Reports

Reports

Stakeholders in healthcare, consumer goods, and other essential industries such as semiconductors have been working at break-neck speeds to meet the demands of consumers during the COVID-19 crisis. Companies in the North America automated rotary indexing table market are supporting these stakeholders by ensuring the supply of machinery and equipment.

Companies in the North America automated rotary indexing table market are capitalizing on the burgeoning growth of eCommerce to boost sales of machinery and equipment. They are taking the advantage of government stimulus packages to stay financially afloat during the pandemic. Manufacturers are taking data-driven decisions before investing in new technologies. Mergers & acquisitions (M&A) are emerging as an effective strategy for new machinery development and innovations.

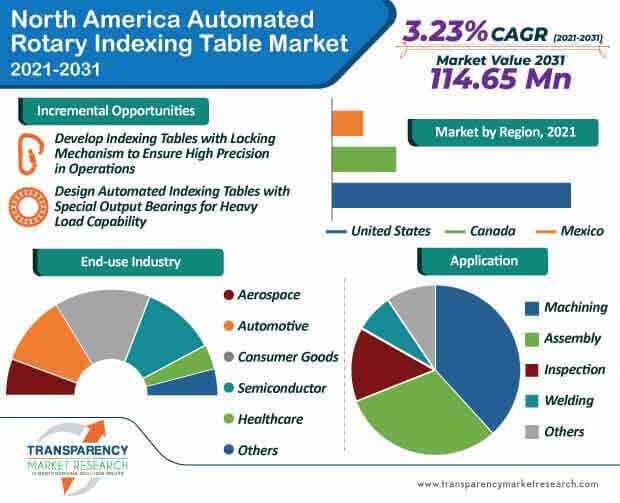

The North America automated rotary indexing table market is estimated to register a sluggish CAGR of 3.23% during the forecast period. This is evident since there is a need for fast indexing times combined with the high precision to create greater output in various automation processes. Hence, companies are increasing their R&D efforts to develop robust automated rotary indexing tables that improve productivity in various end-use cases.

Companies are increasing the availability of standard automation platforms that reduce manufacturing costs, enable fast delivery of end products, and provide fast cycle times. The total cost of construction, installation, and commissioning are significantly reduced with the introduction of the plug-and-play technology in automated rotary indexing tables.

Hydraulic rotary indexing tables are being publicized for high rigidity and precision in machine tools. The FIBROTAKT® hydraulic rotary indexing table provided by the FIBRO India Precision Products Pvt. Ltd. is gaining recognition for withstanding high machining tools. Manufacturers in the North America automated rotary indexing table market are taking cues from such innovations to develop indexing tables with a locking mechanism that ensures high precision and rigidity over the long term.

The built-in indexing table for rotary transfer machines combines the shortest possible cycle times, even with heavy setups. Companies in the North America automated rotary indexing table market are boosting the manufacturing of equipment that caters to processing applications involving extreme forces.

The North America automated rotary indexing table market was valued at US$ 81.36 Mn in 2020 and is expected to reach the revenue of US$ 114.65 Mn by 2031. There is a demand for compact rotary system designs that help achieve high cycle rates. Lanco Integrated - an assembly automation company, is gaining popularity for its innovative rotary solutions that ensure optimal operations and outputs daily.

Companies in the North America automated rotary indexing table market are increasing the availability of machines that require low maintenance, which makes it easier for end users to invest in reliable automation solutions. Cutting-edge rotary indexer solutions promote OEE (Overall Equipment Effectiveness) with proven high cycle rates to meet production goals.

