Reports

Reports

Analysts’ Viewpoint

Focus on improving local air quality is a major factor driving the global NEV taxi market. NEV taxies or electric vehicle taxis (e-taxis) have a higher potential in enhancing urban air quality than private vehicles converted to EVs. Technological developments and increase in sales of EVs in China, India, and the U.K. are projected to propel market development during the forecast period. Furthermore, extensive testing and implementation of EVs by taxi firms are likely to accelerate market expansion in the next few years.

However, range anxiety and battery cost are the major challenges hampering global NEV taxis market demand. Technological advancements and favorable policies are expected to offer lucrative opportunities for market players. Manufacturers are focusing on increasing investment in R&D on lithium-ion battery technologies based on graphene and sulfide in order to lower the cost of production and batteries.

Emerging trend of electric vehicles and burgeoning need to commercialize the public passenger fleet are augmenting the global NEV taxi market value. Newer battery electric vehicle and hybrid electric vehicle versions are being introduced by international automakers. Technological developments are driving the emergence of new energy or electric automobiles. Availability of a range of models to meet the diverse needs of a larger population is projected to increase the usage of NEV taxis.

Growing concerns about vehicle emission and its negative impact on the environment are anticipated to bolster the global NEV taxi business growth. Demand for new energy vehicles is increasing as people become more aware about rapid depletion of fossil fuels, high cost, and the ill effects of pollution.

Rapid rise in air pollution levels, which are bad for the environment and people's health, has pushed national and international regulatory authorities to adopt green mobility initiatives. Electric vehicles are considered the most environmentally friendly option. Hence, these have been developed and put into use quickly for both personal and professional purposes. According to studies and surveys, reduced emission levels have been observed in cities where NEV adoption has been rapid.

Feasibility of NEV vehicles over the conventional ICE vehicles makes them much better option for fleet owners, as EVs have less movable or rotary parts than conventional vehicles. This factor is likely to drive the global NEV taxi market during the forecast period. Operators who shift to NEV taxis can increase revenue by decreasing expenses related to fleet maintenance and operations. These factors increase and influence both taxi owner-drivers and passengers to opt for NEV taxis or cabs, thereby fueling global market progress.

Strict emission regulations imposed by several government authorities, along with tax breaks and subsidies for NEV purchases, are propelling the global NEV taxi market. Rise in awareness about the adoption of green mobility, which is regarded as the future or tomorrow's mobility due to the limited availability of fossil fuel and the auto industry's decreasing reliance on these fuels, is anticipated to create significant opportunities in the market during the forecast period.

Government incentives is another major factor driving the electrification of transportation. Several jurisdictions provide non-cash incentives for electric vehicles, such as free municipal parking in California and access to the Carpool lane. The Government of India, in its recent budget, granted subsidy under the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) for FY23, which is expected to be at INR 2,908 Cr (US$ 350 Mn) or triple the allocation of current fiscal year and nine times higher than the last year.

In terms of NEV type, the hybrid electric vehicles segment accounted for the largest global NEV taxi market share in 2022. Increase in demand for low-emission vehicles and government tax credit exemptions on their purchase are bolstering the segment. However, the battery electric vehicle segment is expected to grow at a rapid pace during the projected period due to zero emissions, lack of pollution, and reduced noise.

Based on vehicle sub-type, the hatchback segment is likely to dominate the global market during the forecast period. In mega cities, hatchback eco-friendly taxis are being adopted at a higher rate due to surge in demand for affordable city travel. Availability of all-electric vehicles and their appeal in emerging economies due to lower cost than alternative options are propelling the segment.

As per NEV taxi industry trends, Asia Pacific accounted for significant share of the global market in 2022. Rise in demand for electric vehicles in China and Japan, and availability of electric charging stations are driving the development of NEV taxi in the region. China's auto sector has placed high priority on electric automobiles. The government is implementing a mega charging station installation program along with extra tax breaks and incentives to encourage the use of NEV taxis and lower the nation's emissions. These factors are driving the NEV taxis market in the country. China is regarded as the world's top market for green taxi, and the trend is projected to continue during the projection period. The Government of India's announcement that electric cabs would be used in the country's major cities is projected to stimulate the regional industry.

Key players in the global NEV Taxi Market are AB Volvo, BAIC Motor Corporation Ltd., Beiqi Foton Motor Co., Ltd., BMW AG, BYD Auto Co., Ltd., Changan Automobile Company Limited., Daimler AG, Ford Motor Company, General Motors Company, Honda Motor Co., Ltd., Hyundai Motor Company, JAC Motors, London Electric Vehicle Company, Mahindra and Mahindra Limited, Nissan Motor Corporation, Renault, TATA Motors, Tesla, Inc., Toyota Motor Corporation, and Volkswagen. Leading players have adopted strategies such R&D, mergers & acquisition, and joint ventures to increase market share and presence.

Each of these players has been profiled in the NEV taxi market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Size in 2021 |

US$ 3.5 Bn |

|

Forecast (Value) in 2031 |

US$ 20.9 Bn |

|

Growth Rate (CAGR) |

22.5% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

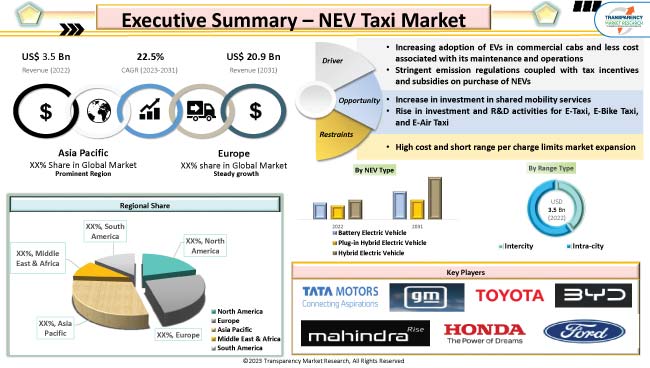

The global industry was valued at US$ 3.5 Bn in 2022

The CAGR is projected to be 22.5% from 2023 to 2031.

