Reports

Reports

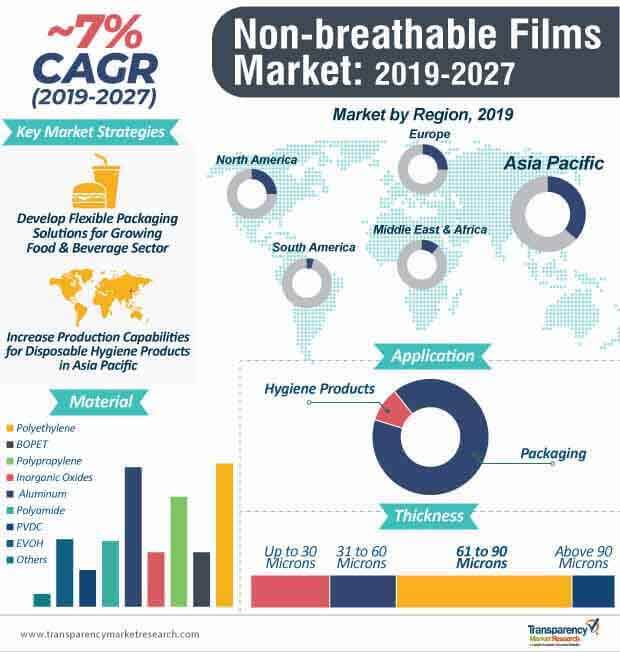

According to TMR’s research on the global packaging industry, ~3.4 trillion packaging units were sold in 2017. Likewise, the demand for efficacious packaging solutions is steadily increasing in the non-breathable films market. Since Asia Pacific is projected for increased scope as far as market growth is concerned, manufacturers in the non-breathable films market are increasing their production capabilities in this region.

A number of drivers are creating lucrative opportunities in Asia Pacific. Increased number of working women and constant improvement in the standard of living of individuals are likely to positively influence market growth. As health commissions are increasingly focused on improving the health & hygiene infrastructure in Asia Pacific, the demand for disposable hygiene products is on the rise. Though the penetration of hygiene products is miniscule in Asia Pacific as compared to more developed regions, the trend of high-quality hygiene products has catalyzed the demand for baby diapers, as a result of the high birth rate in the region. Thus, manufacturers in the non-breathable films market should focus on producing premium quality hygiene products due to increasing awareness about health and hygiene amongst individuals.

Non-breathable Films Gain Popularity through Flexible Packaging Solutions

In 2019, packaging is estimated to account for ~91% of the value share of the non-breathable films market. Increasing number of merger and acquisition (M&A) deals have helped leading and emerging players expand their global footprint to achieve consolidation in the market. On a global level, 53 flexible packaging M&A deals were accounted for in 2017. Hence, manufacturers in the non-breathable films market are capitalizing on this growing trend.

The food industry accounts for the largest share in the packaging space. Increased application of flexible packaging is anticipated to shape the future of food and beverage packaging. The surging popularity of flexible packaging has led to increased food consumption on a global level. To attract more customers at supermarkets and convenience stores, manufacturers in the non-breathable films market are innovating aesthetically-vibrant and novel packaging designs.

Since food and beverages have a limited shelf life, manufacturers are streamlining their production procedures with conscious material selection, testing, and prototyping packaging solutions that meet the needs of stakeholders in the F&B space.

The non-breathable films market is highly fragmented. Hence, it is challenging for leading manufacturers to compete with substitute products offered by emerging market players. Variants of plastic are increasingly being used to produce non-breathable films. Since polyethylene (PE) and polypropylene (PP) are inexpensive raw materials, it is easy for emerging market players in the non-breathable films market to mimic the products offered by leading manufacturers. Hence, leading market players are trademarking their products to reduce the incidence of prototyping original products.

Due to increasing awareness about the hazardous use of plastic, manufacturers in the non-breathable films market are anticipated to witness reluctance from consumers regarding the utilization of plastic. To overcome this challenge, they are developing compostable/biodegradable films. These films help manufacturers comply with the regulations laid down by environment and health commissions. Increasing awareness about biodegradable films has led to the innovation of compostable baby diapers, sanitary napkins, adult diaper, and medical drapes.

Analysts’ Viewpoint

Manufacturers in the non-breathable films market are tapping into new opportunities to develop absorbent and non-breathable backsheet and elastic films for various hygiene products, using the soft touch and soft stretch technology.

However, plastic films are challenging as far as disposal is concerned, and create environmental footprint. Thus, manufacturers should innovate new biodegradable films and increase their capabilities in aluminum films. They should increase the application of high-performance PE polymers in nonwoven materials, as the utilization of nonwovens is on the rise.

Since the food and beverage industry accounts for the largest market share of packaging, manufacturers should focus on introducing novel flexible packaging solutions, especially for the meat and FMCG sectors.

Along with sustainability, flexible packaging solutions are at the forefront of important packaging trends in packaging design, product protection, and consumer convenience, positively impacting the environment, consumers, and businesses.

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. TMR Analysis and Recommendations