Analysts’ Viewpoint

Mission-critical projects for essential industries such as consumer goods, healthcare, and semiconductors are helping to keep economies running for companies in the North America automated rotary indexing table market during the coronavirus crisis. It is has been found that energy consumption on the drive and motor efficiency are becoming a matter of concern in automated rotary indexing tables. Hence, companies should provide standardized automation machines that allow for any indexing pattern. Special output bearings in these automated rotary indexing tables allow for heavy load capability. Next-gen automated rotary indexing tables are being designed to move heavy and large loads faster with more precision. Manufacturers are increasing the availability of tables with varying ratios to maximize the motor’s torque capacity, speed requirements, and accuracy.

|

Attribute |

Detail |

|

Market Size Value in 2021 (Base Year) |

US$ 81.36 Mn |

|

Market Forecast Value in 2031 |

US$ 114.65 Mn |

|

Growth Rate (CAGR) |

3.23% |

|

Forecast Period |

2021-2031 |

|

Quantitative Units |

US$ Mn for Value & ‘000 Units for Volume |

|

Market Analysis |

It includes cross segment analysis at North America as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porters Five Forces analysis, supply chain analysis, parent industry overview, etc. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. North America Automated Rotary and Indexing Table Market Analysis and Forecast

2.2. Regional Outline

2.3. Market Dynamics Snapshot

2.4. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Key Market Indicator

3.3. Drivers

3.3.1. Economic Drivers

3.3.2. Supply Side Drivers

3.3.3. Demand Side Drivers

3.4. Market Restraints and Opportunities

3.5. Market Trends

3.5.1. Demand Side

3.5.2. Supply Side

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Industrial Automation

4.2. Supply Chain Analysis

4.3. Technology Roadmap Analysis

4.4. Industry SWOT Analysis

4.5. Porter Five Forces Analysis

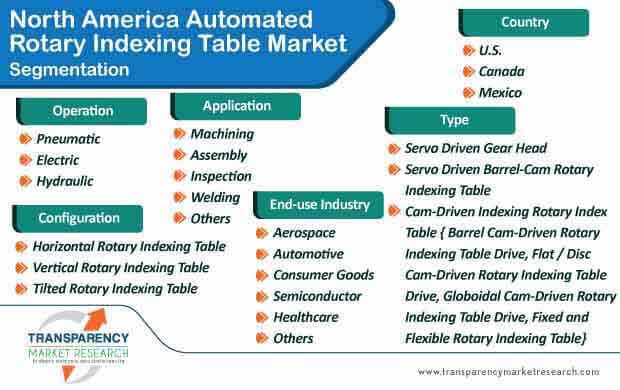

5. North America Automated Rotary and Indexing Table Market Analysis, by Type

5.1. North America Automated Rotary and Indexing Table Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017‒2031

5.1.1. Servo Driven Gear Head

5.1.2. Servo Driven Barrel-Cam Rotary Indexing Table

5.1.3. Cam-Driven Indexing Rotary Indexing Table

5.1.3.1. Barrel Cam-Driven Rotary Indexing Table Drive

5.1.3.2. Flat / Disc Cam-Driven Rotary Indexing Table Drive

5.1.3.3. Globoidal Cam-Driven Rotary Indexing Table Drive

5.1.3.4. Fixed and Flexible Rotary Indexing Table

5.2. North America Automated Rotary and Indexing Table Market Attractiveness Analysis, by Type

6. North America Automated Rotary and Indexing Table Market Analysis, by Configuration

6.1. North America Automated Rotary and Indexing Table Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Configuration, 2017‒2031

6.1.1. Horizontal Rotary Indexing Table

6.1.2. Vertical Rotary Indexing Table

6.1.3. Tilted Rotary Indexing Table

6.2. North America Automated Rotary and Indexing Table Market Attractiveness Analysis, by Configuration

7. North America Automated Rotary and Indexing Table Market Analysis, by Operation

7.1. North America Automated Rotary and Indexing Table Market Size (US$ Mn) Analysis & Forecast, by Operation, 2017‒2031

7.1.1. Pneumatic

7.1.2. Electric

7.1.3. Hydraulic

7.2. North America Automated Rotary and Indexing Table Market Attractiveness Analysis, by Operation

8. North America Automated Rotary and Indexing Table Market Analysis, by Application

8.1. North America Automated Rotary and Indexing Table Market Size (US$ Mn) Analysis & Forecast, by Application, 2017‒2031

