Reports

Reports

Analysts’ Viewpoint

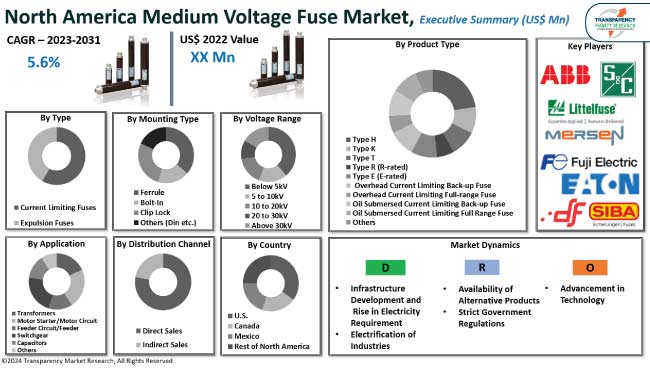

Rapid infrastructure development, surge in electricity requirement, and electrification of industries are the prominent factors boosting the North America medium voltage fuse market size.

The shift toward clean energy sources such as wind and solar entail the usage of medium voltage fuses to protect the electrical systems from overcurrent and short circuits. North America medium voltage fuse market trends include the increase in investments in such renewable energy sources.

North America medium voltage fuse market manufacturers are launching innovative products with faster response time, higher breaking capacity, and improved temperature tolerance. Rapid growth of smart grids and smart cities are the evolving trends in the North America market. Manufacturers are introducing new and improved medium voltage fuses, which are more efficient and reliable, thus driving their adoption in various industries.

A medium voltage fuse is a type of electrical safety device that protects medium voltage systems from overcurrent. It is designed to interrupt the flow of electricity if the current exceeds a certain level, thereby preventing damage to equipment and potential hazards such as fires or explosions. Medium voltage fuses are typically used in electrical systems that operate at voltages between 1kV and 36kV, which are considered to be medium voltage levels. The fuses are an essential component of the power distribution system, as they provide a reliable and cost-effective means of protecting electrical equipment from overload conditions.

Expulsion fuses and current-limiting fuses are the two main types of medium voltage fuses. Expulsion fuses are the traditional type of fuse and work by using a fusible element that melts and produces a gas when subjected to excessive current. This gas build-up causes the fuse to explode, breaking the circuit and interrupting the flow of electricity.

Current-limiting fuses are designed to limit the amount of current that passes through the circuit, preventing it from reaching dangerous levels. These fuses also have a faster response time compared to expulsion fuses, making them more suitable for protecting sensitive equipment.

Infrastructure development has been a key focus in the U.S. for several years now, with significant investments being made in transportation, water systems, and energy. Demand for reliable and efficient infrastructure has grown with the surge in population and rapid urbanization. This has led to a rise in requirement for electricity, which is a crucial factor in the development of any infrastructure project. Development of smart grid systems and the integration of digital technologies in power distribution have increased the demand for advanced and smart medium voltage fuses, thus propelling the North America medium voltage fuse market share.

As per the U.S. Energy Information Administration, total U.S. electricity consumption in 2022 stood at around 4.05 trillion kWh, the highest recorded. Total U.S. electricity end-use consumption in 2022 was about 2.6% higher than in 2021. Medium voltage fuses play a crucial role in protecting electrical equipment from short circuits, and other electrical faults. The surge in demand for electricity in the U.S. is driving the need for medium voltage fuses, thus fuelling market progress.

The U.S. Department of Energy (DOE) has assigned US$ 3.46 Bn for 58 projects spanning 44 states aimed at protecting the resilience and reliability of the nation's electric grid. The projects collectively facilitate the introduction of more than 35 GW of new renewable energy capacity and the establishment of 400 micro grids. This has bolstered the MV fuse market in North America, as they are essential components in ensuring the reliability and safety of the power grid.

Rapid electrification of industries has been a major driving force behind the growth of the North America medium voltage fuse industry. Growth in demand for reliable and safe electrical systems is seen with industries continuing to transition toward more sustainable and efficient methods of production. This has led to widespread adoption of medium voltage fuses, which are essential components in protecting industrial equipment and machinery from power surges and overloads.

