Reports

Reports

As a customer, one understands the risks of losing data due to the technical drawbacks of systems and devices. Hence, vendors in the network attached storage solutions market are under constant pressure to support the backup and storage infrastructure of stakeholders in BFSI, IT & telecommunications, and other sectors that reply on data, valued in terms of millions of dollars.

Since the backing up of data is just one aspect of running a successful business, there is growing demand for high-performance network attached storage devices in the IT and telecommunications landscape that can be upgraded as the organization grows. This explains why the IT and telecommunications sector is estimated for the highest revenue in the network attached storage solutions market, with a value projection of ~US$ 2 billion by the year 2027.

Performance-intensive NAS systems help stakeholders in the IT and telecommunications space to focus on other important aspects of the business. Hence, vendors in the NAS solutions market are simplifying the tasks for other business owners by creating easy-to-manage centralized systems that securely store documents, images, and other multimedia files.

There is increasing demand for efficient and cost-competitive NAS devices that business owners can rely on for data security, with easy search and share options for the data. As such, stakeholders in the network attached storage solutions market are innovating new NAS systems that cater to the growing needs of media and entertainment.

Currently, the media and entertainment sector holds the third-largest position in terms of revenue amongst all the industries in the NAS solutions market, with a value of ~US$ 970 million in 2018. Since media and entertainment forms a significant part of any individual’s lifestyle, market players in the network attached storage solutions market are introducing ideal NAS devices that back-up the data of personal computers and smart devices.

As more and more individuals are becoming active on Over the Top (OTT) media services platforms, they are increasingly adopting NAS technology to store and stream videos and digital photos. NAS devices come in handy for individuals, as these systems are more reliable than cloud service platforms, in cases when a file gets accidentally deleted and in cases of recovery of data from crashed systems.

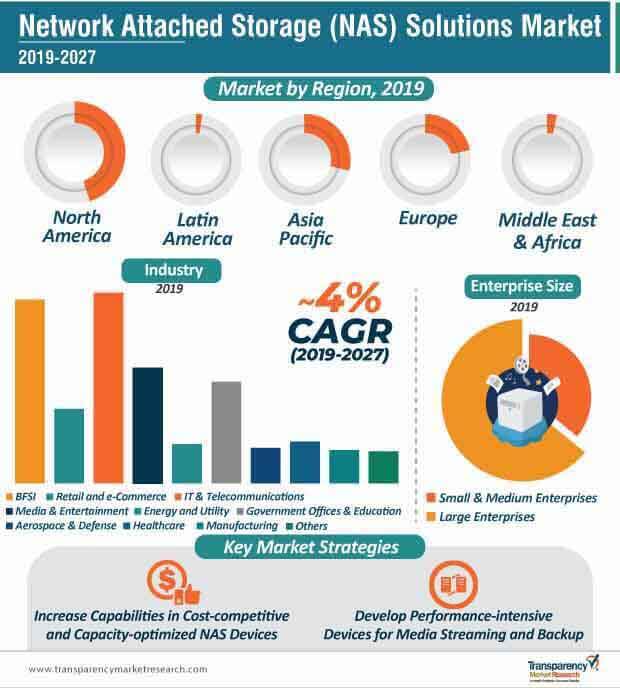

Stakeholders are facing a threat from substitute storage solution options that are more efficient and scalable. Since NAS devices are built on legacy software, consumers demand the integration of these devices with Artificial Intelligence and analytics. This creates substantial evidence for the modest CAGR of ~4% of the network attached storage solutions market.

The network attached storage solutions market is highly consolidated. This is another aspect that is inhibiting market growth. The consolidated nature of the market restricts emerging players from entering the market. Since emerging players lack the capital and resources to compete with leading vendors, it is even more difficult for smaller players to strengthen their business in the market.

Stakeholders are developing hybrid systems that can manage unstructured file storage. They are introducing devices that alleviate the problem of duplicate copies of files and that assist in balancing backend storage. For instance, in May 2019, IBM - a leading American computer hardware company, announced a collaboration with Panzura - a multi-cloud data management & file services company, to launch Panzura Freedom™ - a NAS file services platform, which is an intelligent hybrid cloud storage solution software.

