Reports

Reports

Analysts’ Viewpoint

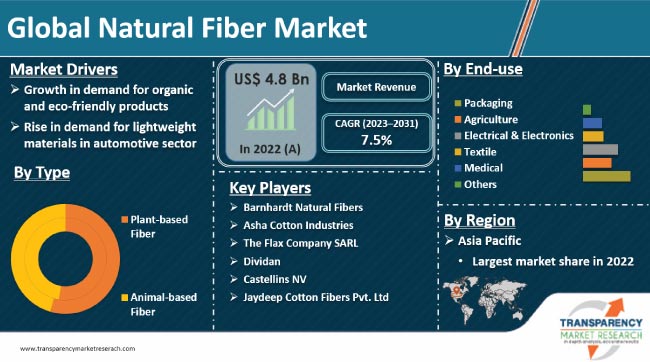

Future market demand for natural fibers appears promising due to growth in several end-use industries such as packaging, agriculture, textiles, electronics, and medical. Increase in demand for organic, sustainable, and eco-friendly products and rise in need for lightweight materials in the automotive sector are primarily driving market progress. Natural fibers are biodegradable, renewable, and have lower environmental impact vis-à-vis synthetic fibers.

Demand for natural fibers, including cotton, wool, silk, hemp, and jute, is rising steadily due to growth in ethical and conscious consumerism. Changing consumer preferences and technological developments are likely to fuel market dynamics. Key manufacturers are focusing on improving sustainability and cost-effectiveness of natural fiber production to increase their market share.

Natural fiber is an environmentally-friendly product that is widely used in textiles and other industries. It is widely used in yarn and fabric forms in the textile sector. Natural fiber is also employed in other applications such as automobiles, boards, and construction of individual or blended structures.

Natural fibers are renewable resources that provide better sustainable solutions due to their low cost, low density, low processing expenditure, lack of health hazards, and strong mechanical and physical properties. Natural fibers are biodegradable and non-carcinogenic. This coupled with cost-effectiveness is driving the demand for natural fibers. Plant-based and animal-based are the two major types of natural fibers.

Natural fibers are derived from various parts of plants, animals, and minerals. Usage of natural fibers in industrial components, especially in automobiles and housing, improves environmental sustainability. Natural fibers have better insulation properties than synthetic materials. Therefore, they play an important role in the construction industry.

Natural fibers are grown naturally; hence, they do not adversely impact the environment. However, certain pesticides, fertilizers, and other toxic chemicals need to be used to improve the production of these fibers. This can be environmentally harmful. However, the adverse impact of synthetic fibers far outweighs that of natural fibers. Researchers are further exploring eco-friendly methods to develop, cultivate, and use natural fibers.

In the textile industry, natural fibers such as cotton, wool, silk, and linen are used in the manufacture of clothing and other textiles. Cotton is the commonly used natural fiber in the textile sector. Demand for organic cotton, which is grown without the usage of synthetic pesticides or fertilizers, is rising across the globe. Similarly, demand for wool and silk produced from sustainably raised animals is also increasing worldwide.

Natural fibers are also employed in industries such as construction, automotive, and packaging. For instance, natural fibers such as jute and kenaf are used to make building materials, while bamboo fibers are used in the manufacture of eco-friendly packaging.

The global market for natural fiber is expected to continue to grow steadily during the forecast period, as consumers are increasingly becoming environmentally conscious and demanding sustainable products. However, the market faces challenges such as limited availability of natural fibers, high production costs, and intense competition from synthetic fibers.

Natural fibers are light in weight and possess a high strength-to-weight ratio. Therefore, they are attractive alternatives to traditional materials such as metal and plastic. Advanced materials are essential for boosting the fuel economy of modern automobiles while maintaining safety and performance.

Lightweight materials such as aluminum (Al) alloys, high-strength steel, magnesium (Mg) alloys, carbon fiber, and polymer composites are primarily used in automobiles to reduce vehicle weight and improve fuel efficiency.

The automotive industry is one of the largest users of natural fibers, with applications in interior and exterior components, such as door panels, dashboard trims, and seat covers. Natural fibers such as flax, hemp, sisal, and kenaf are commonly used in the production of automotive components, as they are biodegradable and recyclable.

