Reports

Reports

Analysts’ Viewpoint

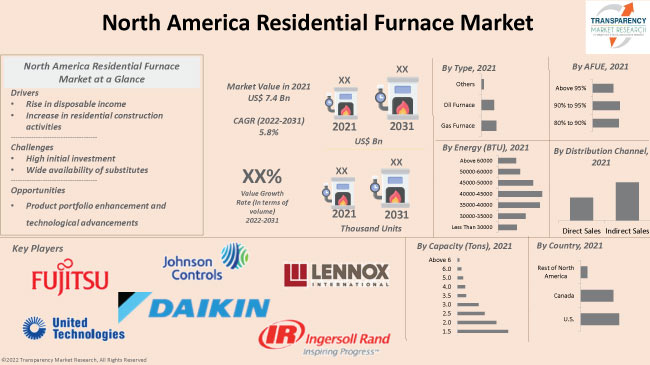

Rise in disposable income of the people and increase in residential construction activities are significant North America residential furnace market growth drivers. Apart from heating the room, residential furnaces improve indoor air quality. Furthermore, they are affordable and safe to use. These factors are also fueling market expansion.

Demand for hybrid furnace is rising due to its comfort and efficiency. Electric furnace is projected to gain significant market share in the next few years, due to its increased energy efficiency and low maintenance cost. Key manufacturers are following North America residential furnace market trends to gain revenue benefits.

Furnace is a type of central heating unit that is used to warm homes, buildings, and other structures. It uses gas, electricity, or induction to generate energy. Natural gas, oil, and electric are the three major types of furnaces.

Electric furnace is an economically and environmentally efficient system that is used in residential spaces. Oil & gas home furnaces are primarily used in North America. Central furnace efficiency is measured by the annual fuel utilization efficiency (AFUE).

According to the HVAC industry statistics, an AFUE of 90% means that 90% of the energy in the fuel becomes heat for the home, while the other 10% escapes up the chimney and elsewhere.

North America residential furnace business growth appears promising during the forecast period, owing to the increase in demand for these furnaces among residential dwellings in cold regions such as Canada and North Dakota.

Residential construction activities are rising in the U.S. and Canada, owing to the increase in population. Growth in residential construction activities is expected to accelerate the usage of household furnaces during the forecast period. This is driving market progress in North America.

The re-elected Liberal Party of Canada is expected to boost investments in housing and renewable energy projects in the near future. As part of the election manifesto, the party announced a plan to invest CAD 2.7 Bn (US$ 2.1 Bn) in building or repairing 1.4 million affordable housing units over the next four years (2021-2025). It also aims to reduce greenhouse gas emissions between 40%-45% of the 2005 levels before the end of this decade.

BMO Financial Group, a Canada-based financial services provider, announced a commitment of CAD 12 Bn (US$ 9.4 Bn) until 2030 in order to support affordable housing construction across the country.

Construction is booming for all types of housing (from single-family homes to high-rise condominiums) in North America owing to the low interest rates and rise in demand for space. Furthermore, the average daily temperature in Canada is around -5.6°C. As a result, demand for heating products is high in the country. These factors are expected to create lucrative opportunities for residential furnace market players during the forecast period.

Increase in disposable income has resulted in an improvement in standard of living in North America. As a result, people are open to adopting innovative products to make houses more comfortable for living. Thus, demand for residential furnaces is increasing in the region. This is expected to positively impact the North America residential furnace market share in the near future.

Among all HVAC systems, furnace is the most preferred heating solution due to its affordability, efficiency, clean burning, and quality comfort. Drastic fall in temperatures and rise in usage of heating equipment are anticipated to fuel market statistics in the near future.

As per the North America residential furnace industry analysis report, the U.S. is expected to dominate during the forecast period. Modern homes in the country are equipped with heaters and furnaces to keep the interior warm. Increase in adoption of heating devices due to the cold climate and presence of numerous manufacturers are contributing to market growth in the U.S.