It is anticipated to reach US$ 20.9 Bn by 2031.

Increase in adoption of EVs in commercial cabs & low cost of maintenance & operations and stringent emission regulations coupled with tax incentives and subsidies on purchase of NEVs are propelling the market

The hybrid electric vehicle segment held the leading market share in 2022

Asia Pacific is the most lucrative region of the global NEV taxi market.

AB Volvo, BAIC Motor Corporation Ltd., Beiqi Foton Motor Co., Ltd., BMW AG, BYD Auto Co., Ltd., Changan Automobile Company Limited., Daimler AG, Ford Motor Company, General Motors Company, Honda Motor Co., Ltd., Hyundai Motor Company, JAC Motors, London Electric Vehicle Company, Mahindra and Mahindra Limited, Nissan Motor Corporation, Renault, TATA Motors, Tesla, Inc., Toyota Motor Corporation, and Volkswagen are the leading companies in the global market.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Size, Volume in units & value in US$ Mn, 2017-2031

1.2. TMR Analysis and Recommendations

1.3. Competitive Dashboard Analysis

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

2.3. Macro-Economic Factors

2.3.1. Per Capita Consumption (PCC)

2.3.2. Government Regulations

2.3.3. Industrial Developments

2.4. Market Dynamics

2.4.1. Drivers

2.4.2. Restraints

2.4.3. Opportunity

2.5. Market Factor Analysis

2.5.1. Porter’s Five Force Analysis

2.5.2. SWOT Analysis

2.6. Regulatory Scenario

2.7. Key Trend Analysis

2.8. Value Chain Analysis

2.8.1. Component Manufacturer

2.8.2. System Suppliers

2.8.3. Tier 1 Players

2.8.4. 0.5 Tier Players/ Technology Providers

2.9. Regulatory Scenario

2.9.1. NEV Taxi Market – Various Government Announcement on EVs

3. NEV Taxi Market – Emission Impact Analysis

3.1. Government Emission Regulations

3.2. Auto Manufacturers Announcement

3.3. Announcement and Implementation on banning ICE

4. Global NEV Taxi Market, by NEV Type

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global NEV Taxi Market Size & Forecast, 2017-2031, by NEV Type

4.2.1. Battery Electric Vehicle

4.2.2. Plug-in Hybrid Electric Vehicle

4.2.3. Hybrid Electric Vehicle

5. Global NEV Taxi Market, by Vehicle Sub-type

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global NEV Taxi Market Size & Forecast, 2017-2031, by Vehicle Sub-type

5.2.1. Hatchback

5.2.2. Sedan

5.2.3. Utility Vehicle

6. Global NEV Taxi Market, by Ownership

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global NEV Taxi Market Size & Forecast, 2017-2031, by Ownership

6.2.1. Company Owned

6.2.2. Individual Owned/ Private

7. Global NEV Taxi Market, by Range Type

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global NEV Taxi Market Size & Forecast, 2017-2031, by Range Type

7.2.1. Intercity

7.2.2. Intra-city

8. Global NEV Taxi Market, by Vehicle Level

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global NEV Taxi Market Size & Forecast, 2017-2031, by Vehicle Level

8.2.1. Entry & Mid-level

8.2.2. Premium

9. Global NEV Taxi Market, by Region

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global NEV Taxi Market Size & Forecast, 2017-2031, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. South America