1.4. Opportunity Analysis

2. Market Viewpoint

2.1. Market Definition

2.2. Market Taxonomy

3. Non-breathable Films Market Overview

3.1. Introduction

3.2. Industry Trends and Recent Developments

3.3. Co-Relation Analysis for Non-breathable Films Market

3.4. Parent/Associated Market Overview

3.4.1. Global Packaging Market Overview

3.4.2. Global Flexible Packaging Market Overview

3.5. PESTLE Analysis

3.6. Porter’s Fiver Forces

3.7. Non-breathable Films Market Value Chain Analysis

3.7.1. Profitability Margins

3.7.2. List of Active Participants

3.7.2.1. Raw Material Suppliers

3.7.2.2. Manufacturers / Converters

3.7.2.3. Suppliers / Distributors

4. Non-breathable Films Market Analysis

4.1. Pricing Analysis

4.2. Market Size (US$ Mn) and Forecast

4.2.1. Market Size and Y-o-Y Growth

4.2.2. Absolute $ Opportunity

5. Non-breathable Films Market Dynamics

5.1. Macro-economic Factors

5.2. Drivers

5.3. Restraints

5.4. Opportunity

5.5. Forecast Factors – Relevance and Impact

6. Global Non-breathable Films Market Analysis and Forecast, By Material

6.1. Introduction

6.1.1. Market share and Basis Points (BPS) Analysis By Material

6.1.2. Y-o-Y Growth Projections By Material

6.2. Historical Market Value (US$ Mn) and Volume (Thousand Tons), 2014-2018, By Material

6.2.1. Polyethylene

6.2.2. BOPET

6.2.3. Polypropylene

6.2.4. Inorganic Oxides

6.2.5. Aluminum

6.2.6. Polyamide

6.2.7. PVDC

6.2.8. EVOH

6.2.9. Others

6.3. Market Size (US$ Mn) and Volume (Thousand Tons) Forecast Analysis 2019-2027 , By Material

6.3.1. Polyethylene

6.3.2. BOPET

6.3.3. Polypropylene

6.3.4. Inorganic Oxides

6.3.5. Aluminum

6.3.6. Polyamide

6.3.7. PVDC

6.3.8. EVOH

6.3.9. Others

6.4. Market Attractiveness Analysis By Material

6.5. Prominent Trends

7. Global Non-breathable Films Market Analysis and Forecast, By Thickness

7.1. Introduction

7.1.1. Market share and Basis Points (BPS) Analysis By Thickness

7.1.2. Y-o-Y Growth Projections By Thickness

7.2. Historical Market Value (US$ Mn) and Volume (Thousand Tons), 2014-2018, By Thickness

7.2.1. Up to 30 micron

7.2.2. 31 to 60 micron

7.2.3. 61 to 90 micron

7.2.4. Above 90 micron

7.3. Market Size (US$ Mn) and Volume (Thousand Tons) Forecast Analysis 2019-2027, By Thickness

7.3.1. Up to 30 micron

7.3.2. 31 to 60 micron

7.3.3. 61 to 90 micron

7.3.4. Above 90 micron

7.4. Market Attractiveness Analysis By Thickness

7.5. Prominent Trends

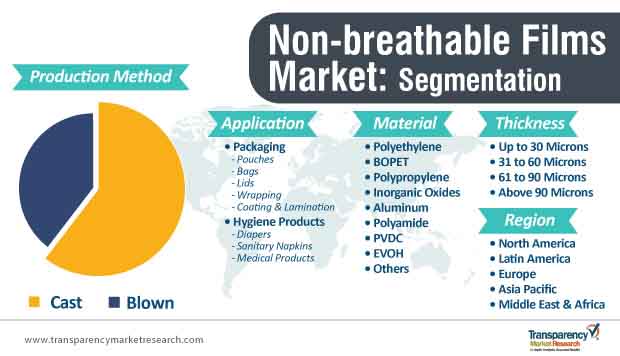

8. Global Non-breathable Films Market Analysis and Forecast, By Production Method

8.1. Introduction

8.1.1. Market share and Basis Points (BPS) Analysis By Production Method

8.1.2. Y-o-Y Growth Projections By Production Method

8.2. Historical Market Value (US$ Mn) and Volume (Thousand Tons), 2014-2018, By Production Method

8.2.1. Cast

8.2.2. Blown

8.3. Market Size (US$ Mn) and Volume (Thousand Tons) Forecast Analysis 2019-2027, By Production Method

8.3.1. Cast

8.3.2. Blown

8.4. Market Attractiveness Analysis By Production Method

8.5. Prominent Trends

9. Global Non-breathable Films Market Analysis and Forecast, By Application

9.1. Introduction

9.1.1. Market share and Basis Points (BPS) Analysis By Application

9.1.2. Y-o-Y Growth Projections By Application

9.2. Historical Market Value (US$ Mn) and Volume (Thousand Tons), 2014-2018, By Application

9.2.1. Packaging

9.2.1.1. Pouches

9.2.1.2. Bags

9.2.1.3. Lids

9.2.1.4. Wrapping

9.2.1.5. Coating & Lamination

9.2.2. Hygiene Products

9.2.2.1. Diapers

9.2.2.1.1. Baby diapers

9.2.2.1.2. Adult diapers

9.2.2.2. Sanitary Napkins

9.2.2.3. Medical Products

9.2.2.3.1. Underpads

9.2.2.3.2. Surgical Clothing

9.3. Market Size (US$ Mn) and Volume (Thousand Tons) Forecast Analysis 2019-2027, By Application

9.3.1. Packaging

9.3.1.1. Pouches

9.3.1.2. Bags

9.3.1.3. Lids

9.3.1.4. Wrapping

9.3.1.5. Coating & Lamination

9.3.2. Hygiene Products

9.3.2.1. Diapers

9.3.2.1.1. Baby diapers

9.3.2.1.2. Adult diapers

9.3.2.2. Sanitary Napkins

9.3.2.3. Medical Products

9.3.2.3.1. Underpads

9.3.2.3.2. Surgical Clothing

9.4. Market Attractiveness Analysis By Application

9.5. Prominent Trends

10. Global Non-breathable Films Market Analysis and Forecast, By Region

10.1. Introduction

10.1.1. Market share and Basis Points (BPS) Analysis By Region

10.1.2. Y-o-Y Growth Projections By Region

10.2. Historical Market Value (US$ Mn) and Volume (Thousand Tons), 2014-2018, By Region

10.2.1. North America

10.2.2. Latin America

10.2.3. Europe

10.2.4. Asia Pacific

10.2.5. Middle East and Africa (MEA)

10.3. Market Size (US$ Mn) and Volume (Thousand Tons) Forecast Analysis 2019-2027 By Region

10.3.1. North America

10.3.2. Latin America

10.3.3. Europe

10.3.4. Asia Pacific