The residential furnace business in Canada is likely to expand at the fastest CAGR during the forecast period, owing to the cold weather, technological advancements, and increase in disposable income of the people in the country.

According to the North America residential furnaces market analysis report, key players are investing significantly in comprehensive research and development activities, primarily to introduce innovative products. North America residential furnace market competitive strategies include expansion of product portfolios and mergers and acquisitions.

Carrier Global Corporation, Daikin Industries, Ltd., Fujitsu General Limited, Goodman Manufacturing, Ingersoll-Rand plc, Johnson Controls, Inc., Lennox International Inc., Nortek Global HVAC LLC, Trane Technologies plc, United Technologies Corporation are the prominent manufacturers operating in the market.

Key players have been profiled in the North America residential furnace market research report based on parameters such as product portfolio, business strategies, business segments, company overview, financial overview, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 7.4 Bn |

|

Market Forecast Value in 2031 |

US$ 12.9 Bn |

|

Growth Rate (CAGR) |

5.8% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

Includes cross segment analysis at regional as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Region Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 7.4 Bn in 2021.

The CAGR is projected to be 5.8% from 2022 to 2031.

Rise in disposable income of the people and increase in residential construction activities.

The segment accounted for significant share in 2021.

Canada is likely to be a more attractive country for vendors in the near future.

Carrier Global Corporation, Daikin Industries, Ltd., Fujitsu General Limited, Goodman Manufacturing, Johnson Controls, Inc., Lennox International Inc., Nortek North America HVAC LLC, Trane Technologies plc, and United Technologies Corporation.

