Reports

Reports

Analysts’ Viewpoint

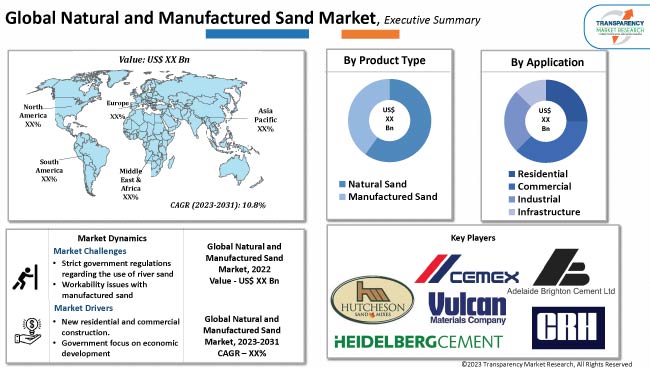

Surge in residential, commercial, and infrastructure construction is propelling the demand for natural and manufactured sand. Expansion of construction activities can be attributed to the worldwide growth of the public and private sector as a result of the rapid population shift toward metropolitan areas.

The market is also driven by government initiatives that favor the use of manufactured sand over natural sand due to the depleting natural sand reservoirs, and environmental concerns surrounding the extraction of natural sand from riverbeds. Manufactured sand is being utilized by construction companies as a substitute to natural sand due to its ease of availability and lower cost. Additionally, manufactured sand crushed from hard granite rocks is easily available, reducing the cost of transportation from inaccessible natural river sand beds.

Sand is a naturally occurring granular material composed of finely ground rock and mineral particles. It is a popular manufacturing material used across a broad spectrum for construction and in the glass industry.

Manufactured sand is artificial sand produced by crushing hard stones into small sand-sized particles, washed and finely graded to be used in construction for the production of mortar mix and concrete. It is an alternative to natural sand used for construction purposes. Manufactured sand differs from natural sand in its physical and mineralogical properties. Manufactured sand produced by appropriate machines increases durability, offers higher strength, and reduces defects in concrete such as segregation & capillarity. It is proving to be economical as a construction material and replacing natural sand in many regions.

Construction is expected to power the global economy during this decade. With rapid urbanization, the need for new buildings and commercial construction are expected to boost natural and manufactured sand market growth during the forecast period.

Residential construction has demonstrated remarkable resilience during the worst of the Coronavirus pandemic when the global economy was significantly disrupted. The high income market continues to generate robust demand for residential properties across the globe as buyers look for their next home after the pandemic.

As per government reports, the construction industry in India is expected to reach US$ 1.4 Trn by 2025. Government schemes such as the revolutionary Smart City Mission (target 100 cities) are projected to enhance the quality of life through technology driven urban planning. Thus, developments in the construction sector are expected to offer lucrative opportunities for market expansion.

Significant use of manufactured sand in concrete, cementitious materials, road building materials, bridges, and artificial marble is boosting the natural and manufactured sand market size. Furthermore, the substantial use of concrete is leading to high usage of natural and manufactured sand, thus fuelling market progress.

The infrastructure sector is a key driver of the economy across all regions. Increase in investment by governments in infrastructure such as launching mega projects for economic development is a key driving factor propelling natural and manufactured sand market demand.

Infrastructure in the U.S. in particular has been under the spotlight. The U.S. Government’s approximately US$1 Trn plan for both infrastructure and economic development is expected to stimulate the economy in the country. Government of India's primary area of focus is the infrastructure sector. India plans to invest US$ 1.4 Trn in infrastructure between 2019 and 2023 to achieve sustainable national development.

According to World Construction Network, the government in China is accelerating works on infrastructure construction in order to drive economic growth. Investment in infrastructure by the government in China increased by 7.4% between January and July 2022.

Strong government emphasis on economic development for a country’s overall growth and to build world class infrastructure on schedule is projected to act as market catalysts in the near future.

The Associated General Contractors of America (AGC) construction data indicates that construction contributes significantly to the U.S. economy and creates nearly US$ 1.8 Trn worth of structures annually. Increased investment in infrastructure, rise in R&D activities in the field of construction, and presence of numerous manufacturers are expected to boost market dynamics in the region in the next few years.

