Reports

Reports

Analysts’ Viewpoint on Market Scenario

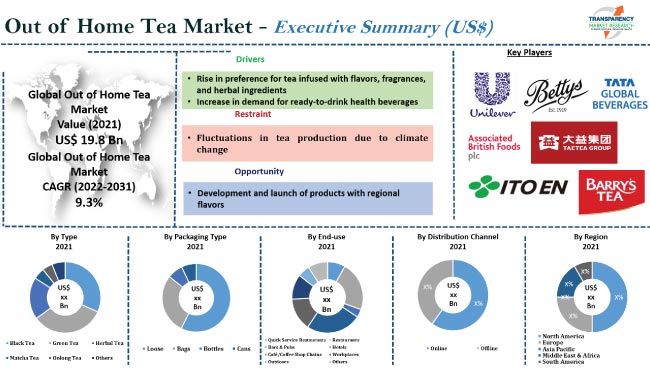

Rise in the preference for tea infused with flavors, fragrances, and herbal ingredients is expected to fuel the global out of home tea market size during the forecast period. Consumers prefer ready-to-drink tea due to its health benefits. Tea boosts the immune system and fights off inflammation. Thus, surge in awareness about tea benefits is likely to drive market progress in the near future.

Development and launch of products with regional flavors is anticipated to offer lucrative growth opportunities for vendors in the industry. Vendors are offering an extensive range of flavors through various e-commerce websites to increase their out of home tea market share.

Out of home tea is consumed outdoors. It can be consumed in various establishments such as quick service restaurants, bars and pubs, lodging institutions, cafés, and workplaces. Out of home tea is available in a variety of tastes and variations, including matcha tea, oolong tea, black tea, herbal tea, and green tea.

Camellia Sinensis, a species of evergreen shrub, is used to make black tea, which is frequently combined with other plants to create different flavors. Black tea is among the most popular and widely consumed beverages in the world. It contains antioxidants and other chemicals that help reduce inflammation in the body. Green tea is a traditional Asian drink with several medicinal properties. It aids to control bleeding, improves heart ailments, and heals wounds.

Tea is a popular drink from ancient times. Several tea manufacturers have started offering various varieties of tea for the last few years. Consumers choose tea based on its origin, flavor, and health benefits. Out of home green tea offers several health advantages, including the prevention of cancer, heart disease, and type 2 diabetes.

Leaf teas are flavored with various substances to provide unique health advantages. White tea, yellow tea, and oolong tea are some of the most well-liked varieties of organic tea. According to the Tea Association of the USA, tea is the most widely consumed beverage in the world next to water, and can be found in almost 80% of all U.S. households. In 2021, people in the U.S. consumed almost 85 billion servings of tea, or more than 3.9 billion gallons of which 84% of all tea consumed was black tea, 15% was green tea, and the small remaining amount was oolong, white and dark tea. Thus, high consumption of tea is projected to drive the demand for out of home tea in the next few years.

Consumption of caffeine is high in the U.S. and several countries in Europe such as Finland, Austria, Slovenia, Denmark, and Germany. Excessive caffeine consumption has negative health effects. It causes the production of stress hormones, which raise blood pressure, heart rate, and levels of tension in the body. Such health risks have led to a significant shift toward tea.

Tea contains no sodium, fat, carbonation, or sugar. It contains flavonoids, naturally occurring compounds that have antioxidant properties. Therefore, various health benefits of tea are likely to propel the out-of-home tea market expansion in the near future.

According to the Tea Association of the USA, imports of black and green tea into the U.S. were projected to reach 240 million pounds in 2021, which is a 6% annual growth rate as compared to that in 2020. Popularity of hot tea and specialty tea among consumers is still increasing, and green tea accounts for 15% of all imported tea. Therefore, surge in imports of tea is expected to augment the out of home tea market dynamics in the next few years.

According to the latest out of home tea market trends, the green tea type segment is anticipated to dominate the industry during the forecast period, followed by black tea. Less oxidation in the manufacturing process leads to green leaves in green tea. Steaming and pan-firing are the two main methods of yielding green tea. Green tea is rich in Epigallocatechin Gallate (EGCG), which helps prevent various diseases.

The black tea type segment is estimated to grow at a significant pace in the near future. Black tea is deeply oxidized and brewed strongly. It contains high amounts of antioxidants, which helps boost overall health and may prevent certain types of cancer.

According to the latest out of home tea market forecast, Asia Pacific is projected to dominate the industry from 2022 to 2031, followed by North America. China and India are top producers of tea. Rise in demand for convenient and healthy products owing to hectic lifestyles is likely to boost market statistics in Asia Pacific.

The industry in North America and Europe is expected to be driven by increase in preference for tea over coffee. Several people in these regions are opting for tea due to various health hazards of coffee.