10.3.5. Middle East and Africa (MEA)

10.4. Market Attractiveness Analysis By Region

10.5. Prominent Trends

11. North America Non-breathable Films Market Analysis and Forecast

11.1. Introduction

11.1.1. Market share and Basis Points (BPS) Analysis By Country

11.1.2. Y-o-Y Growth Projections By Country

11.2. Historical Market Value (US$ Mn) and Volume (Thousand Tons), 2014-2018, By Country

11.2.1. U.S.

11.2.2. Canada

11.3. Market Size (US$ Mn) and Volume (Thousand Tons) Forecast Analysis 2019-2027, By Country

11.3.1. U.S.

11.3.2. Canada

11.4. Historical Market Value (US$ Mn) and Volume (Thousand Tons), 2014-2018, By Material

11.4.1. Polyethylene

11.4.2. BOPET

11.4.3. Polypropylene

11.4.4. Inorganic Oxides

11.4.5. Aluminum

11.4.6. Polyamide

11.4.7. PVDC

11.4.8. EVOH

11.4.9. Others

11.5. Market Size (US$ Mn) and Volume (Thousand Tons) Forecast Analysis 2019-2027, By Material

11.5.1. Polyethylene

11.5.2. BOPET

11.5.3. Polypropylene

11.5.4. Inorganic Oxides

11.5.5. Aluminum

11.5.6. Polyamide

11.5.7. PVDC

11.5.8. EVOH

11.5.9. Others

11.6. Historical Market Value (US$ Mn) and Volume (Thousand Tons), 2014-2018, By Thickness

11.6.1. Up to 30 micron

11.6.2. 31 to 60 micron

11.6.3. 61 to 90 micron

11.6.4. Above 90 micron

11.7. Market Size (US$ Mn) and Volume (Thousand Tons) Forecast Analysis 2019-2027, By Thickness

11.7.1. Up to 30 micron

11.7.2. 31 to 60 micron

11.7.3. 61 to 90 micron

11.7.4. Above 90 micron

11.8. Historical Market Value (US$ Mn) and Volume (Thousand Tons), 2014-2018, By Production Method

11.8.1. Cast

11.8.2. Blown

11.9. Market Size (US$ Mn) and Volume (Thousand Tons) Forecast Analysis 2019-2027, By Production Method

11.9.1. Cast

11.9.2. Blown

11.10. Historical Market Value (US$ Mn) and Volume (Thousand Tons), 2014-2018, By Application

11.10.1. Packaging

11.10.1.1. Pouches

11.10.1.2. Bags

11.10.1.3. Lids

11.10.1.4. Wrapping

11.10.1.5. Coating & Lamination

11.10.2. Hygiene Products

11.10.2.1. Diapers

11.10.2.1.1. Baby diapers

11.10.2.1.2. Adult diapers

11.10.2.2. Sanitary Napkins

11.10.2.3. Medical Products

11.10.2.3.1. Underpads

11.10.2.3.2. Surgical Clothing

11.11. Market Size (US$ Mn) and Volume (Thousand Tons) Forecast Analysis 2019-2027, By Application

11.11.1. Packaging

11.11.1.1. Pouches

11.11.1.2. Bags

11.11.1.3. Lids

11.11.1.4. Wrapping

11.11.1.5. Coating & Lamination

11.11.2. Hygiene Products

11.11.2.1. Diapers

11.11.2.1.1. Baby diapers

11.11.2.1.2. Adult diapers

11.11.2.2. Sanitary Napkins

11.11.2.3. Medical Products

11.11.2.3.1. Underpads

11.11.2.3.2. Surgical Clothing

11.12. Market Attractiveness Analysis

11.12.1. By Country

11.12.2. By Material

11.12.3. By Thickness

11.12.4. By Production Method

11.12.5. By Application

11.13. Prominent Trends

12. Latin America Non-breathable Films Market Analysis and Forecast

12.1. Introduction

12.1.1. Market share and Basis Points (BPS) Analysis By Country

12.1.2. Y-o-Y Growth Projections By Country

12.2. Historical Market Value (US$ Mn) and Volume (Thousand Tons), 2014-2018, By Country

12.2.1. Brazil

12.2.2. Mexico

12.2.3. Rest of Latin America

12.3. Market Size (US$ Mn) and Volume (Thousand Tons) Forecast Analysis 2019-2027 By Country

12.3.1. Brazil

12.3.2. Mexico

12.3.3. Rest of Latin America

12.4. Historical Market Value (US$ Mn) and Volume (Thousand Tons), 2014-2018, By Material

12.4.1. Polyethylene

12.4.2. BOPET

12.4.3. Polypropylene

12.4.4. Inorganic Oxides

12.4.5. Aluminum

12.4.6. Polyamide

12.4.7. PVDC

12.4.8. EVOH

12.4.9. Others

12.5. Market Size (US$ Mn) and Volume (Thousand Tons) Forecast Analysis 2019-2027, By Material

12.5.1. Polyethylene

12.5.2. BOPET

12.5.3. Polypropylene

12.5.4. Inorganic Oxides

12.5.5. Aluminum

12.5.6. Polyamide

12.5.7. PVDC

12.5.8. EVOH

12.5.9. Others

12.6. Historical Market Value (US$ Mn) and Volume (Thousand Tons), 2014-2018, By Thickness

12.6.1. Up to 30 micron

12.6.2. 31 to 60 micron

12.6.3. 61 to 90 micron

12.6.4. Above 90 micron

12.7. Market Size (US$ Mn) and Volume (Thousand Tons) Forecast Analysis 2019-2027, By Thickness

12.7.1. Up to 30 micron

12.7.2. 31 to 60 micron

12.7.3. 61 to 90 micron

12.7.4. Above 90 micron

12.8. Historical Market Value (US$ Mn) and Volume (Thousand Tons), 2014-2018, By Production Method

12.8.1. Cast

12.8.2. Blown

12.9. Market Size (US$ Mn) and Volume (Thousand Tons) Forecast Analysis 2019-2027, By Production Method

12.9.1. Cast

12.9.2. Blown

12.10. Historical Market Value (US$ Mn) and Volume (Thousand Tons), 2014-2018, By Application

12.10.1. Packaging

12.10.1.1. Pouches

12.10.1.2. Bags

12.10.1.3. Lids

12.10.1.4. Wrapping

12.10.1.5. Coating & Lamination

12.10.2. Hygiene Products

12.10.2.1. Diapers

