Reports

Reports

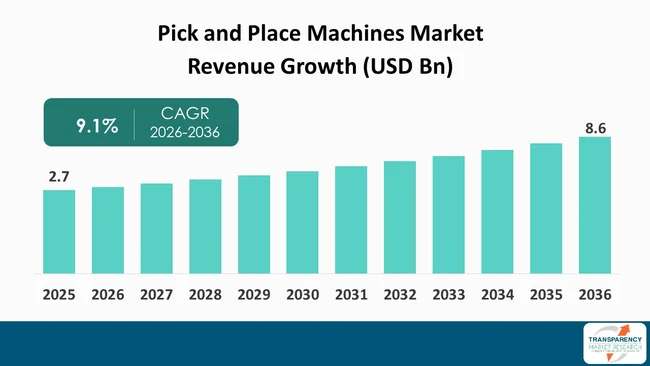

The global pick and place machines market size was valued at USD 2.7 Billion in 2025 and is projected to reach USD 8.6 Billion by 2036, expanding at a CAGR of 9.1% from 2026 to 2036. Market growth is driven by increased electronics manufacturing, expanding semiconductor production, rising demand for consumer electronics, growing adoption of automation in manufacturing, advancements in SMT technology, rising labor costs, demand for high-speed precision assembly, and increasing investment in Industry 4.0 initiatives globally.

The global pick and place machine market is being shaped by upturning trends such as precision manufacturing, electronics miniaturization, and expanding automation level in the industrial systems. The industry has matured beyond conventional surface mount technology assembly to now service high complexity markets such as semiconductor back end processing, electric vehicle power electronics, medical device assembly, and advanced packaging.

Placement speed is no longer the primary competitive factor among manufacturers. They are instead differentiated by accuracy to the level of microns, integrated intelligent vision, AI-enabled optimization, and flexible feeder systems for high mix low volume production. Industry 4.0 is changing buyers’ expectations. Customers are now asking for predictive maintenance, digital twin integration, and integration with MES and ERP for interoperable operations.

Fuji Corporation, Yamaha Motor Co., Ltd., ASMPT, Panasonic Connect Co., Ltd., Hanwha Precision Machinery, Mycronic AB, and the other major players are expanding with respect to modular platforms and smart factory solutions. The investments in strategic areas - AI inspection systems, high-speed chip shooters - are driving competition for the very top in the premium segment.

The competitive landscape of the market is moderately consolidated, yet the innovation cycles are short. Companies with mechanical precision and software intelligence are seeing disproportionate traction. The future path is bound to be influenced by the growth in demand from EV electronics, AI servers, advanced semiconductor packaging, and medical electronics sectors, where placement accuracy and reliability are must-have performance indicators.

A pick and place machines are foundational to high-speed electronic manufacturing and precision component assembly. They are widely used in surface mount technology assembly lines, semiconductor packaging facilities, LED production, automotive electronics manufacturing, medical device assembly, and industrial automation modules. Their function integrates motion control systems, high resolution cameras, vacuum nozzles, feeder mechanisms, and sophisticated control software.

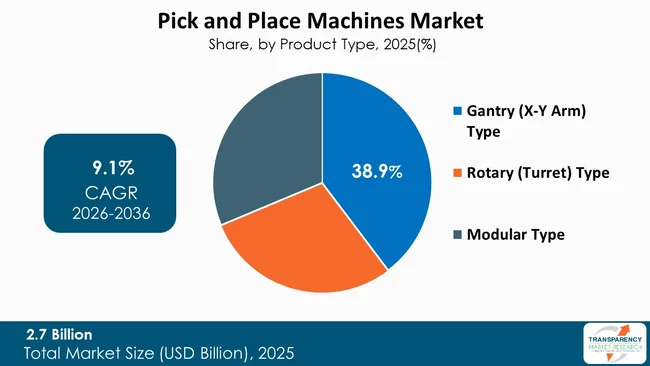

Types of pick and place machines include gantry type systems, turret type machines, rotary systems, and hybrid configurations. Gantry systems are commonly preferred for high precision and flexible placement tasks. Turret machines are known for ultra-high speed chip shooting. Advanced machines also integrate multi head technology and intelligent feeder systems.

Offerings in this pick and place machines market extend beyond hardware. Suppliers provide installation, calibration, programming software, machine optimization, remote diagnostics, and predictive maintenance services. Modern platforms are increasingly integrated with data analytics, artificial intelligence-based inspection, and real time process monitoring to ensure placement accuracy, reduced defect rates, and operational efficiency across automated production environments.

| Attribute | Detail |

|---|---|

| Pick and Place Machines Market Drivers |

|

The accelerating miniaturization of electronic components is significantly driving the demand for next generation pick and place systems. As chip architectures move toward smaller form factors and higher transistor density, placement tolerances have tightened considerably. Conventional mechanical precision is no longer sufficient. Sub-micron accuracy along the high-speed optical alignment is now mandatory.

The proliferation of 5G infrastructure, AI servers, wearable electronics, and electric vehicle control modules requires compact multilayer printed circuit boards populated with ultra-fine pitch components. Advanced packaging formats such as system in package and heterogeneous integration demand precise die and component placement without compromising throughput.

For instance, in early 2026, ASMPT introduced enhanced die bonding and placement systems supporting sub-10-micron accuracy for advanced packaging applications in AI processors and high-performance computing modules. These systems combine high-end vision calibration and dynamic compensation technology to ensure that high-speed production accuracy is maintained. Similarly, global semiconductor back-end capacity expansions in Taiwan, South Korea, and China have raised capital spending in precision placement equipment. Components now come in as small as 01005 packages and are smaller, so consistency in placement is vital to yield performance.

The desire for higher board density with no drop in reliability is leading companies to invest in equipment that can deal with micro components, flip chips, and advanced substrates. With continued miniaturization in consumer electronics, automotive electronics, and medical implants, high-precision pick and place systems will continue to be the backbone of future electronic assembly ecosystems.

The rapid electrification of vehicles and the exponential growth of automotive electronics content per vehicle are significantly strengthening demand for advanced pick and place equipment. Modern electric vehicles incorporate power electronics modules, battery management systems, advanced driver assistance systems, infotainment units, and multiple sensor arrays. Each of these systems requires highly reliable and precisely assembled circuit boards.

Automotive electronics differ from consumer electronics due to stringent reliability standards, vibration tolerance, and temperature resistance requirements. In 2025, Panasonic Connect Co., Ltd. expanded its modular NPM series placement platform for addressing automotive electronics production in Europe and Japan. The enhanced systems featured advanced part recognition and smart feeder monitoring tailored for automotive-grade manufacturing environments.

There is a surge in PCB assembly production due to global EV production expansion in China, Germany, and the U.S. Automotive OEMs are, in addition, requesting traceability integration so that every placed component can be digitally tracked through its lifecycle.

As power electronics modules become increasingly sophisticated with the use of silicon carbide and gallium nitride, the accuracy of placement is critical. Automotive Tier 1 suppliers are increasing automated assembly lines to comply with their reliability standards, and at the same time, keep the throughput.

The structural change from mechanical vehicles to electronically managed machines also enable high-performance pick and place systems tailored to automotive electronics production as a long-term sustainable sales driver.

A major structural opportunity for the pick and place machine market lies in semiconductor reshoring initiatives and government-backed domestic manufacturing expansion programs. Several economies have introduced strategic funding programs to localize semiconductor fabrication, advanced packaging, and electronics assembly. These initiatives are stimulating capital equipment investments across wafer back-end processing, advanced packaging lines, and electronics assembly facilities.

