Reports

Reports

Analysts’ Viewpoint on North America Oil Condition Monitoring Services Market Scenario

Participants in the North America oil condition monitoring services market are taking data-driven decisions before planning to expand their business activities in key revenue-generating industries such as energy and transportation post the pandemic. Eroding natural resources are affecting the growth rate of the North America oil condition monitoring services market. Hence, market players should take advantage of technological improvements in machines that help to use oil and lubricants responsibly. Since organizations have huge investments in assets and other machineries, the need of proper functioning of all assets is fueling the demand for oil condition monitoring services. Moreover, the integration of online and offline services is accelerating business and manufacturing operations.

The widespread application of oil condition monitoring services in automotive, utilities, and marine is creating stable revenue streams for market stakeholders.

Predictive maintenance activities are emerging as a driver for the growth of the North America oil condition monitoring services market. The burgeoning growth of the Industry 4.0 is providing impetus to predictive maintenance activities, which includes oil condition monitoring services. Predictive maintenance evaluates the condition of in-service equipment to estimate the maintenance period and early indicator for the machine downtime. This helps to minimize unplanned downtime in various operations.

After a slowdown due to the coronavirus outbreak, the economy of North America is recovering post the ongoing vaccination measures. The reopening of various end markets such as energy industry, transportation, and construction activities are contributing to the growth of the North America oil condition monitoring services market.

Stakeholders of the North America oil condition monitoring services market are reviving their supply chains to ensure business continuity. Business activities have been affected most where physical presence of human are most necessary. Major demand drivers for the market such as power, energy, and oil & gas is creating income sources for participants in the market landscape. Market stakeholders are witnessing a push and pull effect since in some regions oil prices are declining due to an oversupply of oil reserves. However, on the other hand, oil prices are soaring due to supply disruptions.

Offline lab procedures require routine screening and external lab research, which are potentially time consuming. Hence, market stakeholders are growing interest in online condition monitoring services to overcome the drawbacks of offline methods.

The delay in obtaining oil analysis from labs is hampering business activities in the market. Hence, participants in the market are turning toward online condition monitoring services.

The overuse or inappropriate use of energy and other resources such as oil can elevate carbon footprints & greenhouse gas emissions (GHGs). Global sustainability aspirations are helping to reduce the environmental carbon footprint. The wear and tear due to friction affects the performance of machines. Such findings are fueling the demand for oil products and contributing to the expansion of the North America oil condition monitoring services market.

Companies in the North America oil condition monitoring services market are increasing R&D in oil and lubricants to evaluate their chemical & physical properties based on their tribological application. This analysis helps to save gallons of oil and other natural resources every year, along with a decline in carbon emissions.

Industry 4.0 is significantly changing the North America oil condition monitoring services market landscape. The collaboration of online and offline services is generating incremental opportunities for market stakeholders. The integration of traditional laboratory analysis merged with data produced from online sensors is transforming business operations in the market. The proliferation of the Industrial Internet of Things (IIoT) network is emerging as a market driver.

Oil analysis in the future might not be limited to assessing the health of the lubricant or a specific component, but may play an integral role in optimizing manufacturing processes and remote monitoring of plants. Such trends are fueling the growth of the North America oil condition monitoring services market.