8.1.1. Machining

8.1.2. Assembly

8.1.3. Inspection

8.1.4. Welding

8.1.5. Others (packaging, labeling, etc.)

8.2. North America Automated Rotary and Indexing Table Market Attractiveness Analysis, by Application

9. North America Automated Rotary and Indexing Table Market Analysis, by End-use Industry

9.1. North America Automated Rotary and Indexing Table Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017‒2031

9.1.1. Aerospace

9.1.2. Automotive

9.1.3. Consumer Goods

9.1.4. Semiconductor

9.1.5. Healthcare

9.1.6. Others (metals, oil and gas, etc.,)

9.2. North America Automated Rotary and Indexing Table Market Attractiveness Analysis, by End-use Industry

10. North America Automated Rotary and Indexing Table Market Analysis and Forecast, by Country

10.1. North America Automated Rotary and Indexing Table Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country, 2017 – 2031

10.1.1. U.S.

10.1.2. Canada

10.1.3. Mexico

10.2. North America Automated Rotary and Indexing Table Market Attractiveness Analysis, by Country

11. U.S. Automated Rotary and Indexing Table Market Analysis and Forecast

11.1. Market Snapshot

11.2. Key Trends Analysis

11.3. Drivers and Restraints: Impact Analysis

11.4. Pricing Analysis

11.5. U.S. Automated Rotary and Indexing Table Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017‒2031

11.5.1. Servo Driven Gear Head

11.5.2. Servo Driven Barrel-Cam Rotary Indexing Table

11.5.3. Cam-Driven Indexing Rotary Indexing Table

11.5.3.1. Barrel Cam-Driven Rotary Indexing Table Drive

11.5.3.2. Flat / Disc Cam-Driven Rotary Indexing Table Drive

11.5.3.3. Globoidal Cam-Driven Rotary Indexing Table Drive

11.5.3.4. Fixed and Flexible Rotary Indexing Table

11.6. U.S. Automated Rotary and Indexing Table Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Configuration, 2017‒2031

11.6.1. Horizontal Rotary Indexing Table

11.6.2. Vertical Rotary Indexing Table

11.6.3. Tilted Rotary Indexing Table

11.7. U.S. Automated Rotary and Indexing Table Market Size (US$ Mn) Analysis & Forecast, by Operation, 2017 – 2031

11.7.1. Pneumatic

11.7.2. Electric

11.7.3. Hydraulic

11.8. U.S. Automated Rotary and Indexing Table Market Size (US$ Mn) Analysis & Forecast, by Application, 2017‒2031

11.8.1. Machining

11.8.2. Assembly

11.8.3. Inspection

11.8.4. Welding

11.8.5. Others (packaging, labeling, etc.)

11.9. U.S. Automated Rotary and Indexing Table Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017‒2031

11.9.1. Aerospace

11.9.2. Automotive

11.9.3. Consumer Goods

11.9.4. Semiconductor

11.9.5. Healthcare

11.9.6. Others (metals, oil and gas, etc.,)

11.10. U.S. Automated Rotary and Indexing Table Market Attractiveness Analysis

11.10.1. By Type

11.10.2. By Configuration

11.10.3. By Operation

11.10.4. By Application

11.10.5. By End-use Industry

12. Canada Automated Rotary and Indexing Table Market Analysis and Forecast

12.1. Market Snapshot

12.2. Key Trends Analysis

12.3. Drivers and Restraints: Impact Analysis

12.4. Pricing Analysis

12.5. Canada Automated Rotary and Indexing Table Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017‒2031

12.5.1. Servo Driven Gear Head

12.5.2. Servo Driven Barrel-Cam Rotary Indexing Table

12.5.3. Cam-Driven Indexing Rotary Indexing Table

12.5.3.1. Barrel Cam-Driven Rotary Indexing Table Drive

12.5.3.2. Flat / Disc Cam-Driven Rotary Indexing Table Drive

12.5.3.3. Globoidal Cam-Driven Rotary Indexing Table Drive

12.5.3.4. Fixed and Flexible Rotary Indexing Table

12.6. Canada Automated Rotary and Indexing Table Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Configuration, 2017‒2031