For instance, in early 2026, the United States stated that it would continue with the implementation of semiconductor incentive programs supporting domestic chip manufacturing facilities in Texas and Arizona. Equipment suppliers, including Fuji Corporation and Mycronic AB, reported increased order pipelines from newly commissioned facilities integrating smart factory automation platforms.

Similarly, India’s electronics manufacturing incentive schemes have accelerated the establishment of surface mount assembly lines for mobile devices and industrial electronics. Local contract manufacturers produce high-speed chip shooters and flexible placement systems to serve export-oriented production.

These government-backed expansions are not the exclusive domain of fab plants; advanced packaging, test facilities, and electronics assembly lines also need scalable pick and place platforms. With geopolitical factors continuing to affect the supply chains for semiconductors, the diversification of the manufacturing base will continue.

Vendors of equipment that can offer localized service networks, training infrastructure, and software-driven smart factory integration will maintain the best opportunity to capitalize on this structural opportunity for the next several years.

Gantry type pick and place machines dominate the type of segment of pick and place machines market, accounting for 39.7% of the market, primarily due to their superior precision, flexibility, and scalability across diverse applications. The X Y arm architecture allows controlled linear movement across large working areas while maintaining consistent placement accuracy.

Gantry systems are particularly favored in high mixed production environments where flexibility is critical. For instance, in 2025, Yamaha Motor Co., Ltd. introduced an advanced gantry based YRM platform optimized for smart factory integration. The system offered enhanced placement accuracy with real time correction algorithms and supported seamless integration with automated material handling systems in large scale electronics production facilities.

Compared to turret systems, gantry machines provide better handling for large or irregular components and are well suited for double sided board assembly. Their mechanical stability reduces vibration, enabling improved repeatability in precision driven industries such as medical electronics.

In addition, gantry systems can be combined with AI-based inspection and predictive maintenance modules, enhancing uptime. With the focus of manufacturers being on flexibility, customization, and integration with digital manufacturing ecosystems, gantry-type platforms are increasingly preferred. The blend of scalability, precision, and intelligent automation integration is what keeps gantry-based systems at the top in the pick and place machine market.

| Attribute | Detail |

|---|---|

| Leading Region |

|

Asia Pacific accounts for 38.9% of the total demand in the pick and place machine market, owing to the availability of electronics manufacturing ecosystems. The region accounts for the largest share of global PCB assembly, semiconductor back-end processing, consumer electronics, and automotive electronics manufacturing.

China is still a base for large-scale electronics assembly and for EV electronics manufacturing. Japan dominates high-precision equipment and advanced semiconductor packaging. South Korea is the hub of display panel and memory chip production, and Taiwan is the center of advanced semiconductor packaging and fabrication.

India has emerged as an electronics manufacturing hub with production-linked incentive schemes attracting investment in mobile device and component assembly. Southeast-Asian economies such as Malaysia and Vietnam are also developing contract manufacturing for global electronics household names.

For example, in 2026, a number of Japanese and Korean machine tool manufacturers established service and technical support centers in various locations of Southeast Asia to enhance regional customer support and to minimize downtime of high-speed assembly lines.

The combination of semiconductor production, advanced packaging, PCB production, and end electronics assembly in the same region makes this a closely linked value chain. This concentration of ecosystems, with the availability of skilled labor and depth in the supply chain, is what allows the Asia Pacific to continue dominating the global pick and place machine market.

ASMPT Ltd, CHARMHIGH TECHNOLOGY LIMITED, DDM Novastar, Inc, Essemtec AG, Fuji Machine Manufacturing Co., Ltd., Hanwha Semitech Co., Ltd., JUKI Corporation, Koh Young Technology Inc., Mycronic AB, Panasonic Holdings Corporation, The Europlacer Group, Universal Instruments Corporation, Yamaha Motor Co., Ltd., Zhejiang Huaqi Zhengbang Automation Technology Co., Ltd., Zhejiang Neoden Technology Co., Ltd. are some of the leading manufacturers operating in the global pick and place machines market.

Each of these companies has been profiled in the Pick and Place Machines market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2025 (Base Year) | USD 2.7 Billion |

| Market Forecast Value in 2036 | USD 8.6 Billion |

| Growth Rate (CAGR 2026 to 2036) | 9.1% |

| Forecast Period | 2026-2036 |

| Historical data Available for | 2021-2024 |

| Quantitative Units | US$ Bn for Value and Units for Volume |

| Pick and Place Machines Market Analysis | Global qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape | Market Player - Competition Dashboard and Revenue Share Analysis 2025 Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview) |

| Format | Electronic (PDF) + Excel |

| Market Segmentations | Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

The global pick and place machines market was valued at USD 2.7 Billion in 2025

The global pick and place machines industry is projected to reach at USD 8.6 Billion by the end of 2036

Accelerating electronics miniaturization & advanced packaging and electrification of vehicles & growth of automotive electronics, are some of the driving factors for this market

The CAGR is anticipated to be 9.1% from 2026 to 2036

ASMPT Ltd, CHARMHIGH TECHNOLOGY LIMITED, DDM Novastar, Inc, Essemtec AG, Fuji Machine Manufacturing Co., Ltd., Hanwha Semitech Co., Ltd., JUKI Corporation, Koh Young Technology Inc., Mycronic AB, Panasonic Holdings Corporation, The Europlacer Group, Universal Instruments Corporation, Yamaha Motor Co., Ltd., Zhejiang Huaqi Zhengbang Automation Technology Co., Ltd., Zhejiang Neoden Technology Co., Ltd., and others.

Table 01: Global Pick and Place Machines Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 02: Global Pick and Place Machines Market Volume (Units) Projection, By Type 2021 to 2036

Table 03: Global Pick and Place Machines Market Value (US$ Bn) Projection, By Automation Level 2021 to 2036

Table 04: Global Pick and Place Machines Market Volume (Units) Projection, By Automation Level 2021 to 2036

Table 05: Global Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Method 2021 to 2036

Table 06: Global Pick and Place Machines Market Volume (Units) Projection, By Placement Method 2021 to 2036

Table 07: Global Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Speed 2021 to 2036

Table 08: Global Pick and Place Machines Market Volume (Units) Projection, By Placement Speed 2021 to 2036

Table 09: Global Pick and Place Machines Market Value (US$ Bn) Projection, By End-use Industry 2021 to 2036

Table 10: Global Pick and Place Machines Market Volume (Units) Projection, By End-use Industry 2021 to 2036

Table 11: Global Pick and Place Machines Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 12: Global Pick and Place Machines Market Volume (Units) Projection, By Distribution Channel 2021 to 2036

Table 13: Global Pick and Place Machines Market Value (US$ Bn) Projection, By Region 2021 to 2036

Table 14: Global Pick and Place Machines Market Volume (Units) Projection, By Region 2021 to 2036

Table 15: North America Pick and Place Machines Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 16: North America Pick and Place Machines Market Volume (Units) Projection, By Type 2021 to 2036

Table 17: North America Pick and Place Machines Market Value (US$ Bn) Projection, By Automation Level 2021 to 2036

Table 18: North America Pick and Place Machines Market Volume (Units) Projection, By Automation Level 2021 to 2036

Table 19: North America Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Method 2021 to 2036

Table 20: North America Pick and Place Machines Market Volume (Units) Projection, By Placement Method 2021 to 2036

Table 21: North America Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Speed 2021 to 2036

Table 22: North America Pick and Place Machines Market Volume (Units) Projection, By Placement Speed 2021 to 2036

Table 23: North America Pick and Place Machines Market Value (US$ Bn) Projection, By End-use Industry 2021 to 2036

Table 24: North America Pick and Place Machines Market Volume (Units) Projection, By End-use Industry 2021 to 2036

