Reports

Reports

Analysts’ Viewpoint

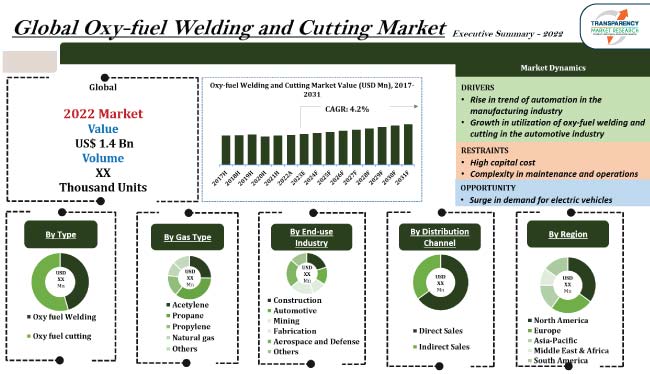

Surge in usage of oxy-fuel welding and cutting technologies in various industries is expected to propel the oxy-fuel welding and cutting market size during the forecast period. Low cost, extensive availability, and high productivity are surging the demand for welding and cutting solutions. Furthermore, technological advancements such as the development of automated welding machines is propelling market progress.

Revival of stalled infrastructure projects, demand for eco-friendly products, and technological innovations in the technology are key factors boosting the oxy-fuel welding and cutting market demand. Manufacturers in the industry are investing significantly in R&D activities to develop cutting-edge materials. Use of high-quality welding and cutting solutions and increase in focus on extending the lifespan are some of the key oxy-fuel welding and cutting market trends.

Oxy-fuel welding and cutting is a type of welding that uses oxygen and fuel gas. The gas is pressurized and ignited, creating a flame that heats two pieces of metal. The flame is used to melt the metals, which are then joined together.

Oxy-fuel welding and cutting is an economical choice for projects, as it requires fewer equipment. However, it is a dangerous process, as it produces large amounts of heat and smoke. This type of welding is used for a variety of tasks, including repair work, fabrication of machine parts, and cutting metal. It is used to join two different types of metal, such as steel and brass. The technique can also be used to cut metal, as the oxygen helps to create a flame that is hot enough to melt the metal. The gas can be used to create a shield that helps protect nearby surfaces from sparks and spatter.

The oxy-fuel flame is much faster than an electric arc welder, making it a more efficient way to cut metal. Additionally, oxy-fuel flame produces very little noise, making it an ideal tool for working in noisy environments. The oxy-fuel flame is useful for welding thick metals, as the pressure from the pressurized gas can help to force the molten metal together. The flame can also be used to heat metal before it is welded, which helps to make the process easier and more efficient.

Increase in demand for automated welding and cutting machines, such as oxy-fuel welding and cutting machines, is ascribed to the fact that they can quickly and accurately complete welding and cutting tasks. Additionally, these machines are energy-efficient, reducing the cost of production. They can be used in a variety of settings, from small-scale workshops to large-scale industrial plants. They are safe to use, reducing the risk of accidents and injuries in the workplace, and are able to produce higher quality welds with fewer defects. Additionally, they reduce pollution and noise, making them an attractive option for many manufacturers.

Automation is among the most effective elements of manufacturing and is crucial for economic growth. Oxy-fuel welding and cutting are ideal for tasks that require extreme accuracy, such as aerospace and automotive applications. Furthermore, they can be used to automate complex tasks, such as joining large structures or creating intricate designs.

The surge in demand for lightweight materials for automotive components is fueling the oxy-fuel welding and cutting market value. Rise in usage of high-strength steel and increase in demand for fuel-efficient vehicles is expected to offer lucrative opportunities for market expansion.

Oxy-fuel welding and cutting is a cost-effective method for joining automotive components. It is suitable for large parts and complex shapes, making it an ideal solution for the automotive industry. It is highly versatile and can be used to weld and cut a variety of materials. Oxy-fuel welding and cutting market share is fueled by their environment-friendly attributes and the absence of health risks.