Detailed profiles of vendors have been provided in the out of home tea market research report to evaluate their financials, key product offerings, recent developments, and strategies. Tata Consumer Products Limited, Unilever, Ito En, Ltd., Apeejay Surrendra Group, Starbucks Coffee Company, Taetea Group, Barry’s Tea, Associated British Foods plc, Bettys and Taylors Group Ltd., and Teekanne GmbH & Co. KG are key entities operating in this industry.

Most firms are focused on increasing their out of home tea market revenue through comprehensive R&D investments. They are also adopting merger & acquisition, partnership, and collaboration strategies to broaden their regional presence.

|

Attribute |

Detail |

|

Market Size Value in 2021 (Base Year) |

US$ 19.8 Bn |

|

Market Forecast Value in 2031 |

US$ 47.7 Bn |

|

Growth Rate (CAGR) |

9.3% |

|

Forecast Period |

2022-2031 |

|

Quantitative Units |

US$ Bn for Value and Thousand Kilograms for Volume |

|

Market Analysis |

Global qualitative analysis includes drivers, restraints, opportunities, key trends, key Market indicators, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

|

Competition Landscape |

Competition Dashboard and Revenue Share Analysis 2021 Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, COVID-19 Response, Strategy & Business Overview) |

|

Regions Covered |

|

|

Market Segmentation |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

It stood at US$ 19.8 Bn in 2021

It is expected to reach US$ 47.7 Bn by 2031

Rise in preference for tea infused with flavors, fragrances, and herbal ingredients and increase in demand for ready-to-drink health beverages

The green tea segment accounted for highest share in 2021

Asia Pacific held 70% share in 2021

Tata Consumer Products Limited, Unilever, Ito En, Ltd., Apeejay Surrendra Group, Starbucks Coffee Company, Taetea Group, Barry’s Tea, Associated British Foods plc, Bettys and Taylors Group Ltd., and Teekanne GmbH & Co. KG.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.4.1. Overall Concrete Industry Overview

5.5. Value Chain Analysis

5.6. Porter’s Five Forces Analysis

5.7. Industry SWOT Analysis

5.8. Covid-19 Impact Analysis

5.9. Global Out of Home Tea Market Analysis and Forecast, 2017-2031

5.9.1. Market Value Projection (US$ Bn)

5.9.2. Market Volume Projection (Thousand Kilograms)

6. Global Out of Home Tea Market Analysis and Forecast, by Type

6.1. Global Out of Home Tea Market Size (US$ Bn and Thousand Kilograms ) Forecast, by Type, 2017 - 2031

6.1.1. Black Tea

6.1.2. Green Tea

6.1.3. Herbal Tea

6.1.4. Matcha Tea

6.1.5. Oolong Tea

6.1.6. Others

6.2. Incremental Opportunity, By Type

7. Global Out of Home Tea Market Analysis and Forecast, by Packaging Type

7.1. Global Out of Home Tea Market Size (US$ Bn and Thousand Kilograms) Forecast, by Packaging Type, 2017 - 2031

7.1.1. Loose

7.1.2. Bags

7.1.3. Bottles

7.1.4. Cans

7.2. Incremental Opportunity, By Packaging Type

8. Global Out of Home Tea Market Analysis and Forecast, by End-use

8.1. Global Out of Home Tea Market Size (US$ Bn and Thousand Kilograms) Forecast, by End-use, 2017 - 2031

8.1.1.1. Quick Service Restaurants

8.1.1.2. Restaurants

8.1.1.3. Bars & Pubs

8.1.1.4. Hotels

8.1.1.5. Café/Coffee Shop Chains

8.1.1.6. Workplaces

8.1.1.7. Outdoors

8.1.1.8. Others

8.2. Incremental Opportunity, By End-use Industry

9. Global Out of Home Tea Market Analysis and Forecast, by Distribution Channel

9.1. Global Out of Home Tea Market Size (US$ Bn and Thousand Kilograms) Forecast, by Distribution Channel, 2017 - 2031

9.1.1. Online

9.1.1.1. Company-owned Websites

9.1.1.2. E-commerce Websites

9.1.2. Offline

9.1.2.1. Hypermarkets/Supermarkets

9.1.2.2. Specialty Stores

9.1.2.3. Others

9.2. Incremental Opportunity, By Distribution Channel

10. Global Out of Home Tea Market Analysis and Forecast, by Region

10.1. Out of Home Tea Market Size (US$ Bn and Thousand Kilograms) Forecast, by Region, 2017-2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Incremental Opportunity, By Region