Table 25: North America Pick and Place Machines Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 26: North America Pick and Place Machines Market Volume (Units) Projection, By Distribution Channel 2021 to 2036

Table 27: North America Pick and Place Machines Market Value (US$ Bn) Projection, By Country 2021 to 2036

Table 28: North America Pick and Place Machines Market Volume (Units) Projection, By Country 2021 to 2036

Table 29: U.S. Pick and Place Machines Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 30: U.S. Pick and Place Machines Market Volume (Units) Projection, By Type 2021 to 2036

Table 31: U.S. Pick and Place Machines Market Value (US$ Bn) Projection, By Automation Level 2021 to 2036

Table 32: U.S. Pick and Place Machines Market Volume (Units) Projection, By Automation Level 2021 to 2036

Table 33: U.S. Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Method 2021 to 2036

Table 34: U.S. Pick and Place Machines Market Volume (Units) Projection, By Placement Method 2021 to 2036

Table 35: U.S. Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Speed 2021 to 2036

Table 36: U.S. Pick and Place Machines Market Volume (Units) Projection, By Placement Speed 2021 to 2036

Table 37: U.S. Pick and Place Machines Market Value (US$ Bn) Projection, By End-use Industry 2021 to 2036

Table 38: U.S. Pick and Place Machines Market Volume (Units) Projection, By End-use Industry 2021 to 2036

Table 39: U.S. Pick and Place Machines Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 40: U.S. Pick and Place Machines Market Volume (Units) Projection, By Distribution Channel 2021 to 2036

Table 41: Canada Pick and Place Machines Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 42: Canada Pick and Place Machines Market Volume (Units) Projection, By Type 2021 to 2036

Table 43: Canada Pick and Place Machines Market Value (US$ Bn) Projection, By Automation Level 2021 to 2036

Table 44: Canada Pick and Place Machines Market Volume (Units) Projection, By Automation Level 2021 to 2036

Table 45: Canada Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Method 2021 to 2036

Table 46: Canada Pick and Place Machines Market Volume (Units) Projection, By Placement Method 2021 to 2036

Table 47: Canada Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Speed 2021 to 2036

Table 48: Canada Pick and Place Machines Market Volume (Units) Projection, By Placement Speed 2021 to 2036

Table 49: Canada Pick and Place Machines Market Value (US$ Bn) Projection, By End-use Industry 2021 to 2036

Table 50: Canada Pick and Place Machines Market Volume (Units) Projection, By End-use Industry 2021 to 2036

Table 51: Canada Pick and Place Machines Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 52: Canada Pick and Place Machines Market Volume (Units) Projection, By Distribution Channel 2021 to 2036

Table 53: Europe Pick and Place Machines Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 54: Europe Pick and Place Machines Market Volume (Units) Projection, By Type 2021 to 2036

Table 55: Europe Pick and Place Machines Market Value (US$ Bn) Projection, By Automation Level 2021 to 2036

Table 56: Europe Pick and Place Machines Market Volume (Units) Projection, By Automation Level 2021 to 2036

Table 57: Europe Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Method 2021 to 2036

Table 58: Europe Pick and Place Machines Market Volume (Units) Projection, By Placement Method 2021 to 2036

Table 59: Europe Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Speed 2021 to 2036

Table 60: Europe Pick and Place Machines Market Volume (Units) Projection, By Placement Speed 2021 to 2036

Table 61: Europe Pick and Place Machines Market Value (US$ Bn) Projection, By End-use Industry 2021 to 2036

Table 62: Europe Pick and Place Machines Market Volume (Units) Projection, By End-use Industry 2021 to 2036

Table 63: Europe Pick and Place Machines Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 64: Europe Pick and Place Machines Market Volume (Units) Projection, By Distribution Channel 2021 to 2036

Table 65: Europe Pick and Place Machines Market Value (US$ Bn) Projection, By Country 2021 to 2036

Table 66: Europe Pick and Place Machines Market Volume (Units) Projection, By Country 2021 to 2036

Table 67: U.K. Pick and Place Machines Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 68: U.K. Pick and Place Machines Market Volume (Units) Projection, By Type 2021 to 2036

Table 69: U.K. Pick and Place Machines Market Value (US$ Bn) Projection, By Automation Level 2021 to 2036

Table 70: U.K. Pick and Place Machines Market Volume (Units) Projection, By Automation Level 2021 to 2036

Table 71: U.K. Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Method 2021 to 2036

Table 72: U.K. Pick and Place Machines Market Volume (Units) Projection, By Placement Method 2021 to 2036

Table 73: U.K. Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Speed 2021 to 2036

Table 74: U.K. Pick and Place Machines Market Volume (Units) Projection, By Placement Speed 2021 to 2036

Table 75: U.K. Pick and Place Machines Market Value (US$ Bn) Projection, By End-use Industry 2021 to 2036

Table 76: U.K. Pick and Place Machines Market Volume (Units) Projection, By End-use Industry 2021 to 2036

Table 77: U.K. Pick and Place Machines Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 78: U.K. Pick and Place Machines Market Volume (Units) Projection, By Distribution Channel 2021 to 2036

Table 79: Germany Pick and Place Machines Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 80: Germany Pick and Place Machines Market Volume (Units) Projection, By Type 2021 to 2036

Table 81: Germany Pick and Place Machines Market Value (US$ Bn) Projection, By Automation Level 2021 to 2036

Table 82: Germany Pick and Place Machines Market Volume (Units) Projection, By Automation Level 2021 to 2036

Table 83: Germany Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Method 2021 to 2036

Table 84: Germany Pick and Place Machines Market Volume (Units) Projection, By Placement Method 2021 to 2036

Table 85: Germany Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Speed 2021 to 2036

Table 86: Germany Pick and Place Machines Market Volume (Units) Projection, By Placement Speed 2021 to 2036

Table 87: Germany Pick and Place Machines Market Value (US$ Bn) Projection, By End-use Industry 2021 to 2036

Table 88: Germany Pick and Place Machines Market Volume (Units) Projection, By End-use Industry 2021 to 2036

Table 89: Germany Pick and Place Machines Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 90: Germany Pick and Place Machines Market Volume (Units) Projection, By Distribution Channel 2021 to 2036

Table 91: France Pick and Place Machines Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 92: France Pick and Place Machines Market Volume (Units) Projection, By Type 2021 to 2036

Table 93: France Pick and Place Machines Market Value (US$ Bn) Projection, By Automation Level 2021 to 2036

Table 94: France Pick and Place Machines Market Volume (Units) Projection, By Automation Level 2021 to 2036

Table 95: France Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Method 2021 to 2036

Table 96: France Pick and Place Machines Market Volume (Units) Projection, By Placement Method 2021 to 2036

Table 97: France Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Speed 2021 to 2036

Table 98: France Pick and Place Machines Market Volume (Units) Projection, By Placement Speed 2021 to 2036

Table 99: France Pick and Place Machines Market Value (US$ Bn) Projection, By End-use Industry 2021 to 2036

Table 100: France Pick and Place Machines Market Volume (Units) Projection, By End-use Industry 2021 to 2036

Table 101: France Pick and Place Machines Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 102: France Pick and Place Machines Market Volume (Units) Projection, By Distribution Channel 2021 to 2036

Table 103: Italy Pick and Place Machines Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 104: Italy Pick and Place Machines Market Volume (Units) Projection, By Type 2021 to 2036

Table 105: Italy Pick and Place Machines Market Value (US$ Bn) Projection, By Automation Level 2021 to 2036

Table 106: Italy Pick and Place Machines Market Volume (Units) Projection, By Automation Level 2021 to 2036

Table 107: Italy Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Method 2021 to 2036

Table 108: Italy Pick and Place Machines Market Volume (Units) Projection, By Placement Method 2021 to 2036