1. Preface

1.1. Market Definitions and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Supply Side

5.3.2. Demand Side

5.4. Key Market Indicators

5.5. Porter’s Five Forces Analysis

5.6. Value Chain Analysis

5.7. Industry SWOT Analysis

5.8. Technological Overview Analysis

5.9. Standards and Regulation

5.10. North America Residential Furnace Market Analysis and Forecast, 2017 - 2031

5.10.1. Market Value Projections (US$ Mn)

5.10.2. Market Volume Projections (Thousand Units)

6. North America Residential Furnace Market Analysis and Forecast, by Type

6.1. Residential Furnace Market (US$ Mn and Thousand Units), by Type, 2017 - 2031

6.1.1. Gas Furnace

6.1.2. Oil Furnace

6.1.3. Others

6.2. Incremental Opportunity, by Type

7. North America Residential Furnace Market Analysis and Forecast, by AFUE

7.1. Residential Furnace Market (US$ Mn and Thousand Units), by AFUE, 2017 - 2031

7.1.1. 80% to 90%

7.1.2. 90% to 95%

7.1.3. Above 95%

7.2. Incremental Opportunity, by AFUE

8. North America Residential Furnace Market Analysis and Forecast, by Energy (BTU)

8.1. Residential Furnace Market (US$ Mn and Thousand Units), by Energy (BTU), 2017 - 2031

8.1.1. Below 30,000

8.1.2. 30,000 to 35,000

8.1.3. 35,000 to 40,000

8.1.4. 40,000 to 45,000

8.1.5. 45,000 to 50,000

8.1.6. 50,000 to 60,000

8.1.7. Above 60,000

8.2. Incremental Opportunity, by Energy (BTU)

9. North America Residential Furnace Market Analysis and Forecast, by Capacity (Tons)

9.1. Residential Furnace Market (US$ Mn and Thousand Units), by Capacity (Tons), 2017 - 2031

9.1.1. 1.5

9.1.2. 2

9.1.3. 2.5

9.1.4. 3

9.1.5. 3.5

9.1.6. 4

9.1.7. 5

9.1.8. 6

9.1.9. Above 6

9.2. Incremental Opportunity, by Capacity (Tons)

10. North America Residential Furnace Market Analysis and Forecast, by Distribution Channel

10.1. Residential Furnace Market (US$ Mn and Thousand Units), by Distribution Channel, 2017 - 2031

10.1.1. Direct Sales

10.1.2. Indirect Sales

10.2. Incremental Opportunity, by Distribution Channel

11. North America Residential Furnace Market Analysis and Forecast, by Region

11.1. Residential Furnace Market (US$ Mn and Thousand Units), by Region, 2017 - 2031

11.1.1. North America

11.1.1.1. U.S.

11.1.1.2. Canada

11.1.1.3. Rest of North America

11.2. Incremental Opportunity, by Region

12. U.S. Residential Furnace Market Analysis and Forecast

12.1. Country Snapshot

12.2. Key Trend Analysis

12.3. Price Trend Analysis

12.3.1. Weighted Average Selling Price (US$)

12.4. Key Supplier Analysis

12.5. Residential Furnace Market (US$ Mn and Thousand Units), by Type, 2017 - 2031

12.5.1. Gas Furnace

12.5.2. Oil Furnace

12.5.3. Others

12.6. Residential Furnace Market (US$ Mn and Thousand Units), by AFUE, 2017 - 2031

12.6.1. 80% to 90%

12.6.2. 90% to 95%

12.6.3. Above 95%

12.7. Residential Furnace Market (US$ Mn and Thousand Units), by Energy (BTU), 2017 - 2031

12.7.1. Below 30,000

12.7.2. 30,000 to 35,000

12.7.3. 35,000 to 40,000

12.7.4. 40,000 to 45,000

12.7.5. 45,000 to 50,000

12.7.6. 50,000 to 60,000

12.7.7. Above 60,000

12.8. Residential Furnace Market (US$ Mn and Thousand Units), by Capacity (Tons), 2017 - 2031

12.8.1. 1.5

12.8.2. 2

12.8.3. 2.5

12.8.4. 3

12.8.5. 3.5

12.8.6. 4

12.8.7. 5

12.8.8. 6

12.8.9. Above 6

12.9. Residential Furnace Market (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

12.9.1. Direct Sales

12.9.2. Indirect Sales

12.10. Incremental Opportunity Analysis

13. Canada Residential Furnace Market Analysis and Forecast

13.1. Country Snapshot

13.2. Key Trend Analysis

13.3. Price Trend Analysis

13.3.1. Weighted Average Selling Price (US$)

13.4. Key Supplier Analysis

13.5. Residential Furnace Market (US$ Mn and Thousand Units), by Type, 2017 - 2031

13.5.1. Gas Furnace

13.5.2. Oil Furnace

13.5.3. Others

13.6. Residential Furnace Market (US$ Mn and Thousand Units), by AFUE, 2017 - 2031

13.6.1. 80% to 90%

13.6.2. 90% to 95%

13.6.3. Above 95%

13.7. Residential Furnace Market (US$ Mn and Thousand Units), by Energy (BTU), 2017 - 2031

13.7.1. Below 30,000

