Reports

Reports

Polyvinylidene Fluoride (PVDF) Market – Snapshot

Polyvinylidene fluoride (PVDF) is a semi-crystalline thermoplastic that belongs to the fluorine polymers group. The fluorine content in PVDF is approximately 59% and it can be manufactured by emulsion and suspension processes. PVDF offers good chemical resistance and high thermal stability, good adhesion, weatherability, and high corrosion resistance. Rods, sheets, tubing, monofilament & drawn fibers, films, membranes, and cast parts are produced from PVDF. Key end-users industries of PVDF include building & construction, chemical processing, automotive, PV modules, oil & gas, and electrical & electronics. Additionally, PVDF finds application in industries such as electric vehicles, water treatment, wires & cables, and textiles. They are used in the form of coatings, sheets, films, pipes, and tubes in various end-use industries.

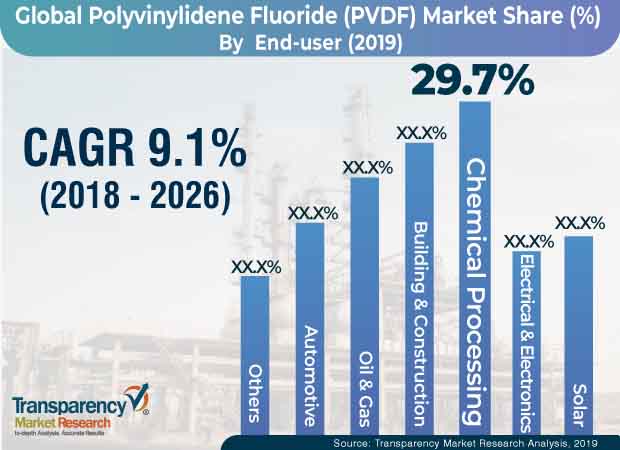

The global polyvinylidene fluoride market has been segmented based on product, type, end-user, and region. In terms of product, the market has been segregated into powder, pellet, and latex. In terms of type, the market has been bifurcated into homopolymer and copolymer. Homopolymer PVDF grades are 100% pure polymer; therefore, they do not have any added substances. Pipes and equipment manufactured from these grades cater to diverse requirements of the construction and chemical processing industries. Copolymer is a flexible PVDF polymer, which exhibits very low shrinkage and excellent impact resistance. It is ideal for the use in insulation and buffering materials, which is used for wire and cable applications and for tubing. In terms of end-user, the polyvinylidene fluoride market has been segregated into chemical processing, solar, oil & gas, building & construction, automotive, electrical & electronics, and others.

PVDF is widely used as metallic coatings in various chemical processing industries for various applications such as heat exchangers, filters, membrane, and pumps. Traditional lining or coating products and poor adhesion of thermoplastics to a metal substrate and lack of consistency in coating applications can affect the service life of metal products. PVDF offers high performance in harsh and wide variety of chemicals. Additionally, it offers superior thermal resistance, corrosion barrier, and abrasion- and chemical-resistance. These factors are anticipated to significantly boost the demand for PVDF during the forecast period. PVDF is used as a solvent dispersion coatings for architectural applications, and shows high solvency in ester and ketone solvents. PVDF possesses crystalline and amorphous phase in its structure due to which PVDF coatings offers superior properties, such as high flexibility and solvent resistance. Rising demand for PVDF in the building & construction industry due to its characteristic features such as high abrasion resistance, high chemical resistance, wear resistance, thermal resistance, UV resistance, and anti-skid. These factors are projected to boost the market during the forecast period.

Rising demand for PVDF coatings due to its excellent UV, chemical, and abrasion resistance in chemical processing and building & construction industries is driving the global polyvinylidene fluoride market. Additionally rising demand for PVDF for pipe and fittings to carry corrosive fluids in various industries such as oil & gas is anticipated to propel the demand for PVDF during the forecast period. PVDF liners offer high corrosion resistance and mechanical strength, under high pressure and vacuum conditions. PVDF-based pipe liners eliminate the usage of toxic corrosion inhibitors; reduce heat loss, which reduces potential pipe buckling; and reduce pumping costs; thus resulting in cost savings of up to 25%. High cost associated with transportation of raw materials such as vinyldiene fluoride (VF2) due to its high flammability properties is likely to hamper the market during the forecast period. Additionally, PVDF is facing stiff competition from other thermoplastics such as PTFE, PVA, and PEEK. These substitutes are readily available and are less expensive than PVDF. This, in turn, is likely to restrain the market during the forecast period. Rising demand for PVDF in lithium-ion battery separator coatings and electrode formulation expected to provide lucrative opportunities to the manufacturers operate in the global polyvinylidene fluoride market. PVDF is extensively used in the lithium battery industry when used as a binder in formulation of electrodes and in separator coatings. PVDF optimizes energy storage efficiency and reduces battery weight in electric vehicles or consumer electronics.