One of the key factors driving the electrification of industries is the rise in focus on reducing carbon emissions and promoting renewable energy sources. Toward this end, there has been a significant increase in usage of electrically powered machinery and equipment, such as electric vehicles, solar panels, and wind turbines. These industries require a robust electrical infrastructure to support their operations, and medium voltage fuses play a crucial role in ensuring the smooth and safe operation of these systems. All these factors are augmenting the North America medium voltage fuse market value.

Moreover, the expansion of smart factories and industrial automation has also contributed to the North America medium voltage fuse market growth. Advanced manufacturing processes rely heavily on sophisticated electrical systems that require protection from potential electrical faults. Medium voltage fuses provide a cost-effective solution for protecting these systems, making them an essential component in the modern industrial landscape, and offering lucrative opportunities for market expansion.

As per the latest North America medium voltage fuse market analysis, the U.S is expected to dominate the landscape during the forecast period. Surge in demand for electricity, widespread adoption of renewable energy sources, and advancements in technology are driving market dynamics in the country.

The North America medium voltage fuse market forecast indicates that Canada is anticipated to grow at the highest CAGR during the forecast period. The increasing demand for reliable and uninterrupted power supply, rise in investments in renewable energy sources, and the development of smart grids are boosting the MV current-limiting fuse market in Canada.

Investments in R&D, product expansions, and mergers and acquisitions are the key North America medium voltage fuse business model of prominent manufacturers. Product development is a major strategy of top players. The market is highly competitive, with the presence of various global and regional players.

ABB, DF Electric, Eaton, Fuji Electric FA Components & Systems Co., Ltd. Littelfuse, Inc. Mersen Group, S&C Electric Company, Schneider Electric, Southern States, LLC, and SIBA GmbH. are the prominent entities profiled in the North America medium voltage fuse market report.

Each of these players has been profiled in the North America medium voltage fuse market research based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size in 2022 | US$ 340.8 Mn |

| Market Forecast Value in 2031 | US$ 549.0 Mn |

| Growth Rate (CAGR) | 5.6% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Mn for Value & Thousand Units for Volume |

| Market Analysis | Includes cross segment analysis at regional as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Region Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 340.8 Mn in 2022

It is projected to expand at a CAGR of 5.6% from 2023 to 2031

Infrastructure development and rise in electricity requirement, and electrification of industries

In terms of product type, Type R (R-rated) accounted for largest share in 2022

The U.S. is expected to hold the dominant share in North America during the forecast period

ABB, DF Electric, Eaton, Fuji Electric FA Components & Systems Co., Ltd. Littelfuse, Inc. Mersen Group, S&C Electric Company, Schneider Electric, Southern States, LLC, and SIBA GmbH

