Reports

Reports

The increasing pressure on pharmaceutical companies to reduce costs while maintaining high levels of efficiency and productivity is one of the primary drivers to the pharmaceutical contract sales outsourcing market. The companies are able to tap the special assets and skills without incurring the overhead expense of supporting a full in-house sales force through sales function outsourcing. In addition, regulatory complexity and the requirement to conform to stringent guidelines also promote the use of CSOs, given that such entities normally have set procedures and expertise in navigating their way out of such obstacles.

The rapid pace of drug development also contributes to increasing the uptake of outsourcing the sales functions. As pharmaceutical firms are presented with decreasing product life cycles and increased competition, selling operations can be outsourced to offer the companies the required velocity to address the demands of the market in a timely manner.

Besides, the increased focus on targeted medicine and biopharmaceutical growth require customized sales approaches best provided by professional contract sales organizations.

Technological advancements have also played a role in expanding the pharmaceutical CSO market. The use of digital technologies and data analysis enables CSOs to streamline sales methods, improve customer interaction, and monitor performance metrics better. The data-driven approach enables pharmaceutical firms to make well-informed decisions and optimize marketing strategies.

Pharmaceutical contract sales organizations (CSOs) imply third-party entities that deliver outsourcing sales and marketing solutions to pharmaceutical and biotech companies. The activities of CSOs are important as they allow drug manufacturers to focus on their core competencies of research and development while entrusting market access and customer engagement to CSOs. CSOs offer a range of services including sales force deployment, promotional support, and market access strategies, tailored to meet the specific needs of their clients.

Pharmaceutical contract sales organizations (CSOs) provide a wide variety of services that assist pharmaceutical and biotechnology firms in marketing and sales. CSOs, for example, are able to provide trained, experienced sales forces within targeted therapeutic categories or products. This assists pharma firms in making rapid entry into new markets without the expense and time of recruiting in-house staff.

In addition, CSOs help build and implement promotion strategies such as detailing, product launches, and interactions with healthcare providers. They offer content and materials that meet their clients' marketing goals. Others provide market access services intended to navigate reimbursement channels, win formulary positions, and interact with payers to get products to the patient. CSOs like to engage with influential stakeholders in the healthcare environment.

As digital media continues to grow, CSOs provide comprehensive digital marketing services such as online promotion, social engagement on media, and content marketing in order to engage healthcare professionals and patients. CSOs provide training services for the sales representatives in the form of product knowledge, compliance, and sales skills, ensuring that teams are adequately trained to represent clients' products.

| Attribute | Detail |

|---|---|

| Pharmaceutical Contract Sales Outsourcing Market Drivers |

|

Cost-effectiveness is one of the key drivers to the pharmaceutical contract sales outsourcing industry, economically revolutionizing how the pharmaceutical companies pursue their sales processes. The drug industry is characterized by massive operational costs, such as the cost of recruitment, training, and retaining in-house pharmaceutical sales experts. Through the outsourcing of sales to professional CSOs, pharmaceutical corporations are able to reap significant cost savings, enabling them to allocate resources strategically.

One of the biggest advantages of outsourcing is reducing fixed costs of having an in-house salesforce. In-house staff requires constant spending in salary, benefits, and training and can be capital-guzzling for new products or small companies.

Additionally, CSOs come with built-in competencies and infrastructure that can lead to more effective selling at a lower cost of building them in-house. CSOs possess large networks and relations with doctors and the other medical specialists in most cases, thereby enabling them to operate within complex healthcare environments more effectively.

Outsourcing also helps in minimizing risks of new market entry or new product introductions. In-house sales team may not necessarily possess local know-how and expertise to enter new markets successfully, committing expensive mistakes or slowing down. CSOs normally have intensive knowledge of local market conditions and thus provide drug companies with a competitive advantage.

During the fast-growing age of digitalization, the ability to use better technologies provides strength to the companies to streamline market approaches, improve customer engagement, and make sales performance streamlined. As pharma companies are under more pressure to demonstrate value and efficacy, embracing digital technology remains a necessity in a bid to remain ahead of the curve.

