Reports

Reports

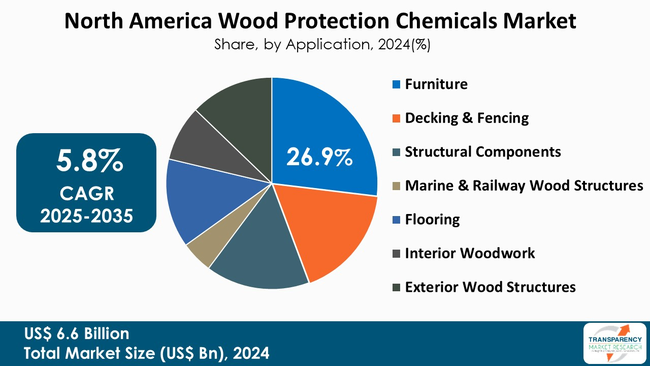

The North America wood protection chemicals market size was valued at US$ 6.6 Bn in 2024 and is projected to reach US$ 12.3 Bn by 2035, expanding at a CAGR of 5.8% from 2025 to 2035. The market growth is driven by growth in residential and commercial construction and rising consumer preference for sustainable and natural materials

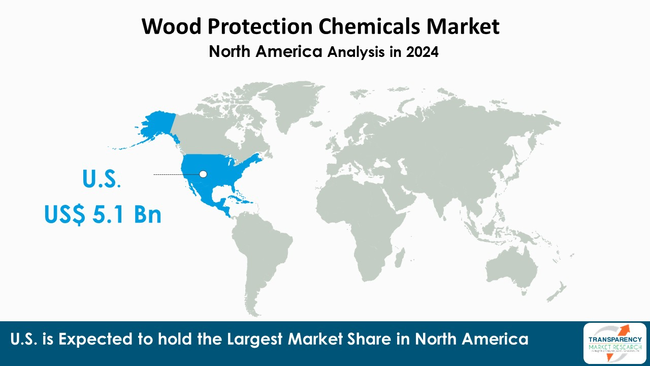

North America wood protection chemicals market is witnessing steadiness due to favorable construction outlook, rising awareness about sustainability, and increased demand in furniture and infrastructure applications. The United States, which comprises over 77.4% of market revenue in North America, is expected to continue to be the primary driver of growth as it undertakes housing projects at a larger scale, and also as furniture and infrastructure shape the market outlook.

Demand for treated wood is also on the rise as developers are increasingly utilizing cross-laminated timber (CLT) and engineered wood as part of mid-rise and commercial projects. This will open up opportunities for more developed preservative and coating technologies.

A notable shift toward environmentally-friendly, water-based formulations that reflect changing regulatory or consumer standards can also be witnessed. There was an increase of over 40% in LEED-certified projects in 2024, and manufacturers are exploring more bio-based, low-VOC solutions that can effectively enhance durability and long-term performance, while satisfying a continued need for compliance, thus further increasing opportunity for wood protection solutions.

Leading companies such as Koppers Performance Chemicals and Sherwin-Williams are utilizing this considerable shift by offering innovative solutions and product partners when developing new products and growing their competitive position in an increasingly competitive market focused on sustainability.

Wood protection chemicals are specific mixtures developed to help improve the service life, performance, and appearance of wood materials used in various situations. Wood is organic and porous, and therefore will naturally be detrimental to living organisms. To counter these effects, wood protection chemicals are applied through surface treatments, impregnation, or in some case, pressure processes, in order to penetrate the wood and protect against internal and external degradation.

Chemicals used in wood protection can be categorized into paint, stain, varnish, lacquer, termite-killer, preservatives, sealants, fire retardants, etc. Preservatives like copper- and borate-based compounds offer protection against insects and fungi by disrupting their metabolic process. Coatings and sealants including stain, varnish, and water repellents also protect wood by sealing and preserving the aesthetics and preventing moisture and UV damage. Fire retardants operate by slowing the combustion process and enhancing char build-up in order to lower the flammability of the wood product.

Wood protection chemicals are commonly used in construction, furniture, decking, and marine & utility applications, where longevity and weathering resistance are needed. Many new wood protection chemical formulations are developed to enhance environmental safety and efficiencies, resulting in many bio-based, low toxicity, and water-based formulations being preferred in place of traditional solvent-based formulations.

| Attribute | Detail |

|---|---|

| North America Wood Protection Chemicals Market Drivers |

|

The growth of both - residential and commercial construction activities across North America remains a key driver for the wood protection chemicals industry. New construction as well as housing renovations have continued to grow in both - the U.S. and Canada, thereby leading to strong demand for treated wood products in aesthetic, structural, and outdoor applications.

In 2024, new housing starts exceeded 1.4 million in the U.S. according to the U.S. Census Bureau. Canada reported nearly 260,000 housing completions, suggesting multi-billion-dollar investments in residential infrastructure. This, in turn, results in greater demand for wood protection chemicals in decking, framing, exterior cladding, and fencing.

