Reports

Reports

Patients who demand physical help, as well as those who are on medicine or who are unwell, utilize patient handling equipment. Home care settings, hospitals, rehabilitation centers, and care facilities for the elderly amongst other places, employ patient handling equipment. Whilst dealing with patients, the patient handling equipment assures the safety of physicians and caregivers. Furthermore, it minimizes the risk of patient injury, hence encouraging the use of patient handling equipment. This factor is estimated to boost growth of the global patient handling equipment market.

Patient handling equipment is becoming more prevalent as the global handicapped population grows. As per the World Health Organization, nearly 15% of the world's population lives with some sort of impairment in 2019, with 2% to 4% experiencing functional issues. Due to the fast expansion of chronic illnesses, the number of handicapped persons is increasing. To carry out their everyday duties, disabled persons require patient handling equipment. Increasing cases of disability is likely to drive the global patient handling equipment market to grow significantly in the years to come.

Furthermore, as compared to other age groups, those aged 65 years and older are more prone to accidents and falls. For increased safety, this age group typically utilizes wheelchairs as well as scooters, resulting in segmental expansion. The need for wheelchairs and scooters will also increase as the aging population grows. In the near future, an expanding population suffering from chronic illnesses such as myocardial infarction and stroke is likely to drive the segmental growth. Furthermore, segmental expansion is fueled by an increase in the number of patient admissions as a result of the increased prevalence of chronic disease. Adoption of novel technology for acute and critical care patient management will further contribute to market expansion.

In addition to that, the COVID-19 epidemic has resulted in a significant rise in the need for medical beds all over the world. As the number of corona cases rises throughout the world, governments in both developed and developing nations are being forced to expand their patient-handling capabilities. The public health systems are contributing cash to purchase the necessary hospital infrastructure, including medical beds, which are a critical prerequisite. Other important aspects that will favorably affect market growth include an increase in fundraising for related with patient handling equipment. However, a lack of caregiver training for accessing patient handling devices and issues with manual handling of bariatric patients are two obstacles that might stymie market expansion.

Global Patient Handling Equipment Market: Snapshot

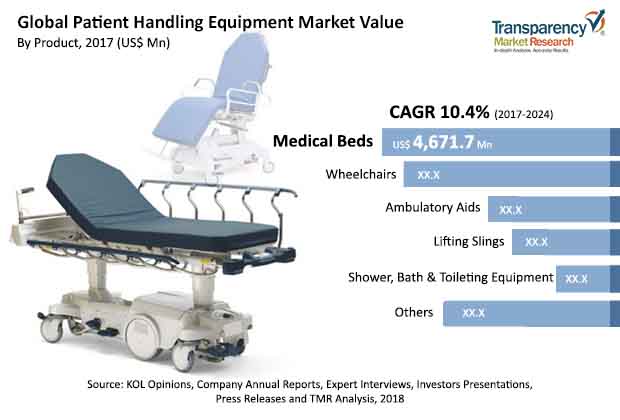

The demand in the global patient handling equipment market is projected to increment at a robust CAGR of 10.4% during the forecast period of 2017 to 2024, gaining traction from a number of factors such as rising geriatric population, high risk of injuries to caregivers as well as the patients during manual handling, increasing incidence of disabilities, and implementation of regulations pertaining to the safety at the healthcare facilities. On the other hand, the lack of skilled professionals to handle these equipment is hindering the market from attaining its true potential. Nevertheless, the vendors operating in the global patient handling equipment market are expected to gain new opportunities from private institutional nursing and the entry of several major players in domestic markets.

As per the estimations of the report, the global patient handling equipment market will be worth US$22.4 bn by the end of 2024, significantly up from its evaluated valuation of US$11.2 bn in 2017. The healthcare industry is currently flourishing in a number of developed and emerging economies, and if the vendors operating in this market can formulate a way to train professionals to operate these equipment, the demand will be ideally met.

