Reports

Reports

Due to the high demand for fluoropolymers in the semiconductor industry, companies in North America, China, & Asia Pacific fluoropolymer lined ISO tanks market for semiconductor chemicals are increasing their efficacy in coating services. For instance, Sun Coating-an ISO-certified provider of functional fluoropolymer coatings has gained expertise in coatings that offer excellent impact strength over a broad temperature range in various semiconductor applications.

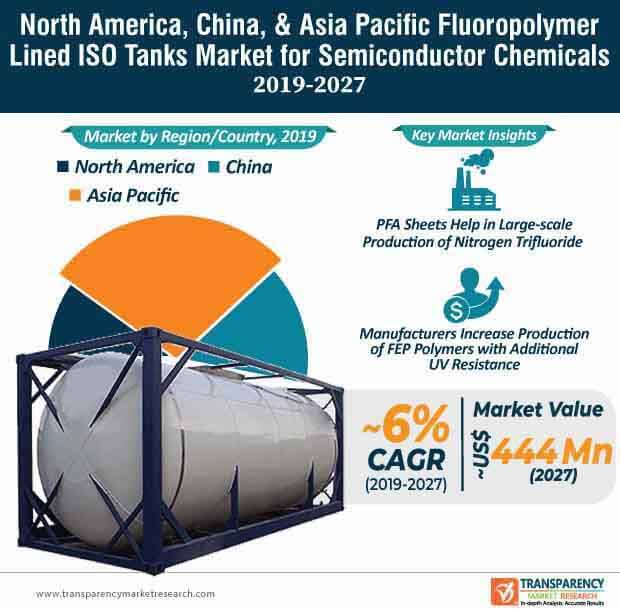

In order to boost their credibility credentials, companies in the North America, China, & Asia Pacific fluoropolymer lined ISO tanks market for semiconductor chemicals are expanding their portfolio in coating services by incorporating Teflon® coatings. Cutting-edge coating services are contributing toward the exponential growth of the market, which is anticipated to progress at a steady CAGR of 6% during the forecast period.

Coating services companies in the market are increasing efforts to become licensed industrial applicator (LIA) of Teflon coatings to meet requirements of stakeholders in the semiconductor sector. Thus, FDA-compliant coating services are gaining importance among end-use customers. Fluoropolymer are being highly publicized for use in chemical handling equipment.

Semi-finished PFA Sheets Comply with Regulations of Semiconductor Industry

Semi-finished perfluoroalkoxy alkane (PFA) sheets are acquiring popularity in the North America, China, & Asia Pacific fluoropolymer lined ISO tanks market for semiconductor chemicals. This can be attributed to the growing number of transporters on road that need to meet the ever-increasing demand for chemicals.

There is a growing demand for PFA sheets that offer corrosion protection in semiconductor applications. This is evident since the North America, China, & Asia Pacific fluoropolymer lined ISO tanks market for semiconductor chemicals is estimated to reach a production output of ~8,800 units by the end of 2027. However, stringent regulations pertaining to the purity of water and chemicals in the semiconductor industry pose a challenge for companies in the market landscape. Hence, companies are increasing R&D in semi-finished products that comply with the global industry standards. Manufacturers in the North America, China, & Asia Pacific fluoropolymer lined ISO tanks market for semiconductor chemicals are increasing the production of PFA sheets that are used in ISO containers for the production of nitrogen trifluoride. As such, there is a growing demand for nitrogen trifluoride in cleaning of process equipment in the semiconductor industry.

The North America, China, & Asia Pacific fluoropolymer lined ISO tanks market for semiconductor chemicals is highly competitive with fragmented players accounting for ~85% of the market share. Hence, the competition is building in the semiconductor space, since manufacturers are competing to increase the availability of PFA sheets used in electrolytic baths. For instance, AGRU-a supplier of high-quality plastic piping systems is increasing the production of PFA sheets that are used in combination with AGRU PFA glass fabric backed sheets in electrolytic baths. Thus, companies in North America, China, & Asia Pacific fluoropolymer lined ISO tanks market for semiconductor chemicals should capitalize on the demand for PFA sheets.

On the other hand, companies in the North America, China, & Asia Pacific fluoropolymer lined ISO tanks market for semiconductor chemicals are increasing efforts to fulfill the demand for PFA sheets used for the treatment of ammonium bifluoride (ABF) to produce nitrogen trifluoride. In order to provide adequate corrosion protection, PFA sheets are being increasingly used inside the lining of tanks for heating ABF.