13.7.2. 30,000 to 35,000

13.7.3. 35,000 to 40,000

13.7.4. 40,000 to 45,000

13.7.5. 45,000 to 50,000

13.7.6. 50,000 to 60,000

13.7.7. Above 60,000

13.8. Residential Furnace Market (US$ Mn and Thousand Units), by Capacity (Tons), 2017 - 2031

13.8.1. 1.5

13.8.2. 2

13.8.3. 2.5

13.8.4. 3

13.8.5. 3.5

13.8.6. 4

13.8.7. 5

13.8.8. 6

13.8.9. Above 6

13.9. Residential Furnace Market (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

13.9.1. Direct Sales

13.9.2. Indirect Sales

13.10. Incremental Opportunity Analysis

14. Competition Landscape

14.1. Market Player – Competition Dashboard

14.2. Market Revenue Share Analysis (%), (2021)

14.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

14.3.1. Carrier North America Corporation

14.3.1.1. Company Overview

14.3.1.2. Sales Area/Geographical Presence

14.3.1.3. Revenue

14.3.1.4. Strategy & Business Overview

14.3.2. Daikin Industries, Ltd.

14.3.2.1. Company Overview

14.3.2.2. Sales Area/Geographical Presence

14.3.2.3. Revenue

14.3.2.4. Strategy & Business Overview

14.3.3. Fujitsu General Limited

14.3.3.1. Company Overview

14.3.3.2. Sales Area/Geographical Presence

14.3.3.3. Revenue

14.3.3.4. Strategy & Business Overview

14.3.4. Goodman Manufacturing

14.3.4.1. Company Overview

14.3.4.2. Sales Area/Geographical Presence

14.3.4.3. Revenue

14.3.4.4. Strategy & Business Overview

14.3.5. Ingersoll-Rand plc

14.3.5.1. Company Overview

14.3.5.2. Sales Area/Geographical Presence

14.3.5.3. Revenue

14.3.5.4. Strategy & Business Overview

14.3.6. Johnson Controls, Inc.

14.3.6.1. Company Overview

14.3.6.2. Sales Area/Geographical Presence

14.3.6.3. Revenue

14.3.6.4. Strategy & Business Overview

14.3.7. Lennox International Inc.

14.3.7.1. Company Overview

14.3.7.2. Sales Area/Geographical Presence

14.3.7.3. Revenue

14.3.7.4. Strategy & Business Overview

14.3.8. Nortek North America HVAC LLC

14.3.8.1. Company Overview

14.3.8.2. Sales Area/Geographical Presence

14.3.8.3. Revenue

14.3.8.4. Strategy & Business Overview

14.3.9. Trane Technologies plc

14.3.9.1. Company Overview

14.3.9.2. Sales Area/Geographical Presence

14.3.9.3. Revenue

14.3.9.4. Strategy & Business Overview

14.3.10. United Technologies

14.3.10.1. Company Overview

14.3.10.2. Sales Area/Geographical Presence

14.3.10.3. Revenue

14.3.10.4. Strategy & Business Overview

15. Key Takeaways

15.1. Identification of Potential Market Spaces

15.1.1. By Type

15.1.2. By AFUE

15.1.3. By Energy (BTU)

15.1.4. By Capacity (Tons)

15.1.5. By Distribution Channel

15.1.6. By Country

15.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: North America Residential Furnace Market Value (US$ Mn) Forecast, 2017-2031, by Type

Table 2: North America Residential Furnace Market Volume (Thousand Units) Forecast, 2017-2031, by Type

Table 3: North America Residential Furnace Market Value (US$ Mn) Forecast, 2017-2031, by AFUE

Table 4: North America Residential Furnace Market Volume (Thousand Units) Forecast, 2017-2031, by AFUE

Table 5: North America Residential Furnace Market Value (US$ Mn) Forecast, 2017-2031, By Energy (BTU)

Table 6: North America Residential Furnace Market Volume (Thousand Units) Forecast, 2017-2031, By Energy (BTU)

Table 7: North America Residential Furnace Market Value (US$ Mn) Forecast, 2017-2031, By Capacity (Tons)

Table 8: North America Residential Furnace Market Volume (Thousand Units) Forecast, 2017-2031, By Capacity (Tons)

Table 9: North America Residential Furnace Market Value (US$ Mn) Forecast, 2017-2031, By Distribution Channel

Table 10: North America Residential Furnace Market Volume (Thousand Units) Forecast, 2017-2031, By Distribution Channel

Table 11: North America Residential Furnace Market Value (US$ Mn) Forecast, 2017-2031, By Region

Table 12: North America Residential Furnace Market Volume (Thousand Units) Forecast, 2017-2031, By Region

Table 13: U.S. Residential Furnace Market Value (US$ Mn) Forecast, 2017-2031, by Type

Table 14: U.S. Residential Furnace Market Volume (Thousand Units) Forecast, 2017-2031, by Type

