vehicle Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Figure 84: South America Port & Material Handling Equipment Vehicle Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031