Analysts’ Viewpoint

Stakeholders in the network attached storage solutions market are offering value-added features such as big data analytics and collaboration applications to contribute to the overall development of business environments.

Since most NAS systems are not scalable in tandem with larger repositories of data, business owners are increasingly taking interest in developing their own customized software to avoid the burden of expensive extension charges. Hence, vendors should increase their production capabilities of hybrid cloud-based software systems that modernize file-based environments.

Market players should increase their focus on catering to the needs of SMEs, since the market share of these enterprises is anticipated to grow from ~36% in 2019 to 39% by 2027, in the NAS solutions market.

1. Preface

1.1. Market Scope

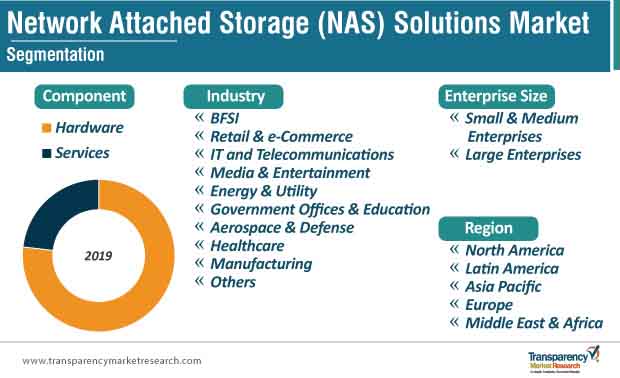

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Market Taxonomy – Segment Definitions

2.2. Research Methodology

2.2.1. List of Primary and Secondary Sources

2.3. Key Assumptions for Data Modelling

3. Executive Summary: Global Network Attached Storage (NAS) Solutions Market

4. Market Overview

4.1. Introduction

4.2. Global Market – Macro Economic Factors Overview

4.2.1. World GDP Indicator – For Top Economies

4.2.2. Global ICT Spending (US$ Mn), 2012, 2019, 2021, 2027

4.3. Market Factor Analysis

4.3.1. Market Dynamics (Growth Influencers)

4.3.1.1. Drivers

4.3.1.2. Restraints

4.3.1.3. Opportunities

4.4. Global Network Attached Storage (NAS) Solutions Market Analysis and Forecast, 2016 - 2027

4.4.1. Market Revenue Analysis (US$ Mn)

4.4.1.1. Forecast Trends, 2019-2027

4.5. Market Opportunity Assessment – By Region (Global/ North America/ Europe/ Asia Pacific/ Middle East & Africa/ South America)