|

Attribute |

Detail |

|

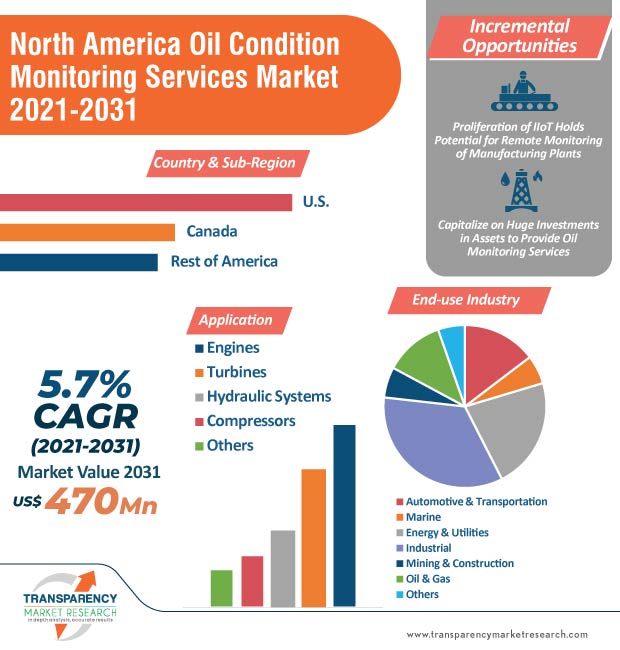

Market Size Value in 2020 |

US$ 260 Mn |

|

Market Forecast Value in 2031 |

US$ 470 Mn |

|

Growth Rate (CAGR) |

5.7% |

|

Forecast Period |

2021-2031 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes segment analysis at North America as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porters Five Forces analysis, supply chain analysis, parent industry overview, etc. |

|

Competitive Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Key Countries Covered |

|

|

Key Segments |

|

|

Key Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

The global Oil Condition Monitoring Services market is projected to reach US$ 1.4 Bn by 2027, at a CAGR of 7%.

Rising Adoption of Predictive Maintenance Among Industries: A Key Driver of Oil Condition Monitoring Services Market

Companies such as Exxon Mobil Corporation, Intertek Group plc, SGS SA, Bureau Veritas, and Veritas Petroleum Services fall under the star category.

North America contributes the largest market share in Oil Condition Monitoring Services market during the forecast period.

Industrial Internet of Things (IIoT) and Industry 4.0 revolution are adding great value to the development of Oil Condition Monitoring Services is expected to shape the market in the coming years

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

2. Assumptions and Research Methodology

2.1. Research Methodology

2.2. Assumption and Acronyms

3. Executive Summary

3.1. North America Oil Condition Monitoring Services Market Analysis and Forecast

3.2. Market Dynamics Snapshot

3.3. Competition Blueprint

4. Market Overview

4.1. Definition’s

4.2. Technology Roadmap Analysis

4.3. Forecast Factors

4.4. Market Dynamics

4.4.1. Supply Side Drivers

4.4.2. Demand Side Drivers

4.4.3. Restraints and Opportunities

4.5. Ecosystem

4.6. COVID-19 Impact Analysis

4.7. Market Opportunity Assessment

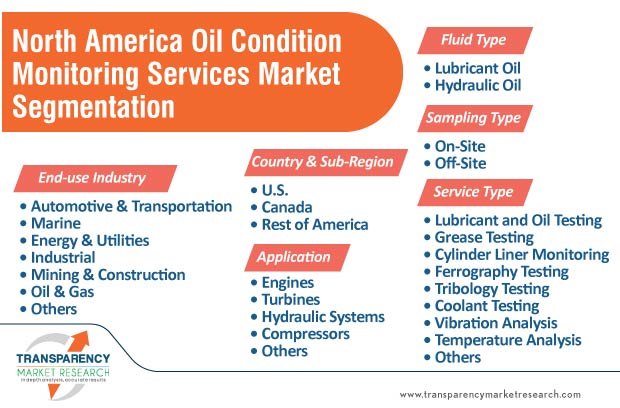

5. North America Oil Condition Monitoring Services, by Service Type

5.1. Oil Conditioning Monitoring Services Market Size (US$ Mn) Analysis & Forecast, by Service Type, 2017‒2031

5.1.1. Lubricant and Oil Testing

5.1.2. Grease Testing

5.1.3. Cylinder Liner Monitoring

5.1.4. Ferrography Testing

5.1.5. Tribology Testing

5.1.6. Coolant Testing

5.1.7. Vibration Data Analysis

5.1.8. Temperature Data Analysis

5.1.9. Others

5.2. North America Oil Conditioning Monitoring Services Market Attractiveness Analysis, by Service Type

6. North America Oil Conditioning Monitoring Services Market Analysis, by Sampling Type

6.1. North America Oil Conditioning Monitoring Services Market Size (US$ Mn) Analysis & Forecast, by Sampling Type, 2017‒2031

6.1.1. On-Site

6.1.2. Off-Site

6.2. North America Oil Conditioning Monitoring Services Market Attractiveness Analysis, by Sampling Type

7. North America Oil Conditioning Monitoring Services Market Analysis, by Fluid Type

7.1. North America Oil Conditioning Monitoring Services Market Size (US$ Mn) Analysis & Forecast, by Fluid Type, 2017‒2031