11. North America Out of Home Tea Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Key Supplier Analysis

11.3. COVID-19 Impact Analysis

11.4. Key Trends Analysis

11.5. Price Trend Analysis

11.5.1. Weighted Average Price

11.6. Out of Home Tea Market Size (US$ Bn and Thousand Kilograms) Forecast, by Type, 2017 - 2031

11.6.1. Black Tea

11.6.2. Green Tea

11.6.3. Herbal Tea

11.6.4. Matcha Tea

11.6.5. Oolong Tea

11.6.6. Others

11.7. Out of Home Tea Market Size (US$ Bn and Thousand Kilograms) Forecast, by Packaging Type, 2017 - 2031

11.7.1. Loose

11.7.2. Bags

11.7.3. Bottles

11.7.4. Cans

11.8. Out of Home Tea Market Size (US$ Bn and Thousand Kilograms) Forecast, by End-use, 2017 - 2031

11.8.1. Quick Service Restaurants

11.8.2. Restaurants

11.8.3. Bars & Pubs

11.8.4. Hotels

11.8.5. Café/Coffee Shop Chains

11.8.6. Workplaces

11.8.7. Outdoors

11.8.8. Others

11.9. Out of Home Tea Market Size (US$ Bn and Thousand Kilograms) Forecast, by Distribution Channel, 2017 - 2031

11.9.1. Online

11.9.1.1. Company-owned Websites

11.9.1.2. E-commerce Websites

11.9.2. Offline

11.9.2.1. Hypermarkets/Supermarkets

11.9.2.2. Specialty Stores

11.9.2.3. Others

11.10. Out of Home Tea Market Size (US$ Bn and Thousand Kilograms) Forecast, by Country, 2017-2031

11.10.1. U.S.

11.10.2. Canada

11.10.3. Rest of North America

11.11. Incremental Opportunity Analysis

12. Europe Out of Home Tea Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Supplier Analysis

12.3. COVID-19 Impact Analysis

12.4. Key Trends Analysis

12.5. Price Trend Analysis

12.5.1. Weighted Average Price

12.6. Out of Home Tea Market Size (US$ Bn and Thousand Kilograms) Forecast, by Type, 2017 - 2031

12.6.1. Black Tea

12.6.2. Green Tea

12.6.3. Herbal Tea

12.6.4. Matcha Tea

12.6.5. Oolong Tea

12.6.6. Others

12.7. Out of Home Tea Market Size (US$ Bn and Thousand Kilograms) Forecast, by Packaging Type, 2017 - 2031

12.7.1. Loose

12.7.2. Bags

12.7.3. Bottles

12.7.4. Cans

12.8. Out of Home Tea Market Size (US$ Bn and Thousand Kilograms) Forecast, by End-use, 2017 - 2031

12.8.1. Quick Service Restaurants

12.8.2. Restaurants

12.8.3. Bars & Pubs

12.8.4. Hotels

12.8.5. Café/Coffee Shop Chains

12.8.6. Workplaces

12.8.7. Outdoors

12.8.8. Others

12.9. Out of Home Tea Market Size (US$ Bn and Thousand Kilograms) Forecast, by Distribution Channel, 2017 - 2031

12.9.1. Online

12.9.1.1. Company-owned Websites

12.9.1.2. E-commerce Websites

12.9.2. Offline

12.9.2.1. Hypermarkets/Supermarkets

12.9.2.2. Specialty Stores

12.9.2.3. Others

12.10. Out of Home Tea Market Size (US$ Bn and Thousand Kilograms) Forecast, by Country, 2017-2031

12.10.1. Germany

12.10.2. U.K.

12.10.3. France

12.10.4. Rest of Europe

12.11. Incremental Opportunity Analysis

13. Asia Pacific Out of Home Tea Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Supplier Analysis

13.3. COVID-19 Impact Analysis

13.4. Key Trends Analysis

13.5. Price Trend Analysis

13.5.1. Weighted Average Price

13.6. Out of Home Tea Market Size (US$ Bn and Thousand Kilograms) Forecast, by Type, 2017 - 2031

13.6.1. Black Tea

13.6.2. Green Tea

13.6.3. Herbal Tea

13.6.4. Matcha Tea

13.6.5. Oolong Tea

13.6.6. Others

13.7. Out of Home Tea Market Size (US$ Bn and Thousand Kilograms) Forecast, by Packaging Type, 2017 - 2031

13.7.1. Loose

13.7.2. Bags

13.7.3. Bottles

13.7.4. Cans

13.8. Out of Home Tea Market Size (US$ Bn and Thousand Kilograms) Forecast, by End-use, 2017 - 2031

13.8.1. Quick Service Restaurants

13.8.2. Restaurants

13.8.3. Bars & Pubs

13.8.4. Hotels