1. Executive Summary

1.1. North America Market Outlook

1.2. Demand Side Trends

1.3. Supply Side Trends

1.4. Key Facts and Figures

1.5. Growth Opportunity Analysis

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Key Market Indicator

2.6. Market Dynamics

2.6.1. Drivers

2.6.2. Restraints

2.6.3. Opportunities

2.7. North America Medium Voltage Fuse Market Analysis and Forecasts, 2020-2031

2.7.1. North America Medium Voltage Fuse Market Revenue (US$ Mn)

2.7.2. North America Medium Voltage Fuse Market Volume (Thousand Units)

2.8. Porter’s Five Forces Analysis

2.9. Value Chain Analysis

2.10. Industry SWOT Analysis

2.11. Product Specification Analysis, By Application

2.12. Technology Development Analysis

2.13. Regulatory Landscape

3. Economic Recovery Analysis Post-COVID 19 Impact

4. Price Trend Analysis and Forecast (US$/Units) by Product Type and by Country

5. North America Market Analysis and Forecast, By Product Type

5.1. Key Findings

5.2. Medium Voltage Fuse Market Size (US$ Mn and Thousand Units) Forecast, By Product Type, 2020 – 2031

5.2.1. Type H

5.2.2. Type K

5.2.3. Type T

5.2.4. Type R (R-rated)

5.2.5. Type E (E-rated)

5.2.6. Overhead Current Limiting Back-up Fuse

5.2.7. Overhead Current Limiting Full-range Fuse

5.2.8. Oil Submersed Current Limiting Back-up Fuse

5.2.9. Oil Submersed Current Limiting Full Range Fuse

5.2.10. Others

5.3. Market Attractiveness Analysis, By Product Type

6. North America Market Analysis and Forecast, By Type

6.1. Key Findings

6.2. Medium Voltage Fuse Market Size (US$ Mn and Thousand Units) Forecast, By Type, 2020 – 2031

6.2.1. Current Limiting Fuses

6.2.2. Expulsion Fuses

6.3. Market Attractiveness Analysis, By Type

7. North America Market Analysis and Forecast, By Mounting Type

7.1. Key Findings

7.2. Medium Voltage Fuse Market Size (US$ Mn and Thousand Units) Forecast, By Mounting Type, 2020 – 2031

7.2.1. Ferrule

7.2.2. Bolt-In

7.2.3. Clip Lock

7.2.4. Others

7.3. Market Attractiveness Analysis, By Mounting Type

8. North America Market Analysis and Forecast, By Voltage Range

8.1. Key Findings

8.2. Medium Voltage Fuse Market Size (US$ Mn and Thousand Units) Forecast, By Voltage Range, 2020 – 2031

8.2.1. Below 5kV

8.2.2. 5 to 10kV

8.2.3. 10 to 20kV

8.2.4. 20 to 30kV

8.2.5. Above 30kV

8.3. Market Attractiveness Analysis, By Voltage Range

9. North America Market Analysis and Forecast, By Application

9.1. Key Findings

9.2. Medium Voltage Fuse Market Size (US$ Mn and Thousand Units) Forecast, By Application, 2020 – 2031

9.2.1. Transformers

9.2.2. Power Transformers

9.2.3. Potential Transformers

9.2.4. Distribution/Service Transformers

9.2.5. Motor Starter/Motor Circuit

9.2.6. Feeder Circuit/Feeder

9.2.7. Switchgear

9.2.8. Capacitors

9.2.9. Others

9.3. Market Attractiveness Analysis, By Application

10. North America Market Analysis and Forecast, By Distribution Channel

10.1. Key Findings

10.2. Medium Voltage Fuse Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2020 – 2031

10.2.1. Direct Sales

10.2.2. Indirect Sales

10.3. Market Attractiveness Analysis, By Distribution Channel

11. North America Market Analysis and Forecast, By Country

11.1. Key Findings

11.2. South America Market Size (US$ Mn and Thousand Units) Forecast, By Country, 2017 - 2031

11.2.1. U.S.

11.2.2. Canada

11.2.3. Mexico

11.2.4. Rest of North America

11.3. Market Attractiveness Analysis, By Country

12. U.S. Market Analysis and Forecast, By Product Type

12.1. Key Findings

12.2. Medium Voltage Fuse Market Size (US$ Mn and Thousand Units) Forecast, By Product Type, 2020 – 2031

12.2.1. Type H

12.2.2. Type K

12.2.3. Type T

12.2.4. Type R (R-rated)