Table 15: U.S. Residential Furnace Market Value (US$ Mn) Forecast, 2017-2031, by AFUE

Table 16: U.S. Residential Furnace Market Volume (Thousand Units) Forecast, 2017-2031, by AFUE

Table 17: U.S. Residential Furnace Market Value (US$ Mn) Forecast, 2017-2031, By Energy (BTU)

Table 18: U.S. Residential Furnace Market Volume (Thousand Units) Forecast, 2017-2031, By Energy (BTU)

Table 19: U.S. Residential Furnace Market Value (US$ Mn) Forecast, 2017-2031, By Capacity (Tons)

Table 20: U.S. Residential Furnace Market Volume (Thousand Units) Forecast, 2017-2031, By Capacity (Tons)

Table 21: U.S. Residential Furnace Market Value (US$ Mn) Forecast, 2017-2031, By Distribution Channel

Table 22: U.S. Residential Furnace Market Volume (Thousand Units) Forecast, 2017-2031, By Distribution Channel

Table 23: U.S. Residential Furnace Market Value (US$ Mn) Forecast, 2017-2031, By Country

Table 24: U.S. Residential Furnace Market Volume (Thousand Units) Forecast, 2017-2031, By Country

Table 25: Canada Residential Furnace Market Value (US$ Mn) Forecast, 2017-2031, by Type

Table 26: Canada Residential Furnace Market Volume (Thousand Units) Forecast, 2017-2031, by Type

Table 27: Canada Residential Furnace Market Value (US$ Mn) Forecast, 2017-2031, by AFUE

Table 28: Canada Residential Furnace Market Volume (Thousand Units) Forecast, 2017-2031, by AFUE

Table 29: Canada Residential Furnace Market Value (US$ Mn) Forecast, 2017-2031, By Energy (BTU)

Table 30: Canada Residential Furnace Market Volume (Thousand Units) Forecast, 2017-2031, By Energy (BTU)

Table 31: Canada Residential Furnace Market Value (US$ Mn) Forecast, 2017-2031, By Capacity (Tons)

Table 32: Canada Residential Furnace Market Volume (Thousand Units) Forecast, 2017-2031, By Capacity (Tons)

Table 33: Canada Residential Furnace Market Value (US$ Mn) Forecast, 2017-2031, By Distribution Channel

Table 34: Canada Residential Furnace Market Volume (Thousand Units) Forecast, 2017-2031, By Distribution Channel

Table 35: Canada Residential Furnace Market Value (US$ Mn) Forecast, 2017-2031, By Country

Table 36: Canada Residential Furnace Market Volume (Thousand Units) Forecast, 2017-2031, By Country

List of Figures

Figure 1: North America Residential Furnace Market Value (US$ Mn) Forecast, 2017-2031, by Type

Figure 2: North America Residential Furnace Market Volume (Thousand Units) Forecast, 2017-2031, by Type

Figure 3: North America Residential Furnace Market Incremental Opportunity (US$ Mn) Forecast, 2022-2031, by Type

Figure 4: North America Residential Furnace Market Value (US$ Mn) Forecast, 2017-2031, by AFUE

Figure 5: North America Residential Furnace Market Volume (Thousand Units) Forecast, 2017-2031, by AFUE

Figure 6: North America Residential Furnace Market Incremental Opportunity (US$ Mn) Forecast, 2022-2031, by AFUE

Figure 7: North America Residential Furnace Market Value (US$ Mn) Forecast, 2017-2031, By Energy (BTU)

Figure 8: North America Residential Furnace Market Volume (Thousand Units) Forecast, 2017-2031, By Energy (BTU)

Figure 9: North America Residential Furnace Market Incremental Opportunity (US$ Mn) Forecast, 2022-2031, By Energy (BTU)

Figure 10: North America Residential Furnace Market Value (US$ Mn) Forecast, 2017-2031, By Capacity (Tons)