4.5.1. By Component

4.5.2. By Enterprise Size

4.5.3. By Industry

4.6. Market Outlook

5. Global Network Attached Storage (NAS) Solutions Market Analysis and Forecast, by Component

5.1. Definitions and Overview

5.2. Network Attached Storage (NAS) Solutions Market Size (US$ Mn) Forecast, by Component, 2016 - 2027

5.2.1. Hardware

5.2.2. Services

5.2.2.1. Consulting

5.2.2.2. System Integration

5.2.2.3. Support & Maintenance

6. Global Network Attached Storage (NAS) Solutions Market Analysis and Forecast, by Enterprise Size

6.1. Definitions and Overview

6.2. Network Attached Storage (NAS) Solutions Market Size (US$ Mn) Forecast, by Enterprise Size, 2016 - 2027

6.2.1. Small and Medium Enterprises (SMEs)

6.2.2. Large Enterprises

7. Global Network Attached Storage (NAS) Solutions Market Analysis and Forecast, by Industry

7.1. Overview

7.2. Network Attached Storage (NAS) Solutions Market Size (US$ Mn) Forecast, by Industry, 2016 - 2027

7.2.1. BFSI

7.2.2. Retail and e-commerce

7.2.3. IT and Telecommunication

7.2.4. Media and Entertainment

7.2.5. Energy and Utility

7.2.6. Government Offices and Education

7.2.7. Aerospace and Defense

7.2.8. Healthcare

7.2.9. Manufacturing

7.2.10. Others (Transportation and Logistics)

8. Global Network Attached Storage (NAS) Solutions Market Analysis and Forecast, by Region

8.1. Overview

8.2. Network Attached Storage (NAS) Solutions Market Size (US$ Mn) Forecast, by Region, 2016 - 2027

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. South America

9. North America Network Attached Storage (NAS) Solutions Market Analysis and Forecast

9.1. Overview

9.2. Network Attached Storage (NAS) Solutions Market Size (US$ Mn) Forecast, by Component, 2016 - 2027

9.2.1. Hardware

9.2.2. Services

9.2.2.1. Consulting

9.2.2.2. System Integration

9.2.2.3. Support & Maintenance

9.3. Network Attached Storage (NAS) Solutions Market Size (US$ Mn) Forecast, by Enterprise Size, 2016 - 2027

9.3.1. Small and Medium Enterprises (SMEs)

9.3.2. Large Enterprises

9.4. Network Attached Storage (NAS) Solutions Market Size (US$ Mn) Forecast, by Industry, 2016 - 2027

9.4.1. BFSI

9.4.2. Retail and e-commerce

9.4.3. IT and Telecommunication

9.4.4. Media and Entertainment

9.4.5. Energy and Utility

9.4.6. Government Offices and Education

9.4.7. Aerospace and Defense

9.4.8. Healthcare

9.4.9. Manufacturing

9.4.10. Others (Transportation and Logistics)

9.5. Network Attached Storage (NAS) Solutions Market Size (US$ Mn) Forecast, by Country & Sub-region, 2016 - 2027

9.5.1. The U.S.

9.5.2. Canada

9.5.3. Rest of North America

10. Europe Network Attached Storage (NAS) Solutions Market Analysis and Forecast

10.1. Overview

10.2. Network Attached Storage (NAS) Solutions Market Size (US$ Mn) Forecast, by Component, 2016 - 2027

10.2.1. Hardware

10.2.2. Services

10.2.2.1. Consulting

10.2.2.2. System Integration

10.2.2.3. Support & Maintenance

10.3. Network Attached Storage (NAS) Solutions Market Size (US$ Mn) Forecast, by Enterprise Size, 2016 - 2027

10.3.1. Small and Medium Enterprises (SMEs)

10.3.2. Large Enterprises

10.4. Network Attached Storage (NAS) Solutions Market Size (US$ Mn) Forecast, by Industry, 2016 - 2027

10.4.1. BFSI

10.4.2. Retail and e-Commerce

10.4.3. IT and Telecommunication

10.4.4. Media and Entertainment

10.4.5. Energy and Utility

10.4.6. Government Offices and Education

10.4.7. Aerospace and Defense

10.4.8. Healthcare

10.4.9. Manufacturing

10.4.10. Others (Transportation and Logistics)

10.5. Network Attached Storage (NAS) Solutions Market Size (US$ Mn) Forecast, by Country & Sub-region, 2016 - 2027

10.5.1. Germany

10.5.2. The U.K.

10.5.3. France

10.5.4. Rest of Europe

11. Asia Pacific Network Attached Storage (NAS) Solutions Market Analysis and Forecast

11.1. Overview

11.2. Network Attached Storage (NAS) Solutions Market Size (US$ Mn) Forecast, by Component, 2016 - 2027

11.2.1. Hardware

11.2.2. Services

11.2.2.1. Consulting

11.2.2.2. System Integration

11.2.2.3. Support & Maintenance

11.3. Network Attached Storage (NAS) Solutions Market Size (US$ Mn) Forecast, by Enterprise Size, 2016 - 2027

11.3.1. Small and Medium Enterprises (SMEs)

11.3.2. Large Enterprises