12.2.5. Type E (E-rated)

12.2.6. Overhead Current Limiting Back-up Fuse

12.2.7. Overhead Current Limiting Full-range Fuse

12.2.8. Oil Submersed Current Limiting Back-up Fuse

12.2.9. Oil Submersed Current Limiting Full Range Fuse

12.2.10. Others

13. U.S. Market Analysis and Forecast, By Type

13.1. Key Findings

13.2. Medium Voltage Fuse Market Size (US$ Mn and Thousand Units) Forecast, By Type,2020 – 2031

13.2.1. Current Limiting Fuses

13.2.2. Expulsion Fuses

14. U.S. Market Analysis and Forecast, By Mounting Type

14.1. Key Findings

14.2. Medium Voltage Fuse Market Size (US$ Mn and Thousand Units) Forecast, By Mounting Type,2020 – 2031

14.2.1. Ferrule

14.2.2. Bolt-In

14.2.3. Clip Lock

14.2.4. Others

15. U.S. Market Analysis and Forecast, By Voltage Range

15.1. Key Findings

15.2. Medium Voltage Fuse Market Size (US$ Mn and Thousand Units) Forecast, By Voltage Range,2020 – 2031

15.2.1. Below 5kV

15.2.2. 5 to 10kV

15.2.3. 10 to 20kV

15.2.4. 20 to 30kV

15.2.5. Above 30kV

16. U.S. Market Analysis and Forecast, By Application

16.1. Key Findings

16.2. Medium Voltage Fuse Market Size (US$ Mn and Thousand Units) Forecast, By Application,2020 – 2031

16.2.1. Transformers

16.2.2. Power Transformers

16.2.3. Potential Transformers

16.2.4. Distribution/Service Transformers

16.2.5. Motor Starter/Motor Circuit

16.2.6. Feeder Circuit/Feeder

16.2.7. Switchgear

16.2.8. Capacitors

16.2.9. Others

17. U.S. Market Analysis and Forecast, By Distribution Channel

17.1. Key Findings

17.2. Medium Voltage Fuse Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel,2020 – 2031

17.2.1. Direct Sales

17.2.2. Indirect Sales

18. Canada Market Analysis and Forecast, By Product Type

18.1. Key Findings

18.2. Medium Voltage Fuse Market Size (US$ Mn and Thousand Units) Forecast, By Product Type, 2020 – 2031

18.2.1. Type H

18.2.2. Type K

18.2.3. Type T

18.2.4. Type R (R-rated)

18.2.5. Type E (E-rated)

18.2.6. Overhead Current Limiting Back-up Fuse

18.2.7. Overhead Current Limiting Full-range Fuse

18.2.8. Oil Submersed Current Limiting Back-up Fuse

18.2.9. Oil Submersed Current Limiting Full Range Fuse

18.2.10. Others

19. Canada Market Analysis and Forecast, By Type

19.1. Key Findings

19.2. Medium Voltage Fuse Market Size (US$ Mn and Thousand Units) Forecast, By Type,2020 – 2031

19.2.1. Current Limiting Fuses

19.2.2. Expulsion Fuses

20. Canada Market Analysis and Forecast, By Mounting Type

20.1. Key Findings

20.2. Medium Voltage Fuse Market Size (US$ Mn and Thousand Units) Forecast, By Mounting Type,2020 – 2031

20.2.1. Ferrule

20.2.2. Bolt-In

20.2.3. Clip Lock

20.2.4. Others

21. Canada Market Analysis and Forecast, By Voltage Range

21.1. Key Findings

21.2. Medium Voltage Fuse Market Size (US$ Mn and Thousand Units) Forecast, By Voltage Range,2020 – 2031

21.2.1. Below 5kV

21.2.2. 5 to 10kV

21.2.3. 10 to 20kV

21.2.4. 20 to 30kV

21.2.5. Above 30kV

22. Canada Market Analysis and Forecast, By Application

22.1. Key Findings

22.2. Medium Voltage Fuse Market Size (US$ Mn and Thousand Units) Forecast, By Application,2020 – 2031

22.2.1. Transformers

22.2.2. Power Transformers

22.2.3. Potential Transformers

22.2.4. Distribution/Service Transformers

22.2.5. Motor Starter/Motor Circuit

22.2.6. Feeder Circuit/Feeder

22.2.7. Switchgear

22.2.8. Capacitors

22.2.9. Others

23. Canada Market Analysis and Forecast, By Distribution Channel

23.1. Key Findings

23.2. Medium Voltage Fuse Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel,2020 – 2031

23.2.1. Direct Sales

23.2.2. Indirect Sales

24. Mexico Market Analysis and Forecast, By Product Type

24.1. Key Findings

24.2. Medium Voltage Fuse Market Size (US$ Mn and Thousand Units) Forecast, By Product Type,2020 – 2031

