Reports

Reports

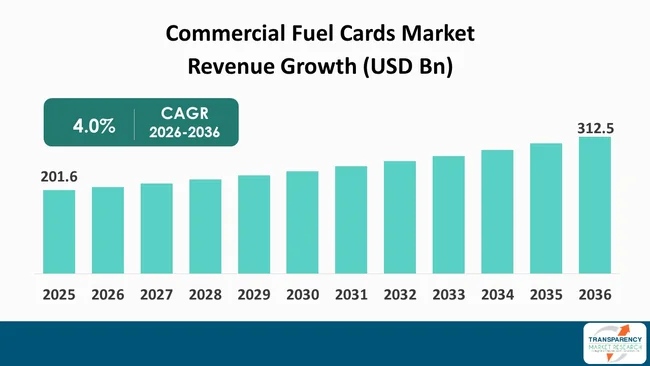

North America commercial fuel cards market size was valued at US$ 201.6 Bn in 2025 and is projected to reach US$ 312.5 Bn by 2036, expanding at a CAGR of 4.0% from 2026 to 2036. The market growth is driven by the need for fuel cost control, expense management, rising adoption of fleet management and telematics solutions.

North America commercial fuel cards market represents a well-established ecosystem of payment and fleet expense solutions designed to support businesses, government agencies, and commercial vehicle operators across the United States and Canada. The market benefits from a highly developed transportation, logistics infrastructure, extensive fueling networks and widespread adoption of digital payment systems. Commercial fuel cards enable cashless fuel purchases while offering centralized control of fuel expenses, transaction records and driver management to organizations with both small and large vehicle fleets.

The U.S. stands out as the dominant region within the North American commercial fuel cards landscape due to the high number of commercial vehicles, movement of long-haul freight, the major fuel card issuers, and fleet service providers who operate in the area. The country’s mature fleet management environment allows fuel cards to be integrated with broader mobility and expense-management platforms, which enables their use as more than basic fuel payment systems.

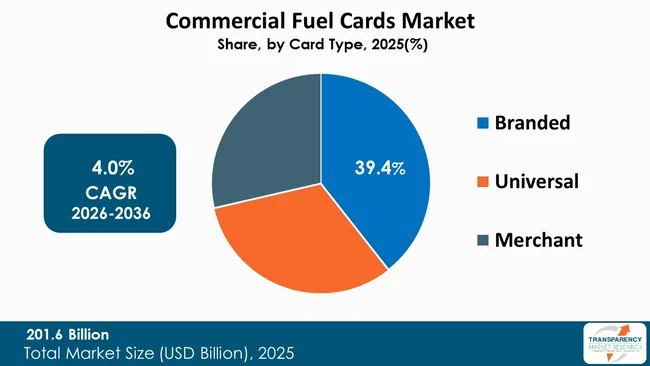

From a segment perspective, branded fuel cards hold 39.4% market share due to their extensive proprietary fuel station networks, attractive volume-based discounts, strong brand credibility, integrated fleet management solutions, detailed expense tracking, and long-term corporate partnerships that enhance cost control and operational reliability.

North America commercial fuel cards market refers to the organized network of fuel card solutions designed for businesses, fleet operators, government agencies, and commercial vehicle owners across the United States and Canada. The commercial fuel card system functions as safe payment methods that authorized drivers use to obtain fuel from designated fueling points while businesses track their fuel-related spending. Fuel retailers, oil companies, fleet management organizations, and financial institutions issue these cards that drivers can use at multiple fueling stations that operate throughout the country.

The North American market is shaped by high vehicle ownership together with a large commercial trucking and logistics sector, long-haul transportation routes, and a mature fleet management ecosystem. The commercial fuel card system provides companies with fuel purchasing capabilities together with value-added services that include toll payment systems, vehicle maintenance services, roadside assistance, parking facilities, and consolidated billing with comprehensive expense reporting capabilities.

North America commercial fuel cards market shows its main characteristics through its advanced digital technologies that enable real-time tracking of transactions, spending management, driver access control, telematics system connections, and data analysis capabilities that organizations use to optimize their fuel efficiency and fleet operational performance. The market is also evolving in response to sustainability goals, with providers increasingly incorporating EV charging compatibility, carbon tracking tools, and alternative fuel options.