7.1.1. Lubricant Oil

7.1.2. Hydraulic Oil

7.2. North America Oil Conditioning Monitoring Services Market Attractiveness Analysis, by Fluid Type

8. North America Oil Conditioning Monitoring Services Market Analysis, by Applications

8.1. North America Oil Conditioning Monitoring Services Market Size (US$ Mn) Analysis & Forecast, by Applications, 2017‒2031

8.1.1. Engines

8.1.2. Turbines

8.1.3. Hydraulic Systems

8.1.4. Compressors

8.1.5. Others

8.2. North America Oil Conditioning Monitoring Services Market Attractiveness Analysis, by Applications

9. North America Oil Conditioning Monitoring Services Market Analysis, by End-use Industry

9.1. North America Oil Conditioning Monitoring Services Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017‒2031

9.1.1. Automotive & Transportation

9.1.2. Marine

9.1.3. Energy & Utilities

9.1.4. Industrial

9.1.5. Mining & Construction

9.1.6. Oil & Gas

9.1.7. Others

9.2. North America Oil Conditioning Monitoring Services Market Attractiveness Analysis, by End-use Industry

10. North America Oil Conditioning Monitoring Services Market Analysis and Forecast, by Country and Sub Region

10.1. North America Oil Conditioning Monitoring Services Market Size (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2017‒2031