Oxy-fuel welding and cutting are used to weld and fabricate automotive components, such as chassis, frames, and body panels. Automotive manufacturers turn to this method for more efficient and cost-effective production. Furthermore, the increasing popularity of electric vehicles is driving the demand for oxy-fuel welding and cutting, as it is required for the fabrication of electric vehicle components. Companies are investing in new oxy-fuel welding and cutting technologies to increase efficiency and reduce costs. More and more automotive manufacturers are opting for this technology and it is also being used for repairing and rebuilding automotive parts, which further contributes to oxy-fuel welding and cutting industry growth.

According to the latest oxy-fuel welding and cutting market forecast, North America is expected to hold largest share from 2023 to 2031. Presence of a large number of major manufacturers, and surge in demand for energy-efficient welding and cutting processes are fueling the market dynamics of the region.

Oxy-fuel welding and cutting technologies are extensively used in the automotive, aerospace, and shipbuilding industries in the region. Increase in adoption of automation and robotics in the manufacturing sector, rise in demand for automation equipment, and a well-established supply chain are further expected to drive the market in the region.

As per the oxy-fuel welding and cutting report, the business model of key players includes investment in R&D, product expansions, and mergers and acquisitions. Product development is a major marketing strategy. The market is highly competitive. Key players are involved in strategic collaborations that strengthen their position in the oxy-fuel welding and cutting industry.

Key players in the oxy-fuel welding and cutting market include American Welding & Gas, American Torch Tip, Messer Cutting Systems, Inc., ESAB, Miller Welding, GCE Group, Koike Aronson, Inc., Nissan Tanaka, Illinois Tool Works Inc., and Rotarex S.A.

Each of these players has been profiled in the oxy-fuel welding and cutting market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 | US$ 1.4 Bn |

| Market Forecast Value in 2031 | US$ 2.1 Bn |

| Growth Rate (CAGR) | 4.2% |

| Forecast Period | 2023-2031 |

| Quantitative Units | US$ Bn for Value & Thousand Units for Volume |

| Market Analysis | Global qualitative analysis includes drivers, restraints, opportunities, key trends, upcoming key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, key supplier analysis. |

| Competition Landscape |

|

| Format |

|

| Market Segmentation |

|

| Regions Covered |

|

| Companies Profiled |

|

| Customization Scope |

|

| Pricing |

|

It was valued at US$ 1.4 Bn 2022

The CAGR is projected to be 4.2% from 2023 to 2031

Rise in trend of automation in the manufacturing industry, and growth in utilization of oxy-fuel welding and cutting in the automotive industry

Oxy-fuel cutting dominated the market in 2022

North America is a more attractive region for vendors

American Welding & Gas, American Torch Tip, Messer Cutting Systems, Inc., ESAB, Miller Welding, GCE Group, Koike Aronson, Inc., Nissan Tanaka, Illinois Tool Works Inc., and Rotarex S.A.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.5. Steel Making Capacity Analysis