12.10.2.1.1. Baby diapers

12.10.2.1.2. Adult diapers

12.10.2.2. Sanitary Napkins

12.10.2.3. Medical Products

12.10.2.3.1. Underpads

12.10.2.3.2. Surgical Clothing

12.11. Market Size (US$ Mn) and Volume (Thousand Tons) Forecast Analysis 2019-2027, By Application

12.11.1. Packaging

12.11.1.1. Pouches

12.11.1.2. Bags

12.11.1.3. Lids

12.11.1.4. Wrapping

12.11.1.5. Coating & Lamination

12.11.2. Hygiene Products

12.11.2.1. Diapers

12.11.2.1.1. Baby diapers

12.11.2.1.2. Adult diapers

12.11.2.2. Sanitary Napkins

12.11.2.3. Medical Products

12.11.2.3.1. Underpads

12.11.2.3.2. Surgical Clothing

12.12. Market Attractiveness Analysis

12.12.1. By Country

12.12.2. By Material

12.12.3. By Thickness

12.12.4. By Production Method

12.12.5. By Application

12.13. Prominent Trends

13. Europe Non-breathable Films Market Analysis and Forecast

13.1. Introduction

13.1.1. Market share and Basis Points (BPS) Analysis By Country

13.1.2. Y-o-Y Growth Projections By Country

13.2. Historical Market Value (US$ Mn) and Volume (Thousand Tons), 2014-2018, By Country

13.2.1. Germany

13.2.2. Spain

13.2.3. Italy

13.2.4. France

13.2.5. U.K.

13.2.6. BENELUX

13.2.7. Russia

13.2.8. Rest of Europe

13.3. Market Size (US$ Mn) and Volume (Thousand Tons) Forecast Analysis 2019-2027 By Country

13.3.1. Germany

13.3.2. Spain

13.3.3. Italy

13.3.4. France

13.3.5. U.K.

13.3.6. BENELUX

13.3.7. Russia

13.3.8. Rest of Europe

13.4. Historical Market Value (US$ Mn) and Volume (Thousand Tons), 2014-2018, By Material

13.4.1. Polyethylene

13.4.2. BOPET

13.4.3. Polypropylene

13.4.4. Inorganic Oxides

13.4.5. Aluminum

13.4.6. Polyamide

13.4.7. PVDC

13.4.8. EVOH

13.4.9. Others

13.5. Market Size (US$ Mn) and Volume (Thousand Tons) Forecast Analysis 2019-2027, By Material

13.5.1. Polyethylene

13.5.2. BOPET

13.5.3. Polypropylene

13.5.4. Inorganic Oxides

13.5.5. Aluminum

13.5.6. Polyamide

13.5.7. PVDC

13.5.8. EVOH

13.5.9. Others

13.6. Historical Market Value (US$ Mn) and Volume (Thousand Tons), 2014-2018, By Thickness

13.6.1. Up to 30 micron

13.6.2. 31 to 60 micron

13.6.3. 61 to 90 micron

13.6.4. Above 90 micron

13.7. Market Size (US$ Mn) and Volume (Thousand Tons) Forecast Analysis 2019-2027, By Thickness

13.7.1. Up to 30 micron

13.7.2. 31 to 60 micron

13.7.3. 61 to 90 micron

13.7.4. Above 90 micron

13.8. Historical Market Value (US$ Mn) and Volume (Thousand Tons), 2014-2018, By Production Method

13.8.1. Cast

13.8.2. Blown

13.9. Market Size (US$ Mn) and Volume (Thousand Tons) Forecast Analysis 2019-2027, By Production Method

13.9.1. Cast

13.9.2. Blown

13.10. Historical Market Value (US$ Mn) and Volume (Thousand Tons), 2014-2018, By Application

13.10.1. Packaging

13.10.1.1. Pouches

13.10.1.2. Bags

13.10.1.3. Lids

13.10.1.4. Wrapping

13.10.1.5. Coating & Lamination

13.10.2. Hygiene Products

13.10.2.1. Diapers

13.10.2.1.1. Baby diapers

13.10.2.1.2. Adult diapers

13.10.2.2. Sanitary Napkins

13.10.2.3. Medical Products

13.10.2.3.1. Underpads

13.10.2.3.2. Surgical Clothing

13.11. Market Size (US$ Mn) and Volume (Thousand Tons) Forecast Analysis 2019-2027, By Application

13.11.1. Packaging

13.11.1.1. Pouches

13.11.1.2. Bags

13.11.1.3. Lids

13.11.1.4. Wrapping

13.11.1.5. Coating & Lamination

13.11.2. Hygiene Products

13.11.2.1. Diapers

13.11.2.1.1. Baby diapers

13.11.2.1.2. Adult diapers

13.11.2.2. Sanitary Napkins

13.11.2.3. Medical Products

13.11.2.3.1. Underpads

13.11.2.3.2. Surgical Clothing

13.12. Market Attractiveness Analysis

13.12.1. By Country

13.12.2. By Material

13.12.3. By Thickness

13.12.4. By Production Method

13.12.5. By Application

13.13. Prominent Trends

14. Asia Pacific Non-breathable Films Market Analysis and Forecast

14.1. Introduction

14.1.1. Market share and Basis Points (BPS) Analysis By Country

14.1.2. Y-o-Y Growth Projections By Country

14.1.3. Key Regulations

14.2. Historical Market Value (US$ Mn) and Volume (Thousand Tons), 2014-2018, By Country

14.2.1. China

14.2.2. India

14.2.3. Japan

14.2.4. ASEAN

14.2.5. Australia and New Zealand

14.2.6. Rest of APAC

14.3. Market Size (US$ Mn) and Volume (Thousand Tons) Forecast Analysis 2019-2027 By Country

14.3.1. China

14.3.2. India

14.3.3. Japan

14.3.4. ASEAN

14.3.5. Australia and New Zealand

14.3.6. Rest of APAC

14.4. Historical Market Value (US$ Mn) and Volume (Thousand Tons), 2014-2018, By Material

14.4.1. Polyethylene

14.4.2. BOPET

14.4.3. Polypropylene

14.4.4. Inorganic Oxides

14.4.5. Aluminum

14.4.6. Polyamide

14.4.7. PVDC

14.4.8. EVOH

14.4.9. Others

14.5. Market Size (US$ Mn) and Volume (Thousand Tons) Forecast Analysis 2019-2027, By Material

14.5.1. Polyethylene

14.5.2. BOPET

14.5.3. Polypropylene