In terms of region, the global polyvinylidene fluoride market has been divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Asia Pacific held a dominant share in the global market in 2018. Rise in demand for PVDF in various industrial components such as fabricated vessels, tanks, pumps, valves, filters, heat exchangers, tower packing, and piping systems, especially in chemical processing industries is likely to boost the market in the region during the forecast period. Additionally, increase in demand for PVDF with high color fastness and gloss in architectural coating applications for various residential, industrial, commercial, and institutional buildings is boosting the demand for PVDF. Surge in production of lithium-ion batteries and steady growth in the production of semiconductors in Japan, China, and South Korea are anticipated to provide lucrative opportunities to PVDF manufacturers in the region in the near future. In North America, the U.S. is a leading consumer of PVDF and is expected to provide lucrative opportunities in the near future. Rising shale gas exploration activities in the region is propelling the demand for flexible pipes and umbilical cables for offshore exploration, pipe for natural gas distribution, underground pipe for gas stations, and fuel lines in trucks and automobile. This, in turn, is expected to propel the demand for PVDF in the oil & gas industry.

Key players operating in the global polyvinylidene fluoride market include Kureha Corporation, 3M Company, Arkema Group, Solvay Group, Rochling Group, Shanghai Ofluorine Chemical Technology Co., Ltd, The Quadrant Group of Companies, Daikin Industries Ltd, RTP Company, Ensinger GmbH, Ambofluor GmbH & Co. KG, Shanghai San Ai Fu New Material Technology Co., Ltd., Zhejiang Fotech International Co.,Ltd., Hubei Everflon Polymer Co., Ltd., and Juhua Group Corporation. These companies engage in capacity expansion and new product launches in lithium-ion battery applications to improve their product portfolios and to increase competition in the market. Arkema Group and Solvay Group are key competitors in the polyvinylidene fluoride market. They are engaged in new product launches and production capacity expansion to improve their geographical presence.

Polyvinylidene Fluoride (PVDF) Market is estimated to rise at a CAGR of 9.1% during forecast period

Rising demand for PVDF coatings due to its excellent UV, chemical, and abrasion resistance in chemical processing and building & construction industries is driving the global polyvinylidene fluoride market

Asia Pacific is more attractive region for vendors in the Polyvinylidene Fluoride (PVDF) Market

Some of the prominent players operating in the global polyvinylidene fluoride market are The Quadrant Group of Companies, Kureha Corporation, Ambofluor GmbH & Co., 3M Company, Hubei Everflon Polymer Co. Ltd., Daikin Industries Ltd, Shanghai San Ai Fu New Material Technology Co. Ltd., RTP Company, Arkema Group, Juhua Group Corporation, , Shanghai Ofluorine Chemical Technology Co. Ltd, Solvay Group, Zhejiang Fotech International Co. Ltd., and Rochling GroupEnsinger GmbH KG Ltd.

The forecast period considered for the Polyvinylidene Fluoride (PVDF) Market is 2019-2027

1. Preface

1.1. Report Scope and Market Segmentation

1.2. Research Highlights

2. Assumptions and Research Methodology

2.1. Assumptions and Acronyms Used

2.2. Research Methodology

3. Executive Summary: Global Polyvinylidene Fluoride (PVDF) Market

3.1. Market Value, Indicative (US$ Thousand)

3.2. Top Three Trends

4. Market Overview

4.1. Product Overview

4.2. Key Market Developments

4.3. Market Indicators

5. Market Dynamics

5.1. Drivers and Restraints Snapshot Analysis

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Porter’s Five Forces Analysis