5.6. Porter’s Five Forces Analysis

5.7. Value Chain Analysis

5.8. Industry SWOT Analysis

5.9. Technology Overview

5.10. Standard and Regulations

5.11. Global Oxy-fuel Welding and Cutting Market Analysis and Forecast, 2017 - 2031

5.11.1. Market Value Projections (US$ Mn)

5.11.2. Market Volume Projections (Thousand Units)

6. Global Oxy-fuel Welding and Cutting Market Analysis and Forecast, By Type

6.1. Global Oxy-fuel Welding and Cutting Market Size (USD Mn and Thousand Units), By Type, 2017 - 2031

6.1.1. Oxy-fuel Welding

6.1.2. Oxy-fuel Cutting

6.2. Incremental Opportunity, By Type

7. Global Oxy-fuel Welding and Cutting Market Analysis and Forecast, By Gas Type

7.1. Global Oxy-fuel Welding and Cutting Market Size (USD Mn and Thousand Units), By Gas Type, 2017 - 2031

7.1.1. Acetylene

7.1.2. Propane

7.1.3. Propylene

7.1.4. Natural gas

7.1.5. Others

7.2. Incremental Opportunity, By Gas Type

8. Global Oxy-fuel Welding and Cutting Market Analysis and Forecast, By End-use Industry

8.1. Global Oxy-fuel Welding and Cutting Market Size (USD Mn and Thousand Units), By End-use Industry, 2017 - 2031

8.1.1. Construction

8.1.2. Automotive

8.1.3. Mining

8.1.4. Fabrication

8.1.5. Aerospace and Defense

8.1.6. Others

8.2. Incremental Opportunity, By End-use Industry

9. Global Oxy-fuel Welding and Cutting Market Analysis and Forecast, By Distribution Channel

9.1. Global Oxy-fuel Welding and Cutting Market Size (USD Mn and Thousand Units), By Distribution Channel, 2017 - 2031

9.1.1. Direct Sales

9.1.2. Indirect Sales

9.2. Incremental Opportunity, By Distribution Channel

10. Global Oxy-fuel Welding and Cutting Market Analysis and Forecast, Region

10.1. Global Oxy-fuel Welding and Cutting Market Size (USD Mn and Thousand Units), By Region, 2017 - 2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Incremental Opportunity, By Region