13.8.5. Café/Coffee Shop Chains

13.8.6. Workplaces

13.8.7. Outdoors

13.8.8. Others

13.9. Out of Home Tea Market Size (US$ Bn and Thousand Kilograms) Forecast, by Distribution Channel, 2017 - 2031

13.9.1. Online

13.9.1.1. Company-owned Websites

13.9.1.2. E-commerce Websites

13.9.2. Offline

13.9.2.1. Hypermarkets/Supermarkets

13.9.2.2. Specialty Stores

13.9.2.3. Others

13.10. Out of Home Tea Market Size (US$ Bn and Thousand Kilograms) Forecast, by Country, 2017-2031

13.10.1. India

13.10.2. China

13.10.3. Japan

13.10.4. Rest of Asia Pacific

13.11. Incremental Opportunity Analysis

14. Middle East & Africa Out of Home Tea Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Supplier Analysis

14.3. COVID-19 Impact Analysis

14.4. Key Trends Analysis

14.5. Price Trend Analysis

14.5.1. Weighted Average Price

14.6. Out of Home Tea Market Size (US$ Bn and Thousand Kilograms) Forecast, by Type, 2017 - 2031

14.6.1. Black Tea

14.6.2. Green Tea

14.6.3. Herbal Tea

14.6.4. Matcha Tea

14.6.5. Oolong Tea

14.6.6. Others

14.7. Out of Home Tea Market Size (US$ Bn and Thousand Kilograms) Forecast, by Packaging Type, 2017 - 2031

14.7.1. Loose

14.7.2. Bags

14.7.3. Bottles

14.7.4. Cans

14.8. Out of Home Tea Market Size (US$ Bn and Thousand Kilograms) Forecast, by End-use, 2017 - 2031

14.8.1. Quick Service Restaurants

14.8.2. Restaurants

14.8.3. Bars & Pubs

14.8.4. Hotels

14.8.5. Café/Coffee Shop Chains

14.8.6. Workplaces

14.8.7. Outdoors

14.8.8. Others

14.9. Out of Home Tea Market Size (US$ Bn and Thousand Kilograms) Forecast, by Distribution Channel, 2017 - 2031

14.9.1. Online

14.9.1.1. Company-owned Websites

14.9.1.2. E-commerce Websites

14.9.2. Offline

14.9.2.1. Hypermarkets/Supermarkets

14.9.2.2. Specialty Stores

14.9.2.3. Others

14.10. Out of Home Tea Market Size (US$ Bn and Thousand Kilograms) Forecast, by Country, 2017-2031

14.10.1. GCC

14.10.2. South Africa

14.10.3. Rest of Middle East & Africa

14.11. Incremental Opportunity Analysis

15. South America Out of Home Tea Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Key Supplier Analysis

15.3. COVID-19 Impact Analysis

15.4. Key Trends Analysis

15.5. Price Trend Analysis

15.5.1. Weighted Average Price

15.6. Out of Home Tea Market Size (US$ Bn and Thousand Kilograms) Forecast, by Type, 2017 - 2031

15.6.1. Black Tea

15.6.2. Green Tea

15.6.3. Herbal Tea

15.6.4. Matcha Tea

15.6.5. Oolong Tea

15.6.6. Others

15.7. Out of Home Tea Market Size (US$ Bn and Thousand Kilograms) Forecast, by Packaging Type, 2017 - 2031

15.7.1. Loose

15.7.2. Bags

15.7.3. Bottles

15.7.4. Cans

15.8. Out of Home Tea Market Size (US$ Bn and Thousand Kilograms) Forecast, by End-use, 2017 - 2031

15.8.1. Quick Service Restaurants

15.8.2. Restaurants

15.8.3. Bars & Pubs

15.8.4. Hotels

15.8.5. Café/Coffee Shop Chains

15.8.6. Workplaces

15.8.7. Outdoors

15.8.8. Others

15.9. Out of Home Tea Market Size (US$ Bn and Thousand Kilograms) Forecast, by Distribution Channel, 2017 - 2031

15.9.1. Online

15.9.1.1. Company-owned Websites

15.9.1.2. E-commerce Websites

15.9.2. Offline

15.9.2.1. Hypermarkets/Supermarkets

15.9.2.2. Specialty Stores

15.9.2.3. Others

15.10. Out of Home Tea Market Size (US$ Bn and Thousand Kilograms) Forecast, by Country, 2017-2031

15.10.1. Brazil

15.10.2. Rest of South America

15.11. Incremental Opportunity Analysis

16. Competition Landscape

16.1. Market Player – Competition Dashboard

16.2. Market Share Analysis – 2020 (%)

16.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview, Go-To-Market Strategy)