North America commercial fuel cards market functions as an essential element that supports the commercial mobility system of the region as it helps businesses achieve their fuel and fleet management needs through cost control, compliance, operational efficiency, and data-driven decision-making.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The North American commercial fuel card market is expanding as companies need to handle their fuel costs while controlling their operational expenses through their current fuel spending and their fleet budgets which react to fuel price changes. The U.S. Energy Information Administration (EIA) reported that the average retail price of regular gasoline in the United States reached US$ 3.30 per gallon in 2024 while on-highway diesel fuel cost US$ 3.76 per gallon.

Every minor change in fuel pricing results in the major cost increase for commercial fleets that consume between thousands and millions of gallons of fuel every year. Fuel costs present businesses that depend on fleets with their most unpredictable expense category which requires difficult management.

Organizations develop structured fuel-expense management systems to achieve better cost control through fuel expense forecasting, which helps them protect their profit margins. Commercial fuel cards support this objective by enabling centralized monitoring of fuel spend across vehicles, drivers, and locations. Businesses achieve better budget planning and financial forecasting through higher budget control that they achieve by using a single invoicing system to combine their fuel transactions.

Fuel cards provide financial benefits through their capacity to manage both - direct fuel expenses and the hidden costs that arise from vehicle fuel use. Fleet managers can use the complete transaction data to detect fuel management problems that include drivers refueling too often and drivers refueling when they are not on their planned routes. Small operational inefficiencies at gasoline stations which charge US$ 3.30 per gallon and diesel stations that charge US$ 3.76 per gallon will produce substantial savings when these savings occur across multiple stations.

As fleets try to achieve better financial management and operational transparency for this valuable resource, their need for advanced fuel cost control systems and expense tracking solutions has grown stronger.

North America commercial fuel cards market experiences growth as fleet management and telematics solutions become more popular, which telematics technologies transform fleet operations, performance monitoring, and cost management processes. The Electronic Logging Device (ELD) rule that requires most commercial motor carriers that operate between states to use electronic logging devices that automatically record driving hours and vehicle operation data represents. It is a federal regulatory framework that exists in the United States through the Federal Motor Carrier Safety Administration (FMCSA).

The telematics systems depend on these devices that deliver current information about fleet operations, compliance status, and routing choices. The ELD mandate requires most fleets to comply, which drives them to use telematics as part of their fleet management systems so they can track more than just driver working hours.

The government has made digital data collection system and vehicle tracking system essential requirements for fleet operation, which has driven fleet managers to implement telematics systems since these systems help organizations achieve both - safety regulations and efficiency improvements. The majority of commercial vehicles now use ELDs which require telematics systems that serve as mandated systems.

The present environment establishes a robust base for digital fleet management systems that incorporate GPS tracking and driver behavior assessment, fuel consumption monitoring and route optimization and predictive maintenance and fuel card data system integration.

Fleet operators can achieve precise cost distribution, fraud detection, and operational planning through telematics data that they link to fuel card systems, their vehicle usage, and performance data. The ongoing safety compliance demands for digital vehicle data collection create a strong incentive for fleets to adopt telematics technology as a fundamental component of their management systems. The implementation of telematics systems within management processes of fleets enables organizations to minimize their operational expenses while enhancing their work efficiency through the use of fuel card systems.

The North America commercial fuel card market shows that branded fuel cards because they control 39.4% of market share represent the most popular card type among users. The card maintains its market position because of its extensive fuel station network and its established partnerships with oil marketers and commercial fleet customers. Major fuel retailers and petroleum companies typically issue branded cards which provide fleet operators access to their extensive station networks that offer stable fuel prices and consistent fuel quality throughout the country. The network functions as a strong logistical support system which provides dependable service to companies that need to transport goods through designated routes.

Cost control establishes another primary reason for market dominance. Branded cards provide large fleet operators with fuel expense predictability through their negotiated fuel discounts, rebates and volume-based pricing structures. The cards provide businesses with transaction tracking systems, purchase control functions, reporting tools which allow them to monitor driver activities, track fuel usage and prevent fuel fraud. The system achieves higher operational efficiency because it connects to fleet management software.