11.4. Network Attached Storage (NAS) Solutions Market Size (US$ Mn) Forecast, by Industry, 2016 - 2027

11.4.1. BFSI

11.4.2. Retail and e-commerce

11.4.3. IT and Telecommunication

11.4.4. Media and Entertainment

11.4.5. Energy and Utility

11.4.6. Government Offices and Education

11.4.7. Aerospace and Defense

11.4.8. Healthcare

11.4.9. Manufacturing

11.4.10. Others (Transportation and Logistics)

11.5. Network Attached Storage (NAS) Solutions Market Size (US$ Mn) Forecast, by Country & Sub-region, 2016 - 2027

11.5.1. China

11.5.2. Japan

11.5.3. India

11.5.4. Australia

11.5.5. Rest of Asia Pacific

12. Middle East & Africa (MEA) Network Attached Storage (NAS) Solutions Market Analysis and Forecast

12.1. Overview

12.2. Network Attached Storage (NAS) Solutions Market Size (US$ Mn) Forecast, by Component, 2016 - 2027

12.2.1. Hardware

12.2.2. Services

12.2.2.1. Consulting

12.2.2.2. System Integration

12.2.2.3. Support & Maintenance

12.3. Network Attached Storage (NAS) Solutions Market Size (US$ Mn) Forecast, by Enterprise Size, 2016 - 2027

12.3.1. Small and Medium Enterprises (SMEs)

12.3.2. Large Enterprises

12.4. Network Attached Storage (NAS) Solutions Market Size (US$ Mn) Forecast, by Industry, 2016 - 2027

12.4.1. BFSI

12.4.2. Retail and e-commerce

12.4.3. IT and Telecommunication

12.4.4. Media and Entertainment

12.4.5. Energy and Utility

12.4.6. Government Offices and Education

12.4.7. Aerospace and Defense

12.4.8. Healthcare

12.4.9. Manufacturing

12.4.10. Others (Transportation and Logistics)

12.5. Network Attached Storage (NAS) Solutions Market Size (US$ Mn) Forecast, by Country & Sub-region, 2016 - 2027

12.5.1. GCC Countries

12.5.2. South Africa

12.5.3. Rest of MEA

13. South America Network Attached Storage (NAS) Solutions Market Analysis and Forecast

13.1. Overview

13.2. Network Attached Storage (NAS) Solutions Market Size (US$ Mn) Forecast, by Component, 2016 - 2027

13.2.1. Hardware

13.2.2. Services

13.2.2.1. Consulting

13.2.2.2. System Integration

13.2.2.3. Support & Maintenance

13.3. Network Attached Storage (NAS) Solutions Market Size (US$ Mn) Forecast, by Enterprise Size, 2016 - 2027

13.3.1. Small and Medium Enterprises (SMEs)

13.3.2. Large Enterprises

13.4. Network Attached Storage (NAS) Solutions Market Size (US$ Mn) Forecast, by Industry, 2016 - 2027

13.4.1. BFSI

13.4.2. Retail and e-commerce

13.4.3. IT and Telecommunication

13.4.4. Media and Entertainment

13.4.5. Energy and Utility

13.4.6. Government Offices and Education

13.4.7. Aerospace and Defense

13.4.8. Healthcare

13.4.9. Manufacturing

13.4.10. Others (Transportation and Logistics)

13.5. Network Attached Storage (NAS) Solutions Market Size (US$ Mn) Forecast, by Country & Sub-region, 2016 - 2027

13.5.1. Brazil

13.5.2. Rest of South America

14. Competition Landscape

14.1. Market Revenue Share Analysis (%), by Company (2018)

15. Company Profiles

15.1. Dawning Information Industry Co. Ltd.

15.1.1. Business Overview

15.1.2. Geographical Presence

15.1.3. Revenue

15.1.4. Strategy

15.2. DataDirect Networks Inc.

15.2.1. Business Overview

15.2.2. Geographical Presence

15.2.3. Revenue

15.2.4. Strategy

15.3. Dell Inc.

15.3.1. Business Overview

15.3.2. Geographical Presence

15.3.3. Revenue

15.3.4. Strategy

15.4. Fujitsu Limited

15.4.1. Business Overview

15.4.2. Geographical Presence

15.4.3. Revenue

15.4.4. Strategy

15.5. Hewlett Packard Enterprise

15.5.1. Business Overview

15.5.2. Geographical Presence

15.5.3. Revenue

15.5.4. Strategy

15.6. Hitachi Ltd.

15.6.1. Business Overview

15.6.2. Geographical Presence

15.6.3. Revenue

15.6.4. Strategy

15.7. Quantum Corporation

15.7.1. Business Overview

15.7.2. Geographical Presence

15.7.3. Revenue

15.7.4. Strategy

15.8. IBM Corporation

15.8.1. Business Overview

15.8.2. Geographical Presence

15.8.3. Revenue

15.8.4. Strategy

15.9. NetApp, Inc.

15.9.1. Business Overview

15.9.2. Geographical Presence

15.9.3. Revenue

15.9.4. Strategy

15.10. Oracle Corporation

15.10.1. Business Overview

15.10.2. Geographical Presence

15.10.3. Revenue

15.10.4. Strategy

16. Key Takeaways

List of Tables

Table 1: North America ICT Spending (US$ Mn)