High-performance FEP Gains Popularity Due to High Thermal Stability

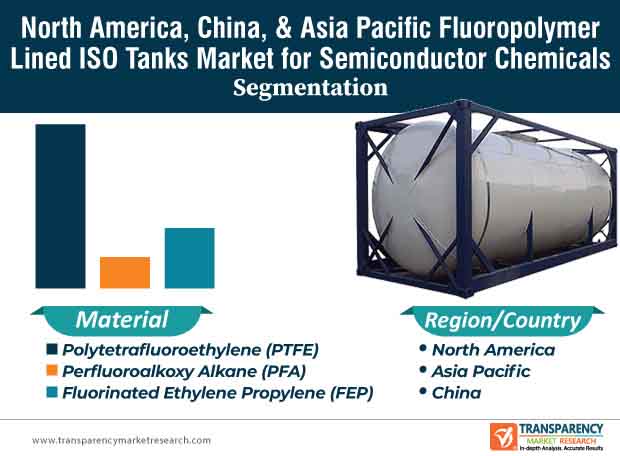

New innovations in high-performance plastics, such as the fluorinated ethylene propylene (FEP) are generating incremental opportunities for manufacturers in the North America, China, & Asia Pacific fluoropolymer lined ISO tanks market for semiconductor chemicals.

Polyvinylidene fluoride (PVDF), ethylene-chlorotrifluoroethylene (ECTFE), along with FEP are being increasingly used for demanding requirements of chemical resistance and service temperature range. Hence, manufacturers are introducing additional attributes, such as UV resistance, physiological safety, and advanced processing properties to meet the highest possible thermal stability requirements. For instance, Simona AG-a manufacturer of thermoplastic products has gained expertise in the development of best-in-class chemical resistance fluoropolymers that are being used in electroplating and the semiconductor industry. Hence, companies in the North America, China, & Asia Pacific fluoropolymer lined ISO tanks market for semiconductor chemicals should increase their focus in FEP polymers.

Fully fluorinated high-performance FEP and its copolymers are acquiring increased popularity in the market landscape. As such, FEP is estimated to account for a significant share of the North America, China, & Asia Pacific fluoropolymer lined ISO tanks market for semiconductor chemicals and the market is anticipated to reach a value of ~US$ 444 Mn by the end of 2027.

Analysts’ Viewpoint

Polytetrafluoroethylene (PTFE) is projected for exponential growth in the North America, China, & Asia Pacific fluoropolymer lined ISO tanks market for semiconductor chemicals and accounts for the highest revenue among all material types. Polymist® Teflon® resins are generating incremental opportunities for companies in the market, owing to their anti-stick and release properties in coatings. Moreover, PFA sheets are becoming increasingly mainstream in semiconductor applications. However, stringent regulations associated with the purity of water and chemicals pose a restraint for companies. Hence, companies should expand their services in FDA-complaint coatings to abide by industry standards. They should tap opportunities with PFA glass fabric backed sheets to produce nitrogen trifluoride used in cleaning of process equipment.

Rise in Demand for Corrosion Resistant Lining/Coating for Chemical Transportation in North America, China, and Asia Pacific

High Price vis-à-vis Epoxy Coatings Hampers Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals in North America, China, & Asia Pacific

Polytetrafluoroethylene Material Offers Lucrative Opportunities to Global Market

Asia Pacific Dominates Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals

Highly Competitive North America, China, & Asia Pacific Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals

1. Preface

1.1. Report Scope and Market Segmentation

1.2. Research Highlights

2. Assumptions and Research Methodology

2.1. Report Assumptions

2.2. Secondary Sources and Acronyms Used

2.3. Research Methodology

3. Executive Summary

3.1. Market Snapshot

3.2. Top Trends

4. Market Overview

4.1. Introduction

4.2. Market Indicators

5. Market Dynamics

5.1. Drivers and Restraints Snapshot Analysis

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Porter's Five Forces Analysis

5.2.1. Threat of Substitutes

5.2.2. Bargaining Power of Buyers

5.2.3. Bargaining Power of Suppliers

5.2.4. Threat of New Entrants

5.2.5. Degree of Competition

5.3. Value Chain Analysis

6. North America, China, & Asia Pacific Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals, by Region, 2018–2027

6.1. Key Findings

6.2. North America, China, & Asia Pacific Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals Volume (Units) and Value (US$ Mn) Analysis & Forecast, by Region, 2018–2027

6.2.1. North America

6.2.2. Asia Pacific

6.2.3. China

6.3. North America, China, & Asia Pacific Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals Attractiveness Analysis, by Region

7. North America, China, & Asia Pacific Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals, by Material, 2018–2027

7.1. Introduction

7.2. Key Findings

7.3. North America, China, & Asia Pacific Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals Volume (Units) and Value (US$ Mn) Analysis & Forecast, by Material, 2018–2027