12.6.1. Horizontal Rotary Indexing Table

12.6.2. Vertical Rotary Indexing Table

12.6.3. Tilted Rotary Indexing Table

12.7. Canada Automated Rotary and Indexing Table Market Size (US$ Mn) Analysis & Forecast, by Operation, 2017 – 2031

12.7.1. Pneumatic

12.7.2. Electric

12.7.3. Hydraulic

12.8. Canada Automated Rotary and Indexing Table Market Size (US$ Mn) Analysis & Forecast, by Application, 2017‒2031

12.8.1. Machining

12.8.2. Assembly

12.8.3. Inspection

12.8.4. Welding

12.8.5. Others (packaging, labeling, etc.)

12.9. Canada Automated Rotary and Indexing Table Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017‒2031

12.9.1. Aerospace

12.9.2. Automotive

12.9.3. Consumer Goods

12.9.4. Semiconductor

12.9.5. Healthcare

12.9.6. Others (metals, oil and gas, etc.,)

12.10. Canada Automated Rotary and Indexing Table Market Attractiveness Analysis

12.10.1. By Type

12.10.2. By Configuration

12.10.3. By Operation

12.10.4. By Application

12.10.5. By End-use Industry

13. Mexico Automated Rotary and Indexing Table Market Analysis and Forecast

13.1. Market Snapshot

13.2. Key Trends Analysis

13.3. Drivers and Restraints: Impact Analysis

13.4. Pricing Analysis

13.5. Mexico Automated Rotary and Indexing Table Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Type, 2017‒2031

13.5.1. Servo Driven Gear Head

13.5.2. Servo Driven Barrel-Cam Rotary Indexing Table

13.5.3. Cam-Driven Indexing Rotary Indexing Table

13.5.3.1. Barrel Cam-Driven Rotary Indexing Table Drive

13.5.3.2. Flat / Disc Cam-Driven Rotary Indexing Table Drive

13.5.3.3. Globoidal Cam-Driven Rotary Indexing Table Drive

13.5.3.4. Fixed and Flexible Rotary Indexing Table

13.6. Mexico Automated Rotary and Indexing Table Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Configuration, 2017‒2031