Table 2: Europe ICT Spending (US$ Mn)

Table 3: Asia Pacific ICT Spending (US$ Mn)

Table 4: MEA ICT Spending (US$ Mn)

Table 5: South America ICT Spending (US$ Mn)

Table 6: Global Network Attached Storage (NAS) Solutions Market Revenue (US$ Mn) Forecast, by Component, 2016 - 2027

Table 7: Global Network Attached Storage (NAS) Solutions Market Revenue (US$ Mn) Forecast, by Component, 2016 - 2027

Table 8: Global Network Attached Storage (NAS) Solutions Market Revenue (US$ Mn) Forecast, by Enterprise Size, 2016 - 2027

Table 9: Global Network Attached Storage (NAS) Solutions Market Revenue (US$ Mn) Forecast, by Industry, 2016 - 2027

Table 10: Global Network Attached Storage (NAS) Solutions Market Revenue (US$ Mn) Forecast, by Industry, 2016 - 2027

Table 11: Global Network Attached Storage (NAS) Solutions Market Revenue (US$ Mn) Forecast, by Region, 2016 - 2027

Table 12: North America Network Attached Storage (NAS) Solutions Market Revenue (US$ Mn) Forecast, by Component, 2016 - 2027

Table 13: North America Network Attached Storage (NAS) Solutions Market Revenue (US$ Mn) Forecast, by Component, 2016 - 2027

Table 14: North America Network Attached Storage (NAS) Solutions Market Revenue (US$ Mn) Forecast, by Enterprise Size, 2016 - 2027

Table 15: North America Network Attached Storage (NAS) Solutions Market Revenue (US$ Mn) Forecast, by Industry, 2016 – 2027 (1/2)

Table 16: North America Network Attached Storage (NAS) Solutions Market Revenue (US$ Mn) Forecast, by Industry, 2016 – 2027 (2/2)

Table 17: North America Network Attached Storage (NAS) Solutions Market Revenue (US$ Mn) Forecast, by Country, 2016 - 2027

Table 18: Europe Network Attached Storage (NAS) Solutions Market Revenue (US$ Mn) Forecast, by Component, 2016 - 2027

Table 19: Europe Network Attached Storage (NAS) Solutions Market Revenue (US$ Mn) Forecast, by Component, 2016 - 2027

Table 20: Europe Network Attached Storage (NAS) Solutions Market Revenue (US$ Mn) Forecast, by Enterprise Size, 2016 - 2027

Table 21: Europe Network Attached Storage (NAS) Solutions Market Revenue (US$ Mn) Forecast, by Industry, 2016 – 2027 (1/2)

Table 22: Europe Network Attached Storage (NAS) Solutions Market Revenue (US$ Mn) Forecast, by Industry, 2016 – 2027 (2/2)

Table 23: Europe Network Attached Storage (NAS) Solutions Market Revenue (US$ Mn) Forecast, by Country, 2016 – 2027

Table 24: Asia Pacific Network Attached Storage (NAS) Solutions Market Revenue (US$ Mn) Forecast, by Component, 2016 - 2027

Table 25: Asia Pacific Network Attached Storage (NAS) Solutions Market Revenue (US$ Mn) Forecast, by Component, 2016 - 2027

Table 26: Asia Pacific Network Attached Storage (NAS) Solutions Market Revenue (US$ Mn) Forecast, by Enterprise Size, 2016 - 2027

Table 27: Asia Pacific Network Attached Storage (NAS) Solutions Market Revenue (US$ Mn) Forecast, by Industry, 2016 – 2027 (1/2)

Table 28: Asia Pacific Network Attached Storage (NAS) Solutions Market Revenue (US$ Mn) Forecast, by Industry, 2016 – 2027 (2/2)

