Reports

Reports

One of the key factors responsible for the rapid growth of the global multiomics market is the increased demand for combined biological data to facilitate the fields of precision medicine, drug discovery, and biomarker identification. This integration of genomics, proteomics, transcriptomics, and metabolomics is providing a more detailed understanding of complicated conditions and opening up cross-sector innovation in healthcare and biotech.

The major factors that are expected to expedite the market growth are more investments in omics-based research, development of computational tools and data analytics along with the inclination of multiomics approaches by pharma and academic institutions. Still, the complexities of the data, limited standards, and the need for highly trained bioinformaticians are some of the factors that could slow down their adoption rate.

The global multiomics market will remain a major beneficiary of technological progress and the growing use of personalized medicine, which are expected to provide substantial opportunities over forecast period.

The global multiomics market is a major source of the life sciences, which provides a system-level study of biology by combining the data of several omic disciplines, such as genomics, proteomics, transcriptomics, metabolomics, and epigenomics. Multiomics provides a more comprehensive understanding of the intricate biological pathways, disease etiologies, and therapy outcomes by combining knowledge from different molecular layers.

Such a comprehensive strategy is changing the face of biomedical research, targeted therapeutics, and pharmaceutical research along with the researchers' ability to find new biomarkers, treatment targets, and diagnostic tools.

One of the main factors driving the global multiomics market is the growing development of high-throughput technologies, bioinformatics, and data integration platforms. Besides, more funds from the public and private sectors for systems biology and precision healthcare are likely to boost the market in the forecast period. For instance, the National Institutes of Health launched the Multi-Omics for Health and Disease Consortium, with approximately US$ 11 Mn awarded in the consortium’s first year of funding. The new consortium aims to advance the generation and analysis of “multi-omic” data for human health research.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The integration of various multi-omics data sets including genomics, proteomics, transcriptomics, and metabolomics would provide a detailed insight into the biological systems, hence the ability to trace the originators of diseases and unveil new drug targets. For instance, European public research infrastructure EU-OPENSCREEN, a network of distributed research infrastructures for chemical biology, has unveiled a novel service category in chemoproteomics and spatial mass spectrometry-based omics that intends to make drug discovery by target identification, mode of action studies, and off-target risk assessment easier.

One benefit of correlating molecular changes between the various biological layers is the ability of researchers to forecast drug responses with greater accuracy, find new biomarkers, and come up with treatment plans that are more targeted and efficient. By utilizing this comprehensive, evidence-based methodology, the process of target validation is improved, drug development timelines and expenses are minimized, and the progress of personalized medicine is facilitated.

Thus, multiomics integration is essential to new pharmaceutical research that wants to be able to keep pace with the rapid changes of the sector. Such a multi-layered analysis enables the drug developers to find potential side-effects and identify the ways a drug can become ineffective at an early stage, thereby making new compounds have better safety and efficacy profiles in general. For instance, the Joint Programming for Neurodegenerative Disease research of the European Union (JPND) has made a plea for integrative multi-omics research to find new therapeutic targets for the neurodegenerative disorders.

Multiomics integration is revolutionizing disease investigation and identification, as it allows for an in-depth understanding of biological systems across various molecular levels. One of the main advantages of multiomics data integration is that it enables researchers to find the complex relationships that are the basis of the disease mechanisms to also devise the exact molecular signatures associated with a specific condition by combining genomics, transcriptomics, proteomics, metabolomics, and the other omics fields.

For instance, The Advanced Research Projects Agency for Health (ARPA-H), an agency within the U.S. Department of Health and Human Services (HHS), announced a new funding opportunity in the form of the Rare disease AI/ML for Precision Integrated Diagnostics (RAPID) program. RAPID intends to transform the rare disease diagnostic odyssey through the development and real-world validation of AI-enabled diagnostic support systems, thereby helping patients reach an accurate diagnosis.