One of the main benefits of cyber information is also the ability to accumulate and process vast amounts of information about product performance, customer action, and market trends. Pharmaceutical companies can make decisions based on knowledge through data analytics based on data about the needs and wants of healthcare providers in view of optimizing to reach their campaign sales.

In addition, web solutions provide instant tracking of marketing campaigns and sales. Pharmaceutical business organizations can monitor KPIs and realign based on data insights. Flexibility is very important in a dynamic environment where conditions in the market can change suddenly. With dashboards and analytics software, organizations can identify underperforming segments and change direction to capitalize on developing opportunities. This pre-planning also ensures maximum utilization of resources as well as maximizes overall efficiency of sales.

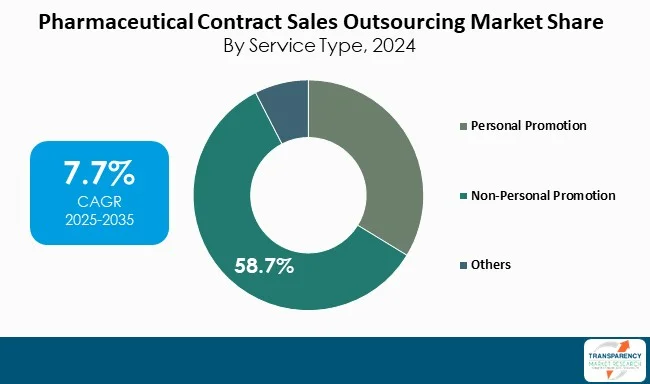

Non-personal promotion is the current prevailing strategy in the pharmaceutical contract sales outsourcing industry based on a wide range of compelling reasons. This is based on enhanced digitization of healthcare, which has revolutionized the mode of communication between pharmaceutical firms and medical practitioners.

Digital promotional channels such as email marketing, social media messaging, and internet-based educational webinars enable long-term outreach and contact in comparison with traditional communication. This method not only conserves face-to-face communication expenses but also makes pinpoint targeting possible for exact audiences.

| Attribute | Detail |

|---|---|

| Leading Region | North America |

As per the latest pharmaceutical contract sales outsourcing market analysis, North America dominated the market in 2024. The region boasts the presence of the major pharmaceutical companies and an established healthcare framework that helps in outsourcing sales functions. Also, having large biotech and pharmaceutical hubs in place especially in the United States is an attractive market for CSOs.

One of the primary reasons for the continued success of North America is the high investment in research and development activities leading to a regular supply of new drugs or therapy with marketing challenges that will need cost-effective solutions. Moreover, the competitive landscape in North America spurs pharmaceutical companies to look for cheap solutions. CSOs can take advantage of this and provide a level of operational efficiency.

Multiple companies in the pharmaceutical contract sales outsourcing sector are investing in digital tools and technologies like customer relationship management (CRM), and data analytics systems. These digital tools help to enhance sales strategies, improve customer engagement, and monitor performance metrics more accurately and timely.

IQVIA, Axxelus, EPS Corporation (EPS Holdings, Inc.), Syneos Health, EVERSANA, CMIC HOLDINGS Co., LTD., QFR Solutions, Sales Focus Inc., GTS Solution, Mercalis, MaBiCo, Mednext Pharmaceuticals Pvt. Ltd., Peak Pharma Solutions Inc., Promoveo Health and Agilify Solutions Inc. are some of the leading players operating in the global pharmaceutical contract sales outsourcing market.

Each of these players has been profiled in the pharmaceutical contract sales outsourcing market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

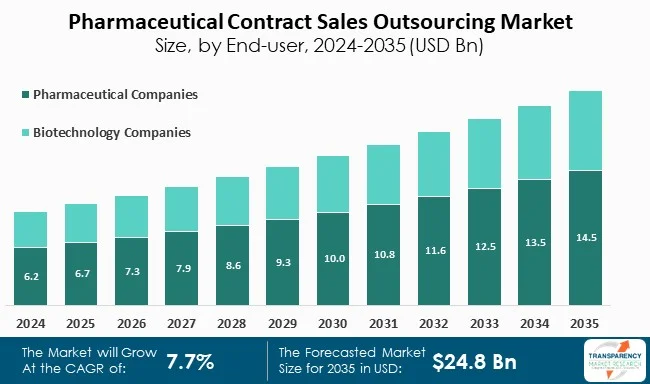

| Size in 2024 | US$ 10.9 Bn |

| Forecast Value in 2035 | US$ 24.8 Bn |

| CAGR | 7.7% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Biotechnology Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global pharmaceutical contract sales outsourcing market was valued at US$ 10.9 Bn in 2024.