Table 29: Asia Pacific Network Attached Storage (NAS) Solutions Market Revenue (US$ Mn) Forecast, by Country, 2016 - 2027

Table 30: Middle East & Africa (MEA) Network Attached Storage (NAS) Solutions Market Revenue (US$ Mn) Forecast, by Component, 2016 - 2027

Table 31: Middle East & Africa (MEA) Network Attached Storage (NAS) Solutions Market Revenue (US$ Mn) Forecast, by Component, 2016 - 2027

Table 32: Middle East & Africa (MEA) Network Attached Storage (NAS) Solutions Market Revenue (US$ Mn) Forecast, by Enterprise Size, 2016 - 2027

Table 33: Middle East & Africa (MEA) Network Attached Storage (NAS) Solutions Market Revenue (US$ Mn) Forecast, by Industry, 2016 – 2027 (1/2)

Table 34: Middle East & Africa (MEA) Network Attached Storage (NAS) Solutions Market Revenue (US$ Mn) Forecast, by Industry, 2016 – 2027 (2/2)

Table 35: Middle East & Africa (MEA) Network Attached Storage (NAS) Solutions Market Revenue (US$ Mn) Forecast, by Country, 2016 - 2027

Table 36: South America Network Attached Storage (NAS) Solutions Market Revenue (US$ Mn) Forecast, by Component, 2016 - 2027

Table 37: South America Network Attached Storage (NAS) Solutions Market Revenue (US$ Mn) Forecast, by Component, 2016 - 2027

Table 38: South America Network Attached Storage (NAS) Solutions Market Revenue (US$ Mn) Forecast, by Enterprise Size, 2016 - 2027

Table 39: South America Network Attached Storage (NAS) Solutions Market Revenue (US$ Mn) Forecast, by Industry, 2016 – 2027 (1/2)

Table 40: South America Network Attached Storage (NAS) Solutions Market Revenue (US$ Mn) Forecast, by Industry, 2016 – 2027 (2/2)

Table 41: South America Network Attached Storage (NAS) Solutions Market Revenue (US$ Mn) Forecast, by Country, 2016 - 2027

List of Figures

Figure 1: Global Market Value (US$ Mn)

Figure 2: Global Network Attached Storage (NAS) Solutions Market, Fastest Growing Region, CAGR (%)

Figure 3: Global Network Attached Storage (NAS) Solutions Market Size (US$ Mn) Forecast, 2016–2027

Figure 4: Top Economies GDP Landscape

Figure 5: Gross Domestic Product (GDP) per Capita; Analysis (1/2) (US$ Tn), By Major Countries, 2012-2017

Figure 6: Global Network Attached Storage (NAS) Solutions Market Size (US$ Mn) Forecast, 2016 – 2027

Figure 7: Global Network Attached Storage (NAS) Solutions Market Y-o-Y Growth (Value %) Forecast, 2017 – 2027

Figure 8: Forecast Trends and Y-o-Y Growth, 2019-2027

Figure 9: Global Network Attached Storage (NAS) Solutions Market Attractiveness Analysis, by Component (2019)

Figure 10: Global Network Attached Storage (NAS) Solutions Market Attractiveness Analysis, by Enterprise Size (2019)

Figure 11: Global Network Attached Storage (NAS) Solutions Market Attractiveness Analysis, by Industry (2019)

Figure 12: Global Network Attached Storage (NAS) Solutions Market Attractiveness Analysis, by Region (2019)

Figure 13: Global Network Attached Storage (NAS) Solutions Market Opportunity by Component (%) (2019 – 2027)

Figure 14: Global Network Attached Storage (NAS) Solutions Market Opportunity by Enterprise Size (%) (2019 – 2027)

Figure 15: Global Network Attached Storage (NAS) Solutions Market Opportunity by Industry (%) (2019 – 2027)

Figure 16: Global Network Attached Storage (NAS) Solutions Market Opportunity by Region (%) (2019 – 2027)

Figure 17: Global Network Attached Storage (NAS) Solutions Market Share Analysis, by Component (2019)

Figure 18: Global Network Attached Storage (NAS) Solutions Market Share Analysis, by Component (2027)