The other benefits include the detection of new biomarkers and the possibility of creating diagnostic tools that are customized for the target. Consequently, multiomics is a key factor in the development of precision medicine, the enhancement of patient stratification, and the facilitation of personalized treatment plans that fit the unique molecular profiles of individuals.

These biomarkers help to identify the differences between the subtypes of the diseases that look similar, thus, decreasing the number of cases wrongly diagnosed and improving the outcomes of the therapy. Further, the development of high-throughput sequencing technologies, bioinformatics, and data assimilation will lead to an exponential growth of multiomics applications in disease research, and diagnostic market will be transformed.

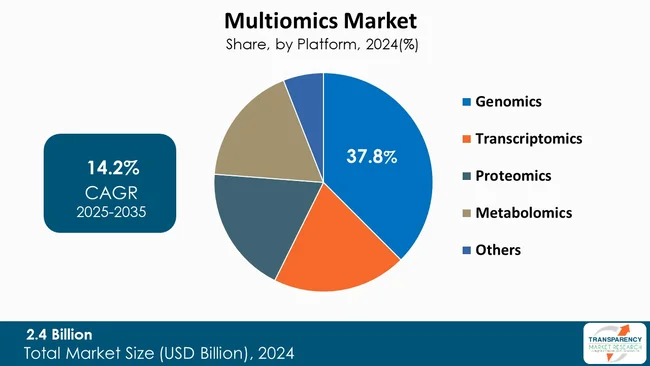

The segment of genomics holds the largest share of 37.8% regarding multiomics market globally and is predicted to continue being the top segment for the next forecast period. One of the main reasons for this leading position is the extensive use of genomic technologies in precision medicine, disease diagnostics, and drug discovery which has propelled the application of genomics.

This segment is supported to an even greater extent by the advanced sequencing platforms that are available, a sharp drop in the price of next-generation sequencing (NGS), and several large-scale genomic projects financed by both the government and private sector. Besides, the association of genomics data with the other layers of omics enhances the understanding of complex biological systems, which is the core feature of multiomics research and application.

For instance, in September 2024 NIH granted US$ 27 Mn to establish a new network of genomics-enabled learning health systems, aimed at promoting the generation of genomic data and its integration into clinical decision making.

| Attribute | Detail |

|---|---|

| Leading Region |

|

The global multiomics market, in which the North American region holds the leading position with market share of 39.7%, is mainly a result of the availability of sophisticated healthcare infrastructure, thriving biotech and pharma industries, and substantial research funding from both - public and private sources.

The United States has a significant multiomics approach in multimodal data system analysis (multi-omics/data) due to the strong financial support for research by agencies such as the National Institutes of Health (NIH), the initiation of several multiomics research projects, and also existence of advanced high-throughput technologies and bioinformatics platforms. Besides, the U.S. leads the initiatives to support the diagnosis of the rare diseases by the RAPID program that applies AI to construct correct diagnostic models by merging the scattered patient data.

For instance, the Centers for Disease Control and Prevention (CDC) has declared an investment program of US$ 90 Mn to build Pathogen Genomics Centers of Excellence, intending to escalate the capacity for disease identification.

BD, Thermo Fisher Scientific Inc., Illumina, Inc., Danaher Corporation, PerkinElmer, Shimadzu Corporation, Bruker Cellular Analysis, QIAGEN, Agilent Technologies, Inc., BGI, 10x Genomics, CYTENA GmbH, F. Hoffmann - La Roche Ltd, Mission Bio., Congenica Ltd. and others are some of the leading manufacturers operating in the global multiomics market.

