Reports

Reports

Analysts’ Viewpoint

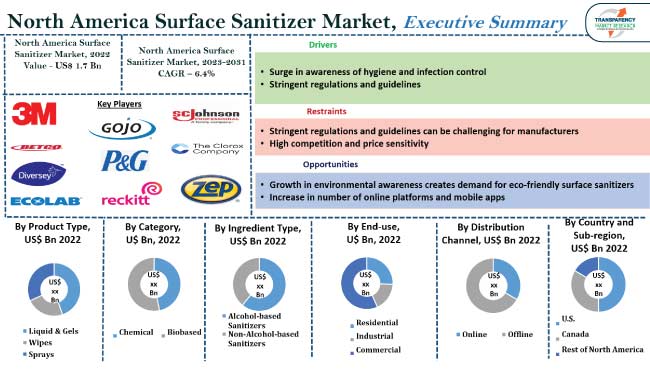

Surge in awareness of hygiene and infection control, and stringent regulations & guidelines are projected to boost the North America surface sanitizer market growth. Furthermore, integration of technology, such as IoT (Internet of Things) and smart sensors into sanitization products helps to monitor and improve sanitization processes, offering lucrative opportunities for market expansion.

Construction of new healthcare facilities and collaborations between public health agencies, private businesses, and non-profit organizations enhances awareness and promotes the responsible use of surface sanitizers.

Manufacturers are exploring opportunities to innovate in packaging, introducing convenient and portable formats for surface sanitizers. Single-use packaging and packaging that minimizes environmental impact are gaining traction among the populace. Key players are striving to develop more sustainable materials as well as eco-friendly surface sanitizer products.

A surface sanitizer is a chemical substance or solution designed to reduce or eliminate the presence of germs, bacteria, viruses, and other pathogens on surfaces. It is commonly used in settings, such as homes, hospitals, restaurants, and public spaces, to maintain a hygienic environment and prevent the spread of infections.

Surface sanitizers work by either killing or inhibiting the growth of microorganisms on surfaces. They are different from cleaning agents, which primarily remove dirt and debris from surfaces. Sanitizers are specifically formulated to target and reduce the microbial load, making surfaces safer for human contact.

Liquid & gel, spray, wipes, etc. are the various types of products available in the surface cleaners market. The common active ingredients in surface sanitizers include alcohol (ethanol or isopropyl alcohol), hydrogen peroxide, quaternary ammonium compounds, and chlorine-based compounds.

Future analysis of surface sanitizers is projected to be the integration of technology, such as smart sensors or indicators. These features are likely to provide real-time data on the cleanliness of surfaces or alert users when it is time to reapply sanitizer.

Individuals and organizations are committed to preventing the spread of bacteria and viruses due to the greater awareness of the transmission of infectious diseases. Surface sanitizers are a crucial component in these prevention efforts, as they help eliminate pathogens from commonly touched surfaces. Moreover, in healthcare settings in North America, where infection control is paramount, the importance of maintaining a sterile environment has led to significant demand for surface sanitizers. Hospitals, clinics, and other healthcare facilities use sanitizers to minimize the risk of healthcare-associated infections, and majorly fuel the North America surface sanitizer market size.

Furthermore, training programs in healthcare, hospitality, and other industries underscore the importance of using surface sanitizers to maintain a clean and safe environment. The Covid-19 pandemic created a heightened sense of urgency and awareness regarding the potential transmission of diseases, prompting individuals and organizations to prioritize the use of surface sanitizers as part of their overall hygiene strategy. This is anticipated to augment the North America surface sanitizer market value in the near future.

Regulations established by health and safety authorities at local, national, and international levels ensure public health, workplace safety, and environmental protection. Health and safety regulations often mandate the use of sanitizers in various settings, including healthcare facilities, food processing units, educational institutions, and public spaces. Businesses and organizations are required to comply with these regulations, driving the demand for surface sanitizers.

Moreover, government health agencies, including the Centers for Disease Control and Prevention (CDC) and the World Health Organization (WHO), have recommended regular surface cleaning and disinfection as part of broader efforts to control the spread of infectious diseases. These recommendations have contributed to increased consumer awareness and demand for sanitization products, consequently fueling market progress.