16.3.1. Tata Consumer Products Limited

16.3.1.1. Company Overview

16.3.1.2. Sales Area/Geographical Presence

16.3.1.3. Revenue

16.3.1.4. Strategy & Business Overview

16.3.1.5. Go-To-Market Strategy

16.3.2. Unilever

16.3.2.1. Company Overview

16.3.2.2. Sales Area/Geographical Presence

16.3.2.3. Revenue

16.3.2.4. Strategy & Business Overview

16.3.2.5. Go-To-Market Strategy

16.3.3. Ito En, Ltd.

16.3.3.1. Company Overview

16.3.3.2. Sales Area/Geographical Presence

16.3.3.3. Revenue

16.3.3.4. Strategy & Business Overview

16.3.3.5. Go-To-Market Strategy

16.3.4. Apeejay Surrendra Group

16.3.4.1. Company Overview

16.3.4.2. Sales Area/Geographical Presence

16.3.4.3. Revenue

16.3.4.4. Strategy & Business Overview

16.3.4.5. Go-To-Market Strategy

16.3.5. Starbucks Coffee Company

16.3.5.1. Company Overview

16.3.5.2. Sales Area/Geographical Presence

16.3.5.3. Revenue

16.3.5.4. Strategy & Business Overview

16.3.5.5. Go-To-Market Strategy

16.3.6. TaeTea Group

16.3.6.1. Company Overview

16.3.6.2. Sales Area/Geographical Presence

16.3.6.3. Revenue

16.3.6.4. Strategy & Business Overview

16.3.6.5. Go-To-Market Strategy

16.3.7. Barry’s Tea

16.3.7.1. Company Overview

16.3.7.2. Sales Area/Geographical Presence

16.3.7.3. Revenue

16.3.7.4. Strategy & Business Overview

16.3.7.5. Go-To-Market Strategy

16.3.8. Associated British Foods plc

16.3.8.1. Company Overview

16.3.8.2. Sales Area/Geographical Presence

16.3.8.3. Revenue

16.3.8.4. Strategy & Business Overview

16.3.8.5. Go-To-Market Strategy

16.3.9. Bettys and Taylors Group Ltd.

16.3.9.1. Company Overview

16.3.9.2. Sales Area/Geographical Presence

16.3.9.3. Revenue

16.3.9.4. Strategy & Business Overview

16.3.9.5. Go-To-Market Strategy

16.3.10. Teekanne GmbH & Co. KILOGRAMS

16.3.10.1. Company Overview

16.3.10.2. Sales Area/Geographical Presence

16.3.10.3. Revenue

16.3.10.4. Strategy & Business Overview

16.3.10.5. Go-To-Market Strategy

17. Key Takeaways

17.1. Identification of Potential Market Spaces

17.1.1. Type

17.1.2. Packaging Type

17.1.3. End-use

17.1.4. Distribution Channel

17.1.5. Region

17.1.6. Prevailing Market Risks

List of Tables

Table 1: Global Out of Home Tea Market Value, by Type, US$ Bn, 2017-2031

Table 2: Global Out of Home Tea Market Volume, by Type, Thousand Kilograms, 2017-2031

Table 3: Global Out of Home Tea Market Value, by Packaging Type, US$ Bn, 2017-2031

Table 4: Global Out of Home Tea Market Volume, by Packaging Type, Thousand Kilograms, 2017-2031

Table 5: Global Out of Home Tea Market Value, by End-use, US$ Bn, 2017-2031

Table 6: Global Out of Home Tea Market Volume, by End-use, Thousand Kilograms, 2017-2031

Table 7: Global Out of Home Tea Market Value, by Distribution Channel, US$ Bn, 2017-2031

Table 8: Global Out of Home Tea Market Volume, by Distribution Channel, Thousand Kilograms, 2017-2031

Table 9: Global Out of Home Tea Market Value, by Region, US$ Bn, 2017-2031

Table 10: Global Out of Home Tea Market Volume, by Region, Thousand Kilograms, 2017-2031

Table 11: North America Out of Home Tea Market Value, by Type, US$ Bn, 2017-2031

Table 12: North America Out of Home Tea Market Volume, by Type, Thousand Kilograms, 2017-2031

Table 13: North America Out of Home Tea Market Value, by Packaging Type, US$ Bn, 2017-2031

Table 14: North America Out of Home Tea Market Volume, by Packaging Type, Thousand Kilograms, 2017-2031

Table 15: North America Out of Home Tea Market Value, by End-use, US$ Bn, 2017-2031

Table 16: North America Out of Home Tea Market Volume, by End-use, Thousand Kilograms, 2017-2031

Table 17: North America Out of Home Tea Market Value, by Distribution Channel, US$ Bn, 2017-2031

Table 18: North America Out of Home Tea Market Volume, by Distribution Channel, Thousand Kilograms, 2017-2031

Table 19: North America Out of Home Tea Market Value, by Country/Sub-region, US$ Bn, 2017-2031

Table 20: North America Out of Home Tea Market Volume, by Country/Sub-region, Thousand Kilograms, 2017-2031

Table 21: Europe Out of Home Tea Market Value, by Type, US$ Bn, 2017-2031

Table 22: Europe Out of Home Tea Market Volume, by Type, Thousand Kilograms, 2017-2031