According to the natural and manufactured sand market forecast, Asia Pacific is expected to show sustainable growth throughout the forecast period. Countries such as China, India, and Japan are expected to contribute significantly to the growth of the regional market. The primary driver for natural and manufactured sand industry growth in Asia Pacific is surge in construction activities ascribed to the advent of smart cities and initiative for infrastructure by governments.

During the forecast period, natural and manufactured sand market share in Middle East & Africa is expected to be promising, owing to the prominent growth in building infrastructure and construction which requires manufactured and natural sand.

Over the years, increased investment in infrastructure in the European Union is likely to have a positive impact on natural and manufactured sand market development in Europe.

The business model of prominent manufacturers includes investments in R&D activities, product expansions, and mergers and acquisitions. Natural and manufactured sand market analysis suggests that product development is a major marketing strategy of key players.

The market is highly competitive, with the presence of various global and regional players. Adelaide Brighton Ltd, Cemex S.A.B. DE C.V., CRH Plc, Duo PLC, Heidelberg Cement AG, Holcim, Hutcheson Sand & Mixes, Johnston North America, McLanahan, and Vulcan Material Company are the prominent entities profiled in the global natural and manufactured sand industry.

Each of these players has been profiled in the natural and manufactured sand industry research report based on factors such as business strategies, product portfolio, company overview, financial overview, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Value in 2022 |

US$ 146.1 Bn |

|

Market Forecast Value in 2031 |

US$ 368.0 Bn |

|

Growth Rate (CAGR) |

10.8% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value & Million Units for Volume |

|

Market Analysis |

Includes cross segment analysis at regional as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 146.1 Bn in 2022.

It is estimated to advance at a CAGR of 10.8% from 2023 to 2031.

New residential and commercial construction, and government focus on economic development.

In terms of product type, the manufactured sand segment accounted for significant share in 2022.

Asia Pacific is likely to be one of the lucrative markets in the next few years.

Adelaide Brighton Ltd, Cemex S.A.B. DE C.V., CRH Plc, Duo PLC, Heidelberg Cement AG, Holcim, Hutcheson Sand & Mixes, Johnston North America, McLanahan, and Vulcan Material Company.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Standards & Regulations

5.5. Key Market Indicators

5.6. Raw Material Analysis

5.7. Porter’s Five Forces Analysis

5.8. Industry SWOT Analysis

5.9. Value Chain Analysis

5.10. Regulatory Framework

5.11. Global Natural and Manufactured Sand Market Analysis and Forecast, 2017 - 2031

5.11.1. Market Value Projections (US$ Bn)

5.11.2. Market Volume Projections (Million Tons)

6. Global Natural and Manufactured Sand Market Analysis and Forecast, By Product Type

6.1. Natural and Manufactured Sand Market Size (US$ Bn and Million Tons) Forecast, By Product Type,2017 – 2031

6.1.1. Natural Sand

6.1.2. Manufactured Sand

6.2. Incremental Opportunity, By Product Type

7. Global Natural and Manufactured Sand Market Analysis and Forecast, By Application

7.1. Natural and Manufactured Sand Market Size (US$ Bn and Million Tons) Forecast, By Application, 2017 - 2031

7.1.1. Residential

7.1.2. Commercial

7.1.3. Industrial

7.1.4. Infrastructure

8. Global Natural and Manufactured Sand Market Analysis and Forecast, By Region

8.1. Natural and Manufactured Sand Market Size (US$ Bn and Million Tons) Forecast, By Region, 2017 - 2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Incremental Opportunity, By Region

