Reports

Reports

Government programs to support energy conservation, disaster resilience, and mandated building codes are causing the pre-engineered steel building uptake in North America, along with the increased requirements for cheap and green construction technologies.

The building sector is one of the leading contributors to global energy consumption and CO2 emissions. North America's governments have recognized the tangible efficiencies of green building materials and construction methods by creating policies like the National Building Code of Canada to promote green building construction. For several reasons, pre-engineered steel buildings provide an ideal solution for ecologically efficient construction; their recyclability, and minimal construction waste, along with their lower CO2 emissions than conventional materials.

Governments are also offering tax credits, grants, and subsidies to promote the uptake of energy-efficient, low-impact construction. The monetary benefits of these incentives provide another added benefit for developers and builders to choose sustainable buildings such as pre-engineered steel buildings.

As demand grows for cheap and easily scaled building solutions in North America, the pre-engineered steel building (PESB) market is emerging and expanding. Local, state, and national government policies seeking to increase the amount of affordable housing alongside rising urbanization and advanced technologies are helping in this regard.

Pre-engineered steel buildings represent a tailored, efficient form of construction process. Prefabricated steel components are built off-site and can be assembled on-site, cutting overall building time, cut labor costs, and waste. Thus, pre-engineered steel building are commonly accepted in the building delivery process when time, cost, and scalability are key factors.

Pre-engineered steel building steel sections are designed to be load bearing although they differ from heavy structural steel because their cross-sectional area is more compact. So for example, from a design standpoint, many pre-engineered steel building sections can be professional lightweight material that can still support/catalog significant amounts of weight designed in a factory building.

Building pre-engineered steel building is on the rise, and as the industry continues to respond to sustainability and Efficiency demands, in regard to energy-efficient applications, pre-engineered steel buildings offer effectiveness.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

Pre-engineered steel buildings are typically 20%-30% cheaper than traditional construction methods as they are optimized, mass produced, and build faster. There is a huge advantage in the form of cost-savings in using pre-engineered buildings (PEBs) as they are manufactured using standardized components.

PEBs are quicker to construct as well as cheaper, and they are appealing for commercial and industrial usage. In complying with the requirements for industrial building projects, time is a critical element. PEB components can be produced quickly on site after their offsite construction as a factory pre-fabricated product. This efficiency greatly decreases the time to get buildings completed. Companies are responding to increasing demand or addressing market opportunities through expansion and readying for operations in a far shorter time line due to the speed of construction that PEBs can offer.

Pre-engineered steel buildings best meet the requirements for strong structural support for industrial buildings without excessive weight due to their high strength-to-weight ratio. This enables the most usable floor area and storage capacity in warehouses and production facilities through the provision of large open spaces. Increasing the need for pre-engineered steel buildings in construction projects.

Sustainable and green buildings have a powerful impact on the acceptance of PEB, especially as PEB may be utilized for energy efficiency. It utilizes a good amount of recycled materials and generates very little construction waste. Sustainability-based building is becoming increasing important in terms of meeting objectives of environmental sustainability.

The precision, versatility, and efficiency associated with the construction of PEB has enhanced as a consequence of the advancement of design and engineering technologies and approaches, digital project management systems, and enhanced building design modelling software.

The steel in PEB is largely recyclable. So, minimizing the impacts of construction/demolition is generally an advantage of PEB. PEB is easily incorporated with energy saving design features such as passive natural lighting and insulation to help save on operational costs while lowering emissions.

The objective of sustainably built infrastructure is the minimization of energy consumption or greenhouse gas emissions over the life of a building or infrastructure. Pre-engineered steel buildings offer the potential for innovative designs using natural ventilation and lighting, energy efficiencies through heating, and air conditioning systems which all lead to lower energy consumption. Some of the latest innovations underway in the North America pre-engineered steel building marketplace are applications of innovative renewable energy technologies.