13.6.1. Horizontal Rotary Indexing Table

13.6.2. Vertical Rotary Indexing Table

13.6.3. Tilted Rotary Indexing Table

13.7. Mexico Automated Rotary and Indexing Table Market Size (US$ Mn) Analysis & Forecast, by Operation, 2017 – 2031

13.7.1. Pneumatic

13.7.2. Electric

13.7.3. Hydraulic

13.8. Mexico Automated Rotary and Indexing Table Market Size (US$ Mn) Analysis & Forecast, by Application, 2017‒2031

13.8.1. Machining

13.8.2. Assembly

13.8.3. Inspection

13.8.4. Welding

13.8.5. Others (packaging, labeling, etc.)

13.9. Mexico Automated Rotary and Indexing Table Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017‒2031

13.9.1. Aerospace

13.9.2. Automotive

13.9.3. Consumer Goods

13.9.4. Semiconductor

13.9.5. Healthcare

13.9.6. Others (metals, oil and gas, etc.,)

13.10. Mexico Automated Rotary and Indexing Table Market Attractiveness Analysis

13.10.1. By Type

13.10.2. By Configuration

13.10.3. By Operation

13.10.4. By Application

13.10.5. By End-use Industry

14. Competition Assessment

14.1. North America Automated Rotary and Indexing Table Market Competition Matrix - a Dashboard View

14.1.1. North America Automated Rotary and Indexing Table Market Company Share Analysis, by Value (2020) and Volume

14.1.2. Technological Differentiator

15. Company Profiles (Manufacturers/Suppliers)

15.1. WEISS North America Inc

15.1.1. Overview

15.1.2. Product Portfolio

15.1.3. Sales Footprint

15.1.4. Key Subsidiaries or Distributors

15.1.5. Strategy and Recent Developments

15.1.6. Financial Analysis

15.2. DESTACO – CAMCO

15.2.1. Overview

15.2.2. Product Portfolio

15.2.3. Sales Footprint

15.2.4. Key Subsidiaries or Distributors

15.2.5. Strategy and Recent Developments

15.2.6. Financial Analysis

15.3. EXPERT-TÜNKERS

15.3.1. Overview

15.3.2. Product Portfolio

15.3.3. Sales Footprint

15.3.4. Key Subsidiaries or Distributors

15.3.5. Strategy and Recent Developments

15.3.6. Financial Analysis

15.4. Fischer-Brodbeck GmbH

15.4.1. Overview

15.4.2. Product Portfolio

15.4.3. Sales Footprint

15.4.4. Key Subsidiaries or Distributors

15.4.5. Strategy and Recent Developments

15.4.6. Financial Analysis

15.5. Hiwin Corporation

15.5.1. Overview

15.5.2. Product Portfolio

15.5.3. Sales Footprint

15.5.4. Key Subsidiaries or Distributors

15.5.5. Strategy and Recent Developments

15.5.6. Financial Analysis

15.6. Kitagawa NorthTech, Inc.

15.6.1. Overview

15.6.2. Product Portfolio

15.6.3. Sales Footprint

15.6.4. Key Subsidiaries or Distributors

15.6.5. Strategy and Recent Developments

15.6.6. Financial Analysis

15.7. Sankyo Automation

15.7.1. Overview

15.7.2. Product Portfolio

15.7.3. Sales Footprint

15.7.4. Key Subsidiaries or Distributors

15.7.5. Strategy and Recent Developments

15.7.6. Financial Analysis

15.8. Motion Index Drives, Inc.

15.8.1. Overview

15.8.2. Product Portfolio

15.8.3. Sales Footprint

15.8.4. Key Subsidiaries or Distributors

15.8.5. Strategy and Recent Developments

15.8.6. Financial Analysis

16. Recommendation

16.1. Opportunity Assessment

16.1.1. By Type

16.1.2. By Configuration

16.1.3. By Operation

16.1.4. By Application

16.1.5. By End-use Industry

16.1.6. By Country

List of Tables

Table 01: North America Automated Rotary Indexing Table Market Revenue (US$ Mn), by Type , 2017–2031

Table 02: North America Automated Rotary Indexing Table Market Volume (Thousand Units), by Type, 2017–2031

Table 03: North America Automated Rotary Indexing Table Market Revenue (US$ Mn), by

Table 04: North America Automated Rotary Indexing Table Market Volume (Thousand Units), by Type, 2017–2031

Table 05: North America Automated Rotary Indexing Table Market Revenue (US$ Mn), by Operation, 2017–2031

Table 06: North America Automated Rotary Indexing Table Market Revenue (US$ Mn), by Application, 2017–2031

Table 07: North America Automated Rotary Indexing Table Market Revenue (US$ Mn), by End-use Industry, 2017–2031

Table 08: North America Automated Rotary Indexing Table Market Revenue (US$ Mn), by Country, 2017–2031

Table 09: North America Automated Rotary Indexing Table Market Volume (Thousand Units), by Region, 2017–2031

Table 10: U.S. Automated Rotary Indexing Table Revenue (US$ Mn), by Type , 2017–2031

Table 11: U.S. Automated Rotary Indexing Table Volume (Thousand Units), by Type , 2017–2031

Table 12: U.S. Automated Rotary Indexing Table Revenue (US$ Mn), by Configuration, 2017–2031

Table 13: U.S. Automated Rotary Indexing Table Volume (Thousand Units), by Configuration, 2017–2031

Table 14: U.S. Automated Rotary Indexing Table Revenue (US$ Mn), by Operation, 2017–2031

Table 15: U.S. Automated Rotary Indexing Table Revenue (US$ Mn), by Application, 2017–2031

Table 16: U.S. Automated Rotary Indexing Table Revenue (US$ Mn), by End-use Industry, 2017–2031

Table 17: Canada Automated Rotary Indexing Table Revenue (US$ Mn), by Type , 2017–2031

Table 18: Canada Automated Rotary Indexing Table Volume (Thousand Units), by Type , 2017–2031