10. North America NEV Taxi Market

10.1. Market Snapshot

10.2. NEV Taxi Market Size & Forecast, 2017-2031, by NEV Type

10.2.1. Battery Electric Vehicle

10.2.2. Plug-in Hybrid Electric Vehicle

10.2.3. Hybrid Electric Vehicle

10.3. NEV Taxi Market Size & Forecast, 2017-2031, by Vehicle Sub-type

10.3.1. Hatchback

10.3.2. Sedan

10.3.3. Utility Vehicle

10.4. NEV Taxi Market Size & Forecast, 2017-2031, by Ownership

10.4.1. Company Owned

10.4.2. Individual Owned/ Private

10.5. NEV Taxi Market Size & Forecast, 2017-2031, by Range Type

10.5.1. Intercity

10.5.2. Intra-city

10.6. NEV Taxi Market Size & Forecast, 2017-2031, by Vehicle Level

10.6.1. Entry & Mid-level

10.6.2. Premium

10.7. Key Country Analysis – North America NEV Taxi Market Size & Forecast, 2017-2031

10.7.1. U.S.

10.7.2. Canada

10.7.3. Mexico

11. Europe NEV Taxi Market

11.1. Market Snapshot

11.2. NEV Taxi Market Size & Forecast, 2017-2031, by NEV Type

11.2.1. Battery Electric Vehicle

11.2.2. Plug-in Hybrid Electric Vehicle

11.2.3. Hybrid Electric Vehicle

11.3. NEV Taxi Market Size & Forecast, 2017-2031, by Vehicle Sub-type

11.3.1. Hatchback

11.3.2. Sedan

11.3.3. Utility Vehicle

11.4. NEV Taxi Market Size & Forecast, 2017-2031, by Ownership

11.4.1. Company Owned

11.4.2. Individual Owned/ Private

11.5. NEV Taxi Market Size & Forecast, 2017-2031, by Range Type

11.5.1. Intercity

11.5.2. Intra-city

11.6. NEV Taxi Market Size & Forecast, 2017-2031, by Vehicle Level

11.6.1. Entry & Mid-level

11.6.2. Premium

11.7. Key Country Analysis - Europe NEV Taxi Market Size & Forecast, 2017-2031

11.7.1. Germany

11.7.2. U. K.

11.7.3. France

11.7.4. Italy

11.7.5. Spain

11.7.6. Nordic Countries

11.7.7. Russia & CIS

11.7.8. Rest of Europe

12. Asia Pacific NEV Taxi Market

12.1. Market Snapshot

12.2. NEV Taxi Market Size & Forecast, 2017-2031, by NEV Type

12.2.1. Battery Electric Vehicle

12.2.2. Plug-in Hybrid Electric Vehicle

12.2.3. Hybrid Electric Vehicle

12.3. NEV Taxi Market Size & Forecast, 2017-2031, by Vehicle Sub-type

12.3.1. Hatchback

12.3.2. Sedan

12.3.3. Utility Vehicle

12.4. NEV Taxi Market Size & Forecast, 2017-2031, by Ownership

12.4.1. Company Owned

12.4.2. Individual Owned/ Private

12.5. NEV Taxi Market Size & Forecast, 2017-2031, by Range Type

12.5.1. Intercity

12.5.2. Intra-city

12.6. NEV Taxi Market Size & Forecast, 2017-2031, by Vehicle Level

12.6.1. Entry & Mid-level

12.6.2. Premium

12.7. Key Country Analysis - Asia Pacific NEV Taxi Market Size & Forecast, 2017-2031

12.7.1. China

12.7.2. India

12.7.3. Japan

12.7.4. ASEAN Countries

12.7.5. South Korea

12.7.6. ANZ

12.7.7. Rest of Asia Pacific

13. Middle East & Africa NEV Taxi Market

13.1. Market Snapshot

13.2. NEV Taxi Market Size & Forecast, 2017-2031, by NEV Type

13.2.1. Battery Electric Vehicle

13.2.2. Plug-in Hybrid Electric Vehicle

13.2.3. Hybrid Electric Vehicle

13.3. NEV Taxi Market Size & Forecast, 2017-2031, by Vehicle Sub-type

13.3.1. Hatchback

13.3.2. Sedan

13.3.3. Utility Vehicle

13.4. NEV Taxi Market Size & Forecast, 2017-2031, by Ownership

13.4.1. Company Owned

13.4.2. Individual Owned/ Private

13.5. NEV Taxi Market Size & Forecast, 2017-2031, by Range Type

13.5.1. Intercity

13.5.2. Intra-city

13.6. NEV Taxi Market Size & Forecast, 2017-2031, by Vehicle Level

13.6.1. Entry & Mid-level

13.6.2. Premium

13.7. Key Country Analysis - Middle East & Africa NEV Taxi Market Size & Forecast, 2017-2031

13.7.1. GCC

13.7.2. South Africa

13.7.3. Turkey

13.7.4. Rest of Middle East & Africa

14. South America NEV Taxi Market

14.1. Market Snapshot

14.2. NEV Taxi Market Size & Forecast, 2017-2031, by NEV Type

14.2.1. Battery Electric Vehicle

14.2.2. Plug-in Hybrid Electric Vehicle

14.2.3. Hybrid Electric Vehicle

14.3. NEV Taxi Market Size & Forecast, 2017-2031, by Vehicle Sub-type

14.3.1. Hatchback

14.3.2. Sedan

14.3.3. Utility Vehicle

14.4. NEV Taxi Market Size & Forecast, 2017-2031, by Ownership

14.4.1. Company Owned

14.4.2. Individual Owned/ Private

14.5. NEV Taxi Market Size & Forecast, 2017-2031, by Range Type

14.5.1. Intercity

14.5.2. Intra-city

14.6. NEV Taxi Market Size & Forecast, 2017-2031, by Vehicle Level

14.6.1. Entry & Mid-level

14.6.2. Premium

14.7. Key Country Analysis - South America NEV Taxi Market Size & Forecast, 2017-2031

14.7.1. Brazil

14.7.2. Argentina

14.7.3. Rest of South America

15. Competitive Landscape

15.1. Company Share Analysis/ Brand Share Analysis, 2022

15.2. Key Strategy Analysis

15.2.1. Strategic Overview - Expansion, M&A, Partnership

15.2.2. Product & Marketing Strategy

15.3. Consumer Trend Analysis for Key Players

15.3.1. Battery Electric Vehicle

15.3.2. Plug-in Hybrid Electric Vehicle

15.3.3. Hybrid Electric Vehicle

15.4. Pricing comparison among key players

15.5. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

16. Company Profile/ Key Players

16.1. AB Volvo

16.1.1. Company Overview

16.1.2. Company Footprints

16.1.3. Production Locations

16.1.4. Product Portfolio

16.1.5. Competitors & Customers