Figure 19: Global Network Attached Storage (NAS) Solutions Market Share Analysis, by Enterprise Size (2019)

Figure 20: Global Network Attached Storage (NAS) Solutions Market Share Analysis, by Enterprise Size (2027)

Figure 21: Global Network Attached Storage (NAS) Solutions Market Share Analysis, by Industry (2019)

Figure 22: Global Network Attached Storage (NAS) Solutions Market Share Analysis, by Industry (2027)

Figure 23: North America Network Attached Storage (NAS) Solutions Market Size (US$ Mn) Forecast, 2016 – 2027

Figure 24: North America Network Attached Storage (NAS) Solutions Market Share Analysis, by Component (2019)

Figure 25: North America Network Attached Storage (NAS) Solutions Market Share Analysis, by Component (2027)

Figure 26: North America Network Attached Storage (NAS) Solutions Market Share Analysis, by Enterprise Size (2019)

Figure 27: North America Network Attached Storage (NAS) Solutions Market Share Analysis, by Enterprise Size (2027)

Figure 28: North America Network Attached Storage (NAS) Solutions Market Share Analysis, by Industry (2019)

Figure 29: North America Network Attached Storage (NAS) Solutions Market Share Analysis, by Industry (2027)

Figure 30: North America Network Attached Storage (NAS) Solutions Market Share Analysis, by Country (2019)

Figure 31: North America Network Attached Storage (NAS) Solutions Market Share Analysis, by Country (2027)

Figure 32: North America Network Attached Storage (NAS) Solutions Market Attractiveness Analysis, by Component (2019)

Figure 33: North America Network Attached Storage (NAS) Solutions Market Attractiveness Analysis, by Enterprise Size (2019)

Figure 34: North America Network Attached Storage (NAS) Solutions Market Attractiveness Analysis, by Industry (2019)

Figure 35: North America Network Attached Storage (NAS) Solutions Market Attractiveness Analysis, by Country (2019)

Figure 36: Europe Network Attached Storage (NAS) Solutions Market Size (US$ Mn) Forecast, 2016 – 2027

Figure 37: Europe Network Attached Storage (NAS) Solutions Market Share Analysis, by Component (2019)

Figure 38: Europe Network Attached Storage (NAS) Solutions Market Share Analysis, by Component (2027)

Figure 39: Europe Network Attached Storage (NAS) Solutions Market Share Analysis, by Enterprise Size (2019)

Figure 40: Europe Network Attached Storage (NAS) Solutions Market Share Analysis, by Enterprise Size (2027)

Figure 41: Europe Network Attached Storage (NAS) Solutions Market Share Analysis, by Industry (2019)

Figure 42: Europe Network Attached Storage (NAS) Solutions Market Share Analysis, by Industry (2027)

Figure 43: Europe Network Attached Storage (NAS) Solutions Market Share Analysis, by Country (2019)

Figure 44: Europe Network Attached Storage (NAS) Solutions Market Share Analysis, by Country (2027)

Figure 45: Europe Network Attached Storage (NAS) Solutions Market Attractiveness Analysis, by Component (2019)

Figure 46: Europe Network Attached Storage (NAS) Solutions Market Attractiveness Analysis, by Enterprise Size (2019)

Figure 47: Europe Network Attached Storage (NAS) Solutions Market Attractiveness Analysis, by Industry (2019)

Figure 48: Europe Network Attached Storage (NAS) Solutions Market Attractiveness Analysis, by Country (2019)

Figure 49: Asia Pacific Network Attached Storage (NAS) Solutions Market Size (US$ Mn) Forecast, 2016 – 2027

Figure 50: Asia Pacific Network Attached Storage (NAS) Solutions Market Share Analysis, by Component (2019)

Figure 51: Asia Pacific Network Attached Storage (NAS) Solutions Market Share Analysis, by Component (2027)

Figure 52: Asia Pacific Network Attached Storage (NAS) Solutions Market Share Analysis, by Enterprise Size (2019)

Figure 53: Asia Pacific Network Attached Storage (NAS) Solutions Market Share Analysis, by Enterprise Size (2027)

Figure 54: Asia Pacific Network Attached Storage (NAS) Solutions Market Share Analysis, by Industry (2019)