11. North America Oxy-fuel Welding and Cutting Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Price Trend Analysis

11.2.1. Weighted Average Selling Price (USD)

11.3. Key Trends Analysis

11.4. Macroeconomic Factors

11.5. Key Supplier Analysis

11.6. Oxy-fuel Welding and Cutting Market Size (USD Mn and Thousand Units), By Type, 2017 - 2031

11.6.1. Oxy-fuel Welding

11.6.2. Oxy-fuel Cutting

11.7. Oxy-fuel Welding and Cutting Market Size (USD Mn and Thousand Units), By Gas Type, 2017 - 2031

11.7.1. Acetylene

11.7.2. Propane

11.7.3. Propylene

11.7.4. Natural gas

11.7.5. Others

11.8. Oxy-fuel Welding and Cutting Market Size (USD Mn and Thousand Units), By End-use Industry, 2017 - 2031

11.8.1. Construction

11.8.2. Automotive

11.8.3. Mining

11.8.4. Fabrication

11.8.5. Aerospace and Defense

11.8.6. Others

11.9. Oxy-fuel Welding and Cutting Market Size (USD Mn and Thousand Units), By Distribution Channel, 2017 - 2031

11.9.1. Direct Sales

11.9.2. Indirect Sales

11.10. Oxy-fuel Welding and Cutting Market Size (USD Mn and Thousand Units), By Country, 2017 - 2031

11.10.1. U.S.

11.10.2. Canada

11.10.3. Rest of North America

11.11. Incremental Opportunity Analysis

12. Europe Oxy-fuel Welding and Cutting Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Price Trend Analysis

12.2.1. Weighted Average Selling Price (USD)

12.3. Key Trends Analysis

12.4. Macroeconomic Factors

12.5. Key Supplier Analysis

12.6. Oxy-fuel Welding and Cutting Market Size (USD Mn and Thousand Units), By Type, 2017 - 2031

12.6.1. Oxy-fuel Welding

12.6.2. Oxy-fuel Cutting

12.7. Oxy-fuel Welding and Cutting Market Size (USD Mn and Thousand Units), By Gas Type, 2017 - 2031

12.7.1. Acetylene

12.7.2. Propane

12.7.3. Propylene

12.7.4. Natural gas

12.7.5. Others

12.8. Oxy-fuel Welding and Cutting Market Size (USD Mn and Thousand Units), By End-use Industry, 2017 - 2031

12.8.1. Construction

12.8.2. Automotive

12.8.3. Mining

12.8.4. Fabrication

12.8.5. Aerospace and Defense

12.8.6. Others

12.9. Oxy-fuel Welding and Cutting Market Size (USD Mn and Thousand Units), By Distribution Channel, 2017 - 2031

12.9.1. Direct Sales

12.9.2. Indirect Sales

12.10. Oxy-fuel Welding and Cutting Market Size (USD Mn and Thousand Units), By Country, 2017 - 2031

12.10.1. U.K.

12.10.2. Germany

12.10.3. France

12.10.4. Rest of Europe

12.11. Incremental Opportunity Analysis

13. Asia Pacific Oxy-fuel Welding and Cutting Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Price Trend Analysis

13.2.1. Weighted Average Selling Price (USD)

13.3. Key Trends Analysis

13.4. Macro-Economic Factors

13.5. Key Supplier Analysis

13.6. Oxy-fuel Welding and Cutting Market Size (USD Mn and Thousand Units), By Type, 2017 - 2031

13.6.1. Oxy-fuel Welding

13.6.2. Oxy-fuel Cutting

13.7. Oxy-fuel Welding and Cutting Market Size (USD Mn and Thousand Units), By Gas Type, 2017 - 2031

13.7.1. Acetylene

13.7.2. Propane

13.7.3. Propylene

13.7.4. Natural gas

13.7.5. Others

13.8. Oxy-fuel Welding and Cutting Market Size (USD Mn and Thousand Units), By End-use Industry, 2017 - 2031

13.8.1. Construction

13.8.2. Automotive

13.8.3. Mining

13.8.4. Fabrication

13.8.5. Aerospace and Defense

13.8.6. Others

13.9. Oxy-fuel Welding and Cutting Market Size (USD Mn and Thousand Units), By Distribution Channel, 2017 - 2031

13.9.1. Direct Sales

13.9.2. Indirect Sales

13.10. Oxy-fuel Welding and Cutting Market Size (USD Mn and Thousand Units), By Country, 2017 - 2031

13.10.1. China

13.10.2. India

13.10.3. Japan

13.10.4. Rest of Asia Pacific

13.11. Incremental Opportunity Analysis

14. Middle East & Africa Oxy-fuel Welding and Cutting Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Price Trend Analysis

14.2.1. Weighted Average Selling Price (USD)

14.3. Key Trends Analysis

14.4. Macro-Economic Factors

14.5. Key Supplier Analysis

14.6. Oxy-fuel Welding and Cutting Market Size (USD Mn and Thousand Units), By Type, 2017 - 2031

14.6.1. Oxy-fuel Welding

14.6.2. Oxy-fuel Cutting

14.7. Oxy-fuel Welding and Cutting Market Size (USD Mn and Thousand Units), By Gas Type, 2017 - 2031

14.7.1. Acetylene

14.7.2. Propane

14.7.3. Propylene

14.7.4. Natural gas

14.7.5. Others

14.8. Oxy-fuel Welding and Cutting Market Size (USD Mn and Thousand Units), By End-use Industry, 2017 - 2031

14.8.1. Construction

14.8.2. Automotive

14.8.3. Mining

14.8.4. Fabrication

14.8.5. Aerospace and Defense

14.8.6. Others

14.9. Oxy-fuel Welding and Cutting Market Size (USD Mn and Thousand Units), By Distribution Channel, 2017 - 2031

14.9.1. Direct Sales

14.9.2. Indirect Sales

14.10. Oxy-fuel Welding and Cutting Market Size (USD Mn and Thousand Units), By Country, 2017 - 2031

14.10.1. GCC

14.10.2. South Africa

14.10.3. Rest of Middle East & Africa

14.11. Incremental Opportunity Analysis

15. South America Oxy-fuel Welding and Cutting Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Price Trend Analysis

15.2.1. Weighted Average Selling Price (USD)

15.3. Key Trends Analysis

15.4. Macroeconomic Factors

15.5. Key Supplier Analysis

15.6. Oxy-fuel Welding and Cutting Market Size (USD Mn and Thousand Units), By Type, 2017 - 2031

15.6.1. Oxy-fuel Welding

15.6.2. Oxy-fuel Cutting

15.7. Oxy-fuel Welding and Cutting Market Size (USD Mn and Thousand Units), By Gas Type, 2017 - 2031

15.7.1. Acetylene

15.7.2. Propane

15.7.3. Propylene

15.7.4. Natural gas

15.7.5. Others

15.8. Oxy-fuel Welding and Cutting Market Size (USD Mn and Thousand Units), By End-use Industry, 2017 - 2031

15.8.1. Construction

15.8.2. Automotive

15.8.3. Mining

15.8.4. Fabrication

15.8.5. Aerospace and Defense

15.8.6. Others

15.9. Oxy-fuel Welding and Cutting Market Size (USD Mn and Thousand Units), By Distribution Channel, 2017 - 2031

15.9.1. Direct Sales

15.9.2. Indirect Sales

15.10. Oxy-fuel Welding and Cutting Market Size (USD Mn and Thousand Units), By Country, 2017 - 2031

15.10.1. Brazil

15.10.2. Rest of South America

15.11. Incremental Opportunity Analysis

16. Competition Landscape

16.1. Market Player - Competition Dashboard

16.2. Market Share Analysis (%), 2022

16.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Financial/Revenue, Strategy & Business Overview, Sales Channel Analysis, Size Portfolio)