Table 23: Europe Out of Home Tea Market Value, by Packaging Type, US$ Bn, 2017-2031

Table 24: Europe Out of Home Tea Market Volume, by Packaging Type, Thousand Kilograms, 2017-2031

Table 25: Europe Out of Home Tea Market Value, by End-use, US$ Bn, 2017-2031

Table 26: Europe Out of Home Tea Market Volume, by End-use, Thousand Kilograms, 2017-2031

Table 27: Europe Out of Home Tea Market Value, by Distribution Channel, US$ Bn, 2017-2031

Table 28: Europe Out of Home Tea Market Volume, by Distribution Channel, Thousand Kilograms, 2017-2031

Table 29: Europe Out of Home Tea Market Value, by Country/Sub-region, US$ Bn, 2017-2031

Table 30: Europe Out of Home Tea Market Volume, by Country/Sub-region, Thousand Kilograms, 2017-2031

Table 31: Asia Pacific Out of Home Tea Market Volume, by Type, US$ Bn, 2017-2031

Table 32: Asia Pacific Out of Home Tea Market Volume, by Type, Thousand Kilograms, 2017-2031

Table 33: Asia Pacific Out of Home Tea Market Value, by Packaging Type, US$ Bn, 2017-2031

Table 34: Asia Pacific Out of Home Tea Market Volume, by Packaging Type, Thousand Kilograms, 2017-2031

Table 35: Asia Pacific Out of Home Tea Market Value, by End-use, US$ Bn, 2017-2031

Table 36: Asia Pacific Out of Home Tea Market Volume, by End-use, Thousand Kilograms, 2017-2031

Table 37: Asia Pacific Out of Home Tea Market Value, by Distribution Channel, US$ Bn, 2017-2031

Table 38: Asia Pacific Out of Home Tea Market Volume, by Distribution Channel, Thousand Kilograms, 2017-2031

Table 39: Asia Pacific Out of Home Tea Market Value, by Country/Sub-region, US$ Bn, 2017-2031

Table 40: Asia Pacific Out of Home Tea Market Volume, by Country/Sub-region, Thousand Kilograms, 2017-2031

Table 41: Middle East & Africa Out of Home Tea Market Value, by Type, US$ Bn, 2017-2031

Table 42: Middle East & Africa Out of Home Tea Market Volume, by Type, Thousand Kilograms, 2017-2031

Table 43: Middle East & Africa Out of Home Tea Market Value, by Packaging Type, US$ Bn, 2017-2031

Table 44: Middle East & Africa Out of Home Tea Market Volume, by Packaging Type, Thousand Kilograms, 2017-2031

Table 45: Middle East & Africa Out of Home Tea Market Value, by End-use, US$ Bn, 2017-2031

Table 46: Middle East & Africa Out of Home Tea Market Volume, by End-use, Thousand Kilograms, 2017-2031

Table 47: Middle East & Africa Out of Home Tea Market Value, by Distribution Channel, US$ Bn, 2017-2031

Table 48: Middle East & Africa Out of Home Tea Market Volume, by Distribution Channel, Thousand Kilograms, 2017-2031

Table 49: Middle East & Africa Out of Home Tea Market Value, by Country/Sub-region, US$ Bn, 2017-2031

Table 50: Middle East & Africa Out of Home Tea Market Volume, by Country/Sub-region, Thousand Kilograms, 2017-2031

Table 51: South America Out of Home Tea Market Value, by Type, US$ Bn, 2017-2031

Table 52: South America Out of Home Tea Market Volume, by Type, Thousand Kilograms, 2017-2031

Table 53: South America Out of Home Tea Market Value, by Packaging Type, US$ Bn, 2017-2031

Table 54: South America Out of Home Tea Market Volume, by Packaging Type, Thousand Kilograms, 2017-2031

Table 55: South America Out of Home Tea Market Value, by End-use, US$ Bn, 2017-2031

Table 56: South America Out of Home Tea Market Volume, by End-use, Thousand Kilograms, 2017-2031

Table 57: South America Out of Home Tea Market Value, by Distribution Channel, US$ Bn, 2017-2031

Table 58: South America Out of Home Tea Market Volume, by Distribution Channel, Thousand Kilograms, 2017-2031

Table 59: South America Out of Home Tea Market Value, by Country/Sub-region, US$ Bn, 2017-2031

Table 60: South America Out of Home Tea Market Volume, by Country/Sub-region, Thousand Kilograms, 2017-2031

List of Figures

Figure 1: Global Out of Home Tea Market Value, by Type, US$ Bn, 2017-2031

Figure 2: Global Out of Home Tea Market Volume, by Type, Thousand Kilograms, 2017-2031

