Reports

Reports

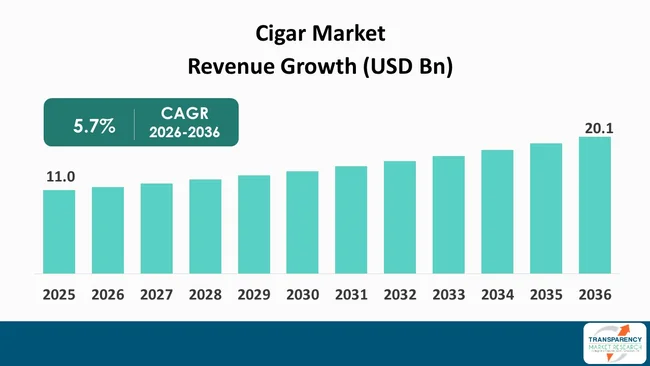

North America cigar market size was valued at US$ 11.0 Bn in 2025 and is projected to reach US$ 20.1 Bn by 2036, expanding at a CAGR of 5.7% from 2026 to 2036. The market growth is driven by shifting consumer lifestyle & social consumption and increasing product diversification & innovation.

North America’s cigar consumption patterns are changing as consumers now prefer smoking premium products during special events. The last few years have experienced stability with respect to cigar market demand due to changing lifestyle patterns and the development of cigar culture through dedicated lounges and social spaces.

The dual impact of regulatory frameworks and health awareness campaigns drives industry transformation by forcing companies to adopt risk reduction methods while they develop new labeling protocols. Short filler, long filler, and premium handcrafted cigars create different price points that businesses use to divide their market segments while they meet both - regulatory needs and business needs.

The demand for artisanal cigar formats shows a strong interest from specific age groups and sociocultural backgrounds who maintain their interest. North America’s cigar market operates as both - strong and adaptable to changes in governmental policies and cultural developments because of these three combined influences.

North America cigar market covers all aspects of cigar production and distribution and consumer cigar consumption in key areas of North America that include the United States, Canada, and Mexico. The market includes multiple types of cigars that range from machine-made and short-filler products targeting budget-conscious buyers to premium long-filler handmade cigars that collectors and enthusiasts desire. Cigar culture in North America exists as a social activity that people use to define their social status in hospitality environments where cigar lounges and events create brand connections extending beyond practical product use.

North American retailers present cigars through multiple sales channels that include specialized tobacconists, convenience stores, and duty-free shops. The dynamics of market growth depend on two factors that include the tobacco product-related regulatory policies and the changing consumer preferences for distinct tobacco product experiences. Customers today demand more from products as they want to experience authentic heritage brands through artisanal craftsmanship and authentic taste experiences.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

Cigars have increasingly been positioned as lifestyle products rather than mere tobacco commodities. Cigar use in North America is looked upon as a leisure activity. Dedicated cigar lounges and clubs and curated events have become popular as people want to experience their new lifestyle choice. The spaces enable customers to try products that create brand loyalty while they view cigars as special items that represent both - cultural heritage and traditional craftsmanship. The premium cigar curatorial process that selects vintage tobaccos and matches them with spirits that creates products attracting adult consumers who want unique leisure items.

As traditional smoking rates for cigarettes decline in many parts of North America, certain adult smokers seek alternatives that align with social rituals or personal indulgence. The market has developed niche demand pockets that exist for both - traditional long-filler cigars and affordable short-filler cigarettes that meet quality standards while remaining accessible.

Experiential retail environments attract customers who want to experience community and lifestyle elements, thereby creating special times for cigar smoking. The social and lifestyle foundations of cigar consumption create sustainable market growth, which continues despite increasing regulations regarding combustible tobacco products.

North America cigar market has responded to changing consumer preferences through increased product diversification and innovation in both - flavor and format. The short-filler and mixed-filler products attract adult smokers who want affordable and easy-to-use smoking options.

The manufacturers developed their product lines through the introduction of different wrapper styles and blending options and special edition products that appeal to both - expert users and casual users who want to enjoy their products. The business strategy enables the company to establish unique product categories while serving different customer needs through its product portfolio.