Table 19: Canada Automated Rotary Indexing Table Revenue (US$ Mn), by Configuration, 2017–2031

Table 20: Canada Automated Rotary Indexing Table Volume (Thousand Units), by Configuration , 2017–2031

Table 21: Canada Automated Rotary Indexing Table Revenue (US$ Mn), by Operation, 2017–2031

Table 22: Canada Automated Rotary Indexing Table Revenue (US$ Mn), by Application, 2017–2031

Table 23: Canada Automated Rotary Indexing Table Revenue (US$ Mn), by End-use Industry, 2017–2031

Table 24: Mexico Automated Rotary Indexing Table Revenue (US$ Mn), by Type , 2017–2031

Table 25: Mexico Automated Rotary Indexing Table Volume (Thousand Units), by Type , 2017–2031

Table 26: Mexico Automated Rotary Indexing Table Revenue (US$ Mn), by Configuration, 2017–2031

Table 27: Mexico Automated Rotary Indexing Table Volume (Thousand Units), by Configuration , 2017–2031

Table 28: Mexico Automated Rotary Indexing Table Revenue (US$ Mn), by Operation, 2017–2031

Table 29: Mexico Automated Rotary Indexing Table Revenue (US$ Mn), by Application, 2017–2031

Table 30: Mexico Automated Rotary Indexing Table Revenue (US$ Mn), by End-use Industry, 2017–2031

List of Figures

Figure 01: North America Automated Rotary Indexing Table Market Value (US$ Mn) Forecast, 2021–2031

Figure 02: North America Automated Rotary Indexing Table Market Size Analysis (2017-2020) and Forecast (2021-2031)

Figure 03: North America Automated Rotary Indexing Table Market Revenue, by Value, 2017‒2031

Figure 04: North America Automated Rotary Indexing Table Market Volume, 2017‒2031

Figure 05: North America Automated Rotary Indexing Table Market, by Servo Driven Gear Head

Figure 06: North America Automated Rotary Indexing Table Market, by Servo Driven Barrel-Cam

Figure 07: North America Automated Rotary Indexing Table Market, by Linear Image Sensor

Figure 08: North America Automated Rotary Indexing Table Market Attractiveness Analysis, by Type

Figure 09: North America Automated Rotary Indexing Table Market, by Horizontal Rotary Indexing Table

Figure 10: North America Automated Rotary Indexing Table Market, by Vertical Rotary Indexing

Figure 11: North America Automated Rotary Indexing Table Market, by Tilted Rotary Indexing Table

Figure 12: North America Automated Rotary Indexing Table Market Attractiveness Analysis, by Configuration

Figure 13: North America Automated Rotary Indexing Table Market, by Pneumatic

Figure 14: North America Automated Rotary Indexing Table Market, by Electric

Figure 15: North America Automated Rotary Indexing Table Market, by Hydraulic

Figure 16: North America Automated Rotary Indexing Table Market Attractiveness Analysis, by Operation

Figure 17: North America Automated Rotary Indexing Table Market, by Machining

Figure 18: North America Automated Rotary Indexing Table Market, by Assembly

Figure 19: North America Automated Rotary Indexing Table Market, by Inspection

Figure 20: North America Automated Rotary Indexing Table Market, by Welding

Figure 21: North America Automated Rotary Indexing Table Market, by Foreign Object Detection

Figure 22: North America Automated Rotary Indexing Table Market Attractiveness Analysis, by Application

Figure 23: North America Automated Rotary Indexing Table Market, by Aerospace

Figure 24: North America Automated Rotary Indexing Table Market, by Automotive

Figure 25: North America Automated Rotary Indexing Table Market, by Consumer Goods

Figure 26: North America Automated Rotary Indexing Table Market, by Semiconductor

Figure 27: North America Automated Rotary Indexing Table Market, by Healthcare

Figure 28: North America Automated Rotary Indexing Table Market, by Others

Figure 29: North America Automated Rotary Indexing Table Market Attractiveness Analysis, by End-use Industry