Workplace safety regulations often include guidelines for maintaining a clean and hygienic work environment. Surface sanitizers are recommended or required in occupational safety guidelines to reduce the risk of infectious diseases among workers. For instance, The Occupational Safety and Health Administration (OSHA) guidelines mandate that all workplaces, corridors, storerooms, service rooms, and walking-working surfaces should be kept clean, tidy, and sanitary. Thus, the numerous hygiene regulations are likely to boost the North America surface sanitizer market share during the forecast period.

According to the latest North America surface sanitizer market forecast, the U.S. accounts for major share in terms of both volume and value. Surge in awareness of the importance of hygiene, especially in the context of public health crises such as the COVID-19 pandemic, has increased the demand for surface sanitizers. People are more conscious of the need to disinfect surfaces to prevent the spread of viruses and bacteria. The presence of major manufacturers and various distribution channels are likely to contribute to a rise in demand for surface sanitizer products in the region.

The market in Canada is expected to witness significant growth during the forecast period. Rise in awareness of public health and hygiene, particularly in the context of the COVID-19 pandemic, has driven Canadians to adopt more rigorous cleaning and sanitization practices. These factors act as key market catalysts. Health authorities in Canada, including the Public Health Agency of Canada, have provided guidelines and recommendations for maintaining cleanliness and disinfection. These guidelines have influenced businesses, institutions, and individuals to use surface sanitizers as part of their infection prevention measures. These factors collectively contribute to the substantial demand for surface sanitizers in Canada.

Detailed profiles of companies are provided in the North America surface sanitizer industry research report to evaluate their financials, key product offerings, recent developments, and strategies. Most companies spend significantly on comprehensive R&D activities, primarily to develop innovative products. Expansion of product portfolios, and mergers & acquisitions are the key strategies adopted by manufacturers in the industry. Leading players are also following the latest market trends to avail lucrative revenue opportunities.

3M, Betco Corporation, Diversey, Inc., Ecolab Inc., GOJO Industries, Inc., Procter & Gamble, Reckitt Benckiser Group plc., SC Johnson Professional USA, Inc., The Clorox Company, and, Zep Inc. are the prominent companies in the surface sanitizer market.

Each of these players has been profiled in the North America surface sanitizer market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, and business segments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 1.7 Bn |

| Market Forecast Value in 2031 | US$ 3.0 Bn |

| Growth Rate (CAGR) | 6.4% |

| Forecast Period | 2023-2031 |

| Quantitative Units | US$ Bn for Value and Million Units for Volume |

| Market Analysis | The North America qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the country level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Countries Covered |

|

| Market Segmentation |

|

| Companies Profile |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 1.7 Bn in 2022

It is expected to reach US$ 3.0 Bn by the end of 2031

Surge in awareness of hygiene and infection control, and stringent regulations and guidelines

Based on product type, the liquid & gels segment contributed the largest share in 2022

The U.S. contributed about 34% in terms of share in 2022

3M, Betco Corporation, Diversey, Inc., Ecolab Inc., GOJO Industries, Inc., Procter & Gamble, Reckitt Benckiser Group plc., SC Johnson Professional USA, Inc., The Clorox Company, and Zep Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. Material Analysis