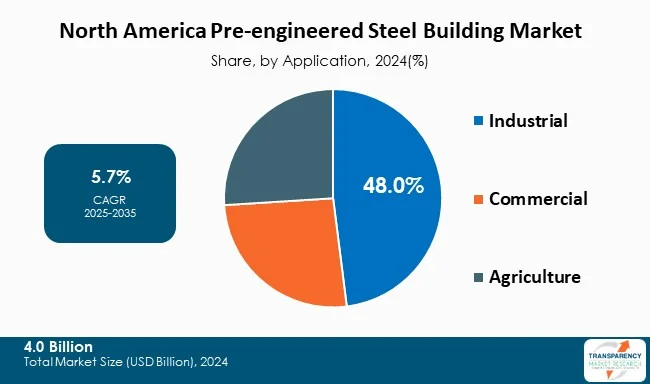

Pre-engineered metal buildings are generally more economical and provide design flexibility across all industry categories. Industrial buildings comprise the largest and fastest growing application group. This group includes warehouses, plants, and storage facilities and is vital in logistics and supply chains. There has been an explosion with e-Commerce, and companies have been searching for large spaces to distribute and fulfill orders. There is also a continual demand for new modern, low maintenance, and longer-lasting buildings and structures.

The commercial buildings category also contributes to significant growth of the pre-engineered steel building industry. This category includes an array of buildings including shopping malls and office buildings; showrooms; recreation centers. More owners and developers are choosing pre-engineered metal buildings, as they are a faster build, subject to lower labor rates, and have space available for future growth.

All in all, pre-engineered metal buildings are becoming more popular in all sectors of developing buildings as they are typically more economical and provide great design flexibility.

| Attribute | Detail |

|---|---|

| Leading Region |

|

The United States is the dominant segment in North America pre-engineered steel construction market because of a well-established construction industry, advancements in technology, and increasing interest in cost-effective and sustainable construction solutions. The use of pre-engineered steel buildings is used across many sectors in the U.S. such as industrial, commercial, agricultural, and institutional to name a few. They are being touted for their efficiencies, durability and speed in building.

The U.S and by extension Canada, are focusing heavily on infrastructure renovation through investments in warehousing, manufacturing and logistics establishments, contributing factors to the push for more pre-engineered steel structures. The benefits of using pre-engineered steel structures include design flexibility, shorter timeline to buildings, and lower overall project costs, making it a beneficial option for both privately funded developers and government funded projects.

The U.S. is home to many established manufacturers and suppliers and is experiencing a boom in the use of brand new products that are ever-changing and customized for a wide variety of construction needs. Whether Pre-engineered steel structures would work for green building practices or energy efficient construction; the preference for steel structures are innumerable because they can be recyclable and friendly on the environment.

The growth of friendly building codes and capabilities of technology such as Building Information Modeling (BIM) and automation, will only accelerate the use of pre-engineered steel buildings. The U.S. is becoming a leader through its infrastructure, economy of scale, and commitment to sustainability.

Al Jaber Steel Co., Al Mana Group, FRAMECAD Limited, Scottsdale Construction Systems Ltd., The Steel Network (TSN), Aegis Metal Framing LLC, ClarkDietrich Building Systems, JFE Steel Corporation, Nippon Steel Corporation, and ArcelorMittal are the prominent North America pre-engineered steel building market manufacturers.

Each of these companies has been profiled in North America pre-engineered steel building market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 (Base Year) | US$ 4.0 Bn |

| Market Forecast Value in 2035 | US$ 7.5 Bn |

| Growth Rate (CAGR 2025 to 2035) | 5.7% |

| Forecast Period | 2025-2035 |

| Historical data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value and Thousand Units for Volume |

| Market Analysis | Global qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape | Market Player – Competition Dashboard and Revenue Share Analysis 2024 Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue , Strategy & Business Overview) |

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Region Covered |

|

| Countries Covered |

|

| Company Profiles |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

North America pre-engineered steel building market was valued at US$ 4.0 Bn in 2024

North America pre-engineered steel building industry is projected to reach more than US$ 7.5 Bn by the end of 2035

Speedy construction and cost efficiency, and surge in focus on sustainable and resilient infrastructure are some of the factors driving the expansion of North America pre-engineered steel building market.