16.3.1. American Welding & Gas.

16.3.1.1. Company Overview

16.3.1.2. Sales Area/Geographical Presence

16.3.1.3. Financial/Revenue

16.3.1.4. Strategy & Business Overview

16.3.1.5. Sales Channel Analysis

16.3.1.6. Size Portfolio

16.3.2. American Torch Tip

16.3.2.1. Company Overview

16.3.2.2. Sales Area/Geographical Presence

16.3.2.3. Financial/Revenue

16.3.2.4. Strategy & Business Overview

16.3.2.5. Sales Channel Analysis

16.3.2.6. Size Portfolio

16.3.3. Messer Cutting Systems, Inc.

16.3.3.1. Company Overview

16.3.3.2. Sales Area/Geographical Presence

16.3.3.3. Financial/Revenue

16.3.3.4. Strategy & Business Overview

16.3.3.5. Sales Channel Analysis

16.3.3.6. Size Portfolio

16.3.4. ESAB

16.3.4.1. Company Overview

16.3.4.2. Sales Area/Geographical Presence

16.3.4.3. Financial/Revenue

16.3.4.4. Strategy & Business Overview

16.3.4.5. Sales Channel Analysis

16.3.4.6. Size Portfolio

16.3.5. Miller Welding

16.3.5.1. Company Overview

16.3.5.2. Sales Area/Geographical Presence

16.3.5.3. Financial/Revenue

16.3.5.4. Strategy & Business Overview

16.3.5.5. Sales Channel Analysis

16.3.5.6. Size Portfolio

16.3.6. GCE Group

16.3.6.1. Company Overview

16.3.6.2. Sales Area/Geographical Presence

16.3.6.3. Financial/Revenue

16.3.6.4. Strategy & Business Overview

16.3.6.5. Sales Channel Analysis

16.3.6.6. Size Portfolio

16.3.7. Koike Aronson, Inc.

16.3.7.1. Company Overview

16.3.7.2. Sales Area/Geographical Presence

16.3.7.3. Financial/Revenue

16.3.7.4. Strategy & Business Overview

16.3.7.5. Sales Channel Analysis

16.3.7.6. Size Portfolio

16.3.8. Nissan Tanaka

16.3.8.1. Company Overview

16.3.8.2. Sales Area/Geographical Presence

16.3.8.3. Financial/Revenue

16.3.8.4. Strategy & Business Overview

16.3.8.5. Sales Channel Analysis

16.3.8.6. Size Portfolio

16.3.9. Illinois Tool Works Inc.

16.3.9.1. Company Overview

16.3.9.2. Sales Area/Geographical Presence

16.3.9.3. Financial/Revenue

16.3.9.4. Strategy & Business Overview

16.3.9.5. Sales Channel Analysis

16.3.9.6. Size Portfolio

16.3.10. Rotarex S.A

16.3.10.1. Company Overview

16.3.10.2. Sales Area/Geographical Presence

16.3.10.3. Financial/Revenue

16.3.10.4. Strategy & Business Overview

16.3.10.5. Sales Channel Analysis

16.3.10.6. Size Portfolio

16.3.11. Other Key Players

16.3.11.1. Company Overview

16.3.11.2. Sales Area/Geographical Presence

16.3.11.3. Financial/Revenue

16.3.11.4. Strategy & Business Overview

16.3.11.5. Sales Channel Analysis

16.3.11.6. Size Portfolio

17. Go to Market Strategy

17.1. Identification of Potential Market Spaces

17.1.1. Type

17.1.2. Gas Type

17.1.3. End-use Industry

17.1.4. Distribution Channel

17.1.5. Region

17.2. Understanding the Buying Process of Customers

17.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Oxy-fuel Welding and Cutting Market Value (US$ Mn), by Type, 2017-2031

Table 2: Global Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by Type2017-2031

Table 3: Global Oxy-fuel Welding and Cutting Market Value (US$ Mn), by Gas Type, 2017-2031

Table 4: Global Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by Gas Type 2017-2031

Table 5: Global Oxy-fuel Welding and Cutting Market Value (US$ Mn), by End-use Industry, 2017-2031

Table 6: Global Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 7: Global Oxy-fuel Welding and Cutting Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 8: Global Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 9: Global Oxy-fuel Welding and Cutting Market Value (US$ Mn), by Region, 2017-2031