Table 109: Italy Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Speed 2021 to 2036

Table 110: Italy Pick and Place Machines Market Volume (Units) Projection, By Placement Speed 2021 to 2036

Table 111: Italy Pick and Place Machines Market Value (US$ Bn) Projection, By End-use Industry 2021 to 2036

Table 112: Italy Pick and Place Machines Market Volume (Units) Projection, By End-use Industry 2021 to 2036

Table 113: Italy Pick and Place Machines Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 114: Italy Pick and Place Machines Market Volume (Units) Projection, By Distribution Channel 2021 to 2036

Table 115: Spain Pick and Place Machines Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 116: Spain Pick and Place Machines Market Volume (Units) Projection, By Type 2021 to 2036

Table 117: Spain Pick and Place Machines Market Value (US$ Bn) Projection, By Automation Level 2021 to 2036

Table 118: Spain Pick and Place Machines Market Volume (Units) Projection, By Automation Level 2021 to 2036

Table 119: Spain Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Method 2021 to 2036

Table 120: Spain Pick and Place Machines Market Volume (Units) Projection, By Placement Method 2021 to 2036

Table 121: Spain Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Speed 2021 to 2036

Table 122: Spain Pick and Place Machines Market Volume (Units) Projection, By Placement Speed 2021 to 2036

Table 123: Spain Pick and Place Machines Market Value (US$ Bn) Projection, By End-use Industry 2021 to 2036

Table 124: Spain Pick and Place Machines Market Volume (Units) Projection, By End-use Industry 2021 to 2036

Table 125: Spain Pick and Place Machines Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 126: Spain Pick and Place Machines Market Volume (Units) Projection, By Distribution Channel 2021 to 2036

Table 127: The Netherlands Pick and Place Machines Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 128: The Netherlands Pick and Place Machines Market Volume (Units) Projection, By Type 2021 to 2036

Table 129: The Netherlands Pick and Place Machines Market Value (US$ Bn) Projection, By Automation Level 2021 to 2036

Table 130: The Netherlands Pick and Place Machines Market Volume (Units) Projection, By Automation Level 2021 to 2036

Table 131: The Netherlands Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Method 2021 to 2036

Table 132: The Netherlands Pick and Place Machines Market Volume (Units) Projection, By Placement Method 2021 to 2036

Table 133: The Netherlands Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Speed 2021 to 2036

Table 134: The Netherlands Pick and Place Machines Market Volume (Units) Projection, By Placement Speed 2021 to 2036

Table 135: The Netherlands Pick and Place Machines Market Value (US$ Bn) Projection, By End-use Industry 2021 to 2036

Table 136: The Netherlands Pick and Place Machines Market Volume (Units) Projection, By End-use Industry 2021 to 2036

Table 137: The Netherlands Pick and Place Machines Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 138: The Netherlands Pick and Place Machines Market Volume (Units) Projection, By Distribution Channel 2021 to 2036

Table 139: Asia Pacific Pick and Place Machines Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 140: Asia Pacific Pick and Place Machines Market Volume (Units) Projection, By Type 2021 to 2036

Table 141: Asia Pacific Pick and Place Machines Market Value (US$ Bn) Projection, By Automation Level 2021 to 2036

Table 142: Asia Pacific Pick and Place Machines Market Volume (Units) Projection, By Automation Level 2021 to 2036

Table 143: Asia Pacific Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Method 2021 to 2036

Table 144: Asia Pacific Pick and Place Machines Market Volume (Units) Projection, By Placement Method 2021 to 2036

Table 145: Asia Pacific Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Speed 2021 to 2036

Table 146: Asia Pacific Pick and Place Machines Market Volume (Units) Projection, By Placement Speed 2021 to 2036

Table 147: Asia Pacific Pick and Place Machines Market Value (US$ Bn) Projection, By End-use Industry 2021 to 2036

Table 148: Asia Pacific Pick and Place Machines Market Volume (Units) Projection, By End-use Industry 2021 to 2036

Table 149: Asia Pacific Pick and Place Machines Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 150: Asia Pacific Pick and Place Machines Market Volume (Units) Projection, By Distribution Channel 2021 to 2036

Table 151: Asia Pacific Pick and Place Machines Market Value (US$ Bn) Projection, By Country 2021 to 2036

Table 152: Asia Pacific Pick and Place Machines Market Volume (Units) Projection, By Country 2021 to 2036

Table 153: China Pick and Place Machines Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 154: China Pick and Place Machines Market Volume (Units) Projection, By Type 2021 to 2036

Table 155: China Pick and Place Machines Market Value (US$ Bn) Projection, By Automation Level 2021 to 2036

Table 156: China Pick and Place Machines Market Volume (Units) Projection, By Automation Level 2021 to 2036

Table 157: China Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Method 2021 to 2036

Table 158: China Pick and Place Machines Market Volume (Units) Projection, By Placement Method 2021 to 2036

Table 159: China Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Speed 2021 to 2036

Table 160: China Pick and Place Machines Market Volume (Units) Projection, By Placement Speed 2021 to 2036

Table 161: China Pick and Place Machines Market Value (US$ Bn) Projection, By End-use Industry 2021 to 2036

Table 162: China Pick and Place Machines Market Volume (Units) Projection, By End-use Industry 2021 to 2036

Table 163: China Pick and Place Machines Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 164: China Pick and Place Machines Market Volume (Units) Projection, By Distribution Channel 2021 to 2036

Table 165: India Pick and Place Machines Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 166: India Pick and Place Machines Market Volume (Units) Projection, By Type 2021 to 2036

Table 167: India Pick and Place Machines Market Value (US$ Bn) Projection, By Automation Level 2021 to 2036

Table 168: India Pick and Place Machines Market Volume (Units) Projection, By Automation Level 2021 to 2036

Table 169: India Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Method 2021 to 2036

Table 170: India Pick and Place Machines Market Volume (Units) Projection, By Placement Method 2021 to 2036

Table 171: India Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Speed 2021 to 2036

Table 172: India Pick and Place Machines Market Volume (Units) Projection, By Placement Speed 2021 to 2036

Table 173: India Pick and Place Machines Market Value (US$ Bn) Projection, By End-use Industry 2021 to 2036

Table 174: India Pick and Place Machines Market Volume (Units) Projection, By End-use Industry 2021 to 2036

Table 175: India Pick and Place Machines Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 176: India Pick and Place Machines Market Volume (Units) Projection, By Distribution Channel 2021 to 2036

Table 177: Japan Pick and Place Machines Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 178: Japan Pick and Place Machines Market Volume (Units) Projection, By Type 2021 to 2036

Table 179: Japan Pick and Place Machines Market Value (US$ Bn) Projection, By Automation Level 2021 to 2036

Table 180: Japan Pick and Place Machines Market Volume (Units) Projection, By Automation Level 2021 to 2036

Table 181: Japan Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Method 2021 to 2036

Table 182: Japan Pick and Place Machines Market Volume (Units) Projection, By Placement Method 2021 to 2036

Table 183: Japan Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Speed 2021 to 2036

Table 184: Japan Pick and Place Machines Market Volume (Units) Projection, By Placement Speed 2021 to 2036

Table 185: Japan Pick and Place Machines Market Value (US$ Bn) Projection, By End-use Industry 2021 to 2036

Table 186: Japan Pick and Place Machines Market Volume (Units) Projection, By End-use Industry 2021 to 2036

Table 187: Japan Pick and Place Machines Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 188: Japan Pick and Place Machines Market Volume (Units) Projection, By Distribution Channel 2021 to 2036

Table 189: Australia Pick and Place Machines Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 190: Australia Pick and Place Machines Market Volume (Units) Projection, By Type 2021 to 2036