6. North America Surface Sanitizer Market Analysis and Forecast, By Product Type

6.1. North America Surface Sanitizer Market Size (US$ Bn and Million Units), By Product Type, 2023 - 2031

6.1.1. Liquid & Gels

6.1.2. Wipes

6.1.3. Sprays

6.2. Incremental Opportunity Analysis, By Product Type

7. North America Surface Sanitizer Market Analysis and Forecast, By Category

7.1. North America Surface Sanitizer Market Size (US$ Bn and Million Units), By Category, 2023 - 2031

7.1.1. Chemical

7.1.2. Bio-based

7.2. Incremental Opportunity Analysis, By Category

8. North America Surface Sanitizer Market Analysis and Forecast, By Ingredient Type

8.1. North America Surface Sanitizer Market Size (US$ Bn and Million Units), By Ingredient Type, 2023 - 2031

8.1.1. Alcohol-based Sanitizers

8.1.2. Non-Alcohol-based Sanitizers

8.2. Incremental Opportunity Analysis, By Ingredient Type

9. North America Surface Sanitizer Market Analysis and Forecast, By End-use

9.1. North America Surface Sanitizer Market Size (US$ Bn and Million Units), By End-use, 2023 - 2031

9.1.1. Residential

9.1.2. Industrial

9.1.3. Commercial

9.1.3.1. Hospitals

9.1.3.2. Laboratories

9.1.3.3. Food Processing Industries

9.1.3.4. Educational Institutes

9.1.3.5. Railways

9.1.3.6. Airports

9.1.3.7. Others (Hotels, Malls, Etc.)

9.2. Incremental Opportunity Analysis, By End-use

10. North America Surface Sanitizer Market Analysis and Forecast, by Distribution Channel

10.1. North America Surface Sanitizer Market Size (US$ Bn and Million Units), By Distribution Channel, 2023 - 2031

10.1.1. Online

10.1.1.1. E-commerce Websites

10.1.1.2. Company-owned Websites

10.1.2. Offline

10.1.2.1. Supermarket/Hypermarket

10.1.2.2. Medical Stores

10.1.2.3. Other Retail Stores

10.2. Incremental Opportunity Analysis, by Distribution Channel

11. North America Surface Sanitizer Market Analysis and Forecast, by Country and Sub-region

11.1. North America Surface Sanitizer Market Size (US$ Bn and Million Units), By Country and Sub-region, 2023 - 2031

11.1.1. U.S.

11.1.2. Canada

11.1.3. Rest of North America

11.2. Incremental Opportunity Analysis, by Region

12. U.S. Surface Sanitizer Market Analysis and Forecast

12.1. Country Snapshot

12.2. Demographic Overview

12.3. Key Trend Analysis

12.4. Market Share Analysis

12.4.1. Local Manufactures vs Import

12.5. Consumer Buying Behavior Analysis

12.6. Pricing Analysis

12.6.1. Weighted Average Selling Price (US$)

12.7. Surface Sanitizer Market Size (US$ Bn and Million Units), By Product Type, 2023 - 2031

12.7.1. Liquid & Gels

12.7.2. Wipes

12.7.3. Sprays

12.8. Surface Sanitizer Market Size (US$ Bn and Million Units), By Category, 2023 - 2031

12.8.1. Chemical

12.8.2. Biobased

12.9. Surface Sanitizer Market Size (US$ Bn and Million Units), By Ingredient Type, 2023 - 2031

12.9.1. Alcohol-based Sanitizers

12.9.2. Non-Alcohol-based Sanitizers

12.10. Surface Sanitizer Market Size (US$ Bn and Million Units), By End-use, 2023 - 2031

12.10.1. Residential

12.10.2. Industrial

12.10.3. Commercial

12.10.3.1. Hospitals

12.10.3.2. Laboratories

12.10.3.3. Food Processing Industries

12.10.3.4. Educational Institutes

12.10.3.5. Railways

12.10.3.6. Airports

12.10.3.7. Others (Hotels, Malls, Etc.)

12.11. Surface Sanitizer Market Size (US$ Bn and Million Units), By Distribution Channel, 2023 - 2031

12.11.1. Online

12.11.1.1. E-commerce Websites

12.11.1.2. Company-owned Websites

12.11.2. Offline

12.11.2.1. Supermarket/Hypermarket

12.11.2.2. Medical Stores

12.11.2.3. Other Retail Stores

12.12. Incremental Opportunity Analysis

13. Canada Surface Sanitizer Market Analysis and Forecast