16.1.6. Subsidiaries & Parent Organization

16.1.7. Recent Developments

16.1.8. Financial Analysis

16.1.9. Profitability

16.1.10. Revenue Share

16.2. BAIC Motor Corporation., Ltd

16.2.1. Company Overview

16.2.2. Company Footprints

16.2.3. Production Locations

16.2.4. Product Portfolio

16.2.5. Competitors & Customers

16.2.6. Subsidiaries & Parent Organization

16.2.7. Recent Developments

16.2.8. Financial Analysis

16.2.9. Profitability

16.2.10. Revenue Share

16.3. Beiqi Foton Motor Co., Ltd.

16.3.1. Company Overview

16.3.2. Company Footprints

16.3.3. Production Locations

16.3.4. Product Portfolio

16.3.5. Competitors & Customers

16.3.6. Subsidiaries & Parent Organization

16.3.7. Recent Developments

16.3.8. Financial Analysis

16.3.9. Profitability

16.3.10. Revenue Share

16.4. BMW AG

16.4.1. Company Overview

16.4.2. Company Footprints

16.4.3. Production Locations

16.4.4. Product Portfolio

16.4.5. Competitors & Customers

16.4.6. Subsidiaries & Parent Organization

16.4.7. Recent Developments

16.4.8. Financial Analysis

16.4.9. Profitability

16.4.10. Revenue Share

16.5. BYD Auto Co., Ltd.

16.5.1. Company Overview

16.5.2. Company Footprints

16.5.3. Production Locations

16.5.4. Product Portfolio

16.5.5. Competitors & Customers

16.5.6. Subsidiaries & Parent Organization

16.5.7. Recent Developments

16.5.8. Financial Analysis

16.5.9. Profitability

16.5.10. Revenue Share

16.6. Changan Automobile Company Limited.

16.6.1. Company Overview

16.6.2. Company Footprints

16.6.3. Production Locations

16.6.4. Product Portfolio

16.6.5. Competitors & Customers

16.6.6. Subsidiaries & Parent Organization

16.6.7. Recent Developments

16.6.8. Financial Analysis

16.6.9. Profitability

16.6.10. Revenue Share

16.7. Daimler AG

16.7.1. Company Overview

16.7.2. Company Footprints

16.7.3. Production Locations

16.7.4. Product Portfolio

16.7.5. Competitors & Customers

16.7.6. Subsidiaries & Parent Organization

16.7.7. Recent Developments

16.7.8. Financial Analysis

16.7.9. Profitability

16.7.10. Revenue Share

16.8. Ford Motor Company

16.8.1. Company Overview

16.8.2. Company Footprints

16.8.3. Production Locations

16.8.4. Product Portfolio

16.8.5. Competitors & Customers

16.8.6. Subsidiaries & Parent Organization

16.8.7. Recent Developments

16.8.8. Financial Analysis

16.8.9. Profitability

16.8.10. Revenue Share

16.9. General Motors Company

16.9.1. Company Overview

16.9.2. Company Footprints

16.9.3. Production Locations

16.9.4. Product Portfolio

16.9.5. Competitors & Customers

16.9.6. Subsidiaries & Parent Organization

16.9.7. Recent Developments

16.9.8. Financial Analysis

16.9.9. Profitability

16.9.10. Revenue Share

16.10. Honda Motor Co., Ltd.

16.10.1. Company Overview

16.10.2. Company Footprints

16.10.3. Production Locations

16.10.4. Product Portfolio

16.10.5. Competitors & Customers

16.10.6. Subsidiaries & Parent Organization

16.10.7. Recent Developments

16.10.8. Financial Analysis

16.10.9. Profitability

16.10.10. Revenue Share

16.11. Hyundai Motor Company

16.11.1. Company Overview

16.11.2. Company Footprints

16.11.3. Production Locations

16.11.4. Product Portfolio

16.11.5. Competitors & Customers

16.11.6. Subsidiaries & Parent Organization

16.11.7. Recent Developments

16.11.8. Financial Analysis

16.11.9. Profitability

16.11.10. Revenue Share

16.12. JAC Motors

16.12.1. Company Overview

16.12.2. Company Footprints

16.12.3. Production Locations

16.12.4. Product Portfolio

16.12.5. Competitors & Customers

16.12.6. Subsidiaries & Parent Organization

16.12.7. Recent Developments

16.12.8. Financial Analysis

16.12.9. Profitability

16.12.10. Revenue Share

16.13. London Electric Vehicle Company

16.13.1. Company Overview

16.13.2. Company Footprints

16.13.3. Production Locations

16.13.4. Product Portfolio

16.13.5. Competitors & Customers

16.13.6. Subsidiaries & Parent Organization

16.13.7. Recent Developments

16.13.8. Financial Analysis

16.13.9. Profitability

16.13.10. Revenue Share

16.14. Mahindra and Mahindra Limited

16.14.1. Company Overview

16.14.2. Company Footprints

16.14.3. Production Locations

16.14.4. Product Portfolio

16.14.5. Competitors & Customers

16.14.6. Subsidiaries & Parent Organization

16.14.7. Recent Developments

16.14.8. Financial Analysis

16.14.9. Profitability

16.14.10. Revenue Share

16.15. Nissan Motor Corporation

16.15.1. Company Overview

16.15.2. Company Footprints

16.15.3. Production Locations

16.15.4. Product Portfolio

16.15.5. Competitors & Customers

16.15.6. Subsidiaries & Parent Organization

16.15.7. Recent Developments

16.15.8. Financial Analysis

16.15.9. Profitability

16.15.10. Revenue Share

16.16. Renault

16.16.1. Company Overview

16.16.2. Company Footprints

16.16.3. Production Locations

16.16.4. Product Portfolio

16.16.5. Competitors & Customers

16.16.6. Subsidiaries & Parent Organization

16.16.7. Recent Developments

16.16.8. Financial Analysis

16.16.9. Profitability

16.16.10. Revenue Share

16.17. TATA Motors