5.2.1. Threat of Substitutes

5.2.2. Bargaining Power of Buyers

5.2.3. Bargaining Power of Suppliers

5.2.4. Threat of New Entrants

5.2.5. Degree of Competition

5.3. Value Chain Analysis

5.4. Comparative Analysis of Polyvinylidiene Fluoride (PVDF) with Other Thermoplastics

5.5. List of Potential Customers

5.6. Regulatory Status: Polyvinylidiene Fluoride (PVDF)

5.7. Global Polyvinylidene Fluoride (PVDF) Market: SWOT Analysis

6. Classification of Grades by Brands on Global Level

7. Global Polyvinylidene Fluoride (PVDF) Market: Price Trend Analysis, 2018

7.1. Average Price Range of Polyvinylidene Fluoride (PVDF), by Form, US$/Ton, 2018–2027

7.2. Average Price Comparison of Polyvinylidene Fluoride (PVDF), by Region, US$/Ton, 2018

7.3. Average Price Range of Polyvinylidene Fluoride (PVDF), by Key Players, US$/Ton, 2018

8. Global Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Analysis, by Form

8.1. Key Findings and Introduction

8.2. Global Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form, 2018–2027

8.2.1. Global Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Powder, 2018–2027

8.2.2. Global Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Pellet, 2018–2027

8.2.3. Global Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Latex, 2018–2027

8.3. Global Polyvinylidene Fluoride (PVDF) Market Attractiveness Analysis, by Form

9. Global Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Analysis, by Type

9.1. Key Findings and Introduction

9.2. Global Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type, 2018–2027

9.2.1. Global Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Homopolymer, 2018–2027

9.2.2. Global Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Copolymer, 2018–2027

9.3. Global Polyvinylidene Fluoride (PVDF) Market Attractiveness Analysis, by Type

10. Global Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Analysis, by End-user

10.1. Key Findings and Introduction

10.2. Global Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by End-user, 2018–2027

10.2.1. Global Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Chemical Processing, 2018–2027

10.2.2. Global Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Oil & Gas, 2018–2027

10.2.3. Global Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Electrical & Electronics, 2018–2027

10.2.4. Global Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Solar, 2018–2027

10.2.5. Global Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Automotive, 2018–2027

10.2.6. Global Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Building & Construction, 2018–2027

10.2.7. Global Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Others, 2018–2027

10.3. Global Polyvinylidene Fluoride (PVDF) Market Attractiveness Analysis, by End-user

11. Global Polyvinylidene Fluoride (PVDF) Market Analysis, by Region

11.1. Global Regulatory Scenario

11.2. Global Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Region

11.2.1. North America

11.2.2. Europe

11.2.3. Asia Pacific

11.2.4. Latin America

11.2.5. Middle East & Africa

11.3. Global Polyvinylidene Fluoride (PVDF) Market Attractiveness Analysis, by Region

12. North America Polyvinylidene Fluoride (PVDF) Market Overview

12.1. North America Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form, 2018–2027

12.2. North America Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type, 2018–2027

12.3. North America Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Country

12.3.1. U.S. Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form, 2018–2027

12.3.2. U.S. Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type, 2018–2027

12.3.3. U.S. Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by End-user, 2018–2027

12.3.4. Canada Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form, 2018–2027

12.3.5. Canada Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type, 2018–2027

12.3.6. Canada Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by End-user, 2018–2027

12.4. North America Polyvinylidene Fluoride (PVDF) Market Attractiveness Analysis, by Form

12.5. North America Polyvinylidene Fluoride (PVDF) Market Attractiveness Analysis, by Type

12.6. North America Polyvinylidene Fluoride (PVDF) Market Attractiveness Analysis, by End-user

13. Europe Polyvinylidene Fluoride (PVDF) Market Overview

13.1. Europe Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form, 2018–2027

13.2. Europe Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type, 2018–2027

13.3. Europe Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by End-user, 2018–2027

13.4. Europe Polyvinylidene Fluoride (PVDF) Market Value (US$ Thousand) and Volume (Tons) Forecast, by Country and Sub-region