Each of these companies has been profiled in the multiomics market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

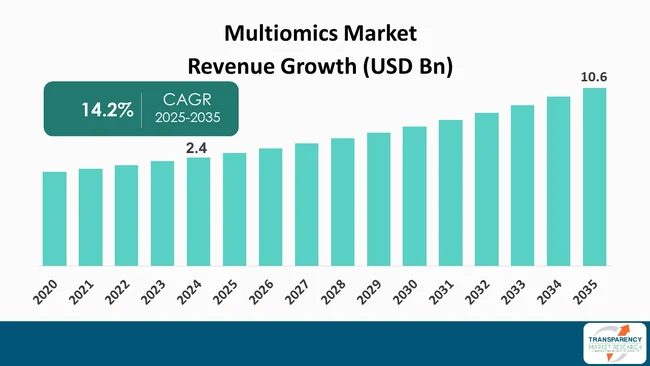

| Size in 2024 | US$ 2.4 Bn |

| Forecast Value in 2035 | More than US$ 10.6 Bn |

| CAGR | 14.2 % |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Product & Service

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global multiomics market was valued at US$ 2.4 Bn in 2024

The global multiomics industry is projected to reach more than US$ 10.6 Bn by the end of 2035

Drug discovery and development, and disease research and diagnosis are some of the factors driving the expansion of multiomics market.

The CAGR is anticipated to be 14.2% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

BD, Thermo Fisher Scientific Inc., Illumina, Inc., Danaher Corporation, PerkinElmer, Shimadzu Corporation, Bruker Cellular Analysis, QIAGEN, Agilent Technologies, Inc., BGI, 10x Genomics, CYTENA GmbH, F. Hoffmann – La Roche Ltd, Mission Bio., Congenica Ltd., and other prominent players.

Table 01: Global Multiomics Market Value (US$ Bn) Forecast, by Product & Service, 2020 to 2035

Table 02: Global Multiomics Market Value (US$ Bn), By Product, 2020 to 2035

Table 03: Global Multiomics Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 04: Global Multiomics Market Value (US$ Bn) Forecast, By Platform, 2020 to 2035

Table 05: Global Multiomics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 06: Global Multiomics Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 07: Global Multiomics Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 08: North America Multiomics Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 09: North America Multiomics Market Value (US$ Bn) Forecast, by Product & Service, 2020 to 2035

Table 10: North America Multiomics Market Value (US$ Bn), By Product, 2020 to 2035

Table 11: North America Multiomics Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 12: North America Multiomics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 13: North America Multiomics Market Value (US$ Bn) Forecast, by Platform, 2020 to 2035

Table 14: North America Multiomics Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 15: Europe Multiomics Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 16: Europe Multiomics Market Value (US$ Bn) Forecast, by Product & Service, 2020 to 2035

Table 17: Europe Multiomics Market Value (US$ Bn), By Product, 2020 to 2035

Table 18: Europe Multiomics Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 19: Europe Multiomics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 20: Europe Multiomics Market Value (US$ Bn) Forecast, by Platform, 2020 to 2035

Table 21: Europe Multiomics Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 22: Asia Pacific Multiomics Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 23: Asia Pacific Multiomics Market Value (US$ Bn) Forecast, by Product & Service, 2020 to 2035

Table 24: Asia Pacific Multiomics Market Value (US$ Bn), By Product, 2020 to 2035

Table 25: Asia Pacific Multiomics Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 26: Asia Pacific Multiomics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 27: Asia Pacific Multiomics Market Value (US$ Bn) Forecast, by Platform, 2020 to 2035

Table 28: Asia Pacific Multiomics Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 29: Latin America Multiomics Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 30: Latin America Multiomics Market Value (US$ Bn) Forecast, by Product & Service, 2020 to 2035

Table 31: Latin America Multiomics Market Value (US$ Bn), By Product, 2020 to 2035

Table 32: Latin America Multiomics Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 33: Latin America Multiomics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 34: Latin America Multiomics Market Value (US$ Bn) Forecast, by Platform, 2020 to 2035

Table 35: Latin America Multiomics Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 36: Middle East and Africa Multiomics Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 37: Middle East and Africa Multiomics Market Value (US$ Bn) Forecast, by Product & Service, 2020 to 2035

Table 38: Middle East and Africa Multiomics Market Value (US$ Bn), By Product, 2020 to 2035