16.17.1. Company Overview

16.17.2. Company Footprints

16.17.3. Production Locations

16.17.4. Product Portfolio

16.17.5. Competitors & Customers

16.17.6. Subsidiaries & Parent Organization

16.17.7. Recent Developments

16.17.8. Financial Analysis

16.17.9. Profitability

16.17.10. Revenue Share

16.18. Tesla, Inc.

16.18.1. Company Overview

16.18.2. Company Footprints

16.18.3. Production Locations

16.18.4. Product Portfolio

16.18.5. Competitors & Customers

16.18.6. Subsidiaries & Parent Organization

16.18.7. Recent Developments

16.18.8. Financial Analysis

16.18.9. Profitability

16.18.10. Revenue Share

16.19. Toyota Motor Corporation

16.19.1. Company Overview

16.19.2. Company Footprints

16.19.3. Production Locations

16.19.4. Product Portfolio

16.19.5. Competitors & Customers

16.19.6. Subsidiaries & Parent Organization

16.19.7. Recent Developments

16.19.8. Financial Analysis

16.19.9. Profitability

16.19.10. Revenue Share

16.20. Volkswagen

16.20.1. Company Overview

16.20.2. Company Footprints

16.20.3. Production Locations

16.20.4. Product Portfolio

16.20.5. Competitors & Customers

16.20.6. Subsidiaries & Parent Organization

16.20.7. Recent Developments

16.20.8. Financial Analysis

16.20.9. Profitability

16.20.10. Revenue Share

List of Tables

Table 1: Global NEV Taxi Market Projections, by NEV Type, Value (US$ Mn), 2017‒2031

Table 2: Global NEV Taxi Market Projections, by NEV Type, Volume (Units), 2017‒2031

Table 3: Global NEV Taxi Market Projections, by Vehicle Sub-type, Value (US$ Mn), 2017‒2031

Table 4: Global NEV Taxi Market Projections, by Vehicle Sub-type, Volume (Units), 2017‒2031

Table 5: Global NEV Taxi Market Projections, by Ownership, Value (US$ Mn), 2017‒2031

Table 6: Global NEV Taxi Market Projections, by Ownership, Volume (Units), 2017‒2031

Table 7: Global NEV Taxi Market Projections, by Range Type, Value (US$ Mn), 2017‒2031

Table 8: Global NEV Taxi Market Projections, by Range Type, Volume (Units), 2017‒2031

Table 9: Global NEV Taxi Market Projections, by Vehicle Level, Value (US$ Mn), 2017‒2031

Table 10: Global NEV Taxi Market Projections, by Vehicle Level, Volume (Units), 2017‒2031

Table 11: Global NEV Taxi Market Projections, by Region, Value (US$ Mn), 2017‒2031

Table 12: Global NEV Taxi Market Projections, by Region, Volume (Units), 2017‒2031

Table 13: North America NEV Taxi Market Projections, by NEV Type, Value (US$ Mn), 2017‒2031

Table 14: North America NEV Taxi Market Projections, by NEV Type, Volume (Units), 2017‒2031

Table 15: North America NEV Taxi Market Projections, by Vehicle Sub-type, Value (US$ Mn), 2017‒2031

Table 16: North America NEV Taxi Market Projections, by Vehicle Sub-type, Volume (Units), 2017‒2031

Table 17: North America NEV Taxi Market Projections, by Ownership, Value (US$ Mn), 2017‒2031

Table 18: North America NEV Taxi Market Projections, by Ownership, Volume (Units), 2017‒2031

Table 19: North America NEV Taxi Market Projections, by Range Type, Value (US$ Mn), 2017‒2031

Table 20: North America NEV Taxi Market Projections, by Range Type, Volume (Units), 2017‒2031

Table 21: North America NEV Taxi Market Projections, by Vehicle Level, Value (US$ Mn), 2017‒2031

Table 22: North America NEV Taxi Market Projections, by Vehicle Level, Volume (Units), 2017‒2031

Table 23: North America NEV Taxi Market Projections, by Country, Value (US$ Mn), 2017‒2031

Table 24: North America NEV Taxi Market Projections, by Country, Volume (Units), 2017‒2031

Table 25: Europe NEV Taxi Market Projections, by NEV Type, Value (US$ Mn), 2017‒2031

Table 26: Europe NEV Taxi Market Projections, by NEV Type, Volume (Units), 2017‒2031

Table 27: Europe NEV Taxi Market Projections, by Vehicle Sub-type, Value (US$ Mn), 2017‒2031

Table 28: Europe NEV Taxi Market Projections, by Vehicle Sub-type, Volume (Units), 2017‒2031

Table 29: Europe NEV Taxi Market Projections, by Ownership, Value (US$ Mn), 2017‒2031

Table 30: Europe NEV Taxi Market Projections, by Ownership, Volume (Units), 2017‒2031

Table 31: Europe NEV Taxi Market Projections, by Range Type, Value (US$ Mn), 2017‒2031

Table 32: Europe NEV Taxi Market Projections, by Range Type, Volume (Units), 2017‒2031

Table 33: Europe NEV Taxi Market Projections, by Vehicle Level, Value (US$ Mn), 2017‒2031

Table 34: Europe NEV Taxi Market Projections, by Vehicle Level, Volume (Units), 2017‒2031

Table 35: Europe NEV Taxi Market Projections, by Country/Sub-region, Value (US$ Mn), 2017‒2031

Table 36: Europe NEV Taxi Market Projections, by Country/Sub-region, Volume (Units), 2017‒2031

Table 37: Asia Pacific NEV Taxi Market Projections, by NEV Type, Value (US$ Mn), 2017‒2031

Table 38: Asia Pacific NEV Taxi Market Projections, by NEV Type, Volume (Units), 2017‒2031

Table 39: Asia Pacific NEV Taxi Market Projections, by Vehicle Sub-type, Value (US$ Mn), 2017‒2031

Table 40: Asia Pacific NEV Taxi Market Projections, by Vehicle Sub-type, Volume (Units), 2017‒2031

Table 41: Asia Pacific NEV Taxi Market Projections, by Ownership, Value (US$ Mn), 2017‒2031