14.5.4. Inorganic Oxides

14.5.5. Aluminum

14.5.6. Polyamide

14.5.7. PVDC

14.5.8. EVOH

14.5.9. Others

14.6. Historical Market Value (US$ Mn) and Volume (Thousand Tons), 2014-2018, By Thickness

14.6.1. Up to 30 micron

14.6.2. 31 to 60 micron

14.6.3. 61 to 90 micron

14.6.4. Above 90 micron

14.7. Market Size (US$ Mn) and Volume (Thousand Tons) Forecast Analysis 2019-2027, By Thickness

14.7.1. Up to 30 micron

14.7.2. 31 to 60 micron

14.7.3. 61 to 90 micron

14.7.4. Above 90 micron

14.8. Historical Market Value (US$ Mn) and Volume (Thousand Tons), 2014-2018, By Production Method

14.8.1. Cast

14.8.2. Blown

14.9. Market Size (US$ Mn) and Volume (Thousand Tons) Forecast Analysis 2019-2027, By Production Method

14.9.1. Cast

14.9.2. Blown

14.10. Historical Market Value (US$ Mn) and Volume (Thousand Tons), 2014-2018, By Application

14.10.1. Packaging

14.10.1.1. Pouches

14.10.1.2. Bags

14.10.1.3. Lids

14.10.1.4. Wrapping

14.10.1.5. Coating & Lamination

14.10.2. Hygiene Products

14.10.2.1. Diapers

14.10.2.1.1. Baby diapers

14.10.2.1.2. Adult diapers

14.10.2.2. Sanitary Napkins

14.10.2.3. Medical Products

14.10.2.3.1. Underpads

14.10.2.3.2. Surgical Clothing

14.11. Market Size (US$ Mn) and Volume (Thousand Tons) Forecast Analysis 2019-2027, By Application

14.11.1. Packaging

14.11.1.1. Pouches

14.11.1.2. Bags

14.11.1.3. Lids

14.11.1.4. Wrapping

14.11.1.5. Coating & Lamination

14.11.2. Hygiene Products

14.11.2.1. Diapers

14.11.2.1.1. Baby diapers

14.11.2.1.2. Adult diapers

14.11.2.2. Sanitary Napkins

14.11.2.3. Medical Products

14.11.2.3.1. Underpads

14.11.2.3.2. Surgical Clothing

14.12. Market Attractiveness Analysis

14.12.1. By Country

14.12.2. By Material

14.12.3. By Thickness

14.12.4. By Production Method

14.12.5. By Application

14.13. Prominent Trends

15. Middle East and Africa Non-breathable Films Market Analysis and Forecast

15.1. Introduction

15.1.1. Market share and Basis Points (BPS) Analysis By Country

15.1.2. Y-o-Y Growth Projections By Country

15.2. Historical Market Value (US$ Mn) and Volume (Thousand Tons), 2014-2018, By Country

15.2.1. North Africa

15.2.2. South Africa

15.2.3. GCC countries

15.2.4. Rest of MEA

15.3. Market Size (US$ Mn) and Volume (Thousand Tons) Forecast Analysis 2019-2027, By Country

15.3.1. North Africa

15.3.2. South Africa

15.3.3. GCC countries

15.3.4. Rest of MEA

15.4. Historical Market Value (US$ Mn) and Volume (Thousand Tons), 2014-2018, By Material

15.4.1. Polyethylene

15.4.2. BOPET

15.4.3. Polypropylene

15.4.4. Inorganic Oxides

15.4.5. Aluminum

15.4.6. Polyamide

15.4.7. PVDC

15.4.8. EVOH

15.4.9. Others

15.5. Market Size (US$ Mn) and Volume (Thousand Tons) Forecast Analysis 2019-2027, By Material

15.5.1. Polyethylene

15.5.2. BOPET

15.5.3. Polypropylene

15.5.4. Inorganic Oxides

15.5.5. Aluminum

15.5.6. Polyamide

15.5.7. PVDC

15.5.8. EVOH

15.5.9. Others

15.6. Historical Market Value (US$ Mn) and Volume (Thousand Tons), 2014-2018, By Thickness

15.6.1. Up to 30 micron

15.6.2. 31 to 60 micron

15.6.3. 61 to 90 micron

15.6.4. Above 90 micron

15.7. Market Size (US$ Mn) and Volume (Thousand Tons) Forecast Analysis 2019-2027, By Thickness

15.7.1. Up to 30 micron

15.7.2. 31 to 60 micron

15.7.3. 61 to 90 micron

15.7.4. Above 90 micron

15.8. Historical Market Value (US$ Mn) and Volume (Thousand Tons), 2014-2018, By Production Method

15.8.1. Cast

15.8.2. Blown

15.9. Market Size (US$ Mn) and Volume (Thousand Tons) Forecast Analysis 2019-2027, By Production Method

15.9.1. Cast

15.9.2. Blown

15.10. Historical Market Value (US$ Mn) and Volume (Thousand Tons), 2014-2018, By Application

15.10.1. Packaging

15.10.1.1. Pouches

15.10.1.2. Bags

15.10.1.3. Lids

15.10.1.4. Wrapping

15.10.1.5. Coating & Lamination

15.10.2. Hygiene Products

15.10.2.1. Diapers

15.10.2.1.1. Baby diapers

15.10.2.1.2. Adult diapers

15.10.2.2. Sanitary Napkins

15.10.2.3. Medical Products

15.10.2.3.1. Underpads

15.10.2.3.2. Surgical Clothing

15.11. Market Size (US$ Mn) and Volume (Thousand Tons) Forecast Analysis 2019-2027, By Application

15.11.1. Packaging

15.11.1.1. Pouches

15.11.1.2. Bags

15.11.1.3. Lids

15.11.1.4. Wrapping

15.11.1.5. Coating & Lamination

15.11.2. Hygiene Products

15.11.2.1. Diapers

15.11.2.1.1. Baby diapers

15.11.2.1.2. Adult diapers

15.11.2.2. Sanitary Napkins

15.11.2.3. Medical Products

15.11.2.3.1. Underpads

15.11.2.3.2. Surgical Clothing

15.12. Market Attractiveness Analysis

15.12.1. By Country

15.12.2. By Material

15.12.3. By Thickness

15.12.4. By Production Method

15.12.5. By Application

15.13. Prominent Trends

16. Competitive Landscape

16.1. Competition Dashboard

16.2. Company Market Share Analysis