Plant-based natural fibers are derived from various plants including cotton, jute, flax, hemp, sisal, and kenaf. These fibers are widely used in the textile industry to produce fabrics for clothing and home textiles. They are also employed in industrial applications.

The plant-based fiber type segment is anticipated to grow at a significant pace in the next few years. Increase in demand for sustainable and eco-friendly products, rise in awareness about the adverse environmental impact of synthetic fibers and animal fibers, and development of new technologies for processing and manufacture of plant-based fibers are some of the key factors augmenting the plant-based fiber segment.

According to the natural fiber market forecast, Asia Pacific held major share of the global landscape in 2022. It is projected to maintain its dominance throughout the forecast period. Expansion in textile and medical industries is expected to fuel natural fiber market growth in the region.

The natural fiber market size in North America is likely to increase in the near future, owing to the rise in demand for eco-friendly products in industries such as textile, construction and packaging in the region.

The global landscape is highly consolidated, with the presence of a few large-scale players controlling majority of the natural fiber market.

According to the latest natural fiber market research, several companies are investing significantly in comprehensive R&D activities, primarily to create environmentally-friendly products. Key manufacturers are striving to enhance the production and processing of natural fibers to increase their natural fiber market share.

As per the latest natural fiber market trends, key players are implementing strategies such as partnerships, expansion of product portfolios, mergers, and acquisitions to expand their global footprint.

Barnhardt Natural Fibers, Asha Cotton Industries, The Flax Company SARL, Dividan, Castellins NV, Jaydeep Cotton Fibers Pvt. Ltd, NATŪRALUS PLUOŠTAS, UAB, Dun Agro Hemp Group, Industrial Hemp Manufacturing, LLC, BAFA Neu GmbH, and Swicofil AG are the key natural fiber companies operating in the market.

Each of these players has been profiled in the natural fiber market report based on parameters such as business strategies, company overview, product portfolio, financial overview, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 57.3 Bn |

|

Market Forecast Value in 2031 |

US$ 94.3 Bn |

|

Growth Rate (CAGR) |

7.5% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2021 |

|

Quantitative Units |

US$ Bn for Value and Tons for Volume |

|

Market Analysis |

It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 57.3 Bn in 2022.

It is likely to grow at a CAGR of 7.5% from 2023 to 2031.

Growth in demand for organic and eco-friendly products and rise in demand for lightweight materials in automobile sector.

Plant-based fiber was the largest type segment in 2022.

Asia Pacific was the most lucrative region in 2022.

Barnhardt Natural Fibers, Asha Cotton Industries, The Flax Company SARL, Dividan, Castellins NV, Jaydeep Cotton Fibers Pvt. Ltd, NATŪRALUS PLUOŠTAS, UAB, Dun Agro Hemp Group, Industrial Hemp Manufacturing, LLC, BAFA Neu GmbH, and Swicofil AG.

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Global Natural Fiber Market Analysis and Forecast, 2023-2031

2.6.1. Global Natural Fiber Market Volume (Tons)

2.6.2. Global Natural Fiber Market Revenue (US$ Mn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Raw Material Providers