Table 191: Australia Pick and Place Machines Market Value (US$ Bn) Projection, By Automation Level 2021 to 2036

Table 192: Australia Pick and Place Machines Market Volume (Units) Projection, By Automation Level 2021 to 2036

Table 193: Australia Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Method 2021 to 2036

Table 194: Australia Pick and Place Machines Market Volume (Units) Projection, By Placement Method 2021 to 2036

Table 195: Australia Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Speed 2021 to 2036

Table 196: Australia Pick and Place Machines Market Volume (Units) Projection, By Placement Speed 2021 to 2036

Table 197: Australia Pick and Place Machines Market Value (US$ Bn) Projection, By End-use Industry 2021 to 2036

Table 198: Australia Pick and Place Machines Market Volume (Units) Projection, By End-use Industry 2021 to 2036

Table 199: Australia Pick and Place Machines Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 200: Australia Pick and Place Machines Market Volume (Units) Projection, By Distribution Channel 2021 to 2036

Table 201: South Korea Pick and Place Machines Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 202: South Korea Pick and Place Machines Market Volume (Units) Projection, By Type 2021 to 2036

Table 203: South Korea Pick and Place Machines Market Value (US$ Bn) Projection, By Automation Level 2021 to 2036

Table 204: South Korea Pick and Place Machines Market Volume (Units) Projection, By Automation Level 2021 to 2036

Table 205: South Korea Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Method 2021 to 2036

Table 206: South Korea Pick and Place Machines Market Volume (Units) Projection, By Placement Method 2021 to 2036

Table 207: South Korea Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Speed 2021 to 2036

Table 208: South Korea Pick and Place Machines Market Volume (Units) Projection, By Placement Speed 2021 to 2036

Table 209: South Korea Pick and Place Machines Market Value (US$ Bn) Projection, By End-use Industry 2021 to 2036

Table 210: South Korea Pick and Place Machines Market Volume (Units) Projection, By End-use Industry 2021 to 2036

Table 211: South Korea Pick and Place Machines Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 212: South Korea Pick and Place Machines Market Volume (Units) Projection, By Distribution Channel 2021 to 2036

Table 213: ASEAN Pick and Place Machines Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 214: ASEAN Pick and Place Machines Market Volume (Units) Projection, By Type 2021 to 2036

Table 215: ASEAN Pick and Place Machines Market Value (US$ Bn) Projection, By Automation Level 2021 to 2036

Table 216: ASEAN Pick and Place Machines Market Volume (Units) Projection, By Automation Level 2021 to 2036

Table 217: ASEAN Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Method 2021 to 2036

Table 218: ASEAN Pick and Place Machines Market Volume (Units) Projection, By Placement Method 2021 to 2036

Table 219: ASEAN Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Speed 2021 to 2036

Table 220: ASEAN Pick and Place Machines Market Volume (Units) Projection, By Placement Speed 2021 to 2036

Table 221: ASEAN Pick and Place Machines Market Value (US$ Bn) Projection, By End-use Industry 2021 to 2036

Table 222: ASEAN Pick and Place Machines Market Volume (Units) Projection, By End-use Industry 2021 to 2036

Table 223: ASEAN Pick and Place Machines Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 224: ASEAN Pick and Place Machines Market Volume (Units) Projection, By Distribution Channel 2021 to 2036

Table 225: Middle East & Africa Pick and Place Machines Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 226: Middle East & Africa Pick and Place Machines Market Volume (Units) Projection, By Type 2021 to 2036

Table 227: Middle East & Africa Pick and Place Machines Market Value (US$ Bn) Projection, By Automation Level 2021 to 2036

Table 228: Middle East & Africa Pick and Place Machines Market Volume (Units) Projection, By Automation Level 2021 to 2036

Table 229: Middle East & Africa Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Method 2021 to 2036

Table 230: Middle East & Africa Pick and Place Machines Market Volume (Units) Projection, By Placement Method 2021 to 2036

Table 231: Middle East & Africa Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Speed 2021 to 2036

Table 232: Middle East & Africa Pick and Place Machines Market Volume (Units) Projection, By Placement Speed 2021 to 2036

Table 233: Middle East & Africa Pick and Place Machines Market Value (US$ Bn) Projection, By End-use Industry 2021 to 2036

Table 234: Middle East & Africa Pick and Place Machines Market Volume (Units) Projection, By End-use Industry 2021 to 2036

Table 235: Middle East & Africa Pick and Place Machines Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 236: Middle East & Africa Pick and Place Machines Market Volume (Units) Projection, By Distribution Channel 2021 to 2036

Table 237: Middle East & Africa Pick and Place Machines Market Value (US$ Bn) Projection, By Country 2021 to 2036

Table 238: Middle East & Africa Pick and Place Machines Market Volume (Units) Projection, By Country 2021 to 2036

Table 239: GCC Countries Pick and Place Machines Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 240: GCC Countries Pick and Place Machines Market Volume (Units) Projection, By Type 2021 to 2036

Table 241: GCC Countries Pick and Place Machines Market Value (US$ Bn) Projection, By Automation Level 2021 to 2036

Table 242: GCC Countries Pick and Place Machines Market Volume (Units) Projection, By Automation Level 2021 to 2036

Table 243: GCC Countries Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Method 2021 to 2036

Table 244: GCC Countries Pick and Place Machines Market Volume (Units) Projection, By Placement Method 2021 to 2036

Table 245: GCC Countries Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Speed 2021 to 2036

Table 246: GCC Countries Pick and Place Machines Market Volume (Units) Projection, By Placement Speed 2021 to 2036

Table 247: GCC Countries Pick and Place Machines Market Value (US$ Bn) Projection, By End-use Industry 2021 to 2036

Table 248: GCC Countries Pick and Place Machines Market Volume (Units) Projection, By End-use Industry 2021 to 2036

Table 249: GCC Countries Pick and Place Machines Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 250: GCC Countries Pick and Place Machines Market Volume (Units) Projection, By Distribution Channel 2021 to 2036

Table 251: South Africa Pick and Place Machines Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 252: South Africa Pick and Place Machines Market Volume (Units) Projection, By Type 2021 to 2036

Table 253: South Africa Pick and Place Machines Market Value (US$ Bn) Projection, By Automation Level 2021 to 2036

Table 254: South Africa Pick and Place Machines Market Volume (Units) Projection, By Automation Level 2021 to 2036

Table 255: South Africa Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Method 2021 to 2036

Table 256: South Africa Pick and Place Machines Market Volume (Units) Projection, By Placement Method 2021 to 2036

Table 257: South Africa Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Speed 2021 to 2036

Table 258: South Africa Pick and Place Machines Market Volume (Units) Projection, By Placement Speed 2021 to 2036

Table 259: South Africa Pick and Place Machines Market Value (US$ Bn) Projection, By End-use Industry 2021 to 2036

Table 260: South Africa Pick and Place Machines Market Volume (Units) Projection, By End-use Industry 2021 to 2036

Table 261: South Africa Pick and Place Machines Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 262: South Africa Pick and Place Machines Market Volume (Units) Projection, By Distribution Channel 2021 to 2036

Table 263: Latin America Pick and Place Machines Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 264: Latin America Pick and Place Machines Market Volume (Units) Projection, By Type 2021 to 2036

Table 265: Latin America Pick and Place Machines Market Value (US$ Bn) Projection, By Automation Level 2021 to 2036

Table 266: Latin America Pick and Place Machines Market Volume (Units) Projection, By Automation Level 2021 to 2036

Table 267: Latin America Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Method 2021 to 2036

Table 268: Latin America Pick and Place Machines Market Volume (Units) Projection, By Placement Method 2021 to 2036

Table 269: Latin America Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Speed 2021 to 2036