Table 42: Asia Pacific NEV Taxi Market Projections, by Ownership, Volume (Units), 2017‒2031

Table 43: Asia Pacific NEV Taxi Market Projections, by Range Type, Value (US$ Mn), 2017‒2031

Table 44: Asia Pacific NEV Taxi Market Projections, by Range Type, Volume (Units), 2017‒2031

Table 45: Asia Pacific NEV Taxi Market Projections, by Vehicle Level, Value (US$ Mn), 2017‒2031

Table 46: Asia Pacific NEV Taxi Market Projections, by Vehicle Level, Volume (Units), 2017‒2031

Table 47: Asia Pacific NEV Taxi Market Projections, by Country/Sub-region, Value (US$ Mn), 2017‒2031

Table 48: Asia Pacific NEV Taxi Market Projections, by Country/Sub-region, Volume (Units), 2017‒2031

Table 49: Middle East & Africa NEV Taxi Market Projections, by NEV Type, Value (US$ Mn), 2017‒2031

Table 50: Middle East & Africa NEV Taxi Market Projections, by NEV Type, Volume (Units), 2017‒2031

Table 51: Middle East & Africa NEV Taxi Market Projections, by Vehicle Sub-type, Value (US$ Mn), 2017‒2031

Table 52: Middle East & Africa NEV Taxi Market Projections, by Vehicle Sub-type, Volume (Units), 2017‒2031

Table 53: Middle East & Africa NEV Taxi Market Projections, by Ownership, Value (US$ Mn), 2017‒2031

Table 54: Middle East & Africa NEV Taxi Market Projections, by Ownership, Volume (Units), 2017‒2031

Table 55: Middle East & Africa NEV Taxi Market Projections, by Range Type, Value (US$ Mn), 2017‒2031

Table 56: Middle East & Africa NEV Taxi Market Projections, by Range Type, Volume (Units), 2017‒2031

Table 57: Middle East & Africa NEV Taxi Market Projections, by Vehicle Level, Value (US$ Mn), 2017‒2031

Table 58: Middle East & Africa NEV Taxi Market Projections, by Vehicle Level, Volume (Units), 2017‒2031

Table 59: Middle East & Africa NEV Taxi Market Projections, by Country/Sub-region, Value (US$ Mn), 2017‒2031

Table 60: Middle East & Africa NEV Taxi Market Projections, by Country/Sub-region, Volume (Units), 2017‒2031

Table 61: South America NEV Taxi Market Projections, by NEV Type, Value (US$ Mn), 2017‒2031

Table 62: South America NEV Taxi Market Projections, by NEV Type, Volume (Units), 2017‒2031

Table 63: South America NEV Taxi Market Projections, by Vehicle Sub-type, Value (US$ Mn), 2017‒2031

Table 64: South America NEV Taxi Market Projections, by Vehicle Sub-type, Volume (Units), 2017‒2031

Table 65: South America NEV Taxi Market Projections, by Ownership, Value (US$ Mn), 2017‒2031

Table 66: South America NEV Taxi Market Projections, by Ownership, Volume (Units), 2017‒2031

Table 67: South America NEV Taxi Market Projections, by Range Type, Value (US$ Mn), 2017‒2031

Table 68: South America NEV Taxi Market Projections, by Range Type, Volume (Units), 2017‒2031

Table 69: South America NEV Taxi Market Projections, by Vehicle Level, Value (US$ Mn), 2017‒2031

Table 70: South America NEV Taxi Market Projections, by Vehicle Level, Volume (Units), 2017‒2031

Table 71: South America NEV Taxi Market Projections, by Country/Sub-region, Value (US$ Mn), 2017‒2031

Table 72: South America NEV Taxi Market Projections, by Country/Sub-region, Volume (Units), 2017‒2031

List of Figures

Figure 1: Global NEV Taxi Market Projections, by NEV Type, Value (US$ Mn), 2017‒2031

Figure 2: Global NEV Taxi Market Projections, by NEV Type, Volume (Units), 2017‒2031

Figure 3: Global NEV Taxi Market, Incremental Opportunity, by NEV Type, (US$ Mn), 2023‒2031

Figure 4: Global NEV Taxi Market Projections, by Vehicle Sub-type, Value (US$ Mn), 2017‒2031

Figure 5: Global NEV Taxi Market Projections, by Vehicle Sub-type, Volume (Units), 2017‒2031

Figure 6: Global NEV Taxi Market, Incremental Opportunity, by Vehicle Sub-type, (US$ Mn), 2023‒2031

Figure 7: Global NEV Taxi Market Projections, by Ownership, Value (US$ Mn), 2017‒2031

Figure 8: Global NEV Taxi Market Projections, by Ownership, Volume (Units), 2017‒2031

Figure 9: Global NEV Taxi Market, Incremental Opportunity, by Ownership, (US$ Mn), 2023‒2031

Figure 10: Global NEV Taxi Market Projections, by Range Type, Value (US$ Mn), 2017‒2031

Figure 11: Global NEV Taxi Market Projections, by Range Type, Volume (Units), 2017‒2031

Figure 12: Global NEV Taxi Market, Incremental Opportunity, by Range Type, (US$ Mn), 2023‒2031

Figure 13: Global NEV Taxi Market Projections, by Vehicle Level, Value (US$ Mn), 2017‒2031

Figure 14: Global NEV Taxi Market Projections, by Vehicle Level, Volume (Units), 2017‒2031

Figure 15: Global NEV Taxi Market, Incremental Opportunity, by Vehicle Level, (US$ Mn), 2023‒2031

Figure 16: Global NEV Taxi Market Projections, by Region, Value (US$ Mn), 2017‒2031