2.9.2. List of Manufacturers

2.9.3. List of Dealers/Distributors

2.9.4. List of Potential Customers

2.10. Production Overview

2.11. Product Specification Analysis

2.11.1. Cost Structure Analysis

3. Economic Recovery Post COVID-19 Impact

3.1. Impact on the Supply Chain of the Natural Fiber

3.2. Impact on the Demand of Natural Fiber– Pre & Post Crisis

4. Impact of Current Geopolitical Scenario

5. Production Output Analysis (Tons), by Region, 2023

5.1. North America

5.2. Europe

5.3. Asia Pacific

5.4. Latin America

5.5. Middle East & Africa

6. Price Trend Analysis and Forecast (US$/Tons), 2023-2031

6.1. Price Comparison Analysis by Type

6.2. Price Comparison Analysis by Region

7. Global Natural Fiber Market Analysis and Forecast, by Type, 2023–2031

7.1. Introduction and Definitions

7.2. Global Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023–2031

7.2.1.1. Plant-based Fiber

7.2.1.1.1. Cotton

7.2.1.1.2. Linen

7.2.1.1.3. Jute

7.2.1.1.4. Hemp

7.2.1.1.5. Others (Bamboo, Sisal, Flex, etc.)

7.2.1.2. Animal-based Fiber

7.2.1.2.1. Wool

7.2.1.2.2. Silk

7.2.1.2.3. Others (Angora, Mohair, etc.)

7.3. Global Natural Fiber Market Attractiveness, by Type

8. Global Natural Fiber Market Analysis and Forecast, by End-use, 2023–2031

8.1. Introduction and Definitions

8.2. Global Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

8.2.1. Packaging

8.2.2. Agriculture

8.2.3. Electrical & Electronics

8.2.4. Textile

8.2.5. Medical

8.2.6. Others

8.3. Global Natural Fiber Market Attractiveness, by End-use

9. Global Natural Fiber Market Analysis and Forecast, by Region, 2023–2031

9.1. Key Findings

9.2. Global Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by Region, 2023–2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. Latin America