10.1.1. The U.S

10.1.2. Canada

10.1.3. Rest of North America

10.2. North America Oil Conditioning Monitoring Services Market Attractiveness Analysis, by Country and Sub-region

11. U.S. Oil Conditioning Monitoring Services Market Analysis and Forecast

11.1. U.S. Oil Conditioning Monitoring Services Market Size (US$ Mn) Analysis & Forecast, by Service Type, 2017‒2031

11.1.1. Lubricant and Oil Testing

11.1.2. Grease Testing

11.1.3. Cylinder Liner Monitoring

11.1.4. Ferrography Testing

11.1.5. Tribology Testing

11.1.6. Coolant Testing

11.1.7. Vibration Data Analysis

11.1.8. Temperature Data Analysis

11.1.9. Others

11.2. U.S. Oil Conditioning Monitoring Services Market Size (US$ Mn) Analysis & Forecast, by Sampling Type, 2017‒2031

11.2.1. On-Site

11.2.2. Off-Site

11.3. U.S. Oil Conditioning Monitoring Services Market Size (US$ Mn) Analysis & Forecast, by Fluid Type, 2017‒2031

11.3.1. Lubricant Oil

11.3.2. Hydraulic Oil

11.4. U.S. Oil Conditioning Monitoring Services Market Size (US$ Mn) Analysis & Forecast, by Applications, 2017‒2031

11.4.1. Engines

11.4.2. Turbines

11.4.3. Hydraulic Systems

11.4.4. Compressors

11.4.5. Others

11.5. U.S. Oil Conditioning Monitoring Services Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017‒2031

11.5.1. Automotive & Transportation

11.5.2. Marine

11.5.3. Energy & Utilities

11.5.4. Industrial

11.5.5. Mining & Construction

11.5.6. Oil & Gas

11.5.7. Others

11.6. U.S. Oil Conditioning Monitoring Services Market Attractiveness Analysis

11.6.1. By Service Type

11.6.2. By Sampling Type

11.6.3. By Fluid Type

11.6.4. By Application

11.6.5. By End-use Industry

12. Canada Oil Conditioning Monitoring Services Market Analysis and Forecast

12.1. Canada Oil Conditioning Monitoring Services Market Size (US$ Mn) Analysis & Forecast, by Service Type, 2017‒2031

12.1.1. Lubricant and Oil Testing

12.1.2. Grease Testing

12.1.3. Cylinder Liner Monitoring

12.1.4. Ferrography Testing

12.1.5. Tribology Testing

12.1.6. Coolant Testing

12.1.7. Vibration Data Analysis

12.1.8. Temperature Data Analysis

12.1.9. Others

12.2. Canada Oil Conditioning Monitoring Services Market Size (US$ Mn) Analysis & Forecast, by Sampling Type, 2017‒2031

12.2.1. On-Site

12.2.2. Off-Site

12.3. Canada Oil Conditioning Monitoring Services Market Size (US$ Mn) Analysis & Forecast, by Fluid Type, 2017‒2031

12.3.1. Lubricant Oil

12.3.2. Hydraulic Oil

12.4. Canada Oil Conditioning Monitoring Services Market Size (US$ Mn) Analysis & Forecast, by Applications, 2017‒2031

12.4.1. Engines

12.4.2. Turbines

12.4.3. Hydraulic Systems

12.4.4. Compressors

12.4.5. Others

12.5. Canada Oil Conditioning Monitoring Services Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017‒2031

12.5.1. Automotive & Transportation

12.5.2. Marine

12.5.3. Energy & Utilities

12.5.4. Industrial

12.5.5. Mining & Construction

12.5.6. Oil & Gas

12.5.7. Others

12.6. Canada Oil Conditioning Monitoring Services Market Attractiveness Analysis

12.6.1. By Service Type

12.6.2. By Sampling Type

12.6.3. By Fluid Type

12.6.4. By Application

12.6.5. By End-use Industry

13. Competition Assessment

13.1. North America Oil Conditioning Monitoring Services Market Competition Matrix - a Dashboard View

13.1.1. North America Oil Conditioning Monitoring Services Market Company Share Analysis, by Value (2020)

13.1.2. Technological Differentiator

14. Company Profiles (Manufacturers/Suppliers)

14.1. Baker Hughes Company

14.1.1. Overview

14.1.2. Product Portfolio

14.1.3. Sales Footprint

14.1.4. Strategy and Recent Developments

14.1.5. Key Financial

14.2. Bureau Veritas

14.2.1. Overview

14.2.2. Product Portfolio

14.2.3. Sales Footprint

14.2.4. Strategy and Recent Developments

14.2.5. Key Financial

14.3. Exxon Mobil Corporation

14.3.1. Overview

14.3.2. Product Portfolio

14.3.3. Sales Footprint

14.3.4. Strategy and Recent Developments

14.3.5. Key Financial

14.4. Fluid Life

14.4.1. Overview

14.4.2. Product Portfolio

14.4.3. Sales Footprint

14.4.4. Strategy and Recent Developments

14.4.5. Key Financial

14.5. Insight Services, Inc.

14.5.1. Overview

14.5.2. Product Portfolio

14.5.3. Sales Footprint

14.5.4. Strategy and Recent Developments

14.5.5. Key Financial

14.6. Intertek Group plc

14.6.1. Overview

14.6.2. Product Portfolio

14.6.3. Sales Footprint

14.6.4. Strategy and Recent Developments

14.6.5. Key Financial

14.7. Royal Dutch Shell plc

14.7.1. Overview

14.7.2. Product Portfolio

14.7.3. Sales Footprint

14.7.4. Strategy and Recent Developments

14.7.5. Key Financial

14.8. SGS SA

14.8.1. Overview

14.8.2. Product Portfolio

14.8.3. Sales Footprint

14.8.4. Strategy and Recent Developments

14.8.5. Key Financial

14.9. Veritas petroleum Services

14.9.1. Overview

14.9.2. Product Portfolio

14.9.3. Sales Footprint

14.9.4. Strategy and Recent Developments

14.9.5. Key Financial

14.10. WearCheck International

14.10.1. Overview

14.10.2. Product Portfolio

14.10.3. Sales Footprint

14.10.4. Strategy and Recent Developments

14.10.5. Key Financial

15. Used Oil Analysis Labs in North America

15.1. Blackstone Laboratories

15.1.1. Overview

15.1.2. Service Offerings

15.1.3. Geographic Footprint

15.2. Castrol

15.2.1. Overview

15.2.2. Service Offerings

15.2.3. Geographic Footprint

15.3. Foley, Inc.

15.3.1. Overview

15.3.2. Service Offerings

15.3.3. Geographic Footprint

15.4. Savant, Inc.

15.4.1. Overview

15.4.2. Service Offerings

15.4.3. Geographic Footprint

15.5. Tribocare INC

15.5.1. Overview

15.5.2. Service Offerings

15.5.3. Geographic Footprint

15.6. Trico Corporation

15.6.1. Overview

15.6.2. Service Offerings

15.6.3. Geographic Footprint

15.7. U.S. Venture, Inc.

15.7.1. Overview

15.7.2. Service Offerings

15.7.3. Geographic Footprint

16. Key Takeaways

16.1. Opportunity Assessment

16.1.1. By Service Type

16.1.2. By Sampling Type

16.1.3. By Fluid Type

16.1.4. By Application

16.1.5. By End-use Industry

16.1.6. By Country and Sub-region

List of Tables

Table 01: North America Oil Condition Monitoring Market Value (US$ Mn) Forecast, by Service Type, 2017‒2031