Figure 17: Global NEV Taxi Market Projections, by Region, Volume (Units), 2017‒2031

Figure 18: Global NEV Taxi Market, Incremental Opportunity, by Region, (US$ Mn), 2023‒2031

Figure 19: North America NEV Taxi Market Projections, by NEV Type, Value (US$ Mn), 2017‒2031

Figure 20: North America NEV Taxi Market Projections, by NEV Type, Volume (Units), 2017‒2031

Figure 21: North America NEV Taxi Market, Incremental Opportunity, by NEV Type, (US$ Mn), 2023‒2031

Figure 22: North America NEV Taxi Market Projections, by Vehicle Sub-type, Value (US$ Mn), 2017‒2031

Figure 23: North America NEV Taxi Market Projections, by Vehicle Sub-type, Volume (Units), 2017‒2031

Figure 24: North America NEV Taxi Market, Incremental Opportunity, by Vehicle Sub-type, (US$ Mn), 2023‒2031

Figure 25: North America NEV Taxi Market Projections, by Ownership, Value (US$ Mn), 2017‒2031

Figure 26: North America NEV Taxi Market Projections, by Ownership, Volume (Units), 2017‒2031

Figure 27: North America NEV Taxi Market, Incremental Opportunity, by Ownership, (US$ Mn), 2023‒2031

Figure 28: North America NEV Taxi Market Projections, by Range Type, Value (US$ Mn), 2017‒2031

Figure 29: North America NEV Taxi Market Projections, by Range Type, Volume (Units), 2017‒2031

Figure 30: North America NEV Taxi Market, Incremental Opportunity, by Range Type, (US$ Mn), 2023‒2031

Figure 31: North America NEV Taxi Market Projections, by Vehicle Level, Value (US$ Mn), 2017‒2031

Figure 32: North America NEV Taxi Market Projections, by Vehicle Level, Volume (Units), 2017‒2031

Figure 33: North America NEV Taxi Market, Incremental Opportunity, by Vehicle Level, (US$ Mn), 2023‒2031

Figure 34: North America NEV Taxi Market Projections, by Country, Value (US$ Mn), 2017‒2031

Figure 35: North America NEV Taxi Market Projections, by Country, Volume (Units), 2017‒2031

Figure 36: North America NEV Taxi Market, Incremental Opportunity, by Country, (US$ Mn), 2023‒2031

Figure 37: Europe NEV Taxi Market Projections, by NEV Type, Value (US$ Mn), 2017‒2031

Figure 38: Europe NEV Taxi Market Projections, by NEV Type, Volume (Units), 2017‒2031

Figure 39: Europe NEV Taxi Market, Incremental Opportunity, by NEV Type, (US$ Mn), 2023‒2031

Figure 40: Europe NEV Taxi Market Projections, by Vehicle Sub-type, Value (US$ Mn), 2017‒2031

Figure 41: Europe NEV Taxi Market Projections, by Vehicle Sub-type, Volume (Units), 2017‒2031

Figure 42: Europe NEV Taxi Market, Incremental Opportunity, by Vehicle Sub-type, (US$ Mn), 2023‒2031

Figure 43: Europe NEV Taxi Market Projections, by Ownership, Value (US$ Mn), 2017‒2031

Figure 44: Europe NEV Taxi Market Projections, by Ownership, Volume (Units), 2017‒2031

Figure 45: Europe NEV Taxi Market, Incremental Opportunity, by Ownership, (US$ Mn), 2023‒2031

Figure 46: Europe NEV Taxi Market Projections, by Range Type, Value (US$ Mn), 2017‒2031

Figure 47: Europe NEV Taxi Market Projections, by Range Type, Volume (Units), 2017‒2031

Figure 48: Europe NEV Taxi Market, Incremental Opportunity, by Range Type, (US$ Mn), 2023‒2031

Figure 49: Europe NEV Taxi Market Projections, by Vehicle Level, Value (US$ Mn), 2017‒2031

Figure 50: Europe NEV Taxi Market Projections, by Vehicle Level, Volume (Units), 2017‒2031

Figure 51: Europe NEV Taxi Market, Incremental Opportunity, by Vehicle Level, (US$ Mn), 2023‒2031

Figure 52: Europe NEV Taxi Market Projections, by Country, Value (US$ Mn), 2017‒2031

Figure 53: Europe NEV Taxi Market Projections, by Country, Volume (Units), 2017‒2031

Figure 54: Europe NEV Taxi Market, Incremental Opportunity, by Country, (US$ Mn), 2023‒2031

Figure 55: Asia Pacific NEV Taxi Market Projections, by NEV Type, Value (US$ Mn), 2017‒2031

Figure 56: Asia Pacific NEV Taxi Market Projections, by NEV Type, Volume (Units), 2017‒2031

Figure 57: Asia Pacific NEV Taxi Market, Incremental Opportunity, by NEV Type, (US$ Mn), 2023‒2031

Figure 58: Asia Pacific NEV Taxi Market Projections, by Vehicle Sub-type, Value (US$ Mn), 2017‒2031

Figure 59: Asia Pacific NEV Taxi Market Projections, by Vehicle Sub-type, Volume (Units), 2017‒2031

Figure 60: Asia Pacific NEV Taxi Market, Incremental Opportunity, by Vehicle Sub-type, (US$ Mn), 2023‒2031

Figure 61: Asia Pacific NEV Taxi Market Projections, by Ownership, Value (US$ Mn), 2017‒2031

Figure 62: Asia Pacific NEV Taxi Market Projections, by Ownership, Volume (Units), 2017‒2031

Figure 63: Asia Pacific NEV Taxi Market, Incremental Opportunity, by Ownership, (US$ Mn), 2023‒2031