9.3. Global Natural Fiber Market Attractiveness, by Region

10. North America Natural Fiber Market Analysis and Forecast, 2023–2031

10.1. Key Findings

10.2. North America Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023–2031

10.3. North America Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

10.4. North America Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

10.4.1. U.S. Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023–2031

10.4.2. U.S. Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

10.4.3. Canada Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023–2031

10.4.4. Canada Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

10.5. North America Natural Fiber Market Attractiveness Analysis

11. Europe Natural Fiber Market Analysis and Forecast, 2023–2031

11.1. Key Findings

11.2. Europe Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023–2031

11.3. Europe Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

11.4. Europe Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by Country/Sub-region, 2023-2031

11.4.1. Germany Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023–2031

11.4.2. Germany Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

11.4.3. France Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023–2031

11.4.4. France Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

11.4.5. U.K. Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023–2031

11.4.6. U.K. Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

11.4.7. Italy Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023–2031

11.4.8. Italy Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

11.4.9. Russia & CIS Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023–2031

11.4.10. Russia & CIS Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

11.4.11. Rest of Europe Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023–2031

11.4.12. Rest of Europe Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

11.5. Europe Natural Fiber Market Attractiveness Analysis

12. Asia Pacific Natural Fiber Market Analysis and Forecast, 2023–2031

12.1. Key Findings

12.2. Asia Pacific Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by Type

12.3. Asia Pacific Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

12.4. Asia Pacific Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by Country/Sub-region, 2023-2031

12.4.1. China Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023–2031

12.4.2. China Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

12.4.3. Japan Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023–2031

12.4.4. Japan Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

12.4.5. India Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023–2031

12.4.6. India Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

12.4.7. ASEAN Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023–2031

12.4.8. ASEAN Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

12.4.9. Rest of Asia Pacific Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023–2031

12.4.10. Rest of Asia Pacific Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

12.5. Asia Pacific Natural Fiber Market Attractiveness Analysis

13. Latin America Natural Fiber Market Analysis and Forecast, 2023–2031

13.1. Key Findings

13.2. Latin America Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023–2031

13.3. Latin America Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

13.4. Latin America Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by Country/Sub-region, 2023-2031

13.4.1. Brazil Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023–2031

13.4.2. Brazil Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

13.4.3. Mexico Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023–2031

13.4.4. Mexico Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

13.4.5. Rest of Latin America Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023–2031

13.4.6. Rest of Latin America Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

13.5. Latin America Natural Fiber Market Attractiveness Analysis

14. Middle East & Africa Natural Fiber Market Analysis and Forecast, 2023–2031

14.1. Key Findings

14.2. Middle East & Africa Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023–2031

14.3. Middle East & Africa Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

14.4. Middle East & Africa Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by Country/Sub-region, 2023-2031

14.4.1. GCC Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023–2031

14.4.2. GCC Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

14.4.3. South Africa Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023–2031

14.4.4. South Africa Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

14.4.5. Rest of Middle East & Africa Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023–2031

14.4.6. Rest of Middle East & Africa Natural Fiber Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

14.5. Middle East & Africa Natural Fiber Market Attractiveness Analysis

15. Competition Landscape

15.1. Market Players - Competition Matrix (by Tier and Size of Companies)

15.2. Market Share Analysis, 2023

15.3. Market Footprint Analysis

15.3.1. By Type

15.3.2. By End-use

15.4. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

15.4.1. Barnhardt Natural Fibers

15.4.1.1. Company Description

15.4.1.2. Business Overview

15.4.1.3. Financial Overview

15.4.1.4. Strategic Overview

15.4.2. Asha Cotton Industries

15.4.2.1. Company Description

15.4.2.2. Business Overview

15.4.2.3. Financial Overview

15.4.2.4. Strategic Overview

15.4.3. The Flax Company SARL

15.4.3.1. Company Description

15.4.3.2. Business Overview

15.4.3.3. Financial Overview

15.4.3.4. Strategic Overview

15.4.4. Dividan

15.4.4.1. Company Description

15.4.4.2. Business Overview

15.4.4.3. Financial Overview

15.4.4.4. Strategic Overview

15.4.5. Castellins NV

15.4.5.1. Company Description

15.4.5.2. Business Overview

15.4.5.3. Financial Overview

15.4.5.4. Strategic Overview

15.4.6. Jaydeep Cotton Fibers Pvt. Ltd

15.4.6.1. Company Description

15.4.6.2. Business Overview

15.4.6.3. Financial Overview

15.4.6.4. Strategic Overview

15.4.7. NATŪRALUS PLUOŠTAS, UAB

15.4.7.1. Company Description

15.4.7.2. Business Overview

15.4.7.3. Financial Overview

15.4.7.4. Strategic Overview

15.4.8. Dun Agro Hemp Group

15.4.8.1. Company Description

15.4.8.2. Business Overview

15.4.8.3. Financial Overview

15.4.8.4. Strategic Overview

15.4.9. Industrial Hemp Manufacturing, LLC

15.4.9.1. Company Description

15.4.9.2. Business Overview

15.4.9.3. Financial Overview

15.4.9.4. Strategic Overview

15.4.10. BAFA Neu GmbH

15.4.10.1. Company Description

15.4.10.2. Business Overview

15.4.10.3. Financial Overview

15.4.10.4. Strategic Overview

15.4.11. Swicofil AG

15.4.11.1. Company Description

15.4.11.2. Business Overview

15.4.11.3. Financial Overview

15.4.11.4. Strategic Overview

15.4.12. China Bambro Textile (Group) Co., Ltd.

15.4.12.1. Company Description

15.4.12.2. Business Overview

15.4.12.3. Financial Overview

15.4.12.4. Strategic Overview

15.4.13. KM Jute Fibre

15.4.13.1. Company Description

15.4.13.2. Business Overview

15.4.13.3. Financial Overview

15.4.13.4. Strategic Overview

16. Primary Research: Key Insights

17. Appendix

List of Tables

Table 1: Global Natural Fiber Market Volume (Tons) Forecast, by Type, 2023–2031

Table 2: Global Natural Fiber Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 3: Global Natural Fiber Market Volume (Tons) Forecast, by End-use, 2023–2031

Table 4: Global Natural Fiber Market Value (US$ Mn) Forecast, by End-use, 2023–2031

Table 5: Global Natural Fiber Market Volume (Tons) Forecast, by Region, 2023–2031

Table 6: Global Natural Fiber Market Value (US$ Mn) Forecast, by Region, 2023–2031

Table 7: North America Natural Fiber Market Volume (Tons) Forecast, by Type, 2023–2031

Table 8: North America Natural Fiber Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 9: North America Natural Fiber Market Volume (Tons) Forecast, by End-use, 2023–2031

Table 10: North America Natural Fiber Market Value (US$ Mn) Forecast, by End-use, 2023–2031

Table 11: North America Natural Fiber Market Volume (Tons) Forecast, by Country, 2023–2031

Table 12: North America Natural Fiber Market Value (US$ Mn) Forecast, by Country, 2023–2031

Table 13: U.S. Natural Fiber Market Volume (Tons) Forecast, by Type, 2023–2031

Table 14: U.S. Natural Fiber Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 15: U.S. Natural Fiber Market Volume (Tons) Forecast, by End-use, 2023–2031

Table 16: U.S. Natural Fiber Market Value (US$ Mn) Forecast, by End-use, 2023–2031