Figure 30: North America Automated Rotary Indexing Table Market Value Share Analysis, by Country (2021E)

Figure 31: North America Automated Rotary Indexing Table Market Value Share Analysis, by Country (2031F)

Figure 32: North America Automated Rotary Indexing Table Market Value Share Analysis, by Country (2021E)

Figure 33: North America Automated Rotary Indexing Table Market Value Share Analysis, by Country (2031F)

Figure 34: North America Automated Rotary Indexing Table Market Attractiveness Analysis, by Country

Figure 35: U.S. Automated Rotary Indexing Table Market Y-o-Y Growth Projection, 2021–2031

Figure 36: U.S. Automated Rotary Indexing Table Market Y-o-Y Growth Projection, 2021–2031

Figure 37: U.S. Automated Rotary Indexing Table Market Revenue (US$ Mn) Forecast, 2017–2031

Figure 38: U.S. Automated Rotary Indexing Table Market Volume (Thousand Units) Forecast, 2017–2031

Figure 39: U.S. Automated Rotary Indexing Table Market Value Share Analysis, by Type (2021)

Figure 40: U.S. Automated Rotary Indexing Table Market Value Share Analysis, by Type (2031)

Figure 41: U.S. Automated Rotary Indexing Table Market Volume Share Analysis, by Type (2021)

Figure 42: U.S. Automated Rotary Indexing Table Market Volume Share Analysis, by Type (2031)

Figure 43: U.S. Automated Rotary Indexing Table Market Value Share Analysis, by Configuration (2021)

Figure 44: U.S. Automated Rotary Indexing Table Market Value Share Analysis, by Configuration (2031)

Figure 45: U.S. Automated Rotary Indexing Table Market Volume Share Analysis, by Configuration (2021)

Figure 46: U.S. Automated Rotary Indexing Table Market Volume Share Analysis, by Configuration (2031)

Figure 47: U.S. Automated Rotary Indexing Table Market Value Share Analysis, by Operation (2021)

Figure 48: U.S. Automated Rotary Indexing Table Market Value Share Analysis, by Operation (2031)

Figure 49: U.S. Automated Rotary Indexing Table Market Value Share Analysis, by Application (2021)

Figure 50: U.S. Automated Rotary Indexing Table Market Value Share Analysis, by Application (2031)

Figure 51: U.S. Automated Rotary Indexing Table Market Value Share Analysis, by Application (2021)

Figure 52: U.S. Automated Rotary Indexing Table Market Value Share Analysis, by Application (2031)

Figure 53: U.S. Automated Rotary Indexing Table Market Attractiveness Analysis, by Type

Figure 54: U.S. Automated Rotary Indexing Table Market Attractiveness Analysis, by Configuration

Figure 55: U.S. Automated Rotary Indexing Table Market Attractiveness Analysis, by Operation

Figure 56: U.S. Automated Rotary Indexing Table Market Attractiveness Analysis, Application

Figure 57: U.S. Automated Rotary Indexing Table Market Attractiveness Analysis, by End-use Industry

Figure 58: Canada Automated Rotary Indexing Table Market Y-o-Y Growth Projection, 2021–2031

Figure 59: Canada Automated Rotary Indexing Table Market Y-o-Y Growth Projection, 2021–2031

Figure 60: Canada Automated Rotary Indexing Table Market Volume (Thousand Units) Forecast, 2017–2031

Figure 61: Canada Automated Rotary Indexing Table Market Revenue (US$ Mn) Forecast, 2017–2031

Figure 62: Canada Automated Rotary Indexing Table Market Value Share Analysis, by Type (2021)

Figure 63: Canada Automated Rotary Indexing Table Market Value Share Analysis, by Type (2031)

Figure 64: Canada Automated Rotary Indexing Table Market Volume Share Analysis, by Type (2021)

Figure 65: Canada Automated Rotary Indexing Table Market Volume Share Analysis, by Type (2031)

Figure 66: Canada Automated Rotary Indexing Table Market Value Share Analysis, by Configuration (2021)