The global pharmaceutical contract sales outsourcing industry is projected to reach more than US$ 24.8 Bn by the end of 2035.

Cost efficiency associated with outsourcing of sales function, rapid market entry, and integration of digital tools and data analytics in sales strategies are some of the factors driving the expansion of pharmaceutical contract sales outsourcing market.

The CAGR is anticipated to be 7.7% from 2025 to 2035.

IQVIA, Axxelus, EPS Corporation (EPS Holdings, Inc.), Syneos Health, EVERSANA, CMIC HOLDINGS Co., LTD., QFR Solutions, Sales Focus Inc., GTS Solution, Mercalis, MaBiCo, Mednext Pharmaceuticals Pvt. Ltd., Peak Pharma Solutions Inc., Promoveo Health and Agilify Solutions Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Pharmaceutical Contract Sales Outsourcing Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Pharmaceutical Contract Sales Outsourcing Market Analysis and Forecasts, 2020 to 2035

4.4.1. Market Revenue Projections (US$ Bn)

5. Key Insights

5.1. Healthcare Expenditure across Key Regions / Countries

5.2. Advantages of Pharmaceutical Sales Outsourcing

5.3. PORTER’s Five Forces Analysis

5.4. PESTLE Analysis

5.5. Key Industry Events (Partnership, Collaborations, Product approvals, merger & acquisitions)

6. Global Pharmaceutical Contract Sales Outsourcing Market Analysis and Forecasts, By Service Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast By Service Type, 2020 to 2035

6.3.1. Personal Promotion

6.3.1.1. Promotional Sales Team

6.3.1.1.1. Dedicated Sales Team

6.3.1.1.2. Syndicated Sales Team

6.3.1.2. Key Account Management

6.3.1.3. Vacancy Management

6.3.2. Non-Personal Promotion

6.3.2.1. Tele-detailing

6.3.2.2. Interactive E-Detailing

6.3.2.3. Customer Service

6.3.2.4. Medical Science Liaisons

6.3.2.5. Patient Engagement Services

6.3.2.6. Others

6.3.3. Others

6.4. Market Attractiveness By Service Type

7. Global Pharmaceutical Contract Sales Outsourcing Market Analysis and Forecasts, By Therapeutic Area

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast By Therapeutic Area, 2020 to 2035

7.3.1. Cardiovascular Disorders

7.3.2. Oncological Disorders

7.3.3. Respiratory Disorders

7.3.4. Metabolic Disorders

7.3.5. Neurological Disorders

7.3.6. Orthopedic Disorders

7.3.7. Infectious Diseases

7.3.8. Others

7.4. Market Attractiveness By Therapeutic Area

8. Global Pharmaceutical Contract Sales Outsourcing Market Analysis and Forecasts, By End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast By End-user, 2020 to 2035

8.3.1. Pharmaceutical Companies

8.3.1.1. Novel Drug Developers

8.3.1.2. Generic Drug Developers

8.3.1.3. Vaccine Developers

8.3.2. Biotechnology Companies

8.4. Market Attractiveness By End-user

9. Global Pharmaceutical Contract Sales Outsourcing Market Analysis and Forecasts, By Region

9.1. Key Findings

9.2. Market Value Forecast By Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness By Region

10. North America Pharmaceutical Contract Sales Outsourcing Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast By Service Type, 2020 to 2035