9. North America Natural and Manufactured Sand Market Analysis and Forecast

9.1. Regional Snapshot

9.2. Brand Analysis

9.3. Price Trend Analysis

9.3.1. Weighted Average Price

9.4. Key Trends Analysis

9.4.1. Demand Side

9.4.2. Supplier Side

9.5. Natural and Manufactured Sand Market Size (US$ Bn and Million Tons) Forecast, By Product Type,2017 – 2031

9.5.1. Natural Sand

9.5.2. Manufactured Sand

9.6. Natural and Manufactured Sand Market Size (US$ Bn and Million Tons) Forecast, By Application, 2017 - 2031

9.6.1. Residential

9.6.2. Commercial

9.6.3. Industrial

9.6.4. Infrastructure

9.7. Natural and Manufactured Sand Market Size (US$ Bn and Million Tons) Forecast, By Country/Sub-region, 2017 - 2031

9.7.1. U.S

9.7.2. Canada

9.7.3. Rest of North America

9.8. Incremental Opportunity Analysis

10. Europe Natural and Manufactured Sand Market Analysis and Forecast

10.1. Regional Snapshot

10.2. Brand Analysis

10.3. Price Trend Analysis

10.3.1. Weighted Average Price

10.4. Key Trends Analysis

10.4.1. Demand Side

10.4.2. Supplier Side

10.5. Natural and Manufactured Sand Market Size (US$ Bn and Million Tons) Forecast, By Product Type,2017 – 2031

10.5.1. Natural Sand

10.5.2. Manufactured Sand

10.6. Natural and Manufactured Sand Market Size (US$ Bn and Million Tons) Forecast, By Application, 2017 - 2031

10.6.1. Residential

10.6.2. Commercial

10.6.3. Industrial

10.6.4. Infrastructure

10.7. Natural and Manufactured Sand Market Size (US$ Bn and Million Tons) Forecast, By Country/Sub-region, 2017 - 2031

10.7.1. U.K

10.7.2. Germany

10.7.3. France

10.7.4. Rest of Europe

10.8. Incremental Opportunity Analysis

11. Asia Pacific Natural and Manufactured Sand Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Brand Analysis

11.3. Key Trends Analysis

11.3.1. Demand Side

11.3.2. Supplier Side

11.4. Natural and Manufactured Sand Market Size (US$ Bn and Million Tons) Forecast, By Product Type,2017 – 2031

11.4.1. Natural Sand

11.4.2. Manufactured Sand

11.5. Natural and Manufactured Sand Market Size (US$ Bn and Million Tons) Forecast, By Application, 2017 - 2031

11.5.1. Residential

11.5.2. Commercial

11.5.3. Industrial

11.5.4. Infrastructure

11.6. Natural and Manufactured Sand Market Size (US$ Bn and Million Tons) Forecast, By Country/Sub-region, 2017 - 2031

11.6.1. India

11.6.2. China

11.6.3. Japan

11.6.4. Rest of Asia Pacific

11.7. Incremental Opportunity Analysis

12. Middle East & South Africa Natural and Manufactured Sand Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Brand Analysis