Table 17: Canada Natural Fiber Market Volume (Tons) Forecast, by Type, 2023–2031

Table 18: Canada Natural Fiber Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 19: Canada Natural Fiber Market Volume (Tons) Forecast, by End-use, 2023–2031

Table 20: Canada Natural Fiber Market Value (US$ Mn) Forecast, by End-use, 2023–2031

Table 21: Europe Natural Fiber Market Volume (Tons) Forecast, by Type, 2023–2031

Table 22: Europe Natural Fiber Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 23: Europe Natural Fiber Market Volume (Tons) Forecast, by End-use, 2023–2031

Table 24: Europe Natural Fiber Market Value (US$ Mn) Forecast, by End-use, 2023–2031

Table 25: Europe Natural Fiber Market Volume (Tons) Forecast, by Country/Sub-region, 2023–2031

Table 26: Europe Natural Fiber Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 27: Germany Natural Fiber Market Volume (Tons) Forecast, by Type, 2023–2031

Table 28: Germany Natural Fiber Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 29: Germany Natural Fiber Market Volume (Tons) Forecast, by End-use, 2023–2031

Table 30: Germany Natural Fiber Market Value (US$ Mn) Forecast, by End-use, 2023–2031

Table 31: France Natural Fiber Market Volume (Tons) Forecast, by Type, 2023–2031

Table 32: France Natural Fiber Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 33: France Natural Fiber Market Volume (Tons) Forecast, by End-use, 2023–2031

Table 34: France Natural Fiber Market Value (US$ Mn) Forecast, by End-use, 2023–2031

Table 35: U.K. Natural Fiber Market Volume (Tons) Forecast, by Type, 2023–2031

Table 36: U.K. Natural Fiber Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 37: U.K. Natural Fiber Market Volume (Tons) Forecast, by End-use, 2023–2031

Table 38: U.K. Natural Fiber Market Value (US$ Mn) Forecast, by End-use, 2023–2031

Table 39: Italy Natural Fiber Market Volume (Tons) Forecast, by Type, 2023–2031

Table 40: Italy Natural Fiber Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 41: Italy Natural Fiber Market Volume (Tons) Forecast, by End-use, 2023–2031

Table 42: Italy Natural Fiber Market Value (US$ Mn) Forecast, by End-use, 2023–2031

Table 43: Spain Natural Fiber Market Volume (Tons) Forecast, by Type, 2023–2031

Table 44: Spain Natural Fiber Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 45: Spain Natural Fiber Market Volume (Tons) Forecast, by End-use, 2023–2031

Table 46: Spain Natural Fiber Market Value (US$ Mn) Forecast, by End-use, 2023–2031

Table 47: Russia & CIS Natural Fiber Market Volume (Tons) Forecast, by Type, 2023–2031

Table 48: Russia & CIS Natural Fiber Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 49: Russia & CIS Natural Fiber Market Volume (Tons) Forecast, by End-use, 2023–2031

Table 50: Russia & CIS Natural Fiber Market Value (US$ Mn) Forecast, by End-use, 2023–2031

Table 51: Rest of Europe Natural Fiber Market Volume (Tons) Forecast, by Type, 2023–2031

Table 52: Rest of Europe Natural Fiber Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 53: Rest of Europe Natural Fiber Market Volume (Tons) Forecast, by End-use, 2023–2031

Table 54: Rest of Europe Natural Fiber Market Value (US$ Mn) Forecast, by End-use, 2023–2031

Table 55: Asia Pacific Natural Fiber Market Volume (Tons) Forecast, by Type, 2023–2031

Table 56: Asia Pacific Natural Fiber Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 57: Asia Pacific Natural Fiber Market Volume (Tons) Forecast, by End-use, 2023–2031

Table 58: Asia Pacific Natural Fiber Market Value (US$ Mn) Forecast, by End-use, 2023–2031

Table 59: Asia Pacific Natural Fiber Market Volume (Tons) Forecast, by Country/Sub-region, 2023–2031

Table 60: Asia Pacific Natural Fiber Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 61: China Natural Fiber Market Volume (Tons) Forecast, by Type, 2023–2031

Table 62: China Natural Fiber Market Value (US$ Mn) Forecast, by Type 2023–2031

Table 63: China Natural Fiber Market Volume (Tons) Forecast, by End-use, 2023–2031