Table 10: Global Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by Region 2017-2031

Table 11: North America Oxy-fuel Welding and Cutting Market Value (US$ Mn), by Type , 2017-2031

Table 12: North America Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by Type2017-2031

Table 13: North America Oxy-fuel Welding and Cutting Market Value (US$ Mn), by Gas Type, 2017-2031

Table 14: North America Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by Gas Type 2017-2031

Table 15: North America Oxy-fuel Welding and Cutting Market Value (US$ Mn), by End-use Industry, 2017-2031

Table 16: North America Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by End-use Industry, 2017-2031

Table 17: North America Oxy-fuel Welding and Cutting Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 18: North America Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 19: North America Oxy-fuel Welding and Cutting Market Value (US$ Mn), by Country, 2017-2031

Table 20: North America Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by Country 2017-2031

Table 21: Europe Oxy-fuel Welding and Cutting Market Value (US$ Mn), by Type , 2017-2031

Table 22: Europe Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by Type2017-2031

Table 23: Europe Oxy-fuel Welding and Cutting Market Value (US$ Mn), by Gas Type, 2017-2031

Table 24: Europe Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by Gas Type 2017-2031

Table 25: Europe Oxy-fuel Welding and Cutting Market Value (US$ Mn), by End-use Industry, 2017-2031

Table 26: Europe Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by End-use Industry, 2017-2031

Table 27: Europe Oxy-fuel Welding and Cutting Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 28: Europe Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 29: Europe Oxy-fuel Welding and Cutting Market Value (US$ Mn), by Country, 2017-2031

Table 30: Europe Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by Country 2017-2031

Table 31: Asia Pacific Oxy-fuel Welding and Cutting Market Value (US$ Mn), by Type , 2017-2031

Table 32: Asia Pacific Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by Type2017-2031

Table 33: Asia Pacific Oxy-fuel Welding and Cutting Market Value (US$ Mn), by Gas Type, 2017-2031

Table 34: Asia Pacific Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by Gas Type2017-2031

Table 35: Asia Pacific Oxy-fuel Welding and Cutting Market Value (US$ Mn), by End-use Industry, 2017-2031

Table 36: Asia Pacific Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by End-use Industry, 2017-2031

Table 37: Asia Pacific Oxy-fuel Welding and Cutting Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 38: Asia Pacific Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 39: Asia Pacific Oxy-fuel Welding and Cutting Market Value (US$ Mn), by Country, 2017-2031

Table 40: Asia Pacific Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by Country 2017-2031

Table 41: Middle East & Africa Oxy-fuel Welding and Cutting Market Value (US$ Mn), by Type , 2017-2031

Table 42: Middle East & Africa Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by Type2017-2031

Table 43: Middle East & Africa Oxy-fuel Welding and Cutting Market Value (US$ Mn), by Gas Type, 2017-2031

Table 44: Middle East & Africa Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by Gas Type 2017-2031

Table 45: Middle East & Africa Oxy-fuel Welding and Cutting Market Value (US$ Mn), by End-use Industry, 2017-2031

Table 46: Middle East & Africa Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 47: Middle East & Africa Oxy-fuel Welding and Cutting Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 48: Middle East & Africa Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 49: Middle East & Africa Oxy-fuel Welding and Cutting Market Value (US$ Mn), by Country, 2017-2031

Table 50: Middle East & Africa Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by Country 2017-2031

Table 51: South America Oxy-fuel Welding and Cutting Market Value (US$ Mn), by Type , 2017-2031

Table 52: South America Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by Type2017-2031

Table 53: South America Oxy-fuel Welding and Cutting Market Value (US$ Mn), by Gas Type, 2017-2031

Table 54: South America Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by Gas Type 2017-2031

Table 55: South America Oxy-fuel Welding and Cutting Market Value (US$ Mn), by End-use Industry, 2017-2031

Table 56: South America Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 57: South America Oxy-fuel Welding and Cutting Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 58: South America Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 59: South America Oxy-fuel Welding and Cutting Market Value (US$ Mn), by Country, 2017-2031

Table 60: South America Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by Country 2017-2031

List of Figures

Figure 1: Global Oxy-fuel Welding and Cutting Market Value (US$ Mn), by Type, 2017-2031

Figure 2: Global Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by Type 2017-2031

Figure 3: Global Oxy-fuel Welding and Cutting Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2023-2031