24.2.1. Type H

24.2.2. Type K

24.2.3. Type T

24.2.4. Type R (R-rated)

24.2.5. Type E (E-rated)

24.2.6. Overhead Current Limiting Back-up Fuse

24.2.7. Overhead Current Limiting Full-range Fuse

24.2.8. Oil Submersed Current Limiting Back-up Fuse

24.2.9. Oil Submersed Current Limiting Full Range Fuse

24.2.10. Others

25. Mexico Market Analysis and Forecast, By Type

25.1. Key Findings

25.2. Medium Voltage Fuse Market Size (US$ Mn and Thousand Units) Forecast, By Type, 2020 – 2031

25.2.1. Current Limiting Fuses

25.2.2. Expulsion Fuses

26. Mexico Market Analysis and Forecast, By Mounting Type

26.1. Key Findings

26.2. Medium Voltage Fuse Market Size (US$ Mn and Thousand Units) Forecast, By Mounting Type,2020 – 2031

26.2.1. Ferrule

26.2.2. Bolt-In

26.2.3. Clip Lock

26.2.4. Others

27. Mexico Market Analysis and Forecast, By Voltage Range

27.1. Key Findings

27.2. Medium Voltage Fuse Market Size (US$ Mn and Thousand Units) Forecast, By Voltage Range,2020 – 2031

27.2.1. Below 5kV

27.2.2. 5 to 10kV

27.2.3. 10 to 20kV

27.2.4. 20 to 30kV

27.2.5. Above 30kV

28. Mexico Market Analysis and Forecast, By Application

28.1. Key Findings

28.2. Medium Voltage Fuse Market Size (US$ Mn and Thousand Units) Forecast, By Application,2020 – 2031

28.2.1. Transformers

28.2.2. Power Transformers

28.2.3. Potential Transformers

28.2.4. Distribution/Service Transformers

28.2.5. Motor Starter/Motor Circuit

28.2.6. Feeder Circuit/Feeder

28.2.7. Switchgear

28.2.8. Capacitors

28.2.9. Others

29. Mexico Market Analysis and Forecast, By Distribution Channel

29.1. Key Findings

29.2. Medium Voltage Fuse Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel,2020 – 2031

29.2.1. Direct Sales

29.2.2. Indirect Sales

30. Competition Landscape

30.1. Market Player – Competition Dashboard

30.2. Market Share Analysis (%), by Company, (2022)

30.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

30.3.1. ABB.

30.3.1.1. Company Revenue

30.3.1.2. Business Overview

30.3.1.3. Product Segments

30.3.1.4. Geographic Footprint

30.3.1.5. Strategic Partnership, New Product Innovation etc.

30.3.2. DF Electric

30.3.2.1. Company Revenue

30.3.2.2. Business Overview

30.3.2.3. Product Segments

30.3.2.4. Geographic Footprint

30.3.2.5. Strategic Partnership, New Product Innovation etc.

30.3.3. Eaton

30.3.3.1. Company Revenue

30.3.3.2. Business Overview

30.3.3.3. Product Segments

30.3.3.4. Geographic Footprint

30.3.3.5. Strategic Partnership, New Product Innovation etc.

30.3.4. Fuji Electric FA Components & Systems Co., Ltd.

30.3.4.1. Company Revenue

30.3.4.2. Business Overview

30.3.4.3. Product Segments

30.3.4.4. Geographic Footprint

30.3.4.5. Strategic Partnership, New Product Innovation etc.

30.3.5. Littelfuse, Inc.

30.3.5.1. Company Revenue

30.3.5.2. Business Overview

30.3.5.3. Product Segments

30.3.5.4. Geographic Footprint

30.3.5.5. Strategic Partnership, New Product Innovation etc.

30.3.6. Mersen Group

30.3.6.1. Company Revenue

30.3.6.2. Business Overview

30.3.6.3. Product Segments

30.3.6.4. Geographic Footprint

30.3.6.5. Strategic Partnership, New Product Innovation etc.

30.3.7. S&C Electric Company

30.3.7.1. Company Revenue

30.3.7.2. Business Overview

30.3.7.3. Product Segments

30.3.7.4. Geographic Footprint

30.3.7.5. Strategic Partnership, New Product Innovation etc.

30.3.8. Schneider Electric

30.3.8.1. Company Revenue

30.3.8.2. Business Overview

30.3.8.3. Product Segments

30.3.8.4. Geographic Footprint

30.3.8.5. Strategic Partnership, New Product Innovation etc.

30.3.9. Southern States, LLC.

30.3.9.1. Company Revenue

30.3.9.2. Business Overview