13.4.1. Germany Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form, 2018–2027

13.4.2. Germany Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type, 2018–2027

13.4.3. Germany Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by End-user, 2018–2027

13.4.4. France Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form, 2018–2027

13.4.5. France Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type, 2018–2027

13.4.6. France Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by End-user, 2018–2027

13.4.7. U.K. Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form, 2018–2027

13.4.8. U.K. Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type, 2018–2027

13.4.9. U.K. Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by End-user, 2018–2027

13.4.10. Italy Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form, 2018–2027

13.4.11. Italy Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type, 2018–2027

13.4.12. Italy Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by End-user, 2018–2027

13.4.13. Spain Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form, 2018–2027

13.4.14. Spain Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type, 2018–2027

13.4.15. Spain Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by End-user, 2018–2027

13.4.16. Rest of Europe Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form, 2018–2027

13.4.17. Rest of Europe Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type, 2018–2027

13.4.18. Rest of Europe Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by End-user, 2018–2027

13.5. Europe Polyvinylidene Fluoride (PVDF) Market Attractiveness Analysis, by Form

13.6. Europe Polyvinylidene Fluoride (PVDF) Market Attractiveness Analysis, by Type

13.7. Europe Polyvinylidene Fluoride (PVDF) Market Attractiveness Analysis, by End-user

14. Asia Pacific Polyvinylidene Fluoride (PVDF) Market Overview

14.1. Asia Pacific Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form, 2018–2027

14.2. Asia Pacific Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type, 2018–2027

14.3. Asia Pacific Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by End-user, 2018–2027

14.4. Asia Pacific Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Country and Sub-region

14.4.1. China Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form, 2018–2027

14.4.2. China Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type, 2018–2027

14.4.3. China Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by End-user, 2018–2027

14.4.4. India Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form

14.4.5. India Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type

14.4.6. India Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by End-user

14.4.7. Japan Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form

14.4.8. Japan Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type

14.4.9. Japan Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by End-user

14.4.10. ASEAN Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form

14.4.11. ASEAN Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type

14.4.12. ASEAN Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by End-user

14.4.13. Rest of Asia Pacific Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form

14.4.14. Rest of Asia Pacific Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type

14.4.15. Rest of Asia Pacific Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by End-user

14.5. Asia Pacific Polyvinylidene Fluoride (PVDF) Market Attractiveness Analysis, by Form

14.6. Asia Pacific Polyvinylidene Fluoride (PVDF) Market Attractiveness Analysis, by Type

14.7. Asia Pacific Polyvinylidene Fluoride (PVDF) Market Attractiveness Analysis, by End-user

15. Latin America Polyvinylidene Fluoride (PVDF) Market Overview

15.1. Latin America Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form, 2018–2027

15.2. Latin America Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type, 2018–2027

15.3. Latin America Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by End-user, 2018–2027

15.4. Latin America Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Country and Sub-region

15.4.1. Brazil Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form, 2018–2027

15.4.2. Brazil Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type, 2018–2027

15.4.3. Brazil Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by End-user, 2018–2027

15.4.4. Mexico Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form, 2018–2027

15.4.5. Mexico Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type, 2018–2027

15.4.6. Mexico Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by End-user, 2018–2027

15.4.7. Rest of Latin America Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form, 2018–2027

15.4.8. Rest of Latin America Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type, 2018–2027

15.4.9. Rest of Latin America Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by End-user, 2018–2027

15.5. Latin America Polyvinylidene Fluoride (PVDF) Market Attractiveness Analysis, by Form

15.6. Latin America Polyvinylidene Fluoride (PVDF) Market Attractiveness Analysis, by Type

15.7. Latin America Polyvinylidene Fluoride (PVDF) Market Attractiveness Analysis, by End-user

16. Middle East & Africa Polyvinylidene Fluoride (PVDF) Market Overview

16.1. Middle East & Africa Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form, 2018–2027

16.2. Middle East & Africa Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type, 2018–2027

16.3. Middle East & Africa Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by End-user, 2018–2027

16.4. Middle East & Africa Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Country and Sub-region

16.4.1. GCC Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form, 2018–2027

16.4.2. GCC Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type, 2018–2027

16.4.3. GCC Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by End-user, 2018–2027

16.4.4. South Africa Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form, 2018–2027

16.4.5. South Africa Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type, 2018–2027

16.4.6. South Africa Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by End-user, 2018–2027

16.4.7. Rest of Middle East & Africa Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form, 2018–2027

16.4.8. Rest of Middle East & Africa Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type, 2018–2027

16.4.9. Rest of Middle East & Africa Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by End-user, 2018–2027

16.5. Middle East & Africa Polyvinylidene Fluoride (PVDF) Market Attractiveness Analysis, by Form

16.6. Middle East & Africa Polyvinylidene Fluoride (PVDF) Market Attractiveness Analysis, by Type

16.7. Middle East & Africa Polyvinylidene Fluoride (PVDF) Market Attractiveness Analysis, by End-user

17. Competition Landscape