Medical Bed Segment Remains Most Prominent

Based on product-type, the market for patient handling equipment has been segment into wheelchairs, lifting slings, medical beds, ambulatory aids, and shower, bath, and toileting equipment. In 2017, medical bed segment was most profitable, and considering they are mandatory equipment for the caregivers and are readily invested on by the hospitals, the segment is expected to remain the most important throughout the forecast period. Moreover, a number of high-end super-specialty healthcare facilities are coming up, which are willing to invest on the latest products that enable their patients in bathing, walking, and toileting. Financially equipped patients in the urban parts of the world are also driven towards hospitals with modern facility, and thereby providing traction to the medical bed segment of the global patient handling equipment market. Curative care beds, long-term care beds, and psychiatric care beds are some of the sub-segments of the medical beds that are gaining demand across the world.

Europe Remains Highly Profitable Region

From geographical perspective, some of the most important regions for the patient handling equipment market are North America, Europe, and Asia Pacific. Among these, Europe held the leading position in 2017, and is likely to retain its top position throughout the forecast period, owing to robust healthcare infrastructure and government regulations in respective countries. By 2024, the Europe patient handling equipment market is estimated to be worth US$8.0 bn. On the other hand, the region of Asia Pacific, which resides some of the most promising emerging economies such as India, China, and Japan, are expected to turn into highly lucrative region towards the end of the forecast period. Growing popularity of medical tourism is also expected to favor the added demand for patient handling equipment from Asia Pacific.

ArjoHuntleigh (Getinge Group) is identified as the most prominent company currently operating in the global patient handling equipment market, although the report also picks out a few other notable players, such as V.Guldmann A/S, DJO Global, Hill-Rom Holdings, Inc., Invacare Corporation, Etac AB, Joerns Healthcare LLC, Permobil AB, Prism Medical, Stiegelmeyer & Co. GMBH, Stryker Corporation, Patterson Medical Holdings, Inc., and Sunrise Medical LLC.

Table of Content

1. Preface

1.1. Report Description

1.2. Market Segmentation

1.3. Research Methodology

1.4. Assumptions

2. Executive Summary

2.1. Global Patient Handling Equipment Market Share, by Geography, 2014–2023 (Value %)

2.2. Market Snapshot: Global Patient Handling Equipment Market

2.3. Introduction: Global Patient Handling Equipment Market, 2016–2024

2.4. Global Patient Handling Equipment Market, by Product Type, 2016–2024 (US$ Mn)

2.5. Global Patient Handling Equipment Market, by End User Type, 2016–2024 (Value %)

3. Global Patient Handling Equipment Market – Market Overview

3.1. Introduction

3.2. Market Dynamics

3.2.1. Market Drivers

3.2.2. Restraints

3.2.3. Opportunity

3.2.4. Regulatory Framework

3.2.5. Global Trend Analysis: Key Pointers

3.3. Porter’s Five Forces Analysis: Global Patient Handling Equipment Market

3.4. Market Attractiveness Analysis: Global Patient Handling Equipment Market

3.5. Competitive Landscape, Global Patient Handling Equipment Market, 2015

4. Market Segmentation – By Product Type

4.1. Introduction

4.2. Global Lifting Slings Market Revenue & Volume Analysis, by Product, (US$ Mn & No. of Units), 2014–2024

4.3. Global Wheelchairs Market Revenue & Volume Analysis, by Product, (US$ Mn & No. of Units), 2014–2024

4.4. Global Medical Beds Market Revenue & Volume Analysis, by Product, (US$ Mn & No. of Units), 2014–2024

4.5. Global Medical Beds Market Revenue, 2014–2024(US$ Mn)

4.6. Global Ambulatory Aids (Walkers, Cranes and Crutches) Market Revenue & Volume Analysis, by Product, (US$ Mn & No. of Units), 2014–2024

4.7. Global Shower, Bath & Toileting Equipment Market Revenue & Volume Analysis, by Product, (US$ Mn & No. of Units), 2014–2024