10.2.1. Personal Promotion

10.2.1.1. Promotional Sales Team

10.2.1.1.1. Dedicated Sales Team

10.2.1.1.2. Syndicated Sales Team

10.2.1.2. Key Account Management

10.2.1.3. Vacancy Management

10.2.2. Non-Personal Promotion

10.2.2.1. Tele-detailing

10.2.2.2. Interactive E-Detailing

10.2.2.3. Customer Service

10.2.2.4. Medical Science Liaisons

10.2.2.5. Patient Engagement Services

10.2.2.6. Others

10.2.3. Others

10.3. Market Value Forecast By Therapeutic Area, 2020 to 2035

10.3.1. Cardiovascular Disorders

10.3.2. Oncological Disorders

10.3.3. Respiratory Disorders

10.3.4. Metabolic Disorders

10.3.5. Neurological Disorders

10.3.6. Orthopedic Disorders

10.3.7. Infectious Diseases

10.3.8. Others

10.4. Market Value Forecast By End-user, 2020 to 2035

10.4.1. Pharmaceutical Companies

10.4.1.1. Novel Drug Developers

10.4.1.2. Generic Drug Developers

10.4.1.3. Vaccine Developers

10.4.2. Biotechnology Companies

10.5. Market Value Forecast By Country, 2020 to 2035

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Service Type

10.6.2. By Therapeutic Area

10.6.3. By End-user

10.6.4. By Country

11. Europe Pharmaceutical Contract Sales Outsourcing Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast By Service Type, 2020 to 2035

11.2.1. Personal Promotion

11.2.1.1. Promotional Sales Team

11.2.1.1.1. Dedicated Sales Team

11.2.1.1.2. Syndicated Sales Team

11.2.1.2. Key Account Management

11.2.1.3. Vacancy Management

11.2.2. Non-Personal Promotion

11.2.2.1. Tele-detailing

11.2.2.2. Interactive E-Detailing

11.2.2.3. Customer Service

11.2.2.4. Medical Science Liaisons

11.2.2.5. Patient Engagement Services

11.2.2.6. Others

11.2.3. Others

11.3. Market Value Forecast By Therapeutic Area, 2020 to 2035

11.3.1. Cardiovascular Disorders

11.3.2. Oncological Disorders

11.3.3. Respiratory Disorders

11.3.4. Metabolic Disorders

11.3.5. Neurological Disorders

11.3.6. Orthopedic Disorders

11.3.7. Infectious Diseases

11.3.8. Others

11.4. Market Value Forecast By End-user, 2020 to 2035

11.4.1. Pharmaceutical Companies

11.4.1.1. Novel Drug Developers

11.4.1.2. Generic Drug Developers

11.4.1.3. Vaccine Developers

11.4.2. Biotechnology Companies

11.5. Market Value Forecast By Country / Sub-region, 2020 to 2035

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Switzerland

11.5.7. The Netherlands

11.5.8. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Service Type

11.6.2. By Therapeutic Area

11.6.3. By End-user

11.6.4. By Country / Sub-region

12. Asia Pacific Pharmaceutical Contract Sales Outsourcing Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast By Service Type, 2020 to 2035

12.2.1. Personal Promotion

12.2.1.1. Promotional Sales Team

12.2.1.1.1. Dedicated Sales Team

12.2.1.1.2. Syndicated Sales Team

12.2.1.2. Key Account Management

12.2.1.3. Vacancy Management

12.2.2. Non-Personal Promotion

12.2.2.1. Tele-detailing

12.2.2.2. Interactive E-Detailing

12.2.2.3. Customer Service

12.2.2.4. Medical Science Liaisons

12.2.2.5. Patient Engagement Services

12.2.2.6. Others

12.2.3. Others

12.3. Market Value Forecast By Therapeutic Area, 2020 to 2035

12.3.1. Cardiovascular Disorders

12.3.2. Oncological Disorders

12.3.3. Respiratory Disorders

12.3.4. Metabolic Disorders

12.3.5. Neurological Disorders

12.3.6. Orthopedic Disorders

12.3.7. Infectious Diseases

12.3.8. Others

12.4. Market Value Forecast By End-user, 2020 to 2035

12.4.1. Pharmaceutical Companies

12.4.1.1. Novel Drug Developers

12.4.1.2. Generic Drug Developers

12.4.1.3. Vaccine Developers

12.4.2. Biotechnology Companies

12.5. Market Value Forecast By Country / Sub-region, 2020 to 2035

12.5.1. China

12.5.2. India

12.5.3. Japan

12.5.4. South Korea

12.5.5. Australia & New Zealand

12.5.6. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Service Type

12.6.2. By Therapeutic Area

12.6.3. By End-user

12.6.4. By Country / Sub-region

13. Latin America Pharmaceutical Contract Sales Outsourcing Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast By Service Type, 2020 to 2035