According to the American Institute of Architects (AIA), the Architecture Billings Index (ABI) continued to grow in 2024, signaling rise in project pipelines. Additionally, architects and developers are using wood as one of the sustainable construction materials with a lower carbon footprint than concrete or steel, which contributes to development of consumer demand for advanced wood protection treatment options, like fire-retardant coatings, copper-based preservatives, and UV resistant sealants.

With improved awareness about climate change and stringent regulations by agencies responsible for the environment, consumers and industries alike are beginning to move away from traditional, solvent-borne wood preservatives toward more environmentally-conscious, reduced-toxicity, bio-based wood preservatives.

The U.S. Green Building Council (USGBC) reports that more than 40% of new commercial construction projects applied for LEED certification in the year 2024. The significant adoption of sustainable practices in construction projects is apparent. In Canada, the Canadian Green Building Council (CaGBC) states that there has been a 20% increase of green building projects over the last three years across Canada. This growth works in favor of the utilization of wood products treated with water-borne, borate, and bio-based protective chemicals, which align well with reduced environmental impact.

Companies such as Lonza Specialty Ingredients and Koppers Inc have begun to incorporate next-generation non-metal preservatives and bio-based coatings that conform to environmental standards published by regulatory authorities, such as U.S. EPA's Safer Choice Program, while ensuring minimal environmental harm.

The furniture market is one of the largest applications in the North America wood protection chemicals market, supported by strong residential, commercial, and hospitality sectors within the region. In fact, in the United States alone, furniture sales account for more than US$ 115 Bn annually, and ongoing improvements will continue to stimulate growth towing to the rise of home renovation trends, e-Commerce penetration, and consumer interest in attractive and durable wooden products.

As wooden furniture continues to be a primary and an accepted choice for indoor versus outdoor environments, manufacturers are increasingly utilizing protective coatings, sealers, preservatives, and stains to aid in extending product life, and moisture-resistance, UV exposure, and termite resistance.

Widely utilized wood protection chemicals including polyurethane coatings, waterborne sealants, and biobased preservatives aid in maintaining color stability, surfacing smoothness, and structural integrity under a variety of climatic conditions. Increased use of wood for outdoor furniture applications has continued to flourish as demonstrated by nearly 8% growth in this segment over the previous year.

| Attribute | Detail |

|---|---|

| Leading Region |

|

With over 77.4% of the regional revenue, the U.S. dominates North America wood protection chemicals industry due to expansive construction, furniture, and infrastructure industries, all of which consume a significant amount of treated wood.

In 2024, U.S. housing starts surpassed 1.4 Mn units and resulted in strong demand for wood preservatives, coatings, and fire-retardant treatment industries. Additionally, the U.S. furniture industry is worth over US$ 115 Bn and increasing popularity of outdoor decking and wood landscaping structures will increase chemical consumption as well.

Moreover, stringent environmental regulations set forth by the U.S. Environmental Protection Agency (EPA) for wood protection chemicals has further encouraged advancements in waterborne and bio-based wood protection and facilitated sustainability while increasing performance of the formulations.

Leading domestic manufacturers such as Koppers Inc., Lonza Specialty Ingredients, and Sherwin-Williams are investing in new advanced people-friendly formulations. Overall, the U.S. is the key growth engine of the North American wood protection chemicals market.

Koppers Performance Chemicals Inc leads North America wood protection chemicals market, generating significant business through its extensive portfolio of wood preservatives and treatment systems. The company is a major supplier of micronized and copper-based preservatives, namely MicroPro, MCA, and CCA for use in commercial, residential, and utility applications.

Sherwin-Williams Company is another industry leader relying on its vast expertise in protective coatings, and sealants for wood preservation. The company has a broad variety of industrial and architectural wood coatings that protect wood by improving durability and weatherability, while also providing aesthetic improvement.

The companies have established supply chains across North America for strengthening its position in the market. Sherwin Williams continues to provide innovation in low VOC and waterborne technology, thereby enabling the company to maintain competitiveness as a leader in the market. As environmental hazards and product sustainability are an emerging trend, Sherwin Williams also provides for customized solutions in wood coatings for furniture, deck, and remodeling for residential and commercial building applications, thereby making it a watchable competitor in the marketplace.

FMC Corporation, Eastman Chemical Company, Huntsman Corporation, Lanxess, PPG Industries, BASF SE, Syngenta, Nisus Corporation, Sirca North America, Janssen PMP, Akzo Nobel N.V., Teknos Group OY, Axalta Coating Systems, Copper Care Wood Preservatives Inc, Osmose Utilities Services Inc, RPM International Inc, and Viance LLC are some other major companies in the North America wood protection chemicals market.