Figure 4: Global Oxy-fuel Welding and Cutting Market Value (US$ Mn), by Gas Type , 2017-2031

Figure 5: Global Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by Gas Type 2017-2031

Figure 6: Global Oxy-fuel Welding and Cutting Market Incremental Opportunity (US$ Mn), Forecast, by Gas Type, 2023-2031

Figure 7: Global Oxy-fuel Welding and Cutting Market Value (US$ Mn), by End-use Industry, 2017-2031

Figure 8: Global Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 9: Global Oxy-fuel Welding and Cutting Market Incremental Opportunity (US$ Mn), Forecast, by End-use Industry, 2023-2031

Figure 10: Global Oxy-fuel Welding and Cutting Market Value (US$ Mn), by Distribution Channel, 2017-2031

Figure 11: Global Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 12: Global Oxy-fuel Welding and Cutting Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 13: Global Oxy-fuel Welding and Cutting Market Value (US$ Mn), by Region, 2017-2031

Figure 14: Global Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by Region 2017-2031

Figure 15: Global Oxy-fuel Welding and Cutting Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2023-2031

Figure 16: North America Oxy-fuel Welding and Cutting Market Value (US$ Mn), by Type, 2017-2031

Figure 17: North America Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by Type 2017-2031

Figure 18: North America Oxy-fuel Welding and Cutting Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2023-2031

Figure 19: North America Oxy-fuel Welding and Cutting Market Value (US$ Mn), by Gas Type, 2017-2031

Figure 20: North America Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by Gas Type2017-2031

Figure 21: North America Oxy-fuel Welding and Cutting Market Incremental Opportunity (US$ Mn), Forecast, by Gas Type, 2023-2031

Figure 22: North America Oxy-fuel Welding and Cutting Market Value (US$ Mn), by End-use Industry, 2017-2031

Figure 23: North America Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 24: North America Oxy-fuel Welding and Cutting Market Incremental Opportunity (US$ Mn), Forecast, by End-user, 2023-2031

Figure 25: North America Oxy-fuel Welding and Cutting Market Value (US$ Mn), by Distribution Channel, 2017-2031

Figure 26: North America Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 27: North America Oxy-fuel Welding and Cutting Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 28: North America Oxy-fuel Welding and Cutting Market Value (US$ Mn), by Country, 2017-2031

Figure 29: North America Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by Country 2017-2031

Figure 30: North America Oxy-fuel Welding and Cutting Market Incremental Opportunity (US$ Mn), Forecast, by Country, 2023-2031

Figure 31: Europe Oxy-fuel Welding and Cutting Market Value (US$ Mn), by Type, 2017-2031

Figure 32: Europe Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by Type 2017-2031

Figure 33: Europe Oxy-fuel Welding and Cutting Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2023-2031

Figure 34: Europe Oxy-fuel Welding and Cutting Market Value (US$ Mn), by Gas Type, 2017-2031

Figure 35: Europe Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by Gas Type 2017-2031

Figure 36: Europe Oxy-fuel Welding and Cutting Market Incremental Opportunity (US$ Mn), Forecast, by Gas Type, 2023-2031

Figure 37: Europe Oxy-fuel Welding and Cutting Market Value (US$ Mn), by End-use Industry, 2017-2031

Figure 38: Europe Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 39: Europe Oxy-fuel Welding and Cutting Market Incremental Opportunity (US$ Mn), Forecast, by End-use Industry, 2023-2031

Figure 40: Europe Oxy-fuel Welding and Cutting Market Value (US$ Mn), by Distribution Channel, 2017-2031

Figure 41: Europe Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 42: Europe Oxy-fuel Welding and Cutting Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 43: Europe Oxy-fuel Welding and Cutting Market Value (US$ Mn), by Country, 2017-2031

Figure 44: Europe Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by Country 2017-2031

Figure 45: Europe Oxy-fuel Welding and Cutting Market Incremental Opportunity (US$ Mn), Forecast, by Country, 2023-2031

Figure 46: Asia Pacific Oxy-fuel Welding and Cutting Market Value (US$ Mn), by Type, 2017-2031

Figure 47: Asia Pacific Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by Type 2017-2031

Figure 48: Asia Pacific Oxy-fuel Welding and Cutting Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2023-2031

Figure 49: Asia Pacific Oxy-fuel Welding and Cutting Market Value (US$ Mn), by Gas Type, 2017-2031