Figure 55: Asia Pacific Network Attached Storage (NAS) Solutions Market Share Analysis, by Industry (2027)

Figure 56: Asia Pacific Network Attached Storage (NAS) Solutions Market Share Analysis, by Country (2019)

Figure 57: Asia Pacific Network Attached Storage (NAS) Solutions Market Share Analysis, by Country (2027)

Figure 58: Asia Pacific Network Attached Storage (NAS) Solutions Market Attractiveness Analysis, by Component (2019)

Figure 59: Asia Pacific Network Attached Storage (NAS) Solutions Market Attractiveness Analysis, by Enterprise Size (2019)

Figure 60: Asia Pacific Network Attached Storage (NAS) Solutions Market Attractiveness Analysis, by Industry (2019)

Figure 61: Asia Pacific Network Attached Storage (NAS) Solutions Market Attractiveness Analysis, by Country (2019)

Figure 62: Middle East & Africa (MEA) Network Attached Storage (NAS) Solutions Market Size (US$ Mn) Forecast, 2016 – 2027

Figure 63: Middle East & Africa (MEA) Network Attached Storage (NAS) Solutions Market Share Analysis, by Component (2019)

Figure 64: Middle East & Africa (MEA) Network Attached Storage (NAS) Solutions Market Share Analysis, by Component (2027)

Figure 65: Middle East & Africa (MEA) Network Attached Storage (NAS) Solutions Market Share Analysis, by Enterprise Size (2019)

Figure 66: Middle East & Africa (MEA) Network Attached Storage (NAS) Solutions Market Share Analysis, by Enterprise Size (2027)

Figure 67: Middle East & Africa (MEA) Network Attached Storage (NAS) Solutions Market Share Analysis, by Industry (2019)

Figure 68: Middle East & Africa (MEA) Network Attached Storage (NAS) Solutions Market Share Analysis, by Industry (2027)

Figure 69: Middle East & Africa (MEA) Network Attached Storage (NAS) Solutions Market Share Analysis, by Country (2019)

Figure 70: Middle East & Africa (MEA) Network Attached Storage (NAS) Solutions Market Share Analysis, by Country (2027)

Figure 71: Middle East & Africa (MEA) Network Attached Storage (NAS) Solutions Market Attractiveness Analysis, by Component (2019)

Figure 72: Middle East & Africa (MEA) Network Attached Storage (NAS) Solutions Market Attractiveness Analysis, by Enterprise Size (2019)

Figure 73: Middle East & Africa (MEA) Network Attached Storage (NAS) Solutions Market Attractiveness Analysis, by Industry (2019)

Figure 74: Middle East & Africa (MEA) Network Attached Storage (NAS) Solutions Market Attractiveness Analysis, by Country (2019)

Figure 75: South America Network Attached Storage (NAS) Solutions Market Size (US$ Mn) Forecast, 2016 – 2027

Figure 76: South America Network Attached Storage (NAS) Solutions Market Share Analysis, by Component (2019)

Figure 77: South America Network Attached Storage (NAS) Solutions Market Share Analysis, by Component (2027)

Figure 78: South America Network Attached Storage (NAS) Solutions Market Share Analysis, by Enterprise Size (2019)

Figure 79: South America Network Attached Storage (NAS) Solutions Market Share Analysis, by Enterprise Size (2027)

Figure 80: South America Network Attached Storage (NAS) Solutions Market Share Analysis, by Industry (2019)

Figure 81: South America Network Attached Storage (NAS) Solutions Market Share Analysis, by Industry (2027)

Figure 82: South America Network Attached Storage (NAS) Solutions Market Share Analysis, by Country (2019)

Figure 83: South America Network Attached Storage (NAS) Solutions Market Share Analysis, by Country (2027)

Figure 84: South America Network Attached Storage (NAS) Solutions Market Attractiveness Analysis, by Component (2019)

Figure 85: South America Network Attached Storage (NAS) Solutions Market Attractiveness Analysis, by Enterprise Size (2019)

Figure 86: South America Network Attached Storage (NAS) Solutions Market Attractiveness Analysis, by Industry (2019)

Figure 87: South America Network Attached Storage (NAS) Solutions Market Attractiveness Analysis, by Country (2019)