Branded fuel providers also invest heavily in customer retention programs, loyalty benefits, and value-added services which include vehicle maintenance discounts, roadside assistance and credit facilities. The bundled offerings establish strong switching obstacles which force commercial clients to stay with their contracts. Established fuel brands maintain higher trust from corporate users because this trust leads to greater adoption of their products than universal or merchant card programs.

| Attribute | Detail |

|---|---|

| Leading Country |

|

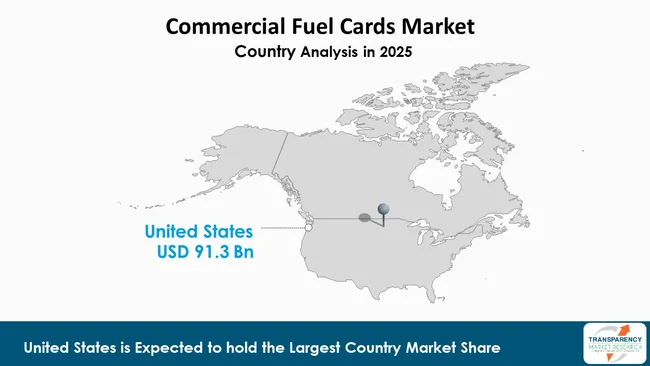

The U.S. holds approximately 45.3 % market share in North America commercial fuel cards market, a position that underscores its dominance in the region's fuel payment and fleet management ecosystem. The dominant share of the market shows that the country has a developed commercial transportation system which includes long-haul trucking and logistics and delivery fleets and service vehicles that need organized fuel expense solutions.

The U.S. operates one of the world's most extensive commercial vehicle networks together with its widespread fueling stations which enable fuel cards to function at both branded and universal networks. The growing use of integrated fleet management systems, advanced telematics, digital payment tools in the United States helps businesses that need complete solutions combining fuel purchase convenience with expense tracking, reporting and cost control.

The dominance of this system exists is attributed to multiple structural elements support its function. The United States operates an extensive interstate highway system that connects with its logistics network to enable both - domestic freight operations and cross-border freight movement with Canada and Mexico. The United States hosts all the major fuel card companies together with fleet management service providers, which allows American companies to test new products before they reach other markets.

The U.S. has achieved higher fuel card market share than any other North American country due to the fleet activity concentration that creates infrastructure and service provider networks. American fleets use fuel cards for payment convenience and also use them as tools to control expenses, track spending, prevent fraud, and improve their operational efficiency that strengthens the U.S. market leadership position in the regional industry.

The commercial fuel card market offers substantial value through its telematics and fleet analytics platform integration as fleet operators require unified data systems to manage vehicle operations and fuel expenses. Modern fleets generate large volumes of operational data through GPS tracking, electronic logging devices, and onboard diagnostics. Organizations obtain a unified view of fuel consumption patterns which they track through fuel card transactions.

The integration of these systems enables fuel card providers to offer advanced fleet intelligence capabilities which extend beyond their basic payment system. Fleet managers use fuel purchase data together with current vehicle information to find operational problems which include drivers taking unauthorized routes, leaving engines running, drivers refueling without permission and vehicles using fuel at abnormal rates. The commercial operators find integrated solutions very appealing because even small efficiency gains lead to substantial cost reductions during implementation across extensive operations which include multiple vehicles.

The provider telematics integration allows companies to deliver premium analytics and subscription-based services with value-added insights which results in greater customer retention and higher revenue per account. Fuel card platforms can incorporate advanced dashboards with predictive maintenance alerts and performance benchmarking to create unique product offerings that will help businesses compete in a challenging marketplace. Fleet-dependent businesses now require seamless data integration that supports compliance reporting, internal audits, and sustainability tracking as these functions have become essential to their operations.

Fuel card providers who achieve successful integration between telematics systems and fleet analytics platforms will gain long-term growth benefits as their services become integral to their customers' daily operations.

AtoB, BP p.l.c., BVD Group, Canadian Tire, Coast, Corpay, Inc., Fillip Fleet Inc., Gulf, Imperial Oil (Esso & Mobil) in association with WEX Inc., Parkland Fuel Corporation, Pilot Travel Centers LLC, Shell International B.V., and Suncor Energy Inc. (Petro-Canada) are some of the leading companies operating in the global Commercial Fuel Cards.