Table 02: North America Oil Condition Monitoring Market Value (US$ Mn) Forecast, by Sampling Type 2017‒2031

Table 03: North America Oil Condition Monitoring Market Value (US$ Mn) Forecast, by Fluid Type, 2017‒2031

Table 04: North America Oil Condition Monitoring Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 05: North America Oil Condition Monitoring Market Value (US$ Mn) Forecast, by End-use Industry, 2017‒2031

Table 06: North America Oil Condition Monitoring Market Value (US$ Mn) Forecast, by Country and Sub-Region, 2017‒2031

Table 07: U.S. Oil Condition Monitoring Market Value (US$ Mn) Forecast, by Service Type, 2017‒2031

Table 08: U.S. Oil Condition Monitoring Market Value (US$ Mn) Forecast, by Sampling Type 2017‒2031

Table 09: U.S. Oil Condition Monitoring Market Value (US$ Mn) Forecast, by Fluid Type, 2017‒2031

Table 10: U.S. Oil Condition Monitoring Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 11: U.S. Oil Condition Monitoring Market Value (US$ Mn) Forecast, by End-use Industry, 2017‒2031

Table 12: Canada Oil Condition Monitoring Market Value (US$ Mn) Forecast, by Service Type, 2017‒2031

Table 13: Canada Oil Condition Monitoring Market Value (US$ Mn) Forecast, by Sampling Type 2017‒2031

Table 14: Canada Oil Condition Monitoring Market Value (US$ Mn) Forecast, by Fluid Type, 2017‒2031

Table 15: Canada Oil Condition Monitoring Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 16: Canada Oil Condition Monitoring Market Value (US$ Mn) Forecast, by End-use Industry, 2017‒2031

List of Figures

Figure 01: North America Oil Condition Monitoring , Value (US$ Mn), 2017‒2031

Figure 02: North America Oil Condition Monitoring Market, Value (US$ Mn), 2017‒2031

Figure 03: North America Oil Condition Monitoring Market Size & Forecast, by Service Type, Revenue (US$ Mn), 2017‒2031

Figure 04: North America Oil Condition Monitoring Market Attractiveness, by Service Type, 2021‒2031

Figure 05: North America Oil Condition Monitoring Market Share Analysis, by Service Type, 2021 & 2031

Figure 06: North America Oil Condition Monitoring Market Size & Forecast, by Sampling Type, Revenue (US$ Mn), 2017‒2031

Figure 07: North America Oil Condition Monitoring Market Attractiveness, by Sampling Type, 2021‒2031

Figure 08: North America Oil Condition Monitoring Market Share Analysis, by Sampling Type, 2021 & 2031

Figure 09: North America Oil Condition Monitoring Market Size & Forecast, by Fluid Type, Revenue (US$ Mn), 2017‒2031

Figure 10: North America Oil Condition Monitoring Market Attractiveness, by Fluid Type, 2021‒2031

Figure 11: North America Oil Condition Monitoring Market Share Analysis, by Fluid Type, 2021 & 2031

Figure 12: North America Oil Condition Monitoring Market Size & Forecast, by Application, Revenue (US$ Mn), 2017‒2031

Figure 13: North America Oil Condition Monitoring Market Attractiveness, by Application, 2021‒2031

Figure 14: North America Oil Condition Monitoring Market Share Analysis, by Application, 2021 & 2031

Figure 15: North America Oil Condition Monitoring Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017‒2031

Figure 16: North America Oil Condition Monitoring Market Attractiveness, by End-use Industry, 2021‒2031

Figure 17: North America Oil Condition Monitoring Market Share Analysis, by End-use Industry, 2021 & 2031

Figure 18: North America Oil Condition Monitoring Market Size & Forecast, by Country and Sub-Region, Revenue (US$ Mn), 2017‒2031

Figure 19: North America Oil Condition Monitoring Market Attractiveness, by Country and Sub-Region, 2021‒2031