13.2.1. Personal Promotion

13.2.1.1. Promotional Sales Team

13.2.1.1.1. Dedicated Sales Team

13.2.1.1.2. Syndicated Sales Team

13.2.1.2. Key Account Management

13.2.1.3. Vacancy Management

13.2.2. Non-Personal Promotion

13.2.2.1. Tele-detailing

13.2.2.2. Interactive E-Detailing

13.2.2.3. Customer Service

13.2.2.4. Medical Science Liaisons

13.2.2.5. Patient Engagement Services

13.2.2.6. Others

13.2.3. Others

13.3. Market Value Forecast By Therapeutic Area, 2020 to 2035

13.3.1. Cardiovascular Disorders

13.3.2. Oncological Disorders

13.3.3. Respiratory Disorders

13.3.4. Metabolic Disorders

13.3.5. Neurological Disorders

13.3.6. Orthopedic Disorders

13.3.7. Infectious Diseases

13.3.8. Others

13.4. Market Value Forecast By End-user, 2020 to 2035

13.4.1. Pharmaceutical Companies

13.4.1.1. Novel Drug Developers

13.4.1.2. Generic Drug Developers

13.4.1.3. Vaccine Developers

13.4.2. Biotechnology Companies

13.5. Market Value Forecast By Country / Sub-region, 2020 to 2035

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Argentina

13.5.4. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Service Type

13.6.2. By Therapeutic Area

13.6.3. By End-user

13.6.4. By Country / Sub-region

14. Middle East & Africa Pharmaceutical Contract Sales Outsourcing Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast By Service Type, 2020 to 2035