17.1. Global Polyvinylidene Fluoride (PVDF) Market Share Analysis, by Company (2018)

17.2. Competition Matrix

17.2.1. Arkema Group

17.2.2. Solvay Group

17.2.3. Kureha Corporation

17.2.4. 3M Company

17.3. Company Profiles

17.3.1. Kureha Corporation

17.3.1.1. Company Description

17.3.1.2. Business Overview

17.3.1.3. Financial Details

17.3.1.4. Business Strategy

17.3.1.5. Product Portfolio

17.3.1.6. Key Developments

17.3.2. Arkema Group

17.3.2.1. Company Description

17.3.2.2. Business Overview

17.3.2.3. Financial Details

17.3.2.4. Business Strategy

17.3.2.5. Product Portfolio

17.3.2.6. Key Developments

17.3.3. Solvay Group

17.3.3.1. Company Description

17.3.3.2. Business Overview

17.3.3.3. Financial Details

17.3.3.4. Business Strategy

17.3.3.5. Product Portfolio

17.3.3.6. Key Developments

17.3.4. The 3M Company

17.3.4.1. Company Description

17.3.4.2. Business Overview

17.3.4.3. Financial Details

17.3.4.4. Business Strategy

17.3.4.5. Product Portfolio

17.3.4.6. Key Developments

17.3.5. Rochling Group

17.3.5.1. Company Description

17.3.5.2. Business Overview

17.3.5.3. Financial Details

17.3.5.4. Business Strategy

17.3.5.5. Product Portfolio

17.3.5.6. Key Developments

17.3.6. Shanghai Ofluorine Chemical Technology Co., Ltd

17.3.6.1. Company Description

17.3.6.2. Business Overview

17.3.6.3. Financial Details

17.3.6.4. Business Strategy

17.3.6.5. Product Portfolio

17.3.6.6. Key Developments

17.3.7. The Quadrant Group of Companies

17.3.7.1. Company Description

17.3.7.2. Business Overview

17.3.7.3. Financial Details

17.3.7.4. Business Strategy

17.3.7.5. Product Portfolio

17.3.7.6. Key Developments

17.3.8. Daikin Industries Ltd.

17.3.8.1. Company Description

17.3.8.2. Company Description

17.3.8.3. Business Overview

17.3.8.4. Financial Details

17.3.8.5. Business Strategy

17.3.8.6. Product Portfolio

17.3.8.7. Key Developments

17.3.9. RTP Company

17.3.9.1. Company Description

17.3.9.2. Business Overview

17.3.9.3. Financial Details

17.3.9.4. Business Strategy

17.3.9.5. Product Portfolio

17.3.9.6. Key Developments

17.3.10. Ensinger GmbH.

17.3.10.1. Company Description

17.3.10.2. Business Overview

17.3.10.3. Financial Details

17.3.10.4. Product Portfolio

17.3.10.5. Key Developments

17.3.11. Ambofluor GmbH & Co. KG

17.3.11.1. Company Description

17.3.11.2. Business Overview

17.3.11.3. Financial Details

17.3.11.4. Business Strategy

17.3.11.5. Product Portfolio

17.3.11.6. Key Developments

17.3.12. Shanghai San Ai Fu New Material Technology Co., Ltd.

17.3.12.1. Company Description

17.3.12.2. Business Overview

17.3.12.3. Financial Details

17.3.12.4. Business Strategy

17.3.12.5. Product Portfolio

17.3.12.6. Key Developments

17.3.13. Zhejiang Fotech International Co.,Ltd.

17.3.13.1. Company Description

17.3.13.2. Business Overview

17.3.13.3. Financial Details

17.3.13.4. Business Strategy

17.3.13.5. Product Portfolio

17.3.13.6. Key Developments

17.3.14. Hubei Everflon Polymer Co., Ltd.

17.3.14.1. Company Description

17.3.14.2. Business Overview

17.3.14.3. Financial Details

17.3.14.4. Business Strategy

17.3.14.5. Product Portfolio

17.3.14.6. Key Developments

17.3.15. Juhua Group Corporation.

17.3.15.1. Company Description

17.3.15.2. Business Overview

17.3.15.3. Financial Details

17.3.15.4. Business Strategy

17.3.15.5. Product Portfolio

17.3.15.6. Key Developments

18. Primary Research: Key Insights

List of Tables

Table 01: Average Price Range of Polyvinylidene Fluoride (PVDF), by Form, US$/Ton, 2018–2027

Table 02: Average Price Comparison of Polyvinylidene Fluoride (PVDF), by Region, US$/Ton, 2018

Table 03: Average Price Range of Polyvinylidene Fluoride (PVDF), by Key Players, US$/KG, 2018

Table 04: Global Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type, 2018–2027

Table 05: Global Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form, 2018–2027

Table 6: Global Polyvinylidene Fluoride (PVDF) Market Volume (Tons) Forecast, by End-user, 2018–2027

Table 07: Global Polyvinylidene Fluoride (PVDF) Market Value (US$ Thousand) Forecast, by End-user, 2018–2027

Table 08: Global Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Region, 2018–2027

Table 09: North America Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type, 2018–2027

Table 10: North America Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form, 2018–2027

Table 11: North America Polyvinylidene Fluoride (PVDF) Market Volume (Tons) Forecast, by End-user, 2018–2027

Table 12: North America Polyvinylidene Fluoride (PVDF) Market Value (US$ Thousand) Forecast, by End-user, 2018–2027

Table 13: North America Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Country, 2018–2027

Table 14: U.S. Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type, 2018–2027

Table 15: U.S. Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form, 2018–2027

Table 16: U.S. Polyvinylidene Fluoride (PVDF) Market Volume (Tons) Forecast, by End-user, 2018–2027

Table 17: U.S. Polyvinylidene Fluoride (PVDF) Market Value (US$ Thousand) Forecast, by End-user, 2018–2027

Table 18: Canada Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type, 2018–2027

Table 19: Canada Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form, 2018–2027

Table 20: Canada Polyvinylidene Fluoride (PVDF) Market Volume (Tons) Forecast, by End-user, 2018–2027

Table 21: Canada Polyvinylidene Fluoride (PVDF) Market Value (US$ Thousand) Forecast, by End-user, 2018–2027

Table 22: Europe Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type, 2018–2027

Table 23: Europe Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form, 2018–2027

Table 24: Europe Polyvinylidene Fluoride (PVDF) Market Volume (Tons) Forecast, by End-user, 2018–2027

Table 25: Europe Polyvinylidene Fluoride (PVDF) Market Value (US$ Thousand) Forecast, by End-user, 2018–2027

Table 26: Europe Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Country and Sub-region, 2018–2027

Table 27: Germany Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type, 2018–2027

Table 28: Germany Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form, 2018–2027

Table 29: Germany Polyvinylidene Fluoride (PVDF) Market Volume (Tons) Forecast, by End-user, 2018–2027

Table 30: Germany Polyvinylidene Fluoride (PVDF) Market Value (US$ Thousand) Forecast, by End-user, 2018–2027

Table 31: U.K. Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type, 2018–2027

Table 32: U.K. Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form, 2018–2027

Table 33: U.K. Polyvinylidene Fluoride (PVDF) Market Volume (Tons) Forecast, by End-user, 2018–2027

Table 34: U.K. Polyvinylidene Fluoride (PVDF) Market Value (US$ Thousand) Forecast, by End-user, 2018–2027

Table 35: France Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type, 2018–2027

Table 36: France Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form, 2018–2027