Figure 20: North America Oil Condition Monitoring Market Share Analysis, by Country and Sub-Region, 2021 & 2031

Figure 21: U.S. Oil Condition Monitoring, Value (US$ Mn), 2017‒2031

Figure 22: U.S. Oil Condition Monitoring Market, Value (US$ Mn), 2017‒2031

Figure 23: U.S. Oil Condition Monitoring Market Size & Forecast, by Service Type, Revenue (US$ Mn), 2017‒2031

Figure 24: U.S. Oil Condition Monitoring Market Attractiveness, by Service Type, 2021‒2031

Figure 25: U.S. Oil Condition Monitoring Market Share Analysis, by Service Type, 2021 & 2031

Figure 26: U.S. Oil Condition Monitoring Market Size & Forecast, by Sampling Type, Revenue (US$ Mn), 2017‒2031

Figure 27: U.S. Oil Condition Monitoring Market Attractiveness, by Sampling Type, 2021‒2031

Figure 28: U.S. Oil Condition Monitoring Market Share Analysis, by Sampling Type, 2021 & 2031

Figure 29: U.S. Oil Condition Monitoring Market Size & Forecast, by Fluid Type, Revenue (US$ Mn), 2017‒2031

Figure 30: U.S. Oil Condition Monitoring Market Attractiveness, by Fluid Type, 2021‒2031

Figure 31: U.S. Oil Condition Monitoring Market Share Analysis, by Fluid Type, 2021 & 2031

Figure 32: U.S. Oil Condition Monitoring Market Size & Forecast, by Application, Revenue (US$ Mn), 2017‒2031

Figure 33: U.S. Oil Condition Monitoring Market Attractiveness, by Application, 2021‒2031

Figure 34: U.S. Oil Condition Monitoring Market Share Analysis, by Application, 2021 & 2031

Figure 35: U.S. Oil Condition Monitoring Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017‒2031

Figure 36: U.S. Oil Condition Monitoring Market Attractiveness, by End-use Industry, 2021‒2031

Figure 37: U.S. Oil Condition Monitoring Market Share Analysis, by End-use Industry, 2021 & 2031

Figure 38: Canada Oil Condition Monitoring, Value (US$ Mn), 2017‒2031

Figure 39: Canada Oil Condition Monitoring Market, Value (US$ Mn), 2017‒2031

Figure 40: Canada Oil Condition Monitoring Market Size & Forecast, by Service Type, Revenue (US$ Mn), 2017‒2031A

Figure 41: Canada Oil Condition Monitoring Market Attractiveness, by Service Type, 2021‒2031

Figure 42: Canada Oil Condition Monitoring Market Share Analysis, by Service Type, 2021 & 2031

Figure 43: Canada Oil Condition Monitoring Market Size & Forecast, by Sampling Type, Revenue (US$ Mn), 2017‒2031

Figure 44: Canada Oil Condition Monitoring Market Attractiveness, by Sampling Type, 2021‒2031

Figure 45: Canada Oil Condition Monitoring Market Share Analysis, by Sampling Type, 2021 & 2031

Figure 46: Canada Oil Condition Monitoring Market Size & Forecast, by Fluid Type, Revenue (US$ Mn), 2017‒2031

Figure 47: Canada Oil Condition Monitoring Market Attractiveness, by Fluid Type, 2021‒2031

Figure 48: Canada Oil Condition Monitoring Market Share Analysis, by Fluid Type, 2021 & 2031

Figure 49: Canada Oil Condition Monitoring Market Size & Forecast, by Application, Revenue (US$ Mn), 2017‒2031

Figure 50: Canada Oil Condition Monitoring Market Attractiveness, by Application, 2021‒2031

Figure 51: Canada Oil Condition Monitoring Market Share Analysis, by Application, 2021 & 2031

Figure 52: Canada Oil Condition Monitoring Market Size & Forecast, by End-use Industry, Revenue (US$ Mn), 2017‒2031

Figure 53: Canada Oil Condition Monitoring Market Attractiveness, by End-use Industry, 2021‒2031

Figure 54: Canada Oil Condition Monitoring Market Share Analysis, by End-use Industry, 2021 & 2031

Figure 55: North America Oil Condition Monitoring Services Market Share Analysis, by Company