12.3. Price Trend Analysis

12.3.1. Weighted Average Price

12.4. Key Trends Analysis

12.4.1. Demand Side

12.4.2. Supplier Side

12.5. Natural and Manufactured Sand Market Size (US$ Bn and Million Tons) Forecast, By Product Type,2017 – 2031

12.5.1. Natural Sand

12.5.2. Manufactured Sand

12.6. Natural and Manufactured Sand Market Size (US$ Bn and Million Tons) Forecast, By Application, 2017 - 2031

12.6.1. Residential

12.6.2. Commercial

12.6.3. Industrial

12.6.4. Infrastructure

12.7. Natural and Manufactured Sand Market Size (US$ Bn and Million Tons) Forecast, By Country/Sub-region, 2017 - 2031

12.7.1. GCC

12.7.2. Rest of MEA

12.8. Incremental Opportunity Analysis

13. South America Natural and Manufactured Sand Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Brand Analysis

13.3. Price Trend Analysis

13.3.1. Weighted Average Price

13.4. Key Trends Analysis

13.4.1. Demand Side

13.4.2. Supplier Side

13.5. Natural and Manufactured Sand Market Size (US$ Bn and Million Tons) Forecast, By Product Type,2017 – 2031

13.5.1. Natural Sand

13.5.2. Manufactured Sand

13.6. Natural and Manufactured Sand Market Size (US$ Bn and Million Tons) Forecast, By Application, 2017 - 2031

13.6.1. Residential

13.6.2. Commercial

13.6.3. Industrial

13.6.4. Infrastructure

13.7. Natural and Manufactured Sand Market Size (US$ Bn and Million Tons) Forecast, By Country/Sub-region, 2017 - 2031

13.7.1. Brazil

13.7.2. Rest of South America

13.8. Incremental Opportunity Analysis

14. Competition Landscape

14.1. Market Player – Competition Dashboard

14.2. Market Share Analysis (%), by Company, (2022)

14.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

14.3.1. Adelaide Brighton Ltd

14.3.1.1. Company Overview

14.3.1.2. Sales Area/Geographical Presence

14.3.1.3. Revenue

14.3.1.4. Strategy & Business Overview

14.3.2. Cemex S.A.B. DE C.V.

14.3.2.1. Company Overview

14.3.2.2. Sales Area/Geographical Presence

14.3.2.3. Revenue

14.3.2.4. Strategy & Business Overview

14.3.3. CRH Plc

14.3.3.1. Company Overview

14.3.3.2. Sales Area/Geographical Presence

14.3.3.3. Revenue

14.3.3.4. Strategy & Business Overview

14.3.4. Duo PLC

14.3.4.1. Company Overview

14.3.4.2. Sales Area/Geographical Presence

14.3.4.3. Revenue

14.3.4.4. Strategy & Business Overview

14.3.5. Heidelberg Cement AG

14.3.5.1. Company Overview

14.3.5.2. Sales Area/Geographical Presence

14.3.5.3. Revenue

14.3.5.4. Strategy & Business Overview

14.3.6. Holcim

14.3.6.1. Company Overview

14.3.6.2. Sales Area/Geographical Presence

14.3.6.3. Revenue

14.3.6.4. Strategy & Business Overview

14.3.7. Hutcheson Sand & Mixes

14.3.7.1. Company Overview

14.3.7.2. Sales Area/Geographical Presence

14.3.7.3. Revenue

14.3.7.4. Strategy & Business Overview

14.3.8. Johnston North America

14.3.8.1. Company Overview

14.3.8.2. Sales Area/Geographical Presence

14.3.8.3. Revenue

14.3.8.4. Strategy & Business Overview

14.3.9. McLanahan

14.3.9.1. Company Overview

14.3.9.2. Sales Area/Geographical Presence

14.3.9.3. Revenue

14.3.9.4. Strategy & Business Overview

14.3.10. Vulcan Material Company

14.3.10.1. Company Overview

14.3.10.2. Sales Area/Geographical Presence

14.3.10.3. Revenue

14.3.10.4. Strategy & Business Overview

15. Key Takeaways

15.1. Identification of Potential Market Spaces

15.1.1. By Product Type

15.1.2. By Application

15.1.3. By Region

15.2. Prevailing Market Risks

15.3. Understanding the Buying Process of Customers

List of Tables

Table 1: Global Natural and Manufactured Sand Market Value (US$ Bn), by Product Type, 2017-2031

Table 2: Global Natural and Manufactured Sand Market Volume (Million Tons), by Product Type 2017-2031

Table 3: Global Natural and Manufactured Sand Market Value (US$ Bn), by Application, 2017-2031

Table 4: Global Natural and Manufactured Sand Market Volume (Million Tons), by Application 2017-2031

Table 5: Global Natural and Manufactured Sand Market Value (US$ Bn), by Region, 2017-2031

Table 6: Global Natural and Manufactured Sand Market Volume (Million Tons), by Region 2017-2031

Table 7: North America Natural and Manufactured Sand Market Value (US$ Bn), by Product Type, 2017-2031

Table 8: North America Natural and Manufactured Sand Market Volume (Million Tons), by Product Type 2017-2031

Table 9: North America Natural and Manufactured Sand Market Value (US$ Bn), by Application, 2017-2031

Table 10: North America Natural and Manufactured Sand Market Volume (Million Tons), by Application 2017-2031

Table 11: North America Natural and Manufactured Sand Market Value (US$ Bn), by Region, 2017-2031

Table 12: North America Natural and Manufactured Sand Market Volume (Million Tons), by Region 2017-2031

Table 13: Europe Natural and Manufactured Sand Market Value (US$ Bn), by Product Type, 2017-2031