Table 37: France Polyvinylidene Fluoride (PVDF) Market Volume (Tons) Forecast, by End-user, 2018–2027

Table 38: France Polyvinylidene Fluoride (PVDF) Market Value (US$ Thousand) Forecast, by End-user, 2018–2027

Table 39: Italy Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type, 2018–2027

Table 40: Italy Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form, 2018–2027

Table 41: Italy Polyvinylidene Fluoride (PVDF) Market Volume (Tons) Forecast, by End-user, 2018–2027

Table 42: Italy Polyvinylidene Fluoride (PVDF) Market Value (US$ Thousand) Forecast, by End-user, 2018–2027

Table 43: Spain Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type, 2018–2027

Table 44: Spain Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form, 2018–2027

Table 45: Spain Polyvinylidene Fluoride (PVDF) Market Volume (Tons) Forecast, by End-user, 2018–2027

Table 46: Spain Polyvinylidene Fluoride (PVDF) Market Value (US$ Thousand) Forecast, by End-user, 2018–2027

Table 47: Rest of Europe Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type, 2018–2027

Table 48: Rest of Europe Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form, 2018–2027

Table 49: Rest of Europe Polyvinylidene Fluoride (PVDF) Market Volume (Tons) Forecast, by End-user, 2018–2027

Table 50: Rest of Europe Polyvinylidene Fluoride (PVDF) Market Value (US$ Thousand) Forecast, by End-user, 2018–2027

Table 51: Asia Pacific Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type, 2018–2027

Table 52: Asia Pacific Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form, 2018–2027

Table 53: Asia Pacific Polyvinylidene Fluoride (PVDF) Market Volume (Tons) Forecast, by End-user, 2018–2027

Table 54: Asia Pacific Polyvinylidene Fluoride (PVDF) Market Value (US$ Thousand) Forecast, by End-user, 2018–2027

Table 55: Asia Pacific Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Country and Sub-region, 2018–2027

Table 56: China Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type, 2018–2027

Table 57: China Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form, 2018–2027

Table 58: China Polyvinylidene Fluoride (PVDF) Market Volume (Tons) Forecast, by End-user, 2018–2027

Table 59: China Polyvinylidene Fluoride (PVDF) Market Value (US$ Thousand) Forecast, by End-user, 2018–2027

Table 60: Japan Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type, 2018–2027

Table 61: Japan Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form, 2018–2027

Table 62: Japan Polyvinylidene Fluoride (PVDF) Market Volume (Tons) Forecast, by End-user, 2018–2027

Table 63: Japan Polyvinylidene Fluoride (PVDF) Market Value (US$ Thousand) Forecast, by End-user, 2018–2027

Table 64: India Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type, 2018–2027

Table 65: India Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form, 2018–2027

Table 66: India Polyvinylidene Fluoride (PVDF) Market Volume (Tons) Forecast, by End-user, 2018–2027

Table 67: India Polyvinylidene Fluoride (PVDF) Market Value (US$ Thousand) Forecast, by End-user, 2018–2027

Table 68: ASEAN Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type, 2018–2027

Table 69: ASEAN Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form, 2018–2027

Table 70: ASEAN Polyvinylidene Fluoride (PVDF) Market Volume (Tons) Forecast, by End-user, 2018–2027

Table 71: ASEAN Polyvinylidene Fluoride (PVDF) Market Value (US$ Thousand) Forecast, by End-user, 2018–2027

Table 72: Rest of Asia Pacific Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type, 2018–2027

Table 73: Rest of Asia Pacific Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form, 2018–2027

Table 74: Rest of Asia Pacific Polyvinylidene Fluoride (PVDF) Market Volume (Tons) Forecast, by End-user, 2018–2027

Table 75: Rest of Asia Pacific Polyvinylidene Fluoride (PVDF) Market Value (US$ Thousand) Forecast, by End-user, 2018–2027

Table 76: Latin America Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type, 2018–2027

Table 77: Latin America Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form, 2018–2027

Table 78: Latin America Polyvinylidene Fluoride (PVDF) Market Volume (Tons) Forecast, by End-user, 2018–2027

Table 79: Latin America Polyvinylidene Fluoride (PVDF) Market Value (US$ Thousand) Forecast, by End-user, 2018–2027

Table 80: Latin America Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Country and Sub-region, 2018–2027

Table 81: Brazil Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type, 2018–2027

Table 82: Brazil Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form, 2018–2027

Table 83: Brazil Polyvinylidene Fluoride (PVDF) Market Volume (Tons) Forecast, by End-user, 2018–2027

Table 84: Brazil Polyvinylidene Fluoride (PVDF) Market Value (US$ Thousand) Forecast, by End-user, 2018–2027

Table 85: Mexico Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type, 2018–2027

Table 86: Mexico Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form, 2018–2027

Table 87: Mexico Polyvinylidene Fluoride (PVDF) Market Volume (Tons) Forecast, by End-user, 2018–2027

Table 88: Mexico Polyvinylidene Fluoride (PVDF) Market Value (US$ Thousand) Forecast, by End-user, 2018–2027