Table 64: China Natural Fiber Market Value (US$ Mn) Forecast, by End-use, 2023–2031

Table 65: Japan Natural Fiber Market Volume (Tons) Forecast, by Type, 2023–2031

Table 66: Japan Natural Fiber Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 67: Japan Natural Fiber Market Volume (Tons) Forecast, by End-use, 2023–2031

Table 68: Japan Natural Fiber Market Value (US$ Mn) Forecast, by End-use, 2023–2031

Table 69: India Natural Fiber Market Volume (Tons) Forecast, by Type, 2023–2031

Table 70: India Natural Fiber Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 71: India Natural Fiber Market Volume (Tons) Forecast, by End-use, 2023–2031

Table 72: India Natural Fiber Market Value (US$ Mn) Forecast, by End-use, 2023–2031

Table 73: India Natural Fiber Market Volume (Tons) Forecast, by End-use, 2023–2031

Table 74: India Natural Fiber Market Value (US$ Mn) Forecast, by End-use 2023–2031

Table 75: ASEAN Natural Fiber Market Volume (Tons) Forecast, by Type, 2023–2031

Table 76: ASEAN Natural Fiber Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 77: ASEAN Natural Fiber Market Volume (Tons) Forecast, by End-use, 2023–2031

Table 78: ASEAN Natural Fiber Market Value (US$ Mn) Forecast, by End-use, 2023–2031

Table 79: Rest of Asia Pacific Natural Fiber Market Volume (Tons) Forecast, by Type, 2023–2031

Table 80: Rest of Asia Pacific Natural Fiber Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 81: Rest of Asia Pacific Natural Fiber Market Volume (Tons) Forecast, by End-use, 2023–2031

Table 82: Rest of Asia Pacific Natural Fiber Market Value (US$ Mn) Forecast, by End-use, 2023–2031

Table 83: Latin America Natural Fiber Market Volume (Tons) Forecast, by Type, 2023–2031

Table 84: Latin America Natural Fiber Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 85: Latin America Natural Fiber Market Volume (Tons) Forecast, by End-use, 2023–2031

Table 86: Latin America Natural Fiber Market Value (US$ Mn) Forecast, by End-use, 2023–2031

Table 87: Latin America Natural Fiber Market Volume (Tons) Forecast, by Country/Sub-region, 2023–2031

Table 88: Latin America Natural Fiber Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 89: Brazil Natural Fiber Market Volume (Tons) Forecast, by Type, 2023–2031

Table 90: Brazil Natural Fiber Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 91: Brazil Natural Fiber Market Volume (Tons) Forecast, by End-use, 2023–2031

Table 92: Brazil Natural Fiber Market Value (US$ Mn) Forecast, by End-use, 2023–2031

Table 93: Mexico Natural Fiber Market Volume (Tons) Forecast, by Type, 2023–2031

Table 94: Mexico Natural Fiber Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 95: Mexico Natural Fiber Market Volume (Tons) Forecast, by End-use, 2023–2031

Table 96: Mexico Natural Fiber Market Value (US$ Mn) Forecast, by End-use, 2023–2031

Table 97: Rest of Latin America Natural Fiber Market Volume (Tons) Forecast, by Type, 2023–2031

Table 98: Rest of Latin America Natural Fiber Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 99: Rest of Latin America Natural Fiber Market Volume (Tons) Forecast, by End-use, 2023–2031

Table 100: Rest of Latin America Natural Fiber Market Value (US$ Mn) Forecast, by End-use, 2023–2031

Table 101: Middle East & Africa Natural Fiber Market Volume (Tons) Forecast, by Type, 2023–2031

Table 102: Middle East & Africa Natural Fiber Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 103: Middle East & Africa Natural Fiber Market Volume (Tons) Forecast, by End-use, 2023–2031

Table 104: Middle East & Africa Natural Fiber Market Value (US$ Mn) Forecast, by End-use, 2023–2031

Table 105: Middle East & Africa Natural Fiber Market Volume (Tons) Forecast, by Country/Sub-region, 2023–2031

Table 106: Middle East & Africa Natural Fiber Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 107: GCC Natural Fiber Market Volume (Tons) Forecast, by Type, 2023–2031