The company develops new products through its packaging system, its partnership projects, and its seasonal products that create excitement for fans of its brand. The product strategies maintain customer interest while helping to drive premiumization trends that are seen particularly in cities that have strong tobacco traditions. Brands now rely on product characteristics to establish their market value as regulators have restricted their traditional advertising methods including marketing through standard channels.

Product innovation at external hospitality and leisure trends has found new opportunities for development. The market develops through two forces that create new business opportunities and customer loyalty through the process of product development and market expansion. Product innovation develops new cigar products that maintain their market appeal through understanding customer behavior.

The growing cigar market in North America benefits from cigar integration into tourism and hospitality through its potential to drive industry expansion. Cigar lounges and specialty bars have become popular additions to hospitality services at urban destinations that offer authentic cultural experiences through their artisanal food and beverage offerings.

The venues provide social environments that transform cigar smoking into social activities that develop into both - lifestyle and experience-based activities. Cigar brands can connect with premium leisure ventures as the market needs to reach leisure tourists who value experience-based learning.

The existing user base represents a significant target market for events that combine cigar smoking with high-end hospitality experiences. Cigar producers and upscale resorts can establish partnerships through cultural festivals, which enable them to introduce cigar culture into local entertainment venues while bringing international visitors and creating economic advantages for all involved parties.

Cigar smoking at travel and lifestyle events provides businesses with new market opportunities through their ability to promote their products when they comply with regulatory standards and share responsible drinking messages. The organization needs to improve its visibility while creating more ways customers can interact with their brand to develop loyalty among current users and new adult customers who want to try their products.

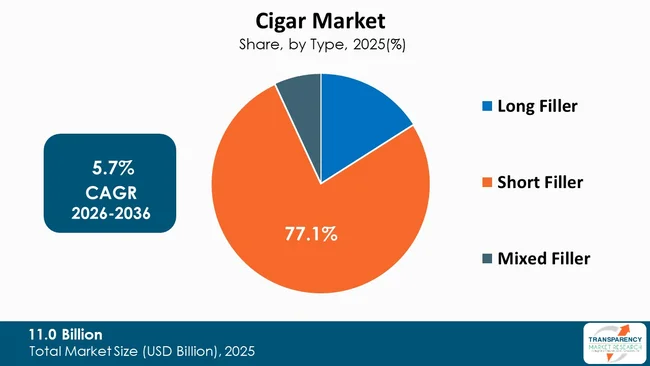

The Short Filler segment controls 77.1% of North America’s cigar market. The wide popularity of short-filler cigars stems from their ability to provide consumers with better price and product accessibility than long-filler and mixed-filler cigars. Price-sensitive smokers and casual social users choose short-filler cigars as these products offer them an affordable smoking option. Short-filler products serve as essential items.

Long Filler cigars that are handmade to create premium products attract a limited audience but they hold substantial cultural value as they draw in dedicated cigar enthusiasts who appreciate skilled tobacco craftsmanship. Mixed Filler cigars serve as a middle ground between mass-market and premium formats, appealing to adult consumers who seek blend complexity without the high cost of long-filler products. The industry trend toward short-filler products shows how consumers prefer economical options that they can use for their daily routines as manufacturers develop their products to achieve affordable pricing and multiple flavor choices and extensive market distribution.

| Attribute | Detail |

|---|---|

| Leading Country |

|

The U.S. holds an 83.3% share of North America cigar market. The United States serves as the main center for regional cigar consumption as it has a large adult population, a developed cigar culture, and a complete retail system.

A diverse consumer base together with the rich tradition of cigar lounges and lifestyle associations maintains a continuous demand for both - mass-market products and premium products. The United States has created a commercial system for cigars as its strict health message and product label rules create clear business regulations that allow companies to prepare for distribution and follow rules.

Canada and Mexico maintain the remaining part of the regional market as their markets operate at lower levels due to cultural and regulatory differences. The Canadian market has expanded into niche premium categories as hotels and restaurants have started to offer these products to their guests while Mexico’s market operates according to local consumption patterns and international trade connections. The U.S. market serves as the primary destination for funding and product research and business alliances which drive North American cigar market evolution.

AJF Cigars, Altadis U.S.A. LLC, Amendola Family Cigar Co., CasadeMontecristo, Drew Estate, Durfort Holdings S.A. (Topper Cigar), Frank Correnti Cigars, J.C. Newman Cigar Company, La Aroma de Cuba, My Father Cigars, Oliva Cigar Family, Padrón Cigars, San Cristobal, Swedish Match, Swisher, and Tatuaje Cigars are some of the leading manufacturers operating in the North America Cigar market.