13.1. Country Snapshot

13.2. Demographic Overview

13.3. Key Trend Analysis

13.4. Market Share Analysis

13.4.1. Local Manufactures vs Import

13.5. Consumer Buying Behavior Analysis

13.6. Pricing Analysis

13.6.1. Weighted Average Selling Price (US$)

13.7. Surface Sanitizer Market Size (US$ Bn and Million Units), By Product Type, 2023 - 2031

13.7.1. Liquid & Gels

13.7.2. Wipes

13.7.3. Sprays

13.8. Surface Sanitizer Market Size (US$ Bn and Million Units), By Category, 2023 - 2031

13.8.1. Chemical

13.8.2. Biobased

13.9. Surface Sanitizer Market Size (US$ Bn and Million Units), By Ingredient Type, 2023 - 2031

13.9.1. Alcohol-based Sanitizers

13.9.2. Non-Alcohol-based Sanitizers

13.10. Surface Sanitizer Market Size (US$ Bn and Million Units), By End-use, 2023 - 2031

13.10.1. Residential

13.10.2. Industrial

13.10.3. Commercial

13.10.3.1. Hospitals

13.10.3.2. Laboratories

13.10.3.3. Food Processing Industries

13.10.3.4. Educational Institutes

13.10.3.5. Railways

13.10.3.6. Airports

13.10.3.7. Others (Hotels, Malls, Etc.)

13.11. Surface Sanitizer Market Size (US$ Bn and Million Units), By Distribution Channel, 2023 - 2031

13.11.1. Online

13.11.1.1. E-commerce Websites

13.11.1.2. Company-owned Websites

13.11.2. Offline

13.11.2.1. Supermarket/Hypermarket

13.11.2.2. Medical Stores

13.11.2.3. Other Retail Stores

13.12. Incremental Opportunity Analysis

14. Competition Landscape

14.1. Market Player – Competition Dashboard

14.2. Market Share Analysis (%), 2022

14.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

14.3.1. 3M

14.3.1.1. Company Overview

14.3.1.2. Sales Area/Geographical Presence

14.3.1.3. Revenue

14.3.1.4. Strategy & Business Overview

14.3.2. Betco Corporation

14.3.2.1. Company Overview

14.3.2.2. Sales Area/Geographical Presence

14.3.2.3. Revenue

14.3.2.4. Strategy & Business Overview

14.3.3. Diversey, Inc.

14.3.3.1. Company Overview

14.3.3.2. Sales Area/Geographical Presence

14.3.3.3. Revenue

14.3.3.4. Strategy & Business Overview

14.3.4. Ecolab Inc.

14.3.4.1. Company Overview

14.3.4.2. Sales Area/Geographical Presence

14.3.4.3. Revenue

14.3.4.4. Strategy & Business Overview

14.3.5. GOJO Industries, Inc.

14.3.5.1. Company Overview

14.3.5.2. Sales Area/Geographical Presence

14.3.5.3. Revenue

14.3.5.4. Strategy & Business Overview

14.3.6. Procter & Gamble

14.3.6.1. Company Overview

14.3.6.2. Sales Area/Geographical Presence

14.3.6.3. Revenue

14.3.6.4. Strategy & Business Overview

14.3.7. Reckitt Benckiser Group plc.

14.3.7.1. Company Overview

14.3.7.2. Sales Area/Geographical Presence

14.3.7.3. Revenue

14.3.7.4. Strategy & Business Overview

14.3.8. SC Johnson Professional USA, Inc.

14.3.8.1. Company Overview

14.3.8.2. Sales Area/Geographical Presence

14.3.8.3. Revenue

14.3.8.4. Strategy & Business Overview

14.3.9. The Clorox Company

14.3.9.1. Company Overview

14.3.9.2. Sales Area/Geographical Presence

14.3.9.3. Revenue

14.3.9.4. Strategy & Business Overview

14.3.10. Zep Inc.

14.3.10.1. Company Overview

14.3.10.2. Sales Area/Geographical Presence

14.3.10.3. Revenue

14.3.10.4. Strategy & Business Overview

14.3.11. Other Key Players

14.3.11.1. Company Overview

14.3.11.2. Sales Area/Geographical Presence

14.3.11.3. Revenue

14.3.11.4. Strategy & Business Overview

15. Go To Market Strategy

15.1. Identification of Potential Market Spaces

15.2. Understanding the Buying Process of Customers

15.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: North America Surface Sanitizer Market Value, by Product Type, US$ Bn, 2023-2031

Table 2: North America Surface Sanitizer Market Volume, by Product Type, Million Units, 2023-2031