Figure 64: Asia Pacific NEV Taxi Market Projections, by Range Type, Value (US$ Mn), 2017‒2031

Figure 65: Asia Pacific NEV Taxi Market Projections, by Range Type, Volume (Units), 2017‒2031

Figure 66: Asia Pacific NEV Taxi Market, Incremental Opportunity, by Range Type, (US$ Mn), 2023‒2031

Figure 67: Asia Pacific NEV Taxi Market Projections, by Vehicle Level, Value (US$ Mn), 2017‒2031

Figure 68: Asia Pacific NEV Taxi Market Projections, by Vehicle Level, Volume (Units), 2017‒2031

Figure 69: Asia Pacific NEV Taxi Market, Incremental Opportunity, by Vehicle Level, (US$ Mn), 2023‒2031

Figure 70: Asia Pacific NEV Taxi Market Projections, by Country, Value (US$ Mn), 2017‒2031

Figure 71: Asia Pacific NEV Taxi Market Projections, by Country, Volume (Units), 2017‒2031

Figure 72: Asia Pacific NEV Taxi Market, Incremental Opportunity, by Country, (US$ Mn), 2023‒2031

Figure 73: Middle East & Africa NEV Taxi Market Projections, by NEV Type, Value (US$ Mn), 2017‒2031

Figure 74: Middle East & Africa NEV Taxi Market Projections, by NEV Type, Volume (Units), 2017‒2031

Figure 75: Middle East & Africa NEV Taxi Market, Incremental Opportunity, by NEV Type, (US$ Mn), 2023‒2031

Figure 76: Middle East & Africa NEV Taxi Market Projections, by Vehicle Sub-type, Value (US$ Mn), 2017‒2031

Figure 77: Middle East & Africa NEV Taxi Market Projections, by Vehicle Sub-type, Volume (Units), 2017‒2031

Figure 78: Middle East & Africa NEV Taxi Market, Incremental Opportunity, by Vehicle Sub-type, (US$ Mn), 2023‒2031

Figure 79: Middle East & Africa NEV Taxi Market Projections, by Ownership, Value (US$ Mn), 2017‒2031

Figure 80: Middle East & Africa NEV Taxi Market Projections, by Ownership, Volume (Units), 2017‒2031

Figure 81: Middle East & Africa NEV Taxi Market, Incremental Opportunity, by Ownership, (US$ Mn), 2023‒2031

Figure 82: Middle East & Africa NEV Taxi Market Projections, by Range Type, Value (US$ Mn), 2017‒2031

Figure 83: Middle East & Africa NEV Taxi Market Projections, by Range Type, Volume (Units), 2017‒2031

Figure 84: Middle East & Africa NEV Taxi Market, Incremental Opportunity, by Range Type, (US$ Mn), 2023‒2031

Figure 85: Middle East & Africa NEV Taxi Market Projections, by Vehicle Level, Value (US$ Mn), 2017‒2031

Figure 86: Middle East & Africa NEV Taxi Market Projections, by Vehicle Level, Volume (Units), 2017‒2031

Figure 87: Middle East & Africa NEV Taxi Market, Incremental Opportunity, by Vehicle Level, (US$ Mn), 2023‒2031

Figure 88: Middle East & Africa NEV Taxi Market Projections, by Country, Value (US$ Mn), 2017‒2031

Figure 89: Middle East & Africa NEV Taxi Market Projections, by Country, Volume (Units), 2017‒2031

Figure 90: Middle East & Africa NEV Taxi Market, Incremental Opportunity, by Country, (US$ Mn), 2023‒2031

Figure 91: South America NEV Taxi Market Projections, by NEV Type, Value (US$ Mn), 2017‒2031

Figure 92: South America NEV Taxi Market Projections, by NEV Type, Volume (Units), 2017‒2031

Figure 93: South America NEV Taxi Market, Incremental Opportunity, by NEV Type, (US$ Mn), 2023‒2031

Figure 94: South America NEV Taxi Market Projections, by Vehicle Sub-type, Value (US$ Mn), 2017‒2031

Figure 95: South America NEV Taxi Market Projections, by Vehicle Sub-type, Volume (Units), 2017‒2031

Figure 96: South America NEV Taxi Market, Incremental Opportunity, by Vehicle Sub-type, (US$ Mn), 2023‒2031

Figure 97: South America NEV Taxi Market Projections, by Ownership, Value (US$ Mn), 2017‒2031

Figure 98: South America NEV Taxi Market Projections, by Ownership, Volume (Units), 2017‒2031

Figure 99: South America NEV Taxi Market, Incremental Opportunity, by Ownership, (US$ Mn), 2023‒2031

Figure 100: South America NEV Taxi Market Projections, by Range Type, Value (US$ Mn), 2017‒2031

Figure 101: South America NEV Taxi Market Projections, by Range Type, Volume (Units), 2017‒2031

Figure 102: South America NEV Taxi Market, Incremental Opportunity, by Range Type, (US$ Mn), 2023‒2031

Figure 103: South America NEV Taxi Market Projections, by Vehicle Level, Value (US$ Mn), 2017‒2031

Figure 104: South America NEV Taxi Market Projections, by Vehicle Level, Volume (Units), 2017‒2031

Figure 105: South America NEV Taxi Market, Incremental Opportunity, by Vehicle Level, (US$ Mn), 2023‒2031

Figure 106: South America NEV Taxi Market Projections, by Country, Value (US$ Mn), 2017‒2031

Figure 107: South America NEV Taxi Market Projections, by Country, Volume (Units), 2017‒2031

Figure 108: South America NEV Taxi Market, Incremental Opportunity, by Country, (US$ Mn), 2023‒2031