Each of these companies has been profiled in North America cigar industry report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2025 (Base Year) | US$ 11.0 Bn |

| Market Forecast Value in 2036 | US$ 20.1 Bn |

| Growth Rate (CAGR 2026 to 2036) | 5.7% |

| Forecast Period | 2026-2036 |

| Historical data Available for | 2021-2023 |

| Quantitative Units | US$ Bn for Value and Thousand Units for Volume |

| Market Analysis | Global qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape | Market Player - Competition Dashboard and Revenue Share Analysis 2025 Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview) |

| Format | Electronic (PDF) + Excel |

| Market Segmentations | By Type

|

| Region Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

North America cigar market was valued at US$ 11.0 Bn in 2025

North America cigar industry is projected to reach at US$ 20.1 Bn by the end of 2036

Shifting consumer lifestyle & social consumption, and increasing product diversification & innovation, are some of the driving factors for this market

The CAGR is anticipated to be 5.7% from 2026 to 2036

AJF Cigars, Altadis U.S.A. LLC, Amendola Family Cigar Co., CasadeMontecristo, Drew Estate, Durfort Holdings S.A. (Topper Cigar), Frank Correnti Cigars, J.C. Newman Cigar Company, La Aroma de Cuba, My Father Cigars, Oliva Cigar Family, Padrón Cigars, San Cristobal, Swedish Match, Swisher, Tatuaje Cigars, and others

Table 01: North America Cigar Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 02: North America Cigar Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 03: North America Cigar Market Value (US$ Bn) Projection, By Flavor Profile 2021 to 2036

Table 04: North America Cigar Market Volume (Thousand Units) Projection, By Flavor Profile 2021 to 2036

Table 05: North America Cigar Market Value (US$ Bn) Projection, By Shape 2021 to 2036

Table 06: North America Cigar Market Volume (Thousand Units) Projection, By Shape 2021 to 2036

Table 07: North America Cigar Market Value (US$ Bn) Projection, By Category 2021 to 2036

Table 08: North America Cigar Market Volume (Thousand Units) Projection, By Category 2021 to 2036

Table 09: North America Cigar Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 10: North America Cigar Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 11: North America Cigar Market Value (US$ Bn) Projection, By Country 2021 to 2036

Table 12: North America Cigar Market Volume (Thousand Units) Projection, By Country 2021 to 2036

Table 13: U.S. Cigar Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 14: U.S. Cigar Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 15: U.S. Cigar Market Value (US$ Bn) Projection, By Flavor Profile 2021 to 2036

Table 16: U.S. Cigar Market Volume (Thousand Units) Projection, By Flavor Profile 2021 to 2036

Table 17: U.S. Cigar Market Value (US$ Bn) Projection, By Shape 2021 to 2036

Table 18: U.S. Cigar Market Volume (Thousand Units) Projection, By Shape 2021 to 2036

Table 19: U.S. Cigar Market Value (US$ Bn) Projection, By Category 2021 to 2036

Table 20: U.S. Cigar Market Volume (Thousand Units) Projection, By Category 2021 to 2036

Table 21: U.S. Cigar Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 22: U.S. Cigar Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Table 23: Canada Cigar Market Value (US$ Bn) Projection, By Type 2021 to 2036

Table 24: Canada Cigar Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Table 25: Canada Cigar Market Value (US$ Bn) Projection, By Flavor Profile 2021 to 2036

Table 26: Canada Cigar Market Volume (Thousand Units) Projection, By Flavor Profile 2021 to 2036

Table 27: Canada Cigar Market Value (US$ Bn) Projection, By Shape 2021 to 2036

Table 28: Canada Cigar Market Volume (Thousand Units) Projection, By Shape 2021 to 2036

Table 29: Canada Cigar Market Value (US$ Bn) Projection, By Category 2021 to 2036

Table 30: Canada Cigar Market Volume (Thousand Units) Projection, By Category 2021 to 2036

Table 31: Canada Cigar Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Table 32: Canada Cigar Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 01: North America Cigar Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 02: North America Cigar Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Figure 03: North America Cigar Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 04: North America Cigar Market Value (US$ Bn) Projection, By Flavor Profile 2021 to 2036