Each of these companies has been profiled in North America commercial fuel cards industry report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2025 (Base Year) | US$ 201.6 Bn |

| Market Forecast Value in 2036 | US$ 312.5 Bn |

| Growth Rate (CAGR 2026 to 2036) | 4.0% |

| Forecast Period | 2026-2036 |

| Historical data Available for | 2021-2024 |

| Quantitative Units | US$ Bn for Value and Units for Volume |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentations | By Card Type

|

| Region Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

North America commercial fuel cards market was valued at US$ 201.6 Bn in 2025

North America commercial fuel cards industry is projected to reach at US$ 312.5 Bn by the end of 2036

The need for fuel cost control, expense management, and rising adoption of fleet management & telematics solutions are some of the driving factors for this market

The CAGR is anticipated to be 4.0% from 2026 to 2036

AtoB, BP p.l.c., BVD Group, Canadian Tire, Coast, Corpay, Inc., Fillip Fleet Inc., Gulf, Imperial Oil (Esso & Mobil) in association with WEX Inc., Parkland Fuel Corporation, Pilot Travel Centers LLC, Shell International B.V., Suncor Energy Inc. (Petro-Canada), and other key players

Table 01: North America Commercial Fuel Cards Market Value (US$ Bn) Projection, By Card Type 2021 to 2036

Table 02: North America Commercial Fuel Cards Market Volume (Units) Projection, By Card Type 2021 to 2036

Table 03: North America Commercial Fuel Cards Market Value (US$ Bn) Projection, By Category 2021 to 2036

Table 04: North America Commercial Fuel Cards Market Volume (Units) Projection, By Category 2021 to 2036

Table 05: North America Commercial Fuel Cards Market Value (US$ Bn) Projection, By Vehicle Type 2021 to 2036

Table 06: North America Commercial Fuel Cards Market Volume (Units) Projection, By Vehicle Type 2021 to 2036

Table 07: North America Commercial Fuel Cards Market Value (US$ Bn) Projection, By Application 2021 to 2036

Table 08: North America Commercial Fuel Cards Market Volume (Units) Projection, By Application 2021 to 2036

Table 09: U.S. Commercial Fuel Cards Market Value (US$ Bn) Projection, By Card Type 2021 to 2036

Table 10: U.S. Commercial Fuel Cards Market Volume (Units) Projection, By Card Type 2021 to 2036

Table 11: U.S. Commercial Fuel Cards Market Value (US$ Bn) Projection, By Category 2021 to 2036

Table 12: U.S. Commercial Fuel Cards Market Volume (Units) Projection, By Category 2021 to 2036

Table 13: U.S. Commercial Fuel Cards Market Value (US$ Bn) Projection, By Vehicle Type 2021 to 2036

Table 14: U.S. Commercial Fuel Cards Market Volume (Units) Projection, By Vehicle Type 2021 to 2036

Table 15: U.S. Commercial Fuel Cards Market Value (US$ Bn) Projection, By Application 2021 to 2036

Table 16: U.S. Commercial Fuel Cards Market Volume (Units) Projection, By Application 2021 to 2036

Table 17: U.S. Commercial Fuel Cards Market Value (US$ Bn) Projection, By Country 2021 to 2036

Table 18: U.S. Commercial Fuel Cards Market Volume (Units) Projection, By Country 2021 to 2036

Table 19: Canada Commercial Fuel Cards Market Value (US$ Bn) Projection, By Card Type 2021 to 2036

Table 20: Canada Commercial Fuel Cards Market Volume (Units) Projection, By Card Type 2021 to 2036

Table 21: Canada Commercial Fuel Cards Market Value (US$ Bn) Projection, By Category 2021 to 2036

Table 22: Canada Commercial Fuel Cards Market Volume (Units) Projection, By Category 2021 to 2036

Table 23: Canada Commercial Fuel Cards Market Value (US$ Bn) Projection, By Vehicle Type 2021 to 2036

Table 24: Canada Commercial Fuel Cards Market Volume (Units) Projection, By Vehicle Type 2021 to 2036

Table 25: Canada Commercial Fuel Cards Market Value (US$ Bn) Projection, By Application 2021 to 2036

Table 26: Canada Commercial Fuel Cards Market Volume (Units) Projection, By Application 2021 to 2036

Figure 01: North America Commercial Fuel Cards Market Value (US$ Bn) Projection, By Card Type 2021 to 2036

Figure 02: North America Commercial Fuel Cards Market Volume (Units) Projection, By Card Type 2021 to 2036

Figure 03: North America Commercial Fuel Cards Market Incremental Opportunities (US$ Bn) Forecast, By Card Type 2026 to 2036

Figure 04: North America Commercial Fuel Cards Market Value (US$ Bn) Projection, By Category 2021 to 2036

Figure 05: North America Commercial Fuel Cards Market Volume (Units) Projection, By Category 2021 to 2036