Table 3: North America Surface Sanitizer Market Value, by Category, US$ Bn, 2023-2031

Table 4: North America Surface Sanitizer Market Volume, by Category, Million Units, 2023-2031

Table 5: North America Surface Sanitizer Market Value, by Ingredient Type, US$ Bn, 2023-2031

Table 6: North America Surface Sanitizer Market Volume, by Ingredient Type, Million Units, 2023-2031

Table 7: North America Surface Sanitizer Market Value, by End-use, US$ Bn, 2023-2031

Table 8: North America Surface Sanitizer Market Volume, by End-use, Million Units, 2023-2031

Table 9: North America Surface Sanitizer Market Value, by Distribution Channel, US$ Bn, 2023-2031

Table 10: North America Surface Sanitizer Market Volume, by Distribution Channel, Million Units, 2023-2031

Table 11: North America Surface Sanitizer Market Value, by Country/Sub-Region, US$ Bn, 2023-2031

Table 12: North America Surface Sanitizer Market Volume, by Country/Sub-Region, Million Units, 2023-2031

Table 13: U.S. Surface Sanitizer Market Value, by Product Type, US$ Bn, 2023-2031

Table 14: U.S. Surface Sanitizer Market Volume, by Product Type, Million Units, 2023-2031

Table 15: U.S. Surface Sanitizer Market Value, by Category, US$ Bn, 2023-2031

Table 16: U.S. Surface Sanitizer Market Volume, by Category, Million Units, 2023-2031

Table 17: U.S. Surface Sanitizer Market Value, by Ingredient Type, US$ Bn, 2023-2031

Table 18: U.S. Surface Sanitizer Market Volume, by Ingredient Type, Million Units, 2023-2031

Table 19: U.S. Surface Sanitizer Market Value, by End-use, US$ Bn, 2023-2031

Table 20: U.S. Surface Sanitizer Market Volume, by End-use, Million Units, 2023-2031

Table 21: U.S. Surface Sanitizer Market Value, by Distribution Channel, US$ Bn, 2023-2031

Table 22: U.S. Surface Sanitizer Market Volume, by Distribution Channel, Million Units, 2023-2031

Table 23: Canada Surface Sanitizer Market Value, by Product Type, US$ Bn, 2023-2031

Table 24: Canada Surface Sanitizer Market Volume, by Product Type, Million Units, 2023-2031

Table 25: Canada Surface Sanitizer Market Value, by Category, US$ Bn, 2023-2031

Table 26: Canada Surface Sanitizer Market Volume, by Category, Million Units, 2023-2031

Table 27: Canada Surface Sanitizer Market Value, by Ingredient Type, US$ Bn, 2023-2031

Table 28: Canada Surface Sanitizer Market Volume, by Ingredient Type, Million Units, 2023-2031

Table 29: Canada Surface Sanitizer Market Value, by End-use, US$ Bn, 2023-2031

Table 30: Canada Surface Sanitizer Market Volume, by End-use, Million Units, 2023-2031

Table 31: Canada Surface Sanitizer Market Value, by Distribution Channel, US$ Bn, 2023-2031

Table 32: Canada Surface Sanitizer Market Volume, by Distribution Channel, Million Units, 2023-2031

List of Figures

Figure 1: North America Surface Sanitizer Market Value, by Product Type, US$ Bn, 2023-2031

Figure 2: North America Surface Sanitizer Market Volume, by Product Type, Million Units, 2023-2031

Figure 3: North America Surface Sanitizer Market Incremental Opportunity, by Product Type, 2021-2031

Figure 4: North America Surface Sanitizer Market Value, by Category, US$ Bn, 2023-2031

Figure 5: North America Surface Sanitizer Market Volume, by Category, Million Units, 2023-2031

Figure 6: North America Surface Sanitizer Market Incremental Opportunity, by Category, 2021-2031

Figure 7: North America Surface Sanitizer Market Value, by Ingredient Type, US$ Bn, 2023-2031

Figure 8: North America Surface Sanitizer Market Volume, by Ingredient Type, Million Units, 2023-2031

Figure 9: North America Surface Sanitizer Market Incremental Opportunity, by Ingredient Type, 2021-2031