4.8. Global Others Market Revenue & Volume Analysis, by Product, (US$ Mn & No. of Units), 2014–2024

5. Market Segmentation – By End Users

5.1. Global Patient Handling Equipment Market Revenue, by End Users, (US$ Mn), 2014 – 2024

5.2. Global Patient Handling Equipment Market Revenue, by Hospitals, (US$ Mn), 2014 – 2024

5.3. Global Patient Handling Equipment Market Revenue, by Nursing Homes, (US$ Mn), 2014 – 2024

5.4. Global Patient Handling Equipment Market Revenue, by Assisted Living Facilities, (US$ Mn), 2014 – 2024

5.5. Global Patient Handling Equipment Market Revenue, Home Healthcare, (US$ Mn), 2014 – 2024

5.6. Global Patient Handling Equipment Market Revenue, by Other End Users, (US$ Mn), 2014 – 2024

6. Market Segmentation – By Geography

6.1. Introduction

6.1.1. Global Patient Handling Equipment Market Revenue, by Geography, 2014–2024(US$ Mn)

6.2. North America Patient Handling Equipment Market Revenue, by Country, 2014–2024(US$ Mn)

6.2.1. U.S.

6.2.2. Canada

6.3. Europe Patient Handling Equipment Market Revenue, by Country, 2014–2024(US$ Mn)

6.3.1. Germany

6.3.2. U.K

6.3.3. Rest of Europe

6.4. Asia Pacific Patient Handling Equipment Market Revenue, by Country, 2014–2024(US$ Mn)

6.4.1. Japan

6.4.2. India

6.4.3. Rest of Asia Pacific

6.5. Rest of the World Patient Handling Equipment Market Revenue, by Country, 2014–2024(US$ Mn)

6.5.1. Latin America

6.5.2. Middle East Patient Handling Equipment Market Revenue, 2014–2024(US$ Mn)

7. Recommendations

8. Company Profiles

8.1. ArjoHuntleigh (Getinge Group)

8.2. DJO Global

8.3. Etac AB

8.4. Hill-Rom Holdings, Inc.

8.5. Invacare Corporation

8.6. Joerns Healthcare LLC

8.7. Patterson Medical Holdings, Inc.

8.8. Prism Medical

8.9. Stiegelmeyer & Co. GMBH

8.10. Stryker Corporation

8.11. Sunrise Medical LLC.

8.12. V.Guldmann A/S

List of Tables

TABLE 1 Patient Handling Equipment Market Snapshot: 2014

TABLE 2 Global Patient Handling Equipment Market Revenue, by Product, (US$ Mn), 2014–2024

TABLE 3 Global Patient Handling Equipment Market Revenue, by End-user (US$ Mn), 2014–2024

TABLE 4 Global Patient Handling Equipment Market Revenue, by Geography, 2014–2024(US$ Mn)

TABLE 5 North America Patient Handling Equipment Market Revenue, by Country, 2014–2024(US$ Mn)

TABLE 6 Europe Patient Handling Equipment Market Revenue, by Country, 2014–2024(US$ Mn)

TABLE 7 Asia Pacific Patient Handling Equipment Market Revenue, by Country, 2014–2024(US$ Mn)

TABLE 8 Rest of the World Patient Handling Equipment Market Revenue, by Region, (US$ Mn), 2014–2024

List of Figures

FIG. 1 Global Patient Handling Equipment Market Revenue, by Product, (US$ Mn), 2015

FIG. 2 Global Patient Handling Equipment Market Share, by End User Type, (Value%), 2015

FIG. 3 Global Patient Handling Equipment Market Share, by End User Type, (Value%), 2024

FIG. 4 Porter’s Five Forces Analysis: Global Patient Handling Equipment Market

FIG. 5 Market Attractiveness Analysis, by Geography, (CAGR%), (2015)

FIG. 6 Market Share Analysis: Global Patient Handling Equipment Market, by Key Players, 2015 (Value %)

FIG. 7 Global Lifting Slings Market Revenue, by Product, (US$ Mn), 2014–2024

FIG. 8 Global Lifting Slings Market Volume, by Product, (No. of Units), 2014–2024