The CAGR is anticipated to be 5.7% from 2025 to 2035

Al Jaber Steel Co., Al Mana Group, FRAMECAD Limited, Scottsdale Construction Systems Ltd., The Steel Network (TSN), Aegis Metal Framing LLC, ClarkDietrich Building Systems, JFE Steel Corporation, Nippon Steel Corporation, and ArcelorMittal are some of the leading companies operating in the North America Pre-engineered Steel Buildings.

Table 1: North America Pre-engineered Steel Building Market Value (US$ Mn) Projection, 2020 to 2035 By Frame

Table 2: North America Pre-engineered Steel Building Market Volume (Thousand Units) Projection, 2020 to 2035 By Frame

Table 3: North America Pre-engineered Steel Building Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 4: North America Pre-engineered Steel Building Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 5: North America Pre-engineered Steel Building Market Value (US$ Mn) Projection, 2020 to 2035 By Country

Table 6: North America Pre-engineered Steel Building Market Volume (Thousand Units) Projection, 2020 to 2035 By Country

Table 7: U.S. Pre-engineered Steel Building Market Value (US$ Mn) Projection, 2020 to 2035 By Frame

Table 8: U.S. Pre-engineered Steel Building Market Volume (Thousand Units) Projection, 2020 to 2035 By Frame

Table 9: U.S. Pre-engineered Steel Building Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 10: U.S. Pre-engineered Steel Building Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 11: Canada Pre-engineered Steel Building Market Value (US$ Mn) Projection, 2020 to 2035 By Frame

Table 12: Canada Pre-engineered Steel Building Market Volume (Thousand Units) Projection, 2020 to 2035 By Frame

Table 13: Canada Pre-engineered Steel Building Market Value (US$ Mn) Projection, 2020 to 2035 By Application

Table 14: Canada Pre-engineered Steel Building Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Figure 1: North America Pre-engineered Steel Building Market Value (US$ Mn) Projection, By Frame 2020 to 2035

Figure 2: North America Pre-engineered Steel Building Market Volume (Thousand Units) Projection, By Frame 2020 to 2035

Figure 3: North America Pre-engineered Steel Building Market Incremental Opportunities (US$ Mn) Forecast, By Frame 2025 to 2035

Figure 4: North America Pre-engineered Steel Building Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 5: North America Pre-engineered Steel Building Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 6: North America Pre-engineered Steel Building Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 7: North America Pre-engineered Steel Building Market Value (US$ Mn) Projection, By Country 2020 to 2035

Figure 8: North America Pre-engineered Steel Building Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 9: North America Pre-engineered Steel Building Market Incremental Opportunities (US$ Mn) Forecast, By Country 2025 to 2035

Figure 10: U.S. Pre-engineered Steel Building Market Value (US$ Mn) Projection, By Frame 2020 to 2035

Figure 11: U.S. Pre-engineered Steel Building Market Volume (Thousand Units) Projection, By Frame 2020 to 2035

Figure 12: U.S. Pre-engineered Steel Building Market Incremental Opportunities (US$ Mn) Forecast, By Frame 2025 to 2035

Figure 13: U.S. Pre-engineered Steel Building Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 14: U.S. Pre-engineered Steel Building Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 15: U.S. Pre-engineered Steel Building Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035

Figure 16: Canada Pre-engineered Steel Building Market Value (US$ Mn) Projection, By Frame 2020 to 2035

Figure 17: Canada Pre-engineered Steel Building Market Volume (Thousand Units) Projection, By Frame 2020 to 2035

Figure 18: Canada Pre-engineered Steel Building Market Incremental Opportunities (US$ Mn) Forecast, By Frame 2025 to 2035

Figure 19: Canada Pre-engineered Steel Building Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 20: Canada Pre-engineered Steel Building Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 21: Canada Pre-engineered Steel Building Market Incremental Opportunities (US$ Mn) Forecast, By Application 2025 to 2035