Each of these players has been profiled in North America wood protection chemicals market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 | US$ 6.6 Bn |

| Market Forecast Value in 2035 | US$ 12.3 Bn |

| Growth Rate (CAGR) | 5.8% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value & Tons for Volume |

| Market Analysis | It includes cross-segment analysis at the regional as well as country level. Furthermore, the qualitative analysis includes drivers, restraints, Wood Protection Chemicals market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | Product Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

North America wood protection chemicals market was valued at US$ 6.6 Bn in 2024

North America wood protection chemicals industry is expected to grow at a CAGR of 5.8% from 2025 to 2035

Growth in residential and commercial construction and rising consumer preference for sustainable and natural materials.

Furniture was the largest application segment in the North America wood protection chemicals market.

U.S. was the most lucrative region in 2024

FMC Corporation, Eastman Chemical Company, Huntsman Corporation, Lanxess, The Sherwin-Williams Company, PPG Industries, BASF SE, Syngenta, Nisus Corporation, Koppers Performance Chemicals, Sirca North America, Janssen PMP, Akzo Nobel N.V., Teknos Group OY, Axalta Coating Systems, Copper Care Wood Preservatives Inc, Osmose Utilities Services Inc, RPM International Inc, and Viance LLC are the prominent players in North America wood protection chemicals market.

Table 1 North America Wood Protection Chemicals Market Volume (Tons) Forecast, by Product Type, 2020 to 2035

Table 2 North America Wood Protection Chemicals Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 3 North America Wood Protection Chemicals Market Volume (Tons) Forecast, by Wood Type, 2020 to 2035

Table 4 North America Wood Protection Chemicals Market Value (US$ Bn) Forecast, by Wood Type, 2020 to 2035

Table 5 North America Wood Protection Chemicals Market Volume (Tons) Forecast, by Application 2020 to 2035

Table 6 North America Wood Protection Chemicals Market Value (US$ Bn) Forecast, by Application 2020 to 2035

Table 7 North America Wood Protection Chemicals Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 8 North America Wood Protection Chemicals Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 9 North America Wood Protection Chemicals Market Volume (Tons) Forecast, by Distribution Channel, 2020 to 2035

Table 10 North America Wood Protection Chemicals Market Value (US$ Bn) Forecast, by Distribution Channel, 2020 to 2035

Table 11 North America Wood Protection Chemicals Market Volume (Tons) Forecast, by Country, 2020 to 2035

Table 12 North America Wood Protection Chemicals Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 13 U.S. Wood Protection Chemicals Market Volume (Tons) Forecast, by Product Type, 2020 to 2035

Table 14 U.S. Wood Protection Chemicals Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 15 U.S. Wood Protection Chemicals Market Volume (Tons) Forecast, by Wood Type, 2020 to 2035

Table 16 U.S. Wood Protection Chemicals Market Value (US$ Bn) Forecast, by Wood Type, 2020 to 2035

Table 17 U.S. Wood Protection Chemicals Market Volume (Tons) Forecast, by Application 2020 to 2035

Table 18 U.S. Wood Protection Chemicals Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 19 U.S. Wood Protection Chemicals Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 20 U.S. Wood Protection Chemicals Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 21 U.S. Wood Protection Chemicals Market Volume (Tons) Forecast, by Distribution Channel, 2020 to 2035

Table 22 U.S. Wood Protection Chemicals Market Value (US$ Bn) Forecast, by Distribution Channel, 2020 to 2035

Table 23 Canada Wood Protection Chemicals Market Volume (Tons) Forecast, by Product Type, 2020 to 2035

Table 24 Canada Wood Protection Chemicals Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 25 Canada Wood Protection Chemicals Market Volume (Tons) Forecast, by Wood Type, 2020 to 2035

Table 26 Canada Wood Protection Chemicals Market Value (US$ Bn) Forecast, by Wood Type, 2020 to 2035

Table 27 Canada Wood Protection Chemicals Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 28 Canada Wood Protection Chemicals Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 29 Canada Wood Protection Chemicals Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 30 Canada Wood Protection Chemicals Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 31 Canada Wood Protection Chemicals Market Volume (Tons) Forecast, by Distribution Channel, 2020 to 2035

Table 32 Canada Wood Protection Chemicals Market Value (US$ Bn) Forecast, by Distribution Channel 2020 to 2035

Figure 1 North America Wood Protection Chemicals Market Volume Share Analysis, by Product Type, 2024, 2028, and 2035

Figure 2 North America Wood Protection Chemicals Market Attractiveness, by Product Type

Figure 3 North America Wood Protection Chemicals Market Volume Share Analysis, by Wood Type, 2024, 2028, and 2035

Figure 4 North America Wood Protection Chemicals Market Attractiveness, by Wood Type

Figure 5 North America Wood Protection Chemicals Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 6 North America Wood Protection Chemicals Market Attractiveness, by Application

Figure 7 North America Wood Protection Chemicals Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 8 North America Wood Protection Chemicals Market Attractiveness, by End-use

Figure 9 North America Wood Protection Chemicals Market Volume Share Analysis, by Distribution Channel, 2024, 2028, and 2035

Figure 10 North America Wood Protection Chemicals Market Attractiveness, by Distribution Channel