30.3.9.3. Product Segments

30.3.9.4. Geographic Footprint

30.3.9.5. Strategic Partnership, New Product Innovation etc.

30.3.10. SIBA GmbH.

30.3.10.1. Company Revenue

30.3.10.2. Business Overview

30.3.10.3. Product Segments

30.3.10.4. Geographic Footprint

30.3.10.5. Strategic Partnership, New Product Innovation etc.

30.3.11. Other Key Players

30.3.11.1. Company Revenue

30.3.11.2. Business Overview

30.3.11.3. Product Segments

30.3.11.4. Geographic Footprint

30.3.11.5. Strategic Partnership, New Product Innovation etc.

31. Go to Market Strategy

31.1. Identification of Potential Market Spaces

31.1.1. By Product Type

31.1.2. Type

31.1.3. Mounting Type

31.1.4. Voltage Range

31.1.5. By Application

31.1.6. By Country

31.2. Preferred Sales & Marketing Strategy

32. Go To Market Strategy

33. Appendix

33.1. Assumptions and Acronyms

33.2. Research Methodology

List of Tables

Table 1: North America Medium Voltage Fuse Market Value (US$ Mn), by Product Type, 2020-2031

Table 2: North America Medium Voltage Fuse Market Volume (Thousand Units), by Product Type, 2020-2031

Table 3: North America Medium Voltage Fuse Market Value (US$ Mn), by Type, 2020-2031

Table 4: North America Medium Voltage Fuse Market Volume (Thousand Units), by Type, 2020-2031

Table 5: North America Medium Voltage Fuse Market Value (US$ Mn), by Mounting Type, 2020-2031

Table 6: North America Medium Voltage Fuse Market Volume (Thousand Units), by Mounting Type, 2020-2031

Table 7: North America Medium Voltage Fuse Market Value (US$ Mn), by Voltage Range, 2020-2031

Table 8: North America Medium Voltage Fuse Market Volume (Thousand Units), by Voltage Range, 2020-2031

Table 9: North America Medium Voltage Fuse Market Value (US$ Mn), by Application, 2020-2031

Table 10: North America Medium Voltage Fuse Market Volume (Thousand Units), by Application, 2020-2031

Table 11: North America Medium Voltage Fuse Market Value (US$ Mn), by Distribution Channel, 2020-2031

Table 12: North America Medium Voltage Fuse Market Volume (Thousand Units), by Distribution Channel, 2020-2031

Table 13: North America Medium Voltage Fuse Market Value (US$ Mn), by Country, 2020-2031

Table 14: North America Medium Voltage Fuse Market Volume (Thousand Units), by Country, 2020-2031

Table 15: U.S. Medium Voltage Fuse Market Value (US$ Mn), by Product Type, 2020-2031

Table 16: U.S. Medium Voltage Fuse Market Volume (Thousand Units), by Product Type, 2020-2031

Table 17: U.S. Medium Voltage Fuse Market Value (US$ Mn), by Type, 2020-2031

Table 18: U.S. Medium Voltage Fuse Market Volume (Thousand Units), by Type, 2020-2031

Table 19: U.S. Medium Voltage Fuse Market Value (US$ Mn), by Mounting Type, 2020-2031

Table 20: U.S. Medium Voltage Fuse Market Volume (Thousand Units), by Mounting Type, 2020-2031

Table 21: U.S. Medium Voltage Fuse Market Value (US$ Mn), by Voltage Range, 2020-2031

Table 22: U.S. Medium Voltage Fuse Market Volume (Thousand Units), by Voltage Range, 2020-2031

Table 23: U.S. Medium Voltage Fuse Market Value (US$ Mn), by Application, 2020-2031

Table 24: U.S. Medium Voltage Fuse Market Volume (Thousand Units), by Application, 2020-2031

Table 25: U.S. Medium Voltage Fuse Market Value (US$ Mn), by Distribution Channel, 2020-2031

Table 26: U.S. Medium Voltage Fuse Market Volume (Thousand Units), by Distribution Channel, 2020-2031

Table 27: Canada Medium Voltage Fuse Market Value (US$ Mn), by Product Type, 2020-2031

Table 28: Canada Medium Voltage Fuse Market Volume (Thousand Units), by Product Type, 2020-2031

Table 29: Canada Medium Voltage Fuse Market Value (US$ Mn), by Type, 2020-2031

Table 30: Canada Medium Voltage Fuse Market Volume (Thousand Units), by Type, 2020-2031