Table 39: Middle East and Africa Multiomics Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 40: Middle East and Africa Multiomics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 41: Middle East and Africa Multiomics Market Value (US$ Bn) Forecast, by Platform, 2020 to 2035

Table 42: Middle East and Africa Multiomics Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Figure 01: Global Multiomics Market Value Share Analysis, by Product & Service, 2024 and 2035

Figure 02: Global Multiomics Market Attractiveness Analysis, by Product & Service, 2025 to 2035

Figure 03: Global Multiomics Market Revenue (US$ Bn), by Products, 2020 to 2035

Figure 04: Global Multiomics Market Revenue (US$ Bn), by Service, 2020 to 2035

Figure 05: Global Multiomics Market Value Share Analysis, by Type, 2024 and 2035

Figure 06: Global Multiomics Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 07: Global Multiomics Market Revenue (US$ Bn), by Single-cell Multiomics, 2020 to 2035

Figure 08: Global Multiomics Market Revenue (US$ Bn), by Bulk-cell Multiomics, 2020 to 2035

Figure 09: Global Multiomics Market Value Share Analysis, by Platform, 2024 and 2035

Figure 10: Global Multiomics Market Attractiveness Analysis, by Platform, 2025 to 2035

Figure 11: Global Multiomics Market Revenue (US$ Bn), by Genomics, 2020 to 2035

Figure 12: Global Multiomics Market Revenue (US$ Bn), by Transcriptomics, 2020 to 2035

Figure 13: Global Multiomics Market Revenue (US$ Bn), by Proteomics, 2020 to 2035

Figure 14: Global Multiomics Market Revenue (US$ Bn), by Metabolomics, 2020 to 2035

Figure 15: Global Multiomics Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 16: Global Multiomics Market Value Share Analysis, by Application, 2024 and 2035

Figure 17: Global Multiomics Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 18: Global Multiomics Market Revenue (US$ Bn), by Cell Biology, 2020 to 2035

Figure 19: Global Multiomics Market Revenue (US$ Bn), by Oncology, 2020 to 2035

Figure 20: Global Multiomics Market Revenue (US$ Bn), by Neurology, 2020 to 2035

Figure 21: Global Multiomics Market Revenue (US$ Bn), by Immunology, 2020 to 2035

Figure 22: Global Multiomics Market Value Share Analysis, by End-user, 2024 and 2035

Figure 23: Global Multiomics Market Attractiveness Analysis, by End-user, 2024 and 2035

Figure 24: Global Multiomics Market Revenue (US$ Bn), by Hospital and Diagnostic Laboratories, 2025 to 2035

Figure 25: Global Multiomics Market Revenue (US$ Bn), by Pharmaceutical & Biotechnology, 2020 to 2035

Figure 26: Global Multiomics Market Revenue (US$ Bn), by Academic & Research Organizations, 2020 to 2035

Figure 27: Global Multiomics Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 28: Global Multiomics Market Value Share Analysis, By Region, 2024 and 2035

Figure 29: Global Multiomics Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 30: North America Multiomics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 31: North America Multiomics Market Value Share Analysis, by Country, 2024 and 2035

Figure 32: North America Multiomics Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 33: North America Multiomics Market Value Share Analysis, by Product & Service, 2024 and 2035

Figure 34: North America Multiomics Market Attractiveness Analysis, by Product & Service, 2025 to 2035

Figure 35: North America Multiomics Value Share Analysis, by Type, 2025 to 2035

Figure 36: North America Multiomics Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 37: North America Multiomics Market Value Share Analysis, by Platform, 2025 to 2035

Figure 38: North America Multiomics Market Attractiveness Analysis, by Platform, 2025 to 2035

Figure 39: North America Multiomics Market Value Share Analysis, by Application, 2024 and 2035

Figure 40: North America Multiomics Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 41: North America Multiomics Market Value Share Analysis, by End-user, 2024 and 2035