Table 14: Europe Natural and Manufactured Sand Market Volume (Million Tons), by Product Type 2017-2031

Table 15: Europe Natural and Manufactured Sand Market Value (US$ Bn), by Application, 2017-2031

Table 16: Europe Natural and Manufactured Sand Market Volume (Million Tons), by Application 2017-2031

Table 17: Europe Natural and Manufactured Sand Market Value (US$ Bn), by Region, 2017-2031

Table 18: Europe Natural and Manufactured Sand Market Volume (Million Tons), by Region 2017-2031

Table 19: Asia Pacific Natural and Manufactured Sand Market Value (US$ Bn), by Product Type, 2017-2031

Table 20: Asia Pacific Natural and Manufactured Sand Market Volume (Million Tons), by Product Type 2017-2031

Table 21: Asia Pacific Natural and Manufactured Sand Market Value (US$ Bn), by Application, 2017-2031

Table 22: Asia Pacific Natural and Manufactured Sand Market Volume (Million Tons), by Application 2017-2031

Table 23: Asia Pacific Natural and Manufactured Sand Market Value (US$ Bn), by Region, 2017-2031

Table 24: Asia Pacific Natural and Manufactured Sand Market Volume (Million Tons), by Region 2017-2031

Table 25: Middle East & Africa Natural and Manufactured Sand Market Value (US$ Bn), by Product Type, 2017-2031

Table 26: Middle East & Africa Natural and Manufactured Sand Market Volume (Million Tons), by Product Type 2017-2031

Table 27: Middle East & Africa Natural and Manufactured Sand Market Value (US$ Bn), by Application, 2017-2031

Table 28: Middle East & Africa Natural and Manufactured Sand Market Volume (Million Tons), by Application 2017-2031

Table 29: Middle East & Africa Natural and Manufactured Sand Market Value (US$ Bn), by Region, 2017-2031

Table 30: Middle East & Africa Natural and Manufactured Sand Market Volume (Million Tons), by Region 2017-2031

Table 31: South America Natural and Manufactured Sand Market Value (US$ Bn), by Product Type, 2017-2031

Table 32: South America Natural and Manufactured Sand Market Volume (Million Tons), by Product Type 2017-2031

Table 33: South America Natural and Manufactured Sand Market Value (US$ Bn), by Application, 2017-2031

Table 34: South America Natural and Manufactured Sand Market Volume (Million Tons), by Application 2017-2031

Table 35: South America Natural and Manufactured Sand Market Value (US$ Bn), by Region, 2017-2031

Table 36: South America Natural and Manufactured Sand Market Volume (Million Tons), by Region 2017-2031

List of Figures

Figure 1: Global Natural and Manufactured Sand Market Value (US$ Bn), by Product Type, 2017-2031

Figure 2: Global Natural and Manufactured Sand Market Volume (Million Tons), by Product Type 2017-2031

Figure 3: Global Natural and Manufactured Sand Market Incremental Opportunity (US$ Bn), Forecast, by Product Type, 2023-2031

Figure 4: Global Natural and Manufactured Sand Market Value (US$ Bn), by Application, 2017-2031

Figure 5: Global Natural and Manufactured Sand Market Volume (Million Tons), by Application 2017-2031

Figure 6: Global Natural and Manufactured Sand Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 7: Global Natural and Manufactured Sand Market Value (US$ Bn), by Region, 2017-2031

Figure 8: Global Natural and Manufactured Sand Market Volume (Million Tons), by Region 2017-2031

Figure 9: Global Natural and Manufactured Sand Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 10: North America Natural and Manufactured Sand Market Value (US$ Bn), by Product Type, 2017-2031

Figure 11: North America Natural and Manufactured Sand Market Volume (Million Tons), by Product Type 2017-2031

Figure 12: North America Natural and Manufactured Sand Market Incremental Opportunity (US$ Bn), Forecast, by Product Type, 2023-2031

Figure 13: North America Natural and Manufactured Sand Market Value (US$ Bn), by Application, 2017-2031

Figure 14: North America Natural and Manufactured Sand Market Volume (Million Tons), by Application 2017-2031

Figure 15: North America Natural and Manufactured Sand Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 16: North America Natural and Manufactured Sand Market Value (US$ Bn), by Region, 2017-2031