14.2.1. Personal Promotion

14.2.1.1. Promotional Sales Team

14.2.1.1.1. Dedicated Sales Team

14.2.1.1.2. Syndicated Sales Team

14.2.1.2. Key Account Management

14.2.1.3. Vacancy Management

14.2.2. Non-Personal Promotion

14.2.2.1. Tele-detailing

14.2.2.2. Interactive E-Detailing

14.2.2.3. Customer Service

14.2.2.4. Medical Science Liaisons

14.2.2.5. Patient Engagement Services

14.2.2.6. Others

14.2.3. Others

14.3. Market Value Forecast By Therapeutic Area, 2020 to 2035

14.3.1. Cardiovascular Disorders

14.3.2. Oncological Disorders

14.3.3. Respiratory Disorders

14.3.4. Metabolic Disorders

14.3.5. Neurological Disorders

14.3.6. Orthopedic Disorders

14.3.7. Infectious Diseases

14.3.8. Others

14.4. Market Value Forecast By End-user, 2020 to 2035

14.4.1. Pharmaceutical Companies

14.4.1.1. Novel Drug Developers

14.4.1.2. Generic Drug Developers

14.4.1.3. Vaccine Developers

14.4.2. Biotechnology Companies

14.5. Market Value Forecast By Country / Sub-region, 2020 to 2035

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Service Type

14.6.2. By Therapeutic Area

14.6.3. By End-user

14.6.4. By Country / Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of companies)

15.2. Market Share Analysis By Company (2024)

15.3. Company Profiles

15.3.1. IQVIA

15.3.1.1. Company Overview

15.3.1.2. Financial Overview

15.3.1.3. Product Portfolio

15.3.1.4. Business Strategies

15.3.1.5. Recent Developments

15.3.2. Axxelus

15.3.2.1. Company Overview

15.3.2.2. Financial Overview

15.3.2.3. Product Portfolio

15.3.2.4. Business Strategies

15.3.2.5. Recent Developments

15.3.3. EPS Corporation (EPS Holdings, Inc.)

15.3.3.1. Company Overview

15.3.3.2. Financial Overview

15.3.3.3. Product Portfolio

15.3.3.4. Business Strategies

15.3.3.5. Recent Developments

15.3.4. Syneos Health

15.3.4.1. Company Overview

15.3.4.2. Financial Overview

15.3.4.3. Product Portfolio

15.3.4.4. Business Strategies

15.3.4.5. Recent Developments

15.3.5. EVERSANA

15.3.5.1. Company Overview

15.3.5.2. Financial Overview

15.3.5.3. Product Portfolio

15.3.5.4. Business Strategies

15.3.5.5. Recent Developments

15.3.6. CMIC HOLDINGS Co., LTD.

15.3.6.1. Company Overview

15.3.6.2. Financial Overview

15.3.6.3. Product Portfolio

15.3.6.4. Business Strategies

15.3.6.5. Recent Developments

15.3.7. QFR Solutions

15.3.7.1. Company Overview

15.3.7.2. Financial Overview

15.3.7.3. Product Portfolio

15.3.7.4. Business Strategies

15.3.7.5. Recent Developments

15.3.8. Sales Focus Inc.

15.3.8.1. Company Overview

15.3.8.2. Financial Overview

15.3.8.3. Product Portfolio

15.3.8.4. Business Strategies

15.3.8.5. Recent Developments

15.3.9. GTS Solution

15.3.9.1. Company Overview

15.3.9.2. Financial Overview

15.3.9.3. Product Portfolio

15.3.9.4. Business Strategies

15.3.9.5. Recent Developments

15.3.10. Mercalis

15.3.10.1. Company Overview

15.3.10.2. Financial Overview

15.3.10.3. Product Portfolio

15.3.10.4. Business Strategies

15.3.10.5. Recent Developments

15.3.11. MaBiCo

15.3.11.1. Company Overview

15.3.11.2. Financial Overview

15.3.11.3. Product Portfolio

15.3.11.4. Business Strategies

15.3.11.5. Recent Developments

15.3.12. Mednext Pharmaceuticals Pvt. Ltd.

15.3.12.1. Company Overview

15.3.12.2. Financial Overview

15.3.12.3. Product Portfolio

15.3.12.4. Business Strategies

15.3.12.5. Recent Developments

15.3.13. Peak Pharma Solutions Inc.

15.3.13.1. Company Overview

15.3.13.2. Financial Overview

15.3.13.3. Product Portfolio

15.3.13.4. Business Strategies

15.3.13.5. Recent Developments

15.3.14. Promoveo Health

15.3.14.1. Company Overview

15.3.14.2. Financial Overview

15.3.14.3. Product Portfolio

15.3.14.4. Business Strategies

15.3.14.5. Recent Developments

15.3.15. Agilify Solutions Inc.

15.3.15.1. Company Overview

15.3.15.2. Financial Overview

15.3.15.3. Product Portfolio

15.3.15.4. Business Strategies

15.3.15.5. Recent Developments

List of Tables

Table 01: Global Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 02: Global Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, By Personal Promotion, 2020 to 2035

Table 03: Global Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, By Promotional Sales Team, 2020 to 2035

Table 04: Global Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, By Non-Personal Promotion, 2020 to 2035

Table 05: Global Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, By Therapeutic Area, 2020 to 2035

Table 06: Global Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 07: Global Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, By Pharmaceutical Companies, 2020 to 2035

Table 08: Global Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 09: North America Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 10: North America Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 11: North America Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, By Personal Promotion, 2020 to 2035

Table 12: North America Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, By Promotional Sales Team, 2020 to 2035

Table 13: North America Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, By Non-Personal Promotion, 2020 to 2035

Table 14: North America Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, By Therapeutic Area, 2020 to 2035

Table 15: North America Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 16: North America Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, By Pharmaceutical Companies, 2020 to 2035

Table 17: Europe Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 18: Europe Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 19: Europe Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, By Personal Promotion, 2020 to 2035

Table 20: Europe Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, By Promotional Sales Team, 2020 to 2035

Table 21: Europe Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, By Non-Personal Promotion, 2020 to 2035

Table 22: Europe Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, By Therapeutic Area, 2020 to 2035

Table 23: Europe Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 24: Europe Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, By Pharmaceutical Companies, 2020 to 2035

Table 25: Asia Pacific Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 26: Asia Pacific Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 27: Asia Pacific Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, By Personal Promotion, 2020 to 2035

Table 28: Asia Pacific Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, By Promotional Sales Team, 2020 to 2035