Table 89: Rest of Latin America Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type, 2018–2027

Table 90: Rest of Latin America Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form, 2018–2027

Table 91: Rest of Latin America Polyvinylidene Fluoride (PVDF) Market Volume (Tons) Forecast, by End-user, 2018–2027

Table 92: Rest of Latin America Polyvinylidene Fluoride (PVDF) Market Value (US$ Thousand) Forecast, by End-user, 2018–2027

Table 93: Middle East & Africa Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type, 2018–2027

Table 94: Middle East & Africa Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form, 2018–2027

Table 95: Middle East & Africa Polyvinylidene Fluoride (PVDF) Market Volume (Tons) Forecast, by End-user, 2018–2027

Table 96: Middle East & Africa Polyvinylidene Fluoride (PVDF) Market Value (US$ Thousand) Forecast, by End-user, 2018–2027

Table 97: Middle East & Africa Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Country and Sub-region, 2018–2027

Table 98: GCC Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type, 2018–2027

Table 99: GCC Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form, 2018–2027

Table 100: GCC Polyvinylidene Fluoride (PVDF) Market Volume (Tons) Forecast, by End-user, 2018–2027

Table 101: GCC Polyvinylidene Fluoride (PVDF) Market Value (US$ Thousand) Forecast, by End-user, 2018–2027

Table 102: South Africa Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type, 2018–2027

Table 103: South Africa Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form, 2018–2027

Table 104: South Africa Polyvinylidene Fluoride (PVDF) Market Volume (Tons) Forecast, by End-user, 2018–2027

Table 105: South Africa Polyvinylidene Fluoride (PVDF) Market Value (US$ Thousand) Forecast, by End-user, 2018–2027

Table 106: Rest of Middle East & Africa Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Type, 2018–2027

Table 107: Rest of Middle East & Africa Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, by Form, 2018–2027

Table 108: Rest of Middle East & Africa Polyvinylidene Fluoride (PVDF) Market Volume (Tons) Forecast, by End-user, 2018–2027

Table 109: Rest of Middle East & Africa Polyvinylidene Fluoride (PVDF) Market Value (US$ Thousand) Forecast, by End-user, 2018–2027

List of Figures

Figure 01: Global Polyvinylidene Fluoride (PVDF) Market Volume Share, by Type, 2018

Figure 02: Global Polyvinylidene Fluoride (PVDF) Market Volume Share, by Form, 2018

Figure 03: Global Polyvinylidene Fluoride (PVDF) Market Volume Share, by Region, 2018

Figure 04: Global Polyvinylidene Fluoride (PVDF) Market Volume Share Analysis, by Type, 2018 and 2027

Figure 05: Global Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand), by Homopolymer, 2018–2027

Figure 06: Global Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand), by Copolymer, 2018–2027

Figure 07: Global Polyvinylidene Fluoride (PVDF) Market Attractiveness Analysis, by Type, 2018

Figure 08: Global Polyvinylidene Fluoride (PVDF) Market Volume Share Analysis, by Form, 2018 and 2027

Figure 09: Global Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand), by Powder, 2018–2027

Figure 10: Global Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand), by Pellet, 2018–2027

Figure 11: Global Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand), by Latex, 2018–2027

Figure 12: Global Polyvinylidene Fluoride (PVDF) Market Attractiveness Analysis, by Form, 2018

Figure 13: Global Polyvinylidene Fluoride (PVDF) Market Volume Share Analysis, by End-user, 2018 and 2027

Figure 14: Global Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand), by Chemical Processing, 2018–2027

Figure 15: Global Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand), by Oil & Gas, 2018–2027

Figure 16: Global Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand), by Electrical & Electronics, 2018–2027

Figure 17: Global Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand), by Solar, 2018–2027

Figure 18: Global Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand), by Automotive, 2018–2027

Figure 19: Global Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand), by Building & Construction, 2018–2027

Figure 20: Global Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand), by Others, 2018–2027

Figure 21: Global Polyvinylidene Fluoride (PVDF) Market Attractiveness Analysis, by End-user, 2018

Figure 22: Global Polyvinylidene Fluoride (PVDF) Market Volume Share Analysis, by Region, 2018 and 2027

Figure 23: Global Polyvinylidene Fluoride (PVDF) Market Attractiveness Analysis, by Region

Figure 24: North America Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, 2018–2027

Figure 25: North America Polyvinylidene Fluoride (PVDF) Market Attractiveness, by Country

Figure 26: North America Polyvinylidene Fluoride (PVDF) Market Volume Share Analysis, by Type, 2018 and 2027

Figure 27: North America Polyvinylidene Fluoride (PVDF) Market Volume Share Analysis, by Form, 2018 and 2027

Figure 28: North America Polyvinylidene Fluoride (PVDF) Market Volume Share Analysis, by End-user, 2018 and 2027

Figure 29: North America Polyvinylidene Fluoride (PVDF) Market Volume Share Analysis, by Country, 2018 and 2027

Figure 30: North America Polyvinylidene Fluoride (PVDF) Market Attractiveness Analysis, by Type, 2018