Figure 3: Global Out of Home Tea Market Incremental Opportunity, by Type, 2021-2031

Figure 4: Global Out of Home Tea Market Value, by Packaging Type, US$ Bn, 2017-2031

Figure 5: Global Out of Home Tea Market Volume, by Packaging Type, Thousand Kilograms, 2017-2031

Figure 6: Global Out of Home Tea Market Incremental Opportunity, by Packaging Type, 2021-2031

Figure 7: Global Out of Home Tea Market Value, by End-use, US$ Bn, 2017-2031

Figure 8: Global Out of Home Tea Market Volume, by End-use, Thousand Kilograms, 2017-2031

Figure 9: Global Out of Home Tea Market Incremental Opportunity, by End-use, 2021-2031

Figure 10: Global Out of Home Tea Market Value, by Distribution Channel, US$ Bn, 2017-2031

Figure 11: Global Out of Home Tea Market Volume, by Distribution Channel, Thousand Kilograms, 2017-2031

Figure 12: Global Out of Home Tea Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 13: Global Out of Home Tea Market Value, by Region, US$ Bn, 2017-2031

Figure 14: Global Out of Home Tea Market Volume, by Region, Thousand Kilograms, 2017-2031

Figure 15: Global Out of Home Tea Market Incremental Opportunity, by Region,2021-2031

Figure 16: North America Out of Home Tea Market Value, by Type, US$ Bn, 2017-2031

Figure 17: North America Out of Home Tea Market Volume, by Type, Thousand Kilograms, 2017-2031

Figure 18: North America Out of Home Tea Market Incremental Opportunity, by Type, 2021-2031

Figure 19: North America Out of Home Tea Market Value, by Packaging Type, US$ Bn, 2017-2031

Figure 20: North America Out of Home Tea Market Volume, by Packaging Type, Thousand Kilograms, 2017-2031

Figure 21: North America Out of Home Tea Market Incremental Opportunity, by Packaging Type, 2021-2031

Figure 22: North America Out of Home Tea Market Value, by End-use, US$ Bn, 2017-2031

Figure 23: North America Out of Home Tea Market Volume, by End-use, Thousand Kilograms, 2017-2031

Figure 24: North America Out of Home Tea Market Incremental Opportunity, by End-use, 2021-2031

Figure 25: North America Out of Home Tea Market Value, by Distribution Channel, US$ Bn, 2017-2031

Figure 26: North America Out of Home Tea Market Volume, by Distribution Channel, Thousand Kilograms, 2017-2031

Figure 27: North America Out of Home Tea Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 28: North America Out of Home Tea Market Value, by Country/Sub-region, US$ Bn, 2017-2031

Figure 29: North America Out of Home Tea Market Volume, by Country/Sub-region, Thousand Kilograms, 2017-2031

Figure 30: North America Out of Home Tea Market Incremental Opportunity, by Country/Sub-region, 2021-2031

Figure 31: Europe Out of Home Tea Market Value, by Type, US$ Bn, 2017-2031

Figure 32: Europe Out of Home Tea Market Volume, by Type, Thousand Kilograms, 2017-2031

Figure 33: Europe Out of Home Tea Market Incremental Opportunity, by Type, 2021-2031

Figure 34: Europe Out of Home Tea Market Value, by Packaging Type, US$ Bn, 2017-2031

Figure 35: Europe Out of Home Tea Market Volume, by Packaging Type, Thousand Kilograms, 2017-2031

Figure 36: Europe Out of Home Tea Market Incremental Opportunity, by Packaging Type, 2021-2031

Figure 37: Europe Out of Home Tea Market Value, by End-use, US$ Bn, 2017-2031

Figure 38: Europe Out of Home Tea Market Volume, by End-use, Thousand Kilograms, 2017-2031

Figure 39: Europe Out of Home Tea Market Incremental Opportunity, by End-use, 2021-2031

Figure 40: Europe Out of Home Tea Market Value, by Distribution Channel, US$ Bn, 2017-2031

Figure 41: Europe Out of Home Tea Market Volume, by Distribution Channel, Thousand Kilograms, 2017-2031

Figure 42: Europe Out of Home Tea Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 43: Europe Out of Home Tea Market Value, by Country/Sub-region, US$ Bn, 2017-2031

Figure 44: Europe Out of Home Tea Market Volume, by Country/Sub-region, Thousand Kilograms, 2017-2031

Figure 45: Europe Out of Home Tea Market Incremental Opportunity, by Country/Sub-region, 2021-2031

Figure 46: Asia Pacific Out of Home Tea Market Value, by Type, US$ Bn, 2017-2031

Figure 47: Asia Pacific Out of Home Tea Market Volume, by Type, Thousand Kilograms, 2017-2031

Figure 48: Asia Pacific Out of Home Tea Market Incremental Opportunity, by Type, 2021-2031