Figure 11: North America Residential Furnace Market Volume (Thousand Units) Forecast, 2017-2031, By Capacity (Tons)

Figure 12: North America Residential Furnace Market Incremental Opportunity (US$ Mn) Forecast, 2022-2031, By Capacity (Tons)

Figure 13: North America Residential Furnace Market Value (US$ Mn) Forecast, 2017-2031, By Distribution Channel

Figure 14: North America Residential Furnace Market Volume (Thousand Units) Forecast, 2017-2031, By Distribution Channel

Figure 15: North America Residential Furnace Market Incremental Opportunity (US$ Mn) Forecast, 2022-2031, By Distribution Channel

Figure 16: North America Residential Furnace Market Value (US$ Mn) Forecast, 2017-2031, By Region

Figure 17: North America Residential Furnace Market Volume (Thousand Units) Forecast, 2017-2031, By Region

Figure 18: North America Residential Furnace Market Incremental Opportunity (US$ Mn) Forecast, 2022-2031, By Region

Figure 19: North America Residential Furnace Market Value (US$ Mn) Forecast, 2017-2031, by Type

Figure 20: North America Residential Furnace Market Volume (Thousand Units) Forecast, 2017-2031, by Type

Figure 21: North America Residential Furnace Market Incremental Opportunity (US$ Mn) Forecast, 2022-2031, by Type

Figure 22: North America Residential Furnace Market Value (US$ Mn) Forecast, 2017-2031, by AFUE

Figure 23: North America Residential Furnace Market Volume (Thousand Units) Forecast, 2017-2031, by AFUE

Figure 24: North America Residential Furnace Market Incremental Opportunity (US$ Mn) Forecast, 2022-2031, by AFUE

Figure 25: North America Residential Furnace Market Value (US$ Mn) Forecast, 2017-2031, By Energy (BTU)

Figure 26: North America Residential Furnace Market Volume (Thousand Units) Forecast, 2017-2031, By Energy (BTU)

Figure 27: North America Residential Furnace Market Incremental Opportunity (US$ Mn) Forecast, 2022-2031, By Energy (BTU)

Figure 28: North America Residential Furnace Market Value (US$ Mn) Forecast, 2017-2031, By Capacity (Tons)

Figure 29: North America Residential Furnace Market Volume (Thousand Units) Forecast, 2017-2031, By Capacity (Tons)

Figure 30: North America Residential Furnace Market Incremental Opportunity (US$ Mn) Forecast, 2022-2031, By Capacity (Tons)

Figure 31: North America Residential Furnace Market Value (US$ Mn) Forecast, 2017-2031, By Distribution Channel

Figure 32: North America Residential Furnace Market Volume (Thousand Units) Forecast, 2017-2031, By Distribution Channel

Figure 33: North America Residential Furnace Market Incremental Opportunity (US$ Mn) Forecast, 2022-2031, By Distribution Channel

Figure 34: North America Residential Furnace Market Value (US$ Mn) Forecast, 2017-2031, By Country

Figure 35: North America Residential Furnace Market Volume (Thousand Units) Forecast, 2017-2031, By Country

Figure 36: North America Residential Furnace Market Incremental Opportunity (US$ Mn) Forecast, 2022-2031, By Country

Figure 37: U.S. Residential Furnace Market Value (US$ Mn) Forecast, 2017-2031, by Type

Figure 38: U.S. Residential Furnace Market Volume (Thousand Units) Forecast, 2017-2031, by Type

Figure 39: U.S. Residential Furnace Market Incremental Opportunity (US$ Mn) Forecast, 2022-2031, by Type

Figure 40: U.S. Residential Furnace Market Value (US$ Mn) Forecast, 2017-2031, by AFUE

Figure 41: U.S. Residential Furnace Market Volume (Thousand Units) Forecast, 2017-2031, by AFUE

Figure 42: U.S. Residential Furnace Market Incremental Opportunity (US$ Mn) Forecast, 2022-2031, by AFUE