Table 29: Asia Pacific Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, By Non-Personal Promotion, 2020 to 2035

Table 30: Asia Pacific Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, By Therapeutic Area, 2020 to 2035

Table 31: Asia Pacific Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 32: Asia Pacific Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, By Pharmaceutical Companies, 2020 to 2035

Table 33: Latin America Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 34: Latin America Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 35: Latin America Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, By Personal Promotion, 2020 to 2035

Table 36: Latin America Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, By Promotional Sales Team, 2020 to 2035

Table 37: Latin America Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, By Non-Personal Promotion, 2020 to 2035

Table 38: Latin America Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, By Therapeutic Area, 2020 to 2035

Table 39: Latin America Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 40: Latin America Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, By Pharmaceutical Companies, 2020 to 2035

Table 41: Middle East & Africa Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 42: Middle East & Africa Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 43: Middle East & Africa Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, By Personal Promotion, 2020 to 2035

Table 44: Middle East & Africa Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, By Promotional Sales Team, 2020 to 2035

Table 45: Middle East & Africa Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, By Non-Personal Promotion, 2020 to 2035

Table 46: Middle East & Africa Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, By Therapeutic Area, 2020 to 2035

Table 47: Middle East & Africa Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 48: Middle East & Africa Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, By Pharmaceutical Companies, 2020 to 2035

List of Figures

Figure 01: Global Pharmaceutical Contract Sales Outsourcing Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 02: Global Pharmaceutical Contract Sales Outsourcing Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 03: Global Pharmaceutical Contract Sales Outsourcing Market Revenue (US$ Bn), by Personal Promotion, 2020 to 2035

Figure 04: Global Pharmaceutical Contract Sales Outsourcing Market Revenue (US$ Bn), by Non-Personal Promotion, 2020 to 2035

Figure 05: Global Pharmaceutical Contract Sales Outsourcing Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 06: Global Pharmaceutical Contract Sales Outsourcing Market Value Share Analysis, By Therapeutic Area, 2024 and 2035

Figure 07: Global Pharmaceutical Contract Sales Outsourcing Market Attractiveness Analysis, By Therapeutic Area, 2025 to 2035

Figure 08: Global Pharmaceutical Contract Sales Outsourcing Market Revenue (US$ Bn), by Cardiovascular Disorders, 2020 to 2035

Figure 09: Global Pharmaceutical Contract Sales Outsourcing Market Revenue (US$ Bn), by Oncological Disorders, 2020 to 2035

Figure 10: Global Pharmaceutical Contract Sales Outsourcing Market Revenue (US$ Bn), by Respiratory Disorders, 2020 to 2035

Figure 11: Global Pharmaceutical Contract Sales Outsourcing Market Revenue (US$ Bn), by Metabolic Disorders, 2020 to 2035

Figure 12: Global Pharmaceutical Contract Sales Outsourcing Market Revenue (US$ Bn), by Neurological Disorders, 2020 to 2035

Figure 13: Global Pharmaceutical Contract Sales Outsourcing Market Revenue (US$ Bn), by Orthopedic Disorders, 2020 to 2035

Figure 14: Global Pharmaceutical Contract Sales Outsourcing Market Revenue (US$ Bn), by Infectious Diseases, 2020 to 2035

Figure 15: Global Pharmaceutical Contract Sales Outsourcing Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 16: Global Pharmaceutical Contract Sales Outsourcing Market Value Share Analysis, By End-user, 2024 and 2035

Figure 17: Global Pharmaceutical Contract Sales Outsourcing Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 18: Global Pharmaceutical Contract Sales Outsourcing Market Revenue (US$ Bn), by Pharmaceutical Companies, 2020 to 2035

Figure 19: Global Pharmaceutical Contract Sales Outsourcing Market Revenue (US$ Bn), by Biotechnology Companies, 2020 to 2035

Figure 20: Global Pharmaceutical Contract Sales Outsourcing Market Value Share Analysis, By Region, 2024 and 2035

Figure 21: Global Pharmaceutical Contract Sales Outsourcing Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 22: North America Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 23: North America Pharmaceutical Contract Sales Outsourcing Market Value Share Analysis, by Country, 2024 and 2035