Figure 10: North America Surface Sanitizer Market Value, by End-use, US$ Bn, 2023-2031

Figure 11: North America Surface Sanitizer Market Volume, by End-use, Million Units, 2023-2031

Figure 12: North America Surface Sanitizer Market Incremental Opportunity, by End-use, 2021-2031

Figure 13: North America Surface Sanitizer Market Value, by Distribution Channel, US$ Bn, 2023-2031

Figure 14: North America Surface Sanitizer Market Volume, by Distribution Channel, Million Units, 2023-2031

Figure 15: North America Surface Sanitizer Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 16: North America Surface Sanitizer Market Value, by Country, US$ Bn, 2023-2031

Figure 17: North America Surface Sanitizer Market Volume, by Country, Million Units, 2023-2031

Figure 18: North America Surface Sanitizer Market Incremental Opportunity, by Country, 2021-2031

Figure 19: U.S. Surface Sanitizer Market Value, by Product Type, US$ Bn, 2023-2031

Figure 20: U.S. Surface Sanitizer Market Volume, by Product Type, Million Units, 2023-2031

Figure 21: U.S. Surface Sanitizer Market Incremental Opportunity, by Product Type, 2021-2031

Figure 22: U.S. Surface Sanitizer Market Value, by Category, US$ Bn, 2023-2031

Figure 23: U.S. Surface Sanitizer Market Volume, by Category, Million Units, 2023-2031

Figure 24: U.S. Surface Sanitizer Market Incremental Opportunity, by Category, 2021-2031

Figure 25: U.S. Surface Sanitizer Market Value, by Ingredient Type, US$ Bn, 2023-2031

Figure 26: U.S. Surface Sanitizer Market Volume, by Ingredient Type, Million Units, 2023-2031

Figure 27: U.S. Surface Sanitizer Market Incremental Opportunity, by Ingredient Type, 2021-2031

Figure 28: U.S. Surface Sanitizer Market Value, by End-use, US$ Bn, 2023-2031

Figure 29: U.S. Surface Sanitizer Market Volume, by End-use, Million Units, 2023-2031

Figure 30: U.S. Surface Sanitizer Market Incremental Opportunity, by End-use, 2021-2031

Figure 31: U.S. Surface Sanitizer Market Value, by Distribution Channel, US$ Bn, 2023-2031

Figure 32: U.S. Surface Sanitizer Market Volume, by Distribution Channel, Million Units, 2023-2031

Figure 33: U.S. Surface Sanitizer Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 34: Canada Surface Sanitizer Market Value, by Product Type, US$ Bn, 2023-2031

Figure 35: Canada Surface Sanitizer Market Volume, by Product Type, Million Units, 2023-2031

Figure 36: Canada Surface Sanitizer Market Incremental Opportunity, by Product Type, 2021-2031

Figure 37: Canada Surface Sanitizer Market Value, by Category, US$ Bn, 2023-2031

Figure 38: Canada Surface Sanitizer Market Volume, by Category, Million Units, 2023-2031

Figure 39: Canada Surface Sanitizer Market Incremental Opportunity, by Category, 2021-2031

Figure 40: Canada Surface Sanitizer Market Value, by Ingredient Type, US$ Bn, 2023-2031

Figure 41: Canada Surface Sanitizer Market Volume, by Ingredient Type, Million Units, 2023-2031

Figure 42: Canada Surface Sanitizer Market Incremental Opportunity, by Ingredient Type, 2021-2031

Figure 43: Canada Surface Sanitizer Market Value, by End-use, US$ Bn, 2023-2031

Figure 44: Canada Surface Sanitizer Market Volume, by End-use, Million Units, 2023-2031

Figure 45: Canada Surface Sanitizer Market Incremental Opportunity, by End-use, 2021-2031

Figure 46: Canada Surface Sanitizer Market Value, by Distribution Channel, US$ Bn, 2023-2031

Figure 47: Canada Surface Sanitizer Market Volume, by Distribution Channel, Million Units, 2023-2031

Figure 48: Canada Surface Sanitizer Market Incremental Opportunity, by Distribution Channel, 2021-2031