Figure 43: U.S. Residential Furnace Market Value (US$ Mn) Forecast, 2017-2031, By Energy (BTU)

Figure 44: U.S. Residential Furnace Market Volume (Thousand Units) Forecast, 2017-2031, By Energy (BTU)

Figure 45: U.S. Residential Furnace Market Incremental Opportunity (US$ Mn) Forecast, 2022-2031, By Energy (BTU)

Figure 46: U.S. Residential Furnace Market Value (US$ Mn) Forecast, 2017-2031, By Capacity (Tons)

Figure 47: U.S. Residential Furnace Market Volume (Thousand Units) Forecast, 2017-2031, By Capacity (Tons)

Figure 48: U.S. Residential Furnace Market Incremental Opportunity (US$ Mn) Forecast, 2022-2031, By Capacity (Tons)

Figure 49: U.S. Residential Furnace Market Value (US$ Mn) Forecast, 2017-2031, By Distribution Channel

Figure 50: U.S. Residential Furnace Market Volume (Thousand Units) Forecast, 2017-2031, By Distribution Channel

Figure 51: U.S. Residential Furnace Market Incremental Opportunity (US$ Mn) Forecast, 2022-2031, By Distribution Channel

Figure 52: U.S. Residential Furnace Market Value (US$ Mn) Forecast, 2017-2031, By Country

Figure 53: U.S. Residential Furnace Market Volume (Thousand Units) Forecast, 2017-2031, By Country

Figure 54: U.S. Residential Furnace Market Incremental Opportunity (US$ Mn) Forecast, 2022-2031, By Country

Figure 55: Canada Residential Furnace Market Value (US$ Mn) Forecast, 2017-2031, by Type

Figure 56: Canada Residential Furnace Market Volume (Thousand Units) Forecast, 2017-2031, by Type

Figure 57: Canada Residential Furnace Market Incremental Opportunity (US$ Mn) Forecast, 2022-2031, by Type

Figure 58: Canada Residential Furnace Market Value (US$ Mn) Forecast, 2017-2031, by AFUE

Figure 59: Canada Residential Furnace Market Volume (Thousand Units) Forecast, 2017-2031, by AFUE

Figure 60: Canada Residential Furnace Market Incremental Opportunity (US$ Mn) Forecast, 2022-2031, by AFUE

Figure 61: Canada Residential Furnace Market Value (US$ Mn) Forecast, 2017-2031, By Energy (BTU)

Figure 62: Canada Residential Furnace Market Volume (Thousand Units) Forecast, 2017-2031, By Energy (BTU)

Figure 63: Canada Residential Furnace Market Incremental Opportunity (US$ Mn) Forecast, 2022-2031, By Energy (BTU)

Figure 64: Canada Residential Furnace Market Value (US$ Mn) Forecast, 2017-2031, By Capacity (Tons)

Figure 65: Canada Residential Furnace Market Volume (Thousand Units) Forecast, 2017-2031, By Capacity (Tons)

Figure 66: Canada Residential Furnace Market Incremental Opportunity (US$ Mn) Forecast, 2022-2031, By Capacity (Tons)

Figure 67: Canada Residential Furnace Market Value (US$ Mn) Forecast, 2017-2031, By Distribution Channel

Figure 68: Canada Residential Furnace Market Volume (Thousand Units) Forecast, 2017-2031, By Distribution Channel

Figure 69: Canada Residential Furnace Market Incremental Opportunity (US$ Mn) Forecast, 2022-2031, By Distribution Channel

Figure 70: Canada Residential Furnace Market Value (US$ Mn) Forecast, 2017-2031, By Country

Figure 71: Canada Residential Furnace Market Volume (Thousand Units) Forecast, 2017-2031, By Country

Figure 72: Canada Residential Furnace Market Incremental Opportunity (US$ Mn) Forecast, 2022-2031, By Country