Figure 05: North America Cigar Market Volume (Thousand Units) Projection, By Flavor Profile 2021 to 2036

Figure 06: North America Cigar Market Incremental Opportunities (US$ Bn) Forecast, By Flavor Profile 2026 to 2036

Figure 07: North America Cigar Market Value (US$ Bn) Projection, By Shape 2021 to 2036

Figure 08: North America Cigar Market Volume (Thousand Units) Projection, By Shape 2021 to 2036

Figure 09: North America Cigar Market Incremental Opportunities (US$ Bn) Forecast, By Shape 2026 to 2036

Figure 10: North America Cigar Market Value (US$ Bn) Projection, By Category 2021 to 2036

Figure 11: North America Cigar Market Volume (Thousand Units) Projection, By Category 2021 to 2036

Figure 12: North America Cigar Market Incremental Opportunities (US$ Bn) Forecast, By Category 2026 to 2036

Figure 13: North America Cigar Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 14: North America Cigar Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 15: North America Cigar Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 16: North America Cigar Market Value (US$ Bn) Projection, By Country 2021 to 2036

Figure 17: North America Cigar Market Volume (Thousand Units) Projection, By Country 2021 to 2036

Figure 18: North America Cigar Market Incremental Opportunities (US$ Bn) Forecast, By Country 2026 to 2036

Figure 19: U.S. Cigar Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 20: U.S. Cigar Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Figure 21: U.S. Cigar Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 22: U.S. Cigar Market Value (US$ Bn) Projection, By Flavor Profile 2021 to 2036

Figure 23: U.S. Cigar Market Volume (Thousand Units) Projection, By Flavor Profile 2021 to 2036

Figure 24: U.S. Cigar Market Incremental Opportunities (US$ Bn) Forecast, By Flavor Profile 2026 to 2036

Figure 25: U.S. Cigar Market Value (US$ Bn) Projection, By Shape 2021 to 2036

Figure 26: U.S. Cigar Market Volume (Thousand Units) Projection, By Shape 2021 to 2036

Figure 27: U.S. Cigar Market Incremental Opportunities (US$ Bn) Forecast, By Shape 2026 to 2036

Figure 28: U.S. Cigar Market Value (US$ Bn) Projection, By Category 2021 to 2036

Figure 29: U.S. Cigar Market Volume (Thousand Units) Projection, By Category 2021 to 2036

Figure 30: U.S. Cigar Market Incremental Opportunities (US$ Bn) Forecast, By Category 2026 to 2036

Figure 31: U.S. Cigar Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 32: U.S. Cigar Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 33: U.S. Cigar Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036

Figure 34: Canada Cigar Market Value (US$ Bn) Projection, By Type 2021 to 2036

Figure 35: Canada Cigar Market Volume (Thousand Units) Projection, By Type 2021 to 2036

Figure 36: Canada Cigar Market Incremental Opportunities (US$ Bn) Forecast, By Type 2026 to 2036

Figure 37: Canada Cigar Market Value (US$ Bn) Projection, By Flavor Profile 2021 to 2036

Figure 38: Canada Cigar Market Volume (Thousand Units) Projection, By Flavor Profile 2021 to 2036

Figure 39: Canada Cigar Market Incremental Opportunities (US$ Bn) Forecast, By Flavor Profile 2026 to 2036

Figure 40: Canada Cigar Market Value (US$ Bn) Projection, By Shape 2021 to 2036

Figure 41: Canada Cigar Market Volume (Thousand Units) Projection, By Shape 2021 to 2036

Figure 42: Canada Cigar Market Incremental Opportunities (US$ Bn) Forecast, By Shape 2026 to 2036

Figure 43: Canada Cigar Market Value (US$ Bn) Projection, By Category 2021 to 2036

Figure 44: Canada Cigar Market Volume (Thousand Units) Projection, By Category 2021 to 2036

Figure 45: Canada Cigar Market Incremental Opportunities (US$ Bn) Forecast, By Category 2026 to 2036

Figure 46: Canada Cigar Market Value (US$ Bn) Projection, By Distribution Channel 2021 to 2036

Figure 47: Canada Cigar Market Volume (Thousand Units) Projection, By Distribution Channel 2021 to 2036

Figure 48: Canada Cigar Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2026 to 2036