Figure 42: North America Multiomics Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 43: Europe Multiomics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 44: Europe Multiomics Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 45: Europe Multiomics Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 46: Europe Multiomics Market Value Share Analysis, by Product & Service, 2024 and 2035

Figure 47: Europe Multiomics Market Attractiveness Analysis, by Product & Service, 2025 to 2035

Figure 48: Europe Multiomics Market Value Share Analysis, by Type, 2024 and 2035

Figure 49: Europe Multiomics Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 50: Europe Multiomics Market Value Share Analysis, by Platform, 2025 to 2035

Figure 51: Europe Multiomics Market Attractiveness Analysis, by Platform, 2025 to 2035

Figure 52: Europe Multiomics Market Value Share Analysis, By Application, 2024 and 2035

Figure 53: Europe Multiomics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 54: Europe Multiomics Market Value Share Analysis, by End-user, 2024 and 2035

Figure 55: Europe Multiomics Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 56: Asia Pacific Multiomics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 57: Asia Pacific Multiomics Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 58: Asia Pacific Multiomics Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 59: Asia Pacific Multiomics Market Value Share Analysis, by Product & Service, 2024 and 2035

Figure 60: Asia Pacific Multiomics Market Attractiveness Analysis, by Product & Service, 2025 to 2035

Figure 61: Asia Pacific Multiomics Market Value Share Analysis, by Type, 2024 and 2035

Figure 62: Asia Pacific Multiomics Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 63: Asia Pacific Multiomics Market Value Share Analysis, by Platform, 2025 to 2035

Figure 64: Asia Pacific Multiomics Market Attractiveness Analysis, by Platform, 2025 to 2035

Figure 65: Asia Pacific Multiomics Market Value Share Analysis, By Application, 2024 and 2035

Figure 66: Asia Pacific Multiomics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 67: Asia Pacific Multiomics Market Value Share Analysis, by End-user, 2024 and 2035

Figure 68: Asia Pacific Multiomics Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 69: Latin America Multiomics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 70: Latin America Multiomics Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 71: Latin America Multiomics Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 72: Latin America Multiomics Market Value Share Analysis, by Product & Service, 2024 and 2035

Figure 73: Latin America Multiomics Market Attractiveness Analysis, by Product & Service, 2025 to 2035

Figure 74: Latin America Multiomics Market Value Share Analysis, by Type, 2024 and 2035

Figure 75: Latin America Multiomics Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 76: Latin America Multiomics Market Value Share Analysis, by Platform, 2025 to 2035

Figure 77: Latin America Multiomics Market Attractiveness Analysis, by Platform, 2025 to 2035

Figure 78: Latin America Multiomics Market Value Share Analysis, By Application, 2024 and 2035

Figure 79: Latin America Multiomics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 80: Latin America Multiomics Market Value Share Analysis, by End-user, 2024 and 2035

Figure 81: Latin America Multiomics Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 82: Middle East and Africa Multiomics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 83: Middle East and Africa Multiomics Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 84: Middle East and Africa Multiomics Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 85: Middle East and Africa Multiomics Market Value Share Analysis, by Product & Service, 2024 and 2035

Figure 86: Middle East and Africa Multiomics Market Attractiveness Analysis, by Product & Service, 2025 to 2035

Figure 87: Middle East and Africa Multiomics Market Value Share Analysis, by Type, 2024 and 2035

Figure 88: Middle East and Africa Multiomics Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 89: Middle East and Africa Multiomics Market Value Share Analysis, by Platform, 2025 to 2035

Figure 90: Middle East and Africa Multiomics Market Attractiveness Analysis, by Platform, 2025 to 2035

Figure 91: Middle East and Africa Multiomics Market Value Share Analysis, by Application, 2024 and 2035

Figure 92: Middle East and Africa Multiomics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 93: Middle East and Africa Multiomics Market Value Share Analysis, by End-user, 2024 and 2035

Figure 94: Middle East and Africa Multiomics Market Attractiveness Analysis, by End-user, 2025 to 2035