16.3. Company Profiles (Details – Overview, Financials, Strategy, Recent Developments, SWOT analysis)

16.4. Global Players

16.4.1. Uflex Ltd.

16.4.1.1. Overview

16.4.1.2. Financials

16.4.1.3. Strategy

16.4.1.4. Recent Developments

16.4.1.5. SWOT Analysis

16.4.2. Jindal Poly Films Limited

16.4.2.1. Overview

16.4.2.2. Financials

16.4.2.3. Strategy

16.4.2.4. Recent Developments

16.4.2.5. SWOT Analysis

16.4.3. Berry Global, Inc.

16.4.3.1. Overview

16.4.3.2. Financials

16.4.3.3. Strategy

16.4.3.4. Recent Developments

16.4.3.5. SWOT Analysis

16.4.4. Winpak Ltd.

16.4.4.1. Overview

16.4.4.2. Financials

16.4.4.3. Strategy

16.4.4.4. Recent Developments

16.4.4.5. SWOT Analysis

16.4.5. Bemis Company, Inc.

16.4.5.1. Overview

16.4.5.2. Financials

16.4.5.3. Strategy

16.4.5.4. Recent Developments

16.4.5.5. SWOT Analysis

16.4.6. Clondalkin Group Holdings BV

16.4.6.1. Overview

16.4.6.2. Financials

16.4.6.3. Strategy

16.4.6.4. Recent Developments

16.4.6.5. SWOT Analysis

16.4.7. Bischof + Klein SE & Co. KG

16.4.7.1. Overview

16.4.7.2. Financials

16.4.7.3. Strategy

16.4.7.4. Recent Developments

16.4.7.5. SWOT Analysis

16.4.8. Polyplex Corporation Ltd.

16.4.8.1. Overview

16.4.8.2. Financials

16.4.8.3. Strategy

16.4.8.4. Recent Developments

16.4.8.5. SWOT Analysis

16.4.9. POLIFILM GmbH

16.4.9.1. Overview

16.4.9.2. Financials

16.4.9.3. Strategy

16.4.9.4. Recent Developments

16.4.9.5. SWOT Analysis

16.4.10. Toray Plastics (America), Inc.

16.4.10.1. Overview

16.4.10.2. Financials

16.4.10.3. Strategy

16.4.10.4. Recent Developments

16.4.10.5. SWOT Analysis

16.4.11. Sealed Air Corporation

16.4.11.1. Overview

16.4.11.2. Financials

16.4.11.3. Strategy

16.4.11.4. Recent Developments

16.4.11.5. SWOT Analysis

16.4.12. Amcor Limited

16.4.12.1. Overview

16.4.12.2. Financials

16.4.12.3. Strategy

16.4.12.4. Recent Developments

16.4.12.5. SWOT Analysis

16.4.13. Mitsubishi Polyester Film, Inc.

16.4.13.1. Overview

16.4.13.2. Financials

16.4.13.3. Strategy

16.4.13.4. Recent Developments

16.4.13.5. SWOT Analysis

16.4.14. Glenroy, Inc.

16.4.14.1. Overview

16.4.14.2. Financials

16.4.14.3. Strategy

16.4.14.4. Recent Developments

16.4.14.5. SWOT Analysis

16.4.15. RKW Group

16.4.15.1. Overview

16.4.15.2. Financials

16.4.15.3. Strategy

16.4.15.4. Recent Developments

16.4.15.5. SWOT Analysis

16.4.16. Trioplast Industrier AB

16.4.16.1. Overview

16.4.16.2. Financials

16.4.16.3. Strategy

16.4.16.4. Recent Developments

16.4.16.5. SWOT Analysis

16.4.17. Fatra A.S.

16.4.17.1. Overview

16.4.17.2. Financials

16.4.17.3. Strategy

16.4.17.4. Recent Developments

16.4.17.5. SWOT Analysis

16.4.18. Schweitzer-Mauduit International, Inc.

16.4.18.1. Overview

16.4.18.2. Financials

16.4.18.3. Strategy

16.4.18.4. Recent Developments

16.4.18.5. SWOT Analysis

16.4.19. GCR Group

16.4.19.1. Overview

16.4.19.2. Financials

16.4.19.3. Strategy

16.4.19.4. Recent Developments

16.4.19.5. SWOT Analysis

17. Assumptions and Acronyms Used

18. Research Methodology

List of Tables

Table 01: Global Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Region

Table 02: Global Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Material (1/2)

Table 03: Global Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Material (2/2)

Table 04: Global Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Thickness

Table 05: Global Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Production Method

Table 06: Global Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Application (1/3)

Table 07: Global Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Application (2/3)

Table 08: Global Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Application (3/3)

Table 09: North America Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Country

Table 10: North America Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Material (1/2)

Table 11: North America Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Material (2/2)

Table 12: North America Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Thickness

Table 13: North America Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Production Method

Table 14: North America Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Application (1/3)

Table 15: North America Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Application (2/3)

Table 16: North America Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Application (3/3)

Table 17: Latin America Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Country

Table 18: Latin America Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Material (1/2)

Table 19: Latin America Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Material (2/2)