Figure 67: Canada Automated Rotary Indexing Table Market Value Share Analysis, by Configuration (2031)

Figure 68: Canada Automated Rotary Indexing Table Market Volume Share Analysis, by Configuration (2021)

Figure 69: Canada Automated Rotary Indexing Table Market Volume Share Analysis, by Configuration (2031)

Figure 70: Canada Automated Rotary Indexing Table Market Value Share Analysis, by Operation (2021)

Figure 71: Canada Automated Rotary Indexing Table Market Value Share Analysis, by Operation (2031)

Figure 72: Canada Automated Rotary Indexing Table Market Value Share Analysis, by Application (2021)

Figure 73: Canada Automated Rotary Indexing Table Market Value Share Analysis, by Application (2031)

Figure 74: Canada Automated Rotary Indexing Table Market Value Share Analysis, by Application (2021)

Figure 75: Canada Automated Rotary Indexing Table Market Value Share Analysis, by Application (2031)

Figure 76: Canada Automated Rotary Indexing Table Market Attractiveness Analysis, by Type

Figure 77: Canada Automated Rotary Indexing Table Market Attractiveness Analysis, by Configuration

Figure 78: Canada Automated Rotary Indexing Table Market Attractiveness Analysis, by Operation

Figure 79: Canada Automated Rotary Indexing Table Market Attractiveness Analysis, Application

Figure 80: Canada Automated Rotary Indexing Table Market Attractiveness Analysis, by End-use Industry

Figure 81: Mexico Automated Rotary Indexing Table Market Y-o-Y Growth Projection, 2021–2031

Figure 82: Mexico Automated Rotary Indexing Table Market Y-o-Y Growth Projection, 2021–2031

Figure 83: Mexico Automated Rotary Indexing Table Market Revenue (US$ Mn) Forecast, 2017–2031

Figure 84: Mexico Automated Rotary Indexing Table Market Volume (Thousand Units) Forecast, 2017–2031

Figure 85: Mexico Automated Rotary Indexing Table Market Value Share Analysis, by Type (2021)

Figure 86: Mexico Automated Rotary Indexing Table Market Value Share Analysis, by Type (2031)

Figure 87: Mexico Automated Rotary Indexing Table Market Volume Share Analysis, by Type (2021)

Figure 88: Mexico Automated Rotary Indexing Table Market Volume Share Analysis, by Type (2031)

Figure 89: Mexico Automated Rotary Indexing Table Market Value Share Analysis, by Configuration (2021)

Figure 90: Mexico Automated Rotary Indexing Table Market Value Share Analysis, by Configuration (2031)

Figure 91: Mexico Automated Rotary Indexing Table Market Volume Share Analysis, by Configuration (2021)

Figure 92: Mexico Automated Rotary Indexing Table Market Volume Share Analysis, by Configuration (2031)

Figure 93: Mexico Automated Rotary Indexing Table Market Value Share Analysis, by Operation (2021)

Figure 94: Mexico Automated Rotary Indexing Table Market Value Share Analysis, by Operation (2031)

Figure 95: Mexico Automated Rotary Indexing Table Market Value Share Analysis, by Application (2021)

Figure 96: Mexico Automated Rotary Indexing Table Market Value Share Analysis, by Application (2031)

Figure 97: Mexico Automated Rotary Indexing Table Market Value Share Analysis, by Application (2021)

Figure 98: Mexico Automated Rotary Indexing Table Market Value Share Analysis, by Application (2031)

Figure 99: Mexico Automated Rotary Indexing Table Market Attractiveness Analysis, by Type

Figure 100: Mexico Automated Rotary Indexing Table Market Attractiveness Analysis, by Configuration

Figure 101: Mexico Automated Rotary Indexing Table Market Attractiveness Analysis, by Operation

Figure 102: Mexico Automated Rotary Indexing Table Market Attractiveness Analysis, Application

Figure 103: Mexico Automated Rotary Indexing Table Market Attractiveness Analysis, by End-use Industry

Figure 104: North America Automated Rotary Indexing Table Market Share Analysis, 2020