Figure 49: Asia Pacific Out of Home Tea Market Value, by Packaging Type, US$ Bn, 2017-2031

Figure 50: Asia Pacific Out of Home Tea Market Volume, by Packaging Type, Thousand Kilograms, 2017-2031

Figure 51: Asia Pacific Out of Home Tea Market Incremental Opportunity, by Packaging Type, 2021-2031

Figure 52: Asia Pacific Out of Home Tea Market Value, by End-use, US$ Bn, 2017-2031

Figure 53: Asia Pacific Out of Home Tea Market Volume, by End-use, Thousand Kilograms, 2017-2031

Figure 54: Asia Pacific Out of Home Tea Market Incremental Opportunity, by End-use, 2021-2031

Figure 55: Asia Pacific Out of Home Tea Market Value, by Distribution Channel, US$ Bn, 2017-2031

Figure 56: Asia Pacific Out of Home Tea Market Volume, by Distribution Channel, Thousand Kilograms, 2017-2031

Figure 57: Asia Pacific Out of Home Tea Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 58: Asia Pacific Out of Home Tea Market Value, by Country/Sub-region, US$ Bn, 2017-2031

Figure 59: Asia Pacific Out of Home Tea Market Volume, by Country/Sub-region, Thousand Kilograms, 2017-2031

Figure 60: Asia Pacific Out of Home Tea Market Incremental Opportunity, by Country/Sub-region, 2021-2031

Figure 61: Middle East & Africa Out of Home Tea Market Value, by Type, US$ Bn, 2017-2031

Figure 62: Middle East & Africa Out of Home Tea Market Volume, by Type, Thousand Kilograms, 2017-2031

Figure 63: Middle East & Africa Out of Home Tea Market Incremental Opportunity, by Type, 2021-2031

Figure 64: Middle East & Africa Out of Home Tea Market Value, by Packaging Type, US$ Bn, 2017-2031

Figure 65: Middle East & Africa Out of Home Tea Market Volume, by Packaging Type, Thousand Kilograms, 2017-2031

Figure 66: Middle East & Africa Out of Home Tea Market Incremental Opportunity, by Packaging Type, 2021-2031

Figure 67: Middle East & Africa Out of Home Tea Market Value, by End-use, US$ Bn, 2017-2031

Figure 68: Middle East & Africa Out of Home Tea Market Volume, by End-use, Thousand Kilograms, 2017-2031

Figure 69: Middle East & Africa Out of Home Tea Market Incremental Opportunity, by End-use, 2021-2031

Figure 70: Middle East & Africa Out of Home Tea Market Value, by Distribution Channel, US$ Bn, 2017-2031

Figure 71: Middle East & Africa Out of Home Tea Market Volume, by Distribution Channel, Thousand Kilograms, 2017-2031

Figure 72: Middle East & Africa Out of Home Tea Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 73: Middle East & Africa Out of Home Tea Market Value, by Country/Sub-region, US$ Bn, 2017-2031

Figure 74: Middle East & Africa Out of Home Tea Market Volume, by Country/Sub-region, Thousand Kilograms, 2017-2031

Figure 75: Middle East & Africa Out of Home Tea Market Incremental Opportunity, by Country/Sub-region, 2021-2031

Figure 76: South America Out of Home Tea Market Value, by Type, US$ Bn, 2017-2031

Figure 77: South America Out of Home Tea Market Volume, by Type, Thousand Kilograms, 2017-2031

Figure 78: South America Out of Home Tea Market Incremental Opportunity, by Type, 2021-2031

Figure 79: South America Out of Home Tea Market Value, by Packaging Type, US$ Bn, 2017-2031

Figure 80: South America Out of Home Tea Market Volume, by Packaging Type, Thousand Kilograms, 2017-2031

Figure 81: South America Out of Home Tea Market Incremental Opportunity, by Packaging Type, 2021-2031

Figure 82: South America Out of Home Tea Market Value, by End-use, US$ Bn, 2017-2031

Figure 83: South America Out of Home Tea Market Volume, by End-use, Thousand Kilograms, 2017-2031

Figure 84: South America Out of Home Tea Market Incremental Opportunity, by End-use, 2021-2031

Figure 85: South America Out of Home Tea Market Value, by Distribution Channel, US$ Bn, 2017-2031

Figure 86: South America Out of Home Tea Market Volume, by Distribution Channel, Thousand Kilograms, 2017-2031

Figure 87: South America Out of Home Tea Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 88: South America Out of Home Tea Market Value, by Country/Sub-region, US$ Bn, 2017-2031

Figure 89: South America Out of Home Tea Market Volume, by Country/Sub-region, Thousand Kilograms, 2017-2031

Figure 90: South America Out of Home Tea Market Incremental Opportunity, by Country/Sub-region, 2021-2031