Table 20: Latin America Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Thickness

Table 21: Latin America Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Production Method

Table 22: Latin America Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Application (1/3)

Table 23: Latin America Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Application (2/3)

Table 24: Latin America Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Application (3/3)

Table 25: Europe Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Country

Table 26: Europe Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Country

Table 27: Europe Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Material (1/2)

Table 28: Europe Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Material (2/2)

Table 29: Europe Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Thickness

Table 30: Europe Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Production Method

Table 31: Europe Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Application (1/3)

Table 32: Europe Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Application (2/3)

Table 33: Europe Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Application (3/3)

Table 34: Asia Pacific Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, by Country

Table 35: Asia Pacific Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Material (1/2)

Table 36: Asia Pacific Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Material (2/2)

Table 37: Asia Pacific Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Thickness

Table 38: Asia Pacific Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Production Method

Table 39: Asia Pacific Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Application (1/3)

Table 40: Asia Pacific Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Application (2/3)

Table 41: Asia Pacific Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, By Application (3/3)

Table 42: MEA Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, by Country

Table 43: MEA Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, by Material (1/2)

Table 44: MEA Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, by Material (2/2)

Table 45: MEA Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, by Thickness

Table 46: MEA Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, by Production Method

Table 47: MEA Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, by Application (1/3)

Table 48: MEA Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, by Application (2/3)

Table 49: MEA Non-breathable Films Market Value (US$ Mn) and Volume (Thousand Tons) 2014-2027, by Application (3/3)

List of Figures

Figure 01: Global Non-breathable Films Market Attractiveness Analysis, by Region 2019(E)-2027(F)

Figure 02: Global Non-breathable Films Market Y-o-Y growth, by Region 2019(E)-2027(F)

Figure 03: Global Non-breathable Films Market Attractiveness Analysis, by Material 2019(E)-2027(F)

Figure 04: Global Non-breathable Films Market Value Share, by Material, 2018(A)

Figure 05: Global Non-breathable Films Market Value Share and BPS Analysis, By Thickness, 2019(E) & 2027(F)

Figure 06: Global Non-breathable Films Market Y-o-Y growth, by Thickness, 2019(E)-2027(F)

Figure 07: Global Non-breathable Films Market Attractiveness Analysis, by Production Method, 2019(E)-2027(F)

Figure 08: Global Non-breathable Films Market Value Share Analysis, By Production Method, 2018(A)

Figure 09: Global Non-breathable Films Market Y-o-Y growth, by Application, 2019(E)-2027(F)

Figure 10: Global Non-breathable Films Market Value Share and BPS Analysis, By Application, 2019(E) & 2027(F)

Figure 11: Global Non-breathable Films Market Analysis, by Application 2019(E) - 2027(F)

Figure 12: Global Non-breathable Films Market Analysis, by Packaging Sub-segment 2019(E)-2027(F)

Figure 13: Global Non-breathable Films Market Analysis, by Hygiene Sub-segment 2019(E)-2027(F)

Figure 14: North America Non-breathable Films Market Value Share and BPS Analysis, By Country, 2019(E) & 2027(F)

Figure 15: North America Non-breathable Films Market Y-o-Y Growth, by Country 2019(E)-2027(F)

Figure 16: North America Non-breathable Films Market Attractiveness Analysis, by Country, 2019(E)-2027(F)

Figure 17: North America Non-breathable Films Market Value Share and BPS Analysis, By Material, 2019(E) & 2027(F)

Figure 18: North America Non-breathable Films Market Y-o-Y growth, by Material, 2019(E)-2027(F)

Figure 19: North America Non-breathable Films Market Attractiveness Analysis, by Material, 2019(E)-2027(F)

Figure 20: North America Non-breathable Films Market Value Share and BPS Analysis, By Thickness, 2019(E) & 2027(F)

Figure 21: North America Non-breathable Films Market Y-o-Y growth, by Thickness, 2019(E)-2027(F)

Figure 22: North America Non-breathable Films Market Attractiveness Analysis, by Thickness, 2019(E)-2027(F)

Figure 23: North America Non-breathable Films Market Value Share and BPS Analysis, By Production Method, 2019(E) & 2027(F)

Figure 24: North America Non-breathable Films Market Y-o-Y growth, by Production Method, 2019(E)-2027(F)

Figure 25: North America Non-breathable Films Market Attractiveness Analysis, by Production Method, 2019(E)-2027(F)

Figure 26: North America Non-breathable Films Market Value Share and BPS Analysis, by Application, 2019(E) & 2027(F)

Figure 27: North America Non-breathable Films Market Y-o-Y Growth, by Application, 2019(E)-2027(F)

Figure 28: North America Non-breathable Films Market Attractiveness Analysis, by Application, 2019(E)-2027(F)

Figure 29: Latin America Non-breathable Films Market Value Share and BPS Analysis, By Country, 2019(E) & 2027(F)

Figure 30: Latin America Non-breathable Films Market Y-o-Y growth, by Country 2019(E)-2027(F)

Figure 31: Latin America Non-breathable Films Market Attractiveness Analysis, by Country, 2019(E)-2027(F)

Figure 32: Latin America Non-breathable Films Market Value Share and BPS Analysis, by Material, 2019(E) & 2027(F)

Figure 33: Latin America Non-breathable Films Market Y-o-Y growth, by Material, 2019(E)-2027(F)

Figure 34: Latin America Non-breathable Films Market Attractiveness Analysis, by Material, 2019(E)-2027(F)

Figure 35: Latin America Non-breathable Films Market Value Share and BPS Analysis, By Thickness, 2019(E) & 2027(F)

Figure 36: Latin America Non-breathable Films Market Y-o-Y growth, by Thickness, 2019(E)-2027(F)

Figure 37: Latin America Non-breathable Films Market Attractiveness Analysis, by Thickness, 2019(E)-2027(F)

Figure 38: Latin America Non-breathable Films Market Value Share and BPS Analysis, by Production Method, 2019(E) & 2027(F)

Figure 39: Latin America Non-breathable Films Market Y-o-Y growth, by Production Method, 2019(E)-2027(F)