FIG. 9 Global Wheelchairs Market Revenue, (US$ Mn), 2014–2024

FIG. 10 Global Wheelchairs Market Volume, (US$ Mn), 2014–2024

FIG. 11 Global Medical Beds Market Revenue, (US$ Mn), 2014–2024

FIG. 12 Global Medical Beds Market Volume, (No. of Units) 2014–2024

FIG. 13 Global Ambulatory Aids (walkers crutches and canes) Market Revenue, (US$ Mn), 2014–2024

FIG. 14 Global Ambulatory Aids (walkers crutches and canes) Market Volume, (No. of Units), 2014–2024

FIG. 15 Global Shower, Bath & Toileting Equipment Market Revenue, (US$ Mn), 2014–2024

FIG. 16 Global Shower, Bath & Toileting Equipment Market Volume, (No. of Units), 2014–2024

FIG. 17 Global Others (transfer & positioning aids, patient lifts etc.) Market, 2014–2024 (US$ Mn)

FIG. 18 Global Others (e.g. transfer & positioning aids, patient lifts etc.) (No. of Units), 2014–2024

FIG. 19 Global Hospitals Market Revenue, (US$ Mn), 2014–2024

FIG. 20 Global Nursing Homes Market Revenue, (US$ Mn), 2014–2024

FIG. 21 Global Assisted Living Facilities Market Revenue, (US$ Mn), 2014–2024

FIG. 22 Global Home Health Care Market Revenue, (US$ Mn), 2014–2024

FIG. 23 Global Other End-users Market Revenue, (US$ Mn), 2014–2024

FIG. 24 U.S. Patient Handling Equipment Market Revenue (US$ Mn), 2014–2024

FIG. 25 Germany Patient Handling Equipment Market Revenue (US$ Mn), 2014–2024

FIG. 26 U.K. Patient Handling Equipment Market Revenue (US$ Mn), 2014–2024

FIG. 27 Rest of Europe Patient Handling Equipment Market Revenue (US$ Mn), 2014–2024

FIG. 28 Japan Patient Handling Equipment Market Revenue (US$ Mn), 2014–2024

FIG. 29 India Patient Handling Equipment Market Revenue (US$ Mn), 2014–2024

FIG. 30 Rest of Asia Pacific Patient Handling Equipment Market Revenue (US$ Mn), 2014–2024

FIG. 31 Latin America Patient Handling Equipment Market Revenue (US$ Mn), 2014–2024

FIG. 32 Middle East & Africa Handling Equipment Market Revenue (US$ Mn), 2014–2024

FIG. 33 ArjoHuntleigh (Getinge Group, Annual Revenue, 2013–2015 (US$ Mn)

FIG. 34 DJO Global, Annual Revenue, 2013–2015 (US$ Mn)

FIG. 35 V.Guldmann A/S, Annual Revenue, 2013–2015 (US$ Mn)

FIG. 36 Hill-Rom Holdings, Inc., Annual Revenue, 2013–2015 (US$ Mn)

FIG. 37 Etac AB, Annual Revenue, 2013–2015 (US$ Mn)

FIG. 38 Invacare Corporation, Annual Revenue, 2013–2015 (US$ Mn)

FIG. 39 Joerns Healthcare LLC, Annual Revenue, 2013–2015 (US$ Mn)

FIG. 40 Patterson Medical Holdings, Inc. , Annual Revenue, 2013–2015 (US$ Mn)

FIG. 41 Permobil AB, Annual Revenue, 2013–2015 (US$ Mn)

FIG. 42 Prism Medical, Annual Revenue, 2013–2015 (US$ Mn)

FIG. 43 Stiegelmeyer & Co. GMBH, Annual Revenue, 2013–2015 (US$ Mn)

FIG. 44 Stryker Corporation, Annual Revenue, 2013–2015 (US$ Mn)

FIG. 45 Sunrise Medical LLC, Annual Revenue, 2013–2015 (US$ Mn)