Table 270: Latin America Pick and Place Machines Market Volume (Units) Projection, By Placement Speed 2021 to 2036

Table 271: Latin America Pick and Place Machines Market Value (US$ Bn) Projection, By End-use Industry 2021 to 2036

Table 272: Latin America Pick and Place Machines Market Volume (Units) Projection, By End-use Industry 2021 to 2036

Table 273: Latin America Pick and Place Machines Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 274: Latin America Pick and Place Machines Market Volume (Units) Projection, By Distribution Channel 2021 to 2036

Table 275: Latin America Pick and Place Machines Market Value (US$ Bn) Projection, By Country 2021 to 2036

Table 276: Latin America Pick and Place Machines Market Volume (Units) Projection, By Country 2021 to 2036

Table 277: Brazil Pick and Place Machines Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 278: Brazil Pick and Place Machines Market Volume (Units) Projection, By Type 2021 to 2036

Table 279: Brazil Pick and Place Machines Market Value (US$ Bn) Projection, By Automation Level 2021 to 2036

Table 280: Brazil Pick and Place Machines Market Volume (Units) Projection, By Automation Level 2021 to 2036

Table 281: Brazil Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Method 2021 to 2036

Table 282: Brazil Pick and Place Machines Market Volume (Units) Projection, By Placement Method 2021 to 2036

Table 283: Brazil Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Speed 2021 to 2036

Table 284: Brazil Pick and Place Machines Market Volume (Units) Projection, By Placement Speed 2021 to 2036

Table 285: Brazil Pick and Place Machines Market Value (US$ Bn) Projection, By End-use Industry 2021 to 2036

Table 286: Brazil Pick and Place Machines Market Volume (Units) Projection, By End-use Industry 2021 to 2036

Table 287: Brazil Pick and Place Machines Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 288: Brazil Pick and Place Machines Market Volume (Units) Projection, By Distribution Channel 2021 to 2036

Table 289: Mexico Pick and Place Machines Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 290: Mexico Pick and Place Machines Market Volume (Units) Projection, By Type 2021 to 2036

Table 291: Mexico Pick and Place Machines Market Value (US$ Bn) Projection, By Automation Level 2021 to 2036

Table 292: Mexico Pick and Place Machines Market Volume (Units) Projection, By Automation Level 2021 to 2036

Table 293: Mexico Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Method 2021 to 2036

Table 294: Mexico Pick and Place Machines Market Volume (Units) Projection, By Placement Method 2021 to 2036

Table 295: Mexico Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Speed 2021 to 2036

Table 296: Mexico Pick and Place Machines Market Volume (Units) Projection, By Placement Speed 2021 to 2036

Table 297: Mexico Pick and Place Machines Market Value (US$ Bn) Projection, By End-use Industry 2021 to 2036

Table 298: Mexico Pick and Place Machines Market Volume (Units) Projection, By End-use Industry 2021 to 2036

Table 299: Mexico Pick and Place Machines Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 300: Mexico Pick and Place Machines Market Volume (Units) Projection, By Distribution Channel 2021 to 2036

Table 301: Argentina Pick and Place Machines Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 302: Argentina Pick and Place Machines Market Volume (Units) Projection, By Type 2021 to 2036

Table 303: Argentina Pick and Place Machines Market Value (US$ Bn) Projection, By Automation Level 2021 to 2036

Table 304: Argentina Pick and Place Machines Market Volume (Units) Projection, By Automation Level 2021 to 2036

Table 305: Argentina Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Method 2021 to 2036

Table 306: Argentina Pick and Place Machines Market Volume (Units) Projection, By Placement Method 2021 to 2036

Table 307: Argentina Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Speed 2021 to 2036

Table 308: Argentina Pick and Place Machines Market Volume (Units) Projection, By Placement Speed 2021 to 2036

Table 309: Argentina Pick and Place Machines Market Value (US$ Bn) Projection, By End-use Industry 2021 to 2036

Table 310: Argentina Pick and Place Machines Market Volume (Units) Projection, By End-use Industry 2021 to 2036

Table 311: Argentina Pick and Place Machines Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 312: Argentina Pick and Place Machines Market Volume (Units) Projection, By Distribution Channel 2021 to 2036

Figure 01: Global Pick and Place Machines Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 02: Global Pick and Place Machines Market Volume (Units) Projection, By Type 2021 to 2036

Figure 03: Global Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 04: Global Pick and Place Machines Market Value (US$ Bn) Projection, By Automation Level 2021 to 2036

Figure 05: Global Pick and Place Machines Market Volume (Units) Projection, By Automation Level 2021 to 2036

Figure 06: Global Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Automation Level 2026 to 2036

Figure 07: Global Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Method 2021 to 2036

Figure 08: Global Pick and Place Machines Market Volume (Units) Projection, By Placement Method 2021 to 2036

Figure 09: Global Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Placement Method 2026 to 2036

Figure 10: Global Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Speed 2021 to 2036

Figure 11: Global Pick and Place Machines Market Volume (Units) Projection, By Placement Speed 2021 to 2036

Figure 12: Global Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Placement Speed 2026 to 2036

Figure 13: Global Pick and Place Machines Market Value (US$ Bn) Projection, By End-use Industry 2021 to 2036

Figure 14: Global Pick and Place Machines Market Volume (Units) Projection, By End-use Industry 2021 to 2036

Figure 15: Global Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2026 to 2036

Figure 16: Global Pick and Place Machines Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 17: Global Pick and Place Machines Market Volume (Units) Projection, By Distribution Channel 2021 to 2036

Figure 18: Global Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 19: Global Pick and Place Machines Market Value (US$ Bn) Projection, By Region 2021 to 2036

Figure 20: Global Pick and Place Machines Market Volume (Units) Projection, By Region 2021 to 2036

Figure 21: Global Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Region 2026 to 2036

Figure 22: North America Pick and Place Machines Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 23: North America Pick and Place Machines Market Volume (Units) Projection, By Type 2021 to 2036

Figure 24: North America Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 25: North America Pick and Place Machines Market Value (US$ Bn) Projection, By Automation Level 2021 to 2036

Figure 26: North America Pick and Place Machines Market Volume (Units) Projection, By Automation Level 2021 to 2036

Figure 27: North America Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Automation Level 2026 to 2036

Figure 28: North America Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Method 2021 to 2036

Figure 29: North America Pick and Place Machines Market Volume (Units) Projection, By Placement Method 2021 to 2036

Figure 30: North America Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Placement Method 2026 to 2036

Figure 31: North America Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Speed 2021 to 2036

Figure 32: North America Pick and Place Machines Market Volume (Units) Projection, By Placement Speed 2021 to 2036

Figure 33: North America Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Placement Speed 2026 to 2036

Figure 34: North America Pick and Place Machines Market Value (US$ Bn) Projection, By End-use Industry 2021 to 2036

Figure 35: North America Pick and Place Machines Market Volume (Units) Projection, By End-use Industry 2021 to 2036

Figure 36: North America Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2026 to 2036

Figure 37: North America Pick and Place Machines Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 38: North America Pick and Place Machines Market Volume (Units) Projection, By Distribution Channel 2021 to 2036

Figure 39: North America Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 40: North America Pick and Place Machines Market Value (US$ Bn) Projection, By Country 2021 to 2036

Figure 41: North America Pick and Place Machines Market Volume (Units) Projection, By Country 2021 to 2036

Figure 42: North America Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Country 2026 to 2036

Figure 43: U.S. Pick and Place Machines Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 44: U.S. Pick and Place Machines Market Volume (Units) Projection, By Type 2021 to 2036

Figure 45: U.S. Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 46: U.S. Pick and Place Machines Market Value (US$ Bn) Projection, By Automation Level 2021 to 2036