Figure 40: Latin America Non-breathable Films Market Attractiveness Analysis, by Production Method, 2019(E)-2027(F)

Figure 41: Latin America Non-breathable Films Market Value Share and BPS Analysis, By Application, 2019(E) & 2027(F)

Figure 42: Latin America Non-breathable Films Market Y-o-Y growth, by Application, 2019(E)-2027(F)

Figure 43: Latin America Non-breathable Films Market Attractiveness Analysis, by Application, 2019(E)-2027(F)

Figure 44: Europe Non-breathable Films Market Value Share and BPS Analysis, By Country, 2019(E) & 2027(F)

Figure 45: Europe Non-breathable Films Market Y-o-Y growth, by Country 2019(E)-2027(F)

Figure 46: Europe Non-breathable Films Market Attractiveness Analysis, by Country, 2019(E)-2027(F)

Figure 47: Europe Non-breathable Films Market Value Share and BPS Analysis, by Material, 2019(E) & 2027(F)

Figure 48: Europe Non-breathable Films Market Y-o-Y growth, by Material, 2019(E)-2027(F)

Figure 49: Europe Non-breathable Films Market Attractiveness Analysis, by Material, 2019(E)-2027(F)

Figure 50: Europe Non-breathable Films Market Value Share and BPS Analysis, by Thickness, 2019(E) & 2027(F)

Figure 51: Europe Non-breathable Films Market Y-o-Y growth, by Thickness, 2019(E)-2027(F)

Figure 52: Europe Non-breathable Films Market Attractiveness Analysis, by Thickness, 2019(E)-2027(F)

Figure 53: Europe Non-breathable Films Market Value Share and BPS Analysis, By Production Method, 2019(E) & 2027(F)

Figure 54: Europe Non-breathable Films Market Y-o-Y growth, by Production Method, 2019(E)-2027(F)

Figure 55: Europe Non-breathable Films Market Attractiveness Analysis, by Production Method, 2019(E)-2027(F)

Figure 56: Europe Non-breathable Films Market Value Share and BPS Analysis, by Application, 2019(E) & 2027(F)

Figure 57: Europe Non-breathable Films Market Y-o-Y growth, by Application, 2019(E)-2027(F)

Figure 58: Europe Non-breathable Films Market Attractiveness Analysis, by Application, 2019(E)-2027(F)

Figure 59: Asia Pacific Non-breathable Films Market Value Share and BPS Analysis, by Country, 2019(E) & 2027(F)

Figure 60: Asia Pacific Non-breathable Films Market Y-o-Y growth, by Country 2019(E)-2027(F)

Figure 61: Asia Pacific Non-breathable Films Market Attractiveness Analysis, by Country, 2019(E)-2027(F)

Figure 62: Asia Pacific Non-breathable Films Market Value Share and BPS Analysis, by Material, 2019(E) & 2027(F)

Figure 63: Asia Pacific Non-breathable Films Market Y-o-Y growth, by Material, 2019(E)-2027(F)

Figure 64: Asia Pacific Non-breathable Films Market Attractiveness Analysis, by Material, 2019(E)-2027(F)

Figure 65: Asia Pacific Non-breathable Films Market Value Share and BPS Analysis, by Thickness, 2019(E) & 2027(F)

Figure 66: Asia Pacific Non-breathable Films Market Y-o-Y growth, by Thickness, 2019(E)-2027(F)

Figure 67: Asia Pacific Non-breathable Films Market Attractiveness Analysis, by Thickness, 2019(E)-2027(F)

Figure 68: Asia Pacific Non-breathable Films Market Value Share and BPS Analysis, By Production Method, 2019(E) & 2027(F)

Figure 69: Asia Pacific Non-breathable Films Market Y-o-Y growth, by Production Method, 2019(E)-2027(F)

Figure 70: Asia Pacific Non-breathable Films Market Attractiveness Analysis, by Production Method, 2019(E)-2027(F)

Figure 71: Asia Pacific Non-breathable Films Market Value Share and BPS Analysis, by Application, 2019(E) & 2027(F)

Figure 72: Asia Pacific Non-breathable Films Market Y-o-Y growth, by Application, 2019(E)-2027(F)

Figure 73: Asia Pacific Non-breathable Films Market Attractiveness Analysis, by Application, 2019(E)-2027(F)

Figure 74: MEA Non-breathable Films Market Value Share and BPS Analysis, By Country, 2019(E) & 2027(F)

Figure 75: MEA Non-breathable Films Market Y-o-Y growth, by Country 2019(E)-2027(F)

Figure 76: MEA Non-breathable Films Market Attractiveness Analysis, by Country, 2019(E)-2027(F)

Figure 77: MEA Non-breathable Films Market Value Share and BPS Analysis, by Material, 2019(E) & 2027(F)

Figure 78: MEA Non-breathable Films Market Y-o-Y growth, by Material, 2019(E)-2027(F)

Figure 79: MEA Non-breathable Films Market Attractiveness Analysis, by Material, 2019(E)-2027(F)

Figure 80: MEA Non-breathable Films Market Value Share and BPS Analysis, by Thickness, 2019(E) & 2027(F)

Figure 81: MEA Non-breathable Films Market Y-o-Y growth, by Thickness, 2019(E)-2027(F)

Figure 82: MEA Non-breathable Films Market Attractiveness Analysis, by Thickness, 2019(E)-2027(F)

Figure 83: MEA Non-breathable Films Market Value Share and BPS Analysis, by Production Method, 2019(E) & 2027(F)

Figure 84: MEA Non-breathable Films Market Y-o-Y growth, by Production Method, 2019(E)-2027(F)

Figure 85: MEA Non-breathable Films Market Attractiveness Analysis, by Production Method, 2019(E)-2027(F)

Figure 86: MEA Non-breathable Films Market Value Share and BPS Analysis, by Application, 2019(E) & 2027(F)

Figure 87: MEA Non-breathable Films Market Y-o-Y growth, by Application, 2019(E)-2027(F)

Figure 88: MEA Non-breathable Films Market Attractiveness Analysis, by Application, 2019(E)-2027(F)