7.3.1. North America, China, & Asia Pacific Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals Volume (Units) and Value (US$ Mn) Forecast, by Polytetrafluoroethylene (PTFE), 2018–2027

7.3.2. North America, China, & Asia Pacific Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals Volume (Units) and Value (US$ Mn) Forecast, by Perfluoroalkoxy Alkane (PFA), 2018–2027

7.3.3. North America, China, & Asia Pacific Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals Volume (Units) and Value (US$ Mn) Forecast, by Fluorinated Ethylene Propylene (FEP), 2018–2027

7.4. North America, China, & Asia Pacific Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals Attractiveness Analysis, by Material

8. North America Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals Analysis, 2018–2027

8.1. Key Findings

8.2. North America Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals Volume (Units) and Value (US$ Mn) Forecast, by Material, 2018–2027

8.3. North America Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals Volume (Units) and Value (US$ Mn) Forecast, by Country, 2018–2027

8.3.1. U.S. Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals Volume (Units) and Value (US$ Mn) Forecast, by Material, 2018–2027

8.3.2. Canada Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals Volume (Units) and Value (US$ Mn) Forecast, by Material, 2018–2027

8.4. North America Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals Attractiveness Analysis, by Material

8.5. North America Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals Attractiveness Analysis, by Country

9. Asia Pacific Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals Analysis, 2018–2027

9.1. Key Findings

9.2. Asia Pacific Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals Volume (Units) and Value (US$ Mn) Forecast, by Material, 2018–2027

9.3. Asia Pacific Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals Volume (Units) and Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

9.3.1. India Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals Volume (Units) and Value (US$ Mn) Forecast, by Material, 2018–2027

9.3.2. Japan Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals Volume (Units) and Value (US$ Mn) Forecast, by Material, 2018–2027

9.3.3. South Korea Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals Volume (Units) and Value (US$ Mn) Forecast, by Material, 2018–2027

9.3.4. ASEAN Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals Volume (Units) and Value (US$ Mn) Forecast, by Material, 2018–2027

9.3.5. Rest of Asia Pacific Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals Volume (Units) and Value (US$ Mn) Forecast, by Material, 2018–2027

9.4. Asia Pacific Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals Attractiveness Analysis, by Material

9.5. Asia Pacific Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals Attractiveness Analysis, by Country and Sub-region

10. China Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals Analysis, 2018–2027

10.1. Key Findings

10.2. China Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals Volume (Units) and Value (US$ Mn) Forecast, by Material, 2018–2027

10.3. China Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals Attractiveness Analysis, by Material

11. Competition Landscape

11.1. Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals Company Share Analysis, 2018

11.2. Competition Matrix

11.3. Market Footprint Analysis

11.3.1. By Material

11.4. Company Profiles

11.4.1. Praxair S.T. Technology, Inc.

11.4.1.1. Company Details

11.4.1.2. Company Description

11.4.1.3. Business Overview

11.4.1.4. Financial Overview

11.4.1.5. Strategic Overview/Recent Development

11.4.2. NICHIAS Corporation

11.4.2.1. Company Details

11.4.2.2. Company Description

11.4.2.3. Business Overview

11.4.2.4. Financial Overview

11.4.3. Valqua NGC, Inc.

11.4.3.1. Company Details

11.4.3.2. Company Description

11.4.3.3. Business Overview

11.4.4. Electro Chemical Engineering & Manufacturing Co.

11.4.4.1. Company Details

11.4.4.2. Company Description

11.4.4.3. Business Overview

11.4.5. Allied Supreme Corp.

11.4.5.1. Company Details

11.4.5.2. Company Description

11.4.5.3. Business Overview

11.4.6. Sigma Roto Lining LLP

11.4.6.1. Company Details

11.4.6.2. Company Description

11.4.6.3. Business Overview

11.4.7. FISHER COMPANY

11.4.7.1. Company Details

11.4.7.2. Company Description

11.4.7.3. Business Overview

11.4.8. Edlon

11.4.8.1. Company Details

11.4.8.2. Company Description

11.4.8.3. Business Overview

11.4.9. Pennwalt Ltd

11.4.9.1. Company Details

11.4.9.2. Company Description

11.4.9.3. Business Overview

11.4.10. Jiangsu Ruineng Anticorrosion Equipment Co.,Ltd

11.4.10.1. Company Details

11.4.10.2. Company Description

11.4.10.3. Business Overview

11.4.11. Gartner Coatings, Inc.

11.4.11.1. Company Details

11.4.11.2. Company Description

11.4.11.3. Business Overview

11.4.12. Plasticon Composites

11.4.12.1. Company Details

11.4.12.2. Company Description

11.4.12.3. Business Overview

11.4.13. Sun Fluoro System Co.,Ltd.

11.4.13.1. Company Details

11.4.13.2. Company Description

11.4.13.3. Business Overview

11.4.14. EVERSUPP TECHNOLOGY CORP.

11.4.14.1. Company Details

11.4.14.2. Company Description

11.4.14.3. Business Overview

List of Tables

Table 01: North America, China, & Asia Pacific Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals Value (US$ Mn) Forecast, by Region, 2018–2027