Figure 50: Asia Pacific Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by Gas Type2017-2031

Figure 51: Asia Pacific Oxy-fuel Welding and Cutting Market Incremental Opportunity (US$ Mn), Forecast, by Gas Type, 2023-2031

Figure 52: Asia Pacific Oxy-fuel Welding and Cutting Market Value (US$ Mn), by End-use Industry, 2017-2031

Figure 53: Asia Pacific Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 54: Asia Pacific Oxy-fuel Welding and Cutting Market Incremental Opportunity (US$ Mn), Forecast, by End-user, 2023-2031

Figure 55: Asia Pacific Oxy-fuel Welding and Cutting Market Value (US$ Mn), by Distribution Channel, 2017-2031

Figure 56: Asia Pacific Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 57: Asia Pacific Oxy-fuel Welding and Cutting Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 58: Asia Pacific Oxy-fuel Welding and Cutting Market Value (US$ Mn), by Country, 2017-2031

Figure 59: Asia Pacific Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by Country 2017-2031

Figure 60: Asia Pacific Oxy-fuel Welding and Cutting Market Incremental Opportunity (US$ Mn), Forecast, by Country, 2023-2031

Figure 61: Middle East & Africa Oxy-fuel Welding and Cutting Market Value (US$ Mn), by Type, 2017-2031

Figure 62: Middle East & Africa Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by Type 2017-2031

Figure 63: Middle East & Africa Oxy-fuel Welding and Cutting Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2023-2031

Figure 64: Middle East & Africa Oxy-fuel Welding and Cutting Market Value (US$ Mn), by Gas Type, 2017-2031

Figure 65: Middle East & Africa Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by Gas Type 2017-2031

Figure 66: Middle East & Africa Oxy-fuel Welding and Cutting Market Incremental Opportunity (US$ Mn), Forecast, by Gas Type,2023-2031

Figure 67: Middle East & Africa Oxy-fuel Welding and Cutting Market Value (US$ Mn), by End-use Industry, 2017-2031

Figure 68: Middle East & Africa Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 69: Middle East & Africa Oxy-fuel Welding and Cutting Market Incremental Opportunity (US$ Mn), Forecast, by End-user, 2023-2031

Figure 70: Middle East & Africa Oxy-fuel Welding and Cutting Market Value (US$ Mn), by Distribution Channel, 2017-2031

Figure 71: Middle East & Africa Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 72: Middle East & Africa Oxy-fuel Welding and Cutting Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 73: Middle East & Africa Oxy-fuel Welding and Cutting Market Value (US$ Mn), by Country, 2017-2031

Figure 74: Middle East & Africa Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by Country 2017-2031

Figure 75: Middle East & Africa Oxy-fuel Welding and Cutting Market Incremental Opportunity (US$ Mn), Forecast, by Country, 2023-2031

Figure 76: South America Oxy-fuel Welding and Cutting Market Value (US$ Mn), by Type, 2017-2031

Figure 77: South America Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by Type 2017-2031

Figure 78: South America Oxy-fuel Welding and Cutting Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2023-2031

Figure 79: South America Oxy-fuel Welding and Cutting Market Value (US$ Mn), by Gas Type, 2017-2031

Figure 80: South America Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by Gas Type, 2017-2031

Figure 81: South America Oxy-fuel Welding and Cutting Market Incremental Opportunity (US$ Mn), Forecast, by Gas Type, 2023-2031

Figure 82: South America Oxy-fuel Welding and Cutting Market Value (US$ Mn), by End-use Industry, 2017-2031

Figure 83: South America Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 84: South America Oxy-fuel Welding and Cutting Market Incremental Opportunity (US$ Mn), Forecast, by End-user, 2023-2031

Figure 85: South America Oxy-fuel Welding and Cutting Market Value (US$ Mn), by Distribution Channel, 2017-2031

Figure 86: South America Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 87: South America Oxy-fuel Welding and Cutting Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 88: South America Oxy-fuel Welding and Cutting Market Value (US$ Mn), by Country, 2017-2031

Figure 89: South America Oxy-fuel Welding and Cutting Market Volume (Thousand Units), by Country 2017-2031

Figure 90: South America Oxy-fuel Welding and Cutting Market Incremental Opportunity (US$ Mn), Forecast, by Country, 2023-2031