Figure 47: U.S. Pick and Place Machines Market Volume (Units) Projection, By Automation Level 2021 to 2036

Figure 48: U.S. Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Automation Level 2026 to 2036

Figure 49: U.S. Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Method 2021 to 2036

Figure 50: U.S. Pick and Place Machines Market Volume (Units) Projection, By Placement Method 2021 to 2036

Figure 51: U.S. Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Placement Method 2026 to 2036

Figure 52: U.S. Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Speed 2021 to 2036

Figure 53: U.S. Pick and Place Machines Market Volume (Units) Projection, By Placement Speed 2021 to 2036

Figure 54: U.S. Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Placement Speed 2026 to 2036

Figure 55: U.S. Pick and Place Machines Market Value (US$ Bn) Projection, By End-use Industry 2021 to 2036

Figure 56: U.S. Pick and Place Machines Market Volume (Units) Projection, By End-use Industry 2021 to 2036

Figure 57: U.S. Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2026 to 2036

Figure 58: U.S. Pick and Place Machines Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 59: U.S. Pick and Place Machines Market Volume (Units) Projection, By Distribution Channel 2021 to 2036

Figure 60: U.S. Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 61: Canada Pick and Place Machines Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 62: Canada Pick and Place Machines Market Volume (Units) Projection, By Type 2021 to 2036

Figure 63: Canada Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 64: Canada Pick and Place Machines Market Value (US$ Bn) Projection, By Automation Level 2021 to 2036

Figure 65: Canada Pick and Place Machines Market Volume (Units) Projection, By Automation Level 2021 to 2036

Figure 66: Canada Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Automation Level 2026 to 2036

Figure 67: Canada Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Method 2021 to 2036

Figure 68: Canada Pick and Place Machines Market Volume (Units) Projection, By Placement Method 2021 to 2036

Figure 69: Canada Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Placement Method 2026 to 2036

Figure 70: Canada Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Speed 2021 to 2036

Figure 71: Canada Pick and Place Machines Market Volume (Units) Projection, By Placement Speed 2021 to 2036

Figure 72: Canada Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Placement Speed 2026 to 2036

Figure 73: Canada Pick and Place Machines Market Value (US$ Bn) Projection, By End-use Industry 2021 to 2036

Figure 74: Canada Pick and Place Machines Market Volume (Units) Projection, By End-use Industry 2021 to 2036

Figure 75: Canada Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2026 to 2036

Figure 76: Canada Pick and Place Machines Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 77: Canada Pick and Place Machines Market Volume (Units) Projection, By Distribution Channel 2021 to 2036

Figure 78: Canada Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 79: Europe Pick and Place Machines Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 80: Europe Pick and Place Machines Market Volume (Units) Projection, By Type 2021 to 2036

Figure 81: Europe Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 82: Europe Pick and Place Machines Market Value (US$ Bn) Projection, By Automation Level 2021 to 2036

Figure 83: Europe Pick and Place Machines Market Volume (Units) Projection, By Automation Level 2021 to 2036

Figure 84: Europe Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Automation Level 2026 to 2036

Figure 85: Europe Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Method 2021 to 2036

Figure 86: Europe Pick and Place Machines Market Volume (Units) Projection, By Placement Method 2021 to 2036

Figure 87: Europe Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Placement Method 2026 to 2036

Figure 88: Europe Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Speed 2021 to 2036

Figure 89: Europe Pick and Place Machines Market Volume (Units) Projection, By Placement Speed 2021 to 2036

Figure 90: Europe Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Placement Speed 2026 to 2036

Figure 91: Europe Pick and Place Machines Market Value (US$ Bn) Projection, By End-use Industry 2021 to 2036

Figure 92: Europe Pick and Place Machines Market Volume (Units) Projection, By End-use Industry 2021 to 2036

Figure 93: Europe Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2026 to 2036

Figure 94: Europe Pick and Place Machines Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 95: Europe Pick and Place Machines Market Volume (Units) Projection, By Distribution Channel 2021 to 2036

Figure 96: Europe Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 97: Europe Pick and Place Machines Market Value (US$ Bn) Projection, By Country 2021 to 2036

Figure 98: Europe Pick and Place Machines Market Volume (Units) Projection, By Country 2021 to 2036

Figure 99: Europe Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Country 2026 to 2036

Figure 100: U.K. Pick and Place Machines Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 101: U.K. Pick and Place Machines Market Volume (Units) Projection, By Type 2021 to 2036

Figure 102: U.K. Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 103: U.K. Pick and Place Machines Market Value (US$ Bn) Projection, By Automation Level 2021 to 2036

Figure 104: U.K. Pick and Place Machines Market Volume (Units) Projection, By Automation Level 2021 to 2036

Figure 105: U.K. Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Automation Level 2026 to 2036

Figure 106: U.K. Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Method 2021 to 2036

Figure 107: U.K. Pick and Place Machines Market Volume (Units) Projection, By Placement Method 2021 to 2036

Figure 108: U.K. Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Placement Method 2026 to 2036

Figure 109: U.K. Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Speed 2021 to 2036

Figure 110: U.K. Pick and Place Machines Market Volume (Units) Projection, By Placement Speed 2021 to 2036

Figure 111: U.K. Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Placement Speed 2026 to 2036

Figure 112: U.K. Pick and Place Machines Market Value (US$ Bn) Projection, By End-use Industry 2021 to 2036

Figure 113: U.K. Pick and Place Machines Market Volume (Units) Projection, By End-use Industry 2021 to 2036

Figure 114: U.K. Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2026 to 2036

Figure 115: U.K. Pick and Place Machines Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 116: U.K. Pick and Place Machines Market Volume (Units) Projection, By Distribution Channel 2021 to 2036

Figure 117: U.K. Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 118: Germany Pick and Place Machines Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 119: Germany Pick and Place Machines Market Volume (Units) Projection, By Type 2021 to 2036

Figure 120: Germany Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 121: Germany Pick and Place Machines Market Value (US$ Bn) Projection, By Automation Level 2021 to 2036

Figure 122: Germany Pick and Place Machines Market Volume (Units) Projection, By Automation Level 2021 to 2036

Figure 123: Germany Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Automation Level 2026 to 2036

Figure 124: Germany Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Method 2021 to 2036

Figure 125: Germany Pick and Place Machines Market Volume (Units) Projection, By Placement Method 2021 to 2036

Figure 126: Germany Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Placement Method 2026 to 2036

Figure 127: Germany Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Speed 2021 to 2036

Figure 128: Germany Pick and Place Machines Market Volume (Units) Projection, By Placement Speed 2021 to 2036

Figure 129: Germany Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Placement Speed 2026 to 2036

Figure 130: Germany Pick and Place Machines Market Value (US$ Bn) Projection, By End-use Industry 2021 to 2036

Figure 131: Germany Pick and Place Machines Market Volume (Units) Projection, By End-use Industry 2021 to 2036

Figure 132: Germany Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2026 to 2036

Figure 133: Germany Pick and Place Machines Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 134: Germany Pick and Place Machines Market Volume (Units) Projection, By Distribution Channel 2021 to 2036

Figure 135: Germany Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 136: France Pick and Place Machines Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 137: France Pick and Place Machines Market Volume (Units) Projection, By Type 2021 to 2036

Figure 138: France Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 139: France Pick and Place Machines Market Value (US$ Bn) Projection, By Automation Level 2021 to 2036

Figure 140: France Pick and Place Machines Market Volume (Units) Projection, By Automation Level 2021 to 2036

Figure 141: France Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Automation Level 2026 to 2036

Figure 142: France Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Method 2021 to 2036

Figure 143: France Pick and Place Machines Market Volume (Units) Projection, By Placement Method 2021 to 2036

Figure 144: France Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Placement Method 2026 to 2036