Table 02: North America, China, & Asia Pacific Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals Volume (Units) Forecast, by Region, 2018–2027

Table 03: North America, China, & Asia Pacific Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals Value (US$ Mn) Forecast, by Material, 2018–2027

Table 04: North America, China, & Asia Pacific Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals Volume (Units) Forecast, by Material, 2018–2027

Table 05: North America Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals Value (US$ Mn) Forecast, by Country, 2018–2027

Table 06: North America Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals Volume (Units) Forecast, by Country, 2018–2027

Table 07: North America Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals, Value (US$ Mn) Forecast, by Material, 2018–2027

Table 08: North America Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals, Volume (Units) Forecast, by Material, 2018–2027

Table 09: U.S. Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals, Value (US$ Mn) Forecast, by Material, 2018–2027

Table 10: U.S. Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals, Volume (Units) Forecast, by Material, 2018–2027

Table 11: Canada Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals, Value (US$ Mn) Forecast, by Material, 2018–2027

Table 12: Canada Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals, Volume (Units) Forecast, by Material, 2018–2027

Table 13: Asia Pacific Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals, Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 14: Asia Pacific Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals, Volume (Units) Forecast, by Country and Sub-region, 2018–2027

Table 15: Asia Pacific Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals, Value (US$ Mn) Forecast, by Material, 2018–2027

Table 16: Asia Pacific Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals, Volume (Units) Forecast, by Material, 2018–2027

Table 17: India Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals, Value (US$ Mn) Forecast, by Material, 2018–2027

Table 18: India Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals, Volume (Units) Forecast, by Material, 2018–2027

Table 19: Japan Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals, Value (US$ Mn) Forecast, by Material, 2018–2027

Table 20: Japan Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals, Volume (Units) Forecast, by Material, 2018–2027

Table 21: South Korea Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals, Value (US$ Mn) Forecast, by Material, 2018–2027

Table 22: South Korea Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals, Volume (Units) Forecast, by Material, 2018–2027

Table 24: ASEAN Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals, Volume (Units) Forecast, by Material, 2018–2027

Table 23: ASEAN Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals, Value (US$ Mn) Forecast, by Material, 2018–2027

Table 26: Rest of Asia Pacific (excluding China) Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals, Value (US$ Mn) Forecast, by Material, 2018–2027

Table 25: Rest of Asia Pacific (excluding China) Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals, Volume (Units) Forecast, by Material, 2018–2027

Table 27: China Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals, Value (US$ Mn) Forecast, by Material, 2018-2027

Table 28: China Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals Market, Volume (Units) Forecast, by Material, 2018-2027

List of Figures

Figure 01: North America, China, & Asia Pacific Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals Value Share Analysis, by Region, 2018 and 2027

Figure 02: North America, China, & Asia Pacific Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals Attractiveness Analysis, by Region

Figure 03: North America, China, & Asia Pacific Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals Value Share Analysis, by Material, 2018 and 2027

Figure 04: North America, China, & Asia Pacific Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals Attractiveness Analysis, by Material

Figure 05: North America Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals Volume (Units) & Value (US$ Mn) Forecast, 2018–2027

Figure 06: North America Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals Value (US$ Mn) Share Analysis, by Country, 2018 and 2027

Figure 07: North America Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals, Value (US$ Mn) Share Analysis, by Material, 2018 and 2027

Figure 08: North America Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals Attractiveness Analysis, by Material

Figure 09: North America Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals Attractiveness Analysis, by Country

Figure 10: Asia Pacific Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals, Volume (Units) and Value (US$ Mn) Forecast, 2018–2027

Figure 11: Asia Pacific Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals, Value (US$ Mn) Share Analysis, by Country and Sub-region, 2018 and 2027

Figure 12: Asia Pacific Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals, Value (US$ Mn) Share Analysis, by Material, 2018 and 2027

Figure 13: Asia Pacific Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals Attractiveness Analysis, by Material

Figure 14: Asia Pacific Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals Attractiveness Analysis, by Country and Sub-region

Figure 15: China Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals, Volume (Units) and Value (US$ Mn) Forecast, 2018–2027

Figure 16: China Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals Value Share (US$ Mn) Analysis, by Material, 2018 and 2027

Figure 17: China Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals Attractiveness Analysis, by Material

Figure 18: North America, China, & Asia Pacific Fluoropolymer Lined ISO Tanks Market for Semiconductor Chemicals, Company Share Analysis, 2018