Table 108: GCC Natural Fiber Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 109: GCC Natural Fiber Market Volume (Tons) Forecast, by End-use, 2023–2031

Table 110: GCC Natural Fiber Market Value (US$ Mn) Forecast, by End-use, 2023–2031

Table 111: South Africa Natural Fiber Market Volume (Tons) Forecast, by Type, 2023–2031

Table 112: South Africa Natural Fiber Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 113: South Africa Natural Fiber Market Volume (Tons) Forecast, by End-use, 2023–2031

Table 114: South Africa Natural Fiber Market Value (US$ Mn) Forecast, by End-use, 2023–2031

Table 115: Rest of Middle East & Africa Natural Fiber Market Volume (Tons) Forecast, by Type, 2023–2031

Table 116: Rest of Middle East & Africa Natural Fiber Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 117: Rest of Middle East & Africa Natural Fiber Market Volume (Tons) Forecast, by End-use, 2023–2031

Table 118: Rest of Middle East & Africa Natural Fiber Market Value (US$ Mn) Forecast, by End-use, 2023–2031

List of Figures

Figure 1: Global Natural Fiber Market Volume Share Analysis, by Type, 2022, 2027, and 2031

Figure 2: Global Natural Fiber Market Attractiveness, by Type

Figure 3: Global Natural Fiber Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 4: Global Natural Fiber Market Attractiveness, by End-use

Figure 5: Global Natural Fiber Market Volume Share Analysis, by Region, 2022, 2027, and 2031

Figure 6: Global Natural Fiber Market Attractiveness, by Region

Figure 7: North America Natural Fiber Market Volume Share Analysis, by Type, 2022, 2027, and 2031

Figure 8: North America Natural Fiber Market Attractiveness, by Type

Figure 9: North America Natural Fiber Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 10: North America Natural Fiber Market Attractiveness, by End-use

Figure 11: North America Natural Fiber Market Volume Share Analysis, by Country, 2022, 2027, and 2031

Figure 12: North America Natural Fiber Market Attractiveness, by Country

Figure 13: Europe Natural Fiber Market Volume Share Analysis, by Type, 2022, 2027, and 2031

Figure 14: Europe Natural Fiber Market Attractiveness, by Type

Figure 15: Europe Natural Fiber Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 16: Europe Natural Fiber Market Attractiveness, by End-use

Figure 17: Europe Natural Fiber Market Volume Share Analysis, by Country/Sub-region, 2022, 2027, and 2031

Figure 18: Europe Natural Fiber Market Attractiveness, by Country/Sub-region

Figure 19: Asia Pacific Natural Fiber Market Volume Share Analysis, by Type, 2022, 2027, and 2031

Figure 20: Asia Pacific Natural Fiber Market Attractiveness, by Type

Figure 21: Asia Pacific Natural Fiber Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 22: Asia Pacific Natural Fiber Market Attractiveness, by End-use

Figure 23: Asia Pacific Natural Fiber Market Volume Share Analysis, by Country/Sub-region, 2022, 2027, and 2031

Figure 24: Asia Pacific Natural Fiber Market Attractiveness, by Country/Sub-region

Figure 25: Latin America Natural Fiber Market Volume Share Analysis, by Type, 2022, 2027, and 2031

Figure 26: Latin America Natural Fiber Market Attractiveness, by Type

Figure 27: Latin America Natural Fiber Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 28: Latin America Natural Fiber Market Attractiveness, by End-use

Figure 29: Latin America Natural Fiber Market Volume Share Analysis, by Country/Sub-region, 2022, 2027, and 2031

Figure 30: Latin America Natural Fiber Market Attractiveness, by Country/Sub-region

Figure 31: Middle East & Africa Natural Fiber Market Volume Share Analysis, by Type, 2022, 2027, and 2031

Figure 32: Middle East & Africa Natural Fiber Market Attractiveness, by Type

Figure 33: Middle East & Africa Natural Fiber Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 34: Middle East & Africa Natural Fiber Market Attractiveness, by End-use

Figure 35: Middle East & Africa Natural Fiber Market Volume Share Analysis, by Country/Sub-region, 2022, 2027, and 2031

Figure 36: Middle East & Africa Natural Fiber Market Attractiveness, by Country/Sub-region