Table 31: Canada Medium Voltage Fuse Market Value (US$ Mn), by Mounting Type, 2020-2031

Table 32: Canada Medium Voltage Fuse Market Volume (Thousand Units), by Mounting Type, 2020-2031

Table 33: Canada Medium Voltage Fuse Market Value (US$ Mn), by Voltage Range, 2020-2031

Table 34: Canada Medium Voltage Fuse Market Volume (Thousand Units), by Voltage Range, 2020-2031

Table 35: Canada Medium Voltage Fuse Market Value (US$ Mn), by Application, 2020-2031

Table 36: Canada Medium Voltage Fuse Market Volume (Thousand Units), by Application, 2020-2031

Table 37: Canada Medium Voltage Fuse Market Value (US$ Mn), by Distribution Channel, 2020-2031

Table 38: Canada Medium Voltage Fuse Market Volume (Thousand Units), by Distribution Channel, 2020-2031

Table 39: Mexico Medium Voltage Fuse Market Value (US$ Mn), by Product Type, 2020-2031

Table 40: Mexico Medium Voltage Fuse Market Volume (Thousand Units), by Product Type, 2020-2031

Table 41: Mexico Medium Voltage Fuse Market Value (US$ Mn), by Type, 2020-2031

Table 42: Mexico Medium Voltage Fuse Market Volume (Thousand Units), by Type, 2020-2031

Table 43: Mexico Medium Voltage Fuse Market Value (US$ Mn), by Mounting Type, 2020-2031

Table 44: Mexico Medium Voltage Fuse Market Volume (Thousand Units), by Mounting Type, 2020-2031

Table 45: Mexico Medium Voltage Fuse Market Value (US$ Mn), by Voltage Range, 2020-2031

Table 46: Mexico Medium Voltage Fuse Market Volume (Thousand Units), by Voltage Range, 2020-2031

Table 47: Mexico Medium Voltage Fuse Market Value (US$ Mn), by Application, 2020-2031

Table 48: Mexico Medium Voltage Fuse Market Volume (Thousand Units), by Application, 2020-2031

Table 49: Mexico Medium Voltage Fuse Market Value (US$ Mn), by Distribution Channel, 2020-2031

Table 50: Mexico Medium Voltage Fuse Market Volume (Thousand Units), by Distribution Channel, 2020-2031

List of Figures

Figure 1: North America Medium Voltage Fuse Market Value (US$ Mn), by Product Type, 2020-2031

Figure 2: North America Medium Voltage Fuse Market Attractive (US$ Mn), Forecast, by Product Type, 2023-2031

Figure 3: North America Medium Voltage Fuse Market Value (US$ Mn), by Type, 2020-2031

Figure 4: North America Medium Voltage Fuse Market Attractive (US$ Mn), Forecast, by Type, 2023-2031

Figure 5: North America Medium Voltage Fuse Market Value (US$ Mn), by Mounting Type, 2020-2031

Figure 6: North America Medium Voltage Fuse Market Attractive (US$ Mn), Forecast, by Mounting Type, 2023-2031

Figure 7: North America Medium Voltage Fuse Market Value (US$ Mn), by Voltage Range, 2020-2031

Figure 8: North America Medium Voltage Fuse Market Attractive (US$ Mn), Forecast, by Voltage Range, 2023-2031

Figure 9: North America Medium Voltage Fuse Market Value (US$ Mn), by Application, 2020-2031

Figure 10: North America Medium Voltage Fuse Market Attractive (US$ Mn), Forecast, by Application, 2023-2031

Figure 11: North America Medium Voltage Fuse Market Value (US$ Mn), by Distribution Channel, 2020-2031

Figure 12: North America Medium Voltage Fuse Market Attractive (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 13: North America Medium Voltage Fuse Market Value (US$ Mn), by Country, 2020-2031

Figure 14: North America Medium Voltage Fuse Market Attractive (US$ Mn), Forecast, by Country, 2023-2031

Figure 15: U.S. Medium Voltage Fuse Market Value (US$ Mn), by Product Type, 2020-2031