Figure 17: North America Natural and Manufactured Sand Market Volume (Million Tons), by Region 2017-2031

Figure 18: North America Natural and Manufactured Sand Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 19: Europe Natural and Manufactured Sand Market Value (US$ Bn), by Product Type, 2017-2031

Figure 20: Europe Natural and Manufactured Sand Market Volume (Million Tons), by Product Type 2017-2031

Figure 21: Europe Natural and Manufactured Sand Market Incremental Opportunity (US$ Bn), Forecast, by Product Type, 2023-2031

Figure 22: Europe Natural and Manufactured Sand Market Value (US$ Bn), by Application, 2017-2031

Figure 23: Europe Natural and Manufactured Sand Market Volume (Million Tons), by Application 2017-2031

Figure 24: Europe Natural and Manufactured Sand Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 25: Europe Natural and Manufactured Sand Market Value (US$ Bn), by Region, 2017-2031

Figure 26: Europe Natural and Manufactured Sand Market Volume (Million Tons), by Region 2017-2031

Figure 27: Europe Natural and Manufactured Sand Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 28: Asia Pacific Natural and Manufactured Sand Market Value (US$ Bn), by Product Type, 2017-2031

Figure 29: Asia Pacific Natural and Manufactured Sand Market Volume (Million Tons), by Product Type 2017-2031

Figure 30: Asia Pacific Natural and Manufactured Sand Market Incremental Opportunity (US$ Bn), Forecast, by Product Type, 2023-2031

Figure 31: Asia Pacific Natural and Manufactured Sand Market Value (US$ Bn), by Application, 2017-2031

Figure 32: Asia Pacific Natural and Manufactured Sand Market Volume (Million Tons), by Application 2017-2031

Figure 33: Asia Pacific Natural and Manufactured Sand Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 34: Asia Pacific Natural and Manufactured Sand Market Value (US$ Bn), by Region, 2017-2031

Figure 35: Asia Pacific Natural and Manufactured Sand Market Volume (Million Tons), by Region 2017-2031

Figure 36: Asia Pacific Natural and Manufactured Sand Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 37: Middle East & Africa Natural and Manufactured Sand Market Value (US$ Bn), by Product Type, 2017-2031

Figure 38: Middle East & Africa Natural and Manufactured Sand Market Volume (Million Tons), by Product Type 2017-2031

Figure 39: Middle East & Africa Natural and Manufactured Sand Market Incremental Opportunity (US$ Bn), Forecast, by Product Type, 2023-2031

Figure 40: Middle East & Africa Natural and Manufactured Sand Market Value (US$ Bn), by Application, 2017-2031

Figure 41: Middle East & Africa Natural and Manufactured Sand Market Volume (Million Tons), by Application 2017-2031

Figure 42: Middle East & Africa Natural and Manufactured Sand Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 43: Middle East & Africa Natural and Manufactured Sand Market Value (US$ Bn), by Region, 2017-2031

Figure 44: Middle East & Africa Natural and Manufactured Sand Market Volume (Million Tons), by Region 2017-2031

Figure 45: Middle East & Africa Natural and Manufactured Sand Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 46: North America Natural and Manufactured Sand Market Value (US$ Bn), by Product Type, 2017-2031

Figure 47: North America Natural and Manufactured Sand Market Volume (Million Tons), by Product Type 2017-2031

Figure 48: North America Natural and Manufactured Sand Market Incremental Opportunity (US$ Bn), Forecast, by Product Type, 2023-2031

Figure 49: North America Natural and Manufactured Sand Market Value (US$ Bn), by Application, 2017-2031

Figure 50: North America Natural and Manufactured Sand Market Volume (Million Tons), by Application 2017-2031

Figure 51: North America Natural and Manufactured Sand Market Incremental Opportunity (US$ Bn), Forecast, by Application, 2023-2031

Figure 52: North America Natural and Manufactured Sand Market Value (US$ Bn), by Region, 2017-2031

Figure 53: North America Natural and Manufactured Sand Market Volume (Million Tons), by Region 2017-2031

Figure 54: North America Natural and Manufactured Sand Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031