Figure 06: North America Commercial Fuel Cards Market Incremental Opportunities (US$ Bn) Forecast, By Category 2026 to 2036

Figure 07: North America Commercial Fuel Cards Market Value (US$ Bn) Projection, By Vehicle Type 2021 to 2036

Figure 08: North America Commercial Fuel Cards Market Volume (Units) Projection, By Vehicle Type 2021 to 2036

Figure 09: North America Commercial Fuel Cards Market Incremental Opportunities (US$ Bn) Forecast, By Vehicle Type 2026 to 2036

Figure 10: North America Commercial Fuel Cards Market Value (US$ Bn) Projection, By Application 2021 to 2036

Figure 11: North America Commercial Fuel Cards Market Volume (Units) Projection, By Application 2021 to 2036

Figure 12: North America Commercial Fuel Cards Market Incremental Opportunities (US$ Bn) Forecast, By Application 2026 to 2036

Figure 13: North America Commercial Fuel Cards Market Value (US$ Bn) Projection, By Country 2021 to 2036

Figure 14: North America Commercial Fuel Cards Market Volume (Units) Projection, By Country 2021 to 2036

Figure 15: North America Commercial Fuel Cards Market Incremental Opportunities (US$ Bn) Forecast, By Country 2026 to 2036

Figure 16: U.S. Commercial Fuel Cards Market Value (US$ Bn) Projection, By Card Type 2021 to 2036

Figure 17: U.S. Commercial Fuel Cards Market Volume (Units) Projection, By Card Type 2021 to 2036

Figure 18: U.S. Commercial Fuel Cards Market Incremental Opportunities (US$ Bn) Forecast, By Card Type 2026 to 2036

Figure 19: U.S. Commercial Fuel Cards Market Value (US$ Bn) Projection, By Category 2021 to 2036

Figure 20: U.S. Commercial Fuel Cards Market Volume (Units) Projection, By Category 2021 to 2036

Figure 21: U.S. Commercial Fuel Cards Market Incremental Opportunities (US$ Bn) Forecast, By Category 2026 to 2036

Figure 22: U.S. Commercial Fuel Cards Market Value (US$ Bn) Projection, By Vehicle Type 2021 to 2036

Figure 23: U.S. Commercial Fuel Cards Market Volume (Units) Projection, By Vehicle Type 2021 to 2036

Figure 24: U.S. Commercial Fuel Cards Market Incremental Opportunities (US$ Bn) Forecast, By Vehicle Type 2026 to 2036

Figure 25: U.S. Commercial Fuel Cards Market Value (US$ Bn) Projection, By Application 2021 to 2036

Figure 26: U.S. Commercial Fuel Cards Market Volume (Units) Projection, By Application 2021 to 2036

Figure 27: U.S. Commercial Fuel Cards Market Incremental Opportunities (US$ Bn) Forecast, By Application 2026 to 2036

Figure 28: Canada Commercial Fuel Cards Market Value (US$ Bn) Projection, By Card Type 2021 to 2036

Figure 29: Canada Commercial Fuel Cards Market Volume (Units) Projection, By Card Type 2021 to 2036

Figure 30: Canada Commercial Fuel Cards Market Incremental Opportunities (US$ Bn) Forecast, By Card Type 2026 to 2036

Figure 31: Canada Commercial Fuel Cards Market Value (US$ Bn) Projection, By Category 2021 to 2036

Figure 32: Canada Commercial Fuel Cards Market Volume (Units) Projection, By Category 2021 to 2036

Figure 33: Canada Commercial Fuel Cards Market Incremental Opportunities (US$ Bn) Forecast, By Category 2026 to 2036

Figure 34: Canada Commercial Fuel Cards Market Value (US$ Bn) Projection, By Vehicle Type 2021 to 2036

Figure 35: Canada Commercial Fuel Cards Market Volume (Units) Projection, By Vehicle Type 2021 to 2036

Figure 36: Canada Commercial Fuel Cards Market Incremental Opportunities (US$ Bn) Forecast, By Vehicle Type 2026 to 2036

Figure 37: Canada Commercial Fuel Cards Market Value (US$ Bn) Projection, By Application 2021 to 2036

Figure 38: Canada Commercial Fuel Cards Market Volume (Units) Projection, By Application 2021 to 2036

Figure 39: Canada Commercial Fuel Cards Market Incremental Opportunities (US$ Bn) Forecast, By Application 2026 to 2036