Figure 145: France Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Speed 2021 to 2036

Figure 146: France Pick and Place Machines Market Volume (Units) Projection, By Placement Speed 2021 to 2036

Figure 147: France Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Placement Speed 2026 to 2036

Figure 148: France Pick and Place Machines Market Value (US$ Bn) Projection, By End-use Industry 2021 to 2036

Figure 149: France Pick and Place Machines Market Volume (Units) Projection, By End-use Industry 2021 to 2036

Figure 150: France Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2026 to 2036

Figure 151: France Pick and Place Machines Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 152: France Pick and Place Machines Market Volume (Units) Projection, By Distribution Channel 2021 to 2036

Figure 153: France Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 154: Italy Pick and Place Machines Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 155: Italy Pick and Place Machines Market Volume (Units) Projection, By Type 2021 to 2036

Figure 156: Italy Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 157: Italy Pick and Place Machines Market Value (US$ Bn) Projection, By Automation Level 2021 to 2036

Figure 158: Italy Pick and Place Machines Market Volume (Units) Projection, By Automation Level 2021 to 2036

Figure 159: Italy Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Automation Level 2026 to 2036

Figure 160: Italy Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Method 2021 to 2036

Figure 161: Italy Pick and Place Machines Market Volume (Units) Projection, By Placement Method 2021 to 2036

Figure 162: Italy Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Placement Method 2026 to 2036

Figure 163: Italy Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Speed 2021 to 2036

Figure 164: Italy Pick and Place Machines Market Volume (Units) Projection, By Placement Speed 2021 to 2036

Figure 165: Italy Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Placement Speed 2026 to 2036

Figure 166: Italy Pick and Place Machines Market Value (US$ Bn) Projection, By End-use Industry 2021 to 2036

Figure 167: Italy Pick and Place Machines Market Volume (Units) Projection, By End-use Industry 2021 to 2036

Figure 168: Italy Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2026 to 2036

Figure 169: Italy Pick and Place Machines Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 170: Italy Pick and Place Machines Market Volume (Units) Projection, By Distribution Channel 2021 to 2036

Figure 171: Italy Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 172: Spain Pick and Place Machines Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 173: Spain Pick and Place Machines Market Volume (Units) Projection, By Type 2021 to 2036

Figure 174: Spain Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 175: Spain Pick and Place Machines Market Value (US$ Bn) Projection, By Automation Level 2021 to 2036

Figure 176: Spain Pick and Place Machines Market Volume (Units) Projection, By Automation Level 2021 to 2036

Figure 177: Spain Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Automation Level 2026 to 2036

Figure 178: Spain Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Method 2021 to 2036

Figure 179: Spain Pick and Place Machines Market Volume (Units) Projection, By Placement Method 2021 to 2036

Figure 180: Spain Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Placement Method 2026 to 2036

Figure 181: Spain Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Speed 2021 to 2036

Figure 182: Spain Pick and Place Machines Market Volume (Units) Projection, By Placement Speed 2021 to 2036

Figure 183: Spain Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Placement Speed 2026 to 2036

Figure 184: Spain Pick and Place Machines Market Value (US$ Bn) Projection, By End-use Industry 2021 to 2036

Figure 185: Spain Pick and Place Machines Market Volume (Units) Projection, By End-use Industry 2021 to 2036

Figure 186: Spain Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2026 to 2036

Figure 187: Spain Pick and Place Machines Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 188: Spain Pick and Place Machines Market Volume (Units) Projection, By Distribution Channel 2021 to 2036

Figure 189: Spain Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 190: The Netherlands Pick and Place Machines Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 191: The Netherlands Pick and Place Machines Market Volume (Units) Projection, By Type 2021 to 2036

Figure 192: The Netherlands Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 193: The Netherlands Pick and Place Machines Market Value (US$ Bn) Projection, By Automation Level 2021 to 2036

Figure 194: The Netherlands Pick and Place Machines Market Volume (Units) Projection, By Automation Level 2021 to 2036

Figure 195: The Netherlands Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Automation Level 2026 to 2036

Figure 196: The Netherlands Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Method 2021 to 2036

Figure 197: The Netherlands Pick and Place Machines Market Volume (Units) Projection, By Placement Method 2021 to 2036

Figure 198: The Netherlands Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Placement Method 2026 to 2036

Figure 199: The Netherlands Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Speed 2021 to 2036

Figure 200: The Netherlands Pick and Place Machines Market Volume (Units) Projection, By Placement Speed 2021 to 2036

Figure 201: The Netherlands Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Placement Speed 2026 to 2036

Figure 202: The Netherlands Pick and Place Machines Market Value (US$ Bn) Projection, By End-use Industry 2021 to 2036

Figure 203: The Netherlands Pick and Place Machines Market Volume (Units) Projection, By End-use Industry 2021 to 2036

Figure 204: The Netherlands Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2026 to 2036

Figure 205: The Netherlands Pick and Place Machines Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 206: The Netherlands Pick and Place Machines Market Volume (Units) Projection, By Distribution Channel 2021 to 2036

Figure 207: The Netherlands Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 208: Asia Pacific Pick and Place Machines Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 209: Asia Pacific Pick and Place Machines Market Volume (Units) Projection, By Type 2021 to 2036

Figure 210: Asia Pacific Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 211: Asia Pacific Pick and Place Machines Market Value (US$ Bn) Projection, By Automation Level 2021 to 2036

Figure 212: Asia Pacific Pick and Place Machines Market Volume (Units) Projection, By Automation Level 2021 to 2036

Figure 213: Asia Pacific Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Automation Level 2026 to 2036

Figure 214: Asia Pacific Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Method 2021 to 2036

Figure 215: Asia Pacific Pick and Place Machines Market Volume (Units) Projection, By Placement Method 2021 to 2036

Figure 216: Asia Pacific Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Placement Method 2026 to 2036

Figure 217: Asia Pacific Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Speed 2021 to 2036

Figure 218: Asia Pacific Pick and Place Machines Market Volume (Units) Projection, By Placement Speed 2021 to 2036

Figure 219: Asia Pacific Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Placement Speed 2026 to 2036

Figure 220: Asia Pacific Pick and Place Machines Market Value (US$ Bn) Projection, By End-use Industry 2021 to 2036

Figure 221: Asia Pacific Pick and Place Machines Market Volume (Units) Projection, By End-use Industry 2021 to 2036

Figure 222: Asia Pacific Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By End-use Industry 2026 to 2036

Figure 223: Asia Pacific Pick and Place Machines Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 224: Asia Pacific Pick and Place Machines Market Volume (Units) Projection, By Distribution Channel 2021 to 2036

Figure 225: Asia Pacific Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 226: Asia Pacific Pick and Place Machines Market Value (US$ Bn) Projection, By Country 2021 to 2036

Figure 227: Asia Pacific Pick and Place Machines Market Volume (Units) Projection, By Country 2021 to 2036

Figure 228: Asia Pacific Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Country 2026 to 2036

Figure 229: China Pick and Place Machines Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 230: China Pick and Place Machines Market Volume (Units) Projection, By Type 2021 to 2036

Figure 231: China Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 232: China Pick and Place Machines Market Value (US$ Bn) Projection, By Automation Level 2021 to 2036

Figure 233: China Pick and Place Machines Market Volume (Units) Projection, By Automation Level 2021 to 2036

Figure 234: China Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Automation Level 2026 to 2036

Figure 235: China Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Method 2021 to 2036

Figure 236: China Pick and Place Machines Market Volume (Units) Projection, By Placement Method 2021 to 2036

Figure 237: China Pick and Place Machines Market Incremental Opportunities (US$ Bn) Forecast, By Placement Method 2026 to 2036

Figure 238: China Pick and Place Machines Market Value (US$ Bn) Projection, By Placement Speed 2021 to 2036