Figure 31: North America Polyvinylidene Fluoride (PVDF) Market Attractiveness Analysis, by Form, 2018

Figure 32: North America Polyvinylidene Fluoride (PVDF) Market Attractiveness Analysis, by End-user, 2018

Figure 33: Europe Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, 2018–2027

Figure 34: Europe Polyvinylidene Fluoride (PVDF) Market Attractiveness, by Country and Sub-region

Figure 35: Europe Polyvinylidene Fluoride (PVDF) Market Volume Share Analysis, by Type, 2018 and 2027

Figure 36: Europe Polyvinylidene Fluoride (PVDF) Market Volume Share Analysis, by Form, 2018 and 2027

Figure 37: Europe Polyvinylidene Fluoride (PVDF) Market Volume Share Analysis, by End-user, 2018 and 2027

Figure 38: Europe Polyvinylidene Fluoride (PVDF) Market Volume Share Analysis, by Country and Sub-region, 2018 and 2027

Figure 39: Europe Polyvinylidene Fluoride (PVDF) Market Attractiveness Analysis, by Type, 2018

Figure 40: Europe Polyvinylidene Fluoride (PVDF) Market Attractiveness Analysis, by Form, 2018

Figure 41: Europe Polyvinylidene Fluoride (PVDF) Market Attractiveness Analysis, by End-user, 2018

Figure 42: Asia Pacific Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, 2018–2027

Figure 43: Asia Pacific Polyvinylidene Fluoride (PVDF) Market Attractiveness, by Country and Sub-region, 2018

Figure 44: Asia Pacific Polyvinylidene Fluoride (PVDF) Market Volume Share Analysis, by Type, 2018 and 2027

Figure 45: Asia Pacific Polyvinylidene Fluoride (PVDF) Market Volume Share Analysis, by Form, 2018 and 2027

Figure 46: Asia Pacific Polyvinylidene Fluoride (PVDF) Market Volume Share Analysis, by End-user, 2018 and 2027

Figure 47: Asia Pacific Market Volume Share Analysis, by Country and Sub-region, 2018 and 2027

Figure 48: Asia Pacific Polyvinylidene Fluoride (PVDF) Market Attractiveness Analysis, by Type, 2018

Figure 49: Asia Pacific Polyvinylidene Fluoride (PVDF) Market Attractiveness Analysis, by Form, 2018

Figure 50: Asia Pacific Polyvinylidene Fluoride (PVDF) Market Attractiveness Analysis, by End-user, 2018

Figure 51: Latin America Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, 2018–2027

Figure 52: Latin America Polyvinylidene Fluoride (PVDF) Market Attractiveness, by Country and Sub-region, 2018

Figure 53: Latin America Polyvinylidene Fluoride (PVDF) Market Volume Share Analysis, by Type, 2018 and 2027

Figure 54: Latin America Polyvinylidene Fluoride (PVDF) Market Volume Share Analysis, by Form, 2018 and 2027

Figure 55: Latin America Polyvinylidene Fluoride (PVDF) Market Volume Share Analysis, by End-user, 2018 and 2027

Figure 56: Latin America Market Volume Share Analysis, by Country and Sub-region, 2018 and 2027

Figure 57: Latin America Polyvinylidene Fluoride (PVDF) Market Attractiveness Analysis, by Type, 2018

Figure 58: Latin America Polyvinylidene Fluoride (PVDF) Market Attractiveness Analysis, by Form, 2018

Figure 59: Latin America Polyvinylidene Fluoride (PVDF) Market Attractiveness Analysis, by End-user, 2018

Figure 60: Middle East & Africa Polyvinylidene Fluoride (PVDF) Market Volume (Tons) and Value (US$ Thousand) Forecast, 2018–2027

Figure 61: Middle East & Africa Polyvinylidene Fluoride (PVDF) Market Attractiveness, by Country and Sub-region

Figure 62: Middle East & Africa Polyvinylidene Fluoride (PVDF) Market Volume Share Analysis, by Type, 2018 and 2027

Figure 63: Middle East & Africa Polyvinylidene Fluoride (PVDF) Market Volume Share Analysis, by Form, 2018 and 2027

Figure 64: Middle East & Africa Polyvinylidene Fluoride (PVDF) Market Volume Share Analysis, by End-user, 2018 and 2027

Figure 65: Middle East & Africa Market Volume Share Analysis, by Country and Sub-region, 2018 and 2027

Figure 66: Middle East & Africa Polyvinylidene Fluoride (PVDF) Market Attractiveness Analysis, by Type, 2018

Figure 67: Middle East & Africa Polyvinylidene Fluoride (PVDF) Market Attractiveness Analysis, by Form, 2018

Figure 68: Middle East & Africa Polyvinylidene Fluoride (PVDF) Market Attractiveness Analysis, by End-user, 2018

Figure 69: Polyvinylidene Fluoride (PVDF) Market Share Analysis, by Company, 2018