Figure 16: U.S. Medium Voltage Fuse Market Attractive (US$ Mn), Forecast, by Product Type, 2023-2031

Figure 17: U.S. Medium Voltage Fuse Market Value (US$ Mn), by Type, 2020-2031

Figure 18: U.S. Medium Voltage Fuse Market Attractive (US$ Mn), Forecast, by Type, 2023-2031

Figure 19: U.S. Medium Voltage Fuse Market Value (US$ Mn), by Mounting Type, 2020-2031

Figure 20: U.S. Medium Voltage Fuse Market Attractive (US$ Mn), Forecast, by Mounting Type, 2023-2031

Figure 21: U.S. Medium Voltage Fuse Market Value (US$ Mn), by Voltage Range, 2020-2031

Figure 22: U.S. Medium Voltage Fuse Market Attractive (US$ Mn), Forecast, by Voltage Range, 2023-2031

Figure 23: U.S. Medium Voltage Fuse Market Value (US$ Mn), by Application, 2020-2031

Figure 24: U.S. Medium Voltage Fuse Market Attractive (US$ Mn), Forecast, by Application, 2023-2031

Figure 25: U.S. Medium Voltage Fuse Market Value (US$ Mn), by Distribution Channel, 2020-2031

Figure 26: U.S. Medium Voltage Fuse Market Attractive (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 27: Canada Medium Voltage Fuse Market Value (US$ Mn), by Product Type, 2020-2031

Figure 28: Canada Medium Voltage Fuse Market Attractive (US$ Mn), Forecast, by Product Type, 2023-2031

Figure 29: Canada Medium Voltage Fuse Market Value (US$ Mn), by Type, 2020-2031

Figure 30: Canada Medium Voltage Fuse Market Attractive (US$ Mn), Forecast, by Type, 2023-2031

Figure 31: Canada Medium Voltage Fuse Market Value (US$ Mn), by Mounting Type, 2020-2031

Figure 32: Canada Medium Voltage Fuse Market Attractive (US$ Mn), Forecast, by Mounting Type, 2023-2031

Figure 33: Canada Medium Voltage Fuse Market Value (US$ Mn), by Voltage Range, 2020-2031

Figure 34: Canada Medium Voltage Fuse Market Attractive (US$ Mn), Forecast, by Voltage Range, 2023-2031

Figure 35: Canada Medium Voltage Fuse Market Value (US$ Mn), by Application, 2020-2031

Figure 36: Canada Medium Voltage Fuse Market Attractive (US$ Mn), Forecast, by Application, 2023-2031

Figure 37: Canada Medium Voltage Fuse Market Value (US$ Mn), by Distribution Channel, 2020-2031

Figure 38: Canada Medium Voltage Fuse Market Attractive (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 39: Mexico Medium Voltage Fuse Market Value (US$ Mn), by Product Type, 2020-2031

Figure 40: Mexico Medium Voltage Fuse Market Attractive (US$ Mn), Forecast, by Product Type, 2023-2031

Figure 41: Mexico Medium Voltage Fuse Market Value (US$ Mn), by Type, 2020-2031

Figure 42: Mexico Medium Voltage Fuse Market Attractive (US$ Mn), Forecast, by Type, 2023-2031

Figure 43: Mexico Medium Voltage Fuse Market Value (US$ Mn), by Mounting Type, 2020-2031

Figure 44: Mexico Medium Voltage Fuse Market Attractive (US$ Mn), Forecast, by Mounting Type, 2023-2031

Figure 45: Mexico Medium Voltage Fuse Market Value (US$ Mn), by Voltage Range, 2020-2031

Figure 46: Mexico Medium Voltage Fuse Market Attractive (US$ Mn), Forecast, by Voltage Range, 2023-2031

Figure 47: Mexico Medium Voltage Fuse Market Value (US$ Mn), by Application, 2020-2031

Figure 48: Mexico Medium Voltage Fuse Market Attractive (US$ Mn), Forecast, by Application, 2023-2031

Figure 49: Mexico Medium Voltage Fuse Market Value (US$ Mn), by Distribution Channel, 2020-2031

Figure 50: Mexico Medium Voltage Fuse Market Attractive (US$ Mn), Forecast, by Distribution Channel, 2023-2031