Figure 24: North America Pharmaceutical Contract Sales Outsourcing Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 25: North America Pharmaceutical Contract Sales Outsourcing Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 26: North America Pharmaceutical Contract Sales Outsourcing Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 27: North America Pharmaceutical Contract Sales Outsourcing Market Value Share Analysis, By Therapeutic Area, 2024 and 2035

Figure 28: North America Pharmaceutical Contract Sales Outsourcing Market Attractiveness Analysis, By Therapeutic Area, 2025 to 2035

Figure 29: North America Pharmaceutical Contract Sales Outsourcing Market Value Share Analysis, By End-user, 2024 and 2035

Figure 30: North America Pharmaceutical Contract Sales Outsourcing Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 31: Europe Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 32: Europe Pharmaceutical Contract Sales Outsourcing Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 33: Europe Pharmaceutical Contract Sales Outsourcing Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 34: Europe Pharmaceutical Contract Sales Outsourcing Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 35: Europe Pharmaceutical Contract Sales Outsourcing Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 36: Europe Pharmaceutical Contract Sales Outsourcing Market Value Share Analysis, By Therapeutic Area, 2024 and 2035

Figure 37: Europe Pharmaceutical Contract Sales Outsourcing Market Attractiveness Analysis, By Therapeutic Area, 2025 to 2035

Figure 38: Europe Pharmaceutical Contract Sales Outsourcing Market Value Share Analysis, By End-user, 2024 and 2035

Figure 39: Europe Pharmaceutical Contract Sales Outsourcing Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 40: Asia Pacific Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 41: Asia Pacific Pharmaceutical Contract Sales Outsourcing Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 42: Asia Pacific Pharmaceutical Contract Sales Outsourcing Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 43: Asia Pacific Pharmaceutical Contract Sales Outsourcing Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 44: Asia Pacific Pharmaceutical Contract Sales Outsourcing Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 45: Asia Pacific Pharmaceutical Contract Sales Outsourcing Market Value Share Analysis, By Therapeutic Area, 2024 and 2035

Figure 46: Asia Pacific Pharmaceutical Contract Sales Outsourcing Market Attractiveness Analysis, By Therapeutic Area, 2025 to 2035

Figure 47: Asia Pacific Pharmaceutical Contract Sales Outsourcing Market Value Share Analysis, By End-user, 2024 and 2035

Figure 48: Asia Pacific Pharmaceutical Contract Sales Outsourcing Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 49: Latin America Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 50: Latin America Pharmaceutical Contract Sales Outsourcing Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 51: Latin America Pharmaceutical Contract Sales Outsourcing Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 52: Latin America Pharmaceutical Contract Sales Outsourcing Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 53: Latin America Pharmaceutical Contract Sales Outsourcing Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 54: Latin America Pharmaceutical Contract Sales Outsourcing Market Value Share Analysis, By Therapeutic Area, 2024 and 2035

Figure 55: Latin America Pharmaceutical Contract Sales Outsourcing Market Attractiveness Analysis, By Therapeutic Area, 2025 to 2035

Figure 56: Latin America Pharmaceutical Contract Sales Outsourcing Market Value Share Analysis, By End-user, 2024 and 2035

Figure 57: Latin America Pharmaceutical Contract Sales Outsourcing Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 58: Middle East & Africa Pharmaceutical Contract Sales Outsourcing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 59: Middle East & Africa Pharmaceutical Contract Sales Outsourcing Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 60: Middle East & Africa Pharmaceutical Contract Sales Outsourcing Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 61: Middle East & Africa Pharmaceutical Contract Sales Outsourcing Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 62: Middle East & Africa Pharmaceutical Contract Sales Outsourcing Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 63: Middle East & Africa Pharmaceutical Contract Sales Outsourcing Market Value Share Analysis, By Therapeutic Area, 2024 and 2035

Figure 64: Middle East & Africa Pharmaceutical Contract Sales Outsourcing Market Attractiveness Analysis, By Therapeutic Area, 2025 to 2035

Figure 65: Middle East & Africa Pharmaceutical Contract Sales Outsourcing Market Value Share Analysis, By End-user, 2024 and 2035

Figure 66: Middle East & Africa Pharmaceutical Contract Sales Outsourcing Market Attractiveness Analysis, By End-user, 2025 to 2035